Grand capital account types

Only demo accounts currently available in most cases, the recommended starting amount is $1,000.

Free forex bonuses

This sum is sufficient for trading any instruments, can withstand a drawdown, allows to hedge volatility risks in currency markets with commodity CFD trades.

Professional instruments for trading and investments

To start, open a trading account

or practice with demo.

Select a service

Active offers

Claim 40% with every deposit!

Probably the best bonus for traders.

Subscribe to our trading blog

Lift your forex trading skills!

Stable instrument. High returns.

We believe that it’s important to to get clear answers to all your questions on the way to successful moneymaking in financial markets.

Ready to begin?

In most cases, the recommended starting amount is $1,000. This sum is sufficient for trading any instruments, can withstand a drawdown, allows to hedge volatility risks in currency markets with commodity CFD trades.

After you register, a standard trading account will be created for you automatically. Make a deposit using a bank card, a payment system or cryptocurrency. If you’re depositing via bank card, you’ll have to pass a verification procedure and provide all the necessary documents required by the processing system.

Start trading. First you’ll need to download a trading platform: MT4, MT5 (for experienced traders) or mobile app grand trade (works for everyone), choose an instrument and start trading. The most popular currency pairs for trading are EUR/USD, USD/CHF, USD/JPY, BTC/USD, ETH/USD, LTC/USD.

If you prefer trading commodities, turn your attention to oil, gas and metals, and if you’re interested in stocks and indices, you can choose from our wide selection of these instruments.

If you don’t know what to start with, visit our page for beginners or contact your personal manager through the ticket system in your private office.

What we offer

RAMM is for investment and management. Connect to the available strategies that are proven successful and create your own. The service is fully automated and easy to use, provides a high level of capital protection, allows setting limits for profit and loss, weekly profit.

Recommended initial deposit is $2,000. Minimum amount of investment in one strategy is $50. Open a RAMM account.

Choose an investment portfolio and make money from stocks of major corporations.

Readily available ideas for trading, free advice, high profit rate.

You can also take advantage of our free service and order a custom portfolio.

Compare services

We offer 500 instruments for trading: cfds on stocks, indices, metals, commodities, currency pairs, cryptocurrency.

ECN and crypto accounts are available to professional traders. Beginners may be interested in our cent account micro. For the most clients, the recommended account type is standard. Algorithmic trading is available on all accounts, including the possibility to create of your own robots in metatrader 5. The following trading platforms are available at grand capital: metatrader 4 metatrader 5 and the mobile app grand trade.

We set high requirements for liquidity providers and aim to provide the most favorable conditions for your work with the market: small fees, highly liquid instruments, immediate execution, 24/7 support. We allow using any robots and eas, high-margin trading is available. Risk diversification is possible thanks to the variety of accounts and instruments. Our clients are always under the protection of the international financial commission finacom that has an insurance fund of 20,000 euros for every client. Moreover, the funds of our clients are protected by the cutting-edge blockchain technology of serenity escrow that prevents any manipulation with the deposit.

Our support

We profit when you profit.

Grand capital is a provider of technology for trading in currency and derivatives markets since 2006. Over these years, we have become a financial partner of more than 500,000 traders all over the world. Stable and reliable operation of the company paired with its vast experience in the field allowed to implement the concept of a long-term mutually beneficial partnership. High standards of the provided services and technology earned prestigious awards from the professional community. Our work is for the benefit of the client, and our income relies on fees for using our services and instruments.

You become a part of the international trading community and use the most advanced services in the field of trading and investing. You participate in loyalty programs and get firsthand access to new instruments and technologies as they are introduced by the company. Each client gets their own personal manager who will help them become more successful. Working with a stable world-class company, you won’t have to worry about the safety of your funds.

First you need to decide whether you want to work as an independent trader or invest funds. If you plan to trade on your own, start with our classic account standard, recommended deposit amount is $500. Download the mobile app. Visit our page for beginners.

If you plan to start as an investor, open a RAMM account and start copying the top-performing strategies in the rating: it’s really a low-risk and profitable way of earning for investors of any level of experience with any budget.

Compare investment services

Let’s take the next step together

Trade and invest with grand capital broker!

Grand capital is a forex broker that provides high-quality services for online trading in financial markets to clients around the world since 2006. Trading in metatrader 4 and metatrader 5. Over 500 financial assets: currency pairs, cfds on the stocks of global corporations, indices, metals.

Download mobile app for trading

and account management

Only demo accounts currently available

- Forex and CFD trading

- Deposit/withdrawal

- Market analysis

- Account management

- Forex and CFD trading

- Deposit/withdrawal

- Market analysis

- Account management

Trading instruments

Trade the most popular assets!

We offer a wide variety of financial instruments for online trading, making the market available to you, always and everywhere.

Профессиональные инструменты для трейдинга и инвестиций

Чтобы начать, откройте торговый

или тренировочный счёт

Выберите услугу

Актуальные предложения

Бонус на любое пополнение +40%.

Пожалуй, лучший бонус для трейдеров!

Подпишись на наш блог про торговлю

Стабильный инструмент. Высокие заработки.

Мы считаем, что на пути к успешному заработку на финансовых рынках важно получить ответы на самые важные вопросы.

Готовы начать?

Оптимальная сумма для начала работы считается $1 000. Эта сумма достаточна для торговли любым инструментом, позволяет выдерживать просадки и хеджировать риски волатильности на валютном рынке за счёт сделок на сырьевых CFD.

Чтобы открыть счет для торговли, зарегистрируйтесь, вам будет автоматически открыт счет standard. Затем пополните счет картой, платежными системами или криптовалютой. Пройдите верификацию личности в случае пополнения картой, предоставьте требуемые документы — это необходимое требование процессинговых систем.

Приступите к самостоятельной торговле. Для этого скачайте торговую платформу МТ4, MT5 (если у вас достаточно опыта) или мобильное приложение grand trade (подойдет всем) и начните торговать, выбрав инструмент. Самые популярные валютные пары — EUR/USD, USD/CHF, USD/JPY, BTC/USD, ETH/USD, LTC/USD.

Если вы предпочитаете торговать сырьем, обратите внимание на нефть, газ и металлы, если интересуют акции и индексы, выберите из широкой линейки инструментов.

Если вы не знаете с чего начать, посетите страницу "новичкам" или свяжитесь с персональным менеджером через тикет-систему в личном кабинете.

Что мы предлагаем?

RAMM — инвестирование и управление. Подключайтесь к готовым доходным стратегиям и создавайте собственные. Сервис прост в управлении, так как полностью автоматизирован. Высокая степень защиты капитала. Выставление лимитов на прибыль/убытки, еженедельный доход.

Рекомендуемая сумма для старта — $ 2000. Минимальная $50. Открыть счёт RAMM.

Выбирайте инвестпортфели для заработка на акциях крупнейших корпораций.

Готовые торговые идеи, бесплатные консультации, высокая доходность.

Воспользуйтесь бесплатной услугой "заказ инвестпортфеля".

Сравните сервисы

Торговля ведется более 500 инструментами: CFD на акции, индексы, металлы, сырье, валютные пары, криптовалюта.

Профессиональные трейдеры могут использовать счета МТ5, ЕСН или crypto. Для начинающих может быть интересен центовый счет micro. Для большинства рекомендован standard. Алгоритмическая торговля доступна на всех счетах, в том числе создание собственных роботов в платформе metatrader 5. Торговля ведется в metatrader 4, metatrader 5 и мобильном приложении grand trade.

Мы предъявляем высокие требования к поставщикам ликвидности и стремимся давать максимально выгодные условия для работы на рынке - низкие комиссии, ликвидные инструменты, мгновенное исполнение, круглосуточную поддержку. Мы позволяем использовать любых роботов и советников, доступна высокомаржинальная торговля. Диверсификация рисков достигается за счет разнообразия счетов и инструментов. Наши клиенты под защитой международной финансовой комиссии финком, со страховым фондом 20 000 евро на каждого клиента. Кроме того, средства клиентов защищены современной блокчейн-технологией эскроу серенити, которая исключает манипуляции с депозитом.

Как мы помогаем?

Мы зарабатываем, когда вы зарабатываете.

Компания grand capital является провайдером технологий для торговли на рынках валют и деривативов с 2006 года. За эти годы мы стали финансовым партнером более полумиллиона человек во всех странах мира. Стабильная надежная работа компании и большой опыт позволили воплотить в жизнь концепцию долгосрочного взаимовыгодного сотрудничества. Высокие требования к уровню предлагаемых сервисов и технологий были отмечены престижными наградами от профессионального сообщества. Мы работаем в интересах клиентов, так как наш заработок складывается из совокупного дохода, получаемого от комиссий за пользование сервисами и инструментами.

Вы становитесь частью международного сообщества трейдеров и пользуетесь передовыми сервисами в области трейдинга и инвестирования. Вы участвуете в программах лояльности и первыми получаете доступ к новым инструментам и технологиям, внедряемым компанией. За каждым клиентом закреплен персональный менеджер, который помогает вам работать эффективнее. Вы можете быть уверены за свои средства, потому что работаете со стабильной компанией мирового уровня.

Определите для себя: вы хотите торговать сами или инвестировать средства? Если хотите самостоятельно торговать, стоит начать с классического счёта standard, рекомендуемый депозит $500. Скачайте мобильное приложение. Начальное обучение пройдите по авторским курсам или бесплатным видеоурокам. Посетите страничку "новичкам".

Если вы хотите начать как инвестор, откройте счет RAMM и подключите самые доходные стратегии из рейтинга — это действительно низкорискованный и в то же время доходный способ заработка для инвесторов любого уровня.

Сравнить инвестиционные сервисы

Давайте сделаем следующий шаг вместе

Торгуйте и инвестируйте с брокером grand capital!

С 2006 года форекс-брокер grand capital обеспечивает трейдеров по всему миру качественными онлайн-сервисами для торговли на финансовых рынках. Торговля ведется в терминале metatrader 4 и metatrader 5. В распоряжении трейдеров более 500 финансовых активов: валютные пары, CFD на акции российских и зарубежных компаний, индексы, металлы.

Скачайте мобильное приложение для трейдинга

и управления своими счетами

Временно доступны только демосчета

- Торговля форекс и CFD

- Ввод/вывод

- Аналитика

- Управление счетами

Инструменты для торговли

Торгуйте на самых популярных активах!

Мы предлагаем большое количество финансовых инструментов для онлайн-трейдинга, делая торговлю доступной всегда и везде.

Grand capital – welcome bonus $500

How to get:

1. Open page “promotions and bonuses”

2. Click button “get the bonus”

3. Fill in the registration form

4. Verify your passport and mobile number

How it works and withdrawal requirements:

1. After registration you get $500 on ‘welcome bonus $500’ account.

2. You trade 7 days to generate profit.

3. After 7 days the bonus will be removed, and profit will be transferred to standard account (profit $100 or more) or to micro account (profit less than $100).

4. To activate real account you need deposit an amount equal to or greater than the profit within 7 days.

5. To withdraw you need make 1 full standard lot for every $5 of profit.

More information:

‘welcome bonus $500’ account has the same trading conditions as standard account.

Maximum leverage is 1:100.

Information about the broker:

grandcapital is a broker from seychelles and from st. Vincent and the grenadines. The broker is a member of finacom and CRFIN. Grand capital provides a large selection of trading accounts. Broker offers attractive contests and bonuses.

Do you recommend this bonus?

[starthumbsblock tpl=25]

What’s new?

Meefx – welcome bonus 5 USD

Instaforex – one million option

MFM securities – matador contest

Forex4you – trading hero contest

Justforex – 2021 trading contest

40 COMMENTS

I like trading with grand capital due to its bonus programs. I started with a small deposit and then I was granted with 40% bonus, so I managed to increase my profit with no extra risk.

After reading these views

it seems this broker is ensnaring people

I had already made 150 profits from their bonus now it seems these guys are dishonest con men

imagine even when you make profits and deposit amount less than the profits made you can’t have your profits what a scam

who ever made this terms is a perfect reflectionot of a thief if not he had forgotten to take his pills that day

I like their bonus program. I deposited $1000, and received extra $400 as a bonus.

With grand capital my incomes have doubled. Never really thought I could really succeed in trading but by opening simple standard account I got an access to a huge number of instruments I always wanted to try. Trading signals I receive are very helpful, so now I truly know what ami doing by opening a trade. I’m still not being a pro, but I can see an improvement of my trading skills, no more losing deposits yet, which makes me so happy.

Guys, most no deposit bonuses have screwed up conditions. Please show me a borker that allows you to withdraw your profit on no-deposit bonus. I also want to know about such broker!! From what I understand, what this grand capital broker offers is a test-drive on the real account with free $500. I think it is a pretty cool idea, considering so many ppl complaining about brokers with trading on demo and live acc defferent. I have never used no deposit bonuses and not looking to change a broker, just saying…

Yeah, they have $30. There is a difference between $500 and $30. Not protecting the broker, just saying..

Thank god i read your experiencies and truth about all this before i wasted my time.Its good to read reviews

I think this no deposit bonus whole trading idea those not make any sense asking someone to deposit the same amount he/she made before withdrawer, the question is who is fooling who?. If the person has that amount why can’t he/she open a trading account and fund at once, please stay away from this broker, they are not serious.

This 500$ bonus is not that good it waste your time if you happen to make more than you can afford . Really bad … the brocker is showing its carelessness , why didn’t they let traders to just supplement the profit made.

Since i read your comments..I took their bonus and i destroy it..In only one day… ��

It requires a deposit amount equivalent to any profit made, otherwise they freeze the account. In my case, I made USD 900 profit and they would like me to deposit USD 900 to allow me continue trading. I spent 7 nights to make a profit from no deposit bonus of USD 500. I am now stranded. The no deposit bonus accounts are a gimmick to entice you into trading with the company. Don’t waste your time. There is no such thing as a freebee. Keep it simple. Deposit your money first and obtain a bonus against it instead.

Dear paresh,

we are sorry you’ve had unsatisfying experience with one of our offers. However, we must add that the bonus terms are freely available on our website. The bonus, indeed, requires a deposit upon the 7-day period. This bonus was designed for novice traders or prospective clients to provide them with an opportunity to try trading with grand capital without investing personal funds. After the bonus expires, the clients have an option whether to make a deposit to continue managing the profit, or open a new account and make a deposit on their own.

The thing is getting a novice traders make money they won’t afford to deposit . I think just get them deposit what they can afford in the next few days . I enjoyed my time with the brocker during this week but what I made is more than I can get to deposit. Just formulate a good condition to just what I stated up there. Also upon depositing what one will afford they will choose themselves account type.

To activate real account it is required deposit to claim profit from $500 bonus. If my deposit amount is not the same as the amount of profit, for example profit $390 and deposit $50 ,is it possible to claim my $390 profit?

Scam ,grand capital page is not like this. Is a very busy page with news,videos, and page green n white

Dear halley,

the deposit amount must equal the profit made.

Thank you,

grand capital team.

Sssssssssssssccccccccccaaaaaaaaaaaaaaammmmmmmmmmm+baaaaaadddddddddd

don’t wast your time

This company is shit

they never gave me $500 bonus

if you want money and time, you have to find another company but this shit

Nxxxii… they wasted my time. I was trading from the bonus because I don’t have the cash to fund a real ACC. Where on earth should I now get the deposit?? My profit is sitting there. Stupid broker

At firist three hours i made 130 usd at the second day them cancel my account without any reason [moderated] broker

This is so sad for a broker like this i made $14000 now am a new trader where in the world would i find that kind of cash,bad broker

They needed to be sanctioned

Just learn to read you all.. This is bonus to deposit , there are the terms and conditions on their site.. If you cant read the best way to save your money is not to trade.. Every broker will fukk you

Just now i am opened ., let us c ., �� !

I know this broker is really stupid and scamers.

BAD COMPANY WITH STUPID BONUS..

If I made profits and the co. Got their money (bonus) back and I am making profits for the co (spreads) why they insist I make deposit, there is a smell of cheating and money swallowing there.

Its a bad company in russia. The livechat is not real, the webtrader is not running correct. There MT4 is not working correct, stay away from this broker if you like your money. Dont send them money!

4.8 in order to activate the real account must be made within 7 days to produce refill for an amount equal to or greater than the resulting profit to the bonus account, but not less than the minimum amount required for the first deposit.

These are serious jokers,join them at your own peril.

Don’t join them,they are newbies not serious ,I made profit of $656 in seven,as profit from $500,they ask me to deposit $656 so that the profit will not be deducted,they are only wasting our time,run away from their website

LEAVE A REPLY cancel reply

Risk warning:

investors should be aware of the serious risks of investing in the forex market, binary options and other financial instruments. Trading on the forex and cfds using the leverage mechanism carries a high level of risk and may not be suitable for all investors.

Disclaimer:

all content on the brokersofforex.Com is provided for informational purposes only and shall not in any way be regarded as financial advice. Brokersofforex.Com and persons associated with brokersofforex.Com disclaim liability for any loss resulting from the use of information contained on this website. The published comments are private opinions of the users. Brokersofforex.Com is not responsible for their content. Used names and trademarks belong to their respective owners and are used for informational purposes only.

Popular category

From may 25, 2018, the general data protection regulation (GDPR), applies to all personal data processing of individuals from the european union.

We comply with this regulation and we would like to inform you about the rules of processing your personal data.

We would also like to inform you that this site uses cookies to provide better services.

Please be advised that by continuing to use this site, without changing your browser settings, you agree to the saving of cookies.

Privacy overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Наші переваги

Котирування онлайн

| інструменти | bid | ask | spread | percentage |

| BTCUSD | 33525,285 | 33530,285 | 1.5 | +2.46% |

| ETHUSD | 1373,580 | 1374,910 | 0.4 | +5.64% |

| LTCUSD | 131,95026 | 132,12976 | 0.1 | +3.05% |

| BCHUSD | 413,615 | 415,495 | 0.6 | +4.01% |

| ETCUSD | 7,401 | 7,655 | 0.1 | +1.70% |

| XMRUSD | 142,502 | 144,068 | 0.5 | +5.79% |

| ZECUSD | 87,821 | 89,460 | 0.5 | +3.86% |

| інструменти | bid | ask | spread | percentage |

| eurusde | 1,20673 | 1,20681 | 0.1 | -0.52% |

| gbpusde | 1,36750 | 1,36770 | 0.1 | -0.21% |

| audcade | 0,98080 | 0,98100 | 0.1 | +0.66% |

| nzdusde | 0,71634 | 0,71655 | 0.1 | +0.10% |

| eurjpye | 126,559 | 126,575 | 0.1 | -0.41% |

| eurchfe | 1,08187 | 1,08204 | 0.1 | +0.25% |

| USDRUB | 75,98680 | 76,29620 | 0.2 | +0.74% |

| USDCNY | 6,4704 | 6,4727 | 0.1 | +0.32% |

| інструменти | bid | ask | spread | percentage |

| #AA | 18,79 | 18,81 | 0.1 | +2.23% |

| #CSCO | 45,46 | 45,48 | 0.1 | +1.59% |

| #MCD | 207,90 | 207,94 | 0.1 | +0.40% |

| #MSFT | 239,95 | 239,97 | 0.1 | +2.15% |

| #APPLE | 134,21 | 134,25 | 0.1 | -0.10% |

| #FORD | 10,86 | 10,88 | 0.1 | +2.07% |

| #TESLA | 841,57 | 841,75 | 0.1 | +2.34% |

| рахунок | дохідність за 3 місяці | вік |

| trade tanzania:4794816 | 675,38% | 39 days |

| LO 2.0:4752263 | 233,66% | 121 days |

| shadow2020:4809613 | 175,22% | 48 days |

| aisha is'haqu mohammed:4428442 | 169,63% | 793 days |

| blackrock:532377 | 163,96% | 1442 days |

| alexander smirnov:4749218 | 162,7% | 189 days |

| money maker:4810394 | 160,62% | 46 days |

| rafalk:4461092 | 132,82% | 770 days |

- Grand capital ltd.

- Contacts

- Company news

- Trading

- CFD, futures contracts

- Metatrader 4

- Investment

- Managers' rating

- Analytics

- Economic calendar

- Analytic reviews

- Partnership

- Contests

- Agreements

- FAQ

Повідомлення про ризики: починаючи працювати на валютних ринках, переконайтеся, що ви усвідомлюєте ризики, з якими пов'язана торгівля з використанням кредитного плеча, і що ви маєте достатній рівень підготовки.

Privacy policy пояснює, яким чином компанія збирає, використовує та захищає персональну інформацію своїх клієнтів

- grandcapital ltd. 24598 IBC 2018 (suite 305, griffith corporate centre, P.O. Box 1510, beachmont, kingstown, st. Vincent and the grenadines)

- grand capital ltd. 036046 (suite 102 aarti chambers, mont fleuri, victoria, mahe, seychelles)

- this information is intended for investors outside of the united states who are not the US/japanese citizens and residents.

- العربيّة

- Deutsch

- English

- Español

- فارسی

- Français

- Bahasa indonesia

- Bahasa melayu

- Polski

- Português

- Русский

- ภาษาไทย

- Українська

- Tiếng việt

- 简体中文

Типы торговых счетов

Что такое торговый счет?

Чтобы начать торговлю на форекс, необходимо открыть счет у брокера.

Торговый счет схож с банковским. Он также используется для хранения, пополнения и вывода средств. Трейдеры используют разные платежные системы, чтобы пополнить и снять средства. Полный список систем, доступных для клиентов justforex, можно найти на странице "пополнение и снятие".

Торговые счета позволяют совершать сделки с различными финансовыми инструментами. Список этих инструментов варьируется в зависимости от типа счета. Здесь вы можете узнать больше об особенностях каждого инструмента.

Для неопытных трейдеров или тех, кто хочет протестировать свои стратегии, justforex предоставляет возможность открыть бесплатный демо-счет. Демо-торговля – это симуляция реальной торговли на форекс, которая предназначена для практики и обучения. Демо-счет не требует инвестиций, что позволяет получить опыт в онлайн-трейдинге, практические навыки работы в metatrader и проверить свою стратегию без каких-либо рисков.

Процесс торговли на демо-счете идентичен торговле на реальных счетах. Графики показывают реальную ситуацию на рынке форекс. Единственное различие в том, что вы торгуете виртуальными деньгами. Ваш демо-доход показывает потенциальную прибыль, которую вы можете получить на реальном счете с теми же условиями. При открытии счета, вы можете самостоятельно установить начальный баланс.

Вы можете начать виртуальную торговлю на любых типах счетов justforex:

standard cent, standard, pro или raw spread. Вы также имеете возможность протестировать торговые условия брокера и выбрать наиболее подходящий для вас счет.

Когда вы достигнете успеха на демо-счете и почувствуете себя уверенно, начинайте торговать на реальном счете.

Standard cent

Standard cent счет разработан специально для трейдеров-новичков. Если вы потренировались на демо-счетах, но все еще не готовы начать торговать на реальных счетах с большим депозитом, standard cent счета отлично вам подойдут. В отличие от других счетов, баланс на этом торговом счете отображается в центах. Таким образом, ваша собственная торговая стратегия, которая принесла прибыль на демо-счете, может помочь вам заработать на standard cent счете.

- Отличная возможность улучшить навыки управления капиталом. Небольшая сумма денег больше всего подходит для этой цели.

- Идеальный способ отточить на практике управление рисками.

- Возможность почувствовать все эмоции торговли на реальные деньги, но с меньшими рисками.

- Инструмент для проверки форекс советников.

- Возможность оценить торговые условия justforex.

Счет standard cent имеет много общего со standard счетами. В то же время, из-за более низких рисков, этот счет позволяет вам постепенно и уверенно изучать основы торговли.

После того, как вы преуспели в торговле на центовом счете, можете перейти на счета типа standard, pro или raw spread.

Standard

Счет типа standard является самым популярным среди трейдеров. В дополнение к высокому кредитному плечу, счет standard включает в себя базовый набор необходимых опций: узкие спреды от 0,3 пункта и отсутствие комиссии. Stop loss и take profit можно установить как при открытии, так и после выставления ордера. Счет standard можно использовать для торговли на дневных графиках и для не агрессивной торговли внутри дня. Вы можете выбрать любую стратегию для торговли на этом счете.

Счет pro предназначен для опытных и профессиональных участников финансовых рынков. Трейдеры могут использовать любой стиль торговли на счетах pro. Этот тип счета характеризуется узкими спредами, высоким кредитным плечом, отсутствием комиссии и отсутствием ограничений на количество ордеров и объем позиций.

Основным преимуществом счета pro является широкий спектр торговых инструментов: более 50 валютных пар, индексов, металлов и сырьевых товаров. Вы можете реализовать все свои торговые и инвестиционные идеи.

Raw spread

Raw spread счет дает вам возможность почувствовать всю динамику торговли. Те участники рынка, которые предпочитают внутридневную торговлю, частые входы и выходы, работу на младших таймфреймах, часто выбирают именно этот тип счета. Он считается лучшим для скальперов. На этом типе счета взимается комиссия за сделки, но зато спред – плавающий, от 0 пунктов, тогда как на других счетах он намного выше. При торговле на этом счете вы получаете весь спектр доступных финансовых инструментов.

Исламские счета

Для мусульман justforex предоставляет исламские счета. Закон шариата запрещает работу со счетами, на которых присутствует своп. В связи с этим были созданы специальные торговые счета без свопа.

Своп – это комиссия, которая взимается за перенос открытых позиций на следующий день. С помощью исламских счетов трейдеры могут держать сделки открытыми неограниченное время, без начисления комиссии в размере свопа. В этом случае, на результат торговли может повлиять только изменение валютных курсов за определенный период времени.

Исламские счета – это дополнительная опция. Чтобы перевести свой standard cent, standard, pro или raw spread счет в группу swap-free, необходимо обратиться в службу поддержки.

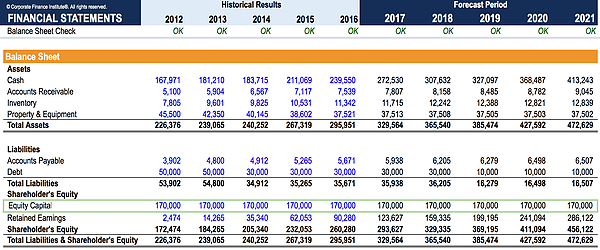

Share capital

What is share capital?

Share capital (shareholders’ capital, equity capital, contributed capital, contributed surplus contributed surplus is an account in the shareholders’ equity section of the balance sheet that reflects excess amounts collected from the or paid-in capital) is the amount invested by a company’s shareholders for use in the business. When a company is first created, if its only asset is the cash invested by the shareholders, the balance sheet is balanced with cash on the left and share capital on the right side.

Share capital is a major line item but is sometimes broken out by firms into the different types of equity issued. There can be common stock and preferred stock, which are reported at their par value or face value. Note that some states allow common shares to be issued without a par value.

Share capital is separate from other types of equity accounts. As the name “additional paid-in capital” indicates, this equity account refers only to the amount “paid-in” by investors and shareholders, and is the difference between the par value of a stock and the price that investors actually paid for it.

Share capital and the balance sheet

Through the fundamental equation where assets equal liabilities plus equity, we can see that assets must be funded through one of the two. One method for a company to fund its assets is to create liabilities (borrow money or issue debt) and, therefore, create obligations that must be paid back. The other option is to issue equity through common shares or preferred shares. In exchange for an ownership interest claim to the company, the company receives cash from investors and shareholders.

Contributed surplus and additional paid-in capital

Share capital may also include an account called contributed surplus or additional paid-in capital additional paid in capital additional paid in capital (APIC) is the value of share capital above its stated par value and is listed under shareholders' equity on the balance sheet. .

Contributed surplus is an accounting item that’s created when a company issues shares above their par value or issues shares with no par value. If a company raised $1 million from shares that had a par value of $100,000 it would have a contributed surplus contributed surplus contributed surplus is an account in the shareholders’ equity section of the balance sheet that reflects excess amounts collected from the of $900,000. The par value of shares is essentially an arbitrary number, as shares cannot be redeemed for their par value.

Additional paid-in capital is the same as described above.

In summary, if a company issued $10 million of common shares with $100,000 par value, it’s equity capital would break down as follows:

- $100,000 common shares

- $900,000 contributed surplus (or additional paid-in capital)

- $1,000,000 total share capital

More resources

CFI is the official provider of the financial modeling and valuation analyst (FMVA)™ FMVA® certification join 350,600+ students who work for companies like amazon, J.P. Morgan, and ferrari certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

- Balance sheet overview balance sheet the balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting

- Debt schedule debt schedule A debt schedule lays out all of the debt a business has in a schedule based on its maturity and interest rate. In financial modeling, interest expense flows

- Investment methods investment methods this guide and overview of investment methods outlines they main ways investors try to make money and manage risk in capital markets. An investment is any asset or instrument purchased with the intention of selling it for a price higher than the purchase price at some future point in time (capital gains), or with the hope that the asset will directly bring in income (such as rental income or dividends).

- Debt to equity ratio debt to equity ratio the debt to equity ratio is a leverage ratio that calculates the value of total debt and financial liabilities against the total shareholder’s equity.

Free accounting courses

Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

These courses will give the confidence you need to perform world-class financial analyst work. Start now!

Building confidence in your accounting skills is easy with CFI courses! Enroll now for FREE to start advancing your career!

Trust account

What is a trust account?

Trust account is created with an intention of encapsulating a specific asset or set of assets held in a separate capacity to be managed accordingly for specified beneficiaries and there can be various uses of this account ranging from paying off mortgages and insurance premium by bank on behalf of its customers to handling a real estate property to be inherited.

Explanation

- A trust is a financial account opened and managed by the trustee in order to overlook and manage the assets or funds of the beneficiary as per the legally binding arrangement.

- The creator of the trust is known as settlor or grantor. A trust account is an important tool for estate planning.

- When a trust is created, the party transfers all the legal ownership of the property to the third party (individual or group) who will be responsible for the proper handling of the property.

- This third party is known as the trustee and the party for whose benefit trustee manages the assets or funds is known as the beneficiary.

- The trust doesn’t have any of the powers with respect to the property until the beneficiary transfers the assets or the funds into a trust account. Generally, a bank or the other financial institution in existence acts as the custodian of the assets of the trust.

- These custodians place the assets in the trust account under the name of the trust. After that, all the distributions and expenses which are related to the beneficiary will be done from this account only.

Features

- “funding the trust” is one of the most important features of the trust account. It is the process under which the funds or assets are transferred to trust. If the ownership of property is not transferred to trust, it has no power to manage the same.

- It is mandatory that the trustee is a mentally competent adult who has the responsibility of handling a trust account.

- A trustee has full authority with respect to making any type of changes in the account except in case specifically mentioned otherwise in the agreement that states otherwise.

- It is the fiduciary duty of the trustee to act in the best interest of beneficiaries.

- According to the state laws prevailing in the particular state, it is the responsibility of the trustee to file annual tax returns. It may at the request of the beneficiary have to file regular accounting.

- All the distributions and expenses which are related to the beneficiary must be done from his trust account only.

Types

There are many types of trusts having somehow the same functions but serving different purposes. An escrow account, for example, is a type of trust account for real estate, through which a mortgage-lending bank holds funds to be used to pay property taxes and homeowners’ insurance on behalf of the home buyer. The availability of the type of trust depends on the state law that is prevailing in the jurisdiction. It has basic four classifications which includes

#1 – living trust

It is the trust that is enforceable during the lifetime of the creator of trust i.E. Settlor.

#2 – testamentary trust

It is the trust that is enforceable after the death of the settlor.

#3- revocable trust

It is the trust having the clause which gives the right to settler to change the agreement of trust or terminate the trust.

#4- irrevocable trust

Under this, there is a restriction on settlor to make any changes in the agreement or to terminate the trust. Once the settlor transfer property under this account, the right of ownership is given up.

Thus one has to first decide about the type of trust account it is interested in, and then it has to decide that who should be the trustee, who all will be the beneficiaries and what are all the assets that can be transferred into the trust account.

Steps to follow while setting up a trust account

Following are the steps which are followed while setting up a trust account:

#1 – selection of type of trust

The first step in setting a trust account is to decide about the type of trust which suits best for the particular person. As stated above a trust may be living trust, testamentary trust, revocable trust or irrevocable trust. The type of trust which one chose determines the trust account form it should open.

#2 – appointment of a trustee

The appointment of a trustee is the second step. A trustee is a person who is responsible for managing your trust assets and executing the terms and conditions of a trust. A trustee can be any person who is mentally competent. It must be remembered that alternate trustees should also be designated who can act as trustees in case of death and incapacity of a trustee.

Generally, a trust department in law firms or banks serves as trustees. In case one is appointing an individual as a trustee then that person should be capable enough to understand the nature of trust and perform his duties efficiently.

#3 – determination of assets

The third step is the determination of the assets in which a person wants to get placed in a trust. There are few assets such as bank accounts, cars, stock, a real estate whose legal title should be changed in the name of a trustee as the trustee is the legal owner of trust property.

Few assets like jewelry and art don’t have any legal title and in such case right in the asset must be transferred to the trustee. It is to be remembered that the powers of the trustee over the assets of the trust must be clearly stated in the trust documents.

#4 – drafting and filing of documents

The fourth step is drafting and filing of the documents. The trust shall be written as per the state laws. The documents should be properly signed and notarized. If in one’s region it is mandatory to file the trust documents with the state then it should file all the documents.

#5 – bank process

Lastly one will go to the bank with the trust documents as these documents will instruct the bank about the steps of setting up a trust account which includes the name and the designation of a trustee.

Thus for setting up the trust solid understanding of the trust laws of the state is required. One should research properly about the trust that the state laws permit along with the rules which govern the operations of the trust. It is risky to transfer the assets in the improperly formed trusts as they can be voided and send your assets into probate. It is always good to consider all the factors and consult a professional before creating a trust account.

Recommended articles

This has been a guide to what is trust account. Here we discuss its features and steps required for setting up a trust account along with its types. You may learn more about our articles below on accounting –

Capital expenses and your business taxes

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/still-life-of-chairs-in-big-stylish-conferenceroom-481489779-576864053df78ca6e41cf903.jpg)

Capital expenses are money a business spends on certain assets of the business each year both for the cost of the assets and their upkeep. These expenses are deductible business expenses, but in a different way from other business assets.

What is capital?

Capital is assets (things of value) bought by a business to make the goods and provide the services it sells. Capital assets can include cash, real estate, inventory, equipment, and vehicles.

To "capitalize" means to spend money on capital assets rather than expenses (continuing costs, like rent). The IRS requires costs of buying capital assets to be capitalized, and this means spreading the cost over time instead of taking it as an expense in the year the asset was bought.

Capital assets and capital expenses explained

Here's how capital expenses work: businesses invest money in several types of assets (things of value), like a building, computer equipment, or office furniture. The business might also spend money to upgrade machinery and other technology to make the business more productive. A business can also purchase vehicles for salespeople, executives, or for transporting products or providing services.

All of these high-value items are called capital assets. Capital assets are property owned by a business. Common types of capital assets are buildings, land, equipment, and vehicles. Some accounting specialists also include intangible assets (like patents, trademarks, and copyrights) in the category of capital expenses.

Capital expenses or expenditures are payments by a business to buy or improve long-term capital assets. Capital expenses are significant purchases that a business makes as an investment. Taking expenses on capital assets is called "capitalizing."

To explain this concept in an accounting context, the purchase of a capital asset adds to the value of the business. The value of the asset increases the owner's net worth, but the expense of paying for the asset increases the owner's liability.

Capital assets and depreciation

Assets lose value over time, reducing the value of the business. This loss in value is depreciation. Depreciation is an expense for a business, but it's considered a non-cash expense because it doesn't have to be paid for with cash. Note that although land is a capital expense, it does not decrease in value and it is deemed to have an indefinite value, so it is not depreciated.

The tax cuts and jobs act (2017) allows more generous depreciation benefits to businesses to buy capital assets. These benefits are in accelerated depreciation that allows a business to take more expenses in the first year of owning and using an asset. Accelerated depreciation benefits are in two types:

- Section 179 deductions, which increase your first-year deduction total of $1 million for buying certain business assets, with an annual limit of $2.5 million. After 2018, the limits are indexed to inflation. This deduction is for assets placed into service (used) in that year.

- Bonus depreciation for property bought and placed into service after september 27, 2017 and before january 1, 2023. This depreciation is in addition to any section 179 deduction.

Accelerated depreciation is complicated. Before you buy business assets, check with your tax professional to discuss the possible tax implications of your purchase.

Are maintenance costs capitalized?

Costs to maintain a capital asset, like a piece of equipment, in working order and in its current condition are not considered capital costs or expenses. These are ordinary business expenses. Called operating expenses. But the cost of repairing a piece of equipment to improve its condition adds to its value, so that's a capital expense.

As you can see, it's tricky to determine which costs are operating costs and which are capital costs. You should get your tax professional involved with making these decisions.

What are operating costs?

The opposite of capital expenditures is operating costs. Capital expenses are not used for ordinary day-to-day operating expenses of a business, like rent, utilities, and insurance.

Another way to consider capital expenses is that they are used to buy and improve assets that have a useful life of more than one year.

For example, if you buy office supplies for your business, that purchase is an operating expense, because office supplies don't typically last more than one year (although you may have those boxes of staples lying around for a long time). On the other hand, if you buy office furniture, it is expected that it will last longer than a year, so you are buying a fixed asset, and that purchase is considered a capital expense.

Capital expenditures and taxes

Businesses usually prefer to take tax deductions for purchases of business assets currently rather than spread them out over time. But the IRS has strict rules on what costs can be immediately expensed. As noted above, the IRS usually wants the costs of buying capital assets to be capitalized and spread out.

Business startup costs as capital

You might think that startup costs could be taken as an expense of beginning a business since they are spent at startup. But the IRS says these costs improve the value of a business. Your business can deduct up to $5,000 in startup costs and $5,000 in costs to set up your business legal structure in your first year of business. The rest of these startup costs must be amortized (similar to depreciation), meaning they must be spread out over time. Read more about startup costs and taxes.

For tax purposes, capital expenditures are typically depreciated, but under section 179 of the IRS code, under certain circumstances, some capital expenditures may be considered current operating expenses.

The sale of capital assets results in a capital gain or loss, depending on the basic value of the asset and its sale price. Capital gains and losses are taxed at a different rate than operating income.

Capital expenses and your business taxes

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/still-life-of-chairs-in-big-stylish-conferenceroom-481489779-576864053df78ca6e41cf903.jpg)

Capital expenses are money a business spends on certain assets of the business each year both for the cost of the assets and their upkeep. These expenses are deductible business expenses, but in a different way from other business assets.

What is capital?

Capital is assets (things of value) bought by a business to make the goods and provide the services it sells. Capital assets can include cash, real estate, inventory, equipment, and vehicles.

To "capitalize" means to spend money on capital assets rather than expenses (continuing costs, like rent). The IRS requires costs of buying capital assets to be capitalized, and this means spreading the cost over time instead of taking it as an expense in the year the asset was bought.

Capital assets and capital expenses explained

Here's how capital expenses work: businesses invest money in several types of assets (things of value), like a building, computer equipment, or office furniture. The business might also spend money to upgrade machinery and other technology to make the business more productive. A business can also purchase vehicles for salespeople, executives, or for transporting products or providing services.

All of these high-value items are called capital assets. Capital assets are property owned by a business. Common types of capital assets are buildings, land, equipment, and vehicles. Some accounting specialists also include intangible assets (like patents, trademarks, and copyrights) in the category of capital expenses.

Capital expenses or expenditures are payments by a business to buy or improve long-term capital assets. Capital expenses are significant purchases that a business makes as an investment. Taking expenses on capital assets is called "capitalizing."

To explain this concept in an accounting context, the purchase of a capital asset adds to the value of the business. The value of the asset increases the owner's net worth, but the expense of paying for the asset increases the owner's liability.

Capital assets and depreciation

Assets lose value over time, reducing the value of the business. This loss in value is depreciation. Depreciation is an expense for a business, but it's considered a non-cash expense because it doesn't have to be paid for with cash. Note that although land is a capital expense, it does not decrease in value and it is deemed to have an indefinite value, so it is not depreciated.

The tax cuts and jobs act (2017) allows more generous depreciation benefits to businesses to buy capital assets. These benefits are in accelerated depreciation that allows a business to take more expenses in the first year of owning and using an asset. Accelerated depreciation benefits are in two types:

- Section 179 deductions, which increase your first-year deduction total of $1 million for buying certain business assets, with an annual limit of $2.5 million. After 2018, the limits are indexed to inflation. This deduction is for assets placed into service (used) in that year.

- Bonus depreciation for property bought and placed into service after september 27, 2017 and before january 1, 2023. This depreciation is in addition to any section 179 deduction.

Accelerated depreciation is complicated. Before you buy business assets, check with your tax professional to discuss the possible tax implications of your purchase.

Are maintenance costs capitalized?

Costs to maintain a capital asset, like a piece of equipment, in working order and in its current condition are not considered capital costs or expenses. These are ordinary business expenses. Called operating expenses. But the cost of repairing a piece of equipment to improve its condition adds to its value, so that's a capital expense.

As you can see, it's tricky to determine which costs are operating costs and which are capital costs. You should get your tax professional involved with making these decisions.

What are operating costs?

The opposite of capital expenditures is operating costs. Capital expenses are not used for ordinary day-to-day operating expenses of a business, like rent, utilities, and insurance.

Another way to consider capital expenses is that they are used to buy and improve assets that have a useful life of more than one year.

For example, if you buy office supplies for your business, that purchase is an operating expense, because office supplies don't typically last more than one year (although you may have those boxes of staples lying around for a long time). On the other hand, if you buy office furniture, it is expected that it will last longer than a year, so you are buying a fixed asset, and that purchase is considered a capital expense.

Capital expenditures and taxes

Businesses usually prefer to take tax deductions for purchases of business assets currently rather than spread them out over time. But the IRS has strict rules on what costs can be immediately expensed. As noted above, the IRS usually wants the costs of buying capital assets to be capitalized and spread out.

Business startup costs as capital

You might think that startup costs could be taken as an expense of beginning a business since they are spent at startup. But the IRS says these costs improve the value of a business. Your business can deduct up to $5,000 in startup costs and $5,000 in costs to set up your business legal structure in your first year of business. The rest of these startup costs must be amortized (similar to depreciation), meaning they must be spread out over time. Read more about startup costs and taxes.

For tax purposes, capital expenditures are typically depreciated, but under section 179 of the IRS code, under certain circumstances, some capital expenditures may be considered current operating expenses.

The sale of capital assets results in a capital gain or loss, depending on the basic value of the asset and its sale price. Capital gains and losses are taxed at a different rate than operating income.

So, let's see, what was the most valuable thing of this article: wide range of trading platforms: MT4, MT5, webtrader, mobile trading platform. Standard, micro, and true-ECN accounts. At grand capital account types

Contents of the article

- Free forex bonuses

- Professional instruments for trading and...

- Select a service

- Active offers

- We believe that it’s important to to get clear...

- Download mobile app for tradingand account...

- Trading instruments

- Профессиональные инструменты для трейдинга и...

- Выберите услугу

- Актуальные предложения

- Мы считаем, что на пути к успешному заработку на...

- Готовы начать?

- Что мы предлагаем?

- Как мы помогаем?

- Торгуйте и инвестируйте с брокером grand capital!

- Скачайте мобильное приложение для трейдинга

- Инструменты для торговли

- Grand capital – welcome bonus $500

- What’s new?

- Meefx – welcome bonus 5 USD

- Instaforex – one million option

- MFM securities – matador contest

- Forex4you – trading hero contest

- Justforex – 2021 trading contest

- LEAVE A REPLY cancel reply

- Наші переваги

- Котирування онлайн

- Типы торговых счетов

- Что такое торговый счет?

- Standard cent

- Standard

- Raw spread

- Исламские счета

- Share capital

- What is share capital?

- Share capital and the balance sheet

- Contributed surplus and additional paid-in capital

- More resources

- Free accounting courses

- Trust account

- What is a trust account?

- Explanation

- Features

- Types

- Steps to follow while setting up a trust account

- #1 – selection of type of trust

- #2 – appointment of a trustee

- #3 – determination of assets

- #4 – drafting and filing of documents

- #5 – bank process

- Recommended articles

- Capital expenses and your business taxes

- What is capital?

- Capital assets and capital expenses explained

- Capital assets and depreciation

- Are maintenance costs capitalized?

- What are operating costs?

- Capital expenditures and taxes

- Capital expenses and your business taxes

- What is capital?

- Capital assets and capital expenses explained

- Capital assets and depreciation

- Are maintenance costs capitalized?

- What are operating costs?

- Capital expenditures and taxes

No comments:

Post a Comment