Tickmill spreads

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open.

Free forex bonuses

The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades. The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

Tickmill review

Tickmill is a forex trading services broker. They give traders access to a wide variety of instruments in several markets like currencies and indices.

To open a live account, you’ll need a minimum deposit of at least €25. Alternatively, tickmill offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the financial conduct authority, UK (FRN: 717270). Tickmill puts all client funds in a segregated bank account and uses tier-1 banks for this. Tickmill has been established since 2014, and have a head office in seychelles, UK.

Before we dive into some of the more detailed aspects of tickmill’s spreads, fees, platforms and trading features, you may want to open tickmill’s website in a new tab by clicking the button below in order to see the latest information directly from tickmill.

Full disclosure: we may receive a commission if you sign up with a broker using one of our links.

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

What are tickmill's spreads & fees?

Like most brokers, tickmill takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on tickmill’s website. The colour bars show how competitive tickmill's spreads are in comparison to other popular brokers featured on brokernotes.

| Tickmill | |||

|---|---|---|---|

| EUR/USD (average: 0.7 pips) | 0.2 pips + $4.00 | 0.7 pips | 0.1 pips |

| GBP/USD (average: 1.1 pips) | 0.7 pips + $4.00 | 1.7 pips | 0.1 pips |

| USD/JPY (average: 1.1 pips) | 0.2 pips + $4.00 | 0.6 pips | 0.1 pips |

| AUD/USD (average: 0.8 pips) | 0.4 pips + $4.00 | 0.6 pips | 0.2 pips |

| USD/CHF (average: 2.3 pips) | 0.7 pips + $4.00 | 2.3 pips | 0.2 pips |

| USD/CAD (average: 2.9 pips) | 0.6 pips + $4.00 | 0.5 pips | 0.3 pips |

| NZD/USD (average: 3.6 pips) | 0.7 pips + $4.00 | 2.8 pips | 0.3 pips |

| EUR/GBP (average: 2.4 pips) | 0.5 pips + $4.00 | 0.5 pips | 0.1 pips |

Spreads are dynamic and are for informational purposes only.

As you can see, tickmill’s minimum spread for trading EUR/USD is 0.2 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with tickmill vs. Similar brokers.

How much does tickmill charge to trade 1 lot of EUR/USD?

If you were to buy one standard lot of EUR/USD (100k units) with tickmill at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $6.94. Here’s a rough breakdown of the fees and how this compares against IG & XTB .

| Tickmill | IG | XTB | |

|---|---|---|---|

| spread from : | $ 0.00 | $ 6.00 | $ 2.00 |

| commission : | $0.00 | $0.00 | $0.00 |

| total cost of a 100k trade: | $ 0.00 | $ 6.00 | $ 2.00 |

| $6 more | $2 more | ||

| visit tickmill | visit IG | visit XTB |

All fees/prices are for informational purposes and are subject to change.

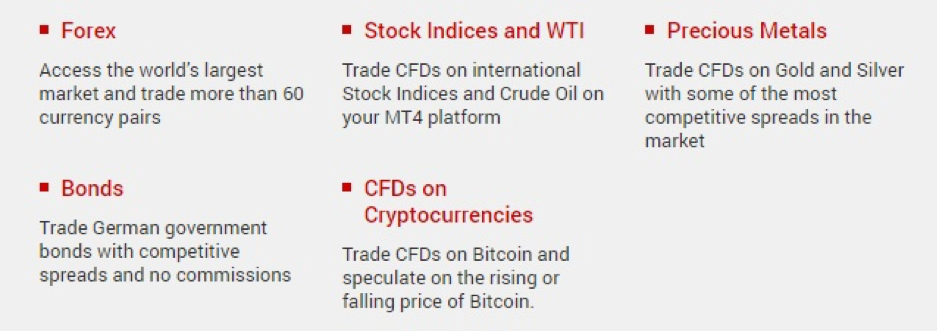

What can you trade with tickmill?

Tickmill offers over different instruments to trade, including over currency pairs. We’ve summarised all of the different types of instruments offered by tickmill below, along with the instruments offered by IG and XTB for comparison.

| FX / currency cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of forex pairs offered | 90 | 48 | |

| major forex pairs | yes | yes | yes |

| minor forex pairs | yes | yes | |

| exotic forex pairs | yes | yes | |

| cryptocurrencies | no | yes | yes |

| commodity cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of commodities offered | 34 | 21 | |

| metals | yes | yes | yes |

| energies | no | yes | yes |

| agricultural | no | yes | yes |

| index & stock cfds | tickmill | IG | XTB |

|---|---|---|---|

| # of stocks offered | 8000 | 1606 | |

| UK shares | no | yes | yes |

| US shares | no | yes | yes |

| german shares | yes | yes | yes |

| japanese shares | yes | yes | yes |

| see tickmill's instruments | see IG's instruments | see XTB's instruments |

What’s the tickmill trading experience like?

1) platforms and apps

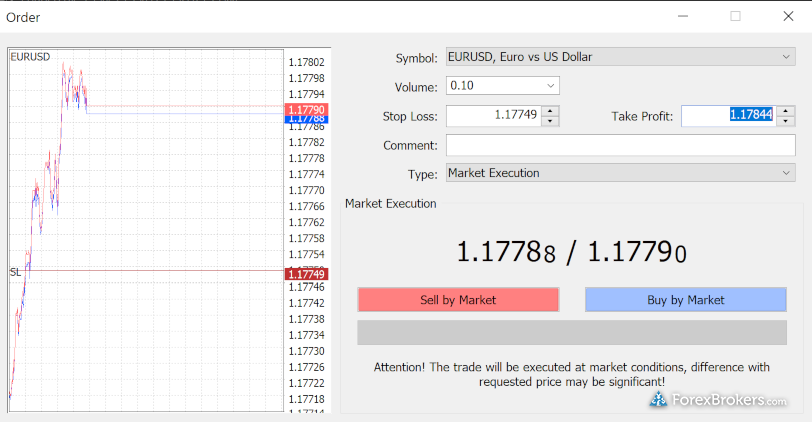

Tickmill offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. The combination of downloadable platforms for both mac and windows allows traders to trade with their device of choice.

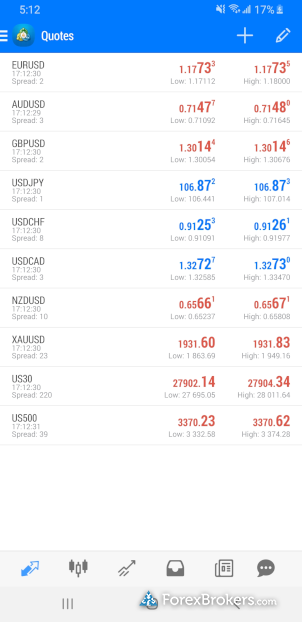

Tickmill also offer mobile apps for android and ios, making it easier to keep an eye on and execute your trades while you are on the move.

Still not sure?

2) executing trades

Tickmill allows you to execute a minimum trade of 0.01 lot. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument. As tickmill offer ECN and STP execution, you can expect very tight spreads with more transparency over the price you’re paying to execute your trades.

As a market maker, tickmill may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As a nice bonus, tickmill are one of very few brokers that claim to have no requotes, so you don’t have to worry about slippage (your trades being ordered at a different price to what you executed them at).

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, we’ve listed some of the popular funding methods that tickmill offers its traders below.

Trading features:

Accounts offered:

- Demo account

- Mini account

- Standard account

- Zero spread account

- ECN account

- Islamic account

Funding methods:

3) client support

Tickmill support a wide range of languages including english, spanish, russian, chinese, indonesian, and vietnamese.

Tickmill has a brokernotes double AA support rating because tickmill offer over three languages email and phone support.

4) what you’ll need to open an account with tickmill

As tickmill is regulated by financial conduct authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so it’s good to have these handy:

- A scanned colour copy of your passport, driving license or national ID

- A utility bill or bank statement from the past three months showing your address

You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore tickmill’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

To start the process of opening an account with tickmill you can visit their website here.

Marcus founded brokernotes in 2014 after trying hard to find a broker for himself to trade and struggling to compare brokers like-for-like. You can find more about brokernotes & marcus here.

Cfds are leveraged products and can result in the loss of your capital. All trading involves risk. Only risk capital you’re prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered as investment advice. All information collected from http://www.Tickmill.Com/ on 01/02/2021.

Tickmill not quite right?

Compare these tickmill alternatives or find your next broker using our free interactive tool.

Tickmill spreads

Estimated time to complete your registration is 3 minutes

please complete the following form using latin letters only

© 2015-2021 tickmill ™

website terms & conditions | terms of business | risk disclosure

tickmill.Com is owned and operated within the tickmill group of companies. Tickmill group consists of tickmill UK ltd, regulated by the financial conduct authority (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill europe ltd, regulated by the cyprus securities and exchange commission (registered office: kedron 9, mesa geitonia, 4004 limassol, cyprus),tickmill south africa (PTY) LTD, FSP 49464, regulated by financial sector conduct authority (FSCA) (registered office: the colosseum, 1st floor, century way, office 10, century city, 7441, cape town), tickmill ltd, regulated by the financial services authority of seychelles and its 100% owned subsidiary procard global ltd, UK registration number 09369927 (registered office: 3rd floor, 27 - 32 old jewry, london, england, EC2R 8DQ, united kingdom), tickmill asia ltd - regulated by the financial services authority of labuan malaysia (license number: MB/18/0028 and registered office: unit B, lot 49, 1st floor, block F, lazenda warehouse 3, jalan ranca-ranca, 87000 F.T. Labuan, malaysia).

Risk warning: all financial products traded on margin carry a high degree of risk to your capital. They are not suited to all investors and you can lose more than your initial deposit. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. See our risk disclosure .

The information on this site is not directed at residents of the united states and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Core spreads vs tickmill

If you're choosing between core spreads and tickmill, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, avatrade, as another alternative to consider.

What would you like to compare?

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

Core spreads is regulated by the financial conduct authority. Core spreads have provided forex trading services since 2014.

Tickmill is regulated by FSA SD008. Tickmill have provided forex trading services since 2014.

Avatrade is regulated by the central bank of ireland, ASIC (australia), FSA (japan), FSB (south africa) and BVI. Avatrade have provided forex trading services since 2006.

TRADING SERVICES OFFERED

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

English, spanish, russian, chinese, indonesian, and vietnamese

English, italian, german, french, greek, hebrew, spanish, arabic, malay, russian, chinese, portuguese and dutch

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by core spreads and tickmill

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

All information collected from https://www.Corespreads.Com/. Last updated on 01/02/2021.

All information collected from http://www.Tickmill.Com/. Last updated on 01/02/2021.

All information collected from http://www.Avatrade.Com/. Last updated on 01/02/2021.

Core spreads is an online trading service provider who are regulated by the financial conduct authority. To open an account with core spreads, minimum deposits start from £/$/10.

With core spreads you can trade currencies, stocks, commodities, indices. If you like to trade on the go, core spreads have iphone, ipad and android apps so you can trade from anywhere on your phone.

Core spreads offer their user friendly coretrader and the popular MT4 platforms to make your trades and also offer customer support in english.

The spreads offered by core spreads for the most popular instruments are:

0.7 EUR/USD 0.8 FTSE 100 0.4 GOLD

0.9 GBP/USD 1.0 DOW/JONES 3.0 crude oil

see all spreads

for more information about trading with core spreads, we have put together an indepth core spreads review with all the pros and cons about this broker.

Tickmill is an online forex trading service provider who are regulated by the financial services authority. To open an account with tickmill, minimum deposits start from $25 or equivalent.

With tickmill you can trade forex, stocks, indices, commodities, cfds and metals. If you like to trade on the go, tickmill have iphone, ipad and android apps so you can trade from anywhere on your phone.

Tickmill offer metatrader 4, metatrader 4 for PC & MAC, metatrader 4 for android & ios, virtual private server (VPS) platforms to make your trades and support 6 different languages.

The spreads offered by tickmill for the most popular instruments are:

1 EUR/USD, 3 FTSE 100, 13 GOLD,

1.5 GBP/USD, 4 DOW/JONES, 4 crude oil,

see all the spreads here.

For more information about trading with tickmill, we have put together an indepth tickmill review with all the pros and cons about this broker.

Since 2006, avatrade have attracted over 20,000 traders to their platform. While their spreads are not the most competitive, they do offer traders a range of great features, such as guaranteed stop losses, the ability to hedge / scalp, and low margins.

For more information about trading with avatrade, we have put together an indepth avatrade review with the pros and cons about this broker.

Popular comparisons feat. Core spreads

Popular comparisons feat. Tickmill

Popular comparisons feat. Avatrade

IC markets vs tickmill 2021

Is IC markets better than tickmill? After testing 27 of the best forex brokers over five months, IC markets is better than tickmill. IC markets caters exceptionally-well to algorithmic traders through its commission-based accounts. That said, the range of markets, and research materials offered by IC markets are not as impressive.

Select brokers keyboard_arrow_down

Overall rating

| feature | IC markets | tickmill |

| overall | 4 | 4 |

| commissions & fees | 4.5 | 5 |

| offering of investments | 3.5 | 3 |

| platforms & tools | 4 | 3 |

| mobile trading | 4 | 3 |

| research | 3.5 | 4 |

| education | 3.5 | 4 |

| trust score | 83 | 81 |

| IC markets review | tickmill review | |

| winner | check_circle | |

| 74-89% of retail CFD accounts lose money | 76% of retail CFD accounts lose money |

Regulation

Tier-1 licenses (high trust)

Investments

Funding

Trading platforms

Trading tools

Mobile trading

Research

Education

Major forex pairs

Overall

| feature | IC markets | tickmill |

| overall | 4 | 4 |

| commissions & fees | 4.5 | 5 |

| offering of investments | 3.5 | 3 |

| platforms & tools | 4 | 3 |

| mobile trading | 4 | 3 |

| research | 3.5 | 4 |

| education | 3.5 | 4 |

| trust score | 83 | 81 |

| IC markets review | tickmill review |

Comparing forex brokers side by side is no easy task. For our 2021 annual forex broker review, we spent hundreds of hours assessing 27 forex and CFD brokerages to find the best forex broker. Let's compare IC markets vs tickmill.

Does IC markets or tickmill offer lower pricing?

Comparing the trading costs of forex and cfds is not easy. Not every broker publishes average spreads data, and pricing structures vary. Based on our thorough annual assessment, tickmill offers better pricing overall for traders.

Is IC markets or tickmill safer for forex and cfds trading?

At forexbrokers.Com, we track where each forex and CFD broker is regulated across over 20 international regulator databases. Here's our findings. Both IC markets and tickmill hold 1 global tier-1 licenses. Tickmill holds 2 global tier-2 licenses, while IC markets holds 1. All regulators considered, IC markets has a trust score of 83.00, while tickmill's trust score is 81.00.

Which trading platform is better: IC markets or tickmill?

To compare the trading platforms of both IC markets and tickmill, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, IC markets offers a better experience. With research, tickmill offers superior market research. Finally, we found IC markets to provide better mobile trading apps.

What about metatrader and copy trading?

For forex and cfds traders, copy trading and metatrader are both popular platform options. IC markets and tickmill both offer copy trading. Both IC markets and tickmill offer metatrader 4 (MT4).

How many forex pairs and cfds are available to trade?

Tickmill provides traders 62 currency pairs (e.G., EUR/USD) compared to IC markets's 61 available pairs. Forex pairs aside, IC markets offers traders access to 230 cfds while tickmill has 13 available cfds, a difference of 217.

Overall winner: IC markets

Related comparisons

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Tickmill review

Tickmill is a plain vanilla MT4 broker offering a minimal selection of tradeable securities. That said, tickmill offers very competitive commission-based pricing for professionals through its VIP and PRO accounts.

Top takeaways for 2021

Here are our top findings on tickmill:

- Founded in 2014, tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and cfds.

- With just the MT4 platform available, tickmill does not stand out compared to the best metatrader brokers.

- Pricing at tickmill is highly competitive, helping the broker finish 1st overall for commissions and fees in 2021. Tickmill also competes well professional trading another category where tickmill finished best in class (top 7) in 2021.

Special offer:

Overall summary

| feature | tickmill |

|---|---|

| overall | 4 stars |

| trust score | 81 |

| offering of investments | 3 stars |

| commissions & fees | 5 stars |

| platforms & tools | 3 stars |

| research | 4 stars |

| mobile trading | 3 stars |

| education | 4 stars |

Is tickmill safe?

Tickmill is considered average-risk, with an overall trust score of 81 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: financial conduct authority (FCA). Learn more about trust score.

Regulations comparison

| feature | tickmill |

|---|---|

| year founded | 2014 |

| publicly traded (listed) | no |

| bank | no |

| tier-1 licenses | 1 |

| tier-2 licenses | 2 |

| tier-3 licenses | 0 |

| trust score | 81 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing mostly currency pairs, with barely a dozen cfds on indices, metals, and bonds. The following table summarizes the different investment products available to tickmill clients.

| Feature | tickmill |

|---|---|

| forex: spot trading | yes |

| currency pairs (total forex pairs) | 62 |

| cfds - total offered | 13 |

| social trading / copy-trading | yes |

| cryptocurrency traded as actual | no |

| cryptocurrency traded as CFD | no |

Commissions and fees

Tickmill offers three accounts. Bottom line, tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest brokers in the industry.

Classic accounts: the classic account is commission-free, where traders only pay the bid/ask spread. However, the average spreads are higher relative to the other two account types, making the classic account unattractive.

Spreads: using typical spread data listed by tickmill for its pro account offering of 0.13 pips for the EUR/USD, the all-in cost equates to 0.53 pips when factoring in the RT commission equivalent of 0.4 pips. It is worth noting that tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: pro and VIP accounts both have a per-trade commission added to lower prevailing spreads and standout as competitive. With a low commission rate, the pro account will be ideal for most traders compared to the classic account, as spreads are inherently less expensive, and 75 instruments, including 62 currency pairs, can be accessed.

VIP versus pro accounts: while the VIP account requires a minimum balance of $50,000 for traders to access low commissions of $1 per standard lot (100k units) or $2 per round-turn (RT), the pro account has similar pricing with an RT commission of just $4 per round-turn standard lot. The pro account is available with as little as a $100 deposit.

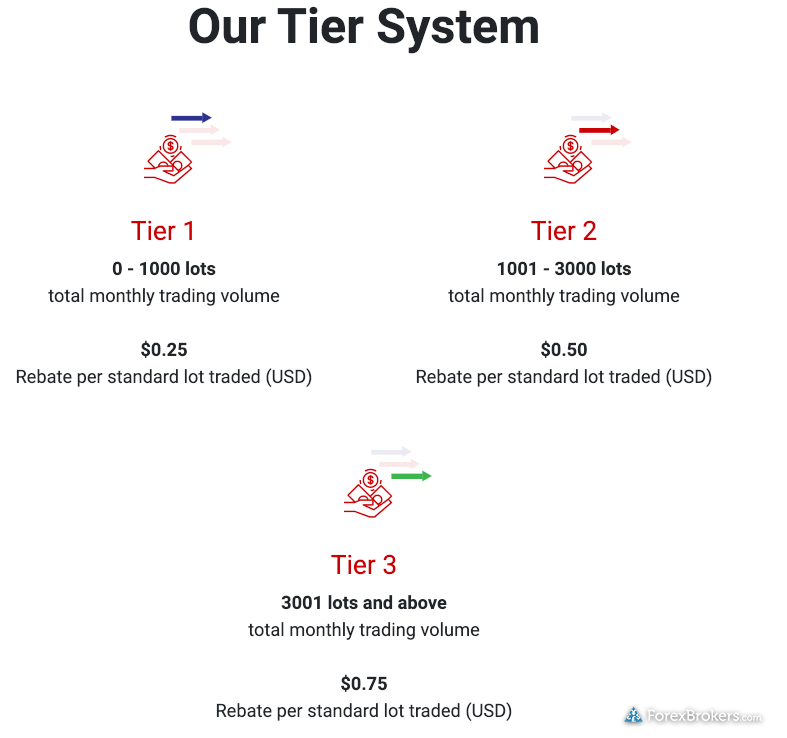

Active trader discounts: tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard for up to 1000 standard lots per month, to as much as $0.75 at tier-3 for those who trade more than 3001 standard lots monthly.

Gallery

| Feature | tickmill |

|---|---|

| minimum initial deposit | $100.00 |

| average spread EUR/USD - standard | 0.53 (august 2020) |

| all-in cost EUR/USD - active | 0.32 (august 2020) |

| active trader or VIP discounts | yes |

Platforms and tools

Tickmill is a metatrader-only broker offering the standard, out-of-the-box experience, for just MT4. Unfortunately, there are no notable add-ons, besides autochartist, to help tickmill stand out among the best metatrader brokers. Even metatrader 5 (MT5) is not offered. Finally, VPS hosting is available at tickmill and is useful for algorithmic traders using MT4.

Gallery

| Feature | tickmill |

|---|---|

| virtual trading (demo) | yes |

| proprietary platform | no |

| desktop platform (windows) | yes |

| web platform | yes |

| social trading / copy-trading | yes |

| metatrader 4 (MT4) | yes |

| metatrader 5 (MT5) | no |

| ctrader | no |

| duplitrade | no |

| zulutrade | yes |

| charting - indicators / studies (total) | 51 |

| charting - drawing tools (total) | 31 |

| charting - trade from chart | yes |

| watchlists - total fields | 7 |

| order type - trailing stop | yes |

Research

Tickmill is competitive in its offering of market research and continues to improve its research year over year. That said, tickmill still lags industry leaders IG and saxo bank in depth, personalization, and overall quality.

Trading tools: tickmill provides autochartist for automated technical analysis, myfxbook powers the broker's economic calendar, and forex news headlines stream from investing.Com.

Copy trading: in addition to the native MQL5 signals market available in MT4, tickmill also offers the autotrade feature of myfxbook for social copy-trading (note: this service is not available from the firm's UK branch).

Market insights: tickmill has a team of analysts that produce daily technical and fundamental analysis on the company's blog. I found that the broker does a good job covering the markets with a wide variety of research content for traders. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its youtube page.

Gallery

| Feature | tickmill |

|---|---|

| daily market commentary | yes |

| forex news (top-tier sources) | yes |

| weekly webinars | yes |

| autochartist | yes |

| trading central (recognia) | no |

| delkos research | no |

| social sentiment - currency pairs | yes |

| economic calendar | yes |

Education

Tickmill's education offering is better than the industry average but not quite good enough to make the cut as best in class (top 7).

Good stuff: highlights include live educational courses, a handful of ebooks, weekly webinars hosted in various languages, and archived webinars through youtube. Tickmill offers variety in both topic and type.

Drawbacks: tickmill continues to expand its scope of education material across written and video formats; however, educational content is mixed with market research, which makes it difficult to navigate and filter through. A dedicated educational portal would be a notable boost to tickmill’s educational offering.

Gallery

| Feature | tickmill |

|---|---|

| has education - forex | yes |

| has education - cfds | yes |

| client webinars | yes |

| client webinars (archived) | yes |

| videos - beginner trading videos | yes |

| videos - advanced trading videos | no |

| investor dictionary (glossary) | yes |

| tutorials/guide (PDF or interactive) | no |

Mobile trading

Since tickmill is a metatrader-only broker, ios and android versions of the MT4 app come standard and are both available for download from the apple itunes store and android play store, respectively.

Gallery

| Feature | tickmill |

|---|---|

| android app | yes |

| apple ios app | yes |

| trading - forex | yes |

| trading - cfds | yes |

| alerts - basic fields | yes |

| watch list | yes |

| watch list syncing | no |

| charting - indicators / studies | 30 |

| charting - draw trendlines | yes |

| charting - trendlines moveable | no |

| charting - multiple time frames | yes |

| charting - drawings autosave | no |

| forex calendar | no |

Final thoughts

Tickmill caters best to high volume, high balance traders who trade only the most popular forex and CFD instruments. With a lack of platforms and a small range of markets, there is no question that there are better forex brokers for traders to consider in 2021 unless you can afford the VIP account at tickmill, which has highly-competitive pricing.

About tickmill

Tickmill was established in 2014 after armada markets moved its retail clients to tickmill's entity in seychelles, where it is regulated by the financial services authority (FSA). Today the tickmill brand holds regulatory status in UK, cyprus, and malaysia. According to its website, tickmill group has over 200 staff and more than 50,000 customers.

2021 review methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers over a three month time period. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

Core spreads vs tickmill

If you're choosing between core spreads and tickmill, we've compared hundreds of data points side-by-side to make finding the right broker for you easier. We've also displayed one of our most popular brokers, avatrade, as another alternative to consider.

What would you like to compare?

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

The BROKERDNA ™ score tells you, overall, how reputable, suitable, and affordable a broker is compared to other brokers.

This score is algorithmically-generated based on 31 factors. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. Learn more here.

Core spreads is regulated by the financial conduct authority. Core spreads have provided forex trading services since 2014.

Tickmill is regulated by FSA SD008. Tickmill have provided forex trading services since 2014.

Avatrade is regulated by the central bank of ireland, ASIC (australia), FSA (japan), FSB (south africa) and BVI. Avatrade have provided forex trading services since 2006.

TRADING SERVICES OFFERED

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

PLATFORM & FEATURES

See the platforms and features offered by each broker

English, spanish, russian, chinese, indonesian, and vietnamese

English, italian, german, french, greek, hebrew, spanish, arabic, malay, russian, chinese, portuguese and dutch

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

ACCOUNT INFORMATION

From micro accounts to ECN accounts, compare the accounts offered by core spreads and tickmill

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

TRADING CONDITIONS

RISK MANAGEMENT

FUNDING METHODS

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

DETAILED INFO

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

66.6% of retail investor accounts lose money when trading cfds with this provider

81% of retail investor accounts lose money when trading cfds with tickmill UK ltd

79% of retail investor accounts lose money when trading cfds with this provider.

All information collected from https://www.Corespreads.Com/. Last updated on 01/02/2021.

All information collected from http://www.Tickmill.Com/. Last updated on 01/02/2021.

All information collected from http://www.Avatrade.Com/. Last updated on 01/02/2021.

Core spreads is an online trading service provider who are regulated by the financial conduct authority. To open an account with core spreads, minimum deposits start from £/$/10.

With core spreads you can trade currencies, stocks, commodities, indices. If you like to trade on the go, core spreads have iphone, ipad and android apps so you can trade from anywhere on your phone.

Core spreads offer their user friendly coretrader and the popular MT4 platforms to make your trades and also offer customer support in english.

The spreads offered by core spreads for the most popular instruments are:

0.7 EUR/USD 0.8 FTSE 100 0.4 GOLD

0.9 GBP/USD 1.0 DOW/JONES 3.0 crude oil

see all spreads

for more information about trading with core spreads, we have put together an indepth core spreads review with all the pros and cons about this broker.

Tickmill is an online forex trading service provider who are regulated by the financial services authority. To open an account with tickmill, minimum deposits start from $25 or equivalent.

With tickmill you can trade forex, stocks, indices, commodities, cfds and metals. If you like to trade on the go, tickmill have iphone, ipad and android apps so you can trade from anywhere on your phone.

Tickmill offer metatrader 4, metatrader 4 for PC & MAC, metatrader 4 for android & ios, virtual private server (VPS) platforms to make your trades and support 6 different languages.

The spreads offered by tickmill for the most popular instruments are:

1 EUR/USD, 3 FTSE 100, 13 GOLD,

1.5 GBP/USD, 4 DOW/JONES, 4 crude oil,

see all the spreads here.

For more information about trading with tickmill, we have put together an indepth tickmill review with all the pros and cons about this broker.

Since 2006, avatrade have attracted over 20,000 traders to their platform. While their spreads are not the most competitive, they do offer traders a range of great features, such as guaranteed stop losses, the ability to hedge / scalp, and low margins.

For more information about trading with avatrade, we have put together an indepth avatrade review with the pros and cons about this broker.

Popular comparisons feat. Core spreads

Popular comparisons feat. Tickmill

Popular comparisons feat. Avatrade

IC markets vs tickmill 2021

Is IC markets better than tickmill? After testing 27 of the best forex brokers over five months, IC markets is better than tickmill. IC markets caters exceptionally-well to algorithmic traders through its commission-based accounts. That said, the range of markets, and research materials offered by IC markets are not as impressive.

Select brokers keyboard_arrow_down

Overall rating

| feature | IC markets | tickmill |

| overall | 4 | 4 |

| commissions & fees | 4.5 | 5 |

| offering of investments | 3.5 | 3 |

| platforms & tools | 4 | 3 |

| mobile trading | 4 | 3 |

| research | 3.5 | 4 |

| education | 3.5 | 4 |

| trust score | 83 | 81 |

| IC markets review | tickmill review | |

| winner | check_circle | |

| 74-89% of retail CFD accounts lose money | 76% of retail CFD accounts lose money |

Regulation

Tier-1 licenses (high trust)

Investments

Funding

Trading platforms

Trading tools

Mobile trading

Research

Education

Major forex pairs

Overall

| feature | IC markets | tickmill |

| overall | 4 | 4 |

| commissions & fees | 4.5 | 5 |

| offering of investments | 3.5 | 3 |

| platforms & tools | 4 | 3 |

| mobile trading | 4 | 3 |

| research | 3.5 | 4 |

| education | 3.5 | 4 |

| trust score | 83 | 81 |

| IC markets review | tickmill review |

Comparing forex brokers side by side is no easy task. For our 2021 annual forex broker review, we spent hundreds of hours assessing 27 forex and CFD brokerages to find the best forex broker. Let's compare IC markets vs tickmill.

Does IC markets or tickmill offer lower pricing?

Comparing the trading costs of forex and cfds is not easy. Not every broker publishes average spreads data, and pricing structures vary. Based on our thorough annual assessment, tickmill offers better pricing overall for traders.

Is IC markets or tickmill safer for forex and cfds trading?

At forexbrokers.Com, we track where each forex and CFD broker is regulated across over 20 international regulator databases. Here's our findings. Both IC markets and tickmill hold 1 global tier-1 licenses. Tickmill holds 2 global tier-2 licenses, while IC markets holds 1. All regulators considered, IC markets has a trust score of 83.00, while tickmill's trust score is 81.00.

Which trading platform is better: IC markets or tickmill?

To compare the trading platforms of both IC markets and tickmill, we tested each broker's trading tools, research capabilities, and mobile apps. For trading tools, IC markets offers a better experience. With research, tickmill offers superior market research. Finally, we found IC markets to provide better mobile trading apps.

What about metatrader and copy trading?

For forex and cfds traders, copy trading and metatrader are both popular platform options. IC markets and tickmill both offer copy trading. Both IC markets and tickmill offer metatrader 4 (MT4).

How many forex pairs and cfds are available to trade?

Tickmill provides traders 62 currency pairs (e.G., EUR/USD) compared to IC markets's 61 available pairs. Forex pairs aside, IC markets offers traders access to 230 cfds while tickmill has 13 available cfds, a difference of 217.

Overall winner: IC markets

Related comparisons

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Tickmill spreads

O tempo estimado para completar o seu registo é de 3 minutos

por favor, complete o seguinte questionário usando apenas letras do alfabeto

© 2015-2021 tickmill ™

termos e condições do website | termos do negócio | divulgação de risco

tickmill.Com pertence e é operado pelo grupo de empresas tickmill. Tickmill group consiste em tickmill UK ltd, regulamentada pela financial conduct authority (registered office: 3rd floor, 27-32 old jewry, londres, inglaterra, EC2R 8DQ, reino unido), tickmill europe ltd, regulamentada pela cyprus securities and exchange commission (sede: kedron 9, mesa geitonia, 4004 limassol, chipre), tickmill south africa (PTY) LTD, FSP 49464, regulamentada pela financial sector conduct authority (FSCA) (sede: the colosseum, 1st floor, century way, office 10, century city, 7441, cidade do cabo), tickmill ltd, regulamentada pela autoridade de serviços financeiros de seychelles e sua subsidiária procard global ltd, 100% detida pela procard global ltd, número de registro no reino unido 09369927 (escritório registrado: 3rd floor, 27-32 old jewry, londres , inglaterra, EC2R 8DQ, reino unido), tickmill asia ltd - regulamentada pela autoridade de serviços financeiros de labuan malásia (número de licença: MB / 18/0028 e escritório registrado: unidade B, lote 49, 1º andar, bloco F, armazém lazenda 3, jalan ranca-ranca, 87000 F.T. Labuan, malásia).

Aviso de risco: todos os produtos financeiros negociados com margem, possuem um elevado grau de risco para o seu capital. Esses produtos não são adequados para todos os investidores e você poderá perder mais do que o seu depósito inicial. Por favor, assegure-se de compreender completamente os riscos envolvidos e procure aconselhamento independente, se necessário. Veja a nossa divulgação de risco .

A informação neste website não é dirigida a residentes dos estados unidos e não é destinada a ser distribuída ou utilizada por qualquer pessoa em qualquer país ou jurisdição onde tal distribuição ou uso seja contrário à lei ou regulamento local.

Important notice

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill UK ltd, a company registered in the UK and regulated by the financial conduct authority of the united kingdom.

You are about to leave tickmill europe ltd client area registration page. By clicking “continue” you will be redirected to the registration page of tickmill ltd, a company registered in the seychelles and regulated by the financial services authority of seychelles.

Tickmill

- Educational section is a little limited.

- No cfds on individual stocks.

- $50,000 deposit required to access really low commission.

Min deposit

Max leverage

Mini account

Bonus

Platforms

Withdrawal options

Review

Comparison

Review

Introduction

Tickmill is a relatively new broker which was founded in 2015. There are two entities with a UK company complying with new CFD and forex regulations and the seychelles registered company offering greater levels of leverage.

Tickmill is regulated by the FCA in the UK and the FSA in the seychelles. They are also authorised by cysec in cyprus.

Tickmill is managing to establish a name for themselves and were awarded the best forex execution broker at the UK forex awards in 2018.

The easy to navigate website is available in 15 languages.

Trading conditions

Tickmill charges floating spreads for all accounts, though the spreads for pro and VIP are zero on some instruments. Stop loss and take profit orders can be entered with no limitations. Trailing stops are only active while MT4 is open.

Leverage for accounts held with tickmill UK complies with ESMA regulations. Maximum leverage for major FX pairs is 1:30, for other currencies, major indices and gold it is 1:20, for silver, oil and other indices 1:10 and for bonds it is 1:5. UK accounts are stopped out at 50% of margin.

Accounts held in the seychelles can increase their leverage to 1:500 and the stop out level falls to 30%.

A new client bonus of $30 is currently offered.

Tickmill offers 4 different types of accounts, including demo accounts.

Classic accounts require a minimum deposit of $100 and offer spreads starting at 1.6 pips with no commission.

Pro accounts require a minimum deposit of $100 and spreads starting at 0, but charge commission.

VIP accounts require a minimum deposit of $50,000 and spreads starting at 0 and charge lower commissions.

All of these accounts can be converted to islamic swap free accounts. They can also all be funded in USD, EUR, GBP and PLN.

Demo accounts allow newbie clients to practice their trading with all the available platforms, instruments and with real time pricing.

Tickmill also offers bespoke solutions for money managers and institutions.

Newbie traders should start with the classic account in the UK which offers competitive spreads, a relatively low deposit requirement and modest leverage.

Products

Tickmill offers more than 60 currency pairs and cfds on 14 stock indexes, oil, precious metals, bonds and cryptocurrencies.

The currency pairs include all major pairs and all the minor and exotic pairs that are favoured by forex traders. Indices include the dow 30, S&P500, FTSE 100 and most other major global indices. These cfds are based on the index futures contracts.

Clients can also trade west texas oil, gold, silver, german government bonds and cfds on bitcoin.

Cfds on individual stocks are not available from this broker.

Regulation

Tickmill UK is based at 1 fore street, london, EC2Y 9DT. This entity is regulated by the financial conduct authority (register number: 717270). UK accounts also benefit from deposit protection.

Tickmill seychelles is based at 3, F28-F29 eden plaza, eden island, mahe, seychelles and regulated by the financial services authority (with licence no. SD 008).

Platforms

Tickmill offers clients a choice of two platforms, metatrader 4 and web trader, which is a browser-based version of the same platform. Tickmill doesn’t seem to have any proprietary platforms on offer.

Metatrader 4 is an award-winning trading platform widely recognised as the gold standard for forex trading. It offers 9 time frames and more than 85 indicators. Users can access and share eas (expert advisors) and automated trading systems, and back test their own trading strategies.

MT4 can be installed on windows and OS X pcs, as well as mobile devices.

Mobile trading

As far as mobile accessibility goes, tickmill’s offering is fairly standard.

The website is reasonably easy to access and navigate using mobile devices. MT4 can be installed as an app on ios and android devices. This allows traders to access their accounts while on the go, with nearly all the functionality of the desktop platforms.

The browser-based version of MT4 is also mobile friendly.

Pricing

Tickmill’s pricing is competitive when compared to other brokers. The spreads charged on the classic accounts are higher, but about average for small accounts.

Both the pro and VIP accounts are ECN accounts and offer lower spreads but charge commission. The low commission on the VIP account is especially attractive, but a $50,000 deposit is required. The higher commission on the pro account is about average for similar accounts, though spreads can add an unknown factor.

The typical spreads for ECN accounts on the EUR/USD pairs seems to be 0.2 pips which is toward the lower end of the range when compared to other brokers.

We didn’t find complaints about the spreads, though some people commenting in online forums complained about slippage.

Deposits & withdrawals

Tickmill offers the usual range of deposit and withdrawal options, including credit and debit cards, wire transfers, neteller, skrill, and a few other ewallet solutions. Minimum deposits are generally $100, and minimum withdraws $10. No fees are charged for any deposits or withdrawals apart from wire deposits below $5,000.

The broker claims deposits are all processed instantly and withdrawals within 1 working day. We did find some complaints online about withdrawals taking longer which tickmill said was due to service providers.

Customer support

Customer support is available via email, phone, call back and live chat. The broker can also be reached on social media channels. Support is advertised as being available 24 hours a day on business days.

Support is available in english, indonesian, italian, chinese, russian, spanish, and polish.

We did find a few complaints regarding the level of professionalism and knowledge of the support staff.

Research & education

Tickmill’s education section consists of an extensive glossary, video tutorials and educational articles. For the most part these are fairly basic and cover the fundamentals clients will need to get started.

Regular webinars are also hosted to discuss the market, though these all appeared to be in portuguese and german when we checked.

The educational resources are sufficient for newbies to get started, but to become a competent trader more material will be needed. That’s not necessarily a problem as there are plenty of educational resources available around the web for free.

Noteworthy points

For the most part tickmill’s offering is very standard, but there are a few unique features. The broker runs a trader of the month competition with a prize of $1,000. The prize is based not only on profits but on risk management as well.

Another unique competition is the NFP machine competition in which clients predict the price of a specific instrument 30 minutes after US non-farm payrolls are released. The prize is $500 for an exact match or $200 for the closest guess.

In 2016 tickmill won the chinese forex expo awards for “the most trusted forex broker” and “the best ECN/STP broker.”

In 2017 they won the “most trusted broker 2017” award from the UK global brands magazine.

IN 2017 tickmill was awarded the ‘best forex trading conditions’ prize at the UK forex awards, and in 2018 they won “best forex execution broker” at the same event.

In general, the broker seems to have a good reputation and most complaints we found seemed to be relatively trivial. They don’t appear to be the subject of any major investigations or disputes

Conclusion

Tickmill is a very standard broker in many respects. For newbie traders the range of instruments is good, and the pricing is fair for small account sizes. The UK entity’s low leverage is ideal for those still learning the ropes. The educational resources are enough to get started. Another advantage for new traders is that the offering is simple without an endless range of platforms and instruments which can be confusing.

More advanced traders may also find the pro account feasible depending on the frequency of their trades. The spreads are very low and the commission reasonable.

Comparison

Broker comparison maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

So, let's see, what was the most valuable thing of this article: registered in the seychelles, you might be wondering is tickmill legit? Since 2016, tickmill have been FCA regulated in the UK. They offer a low minimum deposit, a vast range of accounts and more. Learn more in our in-depth review of tickmill. At tickmill spreads

Contents of the article

- Free forex bonuses

- Tickmill review

- What are tickmill's spreads & fees?

- What can you trade with tickmill?

- What’s the tickmill trading experience like?

- 1) platforms and apps

- Still not sure?

- 2) executing trades

- Trading features:

- Accounts offered:

- Funding methods:

- 3) client support

- 4) what you’ll need to open an account with...

- Tickmill not quite right?

- Tickmill spreads

- Core spreads vs tickmill

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

- IC markets vs tickmill 2021

- Overall rating

- Regulation

- Tier-1 licenses (high trust)

- Investments

- Funding

- Trading platforms

- Trading tools

- Mobile trading

- Research

- Education

- Major forex pairs

- Overall

- Related comparisons

- Tickmill review

- Top takeaways for 2021

- Overall summary

- Is tickmill safe?

- Offering of investments

- Commissions and fees

- Platforms and tools

- Research

- Education

- Mobile trading

- Final thoughts

- About tickmill

- 2021 review methodology

- Forex risk disclaimer

- Core spreads vs tickmill

- What would you like to compare?

- TRADING SERVICES OFFERED

- PLATFORM & FEATURES

- ACCOUNT INFORMATION

- TRADING CONDITIONS

- RISK MANAGEMENT

- FUNDING METHODS

- DETAILED INFO

- IC markets vs tickmill 2021

- Overall rating

- Regulation

- Tier-1 licenses (high trust)

- Investments

- Funding

- Trading platforms

- Trading tools

- Mobile trading

- Research

- Education

- Major forex pairs

- Overall

- Related comparisons

- Tickmill spreads

- Tickmill

- Review

- Introduction

- Trading conditions

- Products

- Regulation

- Platforms

- Mobile trading

- Pricing

- Deposits & withdrawals

- Customer support

- Research & education

- Noteworthy points

- Conclusion

- Comparison

No comments:

Post a Comment