Balance bonus

It’s important to note that these accounts are not no-fee accounts. Monthly service fees apply if you don’t maintain the required minimum balance or activity requirements.

Free forex bonuses

Citi accounts also may charge fees for using non-citi atms, among other charges. But if you’re able to meet those requirements, it’s nice to walk away at least a couple of hundred dollars richer. $2,000 direct deposit requirement to earn the bonus may be a challenge for some households

Best bank bonuses of 2021

Maximize your income with the best new-account offers of 2021

The banking industry is a very competitive place, and financial institutions are all vying to hold your hard-earned dollars. Some banks offer customers a bonus for opening or adding to an account. So if you're thinking about moving around your money, you may want to take advantage of bank bonuses that sweeten the deal.

Some banks will give you a cash bonus after opening a new account if you meet certain conditions, often a minimum balance requirement or direct deposit requirement. Sometimes, banks will even give existing customers a bonus for bringing more dollars into their accounts. But it’s important to research the most attractive options before shifting your money because interest rates are so low that the bonus needs to make the effort worthwhile.

We based this list on the highest bonuses we could find in mid-september 2020. When multiple banks offered similar ones, we chose the bank with the best account features for the typical user. (see more about selection criteria at the end of the story.)

Here are some of the best bank bonuses available today that could offer you lucrative rewards while keeping your money safe.

Best bank bonuses

| bank or credit union | why we picked it | bonus |

| citi | best for a large checking account bonus | up to $700 |

| BBVA | best for direct deposit bonus | $200 |

| chase | best for checking and savings bonus combo | up to $600 |

| PNC | best for low-fee account | $200 |

| capitol one | best for no direct deposit or minimum balance requirements | $100 |

Best for a large checking account bonus: citi – up to $700

:max_bytes(150000):strip_icc()/Citi-5beae80dc9e77c0051b628e8.jpg)

Citibank has a current offer for a bonus worth up to $700 for opening and funding a new checking account. To get the main bonus, worth $200, $400, or $700, you have to open a new checking account and keep a balance of $5,000, $15,000, or $50,000, respectively, for the various levels of bonus. You must keep your funds in the account for 60 days to earn the bonus. Each bonus is tied to a specific citi checking account.

It’s important to note that these accounts are not no-fee accounts. Monthly service fees apply if you don’t maintain the required minimum balance or activity requirements. Citi accounts also may charge fees for using non-citi atms, among other charges. But if you’re able to meet those requirements, it’s nice to walk away at least a couple of hundred dollars richer.

Earn up to $700 for opening and funding a new checking account

Lower bonuses are easier to earn, starting with a $5,000 balance

No direct deposit requirement

Must deposit $50,000 between checking and savings for two months to earn the top bonus

Accounts have monthly service charges (though they can be avoided)

Best for direct deposit bonus: BBVA – $200

:max_bytes(150000):strip_icc()/BBVA-6cbbf9dc3c8a49a79713f656a3627e52.png)

BBVA has a $200 bonus offer that we like because it’s linked to a relatively low direct deposit amount. To earn it, you have to open a new BBVA free checking account with a promo code by oct. 15, 2020, and deposit a total of $500 or more via direct deposit by dec. 15, 2020.

BBVA free checking has no monthly service charges, and is available with a $25 minimum opening balance. There are some small fees for less common activity, notably using non-BBVA atms.

Earn up to $200 for opening a new checking account with just a $25 minimum deposit

No large direct deposit required to earn a bonus

Free checking has no recurring monthly fees

Must meet specific minimum direct deposit requirement to earn bonus

Bonus can be deducted if account is closed within 12 months of opening

Best for checking and savings bonus combo: chase – up to $600

:max_bytes(150000):strip_icc()/chase_LOGO-861a88632e8f45e898470c67c6e5ddaa.png)

Chase is willing to give you a bonus of up to $600 for opening and funding new accounts, but you’ll need to open both a checking account and a savings account with a large balance to make it work. With the current offer, you can earn $300 with a new checking account, $200 with a new savings account, or $600 with both. For the checking bonus, you have to open a new account and set up direct deposit. For the savings bonus, you have to deposit at least $15,000 within 20 days of opening a new account and keep it there for at least 90 days. Do both and you get $100 more.

Chase is great for its huge network of branch locations and atms, but there are some fees to be aware of. Chase total checking has a $12 monthly fee that can be avoided with direct deposit or minimum balance requirements. Chase savings costs $5 per month unless you meet minimum requirements. If you can avoid those fees, this bonus may be a good deal for you.

Earn up to $600 for opening two accounts

Choose one or both bonuses, depending on your needs

No specific dollar requirement for checking account direct deposit

High deposit requirement for the savings account bonus

Accounts charge monthly fees unless you meet fee-waiver requirements

Best for low-fee account: PNC – $200

:max_bytes(150000):strip_icc()/PNCBank-5beae908c9e77c005151cd39.jpg)

PNC’s checking account, called virtual wallet checking pro, comes with a $200 sign-up bonus after $2,000 in direct deposits within the first 60 days of opening your account. You can open the virtual wallet checking pro account on its own, or with a savings and a reserve checking accounts package to qualify for the bonus.

The best part about PNC compared with others on this list is no or low account fees. This checking account has no minimum balance requirements, no monthly service charges, and automatically reimburses up to $20 in ATM fees charged by other banks. While the $200 bonus is likely to lure you in, the low fees may be what keep you around.

Earn $200 with a new checking account

Choose checking-only or checking and savings account packages to earn a bonus

Accounts with very low fees, including no recurring monthly charges

$2,000 direct deposit requirement to earn the bonus may be a challenge for some households

Best for no direct deposit or minimum balance requirements: capital one – $100

:max_bytes(150000):strip_icc()/capital-one-bank_tb_logo-e96bd763449445208857593cadfb2fa7.png)

Capital one is a popular bank for its low-fee accounts, and it currently offers a $100 bonus that doesn’t come with any direct deposit or minimum balance requirements. If you sign up by oct. 20, 2020, with the promo code, you’ll earn $100 after making $300 in purchases using the account’s debit card within 90 days. Many families spend that on groceries and gas alone in a month, so this is a very easy bonus to earn.

360 checking is a low-fee account that has no minimum balance requirement or recurring account fees. capital one has a network of branches and cafes to handle banking in person, though many people use capital one as an online-only bank. One innovative feature at capital one is a choice of how overdrafts are handled. You can choose to have them automatically declined for free or paid with a grace period before paying a fee. That flexibility could help you save money on fees over time.

No minimum deposit required to earn the bonus

No direct deposit requirement to earn the bonus

No recurring fees and no minimum balance requirement for checking account

Relatively low sign-up bonus versus some others

What is a bank bonus?

A bank bonus is a type of reward given to customers by a bank for meeting certain activity requirements, often tied to opening a new checking or savings account. Most bank bonuses require you to meet certain minimum direct deposit requirements for a checking account or minimum balance requirements for a savings account, although this isn’t always the case.

In some cases, you’ll earn a modest bonus that’s a nice perk for opening an account. In others, you could earn hundreds of dollars or more. If you are looking for a new bank anyway, a bonus could be a good motivator for where to move your money next. But remember, in a low-interest-rate environment, you’re not likely to gain on return in the longer term by shifting.

Is the bonus worth it?

Not all bank bonuses are easy to earn. As you can see above, two of the most common hoops you may have to jump through are direct deposit or minimum balance requirements. In some cases, these could be easy for you to satisfy. But in others, it may not be worth it, if you can meet the requirement at all.

For example, a bonus that requires a $50,000 cash deposit for two months is not viable for most people. But there are other bonuses that are much easier to earn. It’s up to you to decide if pursuing a bonus is worth the effort and realistic for your financial situation.

How to find bank bonuses

Bank account bonuses come and go regularly. Some banks are working to attract more cash on hand so they can make loans, which could inspire them to offer a sizable savings account bonus. Others want more-active customers and to boost debit card activity, so they will seek this by promoting bonuses for checking accounts.

You often can find bank account bonuses listed on bank websites. Beyond that, you can peruse researched and fact-checked lists like this one to get an idea of what bonuses are available and could be right for your needs.

How we chose the best bank bonuses

This list of the best bank bonuses is based on the highest bonuses we could find at the time of writing and publication in mid-september 2020. When multiple banks offered similar bonuses, we opted for the bank that had the best account features for the typical user. The size of the bonus was the biggest factor considered, but bank fees, notably ongoing monthly charges, also carried weight when picking winners for this list.

What is bonus pay?

Definition and examples of bonus pay

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1064763952-f762ab6728c94cad888c2de293d5c9ea.jpg)

Bonus pay is compensation in addition to the amount of pay specified as a base salary or hourly rate of pay.

Learn more about when employers hand out bonus pay and what rules come into play.

What is bonus pay?

Bonus pay is additional pay given to an employee on top of their regular earnings; it's used by many organizations as a thank-you to employees or a team that achieves significant goals. Bonus pay is also offered to improve employee morale, motivation, and productivity. When a company ties bonuses to performance, it can encourage employees to reach their goals, which in turn helps the company reach its goals.

How does bonus pay work?

Bonuses may be discretionary or nondiscretionary; in other words, they may be paid out as and when the company sees fit, or they may be specified in an employment contract or other documentation.

Discretionary bonuses: an employer may distribute bonus pay at their discretion, perhaps as a reward for high performance, for an employee-of-the-month program, or for a successful referral of a new employee. Discretionary bonuses are not required to be paid out, and the amount of the bonus is up to to the employer.

For example, many companies do year-end or holiday bonuses. If they are not part of a contract or otherwise promised, they are discretionary bonuses.

Nondiscretionary bonuses: nondiscretionary bonuses are known and expected by the employee. They may be based on a predetermined formula, or on factors such as attendance. They are generally included in the regular rate of pay, which is specified in the employee offer letter, in the employee personnel file, or a contract.

Say, for example, an employer provides an incentive pay plan for employees who achieve certain performance benchmarks. Since the employee knows what is required of them in order to receive the bonus, it would be a nondiscretionary bonus.

The fair labor standards act (FLSA) states that all employee compensation is included in the base rate of pay, which is used to determine overtime pay, but that some bonuses may be excludable if certain criteria are met:

- The employer can decide whether to pay the bonus.

- The employer can decide the amount of the bonus.

- The bonus is not paid according to any agreement or otherwise expected to be paid.

The FLSA also explains that some employees are exempt from its overtime rules if they are:

- Paid a fixed salary, which doesn't change based on their time or efforts

- Paid at least a minimum weekly amount of $684

- Primarily perform "executive, administrative, or professional duties"

Exempt employees may be paid up to 10% of their salary in nondiscretionary bonuses and incentives in order to fulfill the FLSA salary requirements.

Types of bonus payments

There are several different instances in which a company may issue bonus payments.

Contracted bonus payments

Executives, especially those in senior roles, may have contracts that require the company to pay out bonuses. These bonuses are often dependent on the company meeting specific revenue targets. The employer may also base them on different criteria such as sales, employee retention, or meeting growth goals.

Executive bonus payments are not always tied to performance results. Contracted bonus pay is not common outside of the executive suite.

Performance bonus payments

Some companies offer bonuses to people below the executive level as well. These bonuses can be based on many different factors.

- Personal performance: employees are rated based on how they met or exceeded the goals set by their management. This type of bonus can also reward soft skills that had an impact on the organization's performance, such as leadership, effective communication, problem-solving, and collaboration.

- Company goals: an employee would receive a bonus based on how well the company performed as a whole. If an employee had an outstanding year but the company didn't do well overall, the employee wouldn't receive the bonus. But if the company exceeds its goals, it's possible the bonus may be higher.

- Pay grade: typically, if you're paid more money, you're eligible for a higher bonus. As an example, a company might pay one employee $50,000 a year and make them eligible for a 5% bonus if goals are met, but pay another employee $100,000 a year with a possible 10% bonus. Bonuses based on pay grade recognize that a senior employee may have a more significant impact on the company's performance.

Sales commissions

If you're a sales employee (inside or outside), commissions are generally a good portion of your pay. These are often referred to as bonuses as well, but they differ from other bonuses in that they are directly tied to your sales numbers and generally not to anything else. Some companies cap the total sales bonus an individual employee can receive.

One structure of bonus payments frequently found in sales organizations is to reward sales performance at specified levels above commission. Some sales organizations reward employees with bonus pay without commission.

Other organizations set team sales goals instead of individual sales goals. As a team member, you'd earn the same as the other team members make, a portion of the pooled commissions, and bonus, if available.

How to check glo airtime account balance & bonus airtime balance

Don’t know how to check account balance on glo? This guide will help you do that. Also, you’ll learn how to check your bonus account balance, since glo is fond of dishing out bonuses all the time; and sometimes people don’t even know they have bonuses.

One of my elderly relatives keeps getting bonuses and allowing them expire without using them; because sometimes he didn’t even realize he had them.

Another thing is if you can’t check what you have left, you may not really know how to manage it.

How to check account balance on glo

- Dial #124# and wait till you get a message telling you to press 1.

- Enter 1 in the command prompt and click on send.

This should automatically display the available balance you have left.

Alternatively, dial #124*1# to reveal your account balance without having to enter any other command.

How to check bonus account balance on glo

The generic code for checking bonus airtime balance on glo is #122#. However, the prepaid or postpaid tariff plan you’re currently subscribed to may not display the bonuses you have even if you dial #122#

Here are the codes for checking bonuses on different glo tariffs:

- Glo yakata customers need to dial *220*1# to see their bonuses.

- Glo jumbo: dial #122*23#

- Glo campus booster bonuses: #122*10#

- Glo bumpa package: #122*2#

- Glo welcome back bonus: dial #122*34# to check locked welcome back bonuses; and #122*35 to check unlocked bonuses.

In the case of data, we already covered that in our previous publication. It is usually *127*0#. You can learn more about checking glo data and bonus data balance here.

We have covered almost all the tariffs we know of that have varying way to check what you have on your account balance. If there’s anyone we left untouched you can let us know using the comment section of this post below.

Do not forget to like us on facebook to get access to us faster than anyone else.

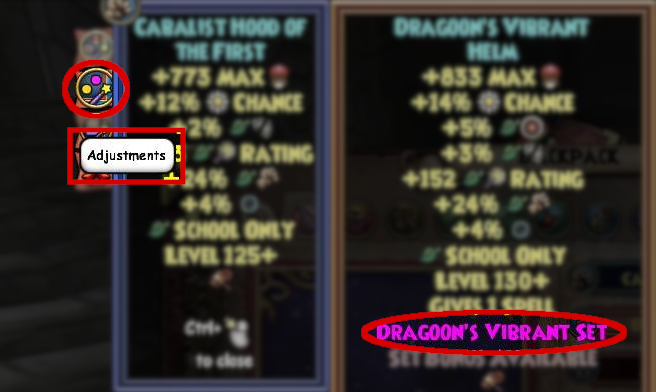

Wizard101

gear set bonuses

Test realm came online and with it, a feature for players who love optimizing their stats: gear set bonuses. This isn’t a foreign concept, in fact it’s a common motif in other mmos. Even when players farmed for their (original) malistaire robe, some daydreamed about the possibility of these bonuses. They asked, “what if wearing a full gearset gave me more than the sum of the individual parts?” this is exactly what a set bonus will do for you today!

How do these bonuses work?

It’s simple! First, equip 2 or more pieces of the same set. Then you gain a stat bonus based on how many pieces of that set you’re wearing. These stats are given in addition to whatever benefits your equipment usually provides. Also, wearing more pieces of a certain set, activates more bonuses for your character!

How do I see these set bonuses?

With the new item interface, you can see if an item is part of a set when you encounter the not-flashy-at-all purple letters plainly telling you the set’s name.

By clicking on the new adjustment button on the left side, you can then see what bonuses that set currently grants you. Also included are the other bonuses you may unlock by equipping further pieces.

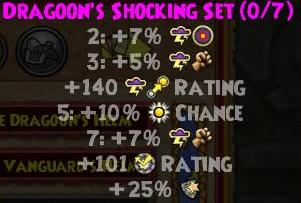

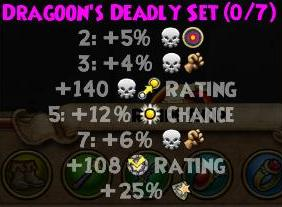

Which gear sets have bonuses so far?

Being a new feature, only a few gear sets have bonus at this time. However, that number is sure to grow very soon. These are some of the more notable sets that will the use the set bonus feature when the test realm hits live.

Dragoon’s (catacombs gear)

full set composed of hat, robe, boots, wand, athame, amulet and ring

Road warrior’s hoard pack

set composed of hat, robe, boots, wand and pet

Are they worth it?

Although the sample size we’ve received is small, the feature appears that it will be a crucial factor in gear choice. Currently the most readily available set bonuses will, of course, be from the dragoon’s gear. The 7 school specific dragoon’s sets are already among the most popular pieces of gear in the current game due to their very pushed base stats. Furthermore, this gear is already a major contributor in pvp, so when the set bonuses come live, expect to see this effect exacerbated.

Players only using 2-3 pieces will get to enjoy some sweet additional accuracy, damage, and pip chance. Those who take a step further might be tempted to strive for the 5-piece bonus where the +12% power pip chance will help them compensate for the lack of pips on the ring and athame.

The road warrior sets, while not impressive at first sight, can also prove to be a simpler and equally formidable combo made of just 2 pieces: the popular pack wand with its matching pet, which enables a 3% resist bonus. This may prove very useful for jade wizards looking to have universal immunity! ��

Perhaps it would be in KI’s best interest to have a throwback thursday to the road warrior’s hoard pack around the time this update comes live…

Gear sets moving forward

According to kingsisle, further set bonuses are going to be added over time as new equipment come out. It’s unclear whether they intend to review old gear and add set bonuses to them. However, developers have confirmed darkmoor sets will not receive a set bonus.

Regarding what future set bonuses might look like, the possibilities for them are as vast as for the equipment that enables them. Set bonuses can manifest in a variety of ways, giving both cumulative stats (like our current set bonuses do) or alternating stats where each new tier gives a different benefit than the previous one.

Set bonuses can also provide anything equipment does, including cards and maycasts, making for a vast ocean of possibilities.

What is bonus pay?

Definition and examples of bonus pay

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1064763952-f762ab6728c94cad888c2de293d5c9ea.jpg)

Bonus pay is compensation in addition to the amount of pay specified as a base salary or hourly rate of pay.

Learn more about when employers hand out bonus pay and what rules come into play.

What is bonus pay?

Bonus pay is additional pay given to an employee on top of their regular earnings; it's used by many organizations as a thank-you to employees or a team that achieves significant goals. Bonus pay is also offered to improve employee morale, motivation, and productivity. When a company ties bonuses to performance, it can encourage employees to reach their goals, which in turn helps the company reach its goals.

How does bonus pay work?

Bonuses may be discretionary or nondiscretionary; in other words, they may be paid out as and when the company sees fit, or they may be specified in an employment contract or other documentation.

Discretionary bonuses: an employer may distribute bonus pay at their discretion, perhaps as a reward for high performance, for an employee-of-the-month program, or for a successful referral of a new employee. Discretionary bonuses are not required to be paid out, and the amount of the bonus is up to to the employer.

For example, many companies do year-end or holiday bonuses. If they are not part of a contract or otherwise promised, they are discretionary bonuses.

Nondiscretionary bonuses: nondiscretionary bonuses are known and expected by the employee. They may be based on a predetermined formula, or on factors such as attendance. They are generally included in the regular rate of pay, which is specified in the employee offer letter, in the employee personnel file, or a contract.

Say, for example, an employer provides an incentive pay plan for employees who achieve certain performance benchmarks. Since the employee knows what is required of them in order to receive the bonus, it would be a nondiscretionary bonus.

The fair labor standards act (FLSA) states that all employee compensation is included in the base rate of pay, which is used to determine overtime pay, but that some bonuses may be excludable if certain criteria are met:

- The employer can decide whether to pay the bonus.

- The employer can decide the amount of the bonus.

- The bonus is not paid according to any agreement or otherwise expected to be paid.

The FLSA also explains that some employees are exempt from its overtime rules if they are:

- Paid a fixed salary, which doesn't change based on their time or efforts

- Paid at least a minimum weekly amount of $684

- Primarily perform "executive, administrative, or professional duties"

Exempt employees may be paid up to 10% of their salary in nondiscretionary bonuses and incentives in order to fulfill the FLSA salary requirements.

Types of bonus payments

There are several different instances in which a company may issue bonus payments.

Contracted bonus payments

Executives, especially those in senior roles, may have contracts that require the company to pay out bonuses. These bonuses are often dependent on the company meeting specific revenue targets. The employer may also base them on different criteria such as sales, employee retention, or meeting growth goals.

Executive bonus payments are not always tied to performance results. Contracted bonus pay is not common outside of the executive suite.

Performance bonus payments

Some companies offer bonuses to people below the executive level as well. These bonuses can be based on many different factors.

- Personal performance: employees are rated based on how they met or exceeded the goals set by their management. This type of bonus can also reward soft skills that had an impact on the organization's performance, such as leadership, effective communication, problem-solving, and collaboration.

- Company goals: an employee would receive a bonus based on how well the company performed as a whole. If an employee had an outstanding year but the company didn't do well overall, the employee wouldn't receive the bonus. But if the company exceeds its goals, it's possible the bonus may be higher.

- Pay grade: typically, if you're paid more money, you're eligible for a higher bonus. As an example, a company might pay one employee $50,000 a year and make them eligible for a 5% bonus if goals are met, but pay another employee $100,000 a year with a possible 10% bonus. Bonuses based on pay grade recognize that a senior employee may have a more significant impact on the company's performance.

Sales commissions

If you're a sales employee (inside or outside), commissions are generally a good portion of your pay. These are often referred to as bonuses as well, but they differ from other bonuses in that they are directly tied to your sales numbers and generally not to anything else. Some companies cap the total sales bonus an individual employee can receive.

One structure of bonus payments frequently found in sales organizations is to reward sales performance at specified levels above commission. Some sales organizations reward employees with bonus pay without commission.

Other organizations set team sales goals instead of individual sales goals. As a team member, you'd earn the same as the other team members make, a portion of the pooled commissions, and bonus, if available.

Best bank account bonuses for february 2021

Advertiser disclosure

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, american express, bank of america, capital one, chase, citi and discover.

How we make money.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Share

At bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money.

Editorial integrity

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.Com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, bankrate does not include information about every financial or credit product or service.

If you’re wishing you had more savings right now, you’re not alone. Many americans impacted by the coronavirus are finding that they need additional funds to make ends meet. A bit of extra cash could be a big help. Fortunately, a number of banks are still giving out free stacks of cash.

In exchange for opening a new savings or checking account, you could wind up with an extra $200 or $300 dollars (or more). Shopping around for a new bank account isn’t exactly exciting, but at a time like this it could be worth your while.

Here are some of the best bank account bonuses in february. Compare these offers along with cds and other savings accounts that pay more interest. And check out other types of bonuses, too, like the best brokerage account bonuses.

Summary of the best bank account bonuses

Best checking account bonuses

- Associated bank: $200, $300 or $500 bonus

- HSBC bank: $200 or $450 bonus

- TD bank: $150 or $300 bonus

- Chase bank: $200 bonus

- PNC bank: $200 or $500 bonus

- Huntington national bank: $150, $200, $400, $500 or $750 bonus

- Bank of america: $100 bonus

- Axos bank: $100 bonus for new business owners

Best savings account bonus

Best checking and savings account bonus

Best referral bonuses

- Axos bank: $20 for referral and referee

- Chase: $50 for each referral up to $500

- Chime: $50 for referral and referee

- TD bank: $50 for referral and referee

- HSBC bank: $50, $200 or $400 referral bonus

Best checking account offers

Associated bank: $200, $300 or $500 bonus

New customers have the opportunity to earn a $200, $300 or $500 bonus when opening a checking account with associated bank and completing qualifying activities by may 31, 2021.

To earn the bonuses, you must maintain a preset balance for the first 61-90 days.

- To earn $200, you must maintain a daily balance of $1,000 – $4,999.

- To earn $300, you must maintain a daily balance of $5,000 – $9,999.

- To earn $500, you must maintain a daily balance of $10,000 or more.

In order to be eligible for the bonuses, you must not have opened an account with associated bank within the last six months and have to keep the account open for a minimum period of 12 months.

Associated bank is based in green bay, wisconsin and has branches located in illinois, minnesota and wisconsin.

HSBC bank: $200 or $450 bonus

HSBC has a couple of checking account bonuses available online. Through march 31, 2021, you can earn:

- $200 for opening an HSBC advance checking account online and receiving recurring monthly direct deposits totaling $500 for three consecutive months (from the second full calendar month after opening the account).

- $450 for opening an HSBC premier checking account online and receiving monthly direct deposits of at least $5,000 for three consecutive months (from the second full calendar month after opening the account).

Another option is to opt for a bonus that pays 3 percent cash back (up to $600 for new premier checking account holders). This offer also expires on march 31. To qualify, you’ll need to set up recurring direct deposits to an HSBC premier checking account at least once per calendar month for six consecutive months following the account’s opening month.

HSBC is based in mclean, virginia. It earned 4 out of 5 stars in bankrate’s full review of its products and offerings.

TD bank: $150 or $300 bonus

A $300 bonus is available for TD bank customers who:

- Open a beyond checking account online.

- Have never had a TD bank personal checking account.

- Have at least $2,500 worth of direct deposit funds within 60 days of opening the account.

There’s also a $150 cash bonus if you’d prefer a convenience checking account (requires direct deposits of $500 within 60 days of opening the account).

Bonuses are available to residents in the district of columbia, pennsylvania and every state on the east coast except georgia.

TD bank is based in wilmington, delaware. In bankrate’s review of TD bank’s services and product offerings, it earned 3.5 out of 5 stars.

Chase bank: $200 bonus

Through april 14, 2021, chase is offering a bonus on new checking and savings accounts.

- To earn $200, open a new total checking account and have a direct deposit totaling $500 or more within the first 90 days.

To qualify for the bonus, you must not have an existing chase fiduciary or checking account (or had one closed with a negative balance or within the last 90 days).

Chase bank has branches in 29 states including georgia and florida and in the western, southwestern, midwestern and northern parts of the country.

Our review of chase’s banking products and services gave the bank 3.4 out of 5 stars. Chase is headquartered in columbus, ohio.

PNC bank: $200 or $500 bonus

As long as you don’t have an existing PNC consumer checking account or have closed one within the past 90 days, you could qualify for a $200 or $500 bonus when you open a business checking or business checking plus account, treasury enterprise plan or analysis business checking account.

To earn the $200 bonus, you must:

- Open a business checking or business checking plus account

- Maintain a minimum balance of $5,000 for each of the first three statement cycles

- Make at least 20 total qualifying transactions in the first three billing statements

To earn the $500 bonus, you must:

- Open a treasury enterprise plan or analysis business checking account

- Maintain a minimum balance of $30,000 for each of the first three statement cycles

Accounts can be opened nationwide online or in-person. The offers expire on march 31, 2021.

PNC is based in wilmington, delaware and earned 3.7 out of 5 stars in bankrate’s full review of its products and offerings.

Huntington national bank: $150, $200, $400, $500 or $750 bonus

Huntington bank has a few checking account bonuses available for both consumers and business owners. Through april 7, 2021 you can earn:

- $150 for opening an asterisk-free checking account and making a cumulative deposit of at least $1,000 within 60 days of the account opening.

- $200 for opening a huntington 5 checking account and making a cumulative deposit of at least $1,000 within 60 days of the account opening.

- $200 for opening a business checking 100 account and making a cumulative deposit of at least $2,000 within 60 days of the account opening.

- $400 for opening an unlimited business checking account and making a cumulative deposit of at least $5,000 within 60 days of the account opening.

- $500 for opening a huntington 25 checking account and making a cumulative deposit of at least $15,000 within 60 days of the account opening.

- $750 for opening an unlimited plus business checking account and making a cumulative deposit of at least $20,000 within 60 days of the account opening.

These offers are only valid for residents of ohio, michigan, indiana, pennsylvania, kentucky, west virginia, illinois and wisconsin.

Huntington is based in columbus, ohio. In the full review of its banking products and offerings, the bank earned 3.4 out of 5 stars.

Bank of america: $100 bonus

New checking customers can earn $100 from bank of america when they open an account online. The offer expires june 30, 2021. To get the bonus, you must:

- Not have had a bank of america personal checking account within the past six months.

- Open a new advantage safebalance banking, advantage plus banking or advantage relationship banking account online.

- Make an opening deposit ($25 opening deposit for the advantage safebalance banking account and $100 opening deposit for the others).

- Receive two direct deposits of at least $250 each within 90 days of opening your account.

An offer code (DOC100CIS) is needed to qualify for the bonus.

Bank of america is headquartered in charlotte, north carolina. It earned 3.2 out of 5 stars in bankrate’s full review of its products and services.

Axos bank: $100 bonus for new business owners

New small-business owners have the opportunity to earn a $100 bonus when they open a small business checking account with axos bank. The offer expires march 31, 2021. To get the bonus, you must:

- Have incorporated your business after june 1, 2020

- Maintain a daily balance of at least $2,500

- All deposits must be new money

An offer code (NEWBIZ100) is needed when applying.

Axos is headquartered in san diego, california. It earned 4.6 out of 5 stars in bankrate’s full review of its products and services.

Best savings account offers

Marcus by goldman sachs: $100 bonus

Savers can earn both a competitive yield and a $100 bonus when they open a high-yield savings account with marcus by feb. 13.

To qualify for the bonus, you must:

- Deposit $10,000 or more in new funds within 10 days of enrollment

- Maintain those funds for 90 days

Marcus by goldman sachs is a brand of goldman sachs bank USA. The bank earned 4.1 out of 5 stars in bankrate’s full review of its products and offerings.

Best checking and savings account bonus

Citibank: $200, $400 or $700 bonus

Customers in the market for a new checking and savings account can open both through citi and potentially earn a bonus.

- To earn $300, open an eligible checking or savings account in the citibank account package. Deposit $15,000 within 30 days and maintain that balance for 60 days.

- To earn $700, open checking and savings accounts in the citi priority account package. Deposit $50,000 within 30 days and maintain that balance for 60 days.

Both offers expire april 1, 2021. Citibank is based in sioux falls, south dakota. In bankrate’s review of citibank’s full suite of products and offerings, it earned 4.3 out of 5 stars.

Best bank account referral bonuses

Axos bank: $20 for referral and referee

Current axos customers have the opportunity to earn and give $20 for referring a friend to the essential checking account.

To qualify for the bonus, your friend must:

- Not have owned an axos bank account

- Use your personalized referral link

- Add and maintain at least $500 for a full month

- Receive a direct deposit of at least $100 within the first two months

If all requirements are met, both parties will receive $20 in their bank account.

Axos is headquartered in san diego, california. It earned 4.6 out of 5 stars in bankrate’s full review of its products and services.

Chase: $50 for each referral up to $500

Current chase customers can earn $50, up to $500 per calendar year, for each friend who opens a qualifying checking or savings account.

To qualify, your friend must:

- Use your personalized referral link

- Open a chase total checking, chase savings or chase college checking account

- Be in good standing at the time of payout

The bonus your friend will receive depends on the type of account she opens and whether she completes the qualifying activities outlined in the bonus.

Our review of chase’s banking products and services gave the bank 3.4 out of 5 stars. Chase is headquartered in columbus, ohio.

Chime: $50 for referral and referee

Current chime customers can get $50 for each friend they refer. To qualify for the bonus, you must:

- Be a new chime customer

- Use your personalized referral link

- Receive a single qualifying direct deposit of $200 or more from a payroll provider within 45 days of opening the account

If all qualifying activities are met, both parties will receive $50.

Chime is based in san francisco, california and is a neobank, meaning it strictly operates online and partners with a bank to hold your deposits.

TD bank: $50 for referral and referee

TD bank customers can earn and give $50 when they refer a friend to a TD bank personal checking account. To qualify for the bonus, your friend must:

- Bring in a referral form with your information

- Be a new TD bank customer

- Receive a direct deposit of at least $250

- OR make at least 15 debit card purchases within 60 days of opening the account

You can refer up to 10 friends per calendar year, meaning you could earn up to $500.

TD bank is based in wilmington, delaware. In bankrate’s review of TD bank’s services and product offerings, it earned 3.5 out of 5 stars.

HSBC bank: $50, $200, $400 referral bonus

Current HSBC customers have a few referral bonuses to choose from that range from as little as $50 all the way up to $400, with the opportunity to earn up to $2,000 per calendar year.

To qualify for each bonus, your friend must use your personalized referral code and complete the qualifying activities listed for each account.

Here are the current bonuses and what your friend will need to do to qualify for them.

- $50 for choice checking: deposit and maintain a balance of $1,500 or receive monthly recurring direct deposits.

- $200 for advance checking: deposit and maintain a balance of $5,000 or receive monthly recurring direct deposits or have an HSBC U.S. Residential mortgage.

- $400 for premier checking: deposit and maintain a balance of $75,000 or receive monthly recurring direct deposit of at least $5,000, or have an HSBC U.S. Residential mortgage loan with an amount of at least $500,000

These offers expire on july 31, 2021.

HSBC is based in mclean, virginia. It earned 3.9 out of 5 stars in bankrate’s full review of its products and offerings.

Why banks have sign-up bonuses

Banks use sign-up bonuses to distinguish themselves from others in the industry. Cash bonuses also help financial institutions bring in new customers and new deposits.

While they could pay account holders a higher yield, for some banks, offering a bonus is preferable.

“it’s much easier to quantify the bonus than it is to raise the rate on what you’re paying out on deposits,” says greg mcbride, CFA, bankrate chief financial analyst.

Some banks, like citibank, offer more than one sign-up bonus. But qualifying for multiple bonuses at the same time at the same bank usually isn’t possible. Bank account bonuses are typically available only to new checking or savings account holders.

What to watch out for

Every bank account bonus isn’t a good deal. Before you sign up, read the fine print.

Watch out for sky-high minimum balance requirements and monthly fees that could eat into your earnings. If earning a bonus seems to require too much effort, you might want to look for another one.

If you’re applying for a checking account, make sure it’s a good match that meets your needs. For example, if you need them, double-check that there are plenty of branches and atms in your area. That way, you’re not driving miles to meet with a banker or wasting money on out-of-network ATM fees. And with coronavirus forcing banking to shift online more than ever before, look for a bank or credit union that offers a solid set of digital tools.

If you’re looking for a new savings account, consider whether you’re better off finding another bank that pays more interest.

For instance, these one-time bonuses are typically offered on accounts that pay minimal interest. So while the bonus is great initially, you may be sacrificing the long-term return.

How to recharge glo yakata and codes for checking your bonus & balance accounts

Image source

Of all the tariff plans offered by globacom, the leading telecommunications company in nigeria, the glo yakata tariff is arguably considered the best. Customers claim this to be accurate due to the sheer amount of benefits they enjoy by subscribing to the tariff plan. For example, recharging your glo yakata line ensures you get access to loads of benefits and bonuses.

Glo yakata offers balanced services by rewarding subscribers with both voice and data bonuses that keep them glued to the tariff plan. Glo launched the tariff plan to ensure customers enjoy great value whenever they part with their money for different services on the glo platform.

This article should prove useful for potential subscribers seeking a new tariff plan after getting tired of their current one or new glo network users who are not familiar with the available tariff plans and what they entail.

What is the glo yakata tariff plan?

Globacom designed the glo yakata tariff plan to reward new glo customers for buying and registering a sim with the network. The tariff plan offers fantastic voice and data goodies to new customers. Individuals who purchase a new SIM will get up to 6GB of data every month for the next six months, tallies up to an incredible 36GB of free data over that period.

Additionally, customers also get an enticing 2200% bonus on recharges of N100 and above under the glo yakata tariff plan. The 2200% can be used to call all local networks in the country as well. The more a customer recharges, the higher the value they enjoy. Suppose a customer’s first recharge of every month is N200 or more. In that case, they will receive a data bonus that is 2.5 times the regular data benefit.

All bonuses have a validity period of just seven days, which means customers are frequently under pressure to exhaust them before the expiration date rolls around the corner.

While it is primarily for new customers, existing customers on the glo platform can also migrate to the plan. All they need to do is dial *230# to subscribe to the tariff plan. First migration within a month is free, but subsequent migrations will attract a migration fee of N100 per migration within that same month.

The glo yakata has proven to be a big hit amongst glo customers. It has also been responsible for the influx of a new set of customers who were previously loyal to other network operators.

Recharging your glo yakata line is just like recharging any glo line

Loading your glo yakata line is not a complicated process. It is the same thing as recharging your glo line as you would typically do. The USSD code used for recharging your glo line is the same code used for recharging your glo yakata line.

There are also no different routes or processes you have to go through to purchase airtime for your glo yakata account. As long as you are already on the tariff, your bonuses will register as soon as you have finished recharging your line.

Below is the step-by-step procedure to recharge a line on glo yakata:

- Purchase the airtime voucher from a nearby retailer or glo accredited store.

- Top up your line by using the code *123*voucher PIN#

- Hit “send”

- Your glo yakata line will be credited with the voucher amount you purchased.

Alternatively, you can use the glo simple recharge process to recharge your glo yakata account.

- You need to ensure you have linked your glo number to your bank accounts.

- After this, proceed to dial *805#.

- Select your bank from the options available.

- Enter in the amount of airtime you wish to purchase.

- Your glo yakata will be credited with the amount within seconds.

How to check glo yakata account balance

Image source

It is essential to check your glo yakata account balance occasionally to keep track of certain information and inform you of how you are consuming your airtime and bonus. The code for checking your glo yakata account balance is the same code all glo customers use to check their account balance.

The code, #124*1#, helps to relay specific information regarding glo customers’ account balances, including those subscribed to the glo yakata tariff plan. The step-by-step procedure for checking your account balance on glo yakata is:

- Launch your dial pad

- Dial #124*1#

- Proceed to hit the “send” button

- You will see your account balance displayed on the screen in seconds.

Glo yakata subscribers will have four account balance reports that include:

- Main account balance

- Bonus account (voice)

- Data value

- First recharge of the month data benefits

Customers will receive information regarding these four categories once they dial the #124*1# USSD code.

How to check glo yakata bonus

Glo yakata subscribers receive a lot of bonus rewards. These bonuses could be in the form of voice or data benefits. The call bonus runs for six months, with customers getting a whopping 2200% value on every N100 recharge.

Because it is a unique feature of the tariff plan, there is a code for checking your glo yakata call bonus that other tariff users cannot use. By dialing *230*1#, glo yakata subscribers can view their call bonus, estimate how much they have left and when it will expire before they have to recharge again.

Glo yakata customers also get rewarded with data bonuses in addition to the call bonus, and customers can also view their data bonus using a USSD code.

- Dial *777# on your phone.

- Press ‘1’ to select the data option.

- Click on ‘5’ for the ‘manage data plan.’

- Finally, select ‘4’ to get the data balance.

- Your data balance, including your glo yakata bonus, gets shown to you.

Alternatively, customers can also dial *127*0# to check their data balance and their glo yakata data bonus.

Frequently asked questions regarding the plan

Glo customers, either new or existing ones, will always have questions about glo’s services and promotions. While many of these customers may prefer to call the customer care agent to seek clarification, some will turn to the faqs and the answers provided. In that vein, here are five frequently asked questions (faqs) with answers.

- How much do I pay for making calls as a glo yakata subscriber? – all calls from a glo yakata line are billed at 70k/s. This charge applies to both the primary and bonus accounts. However, SMS costs N4 from the main account and N20 from the bonus account.

- How do I use the social data benefit? – social data benefits are only available for whatsapp, twitter, and facebook. It does not apply to other sites and purposes.

- Will I get glo yakata benefits if I recharge via E-top up? – yes. The yakata benefits are available on both physical and e-recharge platforms.

- What happens if there is airtime on my main account? – call charges will initially be made from your bonus account even if you have airtime on your main account. Your primary account will only get debited if your bonus balance has expired/is exhausted, making an international call, or paying for value-added services.

- Is glo yakata a promotional offer? – no. The glo yakata offer is a tariff plan that currently has no expiration date. As long as customers remain on it, they will continue to enjoy the benefits and bonuses that come with the plan.

How to calculate your reenlistment bonus

Find your SRB for the army, air force,navy, marines and coast guard

:strip_icc()/Reenlistment_Bonus_C-3-3c17b59c7fb1434ca6f251ae44216ee8.png)

Image by dingding hu © the balance 2019

Many service members are offered a monetary bonus to reenlist. The amount of the bonus is determined by several factors and varies by service. The amounts are periodically modified, as often as quarterly, as are the methods of determining your bonus. Factors generally include the length of active military duty, MOS or specialty and rank. Additional bonuses may be given to personnel in needed specialties. Usually, there is an overall cap on the total number of enlistment bonuses you can receive during your career.

Army reenlistment selective reenlistment bonus (SRB)

Announcements are made quarterly in MILPER messages that announce changes in the SRB program. You should read the current message to find the retention incentive being offered. The numbering system for the messages begins with the year, such as MILPER 18-006 in 2018. Accessing the current message is the best way to determine your reenlistment bonus.

Bonuses will vary by primary military occupational specialty (MOS), skill qualification identifier (SQI), additional skill identifier (ASI) or language code (if any). They are also determined by rank (PFC, SPC, SGT, SSG, SFC). All of these factor into which tier of bonus is offered, from tier 1 to tier 10.

The amount is further determined by the length of enlistment extension. This is broken into 12 to 23 months, 24 to 35 months, 36 to 47 months, 48 to 59 months and 60 months or more. The range is from $500 for tier 1 PFC and SPC enlisting for 12 to 23 months all the way up to $72,000 for a tier 10 SSG/SFC enlisting for 60 months or more.

Additional amounts may be granted for various skills, such as a $7500 additional bonus for language skills, up to an SRB maximum as established. Soldiers may receive more than one SRB throughout their career, but career maximums are also established.

Navy selective reenlistment bonus

To determine your bonus, visit the current NAVADMIN policy update. Bonuses are based on tier, rating, and NEC/zone.

Air force selective reenlistment bonus

The SRB for the air force is determined by air force specialty code, skill level or CEM code, and zone (length of service) for reenlistments of three years or more. Zone A is between 17 months and 6 years of service, zone B between 6 and 10 years, zone C between 10 and 14 years, and zone E between 18 and 20 years. An air force SRB calculator is available to logged-in users at mypers.

Marines selective reenlistment bonus

The SRB for the marines is determined by MOS, rating, and zone. The zones are determined by the length of service. Zone A is 17 months to 6 years of active military service, zone B is six to 10 years of active military service, zone C is 10 to 14 years of active military service. The current SRB bulletin (such as MCBUL 7220) can be viewed at marines.Mil.

Coast guard selected reserve (SELRES) bonuses

You may determine your bonus by visiting the current coast guard policy update.

Best credit card sign-up bonuses of february 2021

The most valuable current offers for new cardholders

We publish unbiased reviews; our opinions are our own and are not influenced by payments we receive from our advertising partners. Learn about our independent review process and partners in our advertiser disclosure.

The best sign-up bonuses available on credit cards stand out for their superior value. They can be worth hundreds of dollars—or even more than $1,000. Credit card issuers offer them as an incentive to apply for an account and use it regularly. If you’re looking for a credit card with a lot of upfront value, here are our top choices based on how much you can earn.

Best sign-up bonus credit cards

- Chase sapphire reserve card

best overall, best for flexible travel rewards - Aadvantage aviator red world elite mastercard

best airline-specific card - World of hyatt credit card

best hotel-specific card - Capital one ventureone rewards credit card

best travel card with no annual fee - Wells fargo propel american express card

best for cash-back rewards

Chase sapphire reserve®

Best overall

Best for flexible travel rewards

:max_bytes(150000):strip_icc()/sapphire_reserve_card-3ee2c82770004c248bb081783fe58fee.png)

50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

| Regular APR (%) | 16.99% - 23.99% variable |

| annual fee | $550 |

| rewards earning rate | earn 3x points on travel immediately after earning your $300 travel credit, 3X points on dining at restaurants, and 1 point per $1 spent on all other purchases. |

| Foreign transaction fee (%) | 0% |

The bonus on this card confirms its place among the elite. If you spend $4,000 in your first three months, you’ll get 50,000 points worth $750 when redeemed for travel in the chase ultimate rewards portal. The points may be worth even more if you transfer them to a partner airline or hotel program with higher-value points or miles (like hyatt or british airways, our research shows.) in fact, the option to convert your points at a 1-to-1 ratio is one of the best things about this card. Plus, the generous rewards, big annual travel credit, and airport lounge membership more than make up for the steep annual fee.

- Earn extra points for travel and dining purchases

- Many different purchases count as travel spending, which makes earning rewards easier

- Several valuable ways to use points, including transfers to partner loyalty programs

- Jam-packed with valuable travel credit and travel insurance benefits

- Receive 50,000 points after spending $4,000 in the first 3 months from account opening.

- Get an annual $300 travel credit for eligible purchases charged to your card each anniversary year.

- Earn 3 points on travel (excluding purchases eligible for the travel credit), restaurants, and dining. Earn 1 point per $1 spent on other purchases.

- Points are worth 50% more when you redeem them for travel through chase's ultimate rewards portal.

- Transfer points 1:1 to eligible ultimate rewards airline and hotel partner programs.

Aadvantage® aviator® red world elite mastercard®

Best airline-specific card

:max_bytes(150000):strip_icc()/aviator-mastercard_FINAL-af1c3a36402c43319aa6ccc2a5801cd8.png)

Earn 50,000 aadvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days.

| Regular APR (%) | 15.99% - 24.99% variable |

| annual fee | $99 |

| rewards earning rate | earn 2X miles for every one dollar spent on eligible american airlines purchases. Earn 1X miles for every dollar spent on all other purchases. |

| Foreign transaction fee (%) | 0% |

This card’s bonus is not just valuable, but incredibly easy to earn. Make just one purchase within 90 days of opening your account (and pay the $99 annual fee, of course), and you’ll get 50,000 miles. Other cards may require you to spend thousands to earn a bonus worth far less. Plus, the balance has found aadvantage miles are among the most valuable offered by a frequent flyer program (2.26 cents each, on average), so the miles alone are worth a whopping $1,130 if used for flights.

- American airlines miles are worth more than most airline miles, according to the balance’s valuations

- Excellent and super-easy-to-earn welcome bonus

- Good array of travel perks, including free checked bags

- Optional program to increase number of miles earned per purchase

- Annual fee isn’t waived for the first year

- Few purchase categories that earn extra miles

- Earn 50,000 aadvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days.

- Get up to $25 back as statement credits on inflight wi-fi purchases every anniversary year on american airlines operated flights.

- Each anniversary year, earn a companion certificate good for 1 guest at $99 (plus taxes and fees) after spending $20,000 on purchases and your account remains open for 45 days after your anniversary date.

- Receive 25% inflight savings as statement credits on food and beverages when you use your card on american airlines operated flights.

World of hyatt credit card

Best hotel-specific card

:max_bytes(150000):strip_icc()/world_of_hyatt_card-5311f4c7735b4c279744dfb05e6e5265.png)

Earn 30,000 bonus points after you spend $3,000 on purchases in the first 3 months from account opening. Plus, 2 bonus points per $1 spent on purchases that earn 1 bonus point up to $15,000 in the first 6 months of account opening.

| Regular APR (%) | 15.99% - 22.99% variable |

| annual fee | $95 |

| rewards earning rate | earn 4X points for hyatt stays, 2x for eligible transit, restaurants, gym memberships, and airfare purchased directly from the airline. 1x on other purchases. |

| Foreign transaction fee (%) | 0% |

For a hotel card, this one is jam-packed with rewards and benefits. It starts with a stellar bonus: spend $3,000 within three months of opening an account to earn 30,000 bonus points. The total bonus is worth $603, thanks to the exceptional value of hyatt points (2.01 cents each, on average, based on the balance's calculations). This card also offers a free hotel stay annually (and a second if you can spend $15,000 each year), a variety of ways to earn points, and several nice hotel perks, thanks to automatic world of hyatt elite status.

- Outstanding two-part bonus for new cardholders

- Points are worth more than any other major U.S. Hotel chain’s, according to the balance’s calculations

- Fitness club, restaurant, and local transportation expenses also earn extra points, unlike other hotel rewards cards

- World of hyatt rewards program includes earning two types of points, which can be complicated to track

- Earn 30,000 bonus points after you spend $3,000 on purchases in the first 3 months from account opening. Plus, 2 bonus points per $1 spent on purchases that earn 1 bonus point up to $15,000 in the first 6 months of account opening.

- Earn a free night certificate valid at any category 1-4 hyatt hotel or resort each year on your cardmember anniversary.

- Receive automatic elite status as long as your account is open.

- Enjoy complimentary world of hyatt discoverist status for as long as your account is open.

- Receive 5 tier qualifying night credits towards status after account opening, and each year after that for as long as your account is open.

Capital one ventureone rewards credit card

Best travel card with no annual fee

:max_bytes(150000):strip_icc()/capital_one_ventureone_FINAL-2b8ee562ce7b4706b6cc7035bdc230b1.png)

Earn 20,000 miles once you spend $500 on purchases within the first 3 months from account opening.

| Regular APR (%) | 15.49% - 25.49% variable |

| annual fee | $0 |

| rewards earning rate | earn 1.25 miles per dollar on every purchase. |

| INTRO PURCHASE APR | 0% for 12 months |

| foreign transaction fee (%) | 0% |

The ventureone offers a nice bonus for new cardholders, and it has an unusual feature for a no-annual-fee travel card: the option to transfer your miles to eligible airline and hotel programs. If you spend $500 within three months of opening your account, you’ll earn 20,000 miles worth at least $200. But if, for example, you transfer your miles to air canada, you may be able to get an even better value, according to our valuation of aeroplan miles. Plus, earning rewards is simple and unlimited: you’ll get 1.25 miles on every purchase. We like that this card comes with a few nice travel insurance benefits, too.

- Simple and predictable rewards

- Rare option (for a no-annual-fee card) to transfer miles to eligible airline and hotel partner programs

- Flexible redemption options

- Travel insurance not common with a no-annual-fee card

- Low rewards-earning rate

- Limited number of travel partners, especially U.S. Airlines

- 1.25X miles on all purchases. Earn unlimited miles with no caps.

- Earn 20,000 miles once you spend $500 on purchases within the first 3 months from account opening.

- Use miles as a statement credit against any airline or hotel booking with no blackout dates. Or, transfer miles to eligible travel loyalty programs.

- Enjoy an introductory APR on purchases for the first 12 months.

Wells fargo propel american express® card

Best for cash-back rewards

:max_bytes(150000):strip_icc()/wells_fargo_propel_american_express_FINAL-ba355ba539e74f4aa0827af35c327639.png)

Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months ($200 cash redemption value).

| Regular APR (%) | 14.49% - 24.99% variable |

| annual fee | $0 |

| rewards earning rate | earn 3X points for eating out and ordering in, gas stations, rideshares, transit, for travel including flights, hotels, homestays and car rentals, as well as popular streaming services. Earn 1X points on other purchases. |

| INTRO PURCHASE APR | 0% for 12 months |

| foreign transaction fee (%) | 0% |

If you spend $1,000 within three months of opening your account, you’ll earn a 20,000-point bonus that’s worth $200—a good value compared to many other cash-back card offers. Even those with comparable bonuses don’t have the same rewards proposition. This no-annual-fee card generously rewards travel and many routine expenses, which makes it very versatile. You’ll earn 3 points per $1 spent on gas, dining out or ordering in, streaming service bills, ride-hailing, transit, flights, hotels, rental cars, and even homestay expenses, such as an airbnb stay.

- Longer 0% APR offers on purchases and balance transfers exist

- Cash back can only be redeemed in $20 or $25 increments

- If you’ve received the bonus or interest deal before, you may not be eligible again

- 20,000 bonus points when you spend $1,000 in purchases in the first 3 months – a $200 cash redemption value.

- Earn 3 points on the following: eating out/ordering in, gas, rideshares, transit, flights, hotels, homestays, car rentals, and popular streaming services.

- $0 annual fee.

- No limit to points you can earn, and points don't expire as long as your account remains open.

- Cell phone protection offers insurance against your cell phone from damage or theft.

What are sign-up bonuses & how do they work?

Sign-up bonuses are incentives that rewards credit cards offer to encourage consumers to open a new credit card account. They can be in the form of cash back, points, or miles, or as a discount on a store credit card.

Depending on the card, you may get the offered bonus (also known as a welcome offer) as soon as you’re approved, after you make your first purchase, or—most commonly—after you spend a certain amount within a specified period.

Bonuses can be a great way to gain value from a credit card fast. While some cards offer them with less than $100 in value, others offer cash back, points, or miles worth much more—sometimes in excess of $1,000.

Credit card issuers sometimes change the bonuses on their cards. Depending on when you apply, you may get a limited-time offer that’s worth more than the card’s typical incentive.

What are the different types of bonuses?

You can break bonuses down by the type of rewards you earn:

Cash back

If you’re applying for a cash-back credit card, you’ll typically receive the bonus as a direct deposit, statement credit, or paper check. Cash-back bonuses are usually represented as the actual cash value you’ll receive.

Points or miles

Some credit cards, primarily travel cards, offer bonuses in the form of points or frequent flyer miles. Depending on the rewards program, however, the value of each point or mile can vary. This means that a larger bonus in terms of points or miles doesn’t necessarily mean more value.

Store discount

Some cards, usually store credit cards, give you a bonus in the form of a discount, which applies to your first purchase with the card or to your immediate purchase if you apply at the cash register.

What are some pros & cons of bonuses?

Focusing on getting the best credit card bonus can be a good thing, but there are also some drawbacks to thinking only of the short term.

You can get hundreds of dollars of value fast

Value can help negate the card’s annual fee

You may miss out on other features

Pros explained

- You can get hundreds of dollars of value fast: most of the best credit card bonuses require you to spend a certain amount of money in the first few months with the card. Once you meet that requirement, you can get hundreds of dollars worth of cash back, points, or miles to use whenever you want.

- Value can help negate the card’s annual fee: many cards that offer big bonuses also charge annual fees. If you want to “test drive” a card before choosing whether to hold onto it long-term, the card’s bonus may cover the cost of the annual fee several times over while you make your decision.

Cons explained

- You may miss out on other features: if you focus solely on a credit card’s bonus for new cardholders, you may miss out on valuable rewards and benefits that come with another card. For example, one card may have an excellent bonus but a mediocre ongoing rewards program and few extra credit card perks. If you’re planning on keeping a card for a long time, look at it holistically instead of focusing on just one feature.

- Temptation to overspend: if you’re required to spend thousands of dollars to qualify for a bonus, it could tempt you to spend more than you normally would. Before you apply for a credit card, check your budget to make sure you can meet the minimum spending requirement with your normal spending habits.

How should you choose a card based on its bonus?

There’s no single credit card bonus best for everyone, so you’ll need to consider a few things before you make a decision:

- Your spending habits: if you don’t spend a lot each month, it may not be worth trying for a bonus that requires that you spend thousands of dollars in the first few months. Check your budget and consider cards that won’t cause you to overspend.

- Real bonus value: figuring the value of a cash-back bonus is simple, but it can get more complicated with travel rewards cards. Check out our list of best travel cards to find links to reviews that contain point-valuation information. That can help you determine the real value of a particular bonus.

- Your preferences: while some cards offer higher bonuses than others, there may be other features that are deal-breakers for you. Check each card’s annual fee and the options you have for redeeming your rewards. If you prefer cash back, for example, a travel card with less flexible redemption options may not be worth it to you, even if it has a higher bonus.

Some of the best credit card bonuses for new cardholders require that you have good or excellent credit. If your credit history needs some work, it's best to focus on that first before applying for a card you're unlikely to be approved for.

If a bonus is an important factor to you as you look for a new credit card, take another look at the cards we consider to have great bonuses:

| best credit card sign-up bonuses | ||

|---|---|---|

| credit card | category | annual fee |

| chase sapphire reserve card | best overall | $550 |

| aadvantage aviator red world elite mastercard | best airline-specific card | $99 |

| world of hyatt credit card | best hotel-specific card | $95 |

| capital one ventureone rewards credit card | best travel card with no annual fee | $0 |

| wells fargo propel american express card | best for cash-back rewards | $0 |

| chase sapphire reserve | best for flexible travel rewards | $550 |

How do you redeem rewards?

Rewards redemption options can vary by credit card, but here are some general options you might get based on the type of credit card you choose:

Cash back

You can typically redeem cash-back rewards as a statement credit, direct deposit, or paper check. With some cards, you may also be able to use rewards to buy gift cards, shop online, book travel, and more.

General travel

These credit cards usually allow you to either use your points or miles to book travel through the card issuer’s travel portal or book travel directly with any travel merchant and use your rewards to get a statement credit for that purchase. You may also have the option to transfer your points or miles to other travel loyalty programs for more flexibility.

Co-branded airline or hotel

Rewards earned with airline and hotel credit cards are deposited into a loyalty program account with the co-branded partner. If you have an airline card, you may be able to use your points or miles for several things, but you’ll usually get the most value with free flights. The same goes for hotel credit cards, which typically get the best value when you redeem points for free hotel stays.

Store

If you have a store credit card, you may be able to redeem your rewards as a certificate for use with the retailer, a credit for online or in-store purchases, gift cards, or even cash back.

Methodology

We collect data on hundreds of cards and score more than 55 features that affect your finances. We do this because it's our mission to give you unbiased, comprehensive credit card reviews.

Our reviews are always impartial. No one can influence which cards we review, the way we present them to you, or the ratings they receive.

About this list

We reviewed more than 100 credit cards that offer one-time bonuses to new cardmembers, and these are the cards that made the cut for this list.

What we score

We look at the number of points or miles earned in a bonus, and convert those bonuses to a dollar value using our analysis of credit cards rewards programs and americans' travel habits. We also evaluate bonuses based on the amount of time a cardholder has to earn the bonus and how much they have to spend to earn it.

Beyond that, we evaluate cards' rewards-earning rates, regular APR, rewards flexibility, and perks. For more information about how the balance evaluates credit cards, see our full credit card review methodology.

So, let's see, what was the most valuable thing of this article: the best bank bonuses can give you hundreds of dollars for opening a new account. Find out how to benefit from these promotions. At balance bonus

Contents of the article

- Free forex bonuses

- Best bank bonuses of 2021

- Maximize your income with the best new-account...

- Best bank bonuses

- Best for a large checking account bonus: citi –...

- Best for direct deposit bonus: BBVA – $200

- Best for checking and savings bonus combo: chase...

- Best for low-fee account: PNC – $200

- Best for no direct deposit or minimum balance...

- What is a bank bonus?

- Is the bonus worth it?

- How to find bank bonuses

- How we chose the best bank bonuses

- What is bonus pay?

- Definition and examples of bonus pay

- What is bonus pay?

- How does bonus pay work?

- Types of bonus payments

- How to check glo airtime account balance & bonus...

- Wizard101 gear set bonuses

- How do these bonuses work?

- How do I see these set bonuses?

- Which gear sets have bonuses so far?

- Are they worth it?

- Gear sets moving forward

- What is bonus pay?

- Definition and examples of bonus pay

- What is bonus pay?

- How does bonus pay work?

- Types of bonus payments

- Best bank account bonuses for february 2021

- Advertiser disclosure

- How we make money.

- Share

- Editorial integrity

- Key principles

- Editorial independence

- How we make money

- Summary of the best bank account bonuses