Tickmill log in

Amaran risiko: semua produk kewangan yang didagangkan pada margin mempunyai tahap risiko yang tinggi terhadap modal anda.

Free forex bonuses

Produk ini tidak sesuai untuk semua pelabur, dan anda mungkin kerugian melebihi nilai deposit awalan anda. Sila pastikan anda benar-benar memahami risiko yang terlibat dan dapatkan nasihat bebas sekiranya diperlukan. Rujuk pendedahan risiko kami.

Maklumat pada laman ini tidak disasarkan untuk penduduk amerika syarikat dan tidak bertujuan untuk pengedaran, atau penggunaan oleh, mana-mana individu di mana-mana negara atau bidang kuasa yang pengedaran atau penggunaannya akan bertentangan dengan undang-undang atau peraturan tempatan. You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

Tickmill log in

Pilih badan kawalan selia anda

Anggaran masa untuk menyelesaikan pendaftaran anda adalah 3 minit

sila lengkapkan borang berikut menggunakan huruf latin sahaja

© 2015-2021 tickmill ™

terma & syarat laman web | terma perniagaan | pendedahan risiko

tickmill.Com dimiliki dan dikendalikan di dalam syarikat tickmill group. Tickmill group terdiri daripada tickmill UK ltd, yang dikawal selia oleh lembaga kelakuan sektor kewangan(pejabat berdaftar: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, yang dikawal selia oleh komisyen sekuriti dan bursa cyprus (pejabat berdaftar: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (PTY) LTD, FSP 49464, diatur oleh lembaga kelakuan sektor kewangan (FSCA) (pejabat berdaftar: the colosseum, tingkat 1, century way, office 10, century city, 7441, cape town), tickmill ltd, dikawal selia oleh lembaga kelakuan sektor kewangan seychelles dan anak syarikat 100% miliknya procard global ltd, nombor pendaftaran UK 09369927 (pejabat berdaftar: tingkat 3, 27 - 32 old jewry, london , england, EC2R 8DQ, united kingdom), tickmill asia ltd - dikawal selia oleh lembaga kelakuan sektor kewangan labuan malaysia (nombor lesen: MB / 18/0028 dan pejabat berdaftar: unit B, lot 49, tingkat 1, blok F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Amaran risiko: semua produk kewangan yang didagangkan pada margin mempunyai tahap risiko yang tinggi terhadap modal anda. Produk ini tidak sesuai untuk semua pelabur, dan anda mungkin kerugian melebihi nilai deposit awalan anda. Sila pastikan anda benar-benar memahami risiko yang terlibat dan dapatkan nasihat bebas sekiranya diperlukan. Rujuk pendedahan risiko kami.

Maklumat pada laman ini tidak disasarkan untuk penduduk amerika syarikat dan tidak bertujuan untuk pengedaran, atau penggunaan oleh, mana-mana individu di mana-mana negara atau bidang kuasa yang pengedaran atau penggunaannya akan bertentangan dengan undang-undang atau peraturan tempatan.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Spreads & swaps

Knowing the transaction costs associated with your trading

Trading costs

with ultimate transparency

Check out our typical spreads and swaps below.

What are forex spreads?

When you begin trading, you’ll notice that you’re given a ‘bid’ (or ‘sell’) price and an ‘ask’ (or ‘buy’) price. The ‘bid’ is the price at which you sell the base currency, and the ‘ask’ is the price at which you buy the base currency. The difference between these two prices is what we call the spread.

When a trade is opened, there are always third parties who facilitate the opening and closing of that trade, like a bank or a liquidity provider. These third parties must make sure that there is an orderly flow of buy and sell orders, which means that they have to find a buyer for every seller and vice versa.

The third party is accepting the risk of a loss while facilitating the trade, thus the reason the third party will retain a part of each trade – that retained part is called the spread!

How do you

calculate the spread?

How do you calculate your transaction cost?

To work out the cost of a trade itself (not including swaps, commissions etc.), you take the spread and pip value and multiply it by the number of lots that you’re trading:

trade cost = spread X trade size X pip value

For example:

A trade you have opened has 1.2 pips spread. In this example, you’re trading with mini lots which are 10,000 base units.

The pip value is at $1, so the transaction cost is $1.20

As you’ve probably gathered, the bigger the trade, the larger your transaction costs will be!

What are swaps?

Important swap/rollover rate facts

swap rates are applied at 00:00 platform time. Each currency pair has its own swap charge and is measured on a standard size of 1 lot (100,000 base units). Swaps are applied each night onto your open positions and when the position is left open it is given a new ‘value date’. On wednesday night however, the new value date for a trade held open is changed to monday. Due to this, swaps are charged at triple the rate. Check your swaps on your MT4 market watch panel. You simply right click, select ‘symbols’, select the instrument and then select ‘properties’.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill group licenses

& regulation

Group licenses

Cyprus securities and exchange commission (cysec)

Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission as a CIF limited company.

Cysec is the financial regulator of the republic of cyprus, established according to section 5 of the securities and exchange commission (establishment and responsibilities) law of 2001. The purpose of cysec is to safeguard investor protection and facilitate the sound development of the securities market through the exercise of efficient supervision.

Seychelles financial services authority (FSA)

Tickmill ltd is regulated as a securities dealer by the seychelles financial services authority.

FSA is established under the financial services authority act 2013. The regulator’s key responsibilities include the licensing, supervision and development of non-bank financial services in seychelles through a solid regulatory regime.

Financial conduct authority (FCA)

Tickmill UK ltd is authorised and regulated by the financial conduct authority.

FCA register number: 717270

The FCA is an independent public body given statutory powers by the financial services and markets act 2000, regulating the conduct of both retail and wholesale financial services firms in the UK. The regulator’s mission is to make financial markets work well with the aim to protect consumers, enhance market integrity and promote competition.

Labuan financial services authority (labuan FSA)

Tickmill asia ltd is authorised and regulated by the labuan financial services authority.

Labuan FSA acts as the central regulatory, supervisory and enforcement authority of the international business and financial services industry in labuan. The authority plays a vital role in ensuring all entities operating under labuan IBFC abide by the highest financial standards.

Financial sector conduct authority (FSCA)

Tickmill south africa (pty) ltd is authorised and regulated by the financial sector conduct authority (FSCA).

Licence number: FSP 49464

The financial sector conduct authority (FSCA) serves as the dedicated market authority in south africa with a mission to enhance the efficiency and integrity of financial markets, promote fair customer treatment by financial institutions and assist in maintaining financial stability.

Registrations

Financial conduct authority

Federal financial supervisory authority

Commissione nazionale per le società e la borsa

Autorité de contrôle prudential

Comisión nacional del mercado de valores

Directives and memberships

Mifid II

The european union’s markets in financial instruments (mifid II) directive 2014/65/EU provides a harmonised regulatory regime for the provision of investment services within the european economic area. The key objectives of the directive are to maximise efficiency, increase financial transparency, encourage competition and offer greater consumer protection. Mifid II allows investment firms to provide investment and ancillary services within the territory of another member state and/or a third country, provided that such services are covered by the investment firm’s authorisation.

Financial services compensation scheme (FSCS)

Tickmill UK ltd is a member of the financial services compensation scheme (FSCS). The FSCS is an independent compensation fund of last resort for customers of authorised UK financial services firms, set up under the financial services and markets act 2000. The FSCS’s objective is to pay compensation up to the value of £85,000 per client if a firm is unable or likely to be unable to pay claims against it in the event the firm has stopped trading or has declared to be in default.

Investor compensation fund (ICF)

Tickmill europe ltd is a member of the investor compensation fund (ICF). The ICF has been set up according to article 59(1) and (2) of law 144(Ι)/2007 as an investor compensation fund for CIF clients and its functions are regulated by the directive DI87-07 of cysec. The fund’s objective is to secure the claims of covered clients against the ICF members through the payment of compensation for any claims arising from the failure of a member of the fund to meet its obligations.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

ABOUT US

SUPPORT

Tickmill europe ltd is authorised and regulated by the cyprus securities and exchange commission – cysec (CIF licence number 278/15) and is a member of the investor compensation fund (ICF).

Tickmill europe ltd is registered with the UK financial conduct authority – FCA (registration number: 733772), the german federal financial supervisory authority – bafin (registration number: 146511), the french autorité de contrôle prudentiel et de résolution – ACPR (registration number 75473), the italian commissione nazionale per le società e la borsa – CONSOB (registration number 4310), the spanish comisión nacional de mercado de valores – CNVM (registration number: 4082).

Tickmill europe ltd is licenced to provide the investment services of reception and transmission of orders, execution of orders on behalf of clients, dealing on own account and portfolio management in relation to transferable securities, options, futures, SWAPS, forward rate agreements, financial contracts for difference (cfds) and other derivatives.

High risk warning: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading cfds with tickmill europe ltd. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks associated with trading contracts for difference (cfds) and seek advice from an independent adviser if you have any doubts. Please refer to the summary risk disclosure.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

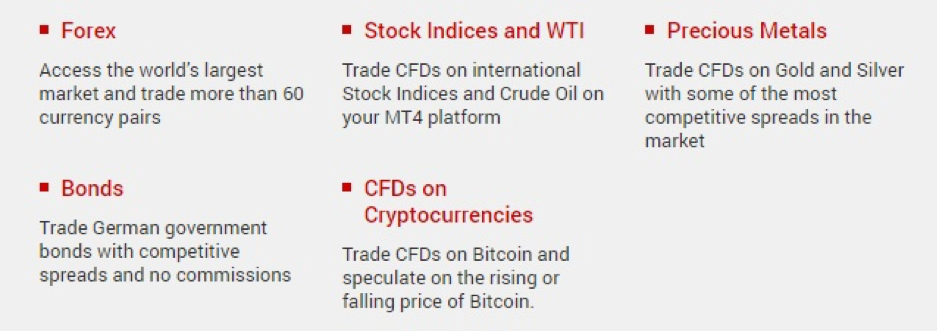

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

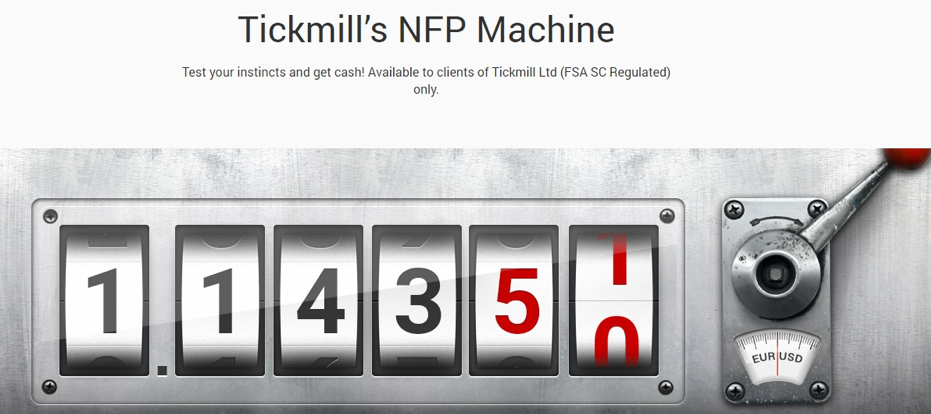

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

Tickmill reviews

286 • great

Write a review

Write a review

Reviews 286

Strugglling trader to find a reliable broker, just go for tickmill

In my case, this broker is best in terms of reliability, exacution speed, zero spread option account, prizes, withdrawals and deposits. It is just instance. From turkey, you might not find better broker among large companies as this. I highly recommend tickmill syc for especially traders from turkey who struggles to find reliable broker. By the way, I witdrawed my money using bank wire (direct bank transfer), it was in my bank account in one day. Thank you tickmill.

Easily claim for refund with mr joe…

Easily claim for refund with mr joe msgs on tele gram joeboss1limited reliable person

Please introduce MT5

I have been trade on tickmill flatform

I have been trade on tickmill flatform, its good, fast excution and low spread

All sense awesome :)

Very good.

Great I love it and I want it better…beutifull

Great I love it and I want it better than all the other one that I have experience

They clearly indicate that they have…

They clearly indicate that they have 0.1 pip spread for forex trading. They are lying. Spread are so wide that it’s impossible for those scalper and day trader and maybe swing trader as well to earn more despite all of your time and efforts and strategies and plans you’ve made. It seems that taking our money is their initial motive. Switch to other broker. This is useless.

All great so far

All great so far. Deposits cleared same day, customer support is excellent and fast while the most important trading experience is supreme as spreads are low and liquidity high even in some exotic pairs

Credit where credit's due.

5 months and.

No problem with deposit, withdraw or transfer between accounts.

No extraordinary spreads or mismatching price/movemens etc.

Great client support, fast feed backs for any kind of questions.

Looks like my last station for now..

Wonderfull broker

Wonderfull broker. Recomended 100%. After working 2 years with them. Couldnt find one issue with there systems attention or connection.

Well done.

Note: only need to add more bank account so they can support more banks arround the world

Tickmill review 2021

All reviews and top lists updated for 2021. Check out the annual brokerchooser awards.

🏆 top 5 stock brokers

🏆 top 5 forex brokers

Summary

Recommended for forex traders looking for low fees and prefer metatrader 4 platform

Tickmill is a global forex and CFD broker, established in 2014. The company is regulated by several financial authorities globally, including the top-tier financial conduct authority (FCA) in the united kingdom.

Tickmill is considered safe because it is regulated by the top-tier FCA.

Disclaimer: cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Tickmill pros and cons

Tickmill has low forex and non-trading fees. The account opening is fast, easy, and fully digital. You can use a lot of options for deposit or withdrawal, and they're free of charge.

On the negative side, tickmill has a limited product portfolio as it offers only forex and cfds. Popular asset classes, such as stocks and etfs are missing. Trading platforms are provided by metatrader, and they have outdated designs. Finally, the news feed is basic and not structured.

| Pros | cons |

|---|---|

| • low forex fees | • only forex and cfds |

| • fast and easy account opening | • trading platforms with outdated design |

| • free deposit and withdrawal | • basic news feeds |

| ��️ country of regulation | UK, cyprus, seychelles, south africa, malaysia |

| �� trading fees class | low |

| �� inactivity fee charged | no |

| �� withdrawal fee amount | $0 |

| �� minimum deposit | $100 |

| �� time to open an account | 1 day |

| �� deposit with bank card | available |

| �� depositing with electronic wallet | available |

| �� number of base currencies supported | 4 |

| �� demo account provided | yes |

| ��️ products offered | forex, CFD |

Author of this review

Author of this review

Ádám nasli

Everything you find on brokerchooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology

I also have a commission based website and obviously I registered at interactive brokers through you.

Especially the easy to understand fees table was great!

Tickmill review

fees

| pros | cons |

|---|---|

| • low forex fees | • average CFD fees |

| • no withdrawal fee | |

| • no inactivity fee |

| assets | fee level | fee terms |

|---|---|---|

| EURUSD | low | pro account pricing: €2 commission per trade per lot plus spread cost. 0.1 pips is the average spread cost during peak trading hours. |

| GBPUSD | low | pro account pricing: £2 commission per trade per lot plus spread cost. 0.3 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | low | the fees are built into the spread, 0.4 points is the average spread cost during peak trading hours. |

| Inactivity fee | low | no inactivity fee |

How we ranked fees

We ranked tickmill's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

To get things rolling, let's go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

Below you will find the most relevant fees of tickmill for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared tickmill's fees with those of two similar brokers we selected, axitrader and FXCM. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of tickmill alternatives.

To have a clear overview of tickmill, let's start with the trading fees.

Tickmill trading fees

Tickmill's trading fees are low. There are different cost structures for different account types. We tested the pro account, which charges a commission but offers tight spreads.

We know it's hard to compare trading fees for forex brokers. So how did we approach the problem of making their fees clear and comparable? We compare brokers by calculating all the fees of a typical trade for selected products.

We have chosen popular instruments in each asset class usually provided by the forex brokers:

- Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP

- Stock index cfds: SPX and EUSTX50

A typical trade means buying a leveraged product, holding it for one week and then selling. For the volume, we chose a $20,000 position for forex and a $2,000 position for stock index and stock CFD transactions. The leverage we used was:

- 30:1 for forex

- 20:1 for stock index cfds

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for tickmill fees.

Forex fees

Tickmill has low forex fees. The forex fees are one of the lowest among the brokers we have reviewed.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| EURUSD benchmark fee | $6.8 | $5.1 | $12.5 |

| GBPUSD benchmark fee | $5.0 | $4.3 | $5.6 |

| AUDUSD benchmark fee | $5.0 | $3.4 | $8.8 |

| EURCHF benchmark fee | $4.7 | $2.9 | $3.3 |

| EURGBP benchmark fee | $7.8 | $5.2 | $16.4 |

The low forex fees are mainly due to the low commission tickmill charges. The commission is 2 base currency units (first currency pair) per lot per trade. For example, it's €2 per lot per trade for EURUSD, while £2 per lot per trade for GBPUSD.

CFD fees

CFD fees are average.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| S&P 500 index CFD fee | $1.5 | $1.3 | $1.5 |

| europe 50 index CFD fee | $1.2 | $2.3 | $1.6 |

Non-trading fees

Tickmill has low non-trading fees. There is no fee for deposit, withdrawal, or inactivity.

| tickmill | axitrader | FXCM | |

|---|---|---|---|

| account fee | no | no | no |

| inactivity fee | no | no | yes |

| deposit fee | $0 | $0 | $0 |

| withdrawal fee | $0 | $0 | $0 |

Tickmill review

account opening

Can you open an account?

Open account

73% of retail CFD accounts lose money

Tickmill accepts clients from all over the world. There are only a few exceptions, e.G. Customers from the US or canada can't open an account.

What is the minimum deposit at tickmill?

The required minimum deposit at tickmill is $100 . For a VIP account, you need to maintain a minimum $50,000 balance.

Account types

Tickmill has several account types that differ in pricing, minimum deposit, and minimum account balance.

| pro | classic | VIP | |

|---|---|---|---|

| minimum deposit | $100 | $100 | - |

| minimum account balance | - | - | $50,000 |

| pricing | tight spread plus commission | wide spread, but no commission | tight spread plus commission |

| commission per $100,000 trade | $2 | no commission | $1 |

Retail clients of tickmill ltd can use leverage up to 1:500 while retail clients of tickmill UK ltd and tickmill europe ltd can use maximum leverage of 1:30. If you qualify for a professional trader, you can trade with higher leverage, up to 1:500 (tickmill UK ltd) or up to 1:300 (tickmill europe ltd).

The criteria for professional clients:

- An average frequency of 10 trades per quarter in the previous four quarters

- Size of your financial instrument portfolio exceeds €500k

- You have at least one year experience in a relevant financial position

You can also open corporate and swap-free islamic accounts. The main difference between islamic aand other accounts is that instead of daily swap rates, an administration fee is charged if you hold some exotic currencies for more than 3 nights.

How to open your account

Account opening is fully digital, fast and straightforward. You can fill out the online application form in a matter of minutes. Our account was verified within one day.

To open an account at tickmill, you have to go through these steps:

- 'choose your regulator' will determine whether you sign up for the tickmill site regulated by the UK, cyprus or the seychelles authority. We recommend going for the UK one or the EU one (cyprus) if available in your country

- Fill in your name, country of residence, email address and telephone number

- Add your personal information, such as your date of birth and address

- Select the base currency

- Provide your financial information and answer questions about your financial knowledge

- Select your account type: pro, classic or VIP

- Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency.

Spreads & swaps

Knowing the transaction costs associated with your trading

Trading costs

with ultimate transparency

Check out our typical spreads and swaps below.

What are forex spreads?

When you begin trading, you’ll notice that you’re given a ‘bid’ (or ‘sell’) price and an ‘ask’ (or ‘buy’) price. The ‘bid’ is the price at which you sell the base currency, and the ‘ask’ is the price at which you buy the base currency. The difference between these two prices is what we call the spread.

When a trade is opened, there are always third parties who facilitate the opening and closing of that trade, like a bank or a liquidity provider. These third parties must make sure that there is an orderly flow of buy and sell orders, which means that they have to find a buyer for every seller and vice versa.

The third party is accepting the risk of a loss while facilitating the trade, thus the reason the third party will retain a part of each trade – that retained part is called the spread!

How do you

calculate the spread?

How do you calculate your transaction cost?

To work out the cost of a trade itself (not including swaps, commissions etc.), you take the spread and pip value and multiply it by the number of lots that you’re trading:

trade cost = spread X trade size X pip value

For example:

A trade you have opened has 1.2 pips spread. In this example, you’re trading with mini lots which are 10,000 base units.

The pip value is at $1, so the transaction cost is $1.20

As you’ve probably gathered, the bigger the trade, the larger your transaction costs will be!

What are swaps?

Important swap/rollover rate facts

swap rates are applied at 00:00 platform time. Each currency pair has its own swap charge and is measured on a standard size of 1 lot (100,000 base units). Swaps are applied each night onto your open positions and when the position is left open it is given a new ‘value date’. On wednesday night however, the new value date for a trade held open is changed to monday. Due to this, swaps are charged at triple the rate. Check your swaps on your MT4 market watch panel. You simply right click, select ‘symbols’, select the instrument and then select ‘properties’.

START TRADING with tickmill

It's simple and fast to join!

REGISTER

Complete registration, log in to your client area and upload the required documents.

CREATE AN ACCOUNT

Once your documents are approved, create a live trading account.

MAKE A DEPOSIT

Select a payment method, fund your trading account and start trading.

TRADING INSTRUMENTS

TRADING CONDITIONS

Forex & cfds

TRADING ACCOUNTS

PLATFORMS

EDUCATION

TOOLS

PARTNERSHIPS

PROMOTIONS

ABOUT US

SUPPORT

Tickmill is the trading name of tickmill group of companies.

Tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus), tickmill south africa (pty) ltd, FSP 49464, regulated by the financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, address: 3, F28-F29 eden plaza, eden island, mahe, seychelles regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london EC2R 8DQ, england), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Clients must be at least 18 years old to use the services of tickmill.

High risk warning: trading contracts for difference (cfds) on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade contracts for difference (cfds), you should carefully consider your trading objectives, level of experience and risk appetite. It is possible for you to sustain losses that exceed your invested capital and therefore you should not deposit money that you cannot afford to lose. Please ensure you fully understand the risks and take appropriate care to manage your risk.

The site contains links to websites controlled or offered by third parties. Tickmill has not reviewed and hereby disclaims responsibility for any information or materials posted at any of the sites linked to this site. By creating a link to a third party website, tickmill does not endorse or recommend any products or services offered on that website. The information contained on this site is intended for information purposes only. Therefore, it should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it would be unlawful to make such an offer or solicitation, nor regarded as recommendation to buy, sell or otherwise deal with any particular currency or precious metal trade. If you are not sure about your local currency and spot metals trading regulations, then you should leave this site immediately.

You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade. Nothing in this site should be read or construed as constituting advice on the part of tickmill or any of its affiliates, directors, officers or employees.

The services of tickmill and the information on this site are not directed at citizens/residents of the united states, and are not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Tickmill reviews

286 • great

Write a review

Write a review

Reviews 286

Great with lowest spread compared to…

Great with lowest spread compared to other's brokers.

Tickmill is the best forex broker I've…

Tickmill is the best forex broker I've ever known. I really believe!

Best. We want traders to succeed

Changing my leverage from 500:1 to…bad history and will not recommend to any other traders

Changing my leverage from 500:1 to 100:1 during my period of trading is not acceptable .Refusing to transfer my money to my visa and bank account even after return the original amount to the initial deposit method which was skrill is not professional way to deal with trader .Nothing in the terms and conditions tell this at all in the web site. I draw all my money and working with other broker who respect and full fill my trading needs

I am not satisfied with WTI changes of…

I am not satisfied with WTI changes of contract. Almost all other brokers I collaborate with, the price for WTI is 40-42 . Your price is 16. You closed possibilities to buy or sell it. You have really large swap for long positions. All these facts are disappointing me. I am still working with you, but if I will get few more negative situations which depends on you, than I will stop collaboration probably with you same like investors which gave me accounts for managing.

This is the most professional

This is the most professional, most user friendly, most supportive brokers I've ever invested in.

Great broker

Great broker

fast funding & withdrawal

Reliable and fast broker

Reliable and fast broker. I've been trading with tickmill for more than 3 years with 100% satisfaction.

Best broker for me

Best broker for me. Very fast and no requotes. Reliable and proven.

Faced no problem so far trading with…

Faced no problem so far trading with them since more than 6 months. The only bad thing for me was that their withdrawal is not automatic, other than that, it's perfect.

Decent broker to trade with

Decent broker to trade with, lots of instruments to trade and multiple deposit options.

I sent my ID and my proof of residence

I sent my ID and my proof of residence. The ID was approved but not the proof of residence. Why? All you want is the address to match the ID, it's my bank statement, do you want to see my personal business too?

As a regulator broker, tickmill follows strict procedures with our KYC documents.

If you need any clarifications or further assistance, do not hesitate to contact our support team.

One of broker that I prefer to use

Strong points : strong regulation / tight spread / trust brand

feedback for improve - more instrument to trade, and cent accounts for grid's strategy

I have been using tickmill since 2017.

I have been using tickmill since 2017.. Their execution speed never dissapoint me. All my withdrawal requests were done, not fast but still processed under 24 hours. I hope they can make it faster in the future.

Very honest broker

My friend say me try this broker for low spreads and I expected I must big deposit to have low spread but they say me I can start with small deposit. I tryed tickmill and thought they have low spread but hi commission, old broker trick..Hahah. But I saw they ggive me low spread, low commission and even no swap charge. It was very big surprise and I said to all my friends. I give 5 stars because honest broker and they give what they promise. And their manager omar always helping my account so I have answers for my questins very fast.

Мощная платформа для форекса и фондовых рынков

Успешный трейдинг на финансовых рынках начинается с удобной и функциональной торговой платформы. И metatrader 5 — это лучший выбор для современного трейдера!

Metatrader 5 — это институциональная мультирыночная платформа для торговли, технического анализа, использования автоматических торговых систем (торговых роботов) и копирования торговых сделок других трейдеров. С metatrader 5 вы можете торговать на валютном рынке (форекс, forex), фондовых биржах и фьючерсами (futures) одновременно.

Встроенный metatrader market — лучшее место, чтобы купить или арендовать торгового робота и технический индикатор

Подпишитесь на сигнал успешного трейдера, и пусть ваша платформа торгует за вас!

Торгуйте на финансовых рынках в режиме 24/5 при помощи смартфона или планшета

Заказывайте торговых роботов и технические индикаторы у опытных программистов за разумную плату

Арендуйте виртуальный хостинг для бесперебойной работы ваших роботов и подписок на торговые сигналы

Торгуйте на финансовых рынках через любой браузер в windows, mac OS X и linux

Metatrader 5 даст вам свободу передвижения — вы больше не привязаны к настольному компьютеру и можете полноценно торговать при помощи смартфонов и планшетных компьютеров. Веб-платформа — дарит еще больше свободы и позволяет работать из любого веб-браузера на любом устройстве. Выбирайте наиболее удобный способ — теперь у вас множество альтернатив, чтобы оставаться на рынке 24 часа в сутки!

Дополнительные сервисы делают широкие возможности платформы поистине безграничными. В metatrader 5 встроены маркет торговых роботов, биржа разработчиков торговых стратегий, сервис копирования сделок других трейдеров и аренда виртуальной платформы (форексный VPS). Используйте их все, чтобы получить запредельные возможности в трейдинге!

Благодаря всем преимуществам metatrader 5 выбрали миллионы пользователей со всего мира. Специально для них мы создали крупнейшее сообщество трейдеров и приглашаем вас тоже присоединиться к MQL5.Community. Там вы сможете: бесплатно скачать тысячи торговых роботов, подписаться на торговые сигналы других трейдеров, обсудить перспективные торговые стратегии и многое другое.

Присоединяйтесь и вы узнаете, насколько много у вас единомышленников!

Скачайте metatrader 5 и убедитесь в этом сами!

Новости

Выбирайте самостоятельно, как будет выглядеть окно котировок в вашей торговой платформе — с обновлением build 2755 в разделе появилось несколько новых настроек, которые сделают работу с metatrader еще удобнее.

Виртуальный хостинг metatrader — это сервис, который помогает вашим роботам и подпискам на сигналы работать круглосуточно даже при выключенном компьютере. Арендовать виртуальный сервер (virtual private server, VPS) можно прямо из платформы metatrader. Наш хостинг удобнее и проще обычных VPS, потому что создан специально для трейдеров.

Запуск платформы metatrader 5 от squaredfinancial совпал с добавлением фьючерсов и акций в линейку финансовых продуктов компании. Новые инструменты включают в себя индекс VIX, золото, нефть марок brent и WTI, а также акции разных компаний — от louis vuitton до amazon.

So, let's see, what was the most valuable thing of this article: tickmill log in pilih badan kawalan selia anda anggaran masa untuk menyelesaikan pendaftaran anda adalah 3 minit sila lengkapkan borang berikut menggunakan huruf latin sahaja © 2015-2021 at tickmill log in

Contents of the article

- Free forex bonuses

- Tickmill log in

- Spreads & swaps

- Trading costs with...

- What are forex spreads?

- How do you calculate the...

- How do you calculate your transaction...

- What are swaps?

- Important swap/rollover rate...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill group licenses& regulation

- Group licenses

- Cyprus securities and exchange commission (cysec)

- Seychelles financial services authority (FSA)

- Financial conduct authority (FCA)

- Labuan financial services authority (labuan FSA)

- Financial sector conduct authority (FSCA)

- Registrations

- Financial conduct authority

- Federal financial supervisory authority

- Commissione nazionale per le società e la borsa

- Autorité de contrôle prudential

- Comisión nacional del mercado de valores

- Directives and memberships

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

- Tickmill reviews

- 286 • great

- Write a review

- Write a review

- Reviews 286

- Strugglling trader to find a reliable broker,...

- Easily claim for refund with mr joe…

- Please introduce MT5

- I have been trade on tickmill flatform

- All sense awesome :)

- Very good.

- Great I love it and I want it better…beutifull

- They clearly indicate that they have…

- All great so far

- Credit where credit's due.

- Wonderfull broker

- Tickmill review 2021

- Summary

- Tickmill review fees

- Tickmill review account opening

- Can you open an account?

- What is the minimum deposit at tickmill?

- Account types

- How to open your account

- Spreads & swaps

- Trading costs with...

- What are forex spreads?

- How do you calculate the...

- How do you calculate your transaction...

- What are swaps?

- Important swap/rollover rate...

- START TRADING with tickmill

- It's simple and fast to join!

- REGISTER

- CREATE AN ACCOUNT

- MAKE A DEPOSIT

- TRADING INSTRUMENTS

- TRADING CONDITIONS

- Forex & cfds

- TRADING ACCOUNTS

- PLATFORMS

- EDUCATION

- TOOLS

- PARTNERSHIPS

- PROMOTIONS

- ABOUT US

- SUPPORT

- It's simple and fast to join!

- Tickmill reviews

- 286 • great

- Write a review

- Write a review

- Reviews 286

- Great with lowest spread compared to…

- Tickmill is the best forex broker I've…

- Changing my leverage from 500:1 to…bad history...

- I am not satisfied with WTI changes of…

- This is the most professional

- Great broker

- Reliable and fast broker

- Best broker for me

- Faced no problem so far trading with…

- Decent broker to trade with

- I sent my ID and my proof of residence

- One of broker that I prefer to use

- I have been using tickmill since 2017.

- Very honest broker

- Мощная платформа для форекса и фондовых рынков

- Скачайте metatrader 5 и убедитесь в этом сами!

- Новости

No comments:

Post a Comment