How much can you make with $100 on forex

- A scalpers’ attitude

Free forex bonuses

To make money day trading forex , you also can keep an eye on other prospects which might end up fruitfully for you. Day trading or scalping is all about adaptability, and you should always have a contingency strategy or plan.

Make 100 a day trading forex

Let’s get straight down to the facts here. Yes, you can make a $100 a day and more while trading in the foreign exchange. It doesn’t matter if you have a micro account with just $250 in it. If you know how to make it you can easily make 100 a day trading forex . Here are a few worthwhile tips which will get you to that mark. A $100 a day means about $30,000 a month, not bad at all!

- Choose the right currency pair and strategy

If you’re thinking that you can make 100 a day trading forex in USD EUR then you’d better ponder on it. This is not saying you can’t, this is simply saying that it depends. There are numerous factors to making a profit and it depends completely on the set or future market trends. For example, if GBP USD has registered a slump and forecasts observe a definite resistance in the future, you should look at investing in it even though you haven’t made much head way into the other asset which you have.

A suggestion would be to have two trading accounts instead of one as this will give you the flexibility in making trades beyond the pre-supposed plan which you might have had at the start of the day. To make money day trading forex , you also can keep an eye on other prospects which might end up fruitfully for you. Day trading or scalping is all about adaptability, and you should always have a contingency strategy or plan.

- Make 100 a day trading forex with proper forecasts

Day trading or scalping requires constant monitoring and quick responses. Price quotes change within seconds irrespective of the time-charts being followed. If you want to properly forecast the market for that day, you need to keep an eye out not only on technical tools and indicators but also on economic news and forecasts by other traders too.

Trading forums are very important for day trading; making money day trading forex is one-shot chance and if you end up predicting the other way, that whole day is lost. You will more than a few situations where your forecasts will not match up with what was originally expected. This forums and blogs provide live updates of the market and will give you a heads-up as to what you might’ve been missing in your forecast.

- A scalpers’ attitude

And it’s not just about the right attitude; it’s about the whole mentality which you need to have to make sure that you do scalp the profit through the day. To make money daily with forex , you need to be an opportunist with a sound strategy and the urgency of getting the job done. Let’s consider an example here to brighten the possibility of it.

Considering that you have a 250:1 leverage account with $500 in it. You buy long $100 in a currency which stands at 1.25 against USD (say) and sell it off at a 1.27. As per leverage, you garner a profit worth $400. That’s 4 times more than what you’ve been thinking you can get through so far!

So invest and make 100 a day trading forex. It’s easier than you think!

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How to make $100-200 A day from forex trading (required account size)

Required trading account size to make $100-200 A day from forex

In this video, I share the math behind the required trading account size to make $100-200 per day as a forex trader. Vlog #183.

The reason why I think it's important to look at this is that many aspiring traders ask me what amount of money they need to make a living off trading. The answer is often lower than some experienced traders would say.

However, it's very important to stop and think about whether you are looking to simply live or instead to grow an account. After all, constantly taking money out of your trading account reduces the pace at which your account grows.

Let's jump on the whiteboard to do the math!

What if you don't have that required trading account size?

A lot of traders get discouraged when they hear they need $50k to make a living off trading.

Wasn't trading supposed to be an easy money-making scheme?

Let me remind you: the moderate cost to study in a private college in the united states is averaged $49,320 in 2016-2017 (source: college data).

However, if you do not have the money to start trading for a living up front, there are alternatives. You can use OPM (other people's money), which is the way I favored.

By using other people's money, you can expect to need a bigger account size since you will only collect 25-30% of the profits. In this case, you would need a 3x-4x account.

More resources

If you are aspiring to trade for other people, you might want to consider checking out the desire to TRADE academy where I’ll help you do precisely that!

Fxdailyreport.Com

Unlike the futures or options markets, you can actually start trading with as low as $100 in the forex market. Forex is a leveraged market, which means you can use a little money to trade up to 20 or 30 times the amount you will be required to stake in a trade (UK and europe), and sometimes even as much as 500 times your required investment amount (known as the margin). This makes the idea of trading forex quite interesting to many. However, trading with $100 in the forex market, even if you have access to a leverage of as high as 1:500, comes with its own set of challenges and rules. This is what this article is all about.

What can’t you do with $100 in your forex account?

Here are some things a $100 forex account cannot do for you.

- It will not enable you to quit your job to start trading full-time. There are countries on this earth where $100 is the equivalent of one day’s rent. It is simply impossible to make $100 a day from $100 capital to survive in such places. Of course, other personal and household bills have not been added to the mix yet.

- You will not become the next warren buffett or george soros overnight. You cannot start trading with $100 and expect to start rubbing shoulders with these guys in terms of monthly earnings from trading.

- You will not grow to $10,000 or $100,000 in a month. We have been seeing such ads coming from advertisers of forex robots and other affiliated software. We also see such ads in the binary options market, as many traders were told that they could achieve this using the short term expiry trades. Forget it: it will not happen.

What can you do with $100 in your forex account?

However, there are positive things you can do with your $100 forex account. You will be able to do the following:

- Learn vital lessons about money management. Since you already have restricted capital, you will learn how to use the little you have very wisely. Most responsible people who are down to their last $100 in the real world will certainly not use it to go gambling or plunge the money into some crazy stuff. They are more likely to use it very wisely and judiciously. So why can such attitudes not be brought into the world of forex trading?

- You can use your $100 forex account to make a smoother transition from the world of virtual trading to the world of live trading. Many people make the mistake of switching from a demo account to a heavily funded live account. This is not a good way to make the transition. Conditions in a live account are very different from the world of demo trading. A live account will mean you are now trading at the level of the broker’s dealing desk with real money. The brokers are also reselling positions to you that were acquired from the interbank market with real money. You can never compare shooting practice with blanks to live fire in a real war situation. That is why soldiers are first started off with blanks and proceed to live fire training before being deployed to a hot zone. Any soldier can relate to this. It’s the same process in forex trading.

- Emotional control is a lesson you can learn from a $100 account. Learn to trade with real money, but not so much as to make you lose sleep. That way, you can condition yourself to what the real money trading situation will bring.

How to start forex trading with $100

These days, the process of opening and funding a forex account has been made very easy. You can do this in a matter of minutes using any of the payment methods available from the broker. After funding your account, you can then trade forex with $100 following these rules.

Rule 1: money management

The first method is to trade with money management as the number 1 focus. This money management-focused method means that you will trade with no more than 3% of this money in total market exposure. This means you can only trade micro-lots ($1000 minimum position size). If you hold an account with a UK or EU broker, you can only use a maximum leverage of 1:30. With a margin of 3.33%, this means that you cannot trade within the boundaries of risk management with an EU broker, as you will need at least $33 to trade 1 micro-lot. However, a brokerage in australia, south africa or any of the other popular offshore jurisdictions still offer leverage of up to 1:500. A micro-lot would therefore need just $2 commitment from the trader, which keeps the position within allowable risk management limits.

Rule 2: risk-reward ratios

The next rule has to do with risk and reward. Risk refers to the stop loss (SL) you will use, and reward has to do with the take profit (TP) setting. You should target to make 3 pips in profit for any 1 pip risked as stop loss. Using your allowable money management that restricts you to 1 micro-lot positions, this means that you should be prepared to target $6 for every $2 used in the stop loss. This translates to at least 60 pips TP, and 20 pips SL.

This means that you have to be super-selective of your trades. Only enter into trades where there is a high chance of winning, and use well-defined parameters of support and resistance to target your setups. Fortunately, some chart patterns such as the flag and pennant have standardized profit targets, and the pattern boundaries can also help define the stop loss.

Rule 3: avoid the news spikes

News trades are highly unpredictable, especially within the first few minutes of a news release. The spikes and whipsaws can easily stop your trades out. With such limited capital, you should avoid news trades like a plague.

Ultimately, you will need to work on getting more capital, but by the time you do, your $100 journey in forex trading would have prepared you adequately to trade larger capital responsibly.

Realistic forex income goals for trading

What are realistic and acceptable forex income goals?

Setting realistic trading revenue goals is a tough question to answer because there are so many factors. Each trader is different, and the reality is that most traders lose money. The reason is that trading is tough and it takes real effort and discipline to be successful.

It is impossible to find out what the best independent traders make. Only a few people share that information. Those who do, may or may not be telling the truth. We will start by looking at some independent forex trader salary public data available on the internet:

We will start by looking at some independent forex trader salary public data available on the internet:

Salary.Com says:

how much does a foreign exchange trader III make? The median annual foreign exchange trader III salary is $166,461, as of march 31, 2017. The range is usually between $130,000-$194,728. However, this can vary widely depending on a variety of factors. Our team of certified compensation professionals analyzed survey data collected from thousands of HR departments at companies of all sizes and industries to present this range of annual salaries for people with the job title foreign exchange trader III in the united states.

This professional forex trader income makes, not the retail traders who work from home.

A foreign exchange trader job is hard to find. But you can do it if you work at it, however, I think it is better if we work on trading for ourselves. Here is everything you need to know about brokers.

How much can you make trading the forex market?

There is no limit on how much you can make! You can make millions of dollars. Anything is possible which is why so many people try to learn how to trade.

WAIT! Forex income is challenging:

Before you get crazy here and start throwing loads of cash into a trading account. I need to tell you that, only a few people get rich trading retail forex. It is difficult, and you must be a master of trading and discipline to make a significant amount of money.

We could play the scenario’s all day long. This is the reason a lot of people get into forex trading in the first place. They see the possibilities of millions of dollars as what is possible. The next thing you know, they will have lost several thousand dollars trading. This is because they trade without knowing what they are doing and lack of discipline.

Realistic trading income calculations:

So let's calculate realistic numbers regarding profit potential.

The first thing you have to realize is that the use of leverage in trading is an excellent way to maximize gains. And risk can be managed fairly well if you have the discipline. That is the problem though is most people do not have the discipline.

But for the sake of this article, I am going to assume you have the trading discipline and have the ability to follow a forex trading income; risk management plan.

The great thing is you do not have to risk much to make a substantial profit. Let me give you an example.

You have an account of 10k, and you want to earn 2.5% per month with a goal of 30% account growth per year.

Now you decide that you are only going to risk 1% of that account per trade.

At 1% risk of 10k, that is $100 USD, and therefore you are only risking 1% at any given time, and you could potentially earn the 30% growth by never risking more than $100 at one time.

Now there are many more numbers that must be calculated such as what is your win rate, what is the risk to reward ratio. So the scenarios could go on and on forever.

You could, in fact, raise your risk to 2.5% or $250 and hit your goal with a single trade and meet our monthly goal by using a risk/reward ratio of 1:1.

Forex income compared to real estate income

Compare that with something real estate where someone might have to risk a great deal more to achieve the 2.5% gain. For example, you could spend 100k or more purchasing a house, and in trading, you can earn 2.5% with a much smaller investment by opening an account for as little as 1000. You can also read the information on gold investments.

You could potentially make 2.5% on one trade versus a lot more upfront money and time involved in real estate investment.

That’s the only trade you would have to make that month in order to gain what you would be averaging in real estate to be considered extremely profitable. The conclusion is simple: forex has such an incredible potential, that it can easily surpass real estate even with minimal risk measures in place.

I cannot think of many investments that yield anywhere near 100% ROI a year. Let's take a look and see how hard it would be to make this with minimal to moderate risk management. It comes out to 6% a month compounding. Now that, my friend, is more than doable in this market. If you are confident in your profitability as a trader and willing to risk, say 3% of your account on each trade, then with an RR of 1:2 you could easily achieve this percentage with one trade in a month.

Forex is an excellent investment IF you take it slow and focus on the long term. Also, read a million USD forex strategy.

What is the average forex trader salary?

I would like to compare forex vs average and above average careers.

Now, looking at the average income per capita (person) in the U.S. The average income per capita in 2015 was $58,714 via wikipedia.

Let us imagine that you would like to make at least $50,000 a year trading. After all, you're doing this for the money, so you want to make as much as possible.

Once again using minimal-moderate risk, we said you could accumulate 8% a month.

Assuming that you increase your lot sizes with your account each month, instead of weekly or daily for risk management purposes. You would need to have a $40,000 account to make $53,265.56 a year at 8% a month.

Now let's say you minimized your expenses and worked a job, so you were able to build your trading account. How long would it take you to make 1 million off of a $10,000 account at 10% ROI a month? In 4 years you would have $970,000. Divide that by 4, and you get $242,500. Which means that you made $242,500 annually. That is if you did not pull any out, instead let your account build at 10% ROI each month.

What if you wanted to wait until five years and then start pulling out all of your profits. In 5 years you would have $3,044,816. Now you can feel free to pull out all of the profits each month. That would mean you would make $304,481 a month! Just imagine that. If you build up your 10k account for five years, you will be making $3,653,779 a year after that if you pull out all of your earnings. So we see that it is much better to build up your account until you feel you NEED to take the money out. I mean, can you imagine making that kind of an income five years from now every month. I am not even talking about something that is unachievable. 10% a month is possible in forex by finding a great trading system, having proper discipline and finding a trading mentor. It's important to keep yourself in check, perfecting your craft each and every day by educating yourself.

In fact, 10% per month can be accomplished with only a few high-quality trades each month. Many traders get caught up in quantity instead of the quality of trades. We have a forex trading income calculator on this site to help you do your calculations.

I would challenge you to find another career in the world that will have you earning that kind of money in 5 years. I mean, honestly, those numbers are mind-blowing, remember though don’t get caught up in the figures. Trading isn't easy but can be done, if you follow a plan.

I say this simply to reinforce how profitable the forex market can be if you work hard, and have long-term goals in mind.

You really can make great income in forex

In conclusion, if we can maintain a realistic view of forex, then we have a greater chance of setting reasonable goals. This helps us maintain a profitable trading strategy that brings us a steady forex income over time. If you don't believe me take a look at the forex compounding calculator which will tell you all you need to know about how much forex income you can make.

"nothing can stop the man with the right mental attitude from achieving his goal. Nothing on earth can help the man with the wrong mental attitude." -thomas jefferson

Please leave a comment below if you have any questions about realistic forex income!

Also, please give this strategy a 5 star if you enjoyed it!

(33 votes, average: 4.45 out of 5)

loading.

The minimum capital required to start day trading forex

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/486965081-56a22da85f9b58b7d0c784b7.jpg)

Martin child / getty images

It's easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

And unlike the stock market, for which the securities and exchange commission requires day traders to maintain an account with $25,000 in assets, there is no legal minimum amount required for forex trading.

But just because you could start with as little as $50 doesn't mean that's the amount you should start with. You may want to consider some scenarios involving the potential risks and rewards of various investment amounts before determining how much money to put in your forex trading account.

Risk management

Day traders shouldn't risk more than 1% of their forex account on a single trade. You should make that a hard and fast rule. That means, if your account contains $1,000, then the most you'll want to risk on a trade is $10. If your account contains $10,000, you shouldn't risk more than $100 per trade.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can't significantly deplete your capital. Risk is determined by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

:max_bytes(150000):strip_icc()/minimum-capital-required-to-start-day-trading-forex-1031370_FINAL1-0fd72348a80a4951b802a7df8b988713.png)

Pip values and trading lots

The forex market moves in pips. Let's say the euro-U.S. Dollar (EUR/USD) currency pair is priced at 1.3025. That means the value of one euro, the first currency in the pair, which is known as the base currency, is $1.3025.

For most currency pairs, a pip is 0.0001, which is equivalent to 1/100th of a percent. If the EUR/USD price changes to 1.3026, that's a one pip move. If it changes to 1.3125, that's a 100 pip move. An exception to the pip value "rule" is made for the japanese yen. A pip for currency pairs in which is the yen is the second currency—called the quote currency—is 0.01, which is equivalent to 1 percent.

Forex pairs trade in units of 1,000, 10,000 or 100,000, called micro, mini, and standard lots.

When USD is listed second in the pair, as in EUR/USD or AUD/USD (australian dollar-U.S. Dollar), and your account is funded with U.S. Dollars, the value of the pip per type of lot is fixed. If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a mini lot of 10,000, then each pip move is $1. if you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk.

Stop-loss orders

When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall.

Capital scenarios

$100 in the account

Assume you open an account for $100. You will want to limit your risk on each trade to $1 (1% of $100).

If you place a trade in EUR/USD, buying or selling one micro lot, your stop-loss order must be within 10 pips of your entry price. Since each pip is worth $0.10, if your stop loss were 11 pips away, your risk would be $1.10 (11 x $0.10), which is more risk than you want.

You can see how opening an account with only $100 severely limits how you can trade. Also, if you are risking a very small dollar amount on each trade, by extension you're going to be making only small gains when you bet correctly. To make bigger gains—and possibly derive a reasonable amount of income from your trading activity—you will require more capital.

$500 in the account

Now assume you open an account with $500. You can risk up to $5 per trade and buy multiple lots. For example, you can set a stop loss 10 pips away from your entry price and buy five micro lots and still be within your risk limit (because 10 pips x $0.10 x 5 micro lots = $5 at risk).

Or if you choose to place a stop loss 25 pips away from the entry price, you can buy two micro lots to keep the risk on the trade below 1% of the account. You would buy only two micro lots because 25 pips x $0.10 x 2 micro lots = $5.

Starting with $500 will provide greater trading flexibility and produce more daily income than starting with $100. But most day traders will still be able to make only $5 to $15 per day off this amount with any regularity.

$5,000 in the account

If you start with $5,000, you have even more flexibility and can trade mini lots as well as micro lots. If you buy the EUR/USD at 1.3025 and place a stop loss at 1.3017 (eight pips of risk), you could buy 6 mini lots and 2 micro lots.

Your maximum risk is $50 (1% of $5,000), and you can trade in mini lots because each pip is worth $1 and you've chosen an 8 pip stop-loss. Divide the risk ($50) by (8 pips x $1) to get 6.25 for the number of mini lots you could buy without exceeding your risk. You would break up 6.25 mini lots into 6 mini lots (6 x $1 x 8 pips = $48) and 2 micro lots (2 x $0.10 x 8 pips = $1.60), which puts a total of only $49.60 at risk.

With this amount of capital and the ability to risk $50 on each trade, the income potential moves up, and traders can potentially make $50 to $150 a day, or more, depending on their forex strategy.

Recommended capital

Starting out with at least $500 gives you flexibility in how you can trade that an account with only $100 in it does not have. Starting with $5,000 or more is even better because it can help you produce a reasonable amount of income that will compensate you for the time you're spending on trading.

How to trade forex with $100 in just 5 minutes january, 2021

Posted by andy | last updated dec 23, 2020 | forex guides | 0

Forex is one of the most reliable and best online trading methods. There are numerous investors across the globe are working keenly with this platform to achieve a remarkable profit by the end of the day. However, the different strategy to focus on the profit is by getting into the proper systematic way.

The newcomers will face a complex task at the entry level of the authorized system. With effective training, you can yield an idea about the real-time analysis of trade’s future patterns and the reliable investing amount.

Hence, all together it will move on to the winning path. In this scenario, many investors afraid about the investment of huge amount for forex trading rather than with a low investment. Such cases, we do not inform that you will not face any risk factor by investing higher than a hundred dollars.

Forex trading

You can easily become a successful trader if you understand the leverage working process, which is most essential. If you ignore the leverage during the trading process then it will end in a disaster. If you are comfortable taking the risks by trading with a huge amount of money may lead to no return. You can also gain significantly if the trade favors on your part.

- Your daily financial responsibilities should not interfere with your forex trading investment or capital.

- You should not invest a huge amount for forex trading because it may even halt your life if anything goes wrong.

- Please remember not to take any risk limit to open trades or invest beyond your level.

This is not to make a quick rich strategy. You need to know how simple by converting $100 into $1000 or more than your forex trading. It is always risky and also a possible step. Leverage is very similar and comparable like a double-edged sword, which helps your profit to boost potentially.

It can plunge your down and boost your risks into the abyss. Your potential losses will be magnified by the leverage if you trade into the negative direction.

The leverage of trading with 100:1 will allow you to trade with a maximum amount of $10,000 and can get every $100 credited to your account. If it is $100,000 trading then you can get $1,000 into your account. With the help of leverage, you can easily earn with a huge profit that is equivalent to $100,000 into your trading account. Even leverage may cause you a heavy loss to your trading account.

Reliable steps to trade forex with $100 january, 2021

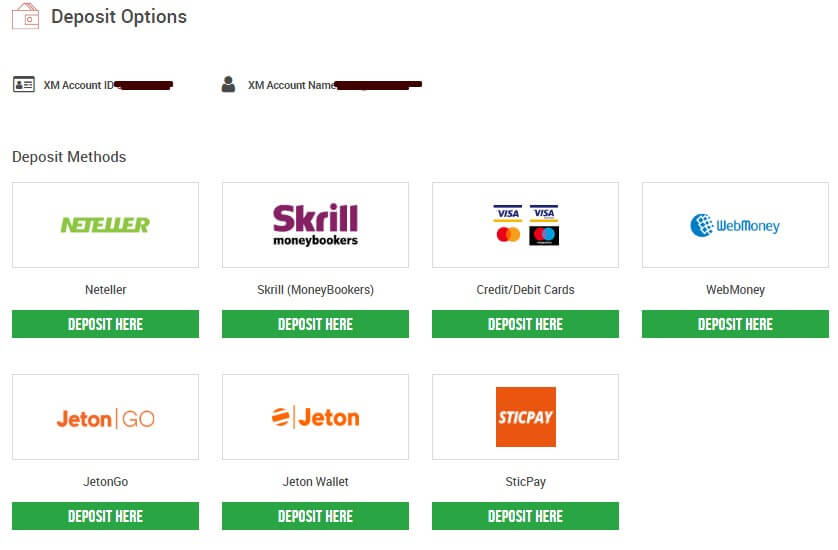

Step 1: start to invest your money in XM trading

You can start the trading journey by investing a hundred dollars in xm market

To do this visit XM.Com and open an real account

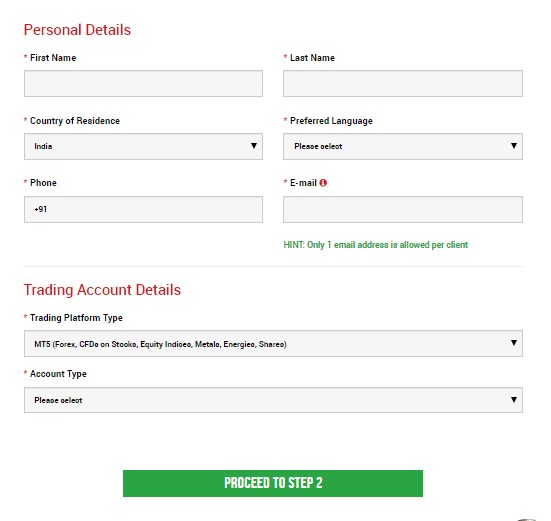

Step 2: filling the personal details

Fill all the box with accurate details

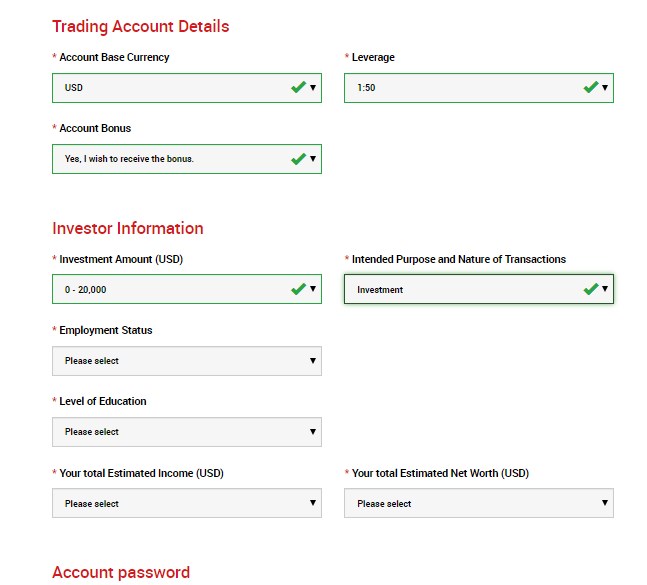

Step 3: investor information & trading account details

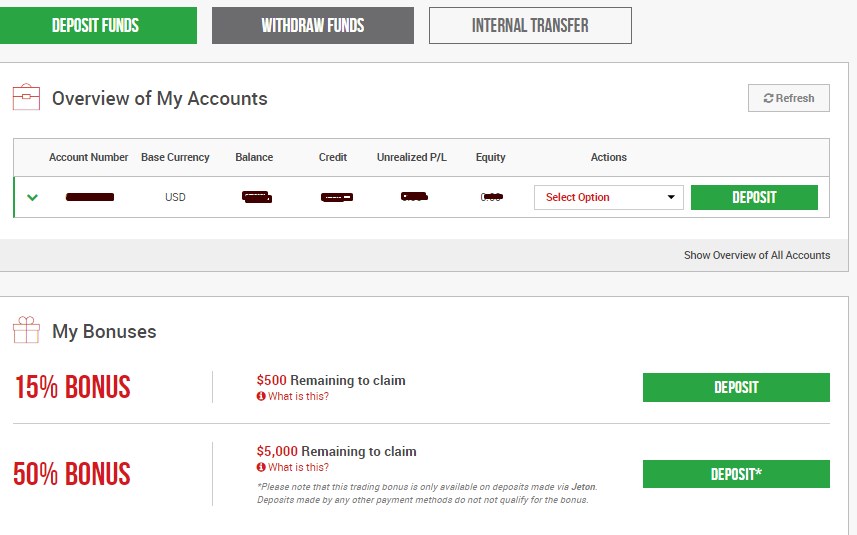

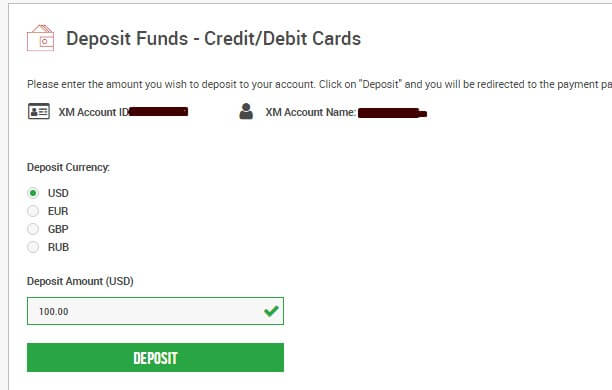

Step 4: depositing $100 to trade

After opening your account you must confirm your email address and then login to XM account with your account username and password.

Click deposit button

Click any of the gateways you prefer. For this article i’m choosing credit/debit cards option

I’m choosing USD and 100 USD as the deposit amount. You choose which currency you prefer and finish the payment.

Hooray! Now you opened real forex trading account with just $100 easily. That’s all go and trade with your skills and make huge money.

Most important point after opening trading account with $100

Please find below the most important points on how to trade forex for a living and start with a trading account:

The margin calculation takes place

The most important battle in trading is the calculation between the two financial units like USD or euro. You should consider investing money in USD units. You need to explore by using euros to get the marginal values with final requirements. Please work on your marginal value and five micro lots to achieve the final value around $60.

Existing margin value calculation – you can place this only trading option to yield the best value with your margin calculation.

Find the equity – you need to analyze your current position and move on with its accordance. The total of two values will be equal to your equity.

Explore your free margin – the calculated equity can be obtained from reducing the existing marginal value with the amount of free marginal value.

Obtain the margin level – the future trading outcomes can be decided to depend upon the percentage of margin level.

You can easily follow the above-provided reliable steps on your forex trading account to yield a profitable change.

Battle procrastination:

The most important step within the forex trading and we all know that the successful traders within the market will never procrastinate. You can easily achieve the trading targets by properly seizing each and every opportunity you received.

Never postpone any tasks or priorities to tomorrow which has to be done by today. You can trade by using the demo account, which can easily assist you with the battling procrastination.

Keep practicing:

The famous quote “practice makes us perfect”, in a similar way, you can practice with the help of demo account to get hands-on experience. This could be much helpful to understand the forex trading platforms working process and get familiar to make use of its features. Learning forex trading will take a lot of passion, effort, and as well as time.

Recognition:

Please be self-aware within the forex marketing, you need to analyze the involved risk, and safety zones to achieve the maximum profit. You can trade accordingly by considering your analysis on object and goals. This is an essential step particularly for the beginners who prefer to start the forex trading.

Investment

The new trader should have started the forex trading with minimal capital and gradually increase the investment from their entire profit and not by any further deposits. The profit cannot be earned or not to invest as a fortune.

You can easily maximize the amount with successful trading. With a minimal investment, you can reduce the great losses risk when it comes to a large amount of money.

Single currency pair

Forex trading with the world of currency is much complex because of its members obstinacies, different characters, and unpredictability of markets. Within the financial world, it is not much easier to groom as a perfect trader. You can start with your familiar single currency pair. It is always better to choose the global wide or your country currency for trading.

Stay vigilant

Please don’t confuse with your emotions that your concern about the forex trading effects. You can easily maintain a logical and practical approach about your trading as it can give you greed, panic, or excitement feeling that can ruin your forex trading career. You can become a successful trader by following the predetermined trading strategy.

Keep a record

You can easily learn the importance of your mistakes. You should track all the records of your success and failures, as well as key mistakes, or any other positive steps that you had followed to reach your desired goal. You can make use of the charts and understand the key indicators by reviewing the losses and wins.

Possibility vs. Probability

Theoretically, with your forex trading account, it is very much possible with any pattern of loss or gain. If you are preferred to do anything that is possible, it doesn’t mean that you can easily implement the same. This could be the main reason, why you should remain safe and very careful during the forex trading with leverage.

Follow the above steps to start forex trading with $100 easily.

Make 100 a day trading forex

Let’s get straight down to the facts here. Yes, you can make a $100 a day and more while trading in the foreign exchange. It doesn’t matter if you have a micro account with just $250 in it. If you know how to make it you can easily make 100 a day trading forex . Here are a few worthwhile tips which will get you to that mark. A $100 a day means about $30,000 a month, not bad at all!

- Choose the right currency pair and strategy

If you’re thinking that you can make 100 a day trading forex in USD EUR then you’d better ponder on it. This is not saying you can’t, this is simply saying that it depends. There are numerous factors to making a profit and it depends completely on the set or future market trends. For example, if GBP USD has registered a slump and forecasts observe a definite resistance in the future, you should look at investing in it even though you haven’t made much head way into the other asset which you have.

A suggestion would be to have two trading accounts instead of one as this will give you the flexibility in making trades beyond the pre-supposed plan which you might have had at the start of the day. To make money day trading forex , you also can keep an eye on other prospects which might end up fruitfully for you. Day trading or scalping is all about adaptability, and you should always have a contingency strategy or plan.

- Make 100 a day trading forex with proper forecasts

Day trading or scalping requires constant monitoring and quick responses. Price quotes change within seconds irrespective of the time-charts being followed. If you want to properly forecast the market for that day, you need to keep an eye out not only on technical tools and indicators but also on economic news and forecasts by other traders too.

Trading forums are very important for day trading; making money day trading forex is one-shot chance and if you end up predicting the other way, that whole day is lost. You will more than a few situations where your forecasts will not match up with what was originally expected. This forums and blogs provide live updates of the market and will give you a heads-up as to what you might’ve been missing in your forecast.

- A scalpers’ attitude

And it’s not just about the right attitude; it’s about the whole mentality which you need to have to make sure that you do scalp the profit through the day. To make money daily with forex , you need to be an opportunist with a sound strategy and the urgency of getting the job done. Let’s consider an example here to brighten the possibility of it.

Considering that you have a 250:1 leverage account with $500 in it. You buy long $100 in a currency which stands at 1.25 against USD (say) and sell it off at a 1.27. As per leverage, you garner a profit worth $400. That’s 4 times more than what you’ve been thinking you can get through so far!

So invest and make 100 a day trading forex. It’s easier than you think!

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of liteforex. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of directive 2004/39/EC.

How much can you make with $100 on forex

Put an end to your quest of hunting for forex courses or coaches, there will be a new one popping out every other week. If you are looking for the “guru’s guru” “the best in the industry” “one of the world’s best forex trader” – as testified by my students.

Let me ask you a question.

Why do forex traders trade?

I mean how many people who’ve started trading actually love the art of trading and don’t just do it to make money?

I’ll admit I do love trading. The art of trading. The beauty of reading charts especially price action trading and the different forex trading strategies. The satisfaction I get when I see the market moving in the intended direction.

It’s just like playing a game. The main difference is that, when you win this game, you are rewarded in material terms. Not in achievements or kudos, but in actual cash that you can use in the real world.

Would you like to play this game? Working your way through it and ensuring you understand as much as possible on how to win?

If this piques your interest, then, yes, forex trading or trading of any sort may suit you.

Contents

Can you get rich by trading forex?

But ezekiel… I hear, how much money can you make trading forex? Can I become rich from it?

“I would like to put in capital of $1000. And if I trade diligently, is it realistic to make $2k a month from trading… say after one year?”

“if I put in $10,000, can I make $100,000 from it in a year? Or… can I make like $10k a month from it?”

You see, being a forex trading coach and mentor, these are the types of questions I get pretty often.

If you want a straight answer to whether you are able to become rich through forex trading, then the answer is yes.

But… is it simple? Not really.

Can trading make you rich?

How can I turn $10,000 into $100,000?

Want to know a method akin to gambling for how you can get rich through trading?

Take a look at this example:

If, let’s say, you put in $10,000 and you want to grow it to $100,000 in a year.

So that’s 10x growth in 12 months.

Or 1000% growth in 12 months.

Now, do you know of any vehicle that gives you that? Not really.

But is it possible in forex trading? Yes it is.

I mean… you could simply enter a trade with a 100% risk. Meaning you go all-in on one trade risking your entire $10k.

And if that trade runs a risk reward ratio of 1:10.

Then there you go… you just made $100k in a trade.

How can I turn $10,000 into $1 million?

Here’s another example of how to “get rich through forex trading”:

You can go all-in at $10k for one trade.

To put it in simple terms, the chances of you winning are 50% and losing are 50%.

So, if it goes up your way, you could have made (let’s not aim so high… but just a risk reward ratio of 1:1) a 100% profit.

Now, let’s say you now put in your $20k (at the same 100% risk) and you win your next trade.

And then you put your $40k into the next trade, you make $80k.

Woo-hoo! Three wins in a row and you just turned $10k into $80k.

The fourth win will make you $160k!

And so you went in with high hopes thinking that, in a couple more trades, you will turn that $160k into $320k, then the $320k into $640k and then into $1.28 million!!

Just four more wins and you will be a millionaire! Fantastic!

But of course, things get in the way and fantasies like this are shattered in no time.

Because you lost the next trade and your $80k account is now busted!

Does the above scenario sound familiar? Because it’s stories like this that we hear all too often.

This above scenario is just like gambling isn’t it? The gambler will tell you how much he won and then he’ll lose it all. And then go on to tell you he will make it back and more the next time because he has “learnt” what not to do.

If you follow that specific method, then I’m pretty sure the next set, and the set after that, will turn out the same.

Because you can get lucky in one trade, in two trades, maybe even in three trades… but how long can you stay lucky that way? It’s not really realistic isn’t it.

Now… let me bring you back down to earth. Because that was fantasy island. ;)

So is it not possible to turn $10k into $100k?

But we have to do it the “slow and steady way”.

How much can you make trading forex?

Trading the safer way

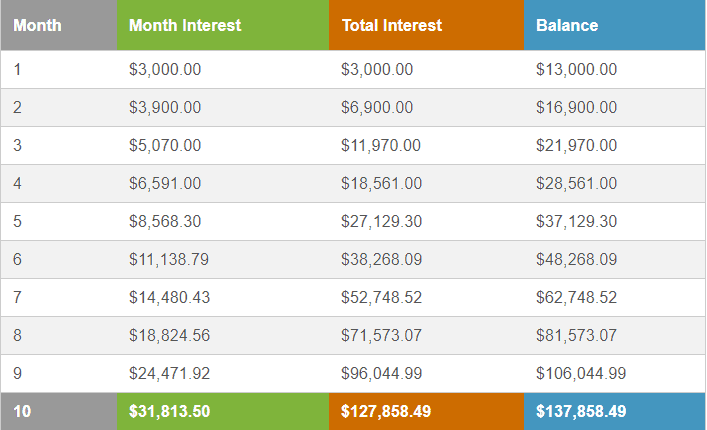

Now let’s say we follow the general rules of risking 1-3% a trade. For this example, let’s put it at 3%.

If your risk reward ratio is, on average, at 1:2…

You will win $600 each trade, and, if you lose, you lose $300.

Let’s say you have a win rate of just 50%.

Therefore, out of 20 trades, you lost 10, meaning you lost $300 * 10 = $3000.

And you won 10 trades, 10 * $600 = $6000.

Out of 20 trades, you made $6000 – $300 = $3000.

So now your capital is at $10,000 + $3000 = $13,000.

Meaning your next trade will be 3% of $13,000 = $390.

Now that’s compounding in action.

Let’s put the above scenario into a compounding calculator.

Assuming you take 20 trades a month…

How long do you need to make $100k?

That’s 9 months.

Now of course, it may also seem unrealistic that you are making 30% a month. Because you made $3k out of $10k in a month.

Let’s tone it down a little.

Let’s say out of 10 trades, you won four and lost six. So you have just a win rate of 40%.

And you now only take 10 trades a month, not 20.

Therefore, out of 10 trades, you lost 6, meaning you lost $300 * 6 = $1800.

And you won 4 trades, 4 * $600 = $2400.

Out of 10 trades, you made $2400 – $1800 = $600.

So now your capital is at $10,000 + $600 = $10,600.

Meaning your next trade will be 3% of $10,600 = $318.

Let’s put it into compounding…

You will reach $100k at month 40. Which is around 3 year 4 months.

Now it may seem way longer. But turning $10k into $100k in 3+ years is still really good, right?

How about if we wait a bit longer…

By month 80, you would have turned it into $1 million dollars!

So is forex really profitable?

Can you get rich by trading forex?

This is the power of compounding put into trading.

Can you make a living trading forex?

As much as it’s possible to do. I don’t want any new traders to be jumping into this game thinking that they can get rich instantly.

The fact is that most new forex traders leave the game after just two years.

And only 10% of traders make money.

It’s because successful trading takes discipline that is incorporated into a solid forex trading system to put the above into action.

Few forex traders want to put in the hard work but only want to get rich.

That’s why there are always gimmicks out there and get-rich-quick schemes which people will always fall into.

Final thoughts

After trading for two decades and seeing the stories of thousands of traders, I can say that I know quite a lot on this subject matter.

So here’s my take away if you want to become successful in this field.

Don’t go into trading with a mindset of wanting to make a million out of a thousand. Instead, go in with the mindset that you are here to learn and hone this skill into a finely crafted tool. Mastering any skill takes time, and nothing is ever achieved without a lot of hard work and practice.

Most people jump into the game and put in loads of money right at the start. On the contrary, in the first six months to a year, you should spend your time learning and practicing with very little money involved. Only when you are ready, and by being ready, I mean that your account is growing steadily, can you then decide to put in more capital.

Try picking up any new sport, e.G. Soccer, basketball, badminton, etc. Were you good at it right from the start? No, everyone who has ever become good at anything has put countless hours into practicing and honing their craft. Working on their weakness and strengthening their game.

The same goes for forex trading. Don’t expect to make big bucks within the first few months of trading. If you somehow manage this, it’s pure luck. Instead, spend time practising and working on your trading game. And this time and effort you put into honing trading into an art will reward you going forward.

How much do forex traders make a day?

This will depend on the number of trades you take in a trade. If your trading style is scalping, then you can probably take 20 trades a day. And by scalping, I mean that you are trading in a timeframe such as one minute.

And if that is your preferred way of trading, the math formula will be:

Your win rate: e.G. You win 6 out of 10 trades = 60% win rate.

Your risk reward ratio: e.G. 1:2.

Your risk percentage: e.G. 2%.

So 20 trades * 60% win rate = 12 wins.

Risk per trade is: 2% * $1k = $200.

12 wins * $400 (risk reward ratio 1:2) = $4800.

Total profit: $4800 – $1600 = $3200.

And the above estimation is based on the above scenario.

But what if scalping is not your style and you prefer mid- to longer-term trading?

So perhaps, you will have just one to three trades a day.

Do the math and you will have the answer.

How much to invest in forex trading to make a living?

Using the formula of calculating your win rate, your risk percentage, your risk reward ratio – the number of trades will give you an estimate of how much you can make a month.

And if your living expenses are $3.2k a month, and if you trade 20 trades a month based on the above example, then $10k capital is needed.

Can you make a living day trading forex?

Yes, aside from your daily trades with wins that have a risk reward ratio of 1:2, there are also trades that can go as high as 1:15 or 1:25. These are what I call a bonus for us forex traders.

Imagine you have a trade with a risk percentage of 3%. And you made a successful trade with a risk reward ratio of 1:25.

You’ve just made a 75% gain of your capital in a single trade with just a risk of 3%.

If your capital is $10k, you would have made $7.5k in a single trade…

And if your capital is $100k, you made $75k profit on that trade.

So apart from your day-to-day trades with the standard risk to reward ratio – these are our salary –the big trades are our big payday. Our bonus.

Trading scenario: what happens if you trade with just $100?

What happens if you open a trading account with just $100?

Or €100? Or £100?

Since margin trading allows you to open trades with just a small amount of money, it’s certainly possible to start trading forex with a $100 deposit.

But should you?

Let’s see what can happen if you do.

In this trading scenario, your retail forex broker has a margin call level at 100% and a stop out level at 20%.

Now that we know what the margin call and stop out levels are, let’s find out if trading with $100 is doable.

If you have not read our lessons on margin call and stop out levels, hit pause on this lesson and start here first!

Step 1: deposit funds into trading account

Since you’re a big baller shot caller, you deposit $100 into your trading account.

You now have an account balance of $100.

This is how it’d look in your trading account:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – |

Step 2: calculate required margin

You want to go short EUR/USD at 1.20000 and want to open 5 micro lots (1,000 units x 5) position. The margin requirement is 1%.

How much margin (“required margin“) will you need to open the position?

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,000.

Now we can calculate the required margin:

Assuming your trading account is denominated in USD, since the margin requirement is 1%, the required margin will be $60.

Step 3: calculate used margin

Aside from the trade we just entered, there aren’t any other trades open.

Since we just have a SINGLE position open, the used margin will be the same as required margin.

Step 4: calculate equity

Let’s assume that the price has moved slightly in your favor and your position is now trading at breakeven.

This means that your floating P/L is $0.

Let’s calculate your equity:

The equity in your account is now $100.

Step 5: calculate free margin

Now that we know the equity, we can now calculate the free margin:

The free margin is $40.

Step 6: calculate margin level

Now that we know the equity, we can now calculate the margin level:

The margin level is 167%. At this point, this is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | – | $100 | – | |||||

| short | EUR/USD | 6,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

EUR/USD rises 80 pips!

EUR/USD rises 80 pips and is now trading at 1.2080. Let’s see how your account is affected.

Used margin

You’ll notice that the used margin has changed.

Because the exchange rate has changed, the notional value of the position has changed.

This requires recalculating the required margin.

Whenever there’s a change in the price for EUR/USD, the required margin changes!

With EUR/USD now trading at 1.20800 (instead of 1.20000), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,040.

Previously, the notional value was $6,000. Since EUR/USD has risen, this means that EUR has strengthened. And since your account is denominated in USD, this causes the position’s notional value to increase.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Since the margin requirement is 1%, the required margin will be $60.40.

Previously, the required margin was $60.00 (when EUR/USD was trading at 1.20000).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has risen from 1.20000 to 1.2080, a difference of 80 pips.

Since you’re trading micro lots, a 1 pip move equals $0.10 per micro lot.

Your position is 5 micro lots, a 1 pip move equals $0.50.

Since you’re short EUR/USD, this means that you have a floating loss of $40.

Equity

Your equity is now $60.

Free margin

Your free margin is now $0.

Margin level

Your margin level has decreased to 99%.

The margin call level is when margin level is 100%.

Your margin level is still now below 100%!

At this point, you will receive a margin call, which is a WARNING.

Your positions will remain open BUT…

You will NOT be able to open new positions as long unless the margin level rises above 100%.

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.2080 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

EUR/USD rises another 96 pips!

EUR/USD rises another 96 pips and is now trading at 1.2176.

Used margin

With EUR/USD now trading at 1.21760 (instead of 1.20800), let’s see how much required margin is needed to keep the position open.

Since our trading account is denominated in USD, we need to convert the value of the EUR to USD to determine the notional value of the trade.

The notional value is $6,088.

Now we can calculate the required margin:

Notice that because the notional value has increased, so has the required margin.

Previously, the required margin was $60.40 (when EUR/USD was trading at 1.20800).

The used margin is updated to reflect changes in required margin for every position open.

In this example, since you only have one position open, the used margin will be equal to the new required margin.

Floating P/L

EUR/USD has now risen from 1.20000 to 1.217600, a difference of 176 pips.

Since you’re trading 5 micro lots, a 1 pip move equals $0.50.

Due to your short position, this means that you have a floating loss of $88.

Equity

Your equity is now $12.

Free margin

Your free margin is now –$48.88.

Margin level

Your margin level has decreased to 20%.

At this point, your margin level is now below the stop out level!

Account metrics

This is how your account metrics would look in your trading platform:

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $100 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

Stop out!

The stop out level is when the margin level falls to 20%.

At this point, your margin level reached the stop out level!

Your trading platform will automatically execute a stop out.

This means that your trade will be automatically closed at market price and two things will happen:

- Your used margin will be “released”.

- Your floating loss will be “realized”.

Your balance will be updated to reflect the realized loss.

Now that your account has no open positions and is “flat”, your free margin, equity, and balance will be the same.

There is no margin level or floating P/L because there are no open positions.

Let’s see how your trading account changed from start to finish.

| Long / short | FX pair | position size | entry price | current price | margin level | equity | used margin | free margin | balance | floating P/L |

| – | $100 | – | $10,000 | $100 | – | |||||

| short | EUR/USD | 5,000 | 1.20000 | 1.20000 | 167% | $100 | $60 | $40 | $100 | $0 |

| short | EUR/USD | 5,000 | 1.20000 | 1.20800 | 99% | $60 | $60.40 | -$0.40 | $100 | -$40 |

| short | EUR/USD | 5,000 | 1.20000 | 1.21760 | 20% | $12 | $60.88 | -$48.88 | $100 | -$88 |

| – | $12 | – | $12 | $12 | – |

Before the trade, you had $100 in cash.

Now after just a SINGLE TRADE, you’re left with $12!

Not even enough to pay for one month of netflix!

You’ve lost 88% of your capital.

And with EUR/USD moving just 176 pips!

Moving 176 pips is nothing. EUR/USD can easily move that much in a day or two. (see real-time EUR/USD volatility on marketmilk™)

Congratulations! You just blew your account! ��

Since your account balance is too low to open any new trades, your trading account is pretty much dead.

So, let's see, what was the most valuable thing of this article: 3 easy tips to make 100 a day trading forex at how much can you make with $100 on forex

Contents of the article

- Free forex bonuses

- Make 100 a day trading forex

- How to make $100-200 A day from forex trading...

- Required trading account size to make $100-200 A...

- What if you don't have that required trading...

- Fxdailyreport.Com

- How to start forex trading with $100

- Realistic forex income goals for trading

- What are realistic and acceptable forex income...

- How much can you make trading the forex market?

- WAIT! Forex income is challenging:

- Realistic trading income calculations:

- Forex income compared to real estate income

- What is the average forex trader salary?

- The minimum capital required to start day trading...

- Risk management

- Pip values and trading lots

- Stop-loss orders

- Capital scenarios

- Recommended capital

- How to trade forex with $100 in just 5 minutes...

- Reliable steps to trade forex with $100...

- Step 1: start to invest your money in XM trading

- Step 2: filling the personal details

- Step 3: investor information & trading account...

- Step 4: depositing $100 to trade

- Most important point after opening...

- Battle procrastination:

- Keep practicing:

- Recognition:

- Investment

- Single currency pair

- Stay vigilant

- Keep a record

- Possibility vs. Probability

- Make 100 a day trading forex

- How much can you make with $100 on forex

- Contents

- Can you get rich by trading forex?

- How can I turn $10,000 into $100,000?

- How can I turn $10,000 into $1 million?

- How much can you make trading forex?

- Can you make a living trading forex?

- Final thoughts

- How much do forex traders make a day?

- How much to invest in forex trading to make a...

- Can you make a living day trading forex?

- Trading scenario: what happens if you trade with...

- Step 1: deposit funds into trading account

- Step 2: calculate required margin

- Step 3: calculate used margin

- Step 4: calculate equity

- Step 5: calculate free margin

- Step 6: calculate margin level

- EUR/USD rises 80 pips!

- EUR/USD rises another 96 pips!

- Stop out!

No comments:

Post a Comment