List of best forex brokers

Brokerage companies are scattered all over the world and have many differences in trading conditions, products and services.

Free forex bonuses

Some companies are regulated, others are not. Some have been around for decades, others are rather young. Certain brokers work as market makers and have fixed spreads, others provide STP or ECN accounts with direct market access and offer a much larger selection of underlying assets for trading. This site was created to help you find the best forex brokers for your specific needs and requirements. There are several sections and filters in the menu on the left. These can be used to create a custom list of entities with preferable parameters and characteristics. If you find a certain broker you are currently trading with or have used before, feel free to share your experience about it in the comments section meant for forex broker reviews. Customer support can now be offered using a variety of means that were not in existence 10 years ago. Social media channels such as facebook and twitter, as well as messaging apps such as telegram can now serve as channels for receiving near-immediate responses from a broker’s customer support desk. Choose a broker with a diversified customer support structure which deploys these new means of communication.

Best forex brokers for 2021

Brokerage companies are scattered all over the world and have many differences in trading conditions, products and services. Some companies are regulated, others are not. Some have been around for decades, others are rather young. Certain brokers work as market makers and have fixed spreads, others provide STP or ECN accounts with direct market access and offer a much larger selection of underlying assets for trading. This site was created to help you find the best forex brokers for your specific needs and requirements. There are several sections and filters in the menu on the left. These can be used to create a custom list of entities with preferable parameters and characteristics. If you find a certain broker you are currently trading with or have used before, feel free to share your experience about it in the comments section meant for forex broker reviews.

The forex brokerage business has undergone a lot of evolution in the last decade. The global financial crisis of 2008 and the events that happened thereafter have reshaped the industry. At about the same time, new technologies came up and also contributed to the evolution of the forex market and forex brokerage business. It is important for traders to understand what forex brokerage is all about and how it will affect their trading ventures. Before we get to meet the best forex brokers for 2021, it is pertinent to identify the role that forex brokers play in a trader’s career and why it is important to go with a forex broker that can match your circumstances and aspirations.

Role of forex brokers

Forex brokers have several roles to play in the market. These roles have also evolved over time, as traders demand a lot more from their trading providers. Forex companies now perform the following roles:

A) access to the market

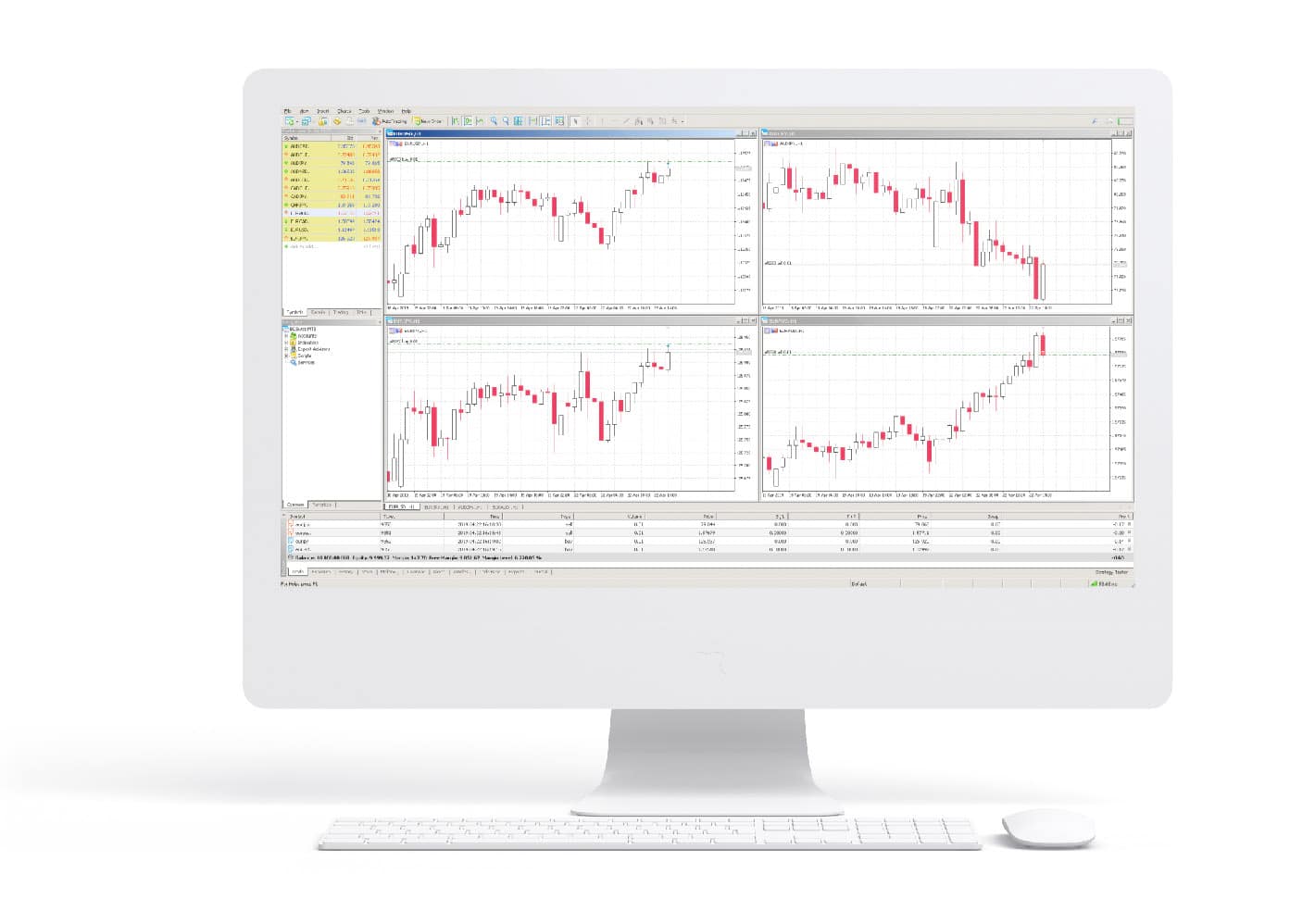

This is the core role of the forex broker. The forex market is a virtual market with no physical location. At the centre of forex market operations is the interbank market, where the big banks offer various currency pairs for sale. Professional and individual traders therefore do not have to proceed to a physical location to trade, but rather have to have a means of accessing the interbank market. They can only gain access to the interbank forex market using software known as platforms. These platforms are provided by the forex brokers. So without the brokers, nobody can get access to the forex interbank market to trade.

Access can be provided directly using the ECN/STP platforms (also known as direct market access platforms), or indirectly using the market maker platforms that route orders to the broker’s dealing desk. Traders should as much as possible, try to understand the implications of getting direct access to the FX market on one hand, and getting indirect access on the other. The type of access granted will determine factors such as amount of capital to start with, as well as the trading styles and processes to be adopted.

B) trader education

This is gradually but surely becoming a very important element of the forex broker’s functions. Research has shown that 90% of retail traders will lose 90% of their accounts in 90 days. This is a well-established market statistic. Majority of the losing traders (if not all) are traders who are uneducated about the market and who do not understand how to trade profitably. These will end falling by the wayside. No broker wants to spend money acquiring clients, only to have them quit the market after decimating their accounts in 90 days. With brokers realizing that such an arrangement is not good for business in the long run, many of them are now investing significantly into trader education. Videos, articles and webinars are the common means by which beginner traders are given an introduction into the forex market.

C) market research

Once traders get established on the platforms using trader educational resources, their trading activities can be sustained via the provision of market research tools, analysis and news feeds. Many brokers have incorporated this into their offerings as well. For the trader, this is a good thing.

Criteria to consider in choosing a forex broker

The criteria for choosing a forex broker have evolved over the years. While there are still some elements that are critical to the choice and which have remained constant over time, there are other parameters which have emerged and which will be considered below.

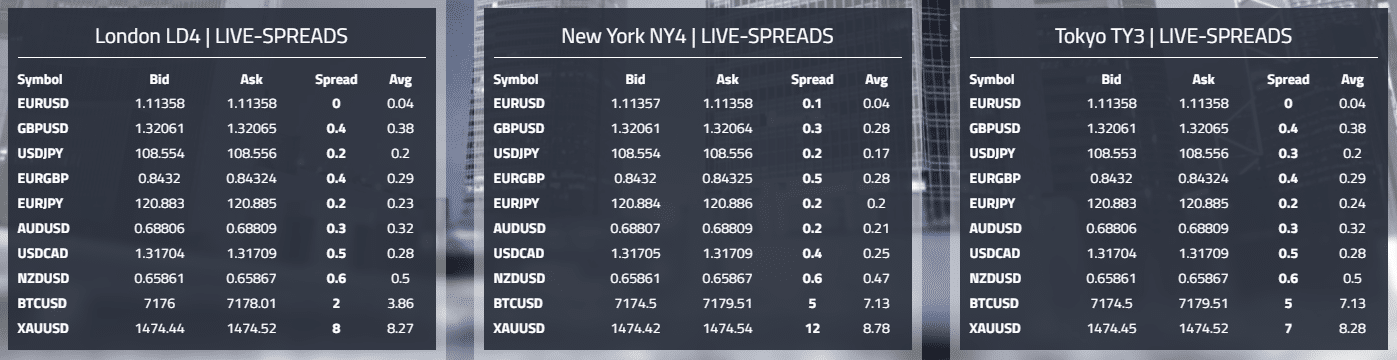

1. Spreads/commissions

Spreads are the primary cost to the trader. Lower costs mean that the trader will have a chance to retain more profits, or at least reduce the losses that may be incurred. Competitive spreads are now a factor used in broker selection. It may not be immediately obvious how much savings on spreads can translate to, but high volume traders such as scalpers know that when up to 300 trades are placed in a month, then savings from reduced spreads can be substantial.

2. Leverage

Leverage in forex is now a big deal. What started off in 2010 when leverage caps were introduced in the US by the commodities and futures trading commission (CFTC), has now been extended into the united kingdom and europe. Retail traders in the UK and EU have seen leverage caps reduced from as high as 1:500, to just 1:30 for major forex pairs. Minor pairs and cfds have even tighter leverage limits. This has increased margin requirements significantly. However, some brokers outside these jurisdictions have continued to maintain the high leverages, thus attracting traders who were caught out by ESMA’s decision. Some of the UK/EU brokers have also opened international divisions, where their international client accounts are being migrated to. So traders now have a choice of operating with the low leverage brokers, or the high leverage ones.

3. Regulation

Regulation will continue to remain a key factor in broker selection. Regulation ensures that traders are protected and that the trading environment is transparent and secure. The brokers presented on this site are regulated in their respective areas of operation, which ensures that traders who open accounts with them are assured of safety of their funds.

4. Broker type

A mention has earlier been made about direct and indirect access to the interbank market. As a trader, you need to know how each type of access will affect you. Market makers provide indirect access because they buy positions from the interbank market and resell them to their clients using a dealing desk. Market makers usually require smaller amounts of starting capital, provide fixed spreads, and tend to have more slippages and requotes. They provide a low barrier for market entry.

ECN brokers on the other hand, provide direct market access. They require large amounts as initial capital, provide variable spreads, but do not have slippages and requotes. However, they charge commissions on trades in addition to spreads. At the end of the day, the trader’s financial capacity will determine if a market maker or an ECN broker will be selected for the trading venture.

5. Trading resources

Trading resources are generally tools that are provided by a broker to enhance the trading experience and potentially improve a trader’s trading outcomes. More is not always better. In this case, it is about finding the broker that has the right mix of trading resources that cover analysis, news and market insight.

6. Customer support

Customer support can now be offered using a variety of means that were not in existence 10 years ago. Social media channels such as facebook and twitter, as well as messaging apps such as telegram can now serve as channels for receiving near-immediate responses from a broker’s customer support desk. Choose a broker with a diversified customer support structure which deploys these new means of communication.

Our list of forex brokers

The list below features best forex brokers selected by us for 2021 year. This list has been prepared after due consideration of all the factors mentioned above. In this list, you will find many brokers that are offshore brokerages with high leverage, or offshore divisions of EU/UK brokerages that can provide high leverage trading platforms to their clients. Feel free to read our forex broker reviews and make an informed choice based on the contents of this website.

Top 7 of best US forex brokers for 2021

Top rated:

Are you searching for the best US forex brokers?

Luckily, our team of professional forex broker reviewers can take care of your every need.

Let alone the best forex broker in USA, our team realizes it is tough to find any broker which offers a trustworthy, and still value for money proposition when you want to trade forex in the USA. Forex brokers accepting US clients may be few and far between, but we have combined years of experience to narrow your selection down to the top five brokers.

These five are among the best forex brokers USA has to offer.

In fact, they are some of the best forex brokers for residents of any country. These brokers will ensure you feel safe, secure, and still have the ability to prosper in your trading career. They have been selected as the best US forex brokers for a variety of reasons.

Among these reasons are the amount of trading support they offer you, they wide range of markets and instruments that are available for trading, and the very competitive pricing and fee structure offered by these top forex brokers.

Table of contents

Is forex trading legal in the USA?

As a forex trader in the US, one of the most important questions you may be asking yourself from the outset surrounds the legality of forex trading in the US. Well, we are pleased to tell you that yes, forex trading is legal in the US. In fact, the US has several top financial regulators providing the best protection to you as a trader. These bodies are FINRA, the SEC, CFTC, and NFA with the latter two being the main regulators when it comes to forex trading and trading in derivatives such as futures. Remember also that cfds trading in the US is not permitted.

How to trade forex in the USA

The process of getting started with a forex broker in the US is typically similar to that of any other country. With any top broker you will usually be asked for the following information:

- Proof of identity. A passport is typically best for this purpose.

- Proof of residence, usually in the form of a bank statement at your current address.

Once these documents are uploaded and verified, a process that takes most forex brokers just a few minutes, you will be free to get started trading forex.

Top 7 forex brokers in the USA listing for 2021

Here’s our list of the best US forex brokers:

1. Forex.Com

When it comes to US forex brokers, forex.Com has to be an immediate consideration for opening your forex trading account in the USA. They are CFTC licensed and NFA regulated (#0339826) and provide a selection of flexible and accessible account types with low spreads starting from 0.2 pips, including their direct market access account. This offers some of the most unbeatable spreads among any of the forex trading brokers USA. They also provide extensive trading options in all of the top forex currency pairs, metals including gold and silver, as well as futures trading. When it comes to forex brokers accepting US clients, forex.Com certainly offers among the most comprehensive range of services to their US-based traders.

The forex.Com minimum deposits starting form $1000 on standard, and commission accounts, and $25,000 on DMA accounts with demo accounts available. There are also a range of other great benefits such as cash rebates and reduced or no fees for active traders.

2. IG markets

With over 40-years in the industry, IG markets is a true pioneer of the industry, and among the most long standing forex brokers accepting US clients. The broker has evolved continually, keeping the requirements of US-based traders as a top priority. These can be traded on MT4, the mainstay trading platform for top US forex brokers and traders from all around the world as well as being both CFTC licensed, and NFA regulated (#0509630). IG markets offers one type of account to all traders and this has a minimum deposit requirement of $250.

Accessibility with IG is also excellent, you can engage with a number of top professional charting packages using your desktop, phone, or other smart device. Beyond the USA, IG markets also featured in our top 10 largest forex brokers australia. This showcases their global appeal to traders. This appeal is further enhanced by a great cost of trading on more than 90 forex pairs with spreads starting at 0.8 pips.

3. Interactive brokers

You will very often find interactive brokers among our lists of top forex brokers. This is also true when it comes to our choice of top US forex brokers. This is thanks to a number of positive aspects which the longstanding broker uses to attract clients around the world. These include an excellent proprietary trading platform which offers some of the most advanced trading tools available on any market, and a widespread list of products which are available at highly competitive rates. These products include currencies, options, metals, and indices within a list which is ever increasing. IB are a FINRA member and regulated by both the CFTC and NFA (#0392970), as well as the SEC (#8-47257).

They have two account types, you can choose the IBKR lite, or IBKR pro both at no minimum deposit though the pro account has a $10 maintenance fee. As mentioned the product range is excellent as is the trading cost with spreads from 0.1 pips on 105 forex pairs. All of these features make IB a top choice particularly for experienced traders.

4. Oanda

Oanda is also making progress toward becoming the best forex broker in the USA. The industry leader is making progressive inroads in the US market, and now offers trading in more than 70 diverse forex currency pairs. This is more than enough for you to trade successfully. Added to this, you can also benefit from the powerful educational and research infrastructure oanda provides. This includes marketpulse, a selection of news, technical analysis, and research resources which are provided by the in-house oanda team. This can combine perfectly with our own online investment guides and educational content. Oanda are also well-regulated by both the CFTC, and NFA (#325821) offering traders two account types.

The standard account type is attractive thanks to the fact it has no minimum deposit, while the premium account requires a $2,000 minimum deposit but has benefits like lower spreads and other costs. An unlimited oanda demo account is also available. The broker also use the much respected MT4 trading platform for trading in all 70 forex pairs and more at a very competitive spread starting from 0 pips. All traders but particularly newer ones, seem to fit well within oanda.

25 best UK forex brokers for 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

Trading forex (currencies) in the united kingdom (UK) is popular among residents. Before any fx broker can accept UK forex and CFD traders as clients, they must become authorised by the financial conduct authority (FCA), which is the financial regulatory body in the UK. The FCA's website is FCA.Org.Uk. We recommend UK residents also follow the FCA on twitter, @thefca.

The FCA was formed out of the financial services act of 2012, effectively replacing its predecessor, the financial services authority (FSA). For a historical breakdown, here's a link to financial conduct authority webpage on wikipedia.

Best UK forex brokers for 2021

To find the best forex brokers in the UK, we created a list of all FCA authorised brokers, then ranked brokers by their trust score. Here is our list of the top UK forex brokers.

- IG - best overall broker 2021, most trusted

- Saxo bank - best for research, trusted global brand

- CMC markets - best web platform, most currency pairs

- Interactive brokers - great for professionals and institutions

- City index - excellent all-round offering

- XTB - best customer service, great trading platform

- FOREX.Com - great all-round offering

- Etoro - best copy trading platform

Best forex brokers UK comparison

Compare UK authorised forex and cfds brokers side by side using the forex broker comparison tool or the summary table below. This broker list is sorted by the firm's forexbrokers.Com trust score.

| Forex broker | accepts GB residents | authorised or regulated by the FCA | average spread EUR/USD - standard | minimum initial deposit | trust score | overall | visit site |

|---|---|---|---|---|---|---|---|

| IG | yes | yes | 0.745 | £250.00 | 99 | 5 stars | visit site |

| saxo bank | yes | yes | 0.800 | $10,000.00 | 99 | 5 stars | visit site |

| CMC markets | yes | yes | 0.740 | $0.00 | 99 | 5 stars | N/A |

| interactive brokers | yes | yes | N/A | $0 | 94 | 4.5 stars | visit site |

| city index | yes | yes | 1.100 | £50.00 | 93 | 4.5 stars | visit site |

| XTB | yes | yes | 0.860 | $0.00 | 92 | 4.5 stars | visit site |

| FOREX.Com | yes | yes | 1.400 | $100.00 | 93 | 4.5 stars | visit site |

| etoro | yes | yes | 1.00 | $200 | 91 | 4 stars | visit site |

| swissquote | yes | yes | N/A | $1000.00 | 99 | 4 stars | N/A |

| FXCM | yes | yes | 1.400 | £300 | 92 | 4 stars | N/A |

| avatrade | yes | 0.910 | $100.00 | 93 | 4 stars | visit site | |

| FP markets | yes | 1.140 | $100 AUD | 81 | 4 stars | visit site | |

| plus500 | yes | yes | 0.600 | €100 | 98 | 4 stars | N/A |

| pepperstone | yes | yes | 1.160 | $200.00 | 90 | 4 stars | N/A |

| IC markets | yes | 0.800 | $200 | 83 | 4 stars | visit site | |

| tickmill | yes | yes | 0.530 | $100.00 | 81 | 4 stars | visit site |

| fxpro | yes | yes | 1.510 | $100.00 | 89 | 4 stars | visit site |

| vantage FX | yes | yes | 1.350 | $200 | 79 | 3.5 stars | N/A |

| moneta markets | yes | yes | 1.300 | $200.00 | 79 | 3.5 stars | N/A |

| HYCM | yes | yes | 2.00 | $100 | 84 | 3.5 stars | visit site |

| eightcap | yes | $100 | 69 | 3.5 stars | N/A | ||

| VT markets | yes | 1.30 | $200 | 79 | 3.5 stars | N/A | |

| blackbull markets | yes | 0.76 | $200 | 70 | 3.5 stars | N/A | |

| octafx | yes | 1.100 | $5 | 59 | 3.5 stars | N/A | |

| hotforex | yes | yes | 1.20 | $50 | 83 | 4 stars | N/A |

| easymarkets | yes | 0.900 | $100.00 | 81 | 3.5 stars | N/A |

How to verfiy FCA authorisation

To identify if a forex broker is licensed to operate in the united kingdom (UK), the first step is to identify the register number from the disclosure text at the bottom of the broker's UK homepage. For example, here's the key disclosure text from IG's website,

Both IG markets ltd (register number 195355) and IG index ltd (register number 114059) are authorised and regulated by the financial conduct authority."

Next, look up the firm on the FCA website to validate the register number is, in fact, legitimate. Here is the official FCA page for IG markets limited.

Summary

To recap, here are the best UK online forex brokers.

More forex guides

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

OANDA - cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909).

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

List of the best 23 forex brokers | trusted reviews

Are you looking for a good and serious forex broker? – then this page is the right place for you. Thanks to the large selection on the internet it is often difficult to make the right decision. With more than 7 years of experience in the financial markets, we present you with the best providers with top service and without hidden costs. Find out in the following texts how to select a secure forex provider and which online broker offers the best conditions.

| Broker: | review: | regulation: | spreads: | assets: | advantages: | open account: |

|---|---|---|---|---|---|---|

| 1. Bdswiss | (5 / 5) ➜ read the review | cysec, FSC | starting 0.0 pips + $ 2.0 commission per 1 lot | 250+ (50+ currency pairs) | + individual offers + trading signals + raw spreads + leverage up to 1:500 + best education + personal support |

Watch our full video review about the best forex brokers (risk warning: your capital is at risk):

Strict criteria for the forex broker review

In contrast to many other comparison sites, we present you on this website only the safest providers with the best conditions for traders. As experts with many years of experience, we have tested many forex brokers and still use some of them. A good provider should have certain characteristics that guarantee good and safe investing.

It is not uncommon to hear of fraud on the internet. This is to be avoided by this comparison. In addition, one would like to save on charges as a trader because the costs for the trade reduce of course the actual profits. Also, the security of customer’s money is of high priority. A regulation or license, for example, is urgently needed for secure trading with international brokers. All these criteria and many more are included in the test. Therefore we can present you on this page the best forex brokers in a list.

Proven facts for a good forex broker:

- Regulation and license of an official finance authority

- High safety of customer funds

- Fast and reliable market execution

- Small forex trading fees and no hidden fees

- No requotes (high liquidity)

- User-friendly trading platform

- Free and unlimited demo account

- Professional support

- Fast deposit and withdraw methods

How does a forex broker work?

A forex broker is an intermediary between a client (trader) and the interbank market for currencies (wikipedia). In addition, the broker can lend capital to the trader so that he can trade with leverage. The broker’s income is generated by the spread and the cost of financing the leveraged positions.

There are 2 different models of brokers: market maker and ECN/NDD broker

Example of live spreads for forex brokers

Market maker:

This broker does not place the trader’s orders directly into the real interbank or spot market. There is an internal matching system between the positions of the traders. Of course, the broker can hedge himself on the real markets so that there are no distortions in supply and demand. In most cases, this system can be opaque, and only as a broker employee, you know the exact functions. A market maker forex broker is not bad or scam. Nowadays, most providers offer good and exact executions.

ECN/NDD (no dealing desk) broker:

ECN and NDD mean direct access to the interbank market through various liquidity providers. These are large banks or very large forex brokers. The provider places the trader’s orders directly into the real market. So the customers get direct and real market prices for trading. With this model, there is no conflict of interest between trader and broker. Zero (no) spread accounts are offered.

Warning: only trade with regulated and licensed forex brokers

Security has the highest priority in online trading. When it comes to trading leveraged financial products, you have to be able to trust the forex broker. It is not uncommon for large sums of money to be used to generate a large profit. For example, brokers in europe must have regulations or licenses if they want to offer their services. The regulation can be in any european country. The same or almost the same requirements apply to brokers everywhere. In order to avoid fraud, it is important to look for such a license.

Licenses are only issued under certain conditions and criteria. If a broker violates these conditions, the license may be withdrawn immediately. All tested companies of mine are always concerned to keep the highest criteria and to guarantee a safe trade. Many brokers, for example, are regulated in cyprus. This has tax advantages. Nevertheless, there are also forex brokers with more than one regulation. The various regulatory authorities can be seen in the table above.

Facts of reliable and secure companies:

- Regulation and license

- Separated customer funds

- Regulated deposit and withdrawal methods

- Using well-known banks

- Large liquidity providers

Another important point for serious trading is the security of customer funds. Payouts of winnings or the deposited amount should work smoothly. It was not uncommon for some brokers to speculate on customer funds themselves. In the end, withdrawals were refused or delays occurred.

How risky is forex trading?

Forex trading is managed by leveraged financial products. That means you are able to trade a bigger contract size than the amount of money in your account. Some brokers offer the leverage up to 1:3000. Many traders are afraid of the obligation to make margin calls and this is not without reason as the past has shown. Account balances could slip into the negative balance. This is possible due to extreme market situations and too large a position size in relation to the account balance.

The providers shown above all have no obligation to make additional contributions (except IC markets and vantage FX). With the providers in the upper table, you are therefore protected against such a scenario. In our experience, this can only happen if the account is too heavily leveraged. You should always beware of sensible risk management.

Beginners should always start with the free demo account to practice forex trading.

A demo account is essential for successful trading. The trading column form and conditions can be tested extensively with this account. It is a virtual credit account that simulates real money trading. It can be traded without risk. This means that new strategies can be developed or new markets tested. The demo accounts of the compared providers are completely free and unlimited. This account is best suited for entry into forex trading.

How to deposit and withdrawal money:

For most traders, the first deposit into their account is very exciting. It should work smoothly and be highly secure. Forex brokers offer well-known and proven payment methods. Capitalize the trading account with electronic methods (credit card, e-wallet, paypal, crypto) or with the classic way of bank transfer. Electronic methods work in real-time and the money is credited directly to the trading account. Trading can be started immediately. The minimum deposit at the compared brokers is very low. For example, you can open an account from as little as 1$. If this is worth it, you have to decide for yourself. There are no fees for deposits.

Example of payment methods of a forex broker

The payout is also very uncomplicated. With a few clicks, you can request a withdrawal on the menu. This is then released in 1-3 working days. However, most brokers payout customer money in less than 24 hours. All presented brokers passed this test. The fees can be high for small payouts. With payments over 200$, the most forex brokers take over the fees but some brokers do not charge any commissions.

Facts about the payments:

- Instant deposit of money

- Fast withdrawal within 1 – 3 working days

- Electronic methods (skrill, neteller, paypal, and more)

- Cryptocurrencies

- Bank wire

Not every country is available for forex trading

Not every country is available for forex brokers and trading. This is because there are some restrictions and special regulations. For example, in some countries, an international broker needs a special license for that specific country. So it is too much afford for some companies to get the license and they stop taking clients from these countries. You can clearly see on the homepage which clients they accept. Not many brokers accept clients of the united states of amerika.

From my experience, the fastest-growing countries are in africa and asia. Because of the development of mobile internet, more people get connected to the forex market. India, nigeria, philippines, malaysia, and china are at the moment the fastest-growing countries.

Is forex trading legal?

Forex trading is fully legal if there is not any ban from the government. Forex trading is just changing money into another currency. This is not an illegal practice. The brokers on my review got official regulations so they act fully legal.

Review conclusion: start trading with a reliable forex broker

On this page, we have presented you with our current list of the top 23 forex brokers in comparison. Now you have a selection of good and reputable companies in front of you. It was particularly important to us that we only present providers here, which we have tested by ourselves with real money. This is not the case with most comparisons.

Profit now from the most favorable fees and the best conditions by my experience of many years. With these providers, you are 100% safe and can take your forex trading to the next level.

We hope you could learn something in this comparison and act now with better providers through my recommendations. If you can’t make up your mind, please also read the reviews.

Successful forex trading requires a good and reliable broker. In this review, we showed you the top 23 secure forex brokers. Now you can choose your professional trading partner.

ECN forex brokers

ECN or electronic communication network is a technology bridge built with the purpose to links retail forex market participants or traders to liquidity providers. So eventually ECN is a non dealing desk bridge with straight-through processing execution that enables execution in a direct connection between the parties. Read more about ECN through wikipedia.

What is ECN broker?

So ECN brokers automatically match requested trading orders to sell or buy at the best available price from available market participants (learn about NASDAQ market participants), while at some time EUR USD spread maybe even 0 pip.

Apart from the competitive trading costs and due to its functions ECN technology also results in extended trading time too, along with high efficiency for automated trading and a variety of strategies suitable for both retail or institutional traders. Besides, ECN execution cannot cause any misunderstanding between the trader and the broker as its interbank connectivity brings transparent trading conditions.

What is ECN fee?

The trading brokers offering ECN account and connection usually offer an interbank spread from 0.0 pips and do charge a fixed commission per lot as a trading cost or fee.

ECN vs standard account

Unlike forex market maker brokers offering standard account that typically charge fixed spread for forex trading added above the quotes you can see via trading terminal, the ECN working with commission fee model. It means, typically there is no commission charge for standard accounts, but a spread only basis while ECN costs split between the interbank spread from 0 pip and commission charge per lot.

- Depending on the strategy you deploy ECN spreads from 0 pips does not necessarily mean lower trading costs, as for particular strategies fixed or variable spread as a trading fee is a much better option. ECN brokers and technology indeed more suitable for experienced traders, professionals or those that operate bigger sizes. While the standard account and market maker execution model might be a good option for beginning traders, for some strategies and regular size traders.

Best ECN forex broker

Firstly, the best ECN broker is a heavily regulated broker, as it is a trustable one in which you would not worry about necessary compliance and safety measures towards your money. The only way to trade with a true ECN broker is to select among the broker with the confirmed regulatory status along with its strong legit obligations. Learn about different type of brokers through SEC website.

Like the regulated brokers you will find in the listing below offers some of the best ECN trading conditions along with applicable standards of operation, transparent conditions and privacy policy.

- GO markets– best overall ECN broker 2020

- FP markets – lowest spread ECN broker 2020

- Exness – best MT4 ECN broker 2020

- XM – best ECN broker for beginners 2020

- Pepperstone– best for scalping and EA ECN 2020

ECN forex brokers list

These are the regulated brokers that offer ECN trading:

Best forex brokers in nigeria for 2021

We compared & then selected the 8 best forex brokers in nigeria that are regulated with FCA (UK), cysec & FSCA.

Forex trading is a popular financial instrument for investing in the markets. However, choosing the right forex broker can be a tricky task.

In a rapidly developing country such as nigeria, there are so many good brokers, but there are also a lot more scam brokers operating in the market. So it is really important to only choose trusted & regulated nigerian forex brokers and avoid the bad ones.

In order to help you find the best forex broker, we have tracked & compared over 10 different brokers that accept nigerian investors.

List of 8 best regulated forex brokers in nigeria for 2021

There are various aspects that we looked into in order to assess each broker, these include the broker’s compliance with multiple top-tier regulations, broker reviews, the amount of fee charged (even the hidden charges), leverage offered, minimum deposit, funding & withdrawal methods and time taken etc.

Our below vetted list is created especially for nigerian traders; it will quickly allow you to compare the key features that you need to look for in any reputed forex broker.

Best forex brokers in nigeria

Here’s our updated list of the 8 best performing forex brokers in nigeria in terms of trading & non-trading fees, promptness of deposits & withdrawals, trade execution, support & deposit bonus (last 6 months):

1. FXTM – best forex broker in nigeria (instant order execution, low deposit & easy withdrawals)

Overall rating 9/10

- Fees: 1.9 pips average spread for EUR/USD with standard account. And 0.3 pips (plus $0.4 per mini lot) with ECN MT5 account.

- Account minimum: ₦2000 or $10 (cent account)

- Leverage: 1:1000

- Promotion: no deposit bonus available currently

Ranks #1 forex broker in nigeria

Forextime or FXTM is the best forex broker in nigeria, and they are one of the few forex brokers that has local office & phone number in nigeria. They are safe for nigerian traders as they are regulated under various trusted jurisdictions such as the FCA in UK, cysec in cyprus, FSCA and FSC of mauritius. FXTM is our recommended forex broker for nigerian traders.

FXTM’s was founded in 2011 & they are a FCA regulated forex broker, which is a top tier regulation, so we consider them to be a safe broker. They offer various account types, all of them can be funded in USD or naira & have very low minimum deposit requirements starting from just ₦2000 with the cent account. This makes FXTM a very good choice for nigerian traders.

Apart from forex trading, FXTM also offer other instruments such as cfds on commodity futures and cfds on spot metals making them a very attractive choice for traders looking to diversify their portfolio. They have also recently upgraded its range of currencies & now offer 57 major & minor currency pairs.

Another important factor that we look for in a broker is their promptness of support & withdrawals, and FXTM beats other brokers hands down in this area.

FXTM broker offers local customer support in english & has 19 deposit & withdrawal options which includes many methods for nigerian traders including bank deposit & card payment. Even allows users to create a demo account in order to build their confidence and learn the art of trading. FXTM also offers a wide range of educational material to its clients, including trading webinars.

- FXTM is a highly regulated forex broker, so trading with them is safe. They are regulated globally with 3 top tier regulators i.E. FCA(UK), FSCA & cysec.

- You can start trading with ₦2000 deposit, making them a good option for new traders.

- Low spreads for most major & minor currency pairs including EUR/USD with ECN MT5 account.

- Fast withdrawals in nigeria.

- Live chat support is available 24/5 & for few hours during weekends. Their support overall is quite good.

- FXTM has bit higher spread with their standard accounts compared to other brokers. For ex. Their typical EUR/USD spread with standard account is around 1.9 pips on average, but its still competitive.

2. Hotforex – best regulated forex broker with low spread & 100% deposit bonus

Overall rating 9.0/10

- Typical fees: 1.2 pips spread for EUR/USD with micro account & 0.3 pips with zero account. This would be variable depending in the market conditions.

- Account minimum: $5 (₦2000)

- Leverage: 1:1000

- Promotion: get 100% bonus on new deposits with at-least ₦30,000 deposit required.

Ranks #2 forex broker in nigeria

Hotforex is our recommended low cost broker for nigeria. They have a local office & phone support in nigeria & are a highly regulated broker (FCA, FSCA & cysec). They are a 100% STP broker which ensures very fair dealing. Plus they offer very good order execution on all trades, have really low spreads for EUR/USD & other majors, and very good customer support as well. We highly recommend hotforex for beginner traders looking for a well regulated low cost broker in nigeria.

Hotforex was established in the year 2010. They are regulated with FCA (UK), cysec & even financial sector conduct authority (south africa), so we find them to be a trusted broker for nigerians.

They have very low minimum deposit, as low as $5. Also, they offer extremely competitive spread of 0.3 pips for EUR/USD with zero account (1.2 pips with premium, micro accounts), 0.8 for USD/JPY, 0.6 for GBP/USD (this may vary depending on the market fluctuations).

Further, hotforex offers trading on various platforms that can be accessed from android, iphone and desktop. You can trade on the metatrader 4 or metatrader 5 platforms, both of which are the most widely used trading platforms in the world.

Hotforex also offers local bank withdraw and deposit methods for nigerian traders, and there are many wallet options as well. Plus, hotforex have ongoing deposit bonus promotion available for traders in nigeria.

- Hotforex is a highly regulated broker, as they are regulated by 3 top-tier regulatory authorities FCA, FSCA & CYSEC. This ensures very fair dealing.

- Low minimum deposit requirements of $5.

- Hotforex has one of the lowest spread of all the brokers that we have compared. Around 0.3 pips typical spread for EUR/USD with their zero account.

- Very attractive 100% sign up bonus for new customers & good loyalty program for existing customers.

- Hotforex offers local deposit options like bank transfers for nigerian customers. You would need to talk to their live chat for the local bank funding options.

- Very good support available via live chat, phone & emails.

- 100% depoit bonus available for every deposit of $250 or higher.

- Their commission per lot of $6 (roundturn) with zero account is higher than other brokers like IC markets, FXTM that offer similar low spread ECN type accounts.

3. Octafx – low spread broker, commission free local deposits, withdrawals & 50% deposit bonus

Overall rating 8.9/10

- Fees: 1.1 pips typical spread for EUR/USD with MT4 micro accounts. And 0.7 pips (plus $0.3 per mini lot) with ECN ctrader account.

- Account minimum: $50 (₦18,000)

- Leverage: 1:500

- Promotion: 50% deposit bonus on all deposits

Ranked #3 forex broker in nigeria

Octafx is a cysec regulated forex broker that also accepts nigerian clients. They offer good trading conditions including competitive spread, fixed as well as variable spread MT4 accounts, local nigerian bank deposit & withdrawal methods, and multiple trading platforms i.E. MT4, MT5 & ctrader for mobile, web, and desktop.

Octafx is a forex & CFD broker that was established in 2011. They have 3 account types i.E: MT4 micro account for new traders with spread starting from 0.4 pips, the MT5 account for expert traders with 0.2 pips spread & ctrader ECN account for professional traders with the lowest raw spread & direct market execution. All their accounts have good trading conditions with support for scalping & hedging.

Their trading instruments on offer are limited though, as octafx offers forex trading on 28 currency pairs, and CFD trading on metals, energies, indices & cryptocurrencies. But they have competitive spread on their available trading assets, especially for traders who are looking to trade major currency pairs, and 3 main cryptos (bitcoin, ethereum and litecoin).

Their support is also very responsive in handing issues. Their live chat support is available for 5 week days, and email support is available 24/7. They also have whatsapp text support available. But they don’t have a nigerian phone number currently.

The funding & withdrawal options at octafx are very wide for nigerian traders. They offer instant funding via skrill, neteller, and quick zero fees funding via bank transfer, or cash, or ATM in their gtbank account. Also they offer BTC funding & withdrawal.

- Octafx is a cysec regulated forex broker, so it is considered safe for nigerian traders to trade with them.

- Their spreads for major currency pairs is quite competitive. For ex. Their spread for EUR/USD starts from 0.4 pips even with their beginner MT4 micro account.

- Local deposit & withdrawals options available in nigeria, and they don’t charge any fees with this method. Also instant wallet funding and withdrawals options are available.

- Their support overall is good, as their live chat support is available 24/5, and their email support is available 24/7.

- They have a 50% deposit bonus available for all deposits.

- Octafx has lesser trading assets available as compared to other forex brokers. They have 28 currency pairs, cfds on 4 metals, 10 indices & 3 cryptos (bitcoin, litecoin, ethereum).

Forex no deposit bonuses

List of free forex no deposit bonuses 2021

Featured forex no deposit bonuses 2021

Forex no deposit bonuses 2021

No-deposit bonuses, which require or may require a deposit in order to withdraw them or profit

Ended bonuses

Is it really free money?

Yes. Brokers offer free bonuses with real money. They are free but require you to do certain activities to receive them and to withdraw them.

Can I withdraw no deposit bonus?

It depends. Some bonuses can be paid out and others cannot. On the other hand, almost always profit is withdrawable.

What should I check when choosing a bonus?

– terms and conditions, the bonuses with the detailed rules are much more reliable

– possibility and requirements to withdraw the bonus

– countries where it is available

– verification procedure, required documents

– possible fees for inactive account

Why brokers offer forex no-deposit bonuses?

To promote themselves. It’s a great way to encourage traders to start trading with the selected forex broker.

What is the difference between no deposit bonuses and deposit bonuses?

No deposit bonuses are incentives that are very rare. Getting this means that the broker is shelling out something to get the investor without receiving a deposit. However, it is best to read the fine print on any advertisement and clarify the information before deciding on this. As opposed to the no deposit bonus, forex deposit bonuses are promotions that are given to new traders who deposit investment money for the first time. There are some brokers who offer this every time additional money is deposited to the account.

Leave a comment or suggest new forex non-deposit bonus

What’s new?

Meefx – welcome bonus 5 USD

Instaforex – one million option

MFM securities – matador contest

Forex4you – trading hero contest

Justforex – 2021 trading contest

117 COMMENTS

Friends. Do not enter these brokers, they are thieves. Brokers have to offer an ECN account welcome bonus

Thanks you are doing great things

Scam scam scam scam scam and big scam

windsor brokers free account $30

I make 31.40 profit when i send to request for withdraw my profit my account is terminated and after received this mail.

Please be informed that the company is not able to verify your identity and therefore may not allow you to proceed with the opening of a trading account as of the 10/07/2020.

So, guys please, don’t waste you time on windsor brokers

Thanks for advice, which one is better?

Can someone here please recommend a trustable NDB broker,really really needed.Thanks for the help in advance .Stay safe!

I once traded with them but only my luck of knowledge…..But they are cool!

As long as the road is right, you are not afraid of the road

Od, and problem solving are concerned as wel facebook.Com

Comment: fund your own account if you don’t want sh***t to happen. These bonus things are have impossible T&C’s, some of the rules change during the course of the trading journey

Traders never ever trade with extreme forex because they are extremely scammers.I traded with their no deposits bonus and completed 5lots with 3weeks but they didn’t allow withdraw

There is no single bonus of new bonuses without proper deposit

all – other than it’s small and trivial – are also false

each of the companies that advertise their offers sets conditions that are impossible to meet

please contact the site management to review these bonuses and make sure they are serious and credible

if I found false do not enable this company to advertise on the site

because these companies are fraudulent and advertising through the site will cause the site to lose its credibility

I hope to work and repeat please that the administrators of the site work with this advice

thanks management site

Ive been try for the freshforex no deposit with bonus of 2019.. I have been trade for 7 days after they withdraw my profit 112 dollars this is. A big scam bonus.

25% deposit bonus

open a new live account and receive a deposit bonus up to $500.

The following terms and conditions apply:

The bonus will be deposited together with your initial deposit.

The minimum deposit for the deposit bonus is $500.

Once we have received your deposit, we will add 25% more in your trading account as a credit, for example if you deposit $1000, we will add a $250 credit, for a $2000 dollar deposit $500 will be added etc.

The maximum deposit bonus credit is $500.

The bonus credit can be withdrawn after the total volume of traded orders reach bonus size divided by 2. For example if your deposit is $1000 and bonus $250, in order to withdraw the bonus, you need have traded at least 125 full lots during the past 6 months.

The campaign applies only to new clients unless invited separately.

Only one deposit bonus is allowed for each client. Family members are not considered as new clients.

The bonus credit cannot be used for margin. If your account balance drops to 20% of your original deposit, the bonus credit will be removed.

Max leverage for accounts with the bonus credit is 1:200.

The bonus has to be requested separately after your account has been activated.

Assetsfx reserves the right to make changes to these terms and end the campaign at its own discretion without any prior warning.

Instant cash back

open a new live account with at least $500 and receive $1.50 instant cash back for each lot you trade!

No need to wait until the end of the month and calculate if have you opened enough trades. We return immediately $1.50 per lot to your account as soon as the trade has been closed.

The following terms and conditions apply:

The minimum initial deposit for a new account is $500 or equivalent in BTC.

The promotion applies only to new clients or returning clients who have not traded their account for at least 6 months.

The bonus has to be requested separately after your account has been activated.

Applies only to forex pairs and metals.

Cannot be added to an account which has been signed under an IB.

Cannot be combined with any other promotion.

Assetsfx reserves the right to make changes to these terms and end the campaign at its own discretion without any prior warning.

Windsor is a scam broker i applied for no deposit bonus when i made 71$ and place the withdraw request they refused and replied you are not entitled for this bonus i advise all the brokers please please don’t waste you on windsor this is a shit broker………

هi trade with them and i take my profit bro i toke 131 dollar

Tell meh about broker you use plz

claudyjumaa@gmail.Com

Which broker did you use,sir?

Roboforex scam don’t open account with them I, after my account verified they said I can’t get 30 bonus

Roboforex is indeed a scam after I verified my doc the say antifraud won’t allow me to receive a bonus

From what I read. You need deposit $10 using your own bank card in order to get the bonus. Please read the terms before registering to any of bonus offered.

Thanks for advice, which one is better?

Hello I just want to know which broker I should open please I open FBS n when I withdrew their tell me stories

It sucks in mongolia, scammed many traders, have issues with withdrawing and pricing. Also it sucks it disapperas money from account (used, regretted, not recommended at all.

XM ер нь хамгийн сайн нь байх гэж бодож байна найзаа. Яагаад гэвэл шалгуур болон боломж нь илүү найдвартай байдаг шд.

Withdraw хийхэд дажгүй болоод л байдаг шд. Удаан л болохоос *hehe*

Haha..I know this brooker very well. I dont wanna lost even bigger with them.

I start my trade with xm and he is the best broker my son introduced me and now I experience myself that he is one of brokers i chose and i recommend my students also to register with xm with 30 no deposit bonus you can make good profit

What are the requirements or terms and conditions before you withdraw ur profits you made by their bonus?

Tell me about they keep saying staff that don’t make sense hot forex is the best

Actually I use FBS withdrawal is easy

WELCOME BONUS OF USDT 100 ( no-deposit bonus )

Inoex exchange offers you the free funding of USDT 100 as welcome bonus to commence risk-free crypto trading.

As, we have integrated meta trader 5, we are pleased to offer ease in trading using salient features of meta trader 5.

Bitcoin, ethereum, ripple; these are some of the highly traded 30+ crypto currencies that you can trade against USDT in meta trader 5.

And the best part is you can trade these at leverage of 1:100. This means you have high margin of profitability as you can control and manage your trade with more sophistically.

When it comes to withdrawal, we offer instant withdrawals on profits made by using USDT 100 welcome bonus. (T&C applies)

our dedicated support team is available 24/7 to help you out of any problem, if any.

In short, inoex gives you the free balance to trade in meta trader 5 and you will have instant withdrawal of profits from the trading.

Sign up now: https://inoex.Exchange/en/index.Html

download MT5: https://inoex.Exchange/en/mt5.Html

Terms and conditions

for USDT100 welcome bonus, you are required to open account with inoex exchange

to avail the USDT100 welcome bonus, you are required to request by contacting us

welcome bonus will be credited to your meta trader 5 trading account

this welcome bonus is in the ownership of the company and is not cash-able

30+ crypto currencies are available for trading including bitcoin, ehtereum, and ripple

the profit can be withdrawn at any time, as long as the equity is at least USDT 100

if the equity is less than USDT 100, withdrawal will be rejected

maximum profit, which can be withdrawn, is equal to USDT 200

withdrawing the profit, welcome bonus and all remaining profit shall be taken out from the trading account

to withdraw the profit, client must deposit at least USDT 100 in the trading account

to withdraw the profit, client must commence trading of 10 lots

the welcome bonus has unlimited duration and can be cancelled at any time on sole discretion of the company

profit earned using welcome bonus is also under the ownership of the company and can be cancelled at any time in sole discretion of the company

it is strictly prohibited to get the welcome bonus again by using a new registration or new trading account

by having this USDT 100 welcome bonus, you agree to the right of the company to cancel the bonus and all profits obtained through the bonus at any time without giving any reasons at sole discretion of the company

Đã nêu chương trình khuyến mãi không cần ký gửi mà yêu cầu phải nạp 100$. Khác gì lừa đảo.

I have profit from broker amega with use promo 222 usd account and i withdraw my profit 22.39 usd from my account 1000016874

I have profit from broker amega and i withdraw my profit 22.39 usd from my account 1000016874

I’m just starting trade with amega no deposit bonus $222.So far this broker is very fast when you close your order.My friend have two times withdraw with no deposit bonus $222.So I recommend this broker you should try.

Many of the bonnets without filing have become unreal

so we ask the officials in the site not to announce them so as not to lose credibility

examples of these bounses:

1 – XM group

2 – kirik markets

3 – forexchief

4 – corsa capital

5 – fxplayer

6 – upforex

7 – CF merchants

8 – fxreino

9 – fxlinked

10 – windsor brokers

11 – emporio tradin

12 – N1CM

13 – FW markets

14 – world forex

15 – paxforex

16 – fortfs

17 – fxgiants

18 – tradevest

19 – continue FX

20 – honor FX

all these companies are fraudulent

XM GROUP is exempted they can be trusted

Si asi es yo retire 1000 dolares de ahi en xm si se puede comerciar

Fraudulent as [moderated] XM

Comment: i give signals, will you try it out.

Uniglobemarkets is offering $100 no deposit bonus

NO deposit bonus $100

https://www.Uniglobemarkets.Com/fb-no-deposit-bonus/

The terms are so unfavorable. 15 lots so many to meet for one to be able to withdraw, no joke when dealing in a volatile market.

I want a no deposit trade

Following no deposit bonus promotion, there are rules to look for. Many traders are late aware of the shortage because they do not really understand the rules. If it is like that, then it doesn’t matter how good the trading, it will not bring desired profit. Therefore, before signing up for a no deposit bonus, understand carefully every policy specified by broker. If you object to the rules, it’s better to leave early than to regret later. After all, no deposit bonus promotion not only available in one broker. Every traders are free to choose the most ideal no deposit bonus promotion according to their condition.

Hello. My account 26258 REALTRADE. I trading profit 70 eur and withdraw to skrill. I waiting money 10 day and support silent…. Broker scam! Carefully.

Https://fxfinance-pro.Com very good brokers offer $100

How do I claim the bonus?

I’ve used windsor and I traded and made 32$ profit and I did withdraw to webmoney they approved my request very fast

If you want a real NDB that you have dreamed about, unlike any other, join the fxfinance-pro promotion before it ends. No limits on profit! Only 1 lot per $10 requirement! No restrictions!

I am so tired of reading bogus reviews running down brokers with this word “scam”. I can bet that most of them are made by people without proper ID or they have used irregular trading methods to obtain profits and lot requirements. These reviews are made in frustration and provide no help to those of us who are looking and searching to kick off their trading careers with a NDB. One of the purposes of no deposit bonuses is to attract new clients and for the broker to test trading conditions. You cant expect to just take something and not be prepared to give something back in good faith. They cannot do their research if you are not trading in a normal fashion.

Another thing is that if you are stupid enough to allow an “advisor” to take over your account and do your trading for you then you shouldn’t cry when you lose all your money. Just because you lost all your money on a bad trade doesn’t necessarily make that broker a “scam”. It is the name of the game. You must know when to pull out of a bad trade before you lose everything. Make your own decisions on when to trade. There are no fantastic “once in a lifetime opportunities” to be missed in this game. Don’t let anyone try tell you that! The stock market exist with thousands of instruments breaking out in all directions every minute. Things go up and down all the time 24/7 365 days a week. Every one is an opportunity not to be missed. Have read fundamental analysis by top “financial experts” saying completely different things on the same day on the same trade. I have read multiple experts all saying the same thing and the market failed to respond. No one knows for sure. Do your own research and use and trust your own instincts. It must be great to be an advisor and play with other people’s money! Their advice is not flawless. They have nothing to lose and will gamble with your hard earned savings without a shadow of regret. Sometimes their job might be to in fact make you lose your money in the case of a market maker stock broker (as opposed to ecn or dma) who would benefit from that, and to get their commission. Their instrument for making making money isn’t the stock market, it’s the telephone! How can you trust someone who you have never ever seen?

That doesn’t make market maker stock brokers a bad thing. I would warn people not to accept a mentor. Be careful if you are asked to provide credit card pics revealing all the numbers or asked to give the numbers over the phone. Don’t give verbal agreement to allow the operator to make a deposit. Only make deposits within an encrypted website. It is possible that account managers act on their own scam operations within good brokers in their greed to earn more commissions. I have no doubt there are some brokers that are complete scams though.

Who can you trust? That is what these reviews are for. To give useful information. Sometimes you may even get a review site that looks good but is a part of a scam and will adverise the scam broker included with the good ones! You can’t just accuse everyone you don’t like as a “scam” or because they didn’t open your account. To “scam” means to steal something valuable from you. If you didn’t make a successful withdrawal from a NDB does NOT mean you got scammed. You can’t get scammed out of a no deposit bonus. You have absolutely nothing to lose except your ID theft at the worst. The only way to do your research and avoid getting

your ID information stolen is to read reviews. Just bear in mind that most of the reviews are bogus and not a true reflection of the broker. If you were not successful with a NDB does not mean that you have been scammed. They have the right to cancel the agreement at anytime and it is the basic agreement of every NDB. They do not have to provide a reason and spend time negotiating on your credibility. I would say that most of the people pointing the scam finger are themselves guilty of doing the scamming or guilty of some dodgey move. That is why they were not paid out. It’s a pity that successful withdrawls are rarely posted.

NDB’s are there for us to learn from our mistakes, and if you are very very very lucky you will be able to actually begin a trading career without an outlay. Most of the time it is just a deposit bonus in disguise. It is very difficult to make any success with anything less than $100 so a lot of them are just a waste of your time. Some of them require you to close 50 lots to achieve $25 which is only available if you deposit another $25!

Like you I have also lost many NDB’s with almost every broker out there trying to get off the ground. I hope that you have learnt your lessons through these experience as I have.

So far I have been lucky with fxfinance-pro. I haven’t made a requested for withdrawal yet, but I have faith that these ruskies will honour the agreement. They don’t have online chat or account managers calling you every five minutes, but if you have a problem their support will get back to in around 24 hours.

Posting this review is not part of their bonus agreement although you do have to make a repost on a russian site merely explaining the terms of the bonus. They do not pay you to make reviews like this, so before you accuse me of working for them, f@# you in advance.

I put my cock on the block and recommend fxinance -pro for a REAL and proper NDB that can get you started and a russian broker you can trust.

Am so happy with this review because likes you just said I have lost many NDB and just lost one today with a very big lesson out of it which made me to start another search again for another NDB and I guess I have found one and strongly believe that this very one will get me started. Thanks.

Hi, bro. I’m a beginner in this world and reading you I noticed you know a lot about it. I would like to talk to you about trading. Can we? Here is my phone number to chat via whatsapp +57 (310) 770-7998.

Ilqar august 7, 2017 at 6:01 pm

Terms & conditions of no deposit bonus

To take part in the promotion, you need to be a client of “GICM” with a real account and verified personal details

minimum withdrawal is 25 USD

bonus amount can’t be use for internel transfer

account should be maintained with us for 30 days

trades should be done as per our terms and conditions

only profit amount allowed to withdraw and it will be processed in any of our payment methods in the direction of company.

The bonus can be awarded once per household or IP address or phone number or a customer.

Good groker il like it

reply

Well, I do find fresh forex as a good broker. I utilised their no deposit bonus and made profit from trading and withdrew without a problem after fulfilling the necessary lots. The speed and execution on their ECN account is great, the customer service is very helpful. No commission on deposits and I am actually impressed with the overall service, so far so good. I recommend.

Why on their terms and conditions written that you should deposit funds similar to gained profit for you to withdraw?

I believe capital one is a scam, the way they spam is so serious.

Totradefx $15 no deposit bonus

The best no deposit bonus offer is back from totradefx.. Register now and get $15 absolutely free.. Best conditions to with draw bonus

These are good brokers XM, fx pro, iron FX and hot forex.

WTF iron fx just askme to deposit 40k to start trading…

so, let's see, what was the most valuable thing of this article: list of the best forex brokers for 2021 providing access to foreign exchange markets. Explore forex broker reviews, ratings, and trading conditions. At list of best forex brokers

Contents of the article

- Free forex bonuses

- Best forex brokers for 2021

- Role of forex brokers

- Criteria to consider in choosing a forex broker

- 1. Spreads/commissions

- 2. Leverage

- 3. Regulation

- 4. Broker type

- 5. Trading resources

- 6. Customer support

- Our list of forex brokers

- Top 7 of best US forex brokers for 2021

- Is forex trading legal in the USA?

- How to trade forex in the USA

- Top 7 forex brokers in the USA listing for 2021

- 25 best UK forex brokers for 2021

- Best UK forex brokers for 2021

- Best forex brokers UK comparison

- How to verfiy FCA authorisation

- Summary

- More forex guides

- Methodology

- Forex risk disclaimer

- List of the best 23 forex brokers | trusted...

- Strict criteria for the forex broker review

- How does a forex broker work?

- Warning: only trade with regulated and...

- How risky is forex trading?

- How to deposit and withdrawal money:

- Not every country is available for forex trading

- Review conclusion: start trading with a reliable...

- ECN forex brokers

- Best ECN forex broker

- ECN forex brokers list

- Best forex brokers in nigeria for 2021

- Best forex brokers in nigeria

- 1. FXTM – best forex broker in nigeria (instant...

- 2. Hotforex – best regulated forex broker with...

- 3. Octafx – low spread broker, commission free...

- Forex no deposit bonuses

- List of free forex no deposit bonuses 2021

- Featured forex no deposit bonuses 2021

- Forex no deposit bonuses 2021

- No-deposit bonuses, which require or may require...

- Ended bonuses

- Is it really free money?

- Can I withdraw no deposit bonus?

- What should I check when choosing a bonus?

- Why brokers offer forex no-deposit bonuses?

- What is the difference between no deposit bonuses...

- Meefx – welcome bonus 5 USD

- Instaforex – one million option

- MFM securities – matador contest

- Forex4you – trading hero contest

- Justforex – 2021 trading contest

No comments:

Post a Comment