Jp markets minimum deposit

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID.

Free forex bonuses

The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

While in the T/C they mention that bank withdrawals take up to 3 days,

JP markets: login, minimum deposit, withdrawal time?

RECOMMENDED FOREX BROKERS

JP markets is solid, at first glance, as african brokers go, but what is most important is that it is actually regulated. Please read on to find out what this broker has to offers traders.

JP markets SA (PTY) LTD is regulated by africa’s financial sector conduct authority (FSCA). The regulatory agency aims to promote fair customer treatment, but above all else to maintain a stable financial market for the institutions under its governance. However, members of the overseer are not eligible for a compensation scheme.

There is however one major obstacle that will prevent us from properly reviewing this brokerage firm: we couldn’t register because the broker asks for bank details and ID. The problem is that you need to provide said details even when opening a demo account. Furthermore, the exact leverage and spread values are nowhere indicated, meaning that one must register first before these details are revealed.

However, seeing that the broker is regulated outside of zone that restrict the leverage amount, like the EU/UK by ESMA, one can expect a relatively high leverage.

The same is applied to the instruments for trading. There is not info on the website as to what they are.

The languages that are made accessible are: english, afrikaans, french, sesotho, kiswahili, zulu and isixhosa. These are all regional african languages and dialects.

JP MARKETS LOGIN

The broker comes with the most popular platform, the MT4.

METATRADER 4

Metatrader’s design and interface is by now well known. The platform is abundant in trading options and possibilities, and attractive to users both rookie and pro. The platform also allows for VPS. The point of the VPS is to let the auto trading bots trade, without worrying that his job will be interrupted by a power failure or net crash.

There is a mention of a $10 commission when using a ECN account, but it’s rather ambiguous; it does not say if it’s round turn or per side. But considering this broker is regulated, we like to think that the value is round turn. Thus the $10 commission adds an additional 1 pip to any cost of trading.

The precise spread and leverage values are, as already mentioned, not indicated anywhere on the website.

The platform can be accessed via: windows trader, for android, and for ios.

JP MARKETS MINIMUM DEPOSIT

There is no minimum deposit, but JP markets recommends starting with at least $200. Upon further inspection we stumbled upon a piece of information claiming that there is a minimum deposit indicted once a user is fully registered:

We leave for the readers to decide what to trust.

Payment methods are all african based banks, and some common ones like visa, mastercard, skrill, i-pay and payfast.

Base currencies are ZAR, USD, GBP. There is no EUR based trading accounts.

The maximum time to allocate a deposit into a trader’s account is 24 hours.

There seem to be no fees concerning the funding of an account.

JP MARKETS WITHDRAWAL TIME AND FEES

Withdrawals can be done via the local banks mentioned in the deposit section up above, and by payfast and skrill.

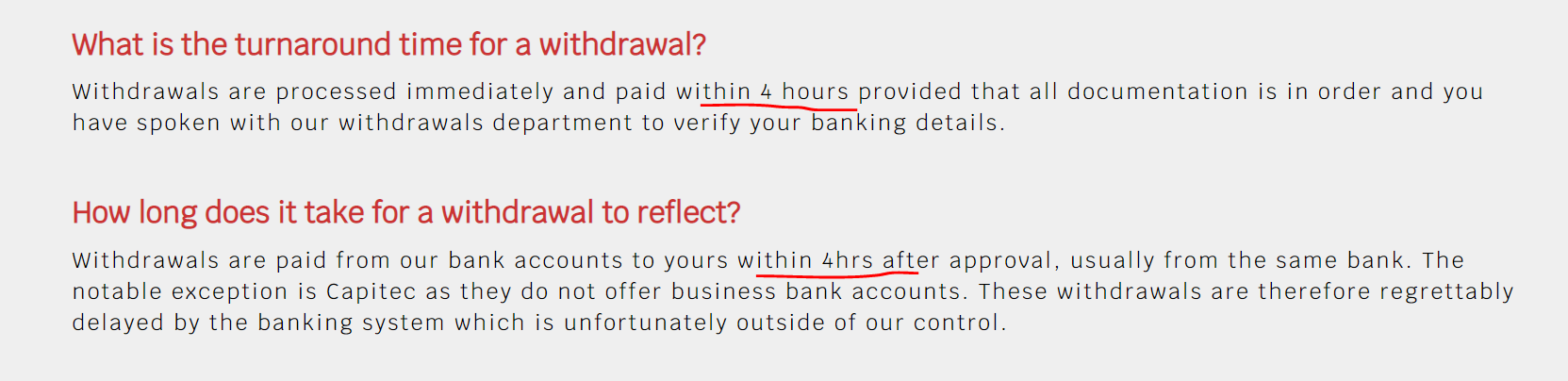

There is confusion surrounding the withdrawal times. In the FAQ the broker claims that withdrawals are processed within 4 hours:

While in the T/C they mention that bank withdrawals take up to 3 days,

There are no withdrawal fees, except for credit card ones.

Yet this is the only time they mention credit card as a withdrawing method.

The minimum withdrawal amount is $25.

BOTTOM LINE

We started off this review on a positive note, but things quickly escalated. Africa has never been the most promising place for forex and cfds trading, and it shows as exemplified by the disorganized website. The inconsistencies are far too many to be taken lightheartedly, and thus we have to advice traders to be careful when dealing with JP markets. Tread at your own risk!

JP markets review

JP markets review by forexsq forex experts, all you need to know about jpmarkets broker like how much is JP markets minimum deposit or how to do JP markets login.

JP markets review

JP markets offers its customers a solitary record sort with variable spreads, no commission liberates, use up to 1:500 and STP showcase execution. Furthermore, PAMM administrations are likewise accessible with this representative.

Remember that scalping, supporting and utilization of mechanized systems (eas) is not permitted with JP markets.

JP markets offers exchanging around 30 forex sets, stock lists, oil, gold and OTHER cfds on the generally utilized metatrader 4 stage. The organization behind the brand, JP markets SA (pty) ltd. Is authorized and directed by the financial services board (FSB), south africa, FSP 46855. The dealer additionally has nearness in kenya, pakistan and bangladesh.

Of late south africa is viewed as a monetary market with incredible potential, as it is a standout amongst the most created nations in africa. FSB is accountable for the authorizing procedure and supervision of forex businesses in the nation. Plus, the south african controller has implementation forces to manage breaks through the requirement board of trustees, and runs a client protestations benefit, the office of the ombud for financial services providers.

Albeit direction in south africa is not among the strictest and most legitimate ones, it gives a specific level of dependability. Privately authorized merchants are required to keep all customer supports in isolated put stock in accounts in a perceived bank in the nation.

JP markets minimum deposit

The base beginning store, required by JP markets adds up to R3 500, which is a sensible add up to begin with. Other south african agents, for example, blackstone futures require more (R5 000).

Spreads and commissions

JP markets charges no commission expenses, yet we observe its spreads too wide to possibly be aggressive: arrived at the midpoint of 2.4 pips on EUR/USD. Albeit settled spreads are for the most part more extensive than drifting ones, blackstone futures offers spreads settled at 1 pips for EUR/USD. For more data, you may look into constant spreads of 15 driving specialists here.

Leverage

The most extreme use on all FX items, offered by JP markets, is 1:500. Such use is considered nearly high, in spite of the fact that various representatives offer comparable or higher use rates.

Merchants, be that as it may, ought to be cautious, for higher use includes more serious hazard. That is the reason restrictions on use rates are set in numerous locales.

JP markets trading platforms

This dealer bolsters the prevalent metatrader 4 (MT4) stage. MT4 offers every one of the a broker needs: usability, various request sorts, an extensive variety of specialized markers, broad back-testing and progressed outlining bundle. The stage is particularly esteemed for its autotrading limits by means of expert advisors (EA) that enable clients to completely computerize their exchanges by and let the program do all the work. Shockingly, JP markets does not permit robotized techniques.

Payment

Customers of JP markets can make stores and withdrawals from and to their records by means of credit/platinum cards, bank and wire exchange, skrill, neteller and bitcoin.

JP markets reviews conclusion

JP markets is an appropriately directed forex and CFD south african handle that backings the powerful MT4 stage. Lamentably, its spreads are high furthermore, it forces many exchanging limitations.

By this JP markets review conducted by forexsq.Com forex professionals you know all about jpmarkets broker like how much is JP markets minimum deposit or how to do JP markets login so if you like this review then share it on social media networks please and let others to know about this JP markets review.

If you have any experience with the broker then submit it in the comment form below of this JP markets review.

Jp markets minimum deposit

Please choose your preferred bank below to deposit and use your JP markets MT4 account number as your reference. Also, payment allocations can take up to 24 hours from mondays to fridays. For faster allocation please email all proof of payments to finance@jpmarkets.Co.Za.

Account name: JP markets SA (pty) ltd

Account number: 408 902 1536

Account type: current account

Currency type: south african rand account (ZAR)

Bank identifier code (BIC): ABSAZAJJ

Your ref: MT4 number: (e.G. 554472).

Nedbank

Nedbank details:

Account name: JP markets SA (pty) ltd

Account number: 113 6899 766

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Standard bank

Standard bank details:

Account name: JP markets SA (pty) ltd

Account number: 271 294 531

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

First national bank

FNB bank details:

Account name: JP markets SA (pty) ltd

Account number: 62638202432

Account type: current account

Currency type: south african rand account (ZAR)

Your ref: MT4 number: (e.G. 554472).

Snapscan

Step 1. Snap

Open snapscan and use your phone’s camera to scan the snapcode displayed at the checkout or on your bill.

Step 2. Pay

Enter the amount you want to pay and confirm payment with your 4-digit PIN.

That’s it. You’re done! Make sure the merchant has received proof of payment – email to finance@jpmarkets.Co.Za with the MT4 number in the subject line

Online gateways

We accept payment through several online gateways. This is done through you client portal, the process is quick and easy, with an added benefit of being much faster than a bank deposit.

Please note: when paying with skrill any amount below R200 may result in your deposit not being allocated due to associated fees.

Mpesa

Make use of mpesa to pay in the greater african area. (south africa currently unavailable)

Please follow this link and complete the regular checkout process.

On checkout be sure to choose the i-pay africa option and complete your payment using mpesa.

Please note: that all international payments and other currencies will be converted to the rate that of the SARB (south african reserve bank).

Risk warning: trading on margin products involves a high level of risk.

It is investors’ responsibility to maintain a prudent level of margin, pay their margin and also meet margin call payments on time and in cleared funds. Please keep in mind the possibility of delays in the banking and payments systems. If your payment is not credited by the time you are required to have the necessary margin or meet the margin call, you could lose some, or all of your positions.

JP markets review

User review

JP markets is an international online broker that started operating in 2016. Although the company has been around for just a few years, it has already built a relationship of trust with its clients. It began as a small company with a small office and a few workers, but today, it has offices in several countries across the globe.

• negative balance protection

• sophisticated trading platforms

• safe and secure

• excellent customer support

• no promotions

• users only trade cryptocurrencies but don’t own them.

The founder of jpmarkets is a south african entrepreneur called justin paulsen. He has a major in finance and economics at the university of cape town. Paulsen got the opportunity to interact with a number of asset managers, hedge fund managers, forex traders, and portfolio managers while working for a leading forex broker in south africa.

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

Reasons to sign up at JP markets for south african traders

Here are six stout reasons for south african investors and traders to sign up at JP markets:

- Negative balance protection – you will never end up owing JP markets any money because it uses a risk management system and an automated transaction management system to prevent a client’s account from turning negative.

- Sophisticated trading platforms – JP markets offers adequate and fast trading platforms. Since there are no lags and requotes, clients get exactly what they want.

- Safe and secure – the forex broker maintains client funds separately from its own funds.

- Free deposits and withdrawals – the broker does not charge clients for processing deposits and withdrawals.

- Fast payment methods – the deposits are instantly credited to traders’ accounts. And customers can instantly withdraw their profits from their accounts. They simply do not have to wait long for the transactions to go through.

- Excellent customer support – the customer support agents are friendly, helpful, and prompt. You can get in touch with the FX broker through live chat, email, or phone.

Is JP markets reliable forex broker?

South african investors can definitely rely on JP markets as it is the biggest forex broker in africa and south africa. During the last few months, the company has experienced tremendous growth and has expanded into bangladesh, pakistan, and kenya.

The broker operates on a license issued by the financial services board of south africa. You can view a copy of the license on the JP markets website.

You can contact JP markets through the telephone number +27-010-590-1250, the email address [email protected], or the facebook account www.Facebook.Com/jpmarketssa. JP markets has offices in johannesburg, pretoria, cape town, swaziland, and polokwane.

Create an account to start trading

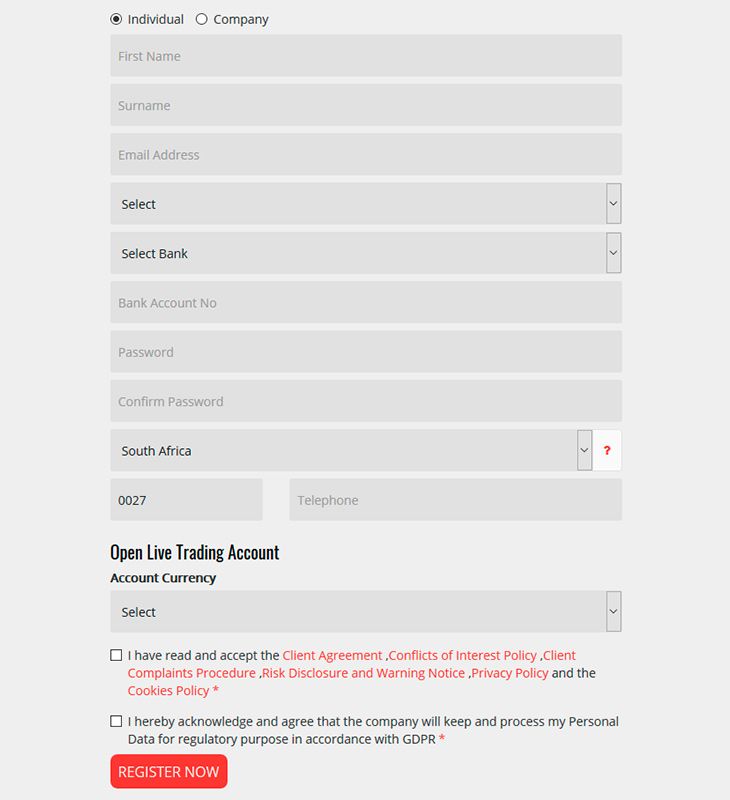

You can open a live trading account at JP markets in three simple steps:

- Complete the online registration form.

- Verify their account by clicking on a link in the FX brokers’ first email.

- Load their trading accounts and start trading.

Traders can open accounts as individuals or companies.

We strongly recommend reading the client agreement form, client complaints procedure, privacy policy, cookies policy, risk disclosure and warning notice, and conflicts of interest policy carefully before registering an account.

Making deposits and withdrawals at JP markets

South african traders can choose a bank from the given list of banks to make a deposit. They can use their MT4 account number for reference. It may take up to 24 hours for the funds to be credited to traders’ accounts. If they want the funds to be credited faster, they have to email payment proofs to [email protected]

- ABSA

- Standard bank

- Nedbank

- Snapscan

- First national bank

- Mpesa

- Online gateways

There are three ways to make withdrawals at JP markets:

- Client portal – you can quickly and easily request payout through their client portal.

- Online platform – you can withdraw through the platform using payfast/skrill or local bank transfers. JP markets processes payout requests from monday to friday, between the hours of 9:00 a.M. And 5:00 p.M. You will receive a verification call from the broker for purposes of security.

- Whatsapp – you can send your payout request to 079-604-4252 and include your MT4 account number and the amount you would like to withdraw. When it receives the request, the company verifies the details and credit payouts in 24 hours after the completion of the verification procedure.

However, withdrawal through whatsapp is available only from 10:00 a.M. To 4:00 p.M. From monday to friday.

Types of trading platforms

Traders can choose from the following platforms at JP markets:

MT4 for windows

Customers can download MT4 for windows, android, and ios and enjoy features such as no rejections, no requotes, and flexible leverage in the range of 1:1 to 500:1. This platform is suitable for traders of different skill levels.

The MT4 platform is popular for its user-friendly interface, technical analysis tools, automated trading capabilities, advanced charting features, and automated trading capabilities. JP markets’ MT4 platform supports multiple currencies such as PLN, SGD, GBP, EUR, and USD. Also, it is available in 30 languages.

MT4 for mac

Traders can use wine, a free software program that enables systems based on unix to run applications developed for MS windows. Unfortunately, wine is not fully stable. So the application may not work as intended.

JP markets recommends playonmac, a free wine-based application that can be used to easily install windows applications on devices that run on the mac operating system.

MT4 for linux

Users of linux computers can use wine to install MT4 on their systems. However, they must understand that the application may not work properly.

Account types

JP markets offers different types of accounts to meet the requirements of different types of customers.

- USD, GBP, and ZAR based accounts

- Accounts that charge commissions

- Accounts that charge spreads as costs

Each type of account gives clients direct access to the market. The orders flow directly to the market, ensuring that traders get the best market prices without any slippage, price manipulation, and lag.

There are micro as well as mini accounts, but the forex broker doesn’t discriminate between the two.

Unique features of JP markets

Here are some features that make jpmarkets unique and set it apart from the other forex & CFD brokers in the industry:

JP markets mastercard

Registered traders at JP markets can apply for the JP markets mastercard and become a VIP mastercard client. They can use their card to make payments and withdraw money at atms. Also, they can use it to manage their profits easily.

To qualify for a JP markets mastercard, customers have to create a trading account and maintain a minimum balance of R5000. The holders of this card can use it only in south africa, not in any other country. This card has been designed to enable JP markets to pay profits to its clients; so traders cannot load any money in it. However, they can apply for a total of three JP markets mastercards.

To check their balance, clients have to log in to www.Whatsonmycard.Com. They should note that they cannot use their card to store any money and accrue interest on it. They have to use their card to either make purchases or withdraw their money at an ATM. They cannot withdraw the funds on their card at any bank.

Copy trading

Customers can earn profits by copying the trades of professional traders at JP markets. They will just be investing funds and a copy master will manage their funds for them. Any professional trader can become a copy master at JP markets. They can do so by following these steps:

- Visit jpmarkets.Co.Za/copy-trader and complete the online application form.

- An account manager will contact them and give them some paper work.

- Visit copytrader.Jpmarkets.Co.Za and open an account.

- When the company approves your fund manager or professional trader status, you can log into your account at copytrader.Jpmarkets.Co.Za

Welcome bonus

You get a welcome bonus of up to 100% just for opening a live trading account and making a deposit. You have to deposit at least R3,000 to qualify.

JP markets offers 25% bonus on deposits in the range of R3000 to R30,000; 40% bonus on deposits in the range of R30,001 to R60,000; 60% bonus on deposits in the range of R60,001 to R100,000; 80% bonus on deposits in the range of R100,001 to R125,000; and 100% bonus on a deposit of $125,000.

JP markets FAQ

Q1: how much should I deposit in my trading account?

A: JP markets doesn’t set any deposit limits for its clients. So you can deposit any amount you wish. However, JP markets recommends a minimum deposit of R3000, especially if you are a new trader in need to training.

Q2: do clients have to pay for the trading education at JP markets?

A: JP markets offers excellent forex trading absolutely free of charge to holders of live trading accounts. The forex broker offers classes at some of its offices in south africa. Also, it offers video courses and online courses for traders who wish to learn at their own pace. Those interested can send an email to [email protected] for more information.

Q3: can I use bitcoin to load my trading account?

A: you can use bitcoin, but only through skrill. You can use bitcoin to load your skrill wallet and then transfer the money to your trading account.

Q4: how much money can I make at JP markets?

A: it all depends on how well you trade. You should learn to make informed decisions using a wide range of trading tools. Also, you should learn how to manage your risks well.

Q5: are my funds safe at JP markets?

A: yes, your money is 100% safe at JP markets. This is because the online broker holds clients’ money in separate accounts and never mixes it with its own funds. In addition, it has professional indemnity insurance to protect clients’ funds.

Should you open an account at JP markets?

If you reside in africa, you certainly should. JP markets is not only licensed and regulated in south africa, but also supports ZAR and offers products designed for african traders. In addition, it has several offices across africa and is founded by a well-known african entrepreneur.

JP markets is not only a safe, secure, and well-regulated online trading platform, but also an excellent educator. If you have never traded before, you can easily learn how to trade at jpmarkets.

JP markets review

He then decided to start his own business and launched JP forex investments. He then passed the RE1 and RE5 exams for the qualifications required to start his own licensed company and that is how JP markets was launched.

JP markets review

Jpmarkets is a forex broker. JP markets offers the metatrader 4 and mobile forex trading top platform. Jpmarkets.Co.Za offers over 25 forex currency pairs, cfds, stocks, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options.

2020-06-19: the south african FSCA has privisionally suspended the license of JP markets. This was done because "there is reasonable belief that substantial prejudice to clients or the general public may occur if they continue rendering financial services."

CLICK HERE to verify.

Broker details

Live discussion

Join live discussion of jpmarkets.Co.Za on our forum

Video

Let other traders know if this service is worth checking or should be avoided.

Traders reviews

Not able to withdraw

Length of use: 6-12 months

Due to the numerous complaints from clients failing to withdraw their funds, the FSCA (financial sector conduct authority) has provisionally suspended JP market's license pending a full investigation. As from the 19th of june 2020 they are no longer allowed to take any new business or clients. I'm not surprised coz when i used them back in 2016 i couldn't even make a deposit to fund my account. Had to do an EFT and then call their office to let them know so they could check with the bank. Very poor service indeed. Anyway you can read the story of their suspension below:

Length of use: over 1 year

Length of use: over 1 year

This is the worst broker in the world, I made withdrawals amounting to R1.5 million in a he past weeks and they started asking me to submit my fica and bank cards of which I did. Only today they told me I won’t be getting my withdrawals since their system says I used different accounts to fund my account of which I didn’t. I don’t even know the people they talked about.

Stay away from this broker. I just can’t wait for this lock down to be over so I can visit their offices

Length of use: over 1 year

Jp markets should be challenged and charged for market and accounts manipulation. This is wrong and we will expose them.

Our funds and pending orders just disappeared and when we tried to contact someone no one answered.

This broker will not last long with the kind of service it provides.

Frequently asked questions

What is the minimum deposit for JP markets?

JP markets does not have a strict minimum deposit. Traders can invest whatever they are comfortable with. However JP markets recommends starting with around ZAR3,000.

Is JP markets a good broker?

Unbiased traders reviews on forexpeacearmy is the best way to answer if JP markets is a good broker. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

Please come back often as broker services are very dynamic and can improve or deteriorate rapidly.

Additionally, we'd recommend to check recent JP markets community discussions: https://www.Forexpeacearmy.Com/community/tags/jpmarkets/

Is JP markets safe?

To define whether a company is safe or not, you'd better get to know about this company, the unbiased traders reviews on forexpeacearmy is the best resources to grant you such knowledge. Https://www.Forexpeacearmy.Com/forex-reviews/13589/jpmarkets-forex-brokers

JP markets at least is regulated with south africa financial services board under license 46855. Being regulated gives you a chance to complain to the authority if it comes down to it.

What is JP markets?

JP markets is an online forex retail broker. JP markets offers a number of assets to be traded on metatrader 4 and JP mobile app.

- Forex currency pairs

- Cryptocurrencies

- Stock indices

- Precious metals

- Commodities

JP markets minimum deposit

The JP markets minimum deposit amount that JP markets requires is ZAR3,000.

The minimum deposit amount of ZAR3,000 when registering a live account is equivalent to USD 170,38 at the current exchange rate between south african rand and the US dollar on the day that this article was written.

JP markets is a south african-based broker which is authorized and regulated by one of the strictest and most demanding regulating entities namely FSCA, and as a regulated broker, one of the requirements is that client funds be kept in segregated accounts.

In complying with this, amidst several other strict rules and regulations, all client funds must be kept separate from the broker account, and it can only be used by traders to conduct trading activities.

In addition to ensuring client fund security through segregated accounts, regulated brokers such as JP markets are required to be a member of a compensation scheme or fund which pays out a certain amount to eligible clients in the case of company insolvency.

Deposit fees and deposit methods

JP markets does not charge any fees when deposits are made into the trader’s account, and traders can deposit the minimum deposit amount by using any of the following methods:

- Bank transfer (ABSA, FNB, nedbank)

- Credit/debit cards

- Skrill

- I-pay

- Payfast

- Transfers from atms, and

- Snapscan, and

- Mpesa

JP markets supports a variety of deposit currencies in which traders can fund their accounts including:

- USD

- GBP

- ZAR

- KWD

Step by step guide to deposit the minimum amount

Once the trader has completed the process of registering on the website, the trader can make the initial minimum deposit by taking down the banking details provided to transfer funds via EFT, or traders can follow these steps for other payments:

- Navigate to the JP markets website and log into the client portal.

- Select the deposit option, the payment method and amount.

- Follow the instructions and additional prompts to deposit the minimum amount.

Traders should take note that with making deposits by using bank wire transfer, the transactions may take a certain amount of time depending on the method, time of the day, and day of the week.

Bank wire transfers take anything from a day to a few business days depending on the time the payment was made during the day along with the day of the week.

Pros and cons

| PROS | CONS |

| 1. Deposit fees and withdrawal fees are not charged | 1. Small variety of deposit methods supported |

| 2. Only a few deposit currencies supported |

What is the minimum deposit for JP markets?

Interactive brokers does not have a specified minimum deposit.

Professional accounts, however, have certain minimum deposits depending on the account that the professional trader opens.

How do I make a deposit and withdrawal with JP markets?

You can make use of the following payment methods to deposit or withdraw funds:

- Bank wire transfer

- US automated clearing house (ACH) transfer initiated at interactive brokers

- Cheques

- Direct debit/electronic money transfer

- Canadian electronic funds transfer, or EFT

- Single euro payment area (SEPA)

- BACS/GIRO/ACH

Does JP markets charge withdrawal fees?

The first withdrawal is free, thereafter traders will be charged per withdrawal depending on the size of the withdrawal and the method of payment.

Forex minimum deposit

Find below a list of forex brokers according to the minimum deposit for opening a forex trading account with low deposit.

Risk warning: your capital is at risk. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Please be advised that certain brokers, products, bonus and/or leverage may not be available for traders from some countries due to legal restrictions.

Trading with a small deposit

It is quite common that traders start to spend time on demo account, then, once they gain experience, some want to start real trading with a low deposit forex account without a large investment or putting substantial assets at risk. It is quite convenient by investing little money because emotions need practice.

Some brokers operate different business models where some operate a large customer base, while others have few high net-worth investors who can bring in large volumes of cash. High net-worth investors could me more interested in brokers having a high minimum deposit.

Risk warning: investments involve a high level of risk. It is possible to lose all your capital. Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 58-89% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation and is not directed at residents of: belgium · france · japan · latvia · turkey · united states ·

JP markets review

JP markets review by forexsq forex experts, all you need to know about jpmarkets broker like how much is JP markets minimum deposit or how to do JP markets login.

JP markets review

JP markets offers its customers a solitary record sort with variable spreads, no commission liberates, use up to 1:500 and STP showcase execution. Furthermore, PAMM administrations are likewise accessible with this representative.

Remember that scalping, supporting and utilization of mechanized systems (eas) is not permitted with JP markets.

JP markets offers exchanging around 30 forex sets, stock lists, oil, gold and OTHER cfds on the generally utilized metatrader 4 stage. The organization behind the brand, JP markets SA (pty) ltd. Is authorized and directed by the financial services board (FSB), south africa, FSP 46855. The dealer additionally has nearness in kenya, pakistan and bangladesh.

Of late south africa is viewed as a monetary market with incredible potential, as it is a standout amongst the most created nations in africa. FSB is accountable for the authorizing procedure and supervision of forex businesses in the nation. Plus, the south african controller has implementation forces to manage breaks through the requirement board of trustees, and runs a client protestations benefit, the office of the ombud for financial services providers.

Albeit direction in south africa is not among the strictest and most legitimate ones, it gives a specific level of dependability. Privately authorized merchants are required to keep all customer supports in isolated put stock in accounts in a perceived bank in the nation.

JP markets minimum deposit

The base beginning store, required by JP markets adds up to R3 500, which is a sensible add up to begin with. Other south african agents, for example, blackstone futures require more (R5 000).

Spreads and commissions

JP markets charges no commission expenses, yet we observe its spreads too wide to possibly be aggressive: arrived at the midpoint of 2.4 pips on EUR/USD. Albeit settled spreads are for the most part more extensive than drifting ones, blackstone futures offers spreads settled at 1 pips for EUR/USD. For more data, you may look into constant spreads of 15 driving specialists here.

Leverage

The most extreme use on all FX items, offered by JP markets, is 1:500. Such use is considered nearly high, in spite of the fact that various representatives offer comparable or higher use rates.

Merchants, be that as it may, ought to be cautious, for higher use includes more serious hazard. That is the reason restrictions on use rates are set in numerous locales.

JP markets trading platforms

This dealer bolsters the prevalent metatrader 4 (MT4) stage. MT4 offers every one of the a broker needs: usability, various request sorts, an extensive variety of specialized markers, broad back-testing and progressed outlining bundle. The stage is particularly esteemed for its autotrading limits by means of expert advisors (EA) that enable clients to completely computerize their exchanges by and let the program do all the work. Shockingly, JP markets does not permit robotized techniques.

Payment

Customers of JP markets can make stores and withdrawals from and to their records by means of credit/platinum cards, bank and wire exchange, skrill, neteller and bitcoin.

JP markets reviews conclusion

JP markets is an appropriately directed forex and CFD south african handle that backings the powerful MT4 stage. Lamentably, its spreads are high furthermore, it forces many exchanging limitations.

By this JP markets review conducted by forexsq.Com forex professionals you know all about jpmarkets broker like how much is JP markets minimum deposit or how to do JP markets login so if you like this review then share it on social media networks please and let others to know about this JP markets review.

If you have any experience with the broker then submit it in the comment form below of this JP markets review.

Fxdailyreport.Com

Benefits of trading with small amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce commissions

When trading small amounts, you are usually constricted to put the majority of your money into a single trade. This, however, helps you reduce commissions. Traders are usually more likely to be sloppy when you are going to be making 20 trades in a day. But when trading with small amounts forces traders to be more selective about the trades they take.

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better management of risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of forex brokers with a low minimum deposits 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial brokerage services (FBS)

so, let's see, what was the most valuable thing of this article: JP markets: login, minimum deposit, withdrawal time? RECOMMENDED FOREX BROKERS JP markets is solid, at first glance, as african brokers go, but what is most important is that it is at jp markets minimum deposit

Contents of the article

- Free forex bonuses

- JP markets: login, minimum deposit, withdrawal...

- RECOMMENDED FOREX BROKERS

- JP MARKETS LOGIN

- JP MARKETS MINIMUM DEPOSIT

- JP MARKETS WITHDRAWAL TIME AND FEES

- BOTTOM LINE

- JP markets review

- JP markets review

- JP markets minimum deposit

- JP markets trading platforms

- JP markets reviews conclusion

- Jp markets minimum deposit

- JP markets review

- Reasons to sign up at JP markets for south...

- Is JP markets reliable forex broker?

- Create an account to start trading

- Making deposits and withdrawals at JP markets

- Types of trading platforms

- Account types

- Unique features of JP markets

- JP markets FAQ

- Should you open an account at JP markets?

- JP markets review

- Broker details

- Live discussion

- Video

- Traders reviews

- Not able to withdraw

- Frequently asked questions

- What is the minimum deposit for JP markets?

- Is JP markets a good broker?

- Is JP markets safe?

- What is JP markets?

- JP markets minimum deposit

- Deposit fees and deposit methods

- Step by step guide to deposit the minimum amount

- Pros and cons

- What is the minimum deposit for JP markets?

- How do I make a deposit and withdrawal with JP...

- Does JP markets charge withdrawal fees?

- Forex minimum deposit

- Trading with a small deposit

- JP markets review

- JP markets review

- JP markets minimum deposit

- JP markets trading platforms

- JP markets reviews conclusion

- Fxdailyreport.Com

- List of forex brokers with a low minimum deposits...

No comments:

Post a Comment