Cpt markets bonus

- Visa/mastercard credit cards – immediate transactions

- Wire transfer – 2-3 business days

- Unionpay – immediate transactions

- USDT – depends on the bank

- QR code – 1-3 business days

- Online banking – 1-3 business days

- SSAC – depends on the bank

Free forex bonuses

Whether these claims are true or not, and whether the broker really has such a big daily turnover, we cannot really prove or disprove, but what we can do is leave no stone unturned and check all of the broker’s offerings.

CPT markets review – would you want to trade with this broker?

Minimum deposit

Bonus

Maximum leverage

Year founded

Regulation

Trading platform

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

Being a good forex broker means being a company that primarily focuses on the well-being of its clients, whereas personal gains are the by-products of high-quality services. And to be fair, you can find many brokers that fit this description.

However, you can also come across scam brokers pretty easily, especially in this era of the internet and mass-communication. It comes to the point when telling apart the fraudsters and legit brokers becomes pretty difficult.

Yet we’re not about to give up on our readers. Here at forex trading bonus, our team will regularly offer you broker reviews and assess them for you. Today, we’ll take a look at the CPT markets forex broker and determine its credibility.

First impressions do matter

Established in and operating from belize, CPT markets is a forex trading broker that claims to have a pretty large user base and the operations scattered across three continents. Whether these claims are true or not, and whether the broker really has such a big daily turnover, we cannot really prove or disprove, but what we can do is leave no stone unturned and check all of the broker’s offerings.

Licensing

The first segment that should give us a pretty good idea about the broker’s credibility is its regulation. As CPT markets’ website notes, the company was established in belize and was licensed by the country’s international financial services commission (IFSC).

Below that notice, the broker also claims to have an FCA license from the UK’s sturdiest financial regulators, which should potentially be the guarantor that the CPT markets scam is just a rumor and nothing more. But we’ll shed some light on this segment in the upcoming chapter.

Website

Next up, we’re going to talk about the website and software support. When it comes to the interface, it’s pretty safe to say that CPT markets hasn’t put much thought or effort to create a top-notch website with a simplistic interface. As for providing information, we found pretty much everything we searched for, yet the majority of details lacked further descriptions.

Then we’ll move on to discussing live accounts that you can get at CPT markets. But there’s not going to be much to discuss here: the broker only offers one account that is supposed to work for all clients of the broker. But in reality, it only works for mid-range traders that have experience and don’t need low-end conditions, yet aren’t too professional for high-end features.

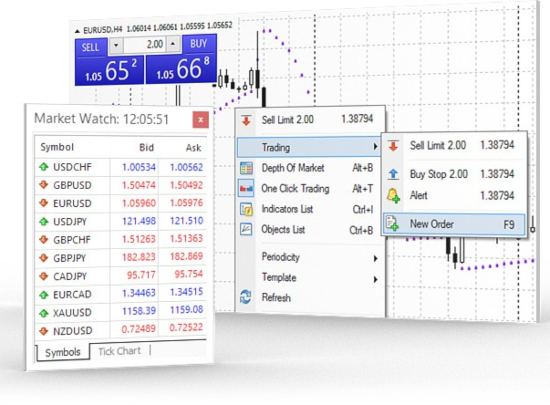

Finally, we’ll take a look at the trading platforms of the CPT markets forex broker. If you sign up for this broker, you’ll get MT4 and ctrader, which, needless to say, is a pretty decent offering.

Trading terms and conditions

The final part of our review will be trading terms and conditions. CPT markets offers a number of trading instruments, including forex pairs, indices, and precious metals.

The conditions that apply to these instruments include very high leverage, also very high deposit requirements, and spreads. In this section, we’ll explain why we’re suspicious about these conditions and why they undermine CPT markets’ credibility.

We’ll conclude this review by listing all available payment methods and their specific conditions. So, it’s going to be a pretty comprehensive review of everything that CPT markets offers.

Is CPT markets legit?

No matter which broker review you read or which reviewing agency has made it, there’s always one section that remains in all of the articles – the license. By carefully examining the broker’s license, you can have a pretty good idea about the nature and the code of conduct of the given broker.

Naturally, that’s exactly what we have in mind today. As CPT markets points out, the company is regulated by the belize international financial services commission (IFSC). Plus, it also claims to have a license from the UK’s financial conduct authority (FCA).

Now, we wouldn’t have any issue with the CPT markets FX brokerage if these claims were actually true. FCA is one of the sturdiest regulatory materials that ensure the highest standards on the forex market, which means a broker with this license will have a hard time getting away by scamming people.

Unfortunately, though, we’re pretty sure that CPT markets doesn’t actually hold the FCA license and its only regulator is belize’s IFSC. The reason for our suspicion is that the trading terms and conditions are way too high for a european license. Take a look at leverage, for example: europe-based brokers go only as high as 1:30 with their leverage offerings due to the riskiness of this tool, yet CPT markets ramps this feature up by 1:1000.

And when it comes to the IFSC license, we’re not convinced that it can really guarantee safe financial conduct, even though it seems to be a legit license for this broker. Belize is not a country one would entrust the regulation of an international forex broker.

The website and software support

Next up, let’s move on to the next section of our review, which is going to be CPT markets’ website and software support. As we have already noted above, the website we saw doesn’t really attract the viewer’s eye; it has a bland interface that has some bright spots, such as blank backgrounds and easily-discernable fonts.

As for obtaining the information, we can say this: CPT markets does provide details about pretty much all trading aspects. Yet our CPT markets opinion is still low even in this section because the broker doesn’t really explain these features or how they should be safely used within trades.

Next up, let’s have a closer look at which trading accounts you can get with CPT markets. The majority of forex brokers, even the ones that are blatantly fraudsters, offer at least three different live accounts for different trader types. Yet CPT markets doesn’t even offer two; the only standard account that it features must work for anyone that wants to associate with this broker.

Granted, this account stands out with some of the most mind-blowing features like a 1:1000 leverage, it’s important to note that it’s not going to be the most accessible account for beginner traders. On top of that, even the veteran traders will find it disadvantageous to use the CPT markets standard account.

When it comes to the trading platform, the CPT markets MT4 and ctrader are the two main pieces of software that you’re getting with this broker. And to be fair, these platforms are the two of the most popular and widely-used applications that almost every broker would like to use. However, they do not guarantee that a broker stays away from scamming its clients if it so chooses.

Should you trust impressive CPT markets promotions?

The last segment, and the one that will probably attract most people’s attention, is going to be the actual numbers and trading conditions at CPT markets. First off, we have to note that CPT markets offers a decent range of tradable instruments, including:

- Currency pairs

- Crude oil

- Precious metals

- Indices

- Cfds

- Cryptocurrencies

It is certainly beneficial to have multiple assets to choose from, which is why we have to give the broker some credit. However, it still doesn’t go as far as to dissipate our CPT markets fraud suspicions, and here’s why:

The maximum leverage the broker offers to its clients goes as high as 1:1000. As we already pointed out above, a broker that operates in europe, and especially if it is licensed by the FCA, cannot possibly go above 1:30 with its leverage offering. The reason for that is pretty simple: high leverage increases your exposure to the market, which brings much larger profits and losses and is exceptionally risky to use.

That’s why both governments and legit brokers continuously warn traders not to use high leverage ratios. And that’s why we don’t appreciate having a 1:1000 leverage without any safety net on the platform.

Next up, let’s talk about spreads. As CPT markets points it out, your trades will be charged with floating spreads that start from 1.8 pips. When compared to other terms and conditions, this might be the most decent condition we’ve found during this CPT markets review.

Then there’s the minimum deposit requirement for the standard account. CPT markets charges you a whopping $500 to let you trade on its platform. This, in our experience, is a very high threshold that not many people will be able to cross. It’s definitely going to be a huge financial strain on beginner traders who want lower fees and basic trading conditions – none of which is available at CPT markets.

Finally, let’s review the financial platforms that power deposits and withdrawals. For each of the transactions, we’re going to make a list of available platforms with transaction times on the side. So, in order to make a deposit at CPT markets, you can use:

- Visa/mastercard credit cards – immediate transactions

- Wire transfer – 2-3 business days

- Unionpay – immediate transactions

- USDT – depends on the bank

- QR code – 1-3 business days

- Online banking – 1-3 business days

- SSAC – depends on the bank

As for withdrawals, there are:

- Wire transfer – 1-3 working days

- Unionpay – 1-3 working days

- Online banking – 1-3 working days

Granted, it is nice to see a multitude of financial platforms power deposits at CPT markets, however, withdrawals are much too limited and plus, there are no famous e-wallet platforms like paypal or neteller.

Should you trade with this broker?

So, what is our final CPT markets opinion? Will you make a good decision by trading with this broker?

Well, let’s re-list all the things we’ve said earlier: the broker has a very low-quality website that barely conveys information about its trading terms and conditions. It also has only one account that cannot possibly work for all traders.

As for licensing, CPT markets only has an IFSC license, even though it also claims to have an FCA regulation. This worsens the broker’s reputation even further.

Finally, CPT markets offers some of the more suspicious trading conditions that should be a red flag for any trader. Ultimately, we think that you shouldn’t commit to this broker financially.

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

CPT markets review and tutorial 2021

CPT markets offers cfds, futures and options trading on the MT4 platform.

Trade over 100 online currency pairs at CPT markets.

CPT markets is an FCA-regulated broker specialising in cfds and forex trading. The broker strives to offer bespoke solutions for clients of all levels and abilities. Our CPT markets review covers account types and login, payment methods, additional features and more.

CPT markets details

CPT markets is part of CPT markets limited, registered in belize and licensed under the international financial services commission of belize. Originally named citypoint trading ltd, the UK branch was established in 2008 with headquarters in london.

More recently, CPT markets UK joined the london stock exchange as a non-clearing member in an ongoing expansion of its services.

Metatrader 4 platform

The broker offers the globally recognised metatrader 4 (MT4) platform. You can download MT4 to desktop devices or trade through major web browsers. MT4 also offers a mobile trading application.

Highlights of the MT4 trading platform:

- Full customisation features

- Highly secure with encryption protocols

- Advanced real-time communication tools

- Over 50 built-in powerful indicators & charting tools

- Easy to use navigation, suitable for traders of all experience levels

- Unrestricted use of expert advisors, with support in over 30 languages

Refer to the broker’s website for full details on the installation of the CPT markets MT4 trading platform, account login, navigation, and tools.

Instruments

Forex & CFD trading markets include:

- 100 forex pairs

- Precious metals

- Major european and US indices

Futures & options market access include:

- Metals

- Energies

- Currencies

- Agricultures

- Equity index

- Fixed income

- Volatility futures

The broker offers variable, floating spreads, starting from 1.8 pips in retail trading accounts. Unfortunately CPT markets doesn’t provide details of average spreads.

The broker does not charge any retail trading commissions, however, fees may apply if a client needs a specific setup or customisation. A finance adjustment fee is charged for positions held overnight.

Leverage

Leverage rates are capped at 1:30 for retail forex trading in line with ESMA guidelines.

- Forex – 1:30

- Indices – 1:20

- Commodities – 1:20

Mobile apps

Metatrader 4 is available as a mobile trading tool, compatible with ios and android devices. The application allows for complete account management and price analysis from your mobile or tablet device. The easy to use platform picks up positive customer reviews online and allows for powerful analysis of the markets and rapid order execution.

Payments

Deposits

The minimum deposit is $100. CPT markets offers several payment methods for live account deposits:

- Wire bank transfers

- Card payments

- Neteller

- Skrill

Withdrawals

Requests are submitted via an online form on the broker’s website and are generally processed within 1 business day with no fees. Withdrawals must be made back to the initial bank account and will be rejected if they bring accounts below margin levels.

Demo account

The broker offers a demo account where users can test their strategies on the metatrader 4 platform. A simple online registration form needs to be completed when opening an account. The trial account is a great place to start if you’re unsure about signing up for real-money trading.

CPT markets bonus

At the time of writing, CPT markets does not offer any promotions to new clients, this includes no deposit bonuses.

Regulation review

CPT markets is authorised and regulated by the financial conduct authority (FCA) meaning the broke operates with a high level of reliability following regulatory standards. The broker also works with reputable credit institutions and legal houses that help to oversee trades and maintain a robust financial standing.

The global brokerage is also licensed with the international financial services commission of belize.

Additional features

CPT markets ltd offers online educational courses split between beginner and intermediate levels. Various topics are covered such as trading caps, managing risk, market indices, basic terms, and MT4 installation, all with training videos.

The broker also provides weekly research bulletins with updated market information and global trading news on both their website and facebook account.

Account types

The online application to open a live trading account is extensive. Users must submit information such as their trading experience and investment objectives, along with identity documents and FATCA.

The brokerage offers two accounts:

- Retail – $100 minimum deposit requirement

- Professional – eligibility criteria must be met, including sufficient evidence of 12 month trading history

Both retail and professional accounts share features such as best execution for orders, clear and transparent information, and FSCS protection. The retail account also offers negative balance protection, client money segregation protection, and access to a financial ombudsman.

Benefits

Advantages of trading with this broker include:

- Demo account

- Weekly express webinars

- Negative balance protection

- FCA regulated and FSCS protection

- Industry renowned MT4 trading platform

Drawbacks

- No live chat customer support

- No new client deals or bonuses

- Lengthy account opening requirements

Trading hours

CPT markets follows standard office and trading hours, however timings do vary by instrument. Forex trading, for example, is available 24/5 on the metatrader platform.

Customer support

CPT markets ltd offers customer support via:

- Email – info@cptmarkets.Co.Uk

- Telephone – 44(0)203 9882277 (7am – 10pm monday to friday)

- Address – 40 bank street, 30th floor canary wharf, london, england, E14 5NR

Security

CPT markets prides itself on its handling of personal information and its robust data policy. Users are also entitled to call upon the financial ombudsman for any trading issues associated with CPT markets UK. The MT4 platform assures high-tech encryptions, secure logins, and industry-standard data privacy.

CPT markets verdict

CPT markets provides opportunities for traders of different abilities on the established MT4 platform along with FCA regulation and FSCS protection. The decent breath of learning resources and payment options also helps to make CPT markets a strong contender.

Accepted countries

CPT markets accepts traders from australia, thailand, canada, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use CPT markets from united states.

Is CPT markets regulated?

Yes, the broker is regulated by the financial conduct authority (FCA) in the UK and the international financial services commission (IFSC) of belize. This indicates a trustworthy brokerage.

What trading platforms does CPT markets use?

The broker offers the well-known industry platform metatrader 4, available to download to desktop or to trade on major web browsers. MT4 mobile app can also be downloaded from respective app stores with compatibility on ios and android devices.

Does CPT markets offer a demo account?

Yes, traders can complete a simple online registration form to access a fully featured demo account.

How do I open an account with CPT markets?

You can complete an online account application form, requiring information such as personal details and trading experience. Alternatively, contact the broker using the customer support telephone number or email address.

What are the payment options to fund my CPT markets account?

Once you have registered for an account, you can make deposits via card payments, bank wire transfers, skrill, neteller and unionpay, among others.

CPT markets review – would you want to trade with this broker?

Mindesteinzahlung

Bonus

Maximale hebelwirkung

Gründungsjahr

Regulierung

Handelsplattform

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

Being a good forex broker means being a company that primarily focuses on the well-being of its clients, whereas personal gains are the by-products of high-quality services. And to be fair, you can find many brokers that fit this description.

However, you can also come across scam brokers pretty easily, especially in this era of the internet and mass-communication. It comes to the point when telling apart the fraudsters and legit brokers becomes pretty difficult.

Yet we’re not about to give up on our readers. Here at forex trading bonus, our team will regularly offer you broker reviews and assess them for you. Today, we’ll take a look at the CPT markets forex broker and determine its credibility.

First impressions do matter

Established in and operating from belize, CPT markets is a forex trading broker that claims to have a pretty large user base and the operations scattered across three continents. Whether these claims are true or not, and whether the broker really has such a big daily turnover, we cannot really prove or disprove, but what we can do is leave no stone unturned and check all of the broker’s offerings.

Licensing

The first segment that should give us a pretty good idea about the broker’s credibility is its regulation. As CPT markets‘ website notes, the company was established in belize and was licensed by the country’s international financial services commission (IFSC).

Below that notice, the broker also claims to have an FCA license from the UK’s sturdiest financial regulators, which should potentially be the guarantor that the CPT markets scam is just a rumor and nothing more. But we’ll shed some light on this segment in the upcoming chapter.

Website

Next up, we’re going to talk about the website and software support. When it comes to the interface, it’s pretty safe to say that CPT markets hasn’t put much thought or effort to create a top-notch website with a simplistic interface. As for providing information, we found pretty much everything we searched for, yet the majority of details lacked further descriptions.

Then we’ll move on to discussing live accounts that you can get at CPT markets. But there’s not going to be much to discuss here: the broker only offers one account that is supposed to work for all clients of the broker. But in reality, it only works for mid-range traders that have experience and don’t need low-end conditions, yet aren’t too professional for high-end features.

Finally, we’ll take a look at the trading platforms of the CPT markets forex broker. If you sign up for this broker, you’ll get MT4 and ctrader, which, needless to say, is a pretty decent offering.

Trading terms and conditions

The final part of our review will be trading terms and conditions. CPT markets offers a number of trading instruments, including forex pairs, indices, and precious metals.

The conditions that apply to these instruments include very high leverage, also very high deposit requirements, and spreads. In this section, we’ll explain why we’re suspicious about these conditions and why they undermine CPT markets‘ credibility.

We’ll conclude this review by listing all available payment methods and their specific conditions. So, it’s going to be a pretty comprehensive review of everything that CPT markets offers.

Is CPT markets legit?

No matter which broker review you read or which reviewing agency has made it, there’s always one section that remains in all of the articles – the license. By carefully examining the broker’s license, you can have a pretty good idea about the nature and the code of conduct of the given broker.

Naturally, that’s exactly what we have in mind today. As CPT markets points out, the company is regulated by the belize international financial services commission (IFSC). Plus, it also claims to have a license from the UK’s financial conduct authority (FCA).

Now, we wouldn’t have any issue with the CPT markets FX brokerage if these claims were actually true. FCA is one of the sturdiest regulatory materials that ensure the highest standards on the forex market, which means a broker with this license will have a hard time getting away by scamming people.

Unfortunately, though, we’re pretty sure that CPT markets doesn’t actually hold the FCA license and its only regulator is belize’s IFSC. The reason for our suspicion is that the trading terms and conditions are way too high for a european license. Take a look at leverage, for example: europe-based brokers go only as high as 1:30 with their leverage offerings due to the riskiness of this tool, yet CPT markets ramps this feature up by 1:1000.

And when it comes to the IFSC license, we’re not convinced that it can really guarantee safe financial conduct, even though it seems to be a legit license for this broker. Belize is not a country one would entrust the regulation of an international forex broker.

The website and software support

Next up, let’s move on to the next section of our review, which is going to be CPT markets‘ website and software support. As we have already noted above, the website we saw doesn’t really attract the viewer’s eye; it has a bland interface that has some bright spots, such as blank backgrounds and easily-discernable fonts.

As for obtaining the information, we can say this: CPT markets does provide details about pretty much all trading aspects. Yet our CPT markets opinion is still low even in this section because the broker doesn’t really explain these features or how they should be safely used within trades.

Next up, let’s have a closer look at which trading accounts you can get with CPT markets. The majority of forex brokers, even the ones that are blatantly fraudsters, offer at least three different live accounts for different trader types. Yet CPT markets doesn’t even offer two; the only standard account that it features must work for anyone that wants to associate with this broker.

Granted, this account stands out with some of the most mind-blowing features like a 1:1000 leverage, it’s important to note that it’s not going to be the most accessible account for beginner traders. On top of that, even the veteran traders will find it disadvantageous to use the CPT markets standard account.

When it comes to the trading platform, the CPT markets MT4 and ctrader are the two main pieces of software that you’re getting with this broker. And to be fair, these platforms are the two of the most popular and widely-used applications that almost every broker would like to use. However, they do not guarantee that a broker stays away from scamming its clients if it so chooses.

Should you trust impressive CPT markets promotions?

The last segment, and the one that will probably attract most people’s attention, is going to be the actual numbers and trading conditions at CPT markets. First off, we have to note that CPT markets offers a decent range of tradable instruments, including:

- Currency pairs

- Crude oil

- Precious metals

- Indices

- Cfds

- Cryptocurrencies

It is certainly beneficial to have multiple assets to choose from, which is why we have to give the broker some credit. However, it still doesn’t go as far as to dissipate our CPT markets fraud suspicions, and here’s why:

The maximum leverage the broker offers to its clients goes as high as 1:1000. As we already pointed out above, a broker that operates in europe, and especially if it is licensed by the FCA, cannot possibly go above 1:30 with its leverage offering. The reason for that is pretty simple: high leverage increases your exposure to the market, which brings much larger profits and losses and is exceptionally risky to use.

That’s why both governments and legit brokers continuously warn traders not to use high leverage ratios. And that’s why we don’t appreciate having a 1:1000 leverage without any safety net on the platform.

Next up, let’s talk about spreads. As CPT markets points it out, your trades will be charged with floating spreads that start from 1.8 pips. When compared to other terms and conditions, this might be the most decent condition we’ve found during this CPT markets review.

Then there’s the minimum deposit requirement for the standard account. CPT markets charges you a whopping $500 to let you trade on its platform. This, in our experience, is a very high threshold that not many people will be able to cross. It’s definitely going to be a huge financial strain on beginner traders who want lower fees and basic trading conditions – none of which is available at CPT markets.

Finally, let’s review the financial platforms that power deposits and withdrawals. For each of the transactions, we’re going to make a list of available platforms with transaction times on the side. So, in order to make a deposit at CPT markets, you can use:

- Visa/mastercard credit cards – immediate transactions

- Wire transfer – 2-3 business days

- Unionpay – immediate transactions

- USDT – depends on the bank

- QR code – 1-3 business days

- Online banking – 1-3 business days

- SSAC – depends on the bank

As for withdrawals, there are:

- Wire transfer – 1-3 working days

- Unionpay – 1-3 working days

- Online banking – 1-3 working days

Granted, it is nice to see a multitude of financial platforms power deposits at CPT markets, however, withdrawals are much too limited and plus, there are no famous e-wallet platforms like paypal or neteller.

Should you trade with this broker?

So, what is our final CPT markets opinion? Will you make a good decision by trading with this broker?

Well, let’s re-list all the things we’ve said earlier: the broker has a very low-quality website that barely conveys information about its trading terms and conditions. It also has only one account that cannot possibly work for all traders.

As for licensing, CPT markets only has an IFSC license, even though it also claims to have an FCA regulation. This worsens the broker’s reputation even further.

Finally, CPT markets offers some of the more suspicious trading conditions that should be a red flag for any trader. Ultimately, we think that you shouldn’t commit to this broker financially.

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

CPT markets review – would you want to trade with this broker?

Mindesteinzahlung

Bonus

Maximale hebelwirkung

Gründungsjahr

Regulierung

Handelsplattform

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

Being a good forex broker means being a company that primarily focuses on the well-being of its clients, whereas personal gains are the by-products of high-quality services. And to be fair, you can find many brokers that fit this description.

However, you can also come across scam brokers pretty easily, especially in this era of the internet and mass-communication. It comes to the point when telling apart the fraudsters and legit brokers becomes pretty difficult.

Yet we’re not about to give up on our readers. Here at forex trading bonus, our team will regularly offer you broker reviews and assess them for you. Today, we’ll take a look at the CPT markets forex broker and determine its credibility.

First impressions do matter

Established in and operating from belize, CPT markets is a forex trading broker that claims to have a pretty large user base and the operations scattered across three continents. Whether these claims are true or not, and whether the broker really has such a big daily turnover, we cannot really prove or disprove, but what we can do is leave no stone unturned and check all of the broker’s offerings.

Licensing

The first segment that should give us a pretty good idea about the broker’s credibility is its regulation. As CPT markets‘ website notes, the company was established in belize and was licensed by the country’s international financial services commission (IFSC).

Below that notice, the broker also claims to have an FCA license from the UK’s sturdiest financial regulators, which should potentially be the guarantor that the CPT markets scam is just a rumor and nothing more. But we’ll shed some light on this segment in the upcoming chapter.

Website

Next up, we’re going to talk about the website and software support. When it comes to the interface, it’s pretty safe to say that CPT markets hasn’t put much thought or effort to create a top-notch website with a simplistic interface. As for providing information, we found pretty much everything we searched for, yet the majority of details lacked further descriptions.

Then we’ll move on to discussing live accounts that you can get at CPT markets. But there’s not going to be much to discuss here: the broker only offers one account that is supposed to work for all clients of the broker. But in reality, it only works for mid-range traders that have experience and don’t need low-end conditions, yet aren’t too professional for high-end features.

Finally, we’ll take a look at the trading platforms of the CPT markets forex broker. If you sign up for this broker, you’ll get MT4 and ctrader, which, needless to say, is a pretty decent offering.

Trading terms and conditions

The final part of our review will be trading terms and conditions. CPT markets offers a number of trading instruments, including forex pairs, indices, and precious metals.

The conditions that apply to these instruments include very high leverage, also very high deposit requirements, and spreads. In this section, we’ll explain why we’re suspicious about these conditions and why they undermine CPT markets‘ credibility.

We’ll conclude this review by listing all available payment methods and their specific conditions. So, it’s going to be a pretty comprehensive review of everything that CPT markets offers.

Is CPT markets legit?

No matter which broker review you read or which reviewing agency has made it, there’s always one section that remains in all of the articles – the license. By carefully examining the broker’s license, you can have a pretty good idea about the nature and the code of conduct of the given broker.

Naturally, that’s exactly what we have in mind today. As CPT markets points out, the company is regulated by the belize international financial services commission (IFSC). Plus, it also claims to have a license from the UK’s financial conduct authority (FCA).

Now, we wouldn’t have any issue with the CPT markets FX brokerage if these claims were actually true. FCA is one of the sturdiest regulatory materials that ensure the highest standards on the forex market, which means a broker with this license will have a hard time getting away by scamming people.

Unfortunately, though, we’re pretty sure that CPT markets doesn’t actually hold the FCA license and its only regulator is belize’s IFSC. The reason for our suspicion is that the trading terms and conditions are way too high for a european license. Take a look at leverage, for example: europe-based brokers go only as high as 1:30 with their leverage offerings due to the riskiness of this tool, yet CPT markets ramps this feature up by 1:1000.

And when it comes to the IFSC license, we’re not convinced that it can really guarantee safe financial conduct, even though it seems to be a legit license for this broker. Belize is not a country one would entrust the regulation of an international forex broker.

The website and software support

Next up, let’s move on to the next section of our review, which is going to be CPT markets‘ website and software support. As we have already noted above, the website we saw doesn’t really attract the viewer’s eye; it has a bland interface that has some bright spots, such as blank backgrounds and easily-discernable fonts.

As for obtaining the information, we can say this: CPT markets does provide details about pretty much all trading aspects. Yet our CPT markets opinion is still low even in this section because the broker doesn’t really explain these features or how they should be safely used within trades.

Next up, let’s have a closer look at which trading accounts you can get with CPT markets. The majority of forex brokers, even the ones that are blatantly fraudsters, offer at least three different live accounts for different trader types. Yet CPT markets doesn’t even offer two; the only standard account that it features must work for anyone that wants to associate with this broker.

Granted, this account stands out with some of the most mind-blowing features like a 1:1000 leverage, it’s important to note that it’s not going to be the most accessible account for beginner traders. On top of that, even the veteran traders will find it disadvantageous to use the CPT markets standard account.

When it comes to the trading platform, the CPT markets MT4 and ctrader are the two main pieces of software that you’re getting with this broker. And to be fair, these platforms are the two of the most popular and widely-used applications that almost every broker would like to use. However, they do not guarantee that a broker stays away from scamming its clients if it so chooses.

Should you trust impressive CPT markets promotions?

The last segment, and the one that will probably attract most people’s attention, is going to be the actual numbers and trading conditions at CPT markets. First off, we have to note that CPT markets offers a decent range of tradable instruments, including:

- Currency pairs

- Crude oil

- Precious metals

- Indices

- Cfds

- Cryptocurrencies

It is certainly beneficial to have multiple assets to choose from, which is why we have to give the broker some credit. However, it still doesn’t go as far as to dissipate our CPT markets fraud suspicions, and here’s why:

The maximum leverage the broker offers to its clients goes as high as 1:1000. As we already pointed out above, a broker that operates in europe, and especially if it is licensed by the FCA, cannot possibly go above 1:30 with its leverage offering. The reason for that is pretty simple: high leverage increases your exposure to the market, which brings much larger profits and losses and is exceptionally risky to use.

That’s why both governments and legit brokers continuously warn traders not to use high leverage ratios. And that’s why we don’t appreciate having a 1:1000 leverage without any safety net on the platform.

Next up, let’s talk about spreads. As CPT markets points it out, your trades will be charged with floating spreads that start from 1.8 pips. When compared to other terms and conditions, this might be the most decent condition we’ve found during this CPT markets review.

Then there’s the minimum deposit requirement for the standard account. CPT markets charges you a whopping $500 to let you trade on its platform. This, in our experience, is a very high threshold that not many people will be able to cross. It’s definitely going to be a huge financial strain on beginner traders who want lower fees and basic trading conditions – none of which is available at CPT markets.

Finally, let’s review the financial platforms that power deposits and withdrawals. For each of the transactions, we’re going to make a list of available platforms with transaction times on the side. So, in order to make a deposit at CPT markets, you can use:

- Visa/mastercard credit cards – immediate transactions

- Wire transfer – 2-3 business days

- Unionpay – immediate transactions

- USDT – depends on the bank

- QR code – 1-3 business days

- Online banking – 1-3 business days

- SSAC – depends on the bank

As for withdrawals, there are:

- Wire transfer – 1-3 working days

- Unionpay – 1-3 working days

- Online banking – 1-3 working days

Granted, it is nice to see a multitude of financial platforms power deposits at CPT markets, however, withdrawals are much too limited and plus, there are no famous e-wallet platforms like paypal or neteller.

Should you trade with this broker?

So, what is our final CPT markets opinion? Will you make a good decision by trading with this broker?

Well, let’s re-list all the things we’ve said earlier: the broker has a very low-quality website that barely conveys information about its trading terms and conditions. It also has only one account that cannot possibly work for all traders.

As for licensing, CPT markets only has an IFSC license, even though it also claims to have an FCA regulation. This worsens the broker’s reputation even further.

Finally, CPT markets offers some of the more suspicious trading conditions that should be a red flag for any trader. Ultimately, we think that you shouldn’t commit to this broker financially.

The reputation of this broker is doubtful!

We do not trust this broker and do not recommend it to you.

FCA regulated brokers 2021

Using a regulated broker is vital to safeguard traders’ funds and interests. The UK is known for it’s tough regulation of online trading brokers and the body overseeing it is named the financial conduct authority (FCA). If you’re looking for a good FCA regulated broker, use our list of FCA regulated trading brokers below.

Top FCA brokers in UK

The FCA

The FCA is a regulatory body, established in 2013, that monitors financial services in the UK. It was brought in to replace the financial services authority in line with the new regulatory structure of the financial services act. The change followed the 2008 financial crisis which led to legislators wanting a tighter grip on the sector.

The body aims to create a safe environment for traders, brokers, and other market participants and has a range of powers and trading regulations at its disposal. It is also one of the most respected and reputable financial regulators in the world. The FCA operates as a separate entity to the UK government and is financed by its 50,000+ industry members.

Markets and products that fall under its trading regulations include:

- Forex

- Binary options

- Cfds & spread betting

- Shares, including penny stocks

- Algorithmic and automated trading

- Cryptocurrencies, including bitcoin, litecoin and ethereum

Note, the FCA regulates both retail and wholesale financial services companies.

Powers & trading regulations

The FCA’s day trading regulations and rules mean that brokers and venues have to meet certain requirements before they are licensed to operate in the UK. These include agreeing to external audits and segregating client money from firm capital. Other conditions include capping retail leverage at 1:30 to limit losses, as well as providing negative balance protection to ensure traders don’t lose more than their deposit.

The body can also ban investing products for up to a year while it contemplates permanent bans. In addition, the FCA helps improve data protection, curtails promotions and bonuses, as well as working to protect vulnerable customers from unregulated scams.

The FCA has the power under trading regulations to proceed with legal action against unregulated providers, and it can offer compensation to consumers up to £30,000 should they get caught in illegitimate deals.

The agency has a history of action, particularly in forex, binary options and cryptocurrency markets. The regulatory body has handed out significant fines to brokers for manipulating prices and acting against the interests of traders. In fact, the FCA has seen years where it’s given out close to £230 million in fines. This is significantly more than the fines many forex trading regulatory bodies have handed out in recent years.

Benefits of FCA approved brokers

Registering with a broker that’s signed up to FCA trading regulations offers several benefits:

- Complaints channels should a broker behave inappropriately

- Disputes service if a broker refuses to pay out profits

- Increased protection from scams

- Added layer of trust

Dangers of unregulated brokers

Though most financial services providers in the UK are regulated by the FCA, it is not a legal requirement and therefore some businesses remain unregulated. There are several dangers to trading with an unregulated broker:

- Exposure to online scams that may steal personal information

- Limited legal channels if a broker doesn’t pay out profits

- Fewer applicable trading regulations

- Limited payment and user security

How to check A broker is FCA regulated

To check a UK forex or CFD broker is FCA registered, simply search the company in the agency’s register. Many of the best-regulated trading platforms and companies also have a disclaimer on their website with the FCA logo.

To get in touch with the FCA, try their helpline or head over to their website to register a complaint.

Final word on UK trading regulations

The FCA is the gold standard for investing and trading regulations. Other agencies from around the world, including the cyprus securities & exchange commission (cysec), often follow the rules and benchmarks laid down by the FCA. We don’t recommend signing up with unregulated day trading brokers due to scam concerns.

Are all online brokers regulated by the FCA?

No, far from all online brokers are regulated by the FCA, and many will not necessarily make it apparent how they are regulated. Careful traders should make sure they trade with a broker that is regulated by the FCA here in the UK. Use our list of FCA regulated brokers to find one.

What is the best FCA regulated broker?

It depends on what you’re looking for as there are many great brokers to choose from. Use our list of FCA regulated brokers to compare them all on the features that are important to you.

CPT markets

- Company CPT markets UK limited, CPT markets limited

- Founded in 2008

- Offices in

Account types:

- Hedging

- Trailing stop

- Pending orders

- One-click trading

- Mobile trading

- Browser-based platform

- Trading via API

- Automated trading

- Forex 1:30

- Gold & silver 1:20

- CFD 1:20

- Oil 1:20

- Futures 1:20

- Indexes 1:20

- Soft commodities 1:20

- Metals 1:20

- Energies 1:20

- Minimum account size $500

- Minimum position size 0.01 lot

- Spread type fixed

- Spread on EUR/USD, pips 2

- Trading instruments

Reviews

2 reviews of CPT markets are presented here. All reviews represent only their author's opinion, which is not necessarily based on the real facts.

Very good execution and friendly chat service. Had no problems with the system.

I do not speak much english but i can say this.

When you have downloaded the application, it is impossible to remove it .

Your other applications do not function any more .

Submit your review

To submit your own forex broker review for CPT markets fill the form below. Your review will be checked by a moderator and published on this page.

By submitting a forex broker review to earnforex.Com you confirm that you grant us rights to publish and change this review at no cost and without any warranties.Make sure that you are entering a valid email address. A confirmation link will be sent to this email. Reviews posted from a disposable e-mail address (e.G. Example@mailinator.Com) will not be published. Please submit your normal e-mail address that can be used to contact you.

Please, try to avoid profanity and foul language in the text of your review, or it will be declined from publishing.

Tag: CPT markets

CPT markets – $30 non-deposit bonus

What’s new?

Meefx – welcome bonus 5 USD

Instaforex – one million option

MFM securities – matador contest

Forex4you – trading hero contest

Justforex – 2021 trading contest

Risk warning:

investors should be aware of the serious risks of investing in the forex market, binary options and other financial instruments. Trading on the forex and cfds using the leverage mechanism carries a high level of risk and may not be suitable for all investors.

Disclaimer:

all content on the brokersofforex.Com is provided for informational purposes only and shall not in any way be regarded as financial advice. Brokersofforex.Com and persons associated with brokersofforex.Com disclaim liability for any loss resulting from the use of information contained on this website. The published comments are private opinions of the users. Brokersofforex.Com is not responsible for their content. Used names and trademarks belong to their respective owners and are used for informational purposes only.

Popular category

From may 25, 2018, the general data protection regulation (GDPR), applies to all personal data processing of individuals from the european union.

We comply with this regulation and we would like to inform you about the rules of processing your personal data.

We would also like to inform you that this site uses cookies to provide better services.

Please be advised that by continuing to use this site, without changing your browser settings, you agree to the saving of cookies.

Privacy overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

CPT markets | first deposit up to $500 bonus

28th march 2020 · 0 comments

We fully understand the real needs of customers and provide specific and targeted service.

With advanced IT technology, we can serve our partners fully and efficiently so that our clients will not have any worries when trading.

Dates: may 31, 2020

Available to: new clients

Bonus information:

- Only available to customers of southeast asia countries and regions.

| Bonus (USD) | trading lots (std lots) | trading duration(days) |

|---|---|---|

| 10 | 5 | 30 |

| 20 | 15 | 30 |

| 50 | 30 | 60 |

| 120 | 50 | 60 |

| 500 | 200 | 180 |

How to get:

- Open an account and verify it.

- Make a deposit

- Receive a bonus

- Start trading

Withdrawal: yes, after meeting the requirement. (read terms and conditions)

Bonus terms and conditions: general terms and conditions apply.

FCA regulated brokers 2021

Using a regulated broker is vital to safeguard traders’ funds and interests. The UK is known for it’s tough regulation of online trading brokers and the body overseeing it is named the financial conduct authority (FCA). If you’re looking for a good FCA regulated broker, use our list of FCA regulated trading brokers below.

Top FCA brokers in UK

The FCA

The FCA is a regulatory body, established in 2013, that monitors financial services in the UK. It was brought in to replace the financial services authority in line with the new regulatory structure of the financial services act. The change followed the 2008 financial crisis which led to legislators wanting a tighter grip on the sector.

The body aims to create a safe environment for traders, brokers, and other market participants and has a range of powers and trading regulations at its disposal. It is also one of the most respected and reputable financial regulators in the world. The FCA operates as a separate entity to the UK government and is financed by its 50,000+ industry members.

Markets and products that fall under its trading regulations include:

- Forex

- Binary options

- Cfds & spread betting

- Shares, including penny stocks

- Algorithmic and automated trading

- Cryptocurrencies, including bitcoin, litecoin and ethereum

Note, the FCA regulates both retail and wholesale financial services companies.

Powers & trading regulations

The FCA’s day trading regulations and rules mean that brokers and venues have to meet certain requirements before they are licensed to operate in the UK. These include agreeing to external audits and segregating client money from firm capital. Other conditions include capping retail leverage at 1:30 to limit losses, as well as providing negative balance protection to ensure traders don’t lose more than their deposit.

The body can also ban investing products for up to a year while it contemplates permanent bans. In addition, the FCA helps improve data protection, curtails promotions and bonuses, as well as working to protect vulnerable customers from unregulated scams.

The FCA has the power under trading regulations to proceed with legal action against unregulated providers, and it can offer compensation to consumers up to £30,000 should they get caught in illegitimate deals.

The agency has a history of action, particularly in forex, binary options and cryptocurrency markets. The regulatory body has handed out significant fines to brokers for manipulating prices and acting against the interests of traders. In fact, the FCA has seen years where it’s given out close to £230 million in fines. This is significantly more than the fines many forex trading regulatory bodies have handed out in recent years.

Benefits of FCA approved brokers

Registering with a broker that’s signed up to FCA trading regulations offers several benefits:

- Complaints channels should a broker behave inappropriately

- Disputes service if a broker refuses to pay out profits

- Increased protection from scams

- Added layer of trust

Dangers of unregulated brokers

Though most financial services providers in the UK are regulated by the FCA, it is not a legal requirement and therefore some businesses remain unregulated. There are several dangers to trading with an unregulated broker:

- Exposure to online scams that may steal personal information

- Limited legal channels if a broker doesn’t pay out profits

- Fewer applicable trading regulations

- Limited payment and user security

How to check A broker is FCA regulated

To check a UK forex or CFD broker is FCA registered, simply search the company in the agency’s register. Many of the best-regulated trading platforms and companies also have a disclaimer on their website with the FCA logo.

To get in touch with the FCA, try their helpline or head over to their website to register a complaint.

Final word on UK trading regulations

The FCA is the gold standard for investing and trading regulations. Other agencies from around the world, including the cyprus securities & exchange commission (cysec), often follow the rules and benchmarks laid down by the FCA. We don’t recommend signing up with unregulated day trading brokers due to scam concerns.

Are all online brokers regulated by the FCA?

No, far from all online brokers are regulated by the FCA, and many will not necessarily make it apparent how they are regulated. Careful traders should make sure they trade with a broker that is regulated by the FCA here in the UK. Use our list of FCA regulated brokers to find one.

What is the best FCA regulated broker?

It depends on what you’re looking for as there are many great brokers to choose from. Use our list of FCA regulated brokers to compare them all on the features that are important to you.

So, let's see, what was the most valuable thing of this article: CPT markets FX brokerage actively boasts with its fancy leverage and shiny licensing materials. Our review will show you whether these offerings are legit at cpt markets bonus

Contents of the article

- Free forex bonuses

- CPT markets review – would you want to trade with...

- First impressions do matter

- Is CPT markets legit?

- The website and software support

- Should you trust impressive CPT markets...

- Should you trade with this broker?

- CPT markets review and tutorial 2021

- CPT markets details

- Metatrader 4 platform

- Instruments

- Leverage

- Mobile apps

- Payments

- Demo account

- CPT markets bonus

- Regulation review

- Additional features

- Account types

- Benefits

- Drawbacks

- Trading hours

- Customer support

- Security

- CPT markets verdict

- Accepted countries

- Is CPT markets regulated?

- What trading platforms does CPT markets use?

- Does CPT markets offer a demo account?

- How do I open an account with CPT markets?

- What are the payment options to fund my CPT...

- CPT markets review – would you want to trade with...

- First impressions do matter

- Is CPT markets legit?

- The website and software support

- Should you trust impressive CPT markets...

- Should you trade with this broker?

- CPT markets review – would you want to trade with...

- First impressions do matter

- Is CPT markets legit?

- The website and software support

- Should you trust impressive CPT markets...

- Should you trade with this broker?

- FCA regulated brokers 2021

- Top FCA brokers in UK

- The FCA

- Benefits of FCA approved brokers

- Dangers of unregulated brokers

- How to check A broker is FCA regulated

- Final word on UK trading regulations

- CPT markets

- Account types:

- Reviews

- Submit your review

- Tag: CPT markets

- CPT markets – $30 non-deposit bonus

- Meefx – welcome bonus 5 USD

- Instaforex – one million option

- MFM securities – matador contest

- Forex4you – trading hero contest

- Justforex – 2021 trading contest

- CPT markets – $30 non-deposit bonus

- CPT markets | first deposit up to $500 bonus

- FCA regulated brokers 2021

- Top FCA brokers in UK

- The FCA

- Benefits of FCA approved brokers

- Dangers of unregulated brokers

- How to check A broker is FCA regulated

- Final word on UK trading regulations

No comments:

Post a Comment