How to check balance on ewallet

View how to send money via online banking the money is sent immediately and the recipient can access the funds immediately

Free forex bonuses

How to check balance on ewallet

This is your third and last login attempt available.

Your profile will be blocked if you fail to enter your login details correctly.

Oh no!

We've noticed that you've tried to login more than 3 times.

You might have blocked your online banking profile.

In order to unblock your profile, reset your username and password.

Cellphone banking

- Dial *130*321#

- Select send money

- Select the account you want to send money from

- Key in the cellphone number you want to send to

- Enter the amount you want to send

- Confirm that all is correct (make sure you entered the right cellphone number)

To send money using FNB cellphone banking you need to be registered for cellphone banking.

To register for cellphone banking, dial *130*321#

Online banking

- Log into FNB online banking

- Select the payments tab

- Enter your one time PIN (OTP)

- Select send money

- Select the account you want to send money from

- Select the amount you want to send

- Key in the cellphone number you want to send money to

- Click on finish

You need to register for online banking to send money via the internet

FNB ATM

- Insert your card and enter your PIN

- Select more options

- Select buy it/pay it

- Select send money. Read the terms and conditions and then select proceed

- Key in the cellphone number you want to send money to and select proceed

- Key in the amount you want to send money to and select proceed

- Confirm that all the details are correct and select proceed

- Remember to take your card

No registration or application is necessary if you send money via an FNB ATM

| fee (BWP) | |

|---|---|

| send money | P9.40 |

| withdrawal (you get 1 free withdrawal with every wallet send without exceeding maximum of 4 free withdrawals in the wallet) | FREE |

| dormant ewallet (up to 6 months) | FREE |

| dormant ewallet (after 6 months) | FREE |

Standard network operator rates apply when using your cellphone.

You have access to ewallet

If you are an FNB client with an active transactional account, you already have access to the ewallet service.

Login to online banking, cellphone banking or visit your nearest ATM and select send money to make use of this safe and convenient way to send money to anyone.

Ewallet

Send money anywhere, any time

The ewallet allows FNB customers to send money to anyone with an active cell number. Money is transferred instantly. Recipients can use the money in the ewallet to buy airtime, send money to other cellphones and more.

How it works

Instantly send money or make payments

- You can send money to friends and family members or make a payment to anyone simply and hassle free

- Money can be sent to anyone who has a valid botswana cellphone number and the recipient does not need to have a bank account

- Any GSM cellphone model can be used to send money or to receive money

- Money is instantly available in the ewallet

- Money will be stored in an ewallet. Recipients will be able access the money immediately at an FNB ATM without needing a bank card and without filling in any forms

- Recipients will get all of the money sent as there are no ATM charges to withdraw money

- Recipients don't have to withdraw all the money at once

- Recipients can also check the balance, get a mini statement, buy prepaid airtime, send money on to someone else's cellphone

- You can send money at any time of the day or night via cellphone banking, FNB online banking, FNB app or at an FNB ATM

What's hot

It's for everyone

Send money to anyone with a valid botswana cellphone number

It's simple

The recipient does not need a bank account or bank card

It's convenient

Money can be sent anytime, anywhere, from the comfort and safety of your own home

It's fast

The money is sent immediately and the recipient can access the funds immediately

It's free of bank charges

Pay no bank charges when you send money via ewallet

Ways to send

Send the way you want to

As an FNB customer you can use one of FNB's convenient digital channels to send money to anyone with a valid cellphone number on any network.

Online banking

View how to send money via online banking

Cellphone banking

View how to send money via cellphone banking

View how to send money via FNB ATM

Ways to use

Withdraw, buy + spend

When you receive an SMS notifying you that money has been sent to your cellphone, you can do the following

- Send a portion of the money in the ewallet to another ewallet in exactly the same way

- Withdraw all or some of the money from the ewallet at an FNB ATM without needing a bank card. The rest of the money can be withdrawn at a later stage

- Buy prepaid airtime from the ewallet

- Check the ewallet account balance or get a mini statement

- How to receive money

How to receive money

Turn your phone into a wallet

Once you've received an SMS telling you that you have been sent money

- Dial *130*392# to access the ewallet

- Set a secret 5-digit PIN for the ewallet

- Select 'withdraw cash' and then 'get ATM PIN'

- You'll receive an SMS with an ATM PIN

- Go to an FNB ATM

- At the ATM press the green button (enter/ proceed) and then wallet services

- Key in your cellphone number and ATM PIN

- Choose the amount of money to withdraw. Make sure that either your transaction has ended or that you press 'cancel' before leaving the ATM

If you have been sent money but you have no airtime , dial *103*392# to buy airtime with the money that has been sent to you. Then dial *130*321# .

How to check balance on ewallet

FNB offers a network of branches for all your face to face banking requirements

Postal address

first national bank zambia limited

PO box 36187

lusaka, zambia

Physical address

stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 253 057 / 250 602

email: fnb@fnbzambia.Co.Zm

Stand number 22768

acacia office park

cnr thabo mbeki and great east roads

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250 090

branch code: 260001

Society house

first floor, shop number G040

plot 3 & 3a cairo road,

central business district

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260050

Shakes investment limited building

plot number 16808

lumumba road

lusaka, zambia

Telephone numbers: +(260) 211 366 900

fax number: +(260) 211 845 453

branch code: 260002

Plot no. 617

shop number 4 musenga house

kwacha road

PO box 11262

chingola, zambia

Telephone numbers: +260 211 366 800

branch code: 260322

Kaonde house

plot no. 921

independence avenue

solwezi, zambia

Telephone numbers: +260 211 366 800

branch code: 262823

Union house

plot 493/494

zambia way and oxford street

kitwe, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 657 145

branch code: 260212

Centro mall premier banking

Unit 63 corner bishop & kabulonga roads

centro mall, kabulonga

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 250602

Neighbours city estate

plot number 50

buteko avenue

ndola, zambia

Telephone numbers: +260 211 366 800

fax number: +260 212 610009

branch code: 260103

Plot 7A livingstone road

PO box 670159

mazabuka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 213 239 023

branch code: 263613

Plot 414 independence road

mkushi, zambia

Telephone numbers: +260 211 366 800

branch code: 262319

Plot 9471/2/3, makeni mall

kafue road, lusaka

PO box 38911,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 369 398

branch code: 260016

Stand no.3539 jacaranda mall

corner of mushili & kabwe road

PO box 73642

ndola, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

PHI shopping mall

plot no. 38147

bennie mwiinga road

lusaka, zambia

Telephone numbers: +260 211 366 800

branch code: 260049

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road, lusaka

PO box 36187,

lusaka, zambia

Telephone numbers: +260 211 366 800

fax number: +260 211 366 875

branch code: 260014

Plot no.87A shop no.2

buntungwa street

kabwe, zambia

Telephone numbers: +260 211 366 800

branch code: 260937

Plot no.ME 46

along livingstone

PO. Box 630819

choma, zambia

Telephone numbers: +260 211 366 800

branch code: 261238

Plot no. 646

corner of pererinyatwa road

& umodzi highway

PO. Box 510080

chipata, zambia

Telephone numbers: +260 211 366 800

branch code: 261121

Plot no.4 wada chovu building

zaone avenue, PO box 90953

luanshya, zambia

Telephone numbers: +260 211 366 800

branch code: 260741

Mukuba mall premier branch

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Telephone numbers: +260 211 366 800

branch code: 260243

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Telephone numbers: +260 211 366 800

branch code: 260544

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Telephone numbers: +260 211 366 800

branch code: 260247

Plot 150/27/4586

chilumbulu road

chilenje

Telephone numbers: +260 211 366 800

branch code: 260046

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

Telephone numbers: +260 211 366 800

branch code: 260046

Stand no. 795

kalumbila high street

kalumbila town

Telephone numbers: +260 211 366 800

Find an ATM

Our atms (automated teller machines) are situated within the FNB zambia branches

Stand number 22768

acacia office park

thabo mbeki and great east roads

lusaka

telephone number: +260 211 366 800

Union house

plot 493/494

zambia way & oxford street

kitwe

telephone number: 260 212 657 100

Shakes investment limited building

plot number 16808

lumumba road

lusaka

telephone number: +260 211 366 900

Plot 7A

livingstone road

mazabuka

telephone number: +260 213 239 000

Neighbours city estate

plot number 50

butek

telephone numbers: +260 212 610 006/ 610 007

Makeni mall

plot 9471/2/3

kafue road

lusaka

telephone number: +260 211 369379

Plot 414 independence road

mkushi

telephone numbers: +260 971254871

mobile number: +260 977 995 476

Jacaranda mall

stand no.3539

corner of mushili & kabwe road

ndola

telephone number: +260 212 626 000

Plot 19222, zone 3 building, manda hill mall

corner great east & manchichi road,

lusaka

telephone number: +260 211 366 863

Musenga house

plot no. 617, shop number 4

kwacha road

chingola

telephone number: +260 212657130

Plot no. ME 46

along livingstone road.

Choma

mobile number: +260 969417613

Plot no. 646

corner of pererinyatwa road

& umodzi highway

chipata

telephone number: +260 216222003

Plot no. 921

kaonde house

independence avenue

solwezi

telephone number: +260 212626013

PHI shopping mall

stand 38147

bennie mwiinga road,

lusaka

telephone number: +260 211366919

Plot no. 87A shop no. 2

buntungwa street

kabwe

mobile number: (+260) 965 085 195

Wada chovu building

shop no. 4

along zaone avenue

mobile number: +260 965 841097

Kabulonga shopping mall,

lusaka

zambia

Phase V ATM lobby,

stand number 2374

arcades shopping centre,

great east road.

Lusaka

zambia

Down town shopping mall,

kafue road,

lusaka

zambia

Stand no. 22845, shop no. 28A,

crossroads shopping mall

leopards hill road

lusaka,

zambia

Plot number 3, independence avenue

city centre

kitwe

Stand no. 272

buteko drive

kalulushi

House no. 33 ndola road

fairview

mufulira

Stand no. KWE/71

kwacha east

kitwe

Stand no. 3680

kabala

kitwe

Plot 643 parklands shopping centre

corner kuomboka/freedom way

kitwe.

Inos holding 93

president avenue

town centre

ndola

Plot no. F/31096

chilengwa road

masaiti area

ndola

Plot no. 10709

kabwe road

ndola

Plot 012

corner president avenue & T3 highway

kafubu mall

ndola

Plot lub/3276/1

chibesa kunda road

ndola

Stand no. 437

cairo road

ndola

SGC filling station

ndola

Stand no. CH/108 hard K shopping complex

chifubu market

ndola

Plot no. 1320,

along great north road

mkushi

Farm no. 3168

farm centre

mkushi farm block

mkushi

SGC filling station

independence avenue

mitech area

solwezi

Industrial park

kalumbila mineral areas

kalumbila,

solwezi

Plot no. 53, 14th street

luanshya town centre

luanshya

Plot no. 2057

corner of gizenda road and chindo road

lusaka

Plot no. 9/65/4586

muramba road

chilenje south

lusaka.

At the real meat stand

lusaka

Oryx filling station

chongwe

Kobil filling station ATM

Corner of ben bella & lumumba road,

lusaka

Plot no. 12/70 - 45/86

kasama road

chilenje south

lusaka

Plot no.5065

mungwi road

lusaka.

Shop no. 18B

manda hill shopping mall

manchinchi road

lusaka

Odys filling station ATM

Plot no. 298

lumumba road

matero

lusaka

Radian stores

along chinika road

lusaka

Shop no. 465

maunda road

kabwata main market

lusaka

Vuma filling station ATM

Plot no. 6076

kafue road

lusaka

Engen filling station ATM

Engen filling station

los angeles road

long acres

lusaka

University of zambia main campus

lusaka

Plot no. 609

foxdale court

zambezi road

lusaka

Plot no. 8674, shop no.1A

corner jambo/almalik drive

riverside

kitwe

36 kabengele avenue

kitwe

Stand no. 100

katilungu road, chimwemwe

kitwe

Plot no. 396A

starbuck food centre

midway road, kamenza

chililabombwe

Konkola hypermarket limited,

mazabuka

Mazabuka sugar farms ATM

Edwina ceri coventry, 52690

lubombo

mazabuka

Intercity bus terminus

lusaka

Shop no. 43, mukuba mall, 6939

cnr freedom way & chiwala ave

parklands, kitwe

Budget stores complex

stand no:8,buteko street

town centre, mufulira

Plot no: 2503 turnpan zambia building

heavy industrial area

off independence avenue

kitwe

Plot 150/27/4586

chilumbulu road

chilenje

mobile: 0964-619518

Spar supermarket

plot 360/S, mosi-O-tunya rd,

livingstone, zambia

telephone numbers: +260 211 366 800

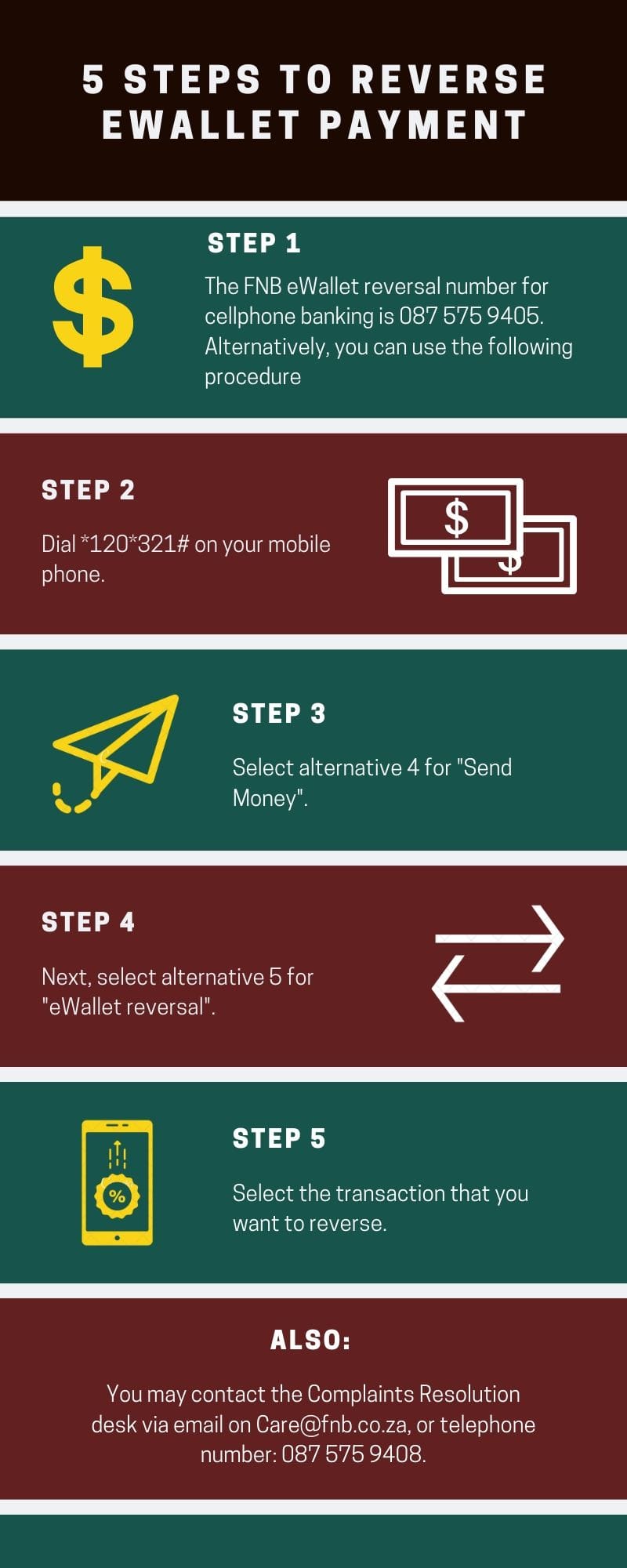

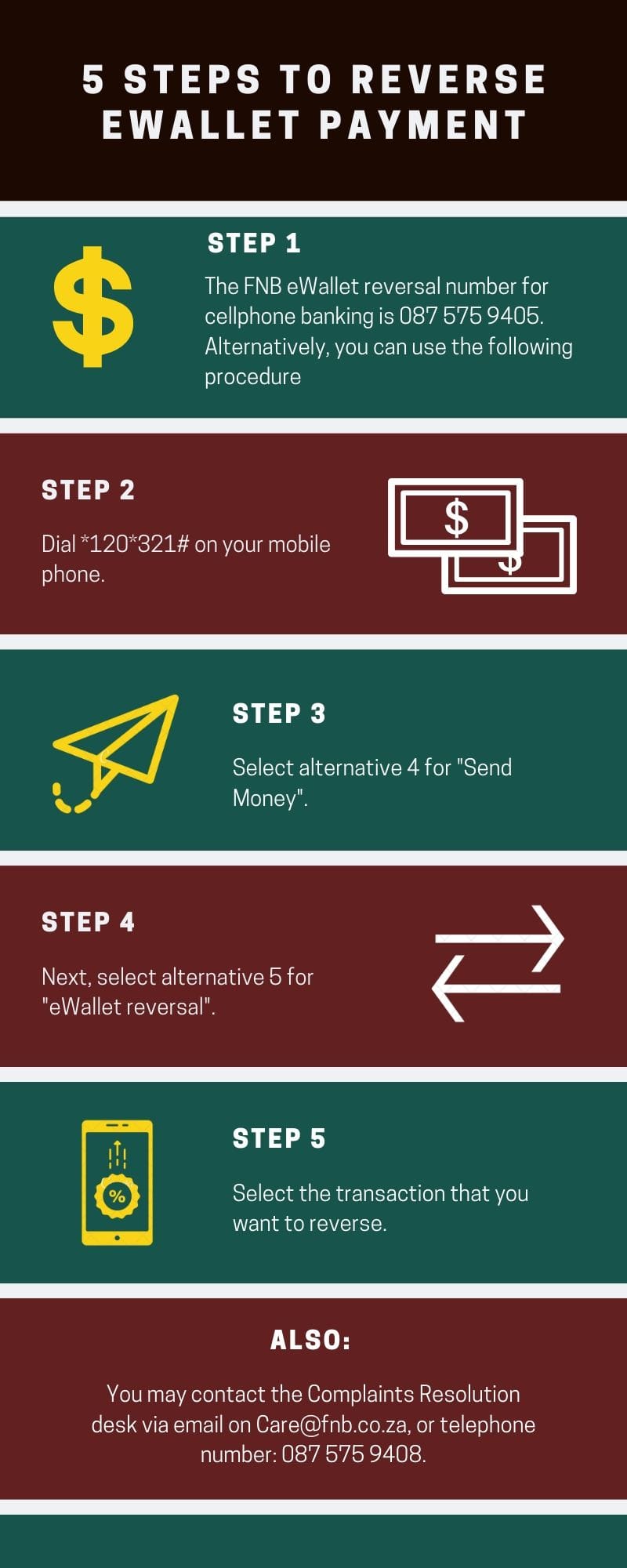

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

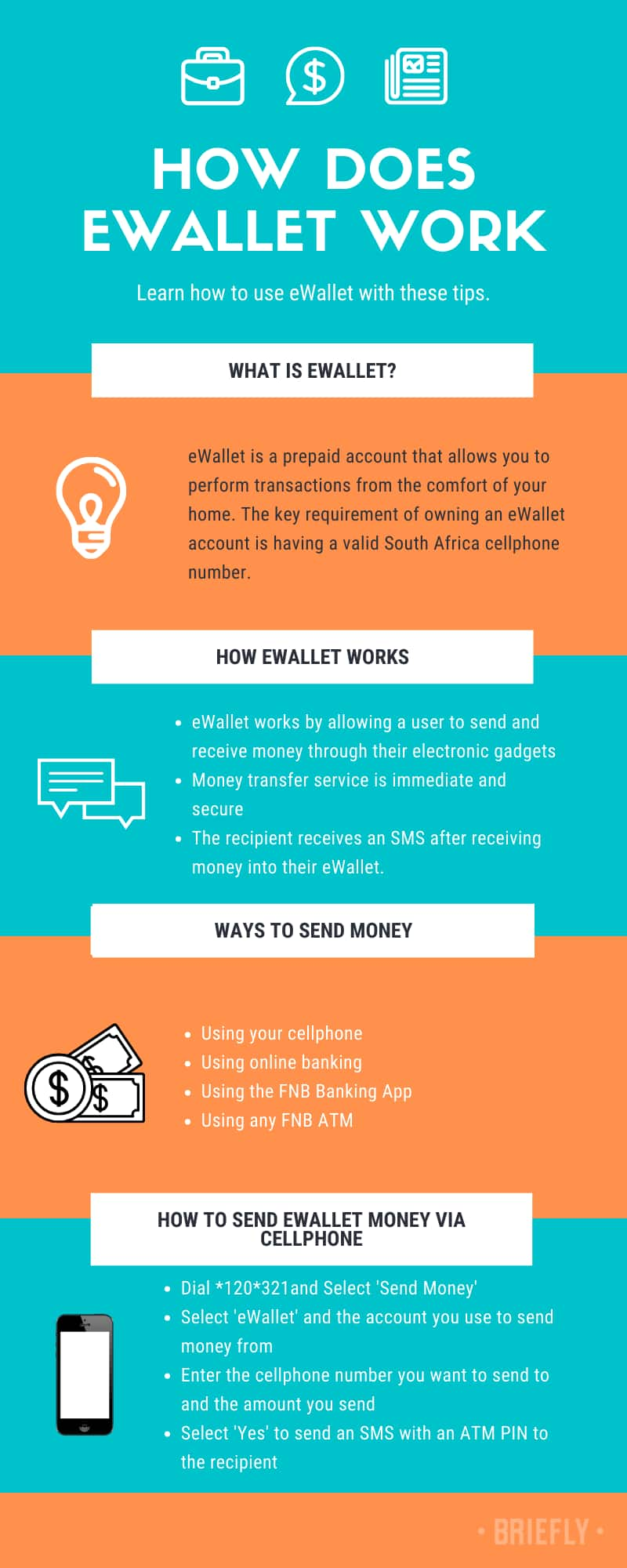

How does ewallet work

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

Image: canva.Com (modified by author)

source: original

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user's account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user's bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient's account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Image: instagram.Com, @fnbsa

source: UGC

READ ALSO: how to apply and use PEP money transfer

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the 'send money' option and clicking okay

- Selecting the 'ewallet' option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

Image: facebook.Com, @fnbsa

source: UGC

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the "ewallet services" on the screen.

- Enter your valid south african phone number on the keypad and select the "proceed" option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

- Verify that you have completed the transaction before leaving the ATM. In case you do not approve the transaction, you can select the " cancel" option to stop the transaction.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the "get retail PIN" option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the "withdraw cash" at checkout option.

- The following screen will ask you to "withdraw cash from ewallet."

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

READ ALSO: how does standard bank instant money transfer work

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

- FNB reverse payment - how can you reverse an EFT payment FNB with ease?

- How to send money to zimbabwe cheap, fast and securely

- How to reverse ewallet payment in 2020?

How ewallet work: this simple guide will help you

South africa is one of the countries whose technological industry is constantly making advancements. One of the greatest inventions that the country has made is ewallet. If you have not heard about it, you can now know how to use ewallet with these tips.

What is ewallet? Ewallet is a prepaid account that allows you to perform transactions, both online and offline, via your computer or smartphone. It works as a fast mode electronic wallet that allows you to perform transactions from the comfort of your home. The key requirement of owning an ewallet account is a south africa cellphone number via FNB atms, FNB cellphone banking, FNB online banking or FNB app.

How does FNB ewallet work?

Being a fast mode of transaction, ewallet works by allowing a user to send and receive money through their electronic gadgets. The first step of the transaction is for the user to load money into their accounts. The money is debited from the user’s account into their ewallet accounts in the form of digital representation. Being in the form of the digital representation means that the money is with the service provider who is responsible for keeping ledgers and records of all the users and their data. Therefore, for any deposits that a user makes, the money is transferred from the user’s bank account to the dedicated bank account that the user has chosen. The records of the ledgers are also automatically updated.

When a user chooses to send money to another ewallet user, there is no actual money transfer from one account to the other. Instead, what happens is that the ledgers are automatically updated to show that a transaction was performed and money was sent from your account to the recipient’s account. The recipient receives an SMS after receiving money into the ewallet. That is how convenient ewallet is. These how to do ewallet operation guides will be beneficial for you if you are a new user.

How to send money via ewallet

There are different ways to send money, including:

- Using your cellphone

- Using online banking

- Using the FNB banking app

- Using any FNB ATM

Sending money is one of the most basic operations that you can do with ewallet. The operation does not require any form of two-factor authentication. The service is, however, available for anyone with a south african cellphone number. The procedure on how to send ewallet money via cellphone is as simple as:

- Dialing *120*321#

- Selecting the ‘send money’ option and clicking okay

- Selecting the ‘ewallet’ option

- Selecting the account from which you want to send money from

- Keying in the cellphone number of the recipient, for this case, the user that you want to send money to

- Entering the amount of money that you want to send

- Selecting the yes option to complete the transaction. That option will also authorize the service to send the recipient a PIN that they will require when withdrawing the funds.

The sender will also be required to confirm the details of the recipient and the amount of money that they wish to send. Senders are advised to be cautious when confirming the details of the recipient since they will be liable for any transactions that are wrongly conducted. Now you know how to send ewallet funds.

FNB ewallet withdrawal

After you have received funds and wish to withdraw them from your ewallet account, the procedure for doing so is not as complex as it may sound. These are the simple steps to follow on how to withdraw ewallet:

- Start by dialing *120*277# for you to access your ewallet.

- In the list of options that will be displayed, select option 1 to get the PIN. You will receive a unique message sending you the five-digit PIN that will be required when withdrawing the money from the ATM. The PIN will expire after sixteen hours.

- Visit the nearest FNB ATM within sixteen hours after receiving the five-digit PIN.

- At the ATM, if you do not have an ATM card, you could opt for the cardless services transaction option.

- Select the “ewallet services” on the screen.

- Enter your valid south african phone number on the keypad and select the “proceed” option.

- The next dialogue box will require you to enter the five-digit PIN that was sent to you at the beginning of the transaction.

- Enter the withdrawal amount that you wish to withdraw from your account. The amount should be less than or equal to the amount of funds that you have in your account. The ATM will dispense the amount of money that you have keyed in.

Apart from the ATM, a user can withdraw cash from the ATM or withdraw funds from any of the selected retail stores. The procedure is as follows:

- Start by dialing *120*277# for you to access ewallet.

- Select option 1 to select the withdraw cash option.

- From the list of options that will be displayed, select option 1, which is the “get retail PIN” option.

- You can then visit any of these listed retail stores in the country to withdraw the cash;

Sutherland ridge SUPERSPAR

- At any of the selected retail stores, you will be required to purchase a credit or debit card. This step is mandatory.

- After purchasing, you will be required to select the “withdraw cash” at checkout option.

- The following screen will ask you to “withdraw cash from ewallet.”

- You will then be prompted to enter your phone number.

- The following dialogue box will require you to enter the four-digit PIN that was sent to you as a text message.

The cashier will then give you the money that you have withdrawn. There is no fee for withdrawing funds from ewallet. You need to, however, check the balance in your account by following the procedure on how to check ewallet balance.

How long does ewallet last?

When performing a transaction, the PIN that is sent to you in the form of a text message lasts for a maximum of sixteen hours. A user is then advised to complete the transaction as soon as they can to avoid any forms of inconveniences that are likely to arise.

How to request a new pin for ewallet

In case your ewallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#. The new PIN that will be sent to you will enable you to withdraw funds from your account without fail.

Technology has made the financial market convenient for users. One of the greatest inventions is ewallet, which has made it possible for users to perform transactions with ease. These details on how does ewallet work will come in handy.

How to reverse ewallet payment in 2021?

In this digital era, sending money across the globe has been made so much easier. Ewallet FNB is one of the simplest, efficient, and cheapest ways to transfer cash to friends and family in south africa. The best part is that you can transfer such funds from your bank account to any registered mobile number all over the country and not necessarily another bank account. In addition, the recipient can access the money instantly at any of the FNB atms. But what happens if you make an error with the recipient's mobile phone or bank information? Here is how to reverse ewallet payment in 2021.

Image: canva.Com (modified by author)

source: UGC

Can I reverse ewallet transaction? In case you send money via this option to the wrong recipient, you need to reverse it and resend it to the right person. Therefore, it is essential to know how to reverse such payments, and here is what you ought to do in case you are caught up in such a situation.

How to reverse ewallet transfer?

How do I reverse FNB ewallet when sent to the wrong recipient? You just noticed that the money has gone to the wrong recipient, and cannot help but panic. Do not worry, as there is an alternative to reversing the transaction. The only way to cancel an already complete transaction is to contact FNB call centre and request for the procedure to be done manually from their end. So, how do you contact FNB call centre on how to reverse ewallet sent to the wrong number manually?

- The FNB ewallet reversal number for cellphone banking is 087 575 9405. Alternatively, you can use the following procedure:

- Dial *120*321# on your mobile phone.

- Select alternative 4 for "send money".

- Next, select alternative 5 for "ewallet reversal".

- Select the transaction that you want to reverse.

- You may also contact the complaints resolution desk via email on care@fnb.Co.Za, or telephone number: 087 575 9408 (option one).

How do I reverse ewallet on FNB app? In case of any inquiries with regards to how to reverse ewallet on app, call 087 575 0362. And for queries on FNB ewallet reversal online, contact 087 575 0000.

Other important details on ewallet reversal

Can you reverse an ewallet transaction? FNB and standard banks permit free money withdrawals at specified retailers. The receiver of the money must know the validity of the ewallet PIN which is normally 30 days for absa and standard bank and 7 days for nedbank. In case the recipient fails to withdraw the cash in the given period, the money is reversed back to the account of the sender.

In case you receive payments wrongly, do not withdraw the cash and the FNB reverse payment will automatically revert to the sender after the PIN expires. The ewallet PIN for FNB is valid for four hours. Upon its expiration, the recipient can opt for FNB ewallet new pin request at any given period by dialing *130*277#.

How long does it take to reverse ewallet?

If you send money to the wrong recipient and call the company's team, the reversal should take up to 4 business days. On the other hand, money is returned to the sender within 15 business days if the recipient's number does not work.

How much does it cost to reverse an ewallet?

Kindly note that you will be charged about R50 as fee to get back the money sent to the wrong number. Also according to FNB, this procedure is not really guaranteed. For a better experience, ensure to double-check the cell phone of the receiver as well as the amount to be sent and this will save you the hassle of making an FNB ewallet reversal. Here is a quick reminder on how to correctly use this platform to send money.

How to correctly send money and avoid reversal inconveniences

Ewallet FNB is very convenient because one can use it in four different platforms which are mobile banking, ATM, mobile app, or online banking. After selecting your preferred option of making the transfer:

- Select send money then choose ewallet.

- Insert the mobile phone number of the person you wish to make the transfer to. Double-check to ensure that the digits are correct.

- Next, select if the app should offer the recipient a PIN or not, then type in the amount you wish to send.

- Lastly, confirm and submit the transaction.

The recipient gets an instant message after the money has been deposited into their account. To withdraw the cash, go to any of the nearby FBN ATM or selected retailers.

- Select FNB card less services in the screen then tap in the ewallet services.

- Insert your mobile number and press the proceed button.

- Type in the ATM PIN included in the message received and input the amount you wish to withdraw.

- After taking the money, ensure that the transaction has completed, or choose ‘cancel’ before departing from the ATM.

- In case you do not wish to withdraw the money, then you can use your FNB ewallet to purchase airtime, data, and electricity as well as pay for goods and services.

Ewallet account can hold a maximum of R5,000 at any point in time. The limit per day when transferring via the mobile app or online banking is R3,000 while the limit for cellphone banking and atms is R1,500. Additionally, FNB ewallet will only charge you a fee of R10.95 per transaction making it the most affordable way to send money in south africa. Ewallet withdraw fees will vary depending on the amount withdrawn.

With the above guide, you now know how to reverse ewallet payments if you incorrectly send the cash. So, if you make the mistake of sending money to the wrong person, do not panic but simply follow the steps and options to reverse the transaction.

DISCLAIMER: this article is intended for general informational purposes only and does not address individual circumstances. It should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility! We are not responsible for any loss, damages, etc. That may occur if the information contained turns out to be inaccurate/incorrect.

FNB ewallet: the ultimate guide for sending/collecting/reversing ewallet

FNB ewallet is the most convenient way of sending money to friends and family members.

It allows FNB account holders to send money from bank accounts to any registered working cellphone number in south africa.

You're able to reverse ewallet should you send money to the wrong number.

FNB ewallet - send money instantly.

Ewallet is the best when coming to sending money via cellphone banking.

The FNB ewallet enables clients to send money to a cellphone number (your wallet), and the money can be accessed instantly, at any FNB atm.

You can send an e-wallet of up to R3,000.00 per day when using the mobile app or online banking. And up to R1,500.00 using cellphone banking or FNB atms.

It's only going to cost you R10.95 for transfers less than R1,000.00. And R13,95 for any amount over R1,000.00 to R3,000.00.

That's the most cost-effective way of sending money to family.

The person you're sending the money to, don't need to have an FNB account in order to receive the money. They only need a working cellphone number together and the pin to withdraw cash.

Here's how it works:

Sending an ewallet is fairly simple.

- As an account holder, follow these steps to send FNB ewallet:

- Access online banking, mobile app, atm or cellphone banking;

- Choose to send money;

- The select ewallet;

- Enter the cellphone number you want to send the money to;

- Choose whether the app should provide the pin to the recipient or not;

- Enter the amount you'd like to send;

- Confirm and complete the transaction

To withdraw money, the receiver needs to visit any of the nearest FNB atm.

On the screen, they need to choose cardless services.

- Select 'ewallet services'

- Key in your cellphone number and select 'proceed'

- Key in the ATM PIN you received via SMS

- Select the amount you want to withdraw

- Take your cash

- Make sure your transaction has ended or that you select 'cancel' before leaving the ATM.

How to reverse an ewallet payment?

Do you want to know how to reverse ewallet sent to the wrong number?

Here's an example of someone who couldn't reverse the ewallet payment and was dearly frustrated. The person sent a lot of money to the wrong number and it's practically impossible to reverse the transaction over a telephone call.

However, the FNB ewallet reversal is very simple nowadays with cellphone banking.

- Dial *120*321# on your mobile phone [USSD]

- Select alternative 4 for "send money" next

- Select alternative 3 for "ewallet reversal"

- Select the transaction that you want to reverse.

Thus far, that's the only quickest way of reversing the ewallet transaction.

There are no options to reverse ewallet on the app or online - unfortunately.

For further assistance, you must contact the ewallet call centre on 087 575 9405 to reverse the money.

How long does ewallet reversal take?

Unfortunately, your ewallet transaction reversal won't immediate.

According to experienced customers, it takes 4 working days for FNB to complete the ewallet reversal process and pay the money back to the sender.

That's if the recipient's number is working, imagine if you've sent money to a cellphone number that doesn't work.

Well, they'll still help you however it will take about 15 business days for the ewallet reversal to complete.

So, before clicking that sent button, double-check the cellphone is correct to avoid penalties

How much does it cost to reverse the ewallet transaction?

Now that you've managed to reverse an ewallet payment, how much is the bank going to charge you for the mistake?

The amount you'll be charged varies depending on the amount you've sent but charges the same amount as when you were sending.One client claimed was charged R50 fee to reverse an ewallet.

To avoid these inconveniences, always double-check and cross-check the cellphone number of the receiver of the money.

It's super easy to send ewallet via the app because it has access to your cellphone contact list to choose from.

Please note there may be a charge when requesting a reversal. If that (wrong-) person had already collected the money, unfortunately, FNB will not be held responsible and does not guarantee you'll get your money back.

Lazada E-wallet guide: check out faster with online payments

If you’re used to cash on delivery want to enhance their online shopping experience, read this lazada E-wallet guide.

Lazada, one of the most popular online shopping websites in the philippines, is an ever-evolving e-commerce platform. Breaking into the scene as an online store for third-party sellers, it has expanded with the launch of lazmall. And with its introduction of the mobile wallet, they’ve made payment transactions even easier and faster.

What is lazada E-wallet?

Lazada e-wallet is a digital payment option that you can use to buy products and avail of services from the lazada digital shop. The minimum amount you can place in the wallet is ₱20, while the maximum amount is ₱50,000. The said balance includes refunds and promotional rebates.

This one-click checkout process eliminates the worry of having to bear the exact amount during cash-on-delivery transactions. To date, digital wallet has become the most preferred payment method by two million online shoppers on the portal.

Features of laz wallet

These are the key features you will benefit from using lazada E-wallet:

- Easy access to cash-in partners

- One-click payments

- All transactions with the e-wallet are protected

- Guaranteed instant refunds

- Get rebates whenever you shop

How to create an e-wallet account on lazada

To enjoy the e-wallet, you should create a lazada account first. Here’s how to do it:

If you are using a desktop

- Go to the lazada website

- In the upper right corner of the page, you can find the “signup” button. Click it to be redirected to the information page.

- Provide the details needed for each field.

- To make it shorter, you can also choose to create an account via your email, facebook, or google account

- Indicate active contact details such as mobile number or email to receive the most recent news and platform updates.

If you are using a mobile device

- Download the app from google play or app store.

- Go to the official website of the said online shop: www.Lazada.Com

- Click signup or login.

- Click “signup now.”

[hsbc-latest-promo-banner-three]

How to activate your lazada wallet

These are the steps for the activation of your digital wallet:

- Open your lazada mobile app, click on the “wallet” button.

- Select the “my wallet” page and click on the “activate my wallet” to continue.

- Type in your mobile number at the empty field, and “get code.”

- You will receive the verification code via SMS. Type it in the corresponding field.

- Click on the “verify mobile number” button to proceed.

- Agree on the terms and policy by ticking its box.

- Once the verification process is complete, a page of your details and balance shows where you can enjoy more of its features.

How do I cash in my lazada E-wallet?

To top up your wallet, follow these steps:

- Log in to your lazada account.

- Access your lazada wallet, and select the button to “cash in.”

- Once redirected to the cash-in page, indicate the amount you want to put into the wallet.

- Select the type of cash-in channel you will be using.

- To cash in using OTC or online banking, you will receive either a subscriber number or reference code to complete the transaction.

- Take note of the payment instructions. Once finished, click “done.”

- You will also be notified of the transaction details via SMS and email.

Cash-in partners of lazada

Currently, these are the available cash-in channels:

- Bank account or direct link: BPI, metrobank, unionbank

- Credit or debit card: visa and mastercard only

- E-wallet: gcash

- Over-the-counter outlets: 7 eleven, express pay, M lhuillier, SM bills counter, true money

- Online banking for bills payment: metrobank and BDO only

How do I pay with lazada E-wallet?

Here’s how you can check out using digital payment:

- For simple purchase, just select the online wallet as your payment method for the checkout.

- If the wallet is not listed as a suggested payment method, click “view” to see other options.

- If you don’t have enough funds while making a purchase, select the button, “cash in and pay.” make sure you top up the wallet within 48 hours to proceed with the order. Non-payment within the given duration will revoke your cash-in transaction.

Lazada E-wallet: frequently asked questions

Can I transfer my balance to another lazada wallet account?

No. Lazada wallet currently doesn’t have that kind of option.

When will my cash in reflect on my wallet account?

Cash-in using all channels will reflect on the account within five minutes. Exceptions apply to metrobank, which takes up one hour; and BDO, with which it takes 25 hours before the new balance appears.

If the balance failed to reflect within the expeted timeframe of each channel, contact the customer service immediately. Prepare proof of cash-in transaction such as deposit slips, email confirmation, receipts, and similar documents.

Can I withdraw my balance for my lazada E-wallet?

No, you can’t withdraw the balance from your wallets, such as deposits (cash in) and refunds of orders. These can only be used to purchase items on the shopping platform.

Do lazada balances expire?

In your laz wallet, the deposited balance and refunds do not have an expiration. However, promotional rebates may expire according to the specified timeframe.

New to digital payments? Apply for a new HSBC credit card and get a ₱2,500 cash rebate! Terms and conditions apply.

Compare credit cards

Find the perfect credit card that suits your lifestyle

Cashback, rewards, and many more perks. Choose now

About the author

Ecomparemo ecomparemo is the no. 1 financial e-commerce site in the philippines. Follow us on twitter and instagram: @ecomparemo.

How to send money through FNB ewallet

Ewallet is a mobile banking service from first national bank FNB. It allows bank account holders to send money anywhere through mobile devices. FNB customers can send money to any mobile number in zambia in local currency. Similar to MTN mobile money, fund is transferred instantly to the recipient. Here’s how to send ewallet FNB zambia, and what you can buy using ewallet.

Instantly withdraw cash from any FNB ATM and sending money. Buy MTN, zamtel and airtel prepaid airtime through ewallet services. You can settle bills and check account balance. Finally follow up on monthly ewallet statements.

How to send ewallet FNB zambia: tips for beginners

There four (4) available methods and options to choose from. Available money sending options, include cellphone banking, online banking, banking app and through ATM. Therefore, one can freely choose any convenient option.

- Cell phone banking: cellphone banking requires an active phone number.

- Online banking: to get started visit FNB online website. Signup for online banking and wait for your account to be activated. To send funds through online banking you must be logged into your account.

- Banking app: the app can be downloaded from the apple store and android store.

- FNB ATM: just locate any nearest ATM in zambia for FNB, to get started

Cellphone banking:

Here are five steps on how to withdraw money from FNB ewallet zambia using cellphone banking:

Step 1: dial *130*321#

To send your money dial *130*321# . Following options below on the image should appear. If not showing, please check network connection and any possible errors.

Zambia

Step 2: select ‘send money’

Choose and select ‘send money’ option, which is the third option on your screen.

How to send MONEY

Step 3: enter recipients number.

If its a number you have previously used used, it should appear below so no need to re enter it again. Ewallet saves the last 4 frequently used numbers from previous transactions. For new number, key in the cellphone number by selecting option 1.

How to send ewallet FNB zambia

Step 4: select amount to send

Choose and enter amount you want to send money from your account to ewallet. Ensure to confirm its correct. Because there is no reversals for any incorrect transactions as shown on the image

How to send ewallet

Step 5: send secrete pin to recipient (optional)

Choose to send secrete pin which recipient must provide upon withdraw through an ATM or cash plus agent. Recipients with no PIN, must provide transaction message as proof of having received money.

How to send ewallet

Congratulations you have just successfully learnt, how to to send ewallet FNB zambia to your recipient. Just wait for text confirmation from FNB. Message confirms of the transaction status and if money sending was a success or failure.

FNB ewallet pros

Ewallet is very simple to use and allows you to send money to anyone. Recipient only need a valid phone number, even with no bank account or bank card and VISA. You can still collect and withdrawal money. Funds are instantly available, and money can be transferred even at night.

FNB ewallet cons

FNB ewallet does not allow for reversal in case you make a mistake during transfer. Charges for every transaction, and its just expensive. Costs K10.00 to send money from your FNB account. Service is unavailable sometimes, but not frequently. Recipients can only withdraw cash through FNB cash plus agents or ATM’s in zambia. Hence for rural urban based citizens its not easily possible because FNB ATM’s are more populated in urban areas.

So, let's see, what was the most valuable thing of this article: how to check balance on ewallet this is your third and last login attempt available. Your profile will be blocked if you fail to enter your login details correctly. Oh no! We've at how to check balance on ewallet

Contents of the article

- Free forex bonuses

- How to check balance on ewallet

- Cellphone banking

- Online banking

- FNB ATM

- You have access to ewallet

- Send money anywhere, any time

- Instantly send money or make payments

- What's hot

- Send the way you want to

- Withdraw, buy + spend

- Turn your phone into a wallet

- How to check balance on ewallet

- Find an ATM

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- How does ewallet work

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How ewallet work: this simple guide will help you

- How does FNB ewallet work?

- How to send money via ewallet

- FNB ewallet withdrawal

- How long does ewallet last?

- How to request a new pin for ewallet

- How to reverse ewallet payment in 2021?

- How to reverse ewallet transfer?

- Other important details on ewallet reversal

- How long does it take to reverse ewallet?

- How much does it cost to reverse an ewallet?

- How to correctly send money and avoid reversal...

- FNB ewallet: the ultimate guide for...

- FNB ewallet - send money instantly.

- How to reverse an ewallet payment?

- Lazada E-wallet guide: check out faster with...

- What is lazada E-wallet?

- Features of laz wallet

- How to create an e-wallet account on lazada

- How to activate your lazada wallet

- How do I cash in my lazada E-wallet?

- Cash-in partners of lazada

- How do I pay with lazada E-wallet?

- Lazada E-wallet: frequently asked questions

- Can I transfer my balance to another lazada...

- When will my cash in reflect on my wallet account?

- Can I withdraw my balance for my lazada E-wallet?

- Do lazada balances expire?

- How to send money through FNB ewallet

- How to send ewallet FNB zambia:...

- Cellphone banking:

- Step 1: dial...

- Step 2: select ‘send money’

- Step 3: enter recipients number.

- Step 4: select amount to send

- Step 5: send secrete pin to...

- FNB ewallet pros

- FNB ewallet cons

- Cellphone banking:

No comments:

Post a Comment