Standard bank bonuses

As it turned out, the labour court did not interdict the bank on bonuses and effectively allowed the retrenchments to go ahead, provided standard bank continues talks with the union and gives more information on the expected cost savings.

Free forex bonuses

An agreement must be reached by december 1st, judge robert lagrange intimated. Standard bank said the ruling "vindicates the bank's actions relating to the retrenchment process." the ruling was closely watched, as standard bank's are the largest retrenchments in the

Standard bank allowed to retrench and pay bonuses

Standard bank described the planned retrenchment of over 2,000 employees in south africa and london as "a deeply saddening process". But africa's largest bank would have been even sadder if the judges had blocked its plans or forced it to cap bonus payments and salary increases, as sasbo, the financial sector union, had demanded.

As it turned out, the labour court did not interdict the bank on bonuses and effectively allowed the retrenchments to go ahead, provided standard bank continues talks with the union and gives more information on the expected cost savings. An agreement must be reached by december 1st, judge robert lagrange intimated. Standard bank said the ruling "vindicates the bank's actions relating to the retrenchment process."

The ruling was closely watched, as standard bank's are the largest retrenchments in the

South african banking sector since nedbank cut 10% of its workforce in 2004. Unlike its smaller rival six years ago, though, standard bank is profitable. Group ceo jacko maree says it is keen to cut costs to avoid being forced to take more drastic measures later and it is determined to reduce its cost-to-income ratio which has reached an "unacceptable" 58.1 per cent.

The cuts will only affect standard bank's head office in johannesburg and its london office. The plan was to lay off 270 employees in the UK and 1.745 people, 1.145 of whom permanent staff, in south africa - including 65 executives and 670 managers - based on "operational requirements and not individual performance".

After days of negotiations "just over 1,000 employees are now likely to be affected," according to suren reddy, director of employee relations at SB, even though "the final numbers cannot yet be determined".

But there could be more retrenchments to come, sim tshabalala, standard bank's SA ceo, said: "we do not have an organisation-wide plan, but we do not exclude the possibility of inefficiencies in pockets of the organisation," he said. "if there are inefficiencies and we are unable to preserve the profitability of the organisation, we will look at it again."

Sasbo itself seems to accept lay-offs are inevitable and damage limitation is the best it can hope for. "we are willing to speak about the numbers," eugene ebersohn, the union's assistant general secretary, said. "we might not get first prize, but second prize will do." but he vouched to keep the pressure on standard bank: "we are very interested to see what they are planning to do with their executives in terms of performance bonuses and increase, because that in itself could save a lot of money

Standard bank promotions: $25, $100 checking, referral bonuses (MD)

Read on to learn more about standard bank promotions, bonuses and offers here.

Typically, they have bonuses that range between $25 to $194 when you meet all the requirements.

About standard bank promotions

Standard bank is headquartered in murrysville, pennsylvania and was founded in 1921. Since then they have grown to 18 locations and boast an A health rating. If you do not live in an area with a standard bank, but still want to earn big bonuses take a look at our nationwide bank bonuses and find an offer for you.

- Availability:MD (bank locator)

- Routing number: 243374250

- Customer service: 1-866-856-2265

While they have many generous bonuses, standard bank doesn’t have great rates for cds and savings. You may want to check out our full list of bank rates and CD rates.

I’ll review the offers below.

| Bank offers you may like see our best bank bonuses updated daily to earn up to $1,000 in free money. Find popular checking offers such as chase bank, HSBC bank, TD bank, huntington bank, BBVA, discover bank, and CIT bank. See our best rates for savings and CD too. | |

| OUR CURRENT TOP PROMOTIONS | |

| chase business complete banking SM $300 bonus | chase total checking® $200 bonus |

| HSBC premier checking $450 bonus | HSBC premier checking up to $600 |

| HSBC advance checking $200 bonus | HSBC advance checking up to $240 |

| TD bank beyond checking $300 bonus | TD bank convenience checking $150 bonus |

| huntington 25 checking $500 bonus | huntington business checking 100 $200 bonus |

| huntington unlimited business checking $400 bonus | huntington unlimited plus business checking $750 bonus |

| axos basic business checking $100 bonus | aspiration spend & save account $100 bonus |

| ally invest up to $3,500 bonus | wise business banking $100 bonus |

| webull 4 free stocks | BBVA free checking & savings $250 bonus |

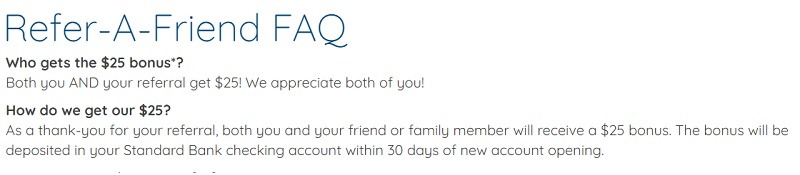

Standard bank $25 referral bonus

Earn $25 for you and your friend just by referring them to standard bank

Standard bank is offering a $25 bonus when you refer a friend to open a new qualifying checking account.

- Account type: navigator checking, kasasa cash back checking, kasasa cash checking, or green checking

- Credit inquiry:unknown

- Chexsystems:unknown

- Opening deposit: $20 for kasasa accounts

- Credit card funding:unknown

- Direct deposit requirement: none

- Monthly fee: none

- Household limit: none listed

- Closing account fee: none listed

How to earn $25 bonus

- When your referee member opens his or her new checking account, an associates will ask “what brought you in today?” at this point, your friend should give your name

- Referee must qualify and open an account

- Both you and your referral get $25

- Refer-A-friend $25 bonus is valid as of 4/01/2016

- Subject to change without notice

- To be eligible for bonus, the checking account of the referring and the new customer must be in good standing at time of credit

- Bonus will be credited within 30 days of new account opening

- The new customer must be a new standard bank customer

- Bonus is subject to 1099 reporting and may be cancelled due to abusive practices

- Keep in mind that by participating in this program your friend will know you have an account with us

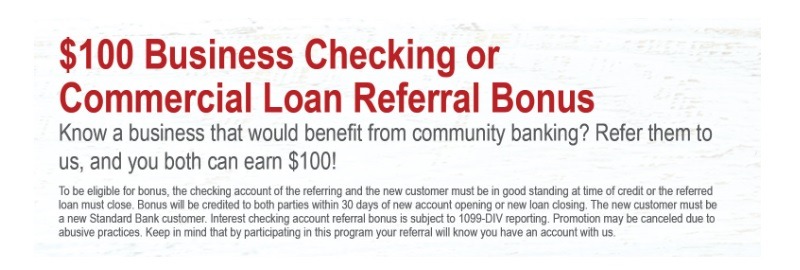

Standard bank $100 business referral bonus

Earn a $100 bonus when you refer your friends to open a business checking account!

Standard bank is offering a $100 bonus when you refer a friend to open a new business checking account.

- Account type: business checking

- Credit inquiry:unknown

- Chexsystems:unknown

- Opening deposit: none listed

- Credit card funding:unknown

- Direct deposit requirement: none

- Monthly fee: varies by account

- Household limit: none listed

- Closing account fee: none listed, check with CSR for more information

How to earn $100 bonus

- Refer friends and family to open a new account

- Have your friend open a new business checking account and keep it open and in good standing

- Business navigator preferred class checking: there are no monthly service fees

- Business navigator first class checking: $10, cannot be waived

- Business green checking: there are no monthly service fees

- Subject to change without notice

- To be eligible for bonus, the checking account of the referring and the new customer must be in good standing at time of credit

- Bonus will be credited within 30 days of new account opening

- The new customer must be a new standard bank customer

- Bonus is subject to 1099 reporting and may be cancelled due to abusive practices

Standard bank $194 checking bonus *expired*

Earn up to $194 with standard bank

Standard bank is offering a $194 bonus when you open a new qualifying checking account.

- Account type: navigator checking, kasasa cash back checking, kasasa cash checking, or green checking

- Credit inquiry:unknown

- Chexsystems:unknown

- Opening deposit: $20 for kasasa accounts

- Credit card funding:unknown

- Direct deposit requirement: none

- Monthly fee: none

- Household limit: none listed

- Closing account fee: none listed

There are several entry checking offers I’d recommend comparing this one to. The chase total checking® ($200 bonus), TD bank convenience checking SM ($150 bonus) and huntington asterisk-free checking ($150 bonus) are all great options. The huntington checking account has no monthly fee, while you would need $1,500 minimum daily balance for chase and $100 minimum for TD bank’s to waive the monthly fee.

How to earn $194 bonus

- Open a checking account from standard bank

- $20 credit will be given when the customer enrolls in e-statements

- $30 credit will be given when the customer enrolls in mobile banking and card controls

- All items must be completed within 30 days of new account opening

- Account must be open and in good standing at time of credit

- Cash reward amounts vary by account and/or class and is per credit transaction, customers may receive up to $12 per statement cycle

- All accounts

- Free visa® check card

- No service charges or fees

- Mobile banking

- Online banking/bill pay

- Free foreign ATM transactions (foreign bank ATM fees still apply)

- Interest earning

- Navigator savings bonus rate

- Free checks

- Exclusive CD specials

- Paper statements

- Identity fraud insurance

- Stop payments

- Cashier’s checks

- Notary service

- Navigator

- $0.10 cash back reward per VISA credit transaction (max $12 per statement cycle)

- Kasasa cash back

- 2.00% cash back on debit card purchases

- Kasasa cash

- 2.00% APY on balances up to $20,000

- 2.00% to 0.25% APY on balances over $20,000 depending on balance in account

- Green

- Check card rewards ($0.05 back for every visa® credit transaction)

- Allow 30 days from eligible date for credit to show in standard bank checking account

- Bonuses are considered interest income and will be reported on IRS 1099-INT

- Third-party data rates apply with standard bank app

- Offer subject to change without notice

- Promotion ends 8/30/2019 or when a $10,000 maximum promotion payout has been met

- All items must be completed within 30 days of new account opening

Bottom line

For residents of maryland, standard bank is offering the chance to earn bonuses ranging from $25-$194. Their accounts have a variety of features and services to really give you the banking experience you desire. I however can only recommend this account if it triggers a soft pull!

Your feedback is highly appreciated and makes our site even better, let us know about your experiences!

Banca de particulares

Disponibilizamos-lhe uma vasta gama de soluções que fazem você gastar menos tempo no banco e mais tempo com a sua vida.

Benefícios para si

Visão

Conveniência

Soluções

Equipa

Com a conta blue terá acesso ao universo standard bank, ao seu cartão de débito e outros serviços que disponibilizamos para transaccionar o seu dinheiro onde e como quiser.

Garante a sua protecção financeira ou das pessoas que tem a seu cargo através do pagamento de uma indemnização segundo os limites de capital assegurado na apólice.

Invista na conta de poupança que lhe oferece um futuro com melhor qualidade de vida, mais segurança e mais independência financeira.

Bens de consumo e de serviços pessoais como a compra de artigos diversos, obras no lar, viagens, pagamentos de dívidas, mobiliário, entre outros é o que temos para lhe oferecer como cliente particular. Adquira este produto de forma simples e rápida.

Financiamento de um bem móvel ou imóvel aos nossos clientes particulares e empresas mediante a celebração de um contrato por uma renda mensal entre as partes, durante um prazo determinado.

Estamos conscientes que a dor maior é a de quem perde o seu ente querido e, nesse sentido, desenvolvemos um produto para proteger a sua família num dos momentos mais sensíveis. O seguro de protecção ao funeral garante, em caso de morte, uma indemnização de acordo com a opção de capital escolhida pelo cliente.

É um seguro que garante os cuidados médicos e hospitalares, dando fácil acesso a uma rede vasta de clínicas e prestadores de serviço de saúde em angola e extensivel a portugal pela rede de clínicas multicare.

Financiamento a curto e médio prazo para a compra de bens móveis, tal como veículos automóveis e equipamento para o seu negócio.

Garantimos cobertura total nos termos estabelecidos em contrato sobre qualquer prestação por perdas ou danos aos bens (móveis e imóveis) assegurados.

Visa cobrir as indemnizações por perdas e danos que legalmente fiquem a cargo do segurado, em consequência da morte acidental, lesão corporal ou doença de qualquer pessoa ou perda acidental e danificação física de bens, que ocorram no exercício ou em conexão com a actividade comercial, dentro dos limites territoriais e durante o período de vigência do seguro.

A pensar na sua comodidade criámos o PME online, um serviço que permite satisfazer todas as necessidades do seu negócio, sem sair do seu escritório. Por telefone ou email, terá ao seu dispôr uma equipa especializada para apresentar-lhe as melhores soluções de investimento. O PME online permite-lhe ainda conectar o seu negócio à nossa rede bancária internacional.

Este serviço consiste num sistema interbancário de cobranças baseado na existência instruções de débito directos a partir das quais são desencadeados os respectivos pagamentos.

Por um lado você poupa por outro lado você ganha. A conta poupança swaip & poupa oferece aos clientes standard bank uma nova forma de poupar, simples e prática.

É um seguro de vida temporário anual renovável, que garante o salário da pessoa segura em caso de morte ou despedimento involuntário. É exclusivo para cidadãos residentes em angola, com idades entre os 18 e os 60 anos, clientes do standard bank com domiciliação do ordenado neste banco, que têm responsabilidades dentro do seu agregado familiar e pretendem assegurar a estabilidade financeira do mesmo.

Standard bank bonuses: $25, $100 checking, referral promotions (MD)

Find the most up to date standard bank promotions, bonuses, and offers for checking accounts here.

Currently, they are offering attractive $25 and $100 bonuses when you refer people for a new checking account.

Standard bank review

Standard bank is headquartered in murrysville, pennsylvania and was founded in 1921. Since then they have grown to 18 locations and boast an A health rating.

- Promotion links:

- $100 checking bonus

- Account type: checking account

- Availability: MD

- Branches: 18 branches (branch locator)

- Credit inquiry:unknown

- Direct deposit options:many options.

This bonus from standard bank is super simple to earn and I recommend taking advantage of this offer before it expires. Standard bank rates aren’t that great, so check our best rates savings, money market, and CD accounts.

If you’re not local to any of the states above, use our bank bonuses page to find other offers. Some popular bank offers include chase bank, discover bank, TD bank, huntington bank, HSBC bank and many more.

I’ll go over all standard bank offers below.

Standard bank $100 referral bonus

Residents can take advantage of a $100 bonus when you refer someone to sign up for a new checking account and meet all the requirements.

- What you’ll get: $100 bonus

- Eligible account: business checking account

- Credit inquiry:unknown, let us know

- Where it’s available: MD

- How to earn it:

- Open a qualifying checking account and meet all the requirements below.

- When you’ll receive it: after all requirements are met, you’ll receive the bonus deposited into your account.

- Monthly fee: none

How to earn the $100 bonus

- Refer friends and family to open a new account

- Have your friend open a new business checking account and keep it open and in good standing

- Online & mobile banking

- Moneypass atms

- Online bill pay

- Estatements

- Free online banking and check viewing

- Cash back rewards

- Free night depository drop off processing

- Business navigator preferred class checking: there are no monthly service fees

- Business navigator first class checking: $10, cannot be waived

- Business green checking: there are no monthly service fees

- Subject to change without notice

- To be eligible for bonus, the checking account of the referring and the new customer must be in good standing at time of credit

- Bonus will be credited within 30 days of new account opening

- The new customer must be a new standard bank customer

- Bonus is subject to 1099 reporting and may be cancelled due to abusive practices

Conclusion

All in all, the current promotion from standard bank is a great promotion offering a $100 bonus for referring qualifying accounts. You will receive a bonus for features you would need with your banking experience. However, I would only recommend this promotion only if it triggers a soft pull.

For those who has had an experience with standard bank, definitely comment below and let us know about how it went! We value your feedback and will keep you posted on the most up to date promotions from this bank!

Check back soon to find more standard bank bonuses, offers, and promotions.

What you need to know about salaries and bonuses at standard chartered in singapore

If you’re looking for a front-office banking job in singapore, standard chartered is probably fairly high on your list of potential employers. Singapore is the bank’s asian headquarters and is home to many of its regional and global heads.

Stan chart made 27% of its global operating income from the region directly served by singapore – ASEAN and south asia – in the first quarter (asia as a whole contributed 67%). And stan chart is always hiring in the hundreds in singapore, no matter the time of year. It has more than 300 local vacancies on its careers website right now.

But while stan chart has plenty of open positions in singapore, how much might it pay you if you land a front-office job in its corporate and institutional banking (CIB) division? Every job offer will come with a different compensation package, but to find some average figures, we examined standard chartered salary and bonus data on glassdoor. We did this across the five broad seniority levels that the website had sufficient data for.

We only looked at high-range singapore salaries at standard chartered, because they reflect the earnings of front-office bankers within CIB (rather than, for example, people working in retail banking). The results (which are approximate rather than definitive) are displayed in the table below.

A spokesperson for standard chartered declined to comment on CIB compensation in singapore.

How much are average salaries at standard chartered in singapore?

Front-office analysts in CIB at standard chartered in singapore earn annual base salaries of about S$100k on average, although that figure would vary according to whether they are first, second or third-year analysts. Their pay rises to approximately S$125k once they reach associate rank, according to glassdoor.

Vice presidents and associate directors earn salaries about S$170k and S$190k, respectively. It’s at associate director level that standard chartered’s bonuses start to rise – they can potentially reach about S$160k, according to glassdoor, although that would partly depend on personal performance.

If you reach director level at standard chartered in singapore, you could potentially earn S$450k in total compensation, including a base salary of approximately S$300k.

Regardless of your salary at standard chartered in singapore, now may be a good time to join the firm. Standard chartered’s first quarter results have been hailed as proof that CEO bill winter’s turnaround strategy is starting to work. The bank has announced a new $1bn share buyback, a 10% rise in quarterly profit, and (crucially) a 2% fall in operating expenses.

Corporate and institutional banking salaries and bonuses at standard chartered in singapore

Image credit: tkkurikawa, getty

Have a confidential story, tip, or comment you’d like to share? Email: smortlock@efinancialcareers.Com or telegram: @simonmortlock

We are on telegram! Join us now

| Standard notes SARB’s hold-back advice on dividends, bonuses |

Note: search is limited to the most recent 250 articles. To access earlier articles, click advanced search and set an earlier date range.

To search for a term containing the '&' symbol, click advanced search and use the 'search headings' and/or 'in first paragraph' options.

Email this article

Article enquiry

Standard notes SARB’s hold-back advice on dividends, bonuses

Embed video

Standard notes SARB’s hold-back advice on dividends, bonuses

By: martin creamer

creamer media editor

JOHANNESBURG (miningweekly.Com) – africa’s biggest bank by assets, standard bank group, said on tuesday that it had noted the contents of the guidance of the prudential authority of the south african reserve bank (SARB) on dividend distributions to ordinary shareholders.

SARB’s prudential authority, headed by kuben naidoo, has recommended that banks hold back on dividend distribution and executive bonuses to preserve capital for continued lending to those impacted by the national coronavirus lockdown.

Standard bank, headed by CEO sim tshabalala, stated in a stock exchange news service (SENS) announcement that, in particular, note had been taken of the prudential authority’s expectation that no distribution of dividends on ordinary shares and no payments of cash bonuses to executive officers and material risk takers should take place in 2020.

Standard bank stated that its group management and board of directors would consider the guidance of the prudential authority and advise shareholders accordingly in due course.

The nonbinding recommendation of the prudential authority follows SARB’s permission for banks to access an additional portion of their regulatory capital reserves to support efforts to lessen the economic impact of the covid-19 lockdown order on south africa.

Standard bank stated that its board fully recognised the importance of dividends to the group’s owners. However, it also recognised the need to support households and businesses amid the covid-19 pandemic as well as the importance of ensuring the stability of the group in the short-, medium- and long-term.

Standard bank stated that it remained well capitalised and liquid.

As reported by mining weekly last week, the bank is benefitting from building up increased capital levels over the last few years in line with basel requirements.

As at december 31, the group had a total capital adequacy ratio of 16.7% and R427-billion worth of contingent liquidity.

Capital and liquidity requirements across all the markets in which it operates are continuing to be met, standard bank group FD dr arno daehnke said during an investor call.

The bank’s small-enterprise, low-income and student clients will be benefitting from an automatic three-month payment holiday from april 1 to june 30, equating to approximately R35-billion, daehnke disclosed.

“I’m confident that standard bank is taking all the appropriate steps to maintain business continuity in order to continue to serve our clients across all the markets in which we operate.

“the private sector has a vital role to play in supporting the government and doing what we can to contain the spread of covid-19 and we must all play our part to protect the most vulnerable in our society,” tshabalala said during the investor call.

As part of its 2019 results announcement, the standard bank board approved a final dividend of 540c a share.

Daehnken concluded last week’s investor call by committing to provide the markets with its normal first-quarter updates via SENS in late april.

Standard bank allowed to retrench and pay bonuses

Standard bank described the planned retrenchment of over 2,000 employees in south africa and london as "a deeply saddening process". But africa's largest bank would have been even sadder if the judges had blocked its plans or forced it to cap bonus payments and salary increases, as sasbo, the financial sector union, had demanded.

As it turned out, the labour court did not interdict the bank on bonuses and effectively allowed the retrenchments to go ahead, provided standard bank continues talks with the union and gives more information on the expected cost savings. An agreement must be reached by december 1st, judge robert lagrange intimated. Standard bank said the ruling "vindicates the bank's actions relating to the retrenchment process."

The ruling was closely watched, as standard bank's are the largest retrenchments in the

South african banking sector since nedbank cut 10% of its workforce in 2004. Unlike its smaller rival six years ago, though, standard bank is profitable. Group ceo jacko maree says it is keen to cut costs to avoid being forced to take more drastic measures later and it is determined to reduce its cost-to-income ratio which has reached an "unacceptable" 58.1 per cent.

The cuts will only affect standard bank's head office in johannesburg and its london office. The plan was to lay off 270 employees in the UK and 1.745 people, 1.145 of whom permanent staff, in south africa - including 65 executives and 670 managers - based on "operational requirements and not individual performance".

After days of negotiations "just over 1,000 employees are now likely to be affected," according to suren reddy, director of employee relations at SB, even though "the final numbers cannot yet be determined".

But there could be more retrenchments to come, sim tshabalala, standard bank's SA ceo, said: "we do not have an organisation-wide plan, but we do not exclude the possibility of inefficiencies in pockets of the organisation," he said. "if there are inefficiencies and we are unable to preserve the profitability of the organisation, we will look at it again."

Sasbo itself seems to accept lay-offs are inevitable and damage limitation is the best it can hope for. "we are willing to speak about the numbers," eugene ebersohn, the union's assistant general secretary, said. "we might not get first prize, but second prize will do." but he vouched to keep the pressure on standard bank: "we are very interested to see what they are planning to do with their executives in terms of performance bonuses and increase, because that in itself could save a lot of money

U.S. Bank bonuses: $100, $400 checking, savings offers (many states)

Currently, you can take advantage of up to $500 bonus with a new checking & savings account.

They have over 3,000 locations branch locations in the following states: AR, AZ, CA, CO, GA, IA, ID, IL, IN, KS, KY, MN, MO, MT, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, and WY.

| Our current top promotions | |

| chase business complete banking SM $300 bonus | chase total checking ® $200 bonus |

| HSBC premier checking $450 bonus | HSBC premier checking up to $600 |

| HSBC advance checking $200 bonus | HSBC advance checking up to $240 |

| TD convenience checking $150 bonus | TD beyond checking $300 bonus |

| huntington 25 checking $500 bonus | huntington business checking 100 $200 bonus |

| huntington unlimited business checking $400 bonus | huntington unlimited plus business checking $750 bonus |

| aspiration $100 bonus | axos basic business checking $100 bonus |

| wise business banking $100 bonus | ally invest up to $3,500 bonus |

| webull 4 free stocks | BBVA free checking + savings $250 bonus |

US bank bonuses review

In 1863, U.S. Bank was established but known as the “first national bank of cincinnati”. Today, U.S. Bank is owned by US bancorp. U.S. Bank has 3,000+ locations and is one of the top banks in the nation in terms of assets.

- Promotion links:

- $400/$100 checking savings bonus (expires 12/14/2020)

- Account type: checking or savings account

- Availability: nationwide

- Branches: 2,900+ branches (bank locator)

- Credit inquiry:soft pull

- Direct deposit requirement:yes

Additionally, US bank has decent rates for cds and savings, but always check out our best rates for savings, money market, and CD accounts from the links below.

Furthermore, use our bank bonuses page to find other offers. Comparatively, some popular bank offers include chase bank, discover bank, TD bank, huntington bank, HSBC bank, and many more.

I’ll go over all U.S. Bank bonuses below.

US bank $400/$100 checking & savings bonus

US bank is offering $400/$100 bonus when you open a new US bank consumer checking or savings account. Then, you must complete all of their requirements.

- What you’ll get: up to $500 bonus

- $400 checking bonus

- $100 savings bonus

- Eligible account:platinum, gold or easy checking account, standard savings account

- Credit inquiry:soft pull

- Where it’s available: AR, AZ, CA, CO, GA, IA, ID, IL, IN, KS, KY, MN, MO, MT, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, and WY

- How to earn it:

- Earn $400 when you open a new platinum, gold, or easy checking account

- Complete qualifying activity

- Earn additional $100 when you open a new savings accounts

- Then complete qualifying activities

- When you’ll receive it: you will receive the bonus within 60 days of direct deposit verification.

- Monthly fee: varies by account, see below

(expires december 14, 2020)

Additionally, you can take advantage of some of the best offers available for entry level checking accounts such as chase total checking ® ( $200 bonus ), HSBC advance checking ( $240 bonus ), huntington 5 checking ( $200 bonus ), huntington asterisk-free ( $150 bonus ) as well as TD bank convenience checking ( $150 bonus ) are all great offers.

How to earn $400/$100 checking bonus

- Earn up to $500 bonus:

- $400 bonus:

- Open a new checking account and complete two recurring direct deposits by december 18, 2020. Bonus you receive depends on recurring direct deposits of two or more that total:

- $1,000-$1,999.99 to earn $100;

- $2,000-$4,999.99 to earn $200;

- $4,000 or more to earn $400

- Open a new checking account and complete two recurring direct deposits by december 18, 2020. Bonus you receive depends on recurring direct deposits of two or more that total:

- $100 bonus:

- Open a new savings account. There are two tiers (must deposit by december 21, maintain it through june 21, 2021):

- Make deposit(s) of $2,500 to $4,999.99 to earn $50

- Make deposit(s) of $5,000 to earn $100

- Open a new savings account. There are two tiers (must deposit by december 21, maintain it through june 21, 2021):

- $400 bonus:

- Easy checking:

- Easy checking simple snapshot (PDF)

- Consumer pricing information

- Deposit account agreement

- Gold checking:

- Free trades

- ATM transaction fees

- Overdraft protection transfer discount

- Family member accounts

- Platinum checking:

- ATM transactions

- Pays interest

- No fee overdraft protection transfers

- Waived paper statement fees

- Personal check discounts

- Family member accounts

- Gold checking: $14.95 monthly fee waived with:

- A U.S. Bank personal loan, line or credit card

- Platinum checking: $24.95 monthly fee waived with:

- $25,000 in combined personal deposits, investments, and/or credit balances

- A relationship with U.S. Bank trust services

- Easy checking: $6.95 monthly fee;

- Can be waived with any:

- Combined monthly direct deposits totaling $1000+

- Average account balance of $1,500

- Account holder(s) age 65 or greater

- Can be waived with any:

- Checking bonus:

- A minimum deposit of $25 is required to open a U.S. Bank checking account.

- To earn your $100, $200 or $400 bonus, open a new U.S. Bank consumer checking account (excluding student checking and safe debit account) from november 5 through and including december 14, 2020.

- Additionally, you must complete recurring direct deposits of two or more that total: $1,000-$1,999.99 to earn $100; $2,000-$4,999.99 to earn $200; $4,000 or more to earn $400 within 60 days of account opening and be enrolled in e-statements by december 18, 2020.

- The checking account bonus will be deposited into your new checking account within 60 days of direct deposit verification, and verification of enrollment in e-statements.

- The account must be open and have a positive balance.

- Bonus will be reported as interest earned on IRS form 1099-INT and recipient is responsible for any applicable taxes.

- Offer may not be combined with any other checking account bonus offers.

- Offer is not valid if you or any signer on the account have an existing U.S. Bank consumer checking account, had a U.S. Bank consumer checking account in the last six months, or received other U.S. Bank checking bonus offers within the past 12 months.

- Savings bonus:

- A $25 minimum deposit is required to open a new U.S. Bank standard savings account.

- To earn your $50 or $100 bonus, open a new U.S. Bank standard savings account from november 5 through and including december 14, 2020.

- Additionally, you must make deposit(s) of $2,500 to $4,999.99 to earn $50; $5,000 or more to earn $100 by december 21, 2020 then maintain a minimum total account balance of $2,500 or more to earn $50; $5,000 or more to earn $100 through june 21, 2021.

- The savings account bonus will be credited to your new savings account based on both balance date terms within 60 days after verification of the maintained balance.

- Offer is not valid if you or any signer on the account has an existing U.S. Bank consumer savings account, had a U.S.

- Bank consumer savings account in the last six months, or received other U.S. Bank savings bonus offers within the past 12 months.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

(expired) US bank $800 checking & savings bonus *in-branch*

US bank is offering a $800 checking bonus when you open a new US bank consumer checking or savings account. Then, you must complete all of their requirements.

- What you’ll get: $800 bonus

- Eligible account: platinum checking & savings account

- Credit inquiry:soft pull

- Where it’s available: AR, AZ, CA, CO, GA, IA, ID, IL, IN, KS, KY, MN, MO, MT, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, and WY

- How to earn it:

- $800 bonus when you open a new platinum checking package and platinum select money market savings account

- When you’ll receive it: you will receive the bonus within 60 days of direct deposit verification.

- Monthly fee: varies

(expires august 31, 2020, in-branch)

You can compare this offer to other advance checking accounts: chase private client ( $2,000 bonus ), HSBC premier checking ( $450 bonus ), huntington 25 checking ( $500 bonus ), as well as the TD bank beyond checking ( $300 bonus ).

How to earn $800 checking bonus

- $800 bonus when you open a new platinum checking package and platinum select money market savings account and complete the following activities:

- $400 bonus when you open a new platinum checking account and make two or more direct deposits that total $4,000 or more and enroll in estatements within 60 days of account opening

- $400 bonus when you open a new platinum select money market savings account and have $25,000 or more in deposit(s) by august 31st, 2020 and maintain a minimum total account balance of $25,00 or more through november 30th, 2020

- Platinum checking:

- ATM transactions

- Pays interest

- No fee overdraft protection transfers

- Waived paper statement fees

- Personal check discounts

- Family member accounts

- Standard savings:

- Online and mobile banking

- Automated savings options

- Estatments

- Overdraft protection

- Custom account alerts

- No ATM transaction fees

- Gold checking: $14.95 monthly fee waived with:

- A U.S. Bank personal loan, line or credit card

- Platinum checking: $24.95 monthly fee waived with:

- $25,000 in combined personal deposits, investments, and/or credit balances

- A relationship with U.S. Bank trust services

- Easy checking: $6.95 monthly fee;

- Can be waived with any:

- Combined monthly direct deposits totaling $1000+

- Average account balance of $1,500

- Account holder(s) age 65 or greater

- Can be waived with any:

- Platinum money market: no monthly maintenance fee

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

- This offer can’t be combined with other offers.

- It’s not valid if you or other signers on the account has an existing U.S. Bank consumer checking account.

- FDIC insured

(expired) US bank $300 savings bonus

To earn this $300 bonus, open a new savings account, and meet all of their requirements.

- What you’ll get: $300 bonus

- Eligible account: savings account

- Credit inquiry:soft pull

- Where it’s available: in-branch only, no online link.

- How to earn it:

- Open a new savings account

- Make a direct deposit of at least $10,000 and uphold that balance for about 3 months after funding

- Use a promo code to sign up ELITE MONEY MARKET SP20

- When you’ll receive it: receive your bonus offer after you’ve met all of their requirements.

- Monthly fee: yes, check how it can be waived below.

(there’s no direct link for this offer)

Compare this savings account to alternatives like chase savings SM ($150 bonus), american express high yield savings, axos bank high-yield savings, and simple account.

How to earn $300 savings bonus

- Open a new savings account

- Make a direct deposit of at least $10,000 and uphold that balance for about 3 months after funding

- Use a promo code to sign up ELITE MONEY MARKET SP20

- Online and mobile banking

- Automated savings options

- Free estatements

- No ATM transaction fees

- Optional overdraft protection

- Receive account notifications

- Avoid the $4 monthly fee for the standard savings account by:

- Having a $300 minimum daily balance or

- $1,000 average monthly balance or

- If you’re under 18 years old.

- All bonuses for these bank accounts will be seen as income or interest. So you have to pay taxes for them as well.

US bank credit cards

You'll earn 4X points on takeout, food delivery & dining; 2X points at grocery stores, grocery delivery, gas stations & on streaming services; 1X point per $1 on all other eligible purchases.

In addition, you'll get $15 credit for annual streaming service purchases such as netflix and spotify.

There is no annual fee with this card.

The U.S. Bank cash+ TM visa signature® card offers new cardmembers a $150 bonus after spending $500 in eligible net purchases in the first 90 days of account opening.

You'll be able to earn 5% cash back on your first $2,000 in eligible net purchases each quarter on the combined two categories you choose. In addition, 2% cash back on your choice of one everyday category, like gas stations or grocery stores; 1% cash back on all other eligible net purchases. All with no limit on total cash back you can earn.

This card comes with no annual fee.

You'll earn 2X points per dollar spent on eligible net purchases made in the top two categories where you spend the most each month - automatically; 1X points per dollar spent on all other eligible net purchases. There are no caps or limits on the total points you can earn with the opportunity to more rewards when you link your card to your U.S. Bank payment processing account. Only U.S. Bank rewards you for both taking payments and making purchases learn more at usbrelationshiprewards.Com.

There is no annual fee for the first year, $95 thereafter. You'll also get free employee cards.

You'll earn 1% cash back on other eligible net purchases with no limit on total rewards and they never expire! Plus, a 25% annual cash rewards bonus, up to $250.

There is no annual fee and you'll get free employee cards.

Conclusion

These are all the current offers from U.S. Bank. We will continue to update you with the latest coupons and the best promotions U.S. Bank has to offer.

Feel free to leave a comment below if you have experience with this bank! Your feedback is highly appreciated and makes our site even better!

What you need to know about salaries and bonuses at standard chartered in singapore

If you’re looking for a front-office banking job in singapore, standard chartered is probably fairly high on your list of potential employers. Singapore is the bank’s asian headquarters and is home to many of its regional and global heads.

Stan chart made 27% of its global operating income from the region directly served by singapore – ASEAN and south asia – in the first quarter (asia as a whole contributed 67%). And stan chart is always hiring in the hundreds in singapore, no matter the time of year. It has more than 300 local vacancies on its careers website right now.

But while stan chart has plenty of open positions in singapore, how much might it pay you if you land a front-office job in its corporate and institutional banking (CIB) division? Every job offer will come with a different compensation package, but to find some average figures, we examined standard chartered salary and bonus data on glassdoor. We did this across the five broad seniority levels that the website had sufficient data for.

We only looked at high-range singapore salaries at standard chartered, because they reflect the earnings of front-office bankers within CIB (rather than, for example, people working in retail banking). The results (which are approximate rather than definitive) are displayed in the table below.

A spokesperson for standard chartered declined to comment on CIB compensation in singapore.

How much are average salaries at standard chartered in singapore?

Front-office analysts in CIB at standard chartered in singapore earn annual base salaries of about S$100k on average, although that figure would vary according to whether they are first, second or third-year analysts. Their pay rises to approximately S$125k once they reach associate rank, according to glassdoor.

Vice presidents and associate directors earn salaries about S$170k and S$190k, respectively. It’s at associate director level that standard chartered’s bonuses start to rise – they can potentially reach about S$160k, according to glassdoor, although that would partly depend on personal performance.

If you reach director level at standard chartered in singapore, you could potentially earn S$450k in total compensation, including a base salary of approximately S$300k.

Regardless of your salary at standard chartered in singapore, now may be a good time to join the firm. Standard chartered’s first quarter results have been hailed as proof that CEO bill winter’s turnaround strategy is starting to work. The bank has announced a new $1bn share buyback, a 10% rise in quarterly profit, and (crucially) a 2% fall in operating expenses.

Corporate and institutional banking salaries and bonuses at standard chartered in singapore

Image credit: tkkurikawa, getty

Have a confidential story, tip, or comment you’d like to share? Email: smortlock@efinancialcareers.Com or telegram: @simonmortlock

We are on telegram! Join us now

so, let's see, what was the most valuable thing of this article: thousands of global open positions in financial services, investment banking, fintech and more. Browse news and career advice from the finance industry. At standard bank bonuses

Contents of the article

- Free forex bonuses

- Standard bank allowed to retrench and pay bonuses

- Standard bank promotions: $25, $100 checking,...

- About standard bank promotions

- Standard bank $25 referral bonus

- Standard bank $100 business referral...

- Standard bank $194 checking bonus...

- Bottom line

- Banca de particulares

- Benefícios para si

- Standard bank bonuses: $25, $100 checking,...

- What you need to know about salaries and bonuses...

- Standard notes...

- Email this article

- Article enquiry

- Embed video

- Standard notes SARB’s hold-back advice on...

- Standard bank allowed to retrench and pay bonuses

- U.S. Bank bonuses: $100, $400 checking, savings...

- US bank bonuses review

- US bank $400/$100 checking & savings...

- (expired) US bank $800 checking & savings...

- (expired) US bank $300 savings bonus

- US bank credit cards

- Conclusion

- What you need to know about salaries and bonuses...

No comments:

Post a Comment