Tickmill fx

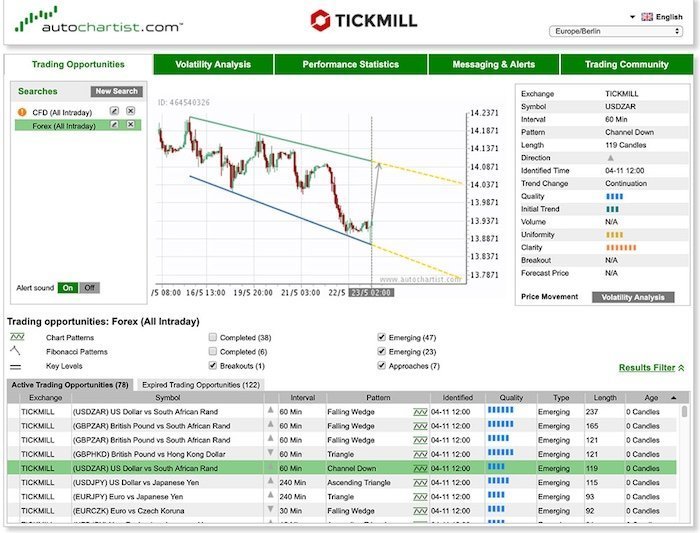

Channel down on US dollar south african rand there are many advantages of signing up with an MT4 broker and using MT4 for trading:

Free forex bonuses

Tickmill review

- Is tickmill safe?

- Trading conditions

- Account types

- Spreads and commissions

- Deposit and withdrawal fees

- Tickmill for beginners

- Educational material

- Analysis material

- Trading platforms

- Trading tools

- Mobile trading apps

- Evaluation method

- Tickmill risk statement

- Overview

Summary

Built by traders, for traders, tickmill offers low spreads and commission on both ECN and traditional accounts. All accounts feature ultra-fast STP execution (0.15s on average and no requotes) and support for the MT4 platform with all strategies allowed.

Regulated by the FCA in the UK, cysec in europe, and the seychelles FSA internationally вђ“ and a regular winner of trade execution and trading conditions awards вђ“ tickmill also offers 80+ instruments to trade alongside dedicated multi-lingual support and negative balance protection.

Reviews

Account information

Trading conditions

Company details

Deposit & withdrawal methods

Supported platforms for tickmill

Is tickmill safe?

Tickmill ltd is regulated by the seychelles FSA (license: SD 008) and has been regulated by the FCA (license: 717270) since 2016. Cysec has regulated the european entity, tickmill europe ltd (license: 278/15) since 2015.

Tickmillвђ™s quality and popularity amongst traders have been noticed and rewarded by its industry peers; in recent years the company has won awards for best CFD broker asia 2019 (international business magazine), best forex CFD provider 2019 (online personal wealth awards), best forex execution broker 2018 (UK forex awards)В andв best forex trading conditions 2017В (UK forex awards).

More importantly for potential customers, tickmill were recipients of the most trusted broker 2017 (global brands magazine) for a continual focus on keeping pricing competitive and maintaining a fair trading environment.

Trading conditions

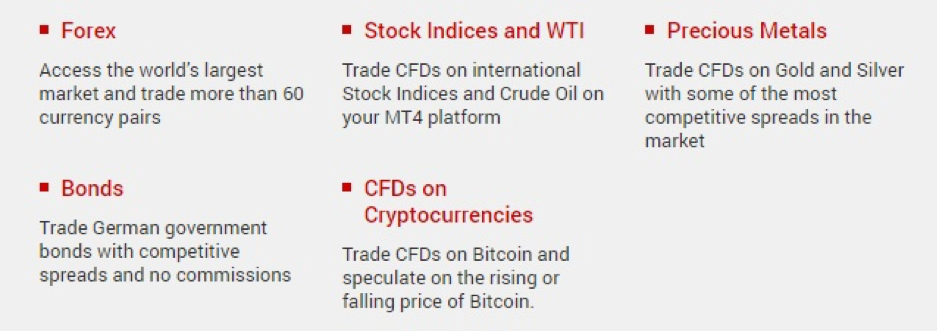

All accounts at tickmill offer STP market executed trades in 0.1 seconds on 62 currency pairs in addition to cfds on stock indices, metals, and bonds, without any dealing desk interference. Tickmill does not offer cryptocurrency cfds.

The margin call and stop-out percentage differ for the retail and professional versions of the accounts where the margin call to stop-out for retail clients is 100% to 50%, and professional is 100% to 30%.

Clients can choose between four wallet currencies вђ“ USD, EUR, GBP, and PLN.

Account types

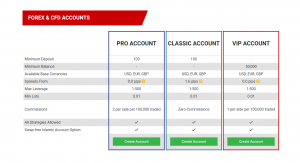

Tickmill offers three different live accounts in addition to the demo account. While trading conditions improve with the account type, the main differentiating factor is the initial deposit required.

Demo account вђ“ A demo account is available for new traders and will remain open until there is no login for seven consecutive days.

Classic account вђ“ this entry-level account requires a minimum deposit of 100 USD, and, like all tickmill accounts, offers a swap-free islamic account option. The spreads start at 1.6 pips and maximum leverage is 1:500 вђ“ note that this is the only account that uses wider spreads instead of charging a commission on each trade.

Pro account вђ“ this account, also with a swap-free islamic option, requires a 100 USD minimum deposit and is the entry-level account for professional traders. Tighter spreads are available in exchange for a commission of 2 USD per side per 100,000 (a standard lot) traded. This commission pricing and structure is an industry-standard and is in line with what other STP brokers offer clients for the same services.

VIP account вђ“ this account, with the same swap-free islamic option, is for high volume professional traders and requires a 50,000 USD minimum deposit. The commission is reduced to 1 USD per side per 100,000 (a standard lot) traded which makes trading even more profitable. This is a very competitive professional account and offers excellent trading conditions.

Spreads and commissions

The minimum spread on the classic account is 1.6 pips with zero commission. The minimum spread on the pro and VIP accounts is 0.0 pips with a commission of 2 USD per side per standard lot trade and 1 USD per side per standard lot traded, respectively.

Deposit and withdrawal fees

Tickmill takes deposits through a variety of global and local methods, under a zero fees policy. They include:

- Visa/mastercard

- Bank transfer

- Neteller/skrill

- STICPAY

- Fasapay

- Unionpay

- Nganluong.Vn

- QIWI

- Webmoney

The zero fees policy means that tickmill will reimburse traders for any fees charged up to 100 USD. If you were charged, submit a copy of the bank statement showing the charge, and the amount will be credited. Should the trading account become inactive, tickmill reserves the right to start reimbursing transfer fees.

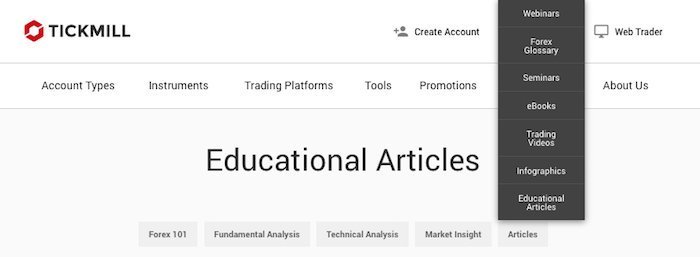

Tickmill for beginners

Tickmill does not have a traditional introductory course, but they do publish webinars and seminars to help new traders get their footing. They have also made available a detailed ebook which many new traders will find useful. Additionally, while the analysis blog and tradingview analysis tools do not explain the basics of trading, they do offer new perspectives on currency markets.

Educational material

For new traders, tickmillвђ™s main resource is its downloadable ebook, but the webinars and seminars are also of great assistance.

The 46-page ebook, titled the majors вђ“ insights & strategies, is well illustrated and a suitable replacement for an online course for beginners. The ebook covers forex trading basics and how forex trading works, an introduction to the major currency pairs, trading strategies and the major types of forex analysis. The ebook ends with a section of top tips which will give traders more confidence in their decisions.

Webinars are run in four languages (english, arabic, italian and german), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like news trading strategies to technical analysis and chart theories like standard elliot wave models.

Tickmill has a schedule of free seminars around the world, which introduce traders to new areas of learning and also allows clients to meet brokers in person and create relationships.

Analysis material

The tickmill research team runs a regular blog which covers topics that relate to both fundamental and technical analysis. Research often covers different currency pairs and encourages traders to learn about market-moving events outside of conventional news sources.

The blog is open to all readers and tickmill allows traders to contact the author with questions about their article. This is unique among brokers, who typically shy away from one-to-one contact with traders when it comes to discussing specific investments.

Tickmill is also active on their tradingview pro account where analysts are continually marking up charts. Even if traders are not going to take advantage of these trading opportunities, they are a great way to learn technical analysis from the pros.

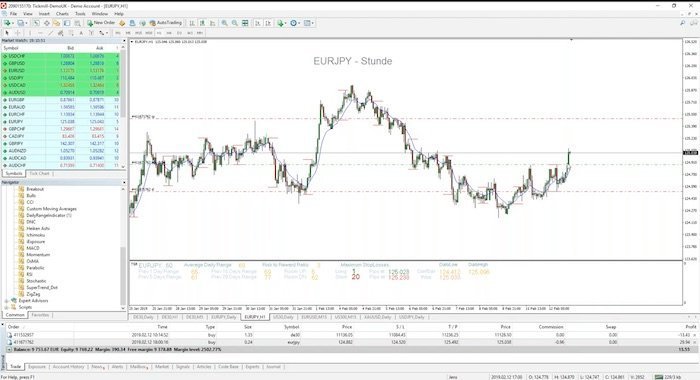

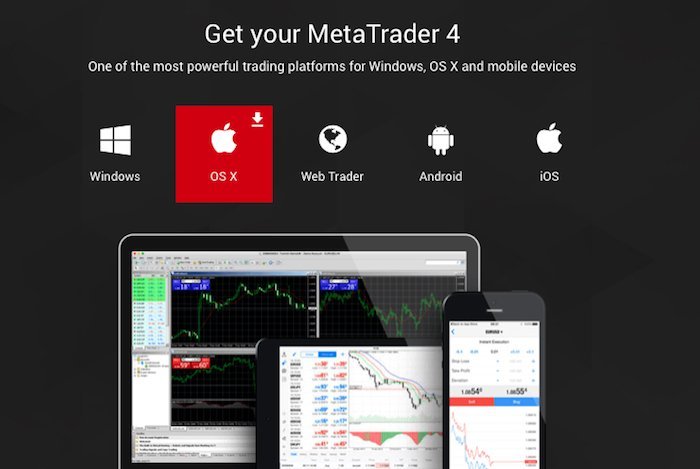

Trading platforms

Tickmill supports metatrader4 (MT4) and the associated web and mobile applications. MT4 is the industry leader and the most common trading platform for CFD traders.

There are many advantages of signing up with an MT4 broker and using MT4 for trading:

- The MT4 community is vast, as is the amount of the text and video resources to support both new and experienced traders.

- The MT4 EA (expert advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, so a new device or computer is not necessary to get started.

Trading tools

Tickmill also provides a number of useful trading tools.

Autochartist is a third-party automated chart analysis tool which scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and adds little complication to the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Tickmill offers autochartist free of charge to all live accounts and the demo account on a delay of five candlesticks.

Another common third-party trading tool available on tickmill is myfxbook autotrade, which is a cross-broker social trading platform that allows for copy trading without the need for additional software.

The one-click trading MT4 expert advisor (EA) is designed to make common trading mechanisms more accessible, which facilitates trading and removes unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Tickmill VPS has partnered with beeksfx to provide discounted VPS services to clients. While many brokers will include VPS as a free service for active traders, VPS has chosen to partner with a leading 3rd party provider and asks clients to take on the additional cost.

Mobile trading apps

Metatrader4 (MT4) is also available on IOS, android and windows mobile phone and tablets. The app will connect to the same account as the desktop software, keeping the trading experience synchronised, and traders mobile.

Evaluation method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the tickmill offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill risk statement

Trading forex is risky, and each broker is required to detail how risky the trading of forex cfds is to clients. Tickmill would like you to know that: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with tickmill ltd.

Overview

Tickmill is an award-winning and trustworthy STP broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, additional premium tools offered to traders for no extra cost, and good trading conditions, tickmill should be a top choice in forex brokerage.

Tickmill vs fxpro 2021

Is fxpro better than tickmill? After testing 27 of the best forex brokers over five months, tickmill is better than fxpro. Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts

Select brokers keyboard_arrow_down

Overall rating

| feature | tickmill | fxpro |

| overall | 4 | 4 |

| commissions & fees | 5 | 3.5 |

| offering of investments | 3 | 3.5 |

| platforms & tools | 3 | 4 |

| mobile trading | 3 | 4 |

| research | 4 | 3.5 |

| education | 4 | 4 |

| trust score | 81 | 89 |

| tickmill review | fxpro review | |

| winner | check_circle | |

| 76% of retail CFD accounts lose money | 80.59% of retail CFD accounts lose money |

Regulation

Tier-1 licenses (high trust)

Investments

Funding

Trading platforms

Trading tools

Mobile trading

Research

Education

Major forex pairs

Overall

| feature | tickmill | fxpro |

| overall | 4 | 4 |

| commissions & fees | 5 | 3.5 |

| offering of investments | 3 | 3.5 |

| platforms & tools | 3 | 4 |

| mobile trading | 3 | 4 |

| research | 4 | 3.5 |

| education | 4 | 4 |

| trust score | 81 | 89 |

| tickmill review | fxpro review |

Comparing forex brokers side by side is no easy task. For our 2021 annual forex broker review, we spent hundreds of hours assessing 27 forex and CFD brokerages to find the best forex broker. Let's compare fxpro vs tickmill.

Does fxpro or tickmill offer lower pricing?

Comparing the trading costs of forex and cfds is not easy. Not every broker publishes average spreads data, and pricing structures vary. Based on our thorough annual assessment, tickmill offers better pricing overall for traders.

Is fxpro or tickmill safer for forex and cfds trading?

At forexbrokers.Com, we track where each forex and CFD broker is regulated across over 20 international regulator databases. Here's our findings. Both fxpro and tickmill hold 1 global tier-1 licenses. Both fxpro and tickmill hold 2 global tier-2 licenses. All regulators considered, fxpro has a trust score of 89.00, while tickmill's trust score is 81.00.

Which trading platform is better: fxpro or tickmill?

To compare the trading platforms of both fxpro and tickmill, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, fxpro offers a better experience. With research, tickmill offers superior market research. Finally, we found fxpro to provide better mobile trading apps.

What about metatrader and copy trading?

For forex and cfds traders, copy trading and metatrader are both popular platform options. Fxpro and tickmill both offer copy trading. Both fxpro and tickmill offer metatrader 4 (MT4).

How many forex pairs and cfds are available to trade?

Fxpro provides traders 69 currency pairs (e.G., EUR/USD) compared to tickmill's 62 available pairs. Forex pairs aside, fxpro offers traders access to 187 cfds while tickmill has 13 available cfds, a difference of 174.

Overall winner: tickmill

Related comparisons

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

TICKMILL (ティックミル)

ユーザー評価

TICKMILLの概要

イギリス発! 英国FCAの認可も取得した海外FX会社「TICKMILL (ティックミル)」上陸!

TICKMILLのメリットとデメリット

TICKMILL 目次

- Tickmillの会社情報や評判

- Tickmillで口座開設するメリットとデメリット

- Tickmillの金融ライセンスや登録機関など

- Tickmillは、もしもの時に備えた補償機構に登録済み

- Tickmillで口座開設する際に選択する金融ライセンスについて

- Tickmillのボーナスやキャンペーン、コンテスト

- 海外FX業者 tickmillの口座開設ボーナス - 30ドル ウェルカム口座

- 海外FX業者 tickmillの予想当てクイズ - NFP(非農業部門雇用統計)マシーン

- 海外FX業者 tickmillのランダムプレゼント - 今月のトレーダー

- Tickmillの取引環境と取引条件

- TICKMILLの口座タイプの違いを比較

- Tickmillの取り扱い銘柄

- Tickmillだから無料で使える有料ツール

- Tickmillのmt4では、オートチャーティストが使える

- Tickmillは、ゼロカット対応で借金リスクゼロ - 追証なし

- Tickmillの入金方法と出金方法

- Tickmillの入金方法 - 入金手数料や反映時間など

- クレジットカードやデビットカードで入金できない入金エラーが発生する理由

- Tickmillの出金方法 - 出金手数料や着金までの日数など

- Tickmillの入金方法 - 入金手数料や反映時間など

Tickmillの会社情報や評判

| 海外FX業者 | tickmill |

|---|---|

| 設立 | 2015年 |

| 運営会社 | tickmillグループ |

| 拠点 | キプロスのリマソル、イギリスのロンドン、エストニアのタリン等 |

| 金融ライセンス | イギリスFCA、キプロスcysec、セーシェルFSA等 |

| 世界の従業員数 | 150名以上 |

| 口座開設数 | 26.3万口座以上 |

| 受賞歴 | 10以上 |

| 日本語サポート | 日本人スタッフ在籍 |

| 電話番号 | +852-5808-2921、+65-3163-0958、+248-434-7072 |

| メールアドレス | [email protected] |

Tickmillは、2015年に創業して以来、下記の賞を受賞しています。

- ベスト取引プラットフォームプロバイダー – fxdailyinfo.Com ブローカーアワード2019

- ベストCFDブローカーアジア – 国際ビジネスマガジン2019

- ベスト外国為替CFDプロバイダー – オンラインパーソナルウェルスアワード2019

- ベスト外国為替ブローカーアジア – forexアワード2019

- 最も透明性の高いブローカー – forexアワード2019

- ベスト外国為替実行ブローカー – 英国外国為替アワード2018

- ベスト外国為替CFDブローカー – ジョーダン外国為替エキスポアワード2018

- トップCFDブローカー – fxdailyinfo.Com ブローカーアワード2018

- ベスト外国為替取引条件 – 英国外国為替アワード2017

- ヨーロッパで最も信頼されているブローカー – グローバルブランドマガジン2017

Tickmillで口座開設するメリットとデメリット

海外FX業者 tickmill(ティックミル)で 口座開設するメリット は、以下の通りです。

- 最大レバレッジ 500倍のハイレバレッジ取引ができる

- ゼロカット対応で借金リスクゼロ – 追証なし

- 日本人スタッフによる日本語対応

- 超高速約定 – 海外FX業界最速の実行時間である平均0.15秒

- 2020年3月にスプレッドとスワップポイントを大幅削減

“多くの流動性プロバイダーと排他的契約を締結し、業界一の低コストブローカーの一つになることをご報告できて光栄です。

主要通貨ペアと金のスプレッドを縮小しました。私たちは、高度なアグリゲーションソフトを利用して、豊富なリクイディティ・デプスを確保すべく、様々な流動性プロバイダーと協力し始めました。こうした努力の結果として、クライアントの皆様に、高度な執行能力を最低ゼロスプレッドで確実に提供することができます。

次に、クライアントの皆様が、不要な追加コストのせいで、利益面で妥協するようなことなく、より長期間ポジションをオープンにしておくことができるよう、スワップレートを大幅に低減しました。”

– tickmillの日本語公式サイト「tickmill がスプレッドとスワップを縮小 – 業界一の低コストブローカーの一つになります!」

反対に、 tickmillのデメリット は以下の通りです。

- ボーナスやキャンペーンが少ない

- 取引プラットフォームはMT4(メタトレーダー4)のみ

- 取り扱い銘柄が多くはない

Tickimillは、口座開設ボーナス 30ドルも提供しています。

tickmikllで タダで海外FXを始めたいトレーダーは、30ドル ウェルカム口座を受け取ってください 。

Tickmillの金融ライセンスや登録機関など

| 会社名 | 金融ライセンスや登録機関 | 番号 |

|---|---|---|

| tickmill ltd | セーシェル金融サービス機構 | SFSA SD008 |

| tickmill UK ltd | イギリス金融行動監督機構 | FCA 717270 |

| tickmill UK ltd | 金融サービス補償機構 | FSCS |

| tickmill europe ltd | キプロス証券取引委員会 | cysec 278/15 |

| tickmill europe ltd | 金融商品市場指令 | mifid II 2014/65/EU |

| tickmill europe ltd | 投資家補償基金 | ICF |

- ドイツbafin(連邦金融監督庁)

- イタリアCONSOB(国家委員会と証券取引所)

- フランスACPR(プルデンシャル監督庁)

- スペインCNMV(国立市場証券委員会)

Tickmillは、もしもの時に備えた補償機構に登録済み

“金融サービス補償機構(FSCS)

Tickmill UK ltdは金融サービス補償機構のメンバーです。FSCSは、2000年金融サービス市場法によって設立された、英国金融サービス企業によって規制されたお客様の最後の手段となる、独立した補償基金です。FSCSの目的は、企業が取引中止、あるいは債務不履行となり請求された金額を支払えない場合に、補償金を支払うことです。”

– tickmillの日本語公式サイト「tickmillについて(ライセンスと規制)」

具体的には、上記FSCSの管理下にあることにより、tickmillの倒産など トレーダーのトレードとは直接的に関係のない不本意な損害をトレーダーが被った際の資金補償として、最大50,000ポンド(約700万円)まで補償 されます。

“投資家補償基金(ICF)

Tickmill europe ltdは投資家補償基金のメンバーです。ICFは、法144(Ι)/2007の条項59(1)と(2)によって、CIFクライアントの投資家補償基金として設立され、その機能はcysecの指令144-2007-15によって規制されています。基金の目的は、ICFメンバーに対するクライアントの請求に関して、基金メンバーが支払い義務を果たすことのできない場合に、いかなる要求への補償支払いを確実にすることです。”

– tickmillの日本語公式サイト「tickmillについて(ライセンスと規制)」

Tickmillで口座開設する際に選択する金融ライセンスについて

Tickmillで金融ライセンスの 選択画面が表示されたら、必ずセイシェルFSAを選択 して下さい。

Tickmillで 500倍の最大レバレッジでトレードできるのはセイシェルFSA下の取引口座のみ となります。

Tickmillのボーナスやキャンペーン、コンテスト

海外FX業者 tickmill(ティックミル)は、現在下記の ボーナスやキャンペーン、コンテストを実施 しています。

海外FX業者 tickmillの口座開設ボーナス – 30ドル ウェルカム口座

| キャンペーンのタイプ | 口座開設ボーナス |

|---|---|

| ボーナス額 | 30ドル |

| 対象者 | tickmillでまだ口座開設していない人 |

| 受け取り条件 | tickmillでウェルカム口座を開設するだけ |

| ボーナス反映のタイミング | ウェルカム口座を開設後すぐ |

| 受け取り期間 | 口座開設から90日間限定、追加で30日間の延長可 |

| 出金制限 | 制限あり |

海外FX業者 tickmillの予想当てクイズ – NFP(非農業部門雇用統計)マシーン

| コンテストのタイプ | SNSコンテスト |

|---|---|

| 賞金 | 最大500ドル |

| 参加者 | wooboxから投稿したトレーダー |

| 参加方法 | NFP発表30分後のMT4の特定銘柄の価格を投稿 |

| コンテスト期間 | 毎月の月初から第1金曜日の午後10時または午後9時まで |

| 参加に伴う制限 | 制限なし |

海外FX業者 tickmillのランダムプレゼント – 今月のトレーダー

Tickmillの取引環境と取引条件

海外FX業者 tickmill(ティックミル)の取引環境と取引条件は、 3種類の口座タイプ で違います。

- クラシック口座

- プロ口座

- VIP口座

いずれの口座タイプでも NDD方式で、最大レバレッジ500倍、平均約定速度0.15秒 の取引環境と取引条件に違いはありません。

また、tickmillでは無料でバーチャルトレードができるデモ口座も提供してます。

TICKMILLの口座タイプの違いを比較

以下の一覧表は、海外FX業者 tickmill(ティックミル)の 口座タイプごとの取引環境と取引条件の違いを比較した一覧表 です。

| 口座タイプ | クラシック口座 | プロ口座 | VIP口座 |

|---|---|---|---|

| 対象者 | 初心者 | 経験者 | 上級者 |

| 取引プラットフォーム | MT4、ウェブトレーダー | MT4、ウェブトレーダー | MT4、ウェブトレーダー |

| 注文処理方式 | NDD | NDD | NDD |

| 最大レバレッジ | 500倍 | 500倍 | 500倍 |

| 取引可能銘柄 | FX通貨ペア、株価指数、原油、金・銀、ドイツ国債 | FX通貨ペア、株価指数、原油、金・銀、ドイツ国債 | FX通貨ペア、株価指数、原油、金・銀、ドイツ国債 |

| 口座の通貨単位 | 米ドル口座、ユーロ口座、ポンド口座 | 米ドル口座、ユーロ口座、ポンド口座 | 米ドル口座、ユーロ口座、ポンド口座 |

| 最低入金額 | 100ドル | 100ドル | – |

| コントラクトサイズ | 10万通貨/lot | 10万通貨/lot | 10万通貨/lot |

| 最小取引量 | 0.01 lots | 0.01 lots | 0.01 lots |

| 最低スプレッド | 1.6 pips | 0.0 pip | 0.0 pip |

| 取引手数料 | 無料 | 4ドル/往復lot | 2ドル/往復lot |

| マージンコール | 100% | 100% | 100% |

| ロスカット | 30% | 30% | 30% |

| ゼロカット対応 | 追証なし | 追証なし | 追証なし |

| イスラム口座 | 開設できる | 開設できる | 開設できる |

スプレッドと取引手数料の取引コストにこだわるなら、プロ口座を開設 してください。

海外fx初心者やtickmillが初めてのトレーダーは、取引手数料が無料のクラシック口座を開設 してください。

Tickmillの取り扱い銘柄

海外FX業者 tickmill(ティックミル)の取り扱い銘柄 は、以下の通りです。

- FX通貨ペア 62銘柄

- 株価指数 15銘柄以上

- エネルギー WTI原油・ブレント原油

- 貴金属 金・銀

- ドイツ国債 4銘柄

Tickmillだから無料で使える有料ツール

- オートチャーティスト(autochartist)

- Myfxbookコピートレーディング(myfxbook autotrade)

- 経済カレンダー(forex calendar)

- FX計算機(forex calculators)

- Tickmill VPS

- ワンクリックトレーディング(one-click trading)

Tickmillのmt4では、オートチャーティストが使える

Tickmillは、ゼロカット対応で借金リスクゼロ – 追証なし

“マイナスの残高保護を提供しますか?またはマイナスの残高をカバーしますか?

Tickmillは、すべてのクライアントにマイナス残高保護を提供します。”

– tickmillの日本語公式サイト「サポート(FAQ)」

ゼロカット対応の海外FX業者では追証が請求されないため、追証なしや借金リスクゼロと言われます。

また、英語ではnegative balance protectionと表現されるので、直訳するとマイナス残高保護となります。

Tickmillの入金方法と出金方法

Tickmillの入金方法 – 入金手数料や反映時間など

海外FX業者 tickmill(ティックミル)の 最新の入金方法 は、以下の通りです。

- クレジットカード

- デビットカード

- オンラインウォレット

- 仮想通貨

- 銀行送金

下記の表は、tickmill(ティックミル)の最新の各入金方法ごとに詳しい入金条件や入金手数料などをまとめた表です。

| クレジットカード | 最低入金額 | 入金手数料 | 入金完了までの時間 | 出金可否 |

|---|---|---|---|---|

| VISAカード | 100ドル | 無料 | 最短数秒 | 出金できる |

| mastercard | 100ドル | 無料 | 最短数秒 | 出金できる |

| unionpay | 700円 | 無料 | 最短数秒 | 出金できる |

| デビットカード | 最低入金額 | 入金手数料 | 入金完了までの時間 | 出金可否 |

|---|---|---|---|---|

| VISAデビット | 100ドル | 無料 | 最短数秒 | 出金できる |

| mastercard | 100ドル | 無料 | 最短数秒 | 出金できる |

| unionpay | 700円 | 無料 | 最短数秒 | 出金できる |

| オンラインウォレット | 最低入金額 | 入金手数料 | 入金完了までの時間 | 出金可否 |

|---|---|---|---|---|

| sticpay | 100ドル | 送金手数料 | 最短数秒 | 出金できる |

| fasapay | 100ドル | 送金手数料 | 数時間 | 出金できる |

| skrill | 100ドル | 送金手数料 | 最短数秒 | 出金できる |

| neteller | 100ドル | 送金手数料 | 最短数秒 | 出金できる |

| qiwi | 100ドル | 送金手数料 | 1営業日 | 出金できる |

| ngân lượng | 2,000,000 ベトナムドン | 送金手数料 | 1営業日 | 出金できる |

クレジットカードやデビットカードで入金できない入金エラーが発生する理由

“クレジット/デビットデポジットが失敗したのはなぜですか?

カード発行元銀行が、カードによる入金の承認を行っていない可能性があります。その場合、別のカードまたは取引口座で利用可能な他の支払い方法を使用してください。”

– tickmillの日本語公式サイト「入金と出金(入出金条件)」

Tickmillの出金方法 – 出金手数料や着金までの日数など

海外FX業者 tickmill(ティックミル)の 最新の出金方法 は、以下の通りです。

- クレジットカード

- デビットカード

- オンラインウォレット

- 銀行送金

下記の表は、tickmill(ティックミル)の最新の各出金方法ごとに詳しい出金条件や出金手数料などをまとめた表です。

Tickmill fx

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill(ティックミル)の評判は?FX歴10年の経験をもとに15項目で斬る!

そんなtickmillの利用価値について、海外FX歴10年の経験をもとに管理人が正直に評価してみた。

口座開設を検討している人は、参考にしてみてほしい。

管理人のtickmillに対する評価まとめ

Tickmillの強み

- 業者の信頼性が高い(親会社がFCAライセンス取得)

- 未入金ボーナス3,000円あり

- 海外FX最高クラスの超低スプレッド(ドル円0.6pips)

- 約定スピードが速い

- NDD方式で取引制限一切なし(スキャし放題、両建て・アービトラージもOK)

- ストップレベルの制限なし

- 最大レバレッジ500倍×追証なし

- 取引可能な金融商品の数が84種類と抱負

- ユニークなキャンペーンを開催している

- 独自の分析ツール「オートチャーティスト」が使える

- 日本語サポートが優秀

Tickmillの弱み

- 入金・出金手段が海外銀行送金のみ

- 円口座に対応していない

- 顧客資産管理が分別管理のみ

- 利用できる取引プラットフォームがMT4のみ

- プロ口座:ドル円0.6pips、ユーロドル0.6pips

- VIP口座:ドル円0.4pips、ユーロドル0.4pips

VIP口座は初回入金額が50万円とハードルが高いが、プロ口座の最低入金額は11,000円程度なので誰でも利用可能だ。

またtickmillには本当の意味で取引制限が一切ない。

スキャルピングはもちろんだが、アービトラージのような他業者では禁止されている取引までやり放題だ。

(※)入金・出金手段が海外銀行送金しかないので注意

もちろんスペックも管理人が利用してきた中で特に優れている業者をピックアップしている。

Tickmillの11つの強み・メリット

信頼性が高い 親会社がイギリスでライセンス取得

特筆すべきは親会社である『tickmill UK limited』が登録しているライセンス。

tickmill UK limitedは 登録難易度が極めて高いイギリスFCA(英国金融行動監視機構)の認可を受けている。

- 入出金フローが全て自動処理されている

(人間が不正できない) - 顧客資金が完全に分別管理されている

(資金を流用できない)

またtickmillの日本人向け法人である『trop-X limited』はセーシェル金融庁(FSA)で認可を受けている。

FSAライセンスにそこまで権威性はないので、どちらかというと「日本人向けに安全性をアピールするため」に登録していると考えられる。

(管理人的には、 親会社がFCAのライセンスを取得している時点で信頼性は高いと判断している。セーシェルライセンスはいわば”お飾り”だ。)

なぜtickmillはわざわざ日本人用に法人を分けているのか

大きな理由として考えられるのは、親会社である『tickmill UK limited』でハイレバレッジを提供できなくなったこと。

欧州証券市場監督局(ESMA)の決議により、欧州を拠点に活動している金融機関は 上限30倍までのレバレッジ規制 を受けている。

【余談】tickmillの公式hpではceoであるsudhanshu agarwal氏が顔出しでインタビューに答えている。

未入金でも3,000円の口座開設ボーナスがもらえる

現在tickmillは新規口座開設で 未入金で3,000円分(30ドル相当)のボーナスが受け取れるキャンペーンを開催中だ。

リスクゼロでtickmillの使用感を試すことができる。

ボーナス自体は出金できないが、取引で発生した利益は出金OK。

ボーナスを受け取る場合は「ウェルカム口座」を開設しよう。

口座開設すれば、3,000円の証拠金が反映された状態になる。

ウェルカム口座は口座開設から90日間限定で利用できる。

- 一度ライブ口座(クラッシック口座orプロ口座orvip口座)に資金を移動させる必要がある。

- 資金移動できる利益は30ドル~100ドル

圧倒的低スプレッド ドル円平均0.6pipsで取引できる

Tickmillは3種類の口座タイプを用意しているが、そのうちプロ口座とVIP口座が抜群の低スプレッドを誇る。

| クラシック口座 | プロ口座 | VIP口座 | |

|---|---|---|---|

| 取引手数料※ | なし | 0.4pips (往復取引) | 0.2pips (往復取引) |

| ドル円 スプレッド | 1.80pips | 0.20pips (0.60pips) | 0.20pips (0.40pips) |

| ユーロ円 スプレッド | 2.20pips | 0.70pips (1.10pips) | 0.70pips (0.90pips) |

| ユーロドル スプレッド | 1.80pips | 0.20pips (0.60pips) | 0.20pips (0.40pips) |

| オージー円 スプレッド | 2.90pips | 0.90pips (1.30pips) | 0.90pips (1.10pips) |

| ポンド円 スプレッド | 3.60pips | 1.10pips (1.50pips) | 1.10pips (1.30pips) |

| オージー米ドル スプレッド | 2.20pips | 0.40pips (0.80pips) | 0.40pips (0.60pips) |

| 初回最低入金額 | 100ドル (11,000円相当) | 100ドル (11,000円相当) | 5万ドル (550万円相当) |

ただ2番目にスプレッドが狭いプ ロ口座でも海外FX屈指の低スプレッド。

管理人が全15業者で比較した「海外FX業者のスプレッドランキング」で1位に君臨する、tradeviewと同じくらいの水準を誇る。

【参考】スプレッドランキング1位のtradeviewのスプレッド

- ドル円:平均0.60pips

- ユーロドル:平均0.60pips

- オージー円:平均1.20pips

約定スピードが速い

Tickmillは公式hpで「平均約定スピード(実行速度)0.1秒」を掲げるほど、約定スピードに自信を持っている。

実際に管理人がお手並拝見してみたが、 平常取引ではタイムラグを感じないくらいサクサク約定した。

指標発表時でも、他の海外FX業者と比べてスリッページは少ない印象だ。

- いつまでもクルクル回って約定されない

- 約定が遅れたせいで利幅が1pipsも減った

スキャルピングOKなど、取引の自由度が高い(おそらくNDD方式)

- スキャルピング取引OK

- EAなどのシステムを用いた大ロット取引OK

- 両建て・裁定取引(アービトラージ)OK

- エントリー枚数に制限なし

Tickmillはおそらくndd方式を採用している

NDD方式とはトレーダーの注文に業者のディーラーが関与しないクリーンな注文処理方式。

業者はトレーダーの注文をカバー先LPに流すだけなので、トレーダーと業者が利益相反することはない。

一方でトレーダーの注文を反対決済で処理するDD方式では、トレーダーと業者が 利益相反の関係 になる。

(「トレーダーが買い注文→業者が売り注文で処理」といった具合になるので、トレーダーが負ければ業者が勝つ図式だ。)

上述したtickmillで許容されている取引手法は、下手をすれば 業者が大損するリスク がある。

ストップレベルの制限がない

これもtickmillならではの珍しい特徴。

指値や逆指値に ストップレベルの制限を儲けていない。

指値と逆指値の注文を入れる際に「エントリー時の価格と指値(逆指値)の間の値幅を制限されること」。

- 指値注文

→100.100円を超える地点にしか注文を入れられない - 逆指値注文

→99.90円を下回る地点にしか注文を入れられない

特に逆指値や指値を細かく設置しているようなEAを用いている人にとって、ストップレベルゼロは大きい。

EAの性能をフルに引き出せるので、利益を最大化できる可能性が高まる。

最大レバレッジ500倍で追証なし

Tickmillの口座レバレッジは最大で500倍。

他の海外FX業者と比べると平均的だが、ハイレバ取引には十分な倍率だ。

(どの業者を利用するにも実際にフルレバエントリーする機会は少なく、実効レバレッジは200倍~300倍の運用になる)

また追証なしのゼロカットシステムもあるので、 絶対に口座残高以上の損失が出ることはない。

万が一ロスカットが作動せずに口座残高がマイナスになっても、tickmillが補填してゼロに戻してくれる。

ロスカット水準は証拠金維持率30%以下

Tickmillで強制ロスカットが執行されるのは、口座の証拠金維持率が30%を下回ったタイミング。

取引可能な商品が84種類で豊富 株価指数、WTI、債権など

Tickmillは取引できる商品が豊富。

通貨ペアのみならず、株価指数(インデックス)や原油、ドイツ国債を売買できる。

- 株価指数(インデックス):最大100倍

- WTI原油:最大100倍

- 貴金属:金→口座レバレッジと同じ、銀→口座レバレッジの4分の1

- ドイツ国債:最大レバレッジ500倍

AUDUSD EURUSD GBPUSD NZDUSD USDCAD USDCHF USDJPY AUDCAD AUDCHF AUDJPY AUDNZD CADJPY CHFJPY EURAUD EURCAD EURCHF EURGBP EURJPY EURNZD GBPAUD GBPCAD GBPCHF GBPJPY GBPNZD NZDCAD NZDCHF EURCZK EURDKK EURHKD EURHUF EURMXN EURNOK EURPLN EURSEK EURSGD EURTRY EURZAR GBPCZK GBPDKK GBPHKD GBPHUF GBPNOK GBPPLN GBPSEK GBPTRY GBPZAR NZDSGD USDCNH USDCZK USDDKK USDHKD USDHUF USDMXN USDNOK USDPLN USDRUB USDSEK USDSGD USDTRY USDZAR

AFRICA40 AUS200 DE30 FRANCE40 HK50 INDIA50 ITALY40 JP225 SPAIN35 STOXX50 SWISS20 UK100 USTEC US30 US500

Tickmill vs fxpro 2021

Is fxpro better than tickmill? After testing 27 of the best forex brokers over five months, tickmill is better than fxpro. Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts

Select brokers keyboard_arrow_down

Overall rating

| feature | tickmill | fxpro |

| overall | 4 | 4 |

| commissions & fees | 5 | 3.5 |

| offering of investments | 3 | 3.5 |

| platforms & tools | 3 | 4 |

| mobile trading | 3 | 4 |

| research | 4 | 3.5 |

| education | 4 | 4 |

| trust score | 81 | 89 |

| tickmill review | fxpro review | |

| winner | check_circle | |

| 76% of retail CFD accounts lose money | 80.59% of retail CFD accounts lose money |

Regulation

Tier-1 licenses (high trust)

Investments

Funding

Trading platforms

Trading tools

Mobile trading

Research

Education

Major forex pairs

Overall

| feature | tickmill | fxpro |

| overall | 4 | 4 |

| commissions & fees | 5 | 3.5 |

| offering of investments | 3 | 3.5 |

| platforms & tools | 3 | 4 |

| mobile trading | 3 | 4 |

| research | 4 | 3.5 |

| education | 4 | 4 |

| trust score | 81 | 89 |

| tickmill review | fxpro review |

Comparing forex brokers side by side is no easy task. For our 2021 annual forex broker review, we spent hundreds of hours assessing 27 forex and CFD brokerages to find the best forex broker. Let's compare fxpro vs tickmill.

Does fxpro or tickmill offer lower pricing?

Comparing the trading costs of forex and cfds is not easy. Not every broker publishes average spreads data, and pricing structures vary. Based on our thorough annual assessment, tickmill offers better pricing overall for traders.

Is fxpro or tickmill safer for forex and cfds trading?

At forexbrokers.Com, we track where each forex and CFD broker is regulated across over 20 international regulator databases. Here's our findings. Both fxpro and tickmill hold 1 global tier-1 licenses. Both fxpro and tickmill hold 2 global tier-2 licenses. All regulators considered, fxpro has a trust score of 89.00, while tickmill's trust score is 81.00.

Which trading platform is better: fxpro or tickmill?

To compare the trading platforms of both fxpro and tickmill, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, fxpro offers a better experience. With research, tickmill offers superior market research. Finally, we found fxpro to provide better mobile trading apps.

What about metatrader and copy trading?

For forex and cfds traders, copy trading and metatrader are both popular platform options. Fxpro and tickmill both offer copy trading. Both fxpro and tickmill offer metatrader 4 (MT4).

How many forex pairs and cfds are available to trade?

Fxpro provides traders 69 currency pairs (e.G., EUR/USD) compared to tickmill's 62 available pairs. Forex pairs aside, fxpro offers traders access to 187 cfds while tickmill has 13 available cfds, a difference of 174.

Overall winner: tickmill

Related comparisons

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Tickmill review

In a FAST-MOVING market, choose a STABLE BROKER

Table of contents

Introduction

Tickmill is one of the most credible and reliable forex brokers in the market. Founded in 2014 with its headquarters in london – UK, this company has been providing quality brokerage services to users across the world from the past six years. Users of this broker get to access various financial markets like forex, soft/hard commodities, indices, bonds, etc.

Compared to other brokers with the level of tickmill’s market experience, this broker proved to be heavily regulated with some of the top tier financial regulators. Tickmill offers four types of well curated accounts and users get to pick the ones that is most appropriate to them. Demo trading facility is also available for users which could help novice traders to get the hang of the platform they are going to use.

This broker offers their services on the MT4 trading platform which is highly accepted by traders across the world. Using this platform, users get to trade on both desktops (windows/mac), and smartphones (android/ios). Apart from these, there are various other services this broker provides for their users like trading bot services called autochartist, VPS and many more.

The unique selling proposition of this broker is the lowest fees they offer. When compared to other regulated brokers, tickmill charges very less commissions and trading fees. Options to deposit and withdrawal are also many and are typically not charged. On the flip side, users get to access limited number of asset classes when compared to other brokers of this range.

Tickmill is now in position to claim that it possesses way above 100,000 traders which have jointly opened more than 250,000 active accounts.

Tickmill.Com is owned and operated within the tickmill group of companies.

– tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 – 32 old jewry, london EC2R 8DQ, england),

– tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),

– tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA)

– tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927

– tickmill asia ltd – regulated by the financial services authority of labuan malaysia (license number: MB/18/0028).

Addresses and phones

Addresses:

tickmill UK ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill europe ltd, registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus

tickmill south africa (pty) ltd, registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town

tickmill ltd, registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england

tickmill asia ltd, registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia

Phones:

+852 5808 2921

+6087-504 565

+44 203 608 6100

+357 25041710

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill review

Tickmill is forex broker. Tickmill offers the MT4 and MT4 webtrader trading currency platforms. Tickmill.Com offers over 60 currency pairs, gold, sliver, bonds and cfds for your personal investment and trading options.

Broker details

| established: | 2015 |

| address: | 3, F28-F29 eden plaza, eden island, mahe, seychelles |

| contact: | support@tickmill.Com, +852 5808 2921 |

| regional offices: | |

| regulators: | cysec #278/15, FSA-S #SD 008, FCA #717270 |

| prohibited countries: |

| deposit methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

| withdrawal methods: | bank wire, VISA, mastercard, fasapay, globe pay, local bank transfers, neteller, ngan luong, qiwi, skrill, sticpay, unionpay |

Live discussion

Join live discussion of tickmill.Com on our forum

Tickmill.Com profile provided by tickmill, nov 10, 2016

Tickmill is an award-winning global ECN broker, authorized and regulated by the FCA of the united kingdom and the FSA of seychelles. Tickmill offers its retail and institutional clients various trading services with a prime focus on forex, stock indices, commodities, cfds and precious metals. The company has distinguished itself among global ECN forex brokers by providing excellent services with low spreads, some of the industry’s lowest ECN commissions and ultra-fast execution with the state-of-the-art london trading servers located at equinix LD4 data center. Our team members have trading experience that goes back to 1989 and we have successfully traded all major financial markets from asia to north america.

In june 2016, tickmill recorded a monthly trading volume of $49.1 billion, followed by a record-high trading volume of $51.7 billion in july, which makes it one of the largest retail forex brokers in the world.

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Length of use: over 1 year

I have been with tickmill over 5 years and they are my experience with them is excellent.

They provide direct market trading with minimal commission and almost no slippage.

Deposits and withdrawals are fast if using skrill or neteller even faster.

They do have a client outreach and communicate with you occasionally on promotions or events they hold.

I have had no qualms' with them at all.

Commendable and one of the best. Keep up the good work.

Length of use: over 1 year

Tickmill threatens with legal action against me because I expose truth on social media how they refuse to pay me my funds, $35 966! Funds are not paid for more then 6 months already, and they now even threaten with legal action against me. I fight this SCAM company hard with regulators and I am going also to bring my case on court. This unjustice and fraudulent behavior must be stopped!

I strongly advise everyone to stay away from tickmill. This is SCAM company and I kindly ask forexpeacearmy to mark this company with SCAM label and their ratings erased to 0.

Aug 17, 2020 - 1 star this is SCAM company and it should be put where it belongs, to SCAM brokers. Their ratings erased.

Their price at the moment is on 24.10 $. Also straight forward crippled price action. While at same time december futures 2020 contract price which they claim they follow is on 43.22 $ with very much visible dips during upside movement. Something which we do not see in tickmill's price action!

For situation to be even worse, they charge insane swap for long positions of more then 14 points! Total SCAM! This must be punished!

Tickmill continues their fraudulent activity by offering imaginary, fake, and wrong spot WTI price. Price which has nothing to do with reality, or with any futures contract price. Random number they transmit.

I am in close contact with FSA regulator which works on my case, and hopefully this week there will be some real progress regarding my case, and my funds paid in full.

Tickmill must pay me funds they owe me, $35 966 must be paid to my trading account # 3033967.

For more information about my case, you can follow it here: scam - scam alerts - tickmill SCAM! Offers invalid WTI price in close only mode, wrong price execution for all bigger trades.

May 11, 2020 - 1 star I am going to describe 2 problems I ran into with tickmill. My trading account # 3033967.

First and main problem is fake and imaginary WTI CFD price they offer in the moment. Their price currently is at 9.64$ for barrel, while true WTI CFD price is 26$ for barrel, it can be checked with any other broker, or simply by looking at CME futures prices for WTI, all contracts are above 25$ for barrel. Tickmill have applied close only mode on WTI, and since I have 3 long positions I am not able to close my positions with significant profit of 26 000$, and trader can not open new long positions on that absurd, fake, low price they offer because it is only close only mode applied. I would have no problems with their close only mode if they offer true WTI CFD price, instrument I was trading with. Their excuse is that they follow movement of december 2020 futures price, which is also invalid since price for december futures is over 30$ for barrel, and also price movement is completely different. They refuse to pay my winnings after weeks of annoying conversations and invalid arguments they try to provide. I am experienced trader who has account with over 10 brokers, and what they say is completely absurd and not acceptable! Difference in their price from true price is almost 300%, no LP can justify that. There is only one true WTI CFD price and it is between 26$ and 27$ for barrel at the moment I am writing this review.

Second problem I encountered with wrong price execution for trades bigger then 1 lot size. This applies for all FX pairs and metals. Order is executed on price NOT SHOWN in MT4, but on price worse for client by 1-2 points. This happens every time, for manually opened positions and pending positions. They stole from me on over 500 trades these 1-2 point. It is not slippage, it is wrong price execution! I brought this issue also to them, and gave them chance to refund what they were stealing from me for years, but they refused with no true explanation provided, only fake arguments which has nothing to do with reality. Experienced trader like me can not be fooled or tricked like that.

I am going to continue to fight with them with these two problems and claim my funds via court if necessary if they continue to refuse to pay what they owe me.

Everyone can feel free to contact me directly here on FPA if further details about tickmill are wanted.

Reply by tickmill submitted may 15, 2020 hi deltoid88,

We have provided all necessary clarifications and have assisted with detailed explanation in regards to your trades.

If you have any additional concerns, you can reach out to our support team.

So, let's see, what was the most valuable thing of this article: considering trading with tickmill? Is it safe? Learn about their trading conditions, pros and cons before you place your money with tickmill. At tickmill fx

Contents of the article

- Free forex bonuses

- Tickmill review

- Summary

- Reviews

- Account information

- Trading conditions

- Company details

- Deposit & withdrawal methods

- Supported platforms for tickmill

- Is tickmill safe?

- Trading conditions

- Tickmill for beginners

- Trading platforms

- Evaluation method

- Overview

- Tickmill vs fxpro 2021

- Overall rating

- Regulation

- Tier-1 licenses (high trust)

- Investments

- Funding

- Trading platforms

- Trading tools

- Mobile trading

- Research

- Education

- Major forex pairs

- Overall

- Related comparisons

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- TICKMILL (ティックミル)

- ユーザー評価

- TICKMILLの概要

- TICKMILL 目次

- Tickmillの会社情報や評判

- Tickmillのボーナスやキャンペーン、コンテスト

- 海外FX業者 tickmillの口座開設ボーナス – 30ドル ウェルカム口座

- 海外FX業者 tickmillの予想当てクイズ – NFP(非農業部門雇用統計)マシーン

- 海外FX業者 tickmillのランダムプレゼント – 今月のトレーダー

- Tickmillの取引環境と取引条件

- Tickmillの入金方法と出金方法

- Tickmill fx

- Tickmill(ティックミル)の評判は?FX歴10年の経験をもとに15項目で斬る!

- 管理人のtickmillに対する評価まとめ

- Tickmillの11つの強み・メリット

- 信頼性が高い 親会社がイギリスでライセンス取得

- 未入金でも3,000円の口座開設ボーナスがもらえる

- 圧倒的低スプレッド ドル円平均0.6pipsで取引できる

- 約定スピードが速い

- スキャルピングOKなど、取引の自由度が高い(おそらくNDD方式)

- ストップレベルの制限がない

- 最大レバレッジ500倍で追証なし

- 取引可能な商品が84種類で豊富 株価指数、WTI、債権など

- 信頼性が高い 親会社がイギリスでライセンス取得

- Tickmill vs fxpro 2021

- Overall rating

- Regulation

- Tier-1 licenses (high trust)

- Investments

- Funding

- Trading platforms

- Trading tools

- Mobile trading

- Research

- Education

- Major forex pairs

- Overall

- Related comparisons

- Tickmill review

- Introduction

- Tickmill review

- Broker details

- Live discussion

- Tickmill.Com profile provided by tickmill, nov...

- Video

- Traders reviews

No comments:

Post a Comment