Opening a trade with $100 and a leverage of 20 will equate to $2,000 investment

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Free forex bonuses

You’ve lost 88% of your capital.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

Leverage trading – what is it and how does it work?

Trading on financial leverage can significantly increase your profit margins without having to put down a massive initial capital. But first, you need to know what you’re doing. As warren buffett famously said, “when you combine ignorance and leverage, you get some pretty interesting results.” in this article, we will take a closer look at leverage trading, how it works, and how you can use it as part of your trading strategy.

What is leverage trading?

In physics, leverage provides a mechanical advantage by amplifying a small input force to achieve greater output. Financial leverage follows the same principle. In this case, however, it amplifies an investor’s buying power in the market.

Also known as margin trading, leverage trading refers to the use of borrowed capital to get a much higher potential return on your investment. This allows you to open positions that are significantly larger than what your original capital would otherwise allow.

The idea here is to use that additional capital to buy more contracts of an asset, expecting that the position’s returns will be greater than the cost of borrowing. But just as leverage can increase potential rewards, it also raises risk exposure. Hence it is mainly experienced traders who use it.

Leverage can also refer to the amount of debt a company uses to expand its asset base and finance capital-intensive purchases. For example, instead of issuing new stocks to raise capital, the company can use debt to acquire more assets and improve their business operations.

Terms you should know about when it comes to leverage trading

- Buying power – this is the amount you have available (plus leverage) to buy the securities.

- Coverage – this is the ratio of the net balance in your trading account compared to the leveraged amount.

- Margin – this is the amount required by your broker to cover possible losses should the trade become unfavorable. It is one of the pillars of leverage trading.

- Margin calls – the broker or financial intermediary will issue a margin call if your trading account balance falls below a specified minimum requirement. It’s basically a warning that your position is exposed to a risk level that the broker cannot accept. You’ll then need to add more funds to your account to meet that minimum required amount. Alternatively, you could close off your trading position and face your accrued losses.

- Open position – this means you’ve opened a trade and have not yet closed it out with an opposing trade. Let’s say you own 1,000 shares of amazon stock. This means you have an open position in amazon stocks until you close it out.

- Close position – this just means the value of your investment at the time you closed it. Say you opened a position at $20, and it rose to $25. You close the position at $25 to realize your profit of $5 on the trade.

- Stop-loss – this helps limit risk exposure on a trade by automatically closing a position based on certain parameters. If the trade goes below a specified price level, it triggers the stop-loss, which automatically closes the position in order to limit further losses.

How does leverage trading work?

You can trade on leverage through your broker. Think of it as getting a loan to purchase an asset. You have your initial capital and the broker finances the bulk of the position’s whole purchase price. Any difference between how much you purchased the asset for (opening price) and how much you sold it for (closing price) is settled in your account balance.

If you have significant leverage and the asset appreciated greatly in value, then the amount owed to the broker is taken out of your profits on that trade. However, if the trade went south and you ended up with a loss on your hands, the amount owed is taken out of what is left in your account.

For this reason, leverage trading facilities are not readily available to every trader. The amount that a broker will be willing to finance will depend on a number of factors. These include how much leverage the trader needs and the current regulations covering online trading in that jurisdiction.

Leverage ratio

Financial leverage is always shown as a ratio between the total assets and equity. Total assets refer to the sum of the debt or loan amount and your equity or capital. The equity or capital is basically the cash you deposit into your brokerage account. This is the formula:

Financial leverage = total assets / equity = (equity + debt) / equity

Some brokers allow traders to use a leverage of up to 100:1 or even more. At least in the forex markets. In this instance, this means that you can leverage your trading position up to 100 times.

Let’s say you have $2,000; this is your equity or capital. If your broker allowed leverage of 100:1, you can expose yourself to a position of $200,000 in the market ($2,000 x 100), with just $2,000. Your broker will effectively allow you to borrow $198,000 for the position. Any profit or loss will be magnified by 100 times.

Some brokers offer negative balance protection. This essentially stops you out before your trading account hits negative in the event of a loss. Without this protection feature, you could end up owing money to the broker. This could happen if the position loss turns out greater than the capital you initially invested.

Which assets can have financial leverage?

You can apply leverage trading to several financial instruments including stocks, FOREX, commodities, futures, options, etfs, indices, and even cryptocurrencies. Financial leverage is also used when buying real estate. Your mortgage is the debt in the financial leverage formula. Your downpayment is the equity in the formula.

Each asset class has its maximum leverage limitations in line with market regulations, as well as the broker’s own efforts in promoting leverage trading on their platform.

Examples of trading with leverage

In the leverage ratio example above, we looked at how a 100:1 ratio with an initial $2,000 can allow you to control $200,000 worth of an asset or currency. Let’s take it from the very beginning and see how much profit or loss you make with and without financial leverage.

Let’s assume you decide to buy the asset or currency at a price of $10 per unit. During the day, the price goes up to $10.50 and you close the position. What would be the results of your trade?

- Without leverage — the asset gained $0.50 and for $2,000 you bought 200 shares. Your total profit in this case is $100 ($0.50 x 200).

- With leverage: you applied leverage of 100:1 to your investment, which means bought 20,000 shares. Your total profit on the trade becomes $10,000 ($0.50 x 20,000).

That’s just a glimpse of how much profit you can make from the same $2,000. Of course, this is only a general overview of how leverage trading works. The actual process will differ depending on the market and the type of security being traded. Let’s look at a few specific scenarios.

Trading with leverage in the stock market

Take a look at this snapshot of tesla stock.

As you can see, the trading day opened at just over $440. But then the price went down to $438.58. Let’s say you decide to open a position for 100 shares. You’ll need to have at least $43,858 in your trading account to execute the order.

It turns out that the trading day closed at $442.59, meaning you would have made a profit of (442.59 – 438.58) x 100 = $401. But considering you just put up $43,858, the return does not seem that significant.

If you executed the trade using leverage, you’d need to put up much less to earn that same $401 profit. If the brokerage allowed for 3:1 leverage, you would be able to earn the same amount with only 43,858 / 3 = $14,619.33 of your own capital.

The profit is the same in both cases since you bought the same number of shares. But because of your financial leverage, you were able to get it with much less capital invested.

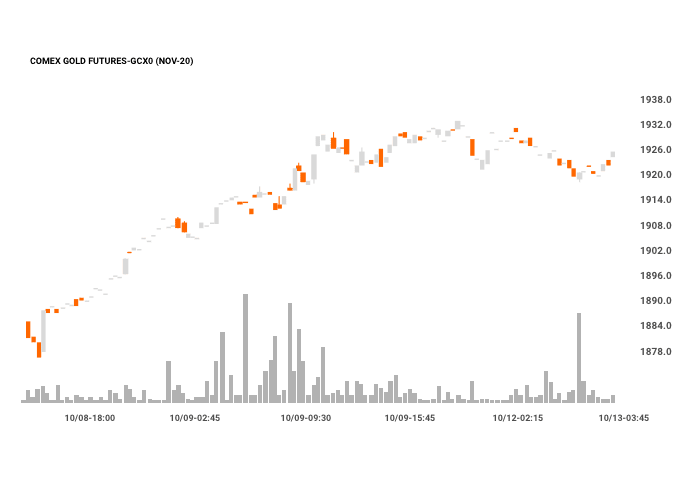

Leverage trading in futures

Gold futures contract specs

| contract unit | 100 troy ounces |

| price quotation | USD per troy ounce |

| trading hours | CME globex: sunday – friday 6:00 p.M. – 5:00 p.M. (5:00 p.M. – 4:00 p.M./CT) with a 60 minute break each day from 5:00 pm (4:00 p.M. CT) CME clearport: asia: sunday – friday 6:00 p.M. ET – 3:30 p.M. China london a.M.: sunday – friday 6:00 p.M. ET – 10:32 p.M. London london p.M.: sunday – friday 6:00 p.M. ET – 3:02 p.M. London |

| minimum price fluctiation | outright: 0.10 per troy ounce = $10.00 |

| product code | CME globex: GC CME clearport: GC clearing: GC TAS: GCT TAM: “GCD”,”GC7″ |

| listed contracts | monthly contracts listed for 3 consecutive months, any feb, apr, aug, oct in the nearest 23 months and any jun and dec in the nearest 72 months |

| settlement method | deliverable |

| termination of trading | trading terminates at 12:30 p.M. CT on the third last business day of the contract month. |

| Trade at market or trade at settlement of trading | TAS table |

| settlement procedures | gold settlement procedures |

| position limits | COMEX position limits |

Let’s assume that you are bullish on the value of gold. If your prediction is correct, buying a gold futures contract would allow you to realize a healthy profit.

CME offers a standard gold futures contract with a unit value of 100 troy ounces. Assuming the futures price of gold is $1,925 per ounce, purchasing the contract lets you own 100 ounces of gold for $192,500.

Most investment vehicles would require you to deposit the full amount ($192,500) before taking ownership of the gold. But with leveraged trading, you will only need to put up between 3% to 12% of the contract’s value.

Let’s say the broker allows a 10% margin requirement, then you only need $19,250 to get exposure to $192,500 worth of gold.

Leverage trading in forex

With over $5 trillion worth of currency being traded every day, the forex market is the world’s largest financial market. This extensive liquidity means most brokers are willing to offer leverage ratios as high as 100:1. Some might even offer higher leverage since it’s so much easier to open and close positions.

In forex trading, we measure currency movements in pips. These represent changes in fractions of a cent. For example, if the GBP/USD pair moves 100 pips from 1.8900 to 1.9000, it just means the exchange rate moved by 1 cent.

Because of these tiny movements, forex transactions are usually carried out in huge volumes so that these fractional pip changes can translate to greater profits.

With this, you can already see how leverage trading can impact forex. If you can potentially control an investment worth $100,000 with just $1,000, you have the potential to get phenomenal profit. But remember to also consider what would happen if the trade results in a heavy loss.

What is the difference between leverage and margin?

Although closely interconnected, leverage and margin are not the same. Financial leverage means you’re taking on debt to boost your buying power. You do this because you believe the asset or security you’re buying will bring in more profit than the original cost of the debt.

On the other hand, the margin is the amount of capital you need to create and maintain leverage. Similar to a downpayment before you can access a loan. If your account balance falls below a predetermined level during the trade, you will incur a margin call.

What determines how much leverage you can get with your margin account? The list includes the security you want to trade, your trading account balance, your trading expertise, and the broker’s leverage policy.

Pros and cons of using financial leverage

- Amplified buying power to purchase more units with only a fraction of the actual cost.

- Potential for higher profit on each trade.

- It can reduce nonsystematic risk since you only need a small percentage to control a large position of diversified assets.

- Amplified risk exposure. Even with the ability to set up stop-losses, leveraged trading carries significant risk.

- Losses sustained while trading with financial leverage are usually way more than would have incurred if you didn’t trade on leverage at all.

How to make the most out of trading with leverage

Because of the risks, leverage trading is more suitable for traders with experience. Still, if you’re looking to try it, here are some tips that might help:

Know your financial situation

Work out how much of a loss you’re willing and able to incur on a trade based on your financial situation. Start small and work your way up taking on only leverage ratios that you can firmly manage.

Do a detailed analysis before opening your position

It seems obvious but there is no room for guesswork when it comes to trading with leverage. Use a mix of leading and lagging technical indicators to determine and confirm price movement before opening a position.

Stop-loss is a must

Outside of your trading experience, applying a stop-loss order to your open positions is the first practical measure to minimize the risks associated with leverage trading.

Set up a take profit order

If a stop-loss is your defense, a take-profit order is your attack. This tool automatically closes out your position once it has hit the profit target you set.

Final thoughts

Leverage trading is one of the most powerful tools available to traders and investors who are looking for huge returns. But like any tool, it all depends on the experience and expertise of the one wielding it.

In the right hands, financial leverage can drastically amplify returns; but in the wrong hands, it can wreak havoc and result in a dreaded margin call.

In any case, constantly educating yourself on best practices is the key. Over time, you can start trying out trading with leverage using all sorts of financial instruments, and start developing your own unique trading strategies.

Guide to leverage

Guide to leverage

What is leverage in trading?

Leveraged trading is a powerful tool for CFD traders. It can help investors to maximise returns on even small price changes, to grow their capital exponentially, and increase their exposure to their desired markets. But it is worth noting that leverage can work for or against you. While you stand to earn magnified profits when asset prices go your way, you also suffer amplified losses when prices move against you

When you are trading with leverage, you put a ‘small amount’ down, but you get the chance to control a much larger trade position in the market. The small amount is what is referred to as ‘margin’. The amount of leverage a broker offers depends on the regulatory conditions that it complies with, in any/all of the jurisdictions it is allowed to offer trading services in.

With leveraged trading, the trader need only invest a certain percentage of the whole position. This can change depending on how much leverage the broker offers, how much leverage the trader would like to implement, and it also relies heavily on the regulatory authorities which are tasked with overseeing the online trading industry in that jurisdiction.

Also, traders use leverage depending on their level of experience, investing goals, their appetite for risk, as well as the underlying market they are trading. In most cases, it is professional traders that tend to use leverage more aggressively, whereas new and less experienced traders are generally advised to use leverage with caution. Also, conservative traders will tend to use the minimum level of leverage possible, whereas traders with a high appetite for risk can use leverage flexibly.

The type of market traded can also dictate the amount of leverage traders can use. Volatile markets, such as gold and bitcoin, should be traded with minimal leverage, whereas less volatile assets that do not post wide price fluctuations, such as the EURCHF pair, can be traded with higher leverage levels.

The leverage ratio is a representation of the position value in relation to the investment amount required. At avatrade, forex traders can trade with a leverage of up to . This however, varies depending on your jurisdiction as well as the asset class you are trading.

Consider this: with leverage of 400:1; you can control a $100,000 trade position in the market with just $250! This would mean that a 1% positive price change in the market will result in a profit of $1,000 (1% of $100,000). Without leverage, a 1% positive price movement will result in a profit of only $2.5 (1% of $250). This means that your trade positions and the resulting profits/losses are multiplied 400 times. This is why it is often stated that leverage is a double-edged sword. With trading leverage, profits are magnified, but losses can equally be devastating.

When trading with high leverage, it is very easy to lose more than your capital. But at avatrade, we offer guaranteed negative balance protection which means that you can never lose more than you have in your trading account balance.

What is margin trading?

As explained above, ‘margin’ is the amount of money a broker allows a trader to put down to trade a much bigger position in the market. It is essentially a security deposit held by the broker. When holding trading positions, price changes in the market will lead to changing margin conditions as well. On most platforms, information on the varying margin conditions will be displayed in your trading account. Here are what the various margin definitions and other terminologies mean:

- Account balance

This is the total amount available in your account as your trading capital. It is essentially your trading bankroll.

- Margin requirement

This is what we have discussed above as the amount your broker requires you to put down as a ‘security deposit’ to control a trade position in the market. It is often expressed as a percentage. For instance, if you use a leverage level of 100:1, your margin requirement is 1%. If you use leverage of 400:1, your margin requirement is 0.25%.

- Used margin

This is the amount of money held as ‘security’ by your broker so that you can keep your open trade positions running. The money is still theoretically yours, but you can only access it after the open positions are closed.

- Usable margin

This is the money in your trading account available for opening new trade positions in the market.

- Margin call

A margin call is a notification by your broker that your margin level has fallen below the required level. This is a dreaded call (notification) for traders. A margin call occurs when losses of an open trade position exceed (or are about to exceed) your used margin. When you receive a margin call, you are essentially being asked to add more funds to your trading account to sustain open trades, failing which the broker will proceed to automatically close the open position. For instance, a margin call level of 20% means that your broker will send the margin call notification when your open trades have sustained losses of over 80% of your account balance.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Pros and cons of leveraged trading

Pros of leverage

- Boosts capital. Leverage boosts the capital available to invest in various markets. For instance, with a 100:1 leverage, you effectively have control of $100,000 in trading capital with only $1,000. This means that you can allocate meaningful amounts to various trade positions in your portfolio.

- Interest-free loan. Leverage is essentially a loan provided by your broker to allow you to take a bigger position in the market. However, this ‘loan’ does not come with any obligations in the form of interest or commission and you can utilise it in any manner that you wish when trading.

- Magnified profits. Leveraged trading allows traders to earn magnified profits from trades that go in their favour. Profits are earned out of the trade position controlled and not the margin put down. This also means that traders can earn substantial profits even if underlying assets make marginal price movements.

- Mitigating against low volatility. Price changes in the markets usually occur in cycles of high and low volatility. Most traders like trading highly volatile markets because money is made out of price movements. This means that periods of low volatility can be particularly frustrating for traders because of the little price action that occurs. Thankfully, with leveraged trading, traders can potentially bank bigger profits even during these seemingly ‘dull’ moments of low volatility.

- Trading premium markets. Leverage makes it possible for traders to trade instruments that are considered to be more expensive or prestigious. Some instruments are priced at a premium and this can lock out many retail investors. But with leverage, such markets or assets can be traded and expose the average retail investor to the many trading opportunities they present.

Cons of leverage

- Amplified losses. The biggest risk when trading with leverage is that, like profit, losses are also amplified when the market goes against you. Leverage may require minimal capital outlay, but because trading results are based on the total position size you are controlling, losses can be substantial.

- Margin call risk. The dreaded ‘margin call’ from your broker occurs when floating losses surpass your used margin. Because leverage amplifies losses, there will always be an ever-present ‘margin call’ risk when you have open trading positions in the fast and dynamic financial markets.

Example of leverage trading – retail clients

Let’s look at another example, this time with gold. The price of one troy ounce of gold is $1,327. The trader believes the price is going rise and wishes to open a large buying position for 10 units.

The full price for this position will be $13,270, which is not only a large amount to risk, but many traders do not possess such amounts.

With a 20:1 leverage offered by avatrade, or a 5.00% margin, the amount will decrease substantially. Meaning that for every $20 of worth in the position, the trader will need to invest $1 out of his account, which comes to $663.5 only.

Open your leveraged trading account at avatrade or try our risk-free demo account!

Margin call – how it works

In order to employ leverage, a trader must have sufficient funds in his account to cover possible losses. Each broker has different requirements. Avatrade requires a retail trader to possess equity of at least 50% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270; for both metatrader 4 and FX options trading accounts. With leverage, the trader invests $663.5 of his capital, and if he has 50% of this used margin in equity, i.E. $331.75, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 50% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s position(s), in a “margin call”.

On avaoptions all the client’s positions will be closed, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 50% of the used margin.

Example of leverage trading – pro/non EU clients

In this example, we’ll take the price of one troy ounce of gold at $1,327. The trader believes the price is going to rise and wishes to open a large buying position for 10 units. The full price for this position would be $13,270, which is not only a large amount to risk, but many traders may not possess such amounts. Using the 200:1 leverage offered by avatrade, or a 0.50% margin, the amount will decrease substantially. Meaning that for every $200 of worth in the position, the trader will need to invest $1 out of his account, which comes to just $66.35.

Margin call – pro/non EU clients

In order to employ leverage, a trader needs to have sufficient funds in his account to cover possible losses. Each broker has different requirements, and avatrade requires a pro/non – EU trader to possess equity of at least 10% of his used margin for metatrader 4 and avaoptions accounts.

Going back to the example above, the position’s original value is $13,270 for both metatrader 4 and FX options trading accounts.

With leverage the trader invests $66.35 of his capital, and if he has 10% of this used margin in equity, i.E. $6.64, his positions will be kept opened.

If, however, the trader has losses and his equity drops below 10% of used margin on metatrader 4 and avaoptions accounts, the broker will shut down the client’s positions.

On avaoptions all the client’s positions will be closed simultaneously, while metatrader 4 will shut down the largest losing position first, and will continue to close positions until the equity level returns above 10% of the used margin.

Leverage trading with avatrade

Avatrade offers many instruments, and each has a different leverage available which can also change based on the trading platform you choose to work with. It is important to make sure you know the available leverage before you start trading.

In order to avoid a margin call always make sure you have enough equity in your account’s balance so you can continue your trades undisturbed.

Finally, it’s worth trying out our avaprotect feature. It is a risk management tool that protects your open positionsif you set it up before you open the trade.

It lasts as long as you want it to, and if your trade is losing upon expiry, you will get all the money back into your account, minus the fee you paid for the avaprotect™ facility.

Leverage main faqs

Because avatrade uses a 50% margin requirement and the use of the margin call your risk of excessive trading losses that exceed the total balance of your account is minimized, but it is not eliminated completely. During a period of extreme volatility, it is possible that a position could move so rapidly against you that it is not possible to liquidate a losing position in time to keep your account balance from going negative. To avoid this, we strongly recommend that you manage your use of leverage wisely.

While leverage and margin are closely interconnected, they are not the same thing. Both do involve borrowing in order to trade in the financial markets, however leverage refers to the act of taking on debt, while margin is the actual money or debt that the trader has taken on to invest in financial markets. So, leverage is referred to as a ration, such as 1:30 or 1:100, which indicates how much debt can be taken on to open a position, while margin is referred to as the actual amount borrowed to create the leverage. For example, with 1:100 leverage you can control $100 of an asset with only $1 in margin.

Leverage is a very complex financial tool and should be respected as such. While it sounds fantastic in theory, the reality can be quite different once traders come to realize that leverage doesn’t only magnify gains, but it also magnifies losses. Any trade using leverage that moves against the trader is going to create a loss that is much larger than it would have been without the use of leverage. This is why caution is recommended until more experience with leverage is gained. This can lead to a longer and more prosperous trading career.

Open your leveraged trading account at avatrade or try our risk-free demo account!

We recommend you to visit our trading for beginners section for more articles on how to trade forex and cfds.

How to calculate leverage, margin, and pip values in forex

Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses.

Important note! The exchange rates used in this article are for illustrative purposes, so the exchange rates themselves are not updated, since it serves no pedagogical purpose. Foreign exchange rates vary continuously, so current exchange rates may deviate largely from what is presented here. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change.

Leverage and margin

Most forex brokers allow a very high leverage ratio, or, to put it differently, have very low margin requirements. This is why profits and losses vary greatly in forex trading even though currency prices do not change all that much — certainly not like stocks. Stocks can double or triple in price, or fall to zero; currency never does. Because currency prices do not vary substantially, much lower margin requirements are less risky than it would be for stocks. Note, however, that there is considerable risk in forex trading, so you may be subject to margin calls when currency exchange rates change rapidly.

The margin in a forex account is often called a performance bond, because it is not borrowed money but only the equity needed to ensure that you can cover your losses. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Thus, no interest is charged for using leverage. So if you buy $100,000 worth of currency, you are not depositing $2,000 and borrowing $98,000 for the purchase. The $2,000 is to cover your losses. Thus, buying or selling currency is like buying or selling futures rather than stocks.

The margin requirement can be met not only with money, but also with profitable open positions. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions.

Total equity = cash + open position profits - open position losses

Your total equity determines how much margin you have left, and if you have open positions, total equity will vary continuously as market prices change. Thus, it is never wise to use 100% of your margin for trades — otherwise, you may be subject to a margin call. Instead of a margin call, the broker may simply close out your largest money-losing positions until the required margin has been restored.

Leverage = 1/margin = 100/margin percentage

To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left.

To calculate the margin for a given trade:

Margin requirement = current price × units traded × margin

Example: calculating margin requirements for a trade and the remaining account equity

Required margin = 100,000 × 1.35 × 0.02 = $2,700.00 USD.

Before this purchase, you had $3,000 in your account. How many more euros could you buy?

Remaining equity = $3,000 - $2,700 = $300

Since your leverage is 50 , you can buy an additional $15,000 ( $300 × 50 ) worth of euros:

To verify, note that if you had used all of your margin in your initial purchase, then, since $3,000 gives you $150,000 of buying power:

Total euros purchased with $150,000 USD = 150,000 / 1.35 ≈ 111,111 EUR

Pip values

Because the quote currency of a currency pair is the quoted price (hence, the name), the value of the pip is in the quote currency. So, for instance, for EUR/USD, the pip = 0.0001 USD, but for USD/EUR, the pip = 0.0001 euro. If the conversion rate for euros to dollars is 1.35, then a euro pip = 0.000135 dollars.

Converting profits and losses in pips to native currency

To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency.

When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. This yields the total pip difference between the opening and closing transaction.

If the pip value is in your native currency, then no further calculations are needed to find your profit or loss, but if the pip value is not in your native currency, then it must be converted. There are several ways to convert your profit or loss from the quote currency to your native currency. If you have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate.

Example: converting CAD pip values to USD

100,000 CAD × 200 pips = 20,000,000 pips total. Since 20,000,000 pips = 2,000 canadian dollars , your profit in USD is 2,000 / 1.1 = 1,818.18 USD.

However, if you have a quote for CAD/USD , which = 1/ 1.1 = 0.90909 , then your profit is calculated thus: 2000 × 0.90909 = 1,818.18 USD, the same result obtained above.

For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. To find that rate, you would look at the quote for the USD/pip currency pair, then multiply the pip value by this rate, or if you only have the quote for the pip currency/USD, then you divide by the rate.

Example: calculating profits for a cross currency pair

You buy 100,000 units of EUR/JPY = 164.09 and sell when EUR/JPY = 164.10 , and USD/JPY = 121.35 .

Profit in JPY pips = 164.10 – 164.09 = .01 yen = 1 pip (remember the yen exception: 1 JPY pip = .01 yen .)

Total profit in JPY pips = 1 × 100,000 = 100,000 pips .

Total profit in yen = 100,000 pips / 100 = 1,000 yen

Because you only have the quote for USD/JPY = 121.35 , to get profit in USD, you divide by the quote currency's conversion rate:

Total profit in USD = 1,000 / 121.35 = 8.24 USD.

If you only have this quote, JPY/USD = 0.00824 , equivalent to USD/JPY = 121.35 , the following formula converts pips in yen to domestic currency:

Total profit in USD = 1,000 × 0.00824 = 8.24 USD.

How leverage is used in forex trading

Leverage is widely used throughout the global markets, not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange or forex.

Forex trading by retail investors has grown significantly in recent years, thanks to the proliferation of online trading platforms and the availability of cheap credit. The use of leverage in trading is often likened to a double-edged sword since it magnifies both gains and losses. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. The examples in the next section illustrate how leverage magnifies returns for both profitable and unprofitable trades.

Examples of forex leverage

Let’s assume that you are an investor based in the U.S. And have an account with an online forex broker. Your broker provides the maximum leverage permissible in the U.S. On major currency pairs of 50:1, which means that for every dollar you put up, you can trade $50 of a major currency. You put up $5,000 as margin, which is the collateral or equity in your trading account. This implies that you can initially place a maximum of $250,000 ($5,000 x 50) in currency trading positions. This amount will obviously fluctuate depending on the profits or losses that you generate (note: this and the examples below are gross of commissions, interest, and other charges).

Example 1: long USD / short euro. Trade amount = EUR 100,000

Assume you initiated the above trade when the exchange rate was EUR 1 = USD 1.3600 (EUR/USD = 1.36), as you are bearish on the european currency and expect it to decline in the near term.

Leverage: your leverage in this trade is just over 27:1 (USD 136,000 / USD 5,000 = 27.2).

Pip value: since the euro is quoted to four places after the decimal, each “pip” or basis point move in the euro is equal to 1 / 100 th of 1% or 0.01% of the amount traded of the base currency. The value of each pip is expressed in USD, since this is the counter currency or quote currency. In this case, based on the currency amount traded of €100,000, each pip is worth $10. (if the amount traded was €1 million versus the USD, each pip would be worth $100.)

Stop-loss: as you are testing the waters with regard to forex trading, you set a tight stop-loss of 50 pips on your long USD / short EUR position. This means that if the stop-loss is triggered, your maximum loss is $500.

Profit / loss: fortunately, you have beginner’s luck, and the euro falls to a level of EUR 1 = USD 1.3400 within a couple of days after you initiated the trade. You close out the position for a profit of 200 pips (1.3600 – 1.3400), which translates to USD 2,000 (200 pips x USD 10 per pip).

Forex math: in conventional terms, you sold short €100,000 and received $136,000 in your opening trade. When you closed the trade, you bought back the euros you had shorted at a cheaper rate of 1.3400, paying $134,000 for €100,000. The difference of $2,000 represents your gross profit.

Effect of leverage: by using leverage, you were able to generate a 40% return on your initial investment of $5,000. What if you had only traded the $5,000 without using any leverage? In that case, you would only have shorted the euro equivalent of $5,000 or €3,676.47 (USD 5,000 / 1.3600). The significantly smaller amount of this transaction means that each pip is only worth USD 0.36764. Closing the short euro position at 1.3400 would have therefore resulted in a gross profit of USD 73.53 (200 pips x USD 0.36764 per pip). Using leverage thus magnified your returns by exactly 27.2 times (USD 2,000 / USD 73.53), or the amount of leverage used in the trade.

Example 2: short USD / long japanese yen. Trade amount = USD 200,000

The 40% gain on your first leveraged forex trade has made you eager to do some more trading. You turn your attention to the japanese yen (JPY), which is trading at 85 to the USD (USD/JPY = 85). You expect the yen to strengthen versus the USD, so you initiate a short USD / long yen position in the amount of USD 200,000. The success of your first trade has made you willing to trade a larger amount since you now have USD 7,000 as margin in your account. While this is substantially larger than your first trade, you take comfort from the fact that you are still well within the maximum amount you could trade (based on 50:1 leverage) of USD 350,000.

Leverage: your leverage ratio for this trade is 28.57 (USD 200,000 / USD 7,000).

Pip value: the yen is quoted to two places after the decimal, so each pip in this trade is worth 1% of the base currency amount expressed in the quote currency, or 2,000 yen.

Stop-loss: you set a stop-loss on this trade at a level of JPY 87 to the USD, since the yen is quite volatile and you do not want your position to be stopped out by random noise.

Remember, you are long yen and short USD, so you ideally want the yen to appreciate versus the USD, which means that you could close out your short USD position with fewer yen and pocket the difference. But if your stop-loss is triggered, your loss would be substantial: 200 pips x 2,000 yen per pip = JPY 400,000 / 87 = USD 4,597.70.

Profit / loss: unfortunately, reports of a new stimulus package unveiled by the japanese government leads to a swift weakening of the yen, and your stop-loss is triggered a day after you put on the long JPY trade. Your loss, in this case, is USD 4,597.70, as explained earlier.

Forex math: in conventional terms, the math looks like this:

Opening position: short USD 200,000 @ USD 1 = JPY 85, i.E. + JPY 17 million

Closing position: triggering of stop-loss results in USD 200,000 short position covered @ USD 1 = JPY 87, i.E. – JPY 17.4 million

The difference of JPY 400,000 is your net loss, which at an exchange rate of 87, works out to USD 4,597.70.

Effect of leverage: in this instance, using leverage magnified your loss, which amounts to about 65.7% of your total margin of USD 7,000. What if you had only shorted USD 7,000 versus the yen (@ USD1 = JPY 85) without using any leverage? The smaller amount of this transaction means that each pip is only worth JPY 70. The stop-loss triggered at 87 would have resulted in a loss of JPY 14,000 (200 pips x JPY 70 per pip). Using leverage thus magnified your loss by exactly 28.57 times (JPY 400,000 / JPY 14,000), or the amount of leverage used in the trade.

Tips when using leverage in forex trading

While the prospect of generating big profits without putting down too much of your own money may be a tempting one, always keep in mind that an excessively high degree of leverage could result in you losing your shirt and much more. A few safety precautions used by professional traders may help mitigate the inherent risks of leveraged forex trading:

- Cap your losses. If you hope to take big profits someday, you must first learn how to keep your losses small. Cap your losses to within manageable limits before they get out of hand and drastically erode your equity.

- Use strategic stops. Strategic stops are of utmost importance in the around-the-clock forex market, where you can go to bed and wake up the next day to discover that your position has been adversely affected by a move of a couple of hundred pips. Stops can be used not just to ensure that losses are capped, but also to protect profits.

- Don’t get in over your head. Do not try to get out from a losing position by doubling down or averaging down on it. The biggest trading losses have occurred because a rogue trader stuck to his guns and kept adding to a losing position until it became so large, it had to be unwound at a catastrophic loss. The trader’s view may eventually have been right, but it was generally too late to redeem the situation. It's far better to cut your losses and keep your account alive to trade another day than to be left hoping for an unlikely miracle that will reverse a huge loss.

- Use leverage appropriate to your comfort level. 50:1 leverage means that a 2% adverse move could wipe out all your equity or margin. If you are a relatively cautious investor or trader, use a lower level of leverage that you are comfortable with, perhaps 5:1 or 10:1.

The bottom line

While the high degree of leverage inherent in forex trading magnifies returns and risks, our examples demonstrate that by using a few precautions used by professional traders, you may help mitigate these risks and improve your chances of increasing returns. For further reading on forex leverage, see "forex leverage: A double-edged sword."

How much money day traders can make (stocks, forex and futures)

How much money can I make as a day trader? – here we’ll look at income potential for stock, forex and futures day traders.

Let’s face it, this is what traders and potential traders want to know–“how much money can I make as a day trader?” obviously there is a massive range of income potential when it comes to day traders. It is quite possible that some people will still need to work another job, but manage to pull a little money out of the market each month through day trading. There are those who can live comfortably on what they make day trading, and there is the small percentage who will make a lot. There is also a large group of want-to-be traders who will fail, and never make any money.

How much money you make as a day trader is largely determined by:

- Which market you trade. Each market has different advantages. Stocks are generally the most capital-intensive asset class, so if you trade another asset class such as futures or forex you can generally start trading with less capital.

- How much money you start with. If you start trading with $2,000 your income potential (in dollars) is far less than someone who starts with $20,000.

- How much time you put into your trading education. To create consistent day trading income—where you have a solid trading plan and are able to implement it—will likely take a year or more if you dedicate yourself to it full-time. If you only practice part-time, it may take a number of years to develop real consistency and attain the type of returns discussed below.

Your income potential is also determined by your personality (are you disciplined and patient?) and the strategies you use. These issues are not our focus here. If you want trading strategies, trading tutorials or articles on trading psychology you can visit the trading tutorials page, or check out my forex strategies guide ebook.

Income potential is also based on volatility in the market. The scenarios below assume a certain number of trades each day, with a certain risk and profit potential. In very slow market conditions you may find fewer trades than discussed, but in active market conditions you may find more trades. Over time, the average number of trades balances out, but on any given day, week or month you could have more or fewer trades than average…which will affect the income that month.

Now, let’s go through a few scenarios to answer the question, “how much money can I make as a day trader?

For all the scenarios I will assume that you never risk more than 1% of your account on a single trade. Risk is the potential loss on a trade, defined as the difference between the entry price and stop loss price, multiplied by how many units of the asset you take (called position size).

There is no reason to risk more than 1% of your account. As I will show, even with keeping risk low (1% or less per trade) you can potentially earn high returns.

The numbers below are based purely on mathematical models, and are not meant to indicate you will make this much. The numbers below are used to show the potential, but are not intended to reflect typical returns. As indicated in the first paragraph, most traders fail.

For all the scenarios below we will be using relatively small accounts, as that is what most day traders start with. It is easier to make high percentage monthly returns on a smaller account compared to a larger account. Therefore, it will become continually more difficult to generate these sorts of returns as the account gets bigger and bigger (this is a problem you all hope to have!). That said, as the account grows, your dollar income may continue to grow, even though your percentage return stagnates or declines.

Plug different numbers into the scenarios below and you’ll see different ways to trade (for example, you could reduce the number of trades and try for much higher reward:risk trades). Very small changes can have a huge impact on profitability. For these scenarios we assume a modest 1.5:1 reward to risk ratio, 5 trades per day and a 50% win rate.

How much money can I make day trading stocks?

Day trading stocks is probably the most well-known day trading market, but it is also the most capital-intensive. In the USA you must have at least $25,000 in your day trading account, otherwise you can’t trade (see: how much money do I need to become a day trader). To stay above this threshold, fund your account with more than $25,000.

Assume you start trading with $30,000. You use 4:1 leverage, which gives you $120,000 in buying power (4 x $30,000). You utilize a strategy that makes you $0.15 on winning trades and you lose $0.10 on losing trades. This is about a 1.5:1 reward to risk ratio.

With a $30,000 account, the absolute most you can risk on each trade is $300 (1% of $30,000). Since your stop loss is $0.10, you can take a position size of 3000 shares (the stock will need to be priced below $40 in order to take this position size, otherwise you won’t have enough buying power). To get those types of stats from a trade, you’ll likely need to trade stocks that have decent volatility and lots of volume (see how to find volatile stocks for day trading).

A good trading system will win 50% of the time. You average 5 trades per day, so if you have 20 trading days in a month, you make 100 trades per month.

50 of them were profitable: 50 x $0.15 x 3000 shares = $22,500

50 of them were unprofitable: 50 x $0.10 x 3000 shares = ($15,000)

You net $7,500, but you still have commissions and possibly some other fees. While this is likely on the high-end, assume your cost per trade is $20 (total, to get in and out). Your commission costs are: 100 trades x $20 =$2000. If you pay for your charting/trading platform, or exchange entitlements then those fees are added in as well.

Therefore, with a decent stock day trading strategy, and $30,000 (leveraged at 4:1), you can make roughly:

$7,500 – $2000 = $5,500/month or about a 18% monthly return.

Remember, you are actually utilizing about $100,000 to $120,000 in buying power on each trade (not just $30,000). This is simply a mathematical formula, and would require finding a stock where you could make this reward:risk ratio (1:5:1) five times a day. That could prove difficult. Also, you are highly leveraged, and there is a chance of catastrophic loss if a stock where to move aggressively against you and your stop loss became ineffective.

So, let's see, what was the most valuable thing of this article: trading scenario: what happens if you trade with just $100? What happens if you open a trading account with just $100 ? Or €100 ? Or £100 ? Since margin trading allows you to open trades at opening a trade with $100 and a leverage of 20 will equate to $2,000 investment

Contents of the article

- Free forex bonuses

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

- Leverage trading – what is it and how does it...

- What is leverage trading?

- How does leverage trading work?

- Which assets can have financial...

- Examples of trading with leverage

- What is the difference between leverage...

- Pros and cons of using financial...

- How to make the most out of trading with...

- Know your financial situation

- Do a detailed analysis before opening your...

- Stop-loss is a must

- Set up a take profit order

- Final thoughts

- Guide to leverage

- Guide to leverage

- What is leverage in trading?

- What is margin trading?

- Pros and cons of leveraged trading

- Margin call – how it works

- Leverage trading with avatrade

- How to calculate leverage, margin, and pip values...

- Leverage and margin

- Pip values

- Converting profits and losses in pips to native...

- How leverage is used in forex trading

- Examples of forex leverage

- Example 1: long USD / short euro. Trade...

- Example 2: short USD / long japanese...

- Tips when using leverage in forex trading

- The bottom line

- How much money day traders can make (stocks,...

No comments:

Post a Comment