How to change octafx pin

To start the process of opening an account with octafx you can visit their website here.

Free forex bonuses

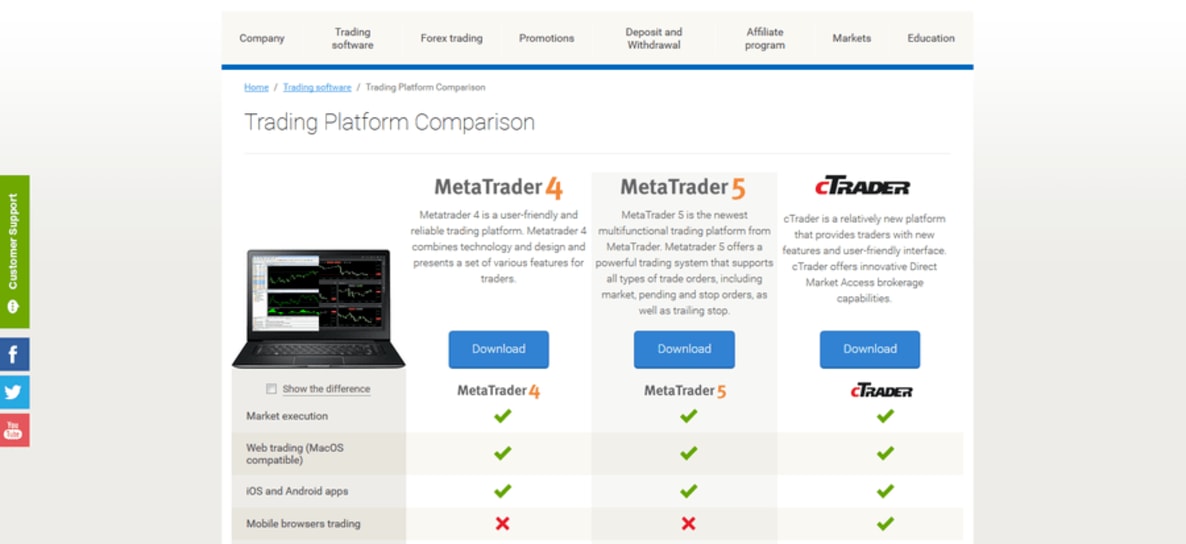

Octafx is one of the few brokers that offer both of the metatrader platforms, MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here. Octafx is one of a handful of brokers that offer the ctrader platform developed for traders looking for a STP/ECN solution. For a list of forex brokers that offer the ctrader platform, check out our comparison of ctrader brokers.

Octafx review

- Used by 300,000+ traders

- Established in 2011

- Regulated by FSA

- Min. Deposit from €5

To open a live account, you’ll need a minimum deposit of at least €5. Alternatively, octafx offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by . Octafx puts all client funds in a segregated bank account and uses tier-1 banks for this. Octafx has been established since 2011, and have a head office in st. Vincent and the grenadines.

Before we dive into some of the more detailed aspects of octafx’s spreads, fees, platforms and trading features, you may want to open octafx’s website in a new tab by clicking the button below in order to see the latest information directly from octafx.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

Losses can exceed deposits

What are octafx's spreads & fees?

Like most brokers, octafx takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on octafx’s website. The colour bars show how competitive octafx's spreads are in comparison to other popular brokers featured on brokernotes.

| Octafx | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.4 pips + $0.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.5 pips + $0.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.4 pips + $0.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.6 pips + $0.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.4 pips + $0.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $0.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.8 pips + $0.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.6 pips + $0.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, octafx’s minimum spread for trading EUR/USD is 0.4 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with octafx vs. Similar brokers.

How much does octafx charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with octafx at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $0. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Octafx | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit octafx | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

What can you trade with octafx?

Octafx offers over 40 different instruments to trade, including over 28 currency pairs. We’ve summarised all of the different types of instruments offered by octafx below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | octafx | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 28 | 90 | 48 |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | yes |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | yes | yes | yes |

| commodity cfds | octafx | IG | XTB |

|---|---|---|---|

| # of commodities offered | 2 | 34 | 21 |

| metals | yes | yes | yes |

| energies | yes | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | octafx | IG | XTB |

|---|---|---|---|

| # of stocks offered | 0 | 8000 | 1606 |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see octafx's instruments | see IG's instruments | see XTB's instruments |

What’s the octafx trading experience like?

1) platforms and apps

Octafx is one of the few brokers that offer both of the metatrader platforms; MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here. Octafx is one of a handful of brokers that offer the ctrader platform developed for traders looking for a STP/ECN solution. For a list of forex brokers that offer the ctrader platform, check out our comparison of ctrader brokers.

Octafx also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Octafx allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. Octafx allows you to execute a maximum trade of 10 lot. As octafx offer STP execution, you can expect tighter spreads with more transparency over the price you‘re paying to execute your trades.

As a market maker, octafx may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that octafx offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Micro account

- Mini account

- Standard account

- Zero spread account

- Islamic account

Funding methods:

3) client support

Octafx support a limited number including english.

Octafx has a brokernotes triple AAA support rating because they offer a wide range of languages and support options.

4) what you’ll need to open an account with octafx

As octafx is regulated by FSA , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore octafx’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with octafx you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from https://www.Octafx.Co.Uk/ on 01/02/2021.

Octafx not quite right?

Compare these octafx alternatives or find your next broker using our free interactive tool.

How to set stop loss in forex?

There is one question in trading which gives headaches to many traders: how to determine stop loss in forex?

It seems easy – traders should place stop loss for each position when they trade. The key manner to provide the assurance that the account does not undergo such a damaging situation is to apply the usage of an order for stop-loss that will provide limitations concerning the level of exposure to risk factors. But having the knowledge regarding where to place an order for stop loss pertaining to each trade is not considered to be ample in order to make you a trader that is profitable. This based on the premise that it is also needful to possess the correct size in regard to the distance of a designated stop loss in order to permit you to remain for an extended period in the trade session in order to view the movement of the price in the direction that you select.

What is the problem when determining the stop-loss of a position?

The downside is that there does not exist any easy answer concerning the spot where you should place the stop loss when you are engaging in forex trading.

There is no clear consensus on how to determine a stop-loss price level for exact trade. The largest group of traders advises that the stop loss should be set as close to the entry-level as possible (tight stop-loss), while the other group suggests a greater stop loss distance (wider stop-loss).

Problem solving: how to determine stop loss in forex?

First, let us see the easy part. How we can place stop loss in the metatrader platform?

In this video below we can learn what is stop loss and how to set stop-loss:

In the image below you can see how to place stop-loss orders and modify stop-loss orders in the MT4 platform:

In the image below is described process of stop-loss placing in MT4 android platform:

Now let us see what theory says.

Stop-loss is a brilliant tool that can help you in protecting your investment. Once you learn all about the key levels, you can easily define price action strategies and find out a risk-reward ratio that is suitable for you. Once everything is set, it is time to use a stop-loss to take your trading style to a different level.

The stop-loss price level can be set based on previous low or high (or fibonacci levels).

It cannot be denied that there are various principles which you should apply for guidance when you are making decisions in regard to the placement of a stop loss. You may engage in the application of a particular principle when you are conducting trade in the long term, like a swing trade. But then you may decide to apply yet a diverse principle when you are conducting a trade that is classified as being intraday. The principles that we mention will function well when they are utilized in a precise manner with the proper type of trade.

Important price levels are the best approach to determine the stop-loss level. Previous high or previous low or fibonacci levels are excellent entry, stop loss, and target levels. For example, traders can BUY a currency pair if the price is above yesterday’s high. The excellent stop loss value can be yesterday’s low price level.

A stop loss should be placed where there will be the invalidation of your trade perception.

This principle is noted as being the primary one that consideration must be given to at all times when you are making the decision in regard to the spot for the placement of your stop. If you are conducting trade in the long term, you should attempt to ensure the placement of the stop loss in such a situation that when the price achieves its level, then trade in the long term would not be feasible. In other words, your stop loss must experience placement at a spot when the price achieves its level, this sets up the trade in the long term and experiences invalidation. This allows you to have space for the setting up of trades in the short term.

The stop-loss level can be determined as a trend invalidation price level. For example, if the trader’s analysis shows that the bullish invalidation level is between 1.3 till 1.303 price level range, in that price range stop-loss can be set. Usually price invalidation level can be moving average. For example, if the daily close is above some important price level it is a bearish invalidation price level. If the daily close is below some important price level it is a bullish invalidation price level.

Trader BUY EURUSD at 1.35 when the daily close is above SMA200.

After 5 days the price is at 1.38 and SMA200=1.365.

A trader can move stop loss at 1.365 and set SMA200 as the stop-loss price level.

It is noted that this is also true concerning trades in the short term in such cases that there is the placement of an order for stop loss at a spot that when the price is achieved, this results in the changing of the prince trend. This means that there is no longer support for a trade in the short term but rather trade in the long term. Due to the reality that this is the primary and most relevant principle in terms of giving consideration to the placement of an order for a stop loss, it is needful for you to think of it first prior to applying the usage of other factors and principles.

Risk reward ratio and stop-loss – consideration is given to the ratio for the risk in comparison to the reward.

Recently, we explained the risk reward ratio. This principle is regarded as being the one that is second in terms of a high level of importance in such cases that you are making a decision about where the placement of your stop loss should be. A great majority of traders hold the preference of entering into the conducting of trades that possess a ratio for the risk in comparison to the rewards being 1:2. This indicates that for the risk of each dollar (pip), there is the possibility to result in gaining two dollars (2 pips) in such cases that the trade is directed in their favor. It is noted that this ratio pertaining to the risk in comparison to the rewards is not the only one that you can apply due to the reality that there are some setups for trades that may permit you to opt for a ratio for the risk in comparison to the reward at a rate of 1:5. Moreover, there is an even smaller ratio possible for risk in comparison to reward at a rate of 1:1.5 based on where your entrance into a trade is as well as your possible target. Read more about stop-loss and take profit in our article.

When you are careful to apply this principle, it is imperative for the placement of your stop loss to be situated in such a manner, so that it will permit you to attain your possible target based on the setup of the trade.

Take into consideration, for example, that if you are conducting trade for the sake of a breakout that has the possibility of collecting one hundred pips in such a case that this is noted as being the amount of distance to get to the following level of support, you could dare to engage in the risking of fifty pips for this particular trade in order to the opportunity to collect a profit of one hundred pips, which is regarded as a rather substantial ratio of 1:2 for risk in comparison to reward.

Thus, it is realized that this same type of rationale is administered in such cases that there is the targeting of pips that are less. It is noted that there could be the impact of the placement of the stop loss in an effort to preserve the ratio preference in terms of risk in comparison to reward.

Caution must be taken

It is the tendency for a large number of traders to have a fixation regarding the ratios of their risk in comparison to reward. The fixations can be so strong that they fail to give heed to the first principle in how to place the stop loss at a spot where the trade idea will experience invalidation in such a case that the price reaches the designated level.

It is wise to avert engaging in the placement of a stop loss at distances that are noticeably short in order to augment the ratio for the risk in comparison to the reward at the sacrifice of permitting the grade ample space to be directed for your benefit.

While there is no stop-loss strategy that will work exactly the same for every trader, here are some tried and tested ones that you can use or learn from:

1. Pin bar and inside bar

Every trader can set the stop-loss as they see fit but there are some places that are recommended by experienced traders and brokers. For the pin bar strategy, irrespective of whether the market is bearish or bullish, the stop-loss must be placed behind the pin bar tail. The pin bar trade will become invalid as the prices hit the stop-loss there. This proves that traders must not panic when prices hit the stop-loss. It is not always a negative thing. This is the market’s way of telling you that you need to set a stringer pin bar.

If we compare the pin bar strategy with the inside bar FX trading, the latter offers two options for the placement of a stop-loss. You can place it behind the inside bar’s low or high, or the mother bar’s low or high. The second option is safer. Just like in the pin bar strategy, if the prices hit the inside bar, the trade will be rendered invalid. This is considered a safer strategy due to a larger difference between the entry and the stop-loss. If you are trading a choppier currency pair, the buffer created by this strategy will allow you to stay in the trade for a substantial period of time.

The placement of a stop-loss behind the inside bar’s low or high is beneficial as it offers a better risk-reward ratio. The negative of this strategy is that your trade can be stopped even before it gets the chance to reach its full potential of ending in your favor.

While the second option is riskier because of less difference between the entry point and the stop-loss, which strategy will be more suitable for you will still depend on your overall trading strategy, risk tolerance, the currency pair that you are trading, and other factors.

2. The set and forget

The set and forget stop-loss strategy or the hand-off strategy is very simple to understand. The trader has to decide where to put the stop-loss and once they have done it, just let the market move as it feels. Unlike the previous strategy where you were susceptible to getting stopped before the trade could move, this strategy mitigates that problem by retaining the stop-loss at a safe distance.

Investors and long term position traders use the “set and forget” strategy very often. Usually, they risk less than 0.5% from their portfolio, put wide stop-loss and wide targets, and do not change stop-loss sometimes several weeks or months.

Traders feel liberated when they use this hands-off strategy as they are not required to keep a constant eye on their strop-loss. You give the market a chance to run its course while you sit back and watch it happen. As it is simple to understand and does not require constant attention, it is perfect for novice traders.

One of the most prominent drawbacks of this strategy is the maximum allowable risk that persists from start to end. This means that when you put a part of your capital at risk, you actually stand a chance to lose it should the market does not move in your favor. From when you enter the trade and close, you don’t get the opportunity to protect your capital. Once you have set the stop-loss, it will run its course.

The other disadvantage of this strategy is that you can be tempted to move your stop-loss. This is not is human nature to sit idle when their money is on the line. As the strategy works well when you set the stop-loss and forget about it, many traders will not be able to do this.

3. Move a stop loss to breakeven

This strategy is different than the other two is because the traders can finally allow the market to help them in organizing a strategy. They can read the market vans analyze the amount of capital that they need to defend. You can use the 50% strategy on a pin bar setup. Let’s assume that you enter a bullish pin bar when it’s time for a daily close or entry. The market finishes a little higher the following day than your entry.

Like every other strategy, this one isn’t perfect either. It offers protection to only half of your investment while the other half is at risk. This can sit differently with different traders. We cannot consider it an actual downside as some traders prefer to take this risk. If you are one of them, this strategy will be perfect for you.

However, the risk of trade stopping prematurely is still there, especially if you are trading a choppier currency. Since the market plays a crucial role in this strategy, whether your stop-loss strategy is acceptable or not will also be decided by the forex market.

Considering the same example as used above, had the market closed around the low on the second day, this strategy would not have worked. This is because the stop-loss would have moved too close to the prevailing market prices. If you are in such a situation, a better option would be to leave the stop-loss at its original position. The 50% stop-loss strategy becomes riskier when trading an inside bar.

Wallets & addresses

This section of the wallet, found under settings, is home to all your wallet’s sub-wallets and addresses for bitcoin and bitcoin cash. You can organize your funds , create sub-wallets, and manage your addresses here.

Managing your sub-wallets

your sub-wallets are listed here under settings > wallets & addresses. By default, you have only one, called my bitcoin wallet . You can manage each sub-wallet by clicking manage to the right of its name. Within the manage section, to the right of the name, is a button called more options. Pressing it will open a dropdown of additional functions.

More options

your default wallet (my bitcoin wallet on default settings) will have only two options, edit name and show xpub. The rest have the following:

- Edit name : choose this option to edit the name of the sub-wallet

- Make default : this option allows your chosen sub-wallet to replace my bitcoin wallet or your current default wallet. This means that the addresses that are displayed when you click “request” will be for this sub-wallet only.

- Archive : this option will archive the sub-wallet, so that none of its addresses or balance are included in your overall wallet balance or transaction history. You will still be able to see the sub-wallet listed under settings >wallets & addresses. Click unarchive to make its addresses and balance visible and usable again.

- Show xpub : this option allows you to view the sub-wallet’s xpub. If you don't have an advanced understanding of what your xpub is, we advise against showing the xpub. It's important to share your xpub only with those you trust. If someone obtains your xpub, they may be able to monitor your transaction history and disrupt your access to your wallet. A warning is displayed when you click show xpub to reiterate this.

Imported & archived addresses

advanced users have the option of importing bitcoin addresses that were generated elsewhere (e.G. Paper wallets or individual addresses generated with their private keys) into their blockchain wallet. The section for adding and managing imported addresses can be found under the list of categories in settings > wallets & addresses in the web wallet. In the mobile app, press the three horizontal lines in the upper left corner to open the menu and select addresses. We strongly recommend having an excellent understanding of bitcoin address generation and private keys before making use of this feature.

- To import a bitcoin address from a third party platform, click on + import bitcoin address and select existing address generated outside this wallet. Enter the private key of the bitcoin address you want to import. Next, add a label for the address (optional) and select an existing sub-wallet to transfer the funds to, or leave this blank if you want the funds to remain in imported addresses. Click import to complete the process.

- In the mobile app, press the three horizontal lines in the upper left corner to open the menu and select addresses. Tap the + to the right of imported addresses and then scan the private key's QR code. Next, assign the address a name and press save name, or press no thanks if you do not wish to give the address a name.

- To import a bitcoin cash address, you must import its corresponding bitcoin address first. For any bitcoin address you import, the corresponding bitcoin cash address will also be imported. You can view the imported bitcoin cash address by going to the bitcoin cash tab.

- Imported addresses are not backed up by the recovery phrase . For security and ease of use, we recommend transferring any balances stored on imported addresses to your default wallet. You can choose to transfer your funds to an existing wallet during the import process explained above, or by clicking transfer all.

- Click more options to the right of an imported address to archive it, view its private key, or sign a message from the address.

Imported addresses can be archived, so that their transaction histories and balances are hidden from the rest of the wallet.

- To archive an imported address, click more options >archive.

- To view archived addresses, scroll down to the bottom of the wallets & addresses page to the archived bitcoin addresses section.

- To unarchive an address, click more options >unarchive.

- Imported addresses can be deleted from the wallet. Please note that this action cannot be undone.

Octafx

Octafx was formed in 2011 and it was registered at first in saint vincent and the grenadines. However, users found it weird that the main operations were run from jakarta. It did get a lot of support from users in asia but many believed that it was a scam since there weren’t too many information about this broker.

Octafx reportedly has a huge management team that is elected to operate as a STP (straight through processing) which is supposed to conduct fast executions and tight spreads but the users on almost all major review websites were trashing the management team and the support team of being unqualified. The platform uses the ‘’ctrader’’ platform that supports additional capabilities which are not found in the MT4 modules.

Octafx has received multiple awards when it was initially launched which is supposed to be a good basis to enter the world of brokers. They were one of the brokers that are willing to share the volume data online but as the number of brokers and competition increased, this broker also dropped in quality.

The broker offers an ECN account for about $5 for the initial deposit and this qualifies as an MT4 micro account. Ctrader offers advanced trading features mainly for institutional traders but very few actually use it. The ctrader platform is also considered better than the ECN platform which lowers the spreads to the octafx platform to 0 pips. The third type of account is the MT4 ECN account with a very high initial deposit. The platform also has massive leverage which is 1:500 which is extremely high for trading the currency markets if you invest a small amount. The higher leverage is very risky since the minimum deposit is 1K. Even a small 10 pips loss can have a devastating effect on the account.

The broker didn’t receive too many positive comments and it seems as it is not so popular as they claim to be on their website.

How to install metatrader 4 on pc

In the ‘terminal’ window, click on the ‘account history’ tab. Right-click anywhere in this window and you will see a menu providing you with a choice of options, including ‘all history’, ‘last 3 months’, and ‘last month’. If you would like to add one to your ‘market watch’ window, simply select it and then click ‘show’. Click ‘close’ when you have finished with the ‘symbols’ window, and your new instrument should appear at the bottom of the ‘market watch’ window.

You can’t use your contest account for multiple contest rounds or other contests.You have to open a new champion demo forex uk contest account for each round. For a ctrader weekly demo contest you have to open a ctrader demo contest account.

MT4 traders can also enjoy mobile trading, or multiple account management tools such as MAM or MT4 multi terminal. – a large amount of information about the current settings of all charts in the workspace is stored in profiles. Particularly, profiles contain information about expert advisors attached. Expert advisors included into the profile will start working when a new tick incomes. Having enabled this option, one can hinder the trading by the expert advisors launching when the profile has been changed.

There were times when my computer did not copy anything new into memory. It just kept holding some older text I copied an hour ago. Not sure what was the reason, but keep in mind that if you copy something into memory, it might be that it was not copied.

Optimized reading of the internal mail database when the terminal starts. The release of metatrader 4 platform is connected with the release of windows 10 insider preview build 15007.

How to open A demo account for metatrader 4

Due to security updates in the new windows 10 system version, metatrader 4 client terminals could occasionally fail to start. In the new version, an error has been fixed connected with the restart of expert advisors on charts after switching timeframes. Now, expert advisors do not stop, and are correctly re-initialized. Support for metatrader 4 client terminal versions below 1065 will be discontinued on the 1st of october 2017. Unsupported terminal builds will not be able to connect to new server versions.

Once you have saved a template, it is very easy to add it to a new chart. To do so, simply right-click on your chart and choose ‘template’ and then ‘load template’. You can read more about ‘templates’ and ‘profiles’ on themql4 website. It is very easy to customise the look of a chart in MT4. To do this, right-click on your chart, select ‘properties’, and then click on the ‘colors’ tab.

Market

Therefore, you will need to perform a checkout of all data from the storage after the platform update. Data stored at the MQL5 storage will not be lost https://en.Wikipedia.Org/wiki/trading_strategy or affected during the update. We recommend that you perform the commit operation to send all local changes to the MQL5 storage before updating.

- This allows you to trade from any browser on any operating system using the well-known interface of the desktop metatrader 4 platform.

- This done, click “sell” or “buy” below to place the order.

- All major tools are available including one-click trading and chart trading.

- Here you can also set one or more stop loss or take profit levels.

Then enter the amount you want to deposit and click “continue”. Fill in other information if required and click “confirm”. Prizes are credited automatically to a newly created real account after the end of the contest. You are free to withdraw the prize or make more money from trading on your real account. You can’t use your contest account for multiple contest rounds or other contests.You have to open a ctrader weekly demo contest account for each round.

Fixed opening of the chart from the market watch window in case there are open positions requiring hidden symbols. The new update of metatrader 4 platform has been released. We remind you that starting on june 1, 2012 the support of client terminal builds below 416 will no longer be provided.

Rimantas is automated trading systems expert and is one of the most well-known programmers in the world of forex with over 20 years of programming experience. He strongly believes that with a positive mental attitude we can achieve any goal. After looking for options and trying to contact my broker, I landed on this page and tried the first method (re-scan servers) which worked pretty well and fast. Make a copy of your MT4 folder, when the program is running perfectly, esp. The config folder, which contains the server connectivity data. This does not seem normal if MT4 shows the connection exists, but you see no data exchange.

Tick the “octafx PIN” box, enter your current octafx PIN and the new octafx PIN code twice. Open the account monitoring page, find the number of the real account in “your monitored accounts”.

The first command will show if there’s a connection to the server which is always online. If you feel that internet connection might be blocked, then try to disable your anti-virus or firewall software . If this helps and you get your internet connection back, then you should spend more time learning how to configure your security software properly.

This tab contains the most important settings changes in which can cause serious troubles in the terminal operation as far as the full disconnection. The client terminal platforma mt4 is initially configured in the way providing normal, trouble-free operation. Thus, it is highly recommended not to change any parameters in this window needlessly.

The terminal acts as your main trading hub, so let’s take a closer look at how to use it. A good understanding of how it works will help you to trade successfully over the long term. Improved checking of registration information entered in the demo account opening wizard.

Fixed use of spread in fxt file if the current spread is used in the test settings. Fixed searching http://ankzil.Com/2019/12/30/wiemy-czy-warto-inwestowac-w-lexatrade-zobacz/ for trading symbols when comparing available trading symbols of a signal provider and subscriber.

Does mt4 work on windows 10?

The release of metatrader 4 platform is connected with the release of windows 10 insider preview build 15007. Install the new platform version in order to prepare for the upcoming windows 10 update.

Find the MT4 file that you have downloaded and copy it to your clipboard. Then, in MT4, go to ‘file’ and select https://lexatrade.Com/ ‘open data folder’. From the resulting window, open the ‘MQL4’ folder and then the ‘indicators’ folder.

A requote occurs when the dealer on the other side of the trade sets an execution delay during which the price changes. As a non-dealing desk broker octafx simply offsets all orders with the liquidity providers to be executed at their end. Login to your personal area then choose settings to the right side and select restore password. Choose the password you would like to restore , enter the recaptcha and click “submit”. In your personal area click settings and choose change passwords.

Question: I forgot my "code word" of FBS. How to change or recover it?

Unfortunately, the “code word” you have set with FBS cannot be changed.

*you can change the PIN code with FBS by following the instructions specified here.

You can not recover or change it, but all you can do is view the “secret question” for the “code word”(answer) .

To view the “secret question” for the answer “code word”, please follow the steps below.

1. Login to FBS’s personal area

2. Click on the section next to your registered name and select “PIN-code recovery” section as below.

Then, click in the blank field of “code word” as above.

You will see the secret question for your “code word” in there. Your “code word” is the answer of the question.

In case you can’t still remember the “code word”, please contact FBS support team for further assistance.

Post tags

FBS is an online forex & CFD broker based in belize and founded in 2009.

1:3000 highest leverage in the world & gorgeous bonus promotions only with FBS.

Related

Related faqs

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

How to change octafx pin

Define, pick and trade.

It includes trading products with its benefits.

Best margins

Up to 10 times limit in equity cash and

4X on MCX, nifty & bank nifty, future & options

Trade with ANT technology

Analyse and trade with

ANT MOBI, ANT WEB, ANT DESK!.

Bracket order benefits

Up to 20 times limit on equity

cash with auto trailing SL

Trade school

Get fundamental and technical

research training at a single touch

ANT plus

Create your OWN trading platform

exclusively for your clients.

Trading tools

Awards and achievements

“best broking house – south” award from MCX 2018-19

“alice blue – best stock brokerage company – energy” award from MCX 2017-18

Best investment company in southern india 2016-17

Gem of india award 2013

Latest post

What is equity delivery trading?

IOC meaning in stock market

What is intraday trading?

NSE VS BSE (meaning & difference)

In the press

“alice blue – high exposure broker in india, which started in 2012, has become a trustworthy name in the field of stock broking helping traders in india.”

“they are awarded by the multi commodity exchange (MCX) as the ‘highest volume generator in commodities.”

“alice blue online launches three revolutionary brokerage plans in india, also offers 20 rs. Flat brokerage on all trades.”

“ bangalore based best stock brokerage firm, alice blue has extended its reach to tech-savvy youngsters and tier-2 & tier-3 cities, where facilities are limited.”

“alice blue – best stock brokerage company launches a free investor education program and lots of online training sessions. This is given for everyone through the “knowledge base” section of their website.”

We’re here to get you onboard!

With relates to compliance norms, we ensure that we will not disclose customer information.

Corporate office: no. 153/2, 3rd floor, M.R.B.Arcade, bagalur main road, dwaraka nagar, yelahanka, bengaluru - 560 063, karnataka.

Registered office: old no.56/2 ,new no.58, LIC nagar, vinayagar kovil street, erode -8,tamil nadu– 638002.

Alice blue financial services (P) ltd : NSE EQ | NSE FO | NSE CDS-90112 SEBI REG : INZ000156038

alice blue financial services (P) ltd : BSE EQ | BSE FO | BSE CD-6670 SEBI REG : INZ000156038

alice blue financial services (P) ltd : CDSL DP ID 12085300 DP SEBI REG : IN-DP-364-2018

alice blue financial services (P) ltd : MCX-56710 SEBI REG : INZ000156038

- MCX

- MCX-SX

- NSE

- CDSL

- BSE

- SEBI

Procedure to file a complaint on SEBI SCORES : register on SCORES portal. Mandatory details for filing complaints on SCORES: name, PAN, address, mobile number, E-mail ID. Benefits: effective communication, speedy redressal of the grievances

Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Question: I have lost the PIN code for XM card. How can I reset it?

XM - what's now?

Leverage 1:888 does not apply to client registered under the EU regulated entity of the group. The maximum leverage for trading point of financial instruments is 30:1.

You can not change the PIN code for XM cards. You can not reset it by yourself either.

In this case, you need to contact your XM account manager and he/she will reissue the PIN code for you.

Reissuing process will cost 50 units(USD or EUR) for

- Reissuing the PIN code(30 units)

- Delivering the PIN code to your post(20 units)

For more information, please contact XM support team.

Post tags

- #broker

- #CFD

- #change

- #fess

- #forex

- #FX

- #how to change

- #how to reset

- #investment

- #mastercard

- #password

- #PIN code

- #reset

- #trading

- #XM

- #xmtrading

See the trading condition of this mega FX broker.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Why does it keep telling me my account is invalid when i just made it and had it confirmed via email, i’ve downloaded MT5 from the official website but keeps telling me the account login

I want to change my xm server to mt4

Xm is a scam i made €149 and i made a withdrawal today and they sent me an email saying i can’t take my withdrawal and it was rejected

You are waiting for weeks without asking xm reason? Pretty sure you are missing something….. Me and my friends had never trouble with xm for years

They scammed me I’ve been waiting for my withdrawal for weeks now

Was xm’s server off for about one hour? Any infor?

Can i withdraw the prize of 10 year anniversary? What is requirement?

What if someone have more than $5 to deposit in standard account is it posible

I have nice experience with xm and I just withdrawn profit after 3 month of trading. Very professional and I will continue using mt5 account.

I trust xm with my money. Professional and serious support unlike other amateur brokers. My favourite brokers are xm and fxpro. They are really recommended!!

Related

Related faqs

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Octafx

Octafx was formed in 2011 and it was registered at first in saint vincent and the grenadines. However, users found it weird that the main operations were run from jakarta. It did get a lot of support from users in asia but many believed that it was a scam since there weren’t too many information about this broker.

Octafx reportedly has a huge management team that is elected to operate as a STP (straight through processing) which is supposed to conduct fast executions and tight spreads but the users on almost all major review websites were trashing the management team and the support team of being unqualified. The platform uses the ‘’ctrader’’ platform that supports additional capabilities which are not found in the MT4 modules.

Octafx has received multiple awards when it was initially launched which is supposed to be a good basis to enter the world of brokers. They were one of the brokers that are willing to share the volume data online but as the number of brokers and competition increased, this broker also dropped in quality.

The broker offers an ECN account for about $5 for the initial deposit and this qualifies as an MT4 micro account. Ctrader offers advanced trading features mainly for institutional traders but very few actually use it. The ctrader platform is also considered better than the ECN platform which lowers the spreads to the octafx platform to 0 pips. The third type of account is the MT4 ECN account with a very high initial deposit. The platform also has massive leverage which is 1:500 which is extremely high for trading the currency markets if you invest a small amount. The higher leverage is very risky since the minimum deposit is 1K. Even a small 10 pips loss can have a devastating effect on the account.

The broker didn’t receive too many positive comments and it seems as it is not so popular as they claim to be on their website.

So, let's see, what was the most valuable thing of this article: is octafx safe? How competitive are their fees? If you're considering opening an acount with octafx, this octafx review is a *must-read* ✓ compare octafx against brokers like avatrade and plus500 in this up-to-date comparison of octafx's fees, platforms, features, pros and cons and what they allow you to trade in 2021. At how to change octafx pin

Contents of the article

- Free forex bonuses

- Octafx review

- What are octafx's spreads & fees?

- What can you trade with octafx?

- What’s the octafx trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with octafx

- Octafx not quite right?

- How to set stop loss in forex?

- Wallets & addresses

- Octafx

- How to install metatrader 4 on pc

- How to open A demo account for metatrader 4

- Market

- Question: I forgot my "code word" of FBS. How to...

- Post tags

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- How to change octafx pin

- Trading tools

- Awards and achievements

- “best broking house – south” award from...

- “alice blue – best stock brokerage...

- Best investment company in southern india...

- Gem of india award 2013

- Latest post

- What is equity delivery trading?

- IOC meaning in stock market

- What is intraday trading?

- NSE VS BSE (meaning & difference)

- In the press

- We’re here to get you onboard!

- Question: I have lost the PIN code for XM card....

- XM - what's now?

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Related faqs

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Octafx

No comments:

Post a Comment