How to withdraw profit from forex

Established in 2010 and headquartered in cyprus, hotforex is an award winning forex broker that offers a wide range of account types and trading instruments.

Free forex bonuses

The broker is pursuing a policy of providing the most convenient and advantageous trading conditions for the traders. You can deposit money in hotforex using credit or debit cards and bank wire transfers. Apart from that hotforex also accepts skrill, neteller, fasapay, sofort, mybitwallet, ideal and webmoney. Just log in to the client portal, navigate to the money withdrawal section, fill the online form and click the submit button. Congratulations!

Forex brokers with best money withdrawal options in 2021

The best and most exciting thing about forex trading is, of course, to withdraw your profit from the forex broker. Say you have been trading, made a considerable amount of profit and now you want to spend your profit. In order to be able to do it, first you have to get your money back from the broker. To withdraw money from your forex account is very straightforward in general but does require you to take few steps.

Forex brokers with best money withdrawal options

Forex.Com

Forex.Com is owned and operated by an industry giant; GAIN capital holdings who has been around for more than 20 years. Forex.Com is registered and regulated by CFTC, NFA and CIMA. The broker accepts clients from the US. Investors can deposit and withdraw funds by credit card, bank card and wire transfer. Digital wallets are going to be available soon.

Money withdrawal options: credit card, bank card, wire transfer

XM

XM puts more than ten methods of deposit and withdrawal under disposal of its clients. In addition to international bank transfer and credit card which has become industry standards as deposit and withdrawal methods, XM clients can use various other methods. Those methods include neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort and western union. One important detail which makes XM even more favorable is that the broker covers international wire transfer commission of its own part which considerably reduces the withdrawal cost.

Money withdrawal options: wire transfer, credit card, neteller, skrill, unionpay, web money, ideal, moneybookers, moneygram, sofort, western union

Fxpro

Regulated by FCA,cysec and SCB, fxpro is headquarted in london and one of the most prominent forex brokers in the industry. Traders who open an account at fxpro can withdraw and deposit funds through credit card, international bank transfer (SWIFT), paypal, skrill, neteller and china unionpay.

Money withdrawal options: wire transfer, credit card, paypal, skrill, neteller, unionpay

Hotforex

Established in 2010 and headquartered in cyprus, hotforex is an award winning forex broker that offers a wide range of account types and trading instruments. The broker is pursuing a policy of providing the most convenient and advantageous trading conditions for the traders. You can deposit money in hotforex using credit or debit cards and bank wire transfers. Apart from that hotforex also accepts skrill, neteller, fasapay, sofort, mybitwallet, ideal and webmoney.

Money withdrawal options: wire transfer, credit card, skrill, neteller, fasapay, sofort, ideal, webmoney, bitcoin

Exness

Exness was founded in 2008 in russia and has grown into one of the most popular forex brokers in europe since then. The company is regulated by cysec in cyprus and FCA in UK. Having a wide array of payment methods, transacting money on this brokerage platform is pretty easy and quick.

Money withdrawal options: wire transfer, credit card, skrill, neteller, webmoney, perfect money, sticpay, jeton wallet

Choose the withdrawal option

When it comes to withdraw your profit from forex brokers, the methods are not scarce including credit card, wire transfer, paypal, neteller, skrill, western union, bitcoin to name a few.

I usually go with wire transfer when withdrawing my profit. Nevertheless it comes with some caveats. Wire transfer is recommended if only you are going to withdraw an amount over a thousand. Otherwise the bank transfer fees are going to eat up your hard earned profit. Bear in mind that when you choose to get your money back through wire transfer, you are going to get double charged (once by the bank in where your forex broker is located and again by your local bank). The fees could range from $50 to $100 in total. The certain amount completely depends on the bank the broker is working with and your local bank. International wire transfer fees charged by some US banks are explained in this article.

My second favorite option to withdraw funds from forex account is credit card. Again there are some caveats. Some forex brokers don’t allow you to withdraw more than what you deposited with the same credit card. When you deposit $1000 to your forex account using credit card, you can only withdraw an amount up to $1000 by the same card. So you will have to choose another withdrawal method to transfer your profit.

Though I haven’t used so far, other popular methods are digital wallets like neteller, skrill, paypal. Forex brokers don’t charge extra fees to withdraw money by digital wallets however those services apply their own fees when you want to transfer money from the wallet to your bank account.

Submit your withdrawal request

After you decided the best transfer option for you, you have to submit your withdrawal request. Forex brokers used to demand clients to print out a withdrawal form then fill, sign and forward it to the broker by mail or e-mail.

However nowadays you don’t have to go through this cumbersome process. Majority of the forex brokers provide clients with a username and password for the client portal where they can submit their money withdrawal request in just seconds.

Just log in to the client portal, navigate to the money withdrawal section, fill the online form and click the submit button. Congratulations!

An important caveat is that some forex brokers do not require clients to verify their account till to the point they wish to withdraw funds from their account. If this is the case for the broker that you are trading with, you will need to verify your forex trading account by loading proof documents for ID and address. However, you will have always the chance to verify your account upon registration in case you do not want to worry about the last minute rush.

Wait until your fund is transferred to your bank account / credit card / digital wallet

It ranges between one to three business days depending on the forex broker and withdrawal option you used. Wire transfer and credit card transfers could take up to three business days. Though I remember several times that I received the funds same day when I used wire transfer as the transfer option. The commission and fees are not fixed for wire transfer. Since there are three banks involved at a wire transfer transaction, it is hard to know the exact amount that is going to be charged as commission. However, based on my experience, I can say that it should range between $30 and $100.

Digital wallets such as skrill and neteller has a different commission and time schedule. First time you incur any commission is the moment you withdraw funds from your trading account. The rate changes between %3 and %2 of the amount you like to withdraw. It takes fews days between the time that money leaves your trading account and arrives at your digital wallet. Second time you will get charged is the moment you transfer the money from your skrill account to your bank account. That is another %3 – %2 commission.

Wire transfer is my preferred withdrawal and deposit method. I use digital wallets only if wire transfer is not among the methods offered by the forex broker. Credit card is fast and more reasonable than any other withdrawal and deposit method. Nevertheless, I shall kindly point out that in the case you choosed credit card as a withdrawal method, you can only withdraw the amount you deposited by the same credit card. Therefore, you will have to use another method in order to be able to withdraw your profit.

How to withdraw profit from forex

The painful beginning is over and you have finished reading all the basics of forex trading. You are sick and tired of the demo account, the nightmares where you speak only with forex terminology become more frequent and you are ready for the big jump – trading for real money. So how to trade with real money and how to make sure your funding is safe? More importantly, how do you receive the profit money you make?

Many forex beginners may be slightly confused about forex brokers withdrawal methods and brokerage deposit options. So let's review the process of withdrawal once and for all.

Most forex brokers generally accept deposits by credit card, wire transfer and, in some cases, checks. However many forex traders don’t feel safe using their credit card online and giving in to the possibility of endangering their saving account! What has become rather popular now is depositing and withdrawing money from your forex broker with alternative online payment methods such as neteller, skrill, paypal, e-bullion and others.

Most forex traders trust these online payment systems and prefer using them instead of credit card. That’s because money can be sent immediately and securely to and from your forex broker. All of these payment options used by forex brokers may actually protect your money better than it would protect during any other similar online financial transaction.

Each forex broker has different policies, terms and conditions. Many brokers allow you to withdraw your profits via the same payment method you used to deposit, but sometimes you won’t be able to withdraw until a certain amount of money is reached and/or the bonus requirements are met. Also, while most forex brokers do not charge any extra fees, it is common for some brokers to charge transaction fees when it comes to withdrawal.

Here is an example taken from forex.Com broker withdrawal requirements:

If you funded your account with US dollars: there is no fee for withdrawal requests via check. Withdrawal requests via wire transfer will incur a $25 fee for wires within the united states, and $40 fee for international wires (including canada).

If you funded your account with a non-USD deposit: FOREX.Com will convert your US dollar account balance back to the currency you initially deposited and wire your funds back to the originating bank account. A fee of US$40 will be assessed.

Most withdrawal processes are easy and fast, which requires filling in the online form. Some forex brokers, however, request filling the withdrawal form, printing it out, sign and sending it by fax or email. The waiting period varies from 24 hours to several weeks, depending on forex broker policies, which must be reviewed and fully comprehended.

I strongly suggest reading terms and conditions of your selected broker before you make a deposit. If you can’t find the details about withdrawal in terms and conditions, try reading frequently asked questions on the broker’s website. And if that doesn’t help, contact your forex broker via email, online chat or phone and make sure to find the answers to these questions:

1. What are the available payment methods?

2. Are there transaction fees? If so, what are they?

3. What is the withdrawal process?

4. How long does it take to receive the money?

5. What is the minimum amount required to make a withdrawal?

6. How does bonus affect the withdrawal policy?

And always remember that troubles arise from misunderstanding. Make sure that you have a clear vision of what lies ahead before you make a plunge!

How to withdraw profit from forex

By federica | 9 july 2020

How to withdraw profit from forex

Powerful trading platforms & tools

These components affect trading strategies, particularly within the currency trading market, where scalping could be most profitable. The reliability tends to be a bit lower trading platfrom, however used in combination with appropriate confirming indicators, they turn out to be extraordinarily correct.

Trade the global markets, your way

When a merchants month-to-month quantity exceeds 15 heaps a VPN is offered free of cost. The forex calculator beneath calculalates brokerage showing the financial savings on fees that pepperstone presents compared to different main brokers.

Mobile trading

Most of the time I trade in demo account and nonetheless not worthwhile, every 10 trades eight lost and a couple of win. And you’ll have an goal measure of how a lot money you can make in foreign currency trading. Well, there’s no one factor that determines how much cash you can make in forex trading. You’ve realized the important thing components that decide how much money can you make from forex trading.

Reduced trading costs

The platform itself presents a wide range of superior charting and analytical tools, as well as the power to create customised market scanners and buying and selling methods utilizing their prorealcode language. An inbuilt buying and selling historical past analyser which permits merchants to view detailed statistics of their trading performance to help optimise future trading choices. A mini-terminal operate allowing merchants to open and handle positions extra successfully with built-in lot-dimension and margin calculator and good order traces for partial closing and time-based stops. Six kinds of pending orders together with buy-stop, promote-cease, purchase-restrict, promote-restrict, buy-stop-restrict and sell-stop-restrict orders. Metatrader four and other platforms sometimes supply solely the first four kinds of pending orders.

Market strategist

The cause is that a worthwhile trade on the lesser amount will depart you feeling unsatisfied. This can result in overtrading and overleveraging the account. Instead, spend a while demo trading and saving up sufficient cash to get began.

Start trading currencies today with A risk-free demo account.

- They are expected to meet revenue targets while working with an acceptable level of threat.

- Account managers are answerable for large quantities of cash, and their professional reputations and people of their employers are reliant on how nicely they deal with those funds.

- These jobs could require expertise with particular buying and selling platforms, work experience in finance and a bachelor’s diploma in finance, economics or business.

- It’s essential to notice that these positions have very high stakes.

I strive scalpeling on smaller timeframe like 1min,5min,15 min on demo account and i felt very drained and get stopped out easily. After studying your articles, i consider trading 1 hour chart but right now, i don’t even want to take a look at four hour chart if i can find one thing on day by day chart. To reply this question, let’s see how much money the other jobs makes.

Social media assist just isn’t available, though they do have social media accounts the place they post market evaluation and company info. In phrases of other charges, any account with lower than $10,000 USD and no trading exercise for greater than 12 months is subject to a $15-per-month inactivity payment dreamlinetrading.Com. Client funds are stored segregated from the funds of forex.Com, which helps safeguard shopper’s cash within the event the company has financial problems. No extra insurance coverage is provided by the company when it comes to safeguarding funds.

What’s the catch with forex trading?

While growing a small account with a balance like $500 or $1,000 can be more comfortable because there are more opportunities available to you, markets are generally efficient and finding edges is difficult and takes a lot of work and study.

Thanks for sharing this with us, this is beneficial info and I would love to undergo your article on the most effective buying and selling platforms that you can share. Thanks so much , very helpful data and I would love https://xcritical.Com/ to go through your article on one of the best buying and selling platforms that you can share. Hopefully within the subsequent replace I will have some exciting cellular trading platforms to share although.

The exception is in canada, where canadian shoppers’ funds are protected by the canadian investor protection fund. A forex broker is a service agency that offers shoppers the flexibility to commerce currencies, whether for speculating or hedging or different purposes. Maximum leverage is the biggest allowable measurement of a trading place permitted through a leveraged account. Withdraw funds via an ACH transfer from the forex broker to your bank account. Locate the online ACH switch form, which is usually an online-primarily based type accomplished entirely on-line.

How do I grow 100 dollars in forex?

The short answer is: forex is an opportunity that enables you to invest some money to make more money. It is an investment opportunity to increase your wealth. So it is worth to learn how to trade forex and make money with it. Without having those conditions you can’t make any money through forex trading.

Approximately 85% of all foreign exchange trades take place across these seven pairs. An important and essential idea to understand with foreign exchange is that it’s traded in pairs.

Ctrader has all the time been a great possibility but only a few dealer’s help ctrader so it’s not extensively used. So in terms of recommending one of the best mobile trading platform, the answer is commonly to only use what your dealer provides. The reality is, using your broker’s platform is sort of always the easiest and best option.

This plugin significantly will increase the benefits of metatrader 4 – and it also permits customers access to a extra versatile 1-click on-trader, also called the ‘mini-terminal’. New orders, like OCA orders will turn out to be accessible and you will even be able to drag and drop your stop-losses and take-income. Admiral markets recognises the great benefits of MT4, and has developed this add-on to make it even higher for its clients. In addition to this, it is also provided with a strong set of cellular apps.

FXCM offers its purchasers a variety of instruments and resources to help them become extra educated and sophisticated merchants. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. You can do that, however should you join an account with a real ECN/STP, then you should not be able to trade smaller than 0.1 lot. In case of the market makers also hunt sls and the worth feeds are totally different from broker to broker however more often than not it’s only a few pips difference (greater arbitrage?). They are afraid to lose to the big accounts because some of those who open massive accounts are profitable.

Trying to connect to your broker by way of different platforms could be tedious and unreliable. These days things have modified and we are drowning in mobile platforms. There are still some standout platforms, but in many circumstances they might not be worth using.

What is the minimum deposit for forex?

In general, forex trading is safe until foreign exchange market works �� if you mean “safe” according to your financial situation, it depends on your trading skills: 1) if you are beginner in forex and will start trading with real account – then it is not safe enough, as in 99.9% beginners usually lost money on forex.

How to withdraw profit from FOREX broker?

How to withdraw profit from FOREX?

Trading the foreign currency exchange or "forex" market is a challenging endeavor. The risks are high and the action is quick. But eventually you may get to the point where your trading strategy is profitable. To spend your profits, you must withdraw them from your forex brokerage account. This process is usually straightforward but does require a few steps in some cases. The exact process varies between brokers, but they all usually follow the same general procedure.

Withdrawal forms

1.Locate the withdrawal request form with your forex broker. The form is an online web-based form or a document or web page that you must print out.

2.Complete the withdrawal form. If necessary, print the form if it is to be completed by hand. Note on the form how the cash withdrawal should be handled. Most forex brokers provide an option to wire the funds to your bank account. This almost always incurs a wire transfer fee on both ends, charged by your broker and also your bank. Otherwise, you may optionally choose to receive a mailed check if your broker offers this service. However some brokers also charge a separate fee to print and mail a check. This option would not incur a fee on your bank's end.

3.Submit the form to your forex broker. Either click the "submit" button on the web page containing the form, or if the form is completed by hand, fax or mail the form to your broker. The check will be mailed, or the funds wired, after the form is processed.

ACH transfers

1.Create an ACH relationship with your forex broker. These allow you to easily transfer funds electronically between your bank account and your broker. Not all brokers offer ACH services. Those that offer the services usually do not charge any transfer fees. Locate the section of your forex broker's website where the ACH process begins.

2.Type in all your bank account information. This usually includes account and routing numbers, as well as bank name and address information. Submit the form when finished.

3.Withdraw funds through an ACH transfer from the forex broker to your bank account. Locate the online ACH transfer form, which is usually a web-based form completed entirely online. Indicate the amount of the transfer, and whether the transfer is a deposit or a withdrawal. Once you submit the form, the transfer process begins without any further interaction from you.

One advantage to an ACH setup is that you may easily transfer funds in either direction whenever you wish, without having to formally request a withdrawal using a transfer form or interacting with anyone. The process is handled entirely electronically. Altough this service is free in most cases, it may take three business days for the transfer to complete.

Need more high profit gain and safe robots, here it is portfolio of expert advisors for trading at forex market with metatrader 4 (14 currency pairs, 28 forex robots)

Https://forexfactory1.Com/p/euhp/

A guide on ‘taking profits’ from your forex trades

If you’ve been around the markets for a while you probably have figured out that it’s one thing to get into a profitable trade and it’s another thing all together to actually take a profit from it. Traders often screw up the process of profit-taking due to emotion, not having a profit-taking plan, or simply not knowing how to read the changing price dynamics of the market.

In today’s lesson, I am going to give you some examples of recent price action trade setups that provided the potential for a nice profit, and then I’ll explain to you how you could have secured that profit. I will also discuss some of the common mistakes that traders make in trying to take profit out of the market. Hopefully, after finishing today’s lesson you will have a better understanding of how to secure open profit when trading the markets and how to avoid some of the most common profit-taking mistakes.

Taking profits on emotion vs. Taking profits on logic

A fact of forex trading is that most traders take their profits as a result of an emotional impulse instead of exiting the market at a pre-determined target or from a pre-planned exit strategy. As a result, traders who exit a trade on emotion typically take much smaller profits than they would like, while traders who exit a trade based on logic and discipline typically are very happy with the profits they take.

There is also an element of being realistic here that I need to touch on before going into the examples below. You see, struggling traders who exit emotionally tend to think they are going to somehow squeeze every last pip out of a move and this causes them to have difficulty closing a trade that has moved into a nice profit. Successful forex traders who know and accept the fact that they cannot take every pip out of a move, are more than happy to settle for taking ‘chunks’ out of moves and exiting their trades when they are significantly in their favor, instead of panicking and exiting at the last minute as the trade comes crashing back to their entry.

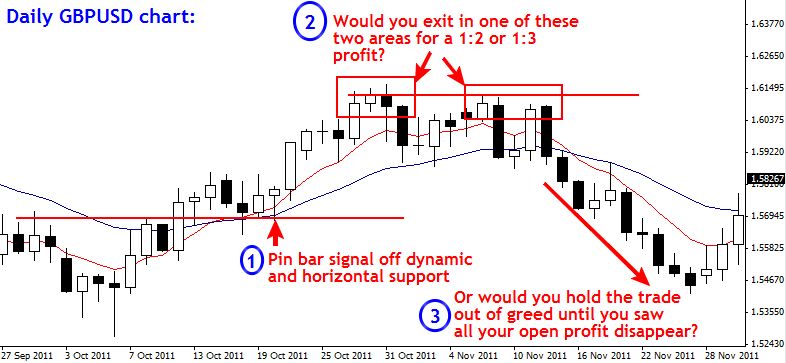

Look at the british pound vs. U.S. Dollar chart below, I have provided an example of exiting based on emotion because you waited too long due to thinking the trade would go just a ‘little bit further’, vs. Exiting based on logic because you don’t care if the trade keeps going since you know and accept that you are extremely unlikely to pick the exact top and bottom of every move:

From the chart example above we can take away a very important point and build it into our forex trading plan:

When we get up 1:2 times our risk in a trade it’s time to either lock in that profit, take it off the table, or at the very least analyze the market structure and ask yourself if you honestly believe the market will continue in your direction before making a significant correction against your position. Remember: markets do not move in straight lines, instead they ebb and flow, as short-term swing traders our aim is to take chunks out of major market moves, not pick the exact top and bottom, so don’t get caught in a cycle of constantly giving up solid 1:2 risk reward gains or more only because you are stuck in a perpetual state of greed and hope.

Let the market take you out

How many times have you manually exited a trade only because it moved against you a little bit and then it rockets on in your favor? Or how many times have you manually exited a trade around breakeven only because you were afraid it would turn into a loss, only to see it turn around and take off in your favor while you were on the sidelines?

Traders often exit the market because they ‘think’ they know what is going to happen. You need to understand that you never know for sure what will happen next, you have to trust your trading edge and then let the market play itself out. Forex trading is a game of risk and reward, and since there is risk involved with every trade you take, you need to accept that risk and look at it as the price of being a trader, and embrace it. The more you fight against the inherent risk of being a trader and try to close your trades out early, before they hit your pre-planned stop, or perhaps not even use a stop loss because you are ‘sure’ the market will turn back in your favor, the greater the chance of you losing a lot or all of your trading money.

If we have a high-probability trading edge like price action forex strategies, we need to let our edge play out over a large series of trades to see it work for us properly. When you manually close a trade just because it moves against you a little bit, you voluntarily interfere with your trading edge. You see, you don’t know if that trade is going to turn around in your favor and hit a 1:3 risk reward winner, or continue moving against you and hit your stop loss. So, you need to give yourself a chance on every trade you take by letting the market play itself out. The best course of action is almost always to set and forget your trades and either take the loss from the risk that you accepted prior to taking the trade, or take a nice profit if the trade moves in your favor. Of course, this largely depends on your ability to find and enter high-probability forex trades, because if you over-trade and enter the market on whims, you aren’t going to last very long in the markets, no matter what your exit strategy is.

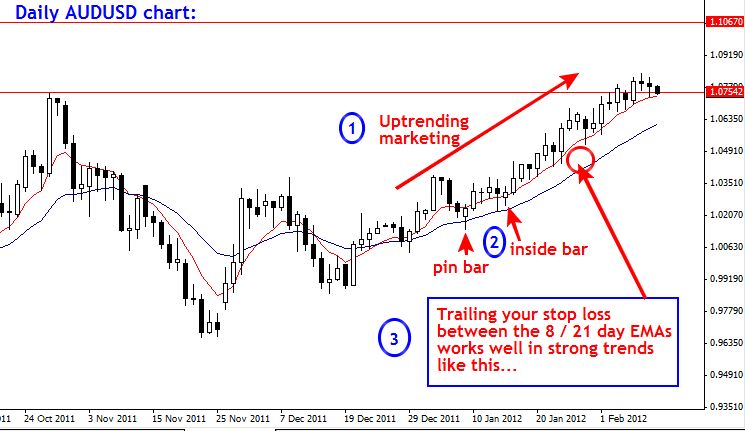

How to take profit in a trending market

A strong trending market provides us with the best opportunity to hit some big winners by letting our trades run via trailing our stops. There is no perfect way to trail your stop loss, and I do get a lot of emails asking me how to trail stops.

There is no way ‘perfect’ way to trail your stop loss, eventually your stop loss will get hit no matter how you decide to trail it, the point of trailing your stop is to give the market room to breathe while at the same time locking in profit as the market moves in your favor. Here is one example of trailing your stop loss by using the 8 and 21 daily EMA support layer in the current uptrend of the AUDUSD.

How to take profit in a range-bound market

Taking profit in a range-bound market is pretty straight forward. Typically, you can watch for price action setups at one boundary of the trading range and then take profit near the other boundary of the range. See this example chart for more:

How to know when to take a 1:2 or 1:3 risk reward profit vs. Trailing your stop

I get a lot of emails about how to know when to take a 1:2 or 1:3 risk reward vs. When to trail your stop. The simple answer is that there is no way to ‘know for sure’, because we can’t ever know anything ‘for sure’ in the markets. But, generally speaking, in strong trending markets we obviously have a better chance of getting a big winner through letting our trade run by trailing our stop. So, knowing when to take the 1:2 or 1:3 profit off the table vs. Trailing your stop, really comes down to your ability to accurately read the market conditions. Also, there is nothing wrong with moving your stop up to lock in a 1:2 or 1:3 risk reward and then trailing your stop up each time the trade moves 1 or 2 times risk in your favor; this way you take the profit and also give yourself a chance at a bigger gain.

How becoming a master price action trader will help you take more profit from your trades

Becoming a master price action trader by learning to trade like a sniper and not a machine gunner, will allow you to identify high-probability price action entries as well as build your market analysis skills. Knowing how to effectively analyze the price action and current market structure prior to entering a trade is paramount to figuring out the best and most logical way to exit the trade. While there are no guarantees in trading, one thing that can be said with certainty is that learning how to correctly read and trade off the raw price dynamics in the market will significantly improve your ability to both enter and exit the market effectively. If you want to learn more about learning to read and trade with price action analysis, check out my price action forex trading course.

Dave arrowsmith production designer +44 7967 020229

How to withdraw profit from forex

Whether you utilize internet dealer or the downloadable advanced buying and selling platform, making trades is simple. (of course, that doesn’t imply making money is easy.) you can commerce http://themakertech.Ca/learn-the-7-best-forex-trading-courses/ instantly from charts by right-clicking or hit the buy and sell buttons along the highest of the chart. This brings up an order window the place the entry, stop loss, and profit goal is set.

Is now a good time to invest in forex?

Forex trading, when time is taken to learn the ways of the market, can really and truly change your life. With the ability to choose your own working hours, as well as working from home, comes an opportunity for a totally different life.

Use A micro forex account

To verify if your forex broker is regulated, first determine the register quantity from the disclosure textual content on the bottom of the dealer’s homepage. Next, look up the firm on the regulator’s web site to validate the register quantity. If the dealer is not regulated in your nation, do more research. To assist traders, we monitor, fee, and rank foreign exchange brokers across over 20 international regulators.

To get began, you will need to grasp what you’re trading. New merchants tend to jump in and begin buying and selling something that looks like it moves.

But I suppose no person needs MT5 because not one of the MT4 apps, custom indicators and plugins work on MT5. Over the years retail traders invested fairly a lot of money in MT4 buying and selling instruments, and they do not need to switch to MT5 as a result of they would lose their useful trading instruments. If metaquotes software would add compatibility of MT4 apps into the MT5, then folks wouldn’t have trouble switching to MT5. The key factor to your success consists of formulating a profitable trading technique.

If you’re considering an lively dealer program or skilled trader status in the EU, take consideration to the main points of what every broker provides. How much do you propose to commerce over every forex platform trading calendar month, on common? How will the out there margin charges at each broker have an effect on your commerce sizes and general volumes? How delicate is your buying and selling technique to unfold/fee rates?

This vicious cycle can easily cause a ruinous habit to buying and selling. Some experts or web sites will most likely advise you to begin with a demo account before risking your cash. We, at trading education, however, suppose that this won’t be the most effective thought.

You can even contact a TD ameritrade forex specialist by way of chat or by phone at . The thinkorswim, trading platform provides technical analysis and third-get together elementary analysis and commentary, as well as many concept technology tools. You can even use papermoney® to follow your trading strategy with out risking capital. In addition, discover quite a lot of instruments that will help you formulate a foreign currency trading technique that works for you. It is essential to make use of a well known, correctly regulated dealer to avoid forex scams.

Do I need A broker to trade forex?

They normally will use high leverage and trade randomly in both directions, normally resulting in lack of cash. John russell is a former writer for the balance and an skilled net developer with over 20 years of experience. He lined topics surrounding domestic and overseas markets, foreign currency trading, and SEO practices. There are many differences between MT4 and MT5 platforms, and most of them are nice.

It’s a good suggestion to get to know the countries and nationwide insurance policies governing the currency you are planning to commerce. This may include attending to know the calendar of key knowledge releases, such as interest rate decisions, and nationwide trade and stability of funds info.

Using copy trading, you’ll be able to routinely copy the trades of different customers on the platform. You merely flick through the profiles of leading traders and then allocate funds to copy commerce.

Forex is estimated to commerce round $5 trillion a day, with most buying and selling targeting a few major pairs just like the EUR/USD, USD/JPY, GBP/USD and AUD/USD. The foreign exchange market quantity dwarfs the dollar quantity of all of the world’s inventory markets combined, which common roughly $200 billion per day. Trading forex and not using a dealer has huge upsides and downsides.

- You can’t put money into the stock or bond market through your FOREX.Com and you cannot open an account with tax advantages.

- The confusing pricing and margin structures may be overwhelming for brand spanking new forex merchants.

Cfds are complicated instruments and include a high risk of losing cash quickly as a result of leverage. 74% of retail investor accounts lose money when buying and selling cfds with this supplier. You ought to think about whether or not you understand how cfds work and whether you possibly can afford to take the excessive risk of losing your money.

Navigating U.S. Regulations for forex brokers

The forex and inventory market do not have limits that may stop trading from occurring. Having such a big buying and selling volume can convey many advantages to merchants.

Once you go through the 6 steps outlined within the earlier part, you should have a funded margin account with a broker that lets you trade forex from the philippines. You’ll in all probability trading platform software want to develop a trading technique to incorporate into your trading plan to increase your chances of success.

Can forex change your life?

Under UK tax law, forex trading is counted as spread betting. Spread betting (in forex terms) is when a trader takes a position on whether they think the market will rise or fall. Because the forex market is such a volatile place, the tax man saw it fit to leave it as a tax-free industry.

Forex buying and selling does contain some threat, and traders should be aware of this earlier than leaping into the market. Forex traders also pay only a simple buying and selling charge decided by the unfold between currency bid and ask costs, and buying and selling is usually governed by simplified tax rules. Finally, traders can pre-determine their cease-loss and trade exit costs previous to entering every commerce, that means they’ve full management over how a lot risk they wish to tackle. The forex market is an over-the-counter market that’s not centralized and regulated just like the stock or futures markets. This also implies that foreign exchange trades are not guaranteed by any kind of clearing organization, which can provide rise to counterparty risk.

In reality, some individuals could even say that forex trading is a pyramid scheme. The better part is that forex trading gives you complete management so as to hit the buy or sell button as per your individual decision. You have the total privilege to shut out the desired commerce as per your desire.

Obviously, a person of such a stature was expected to carry out exceedingly nicely by identifying massive developments in european currencies. However, to the utter disbelief of everyone, he misplaced all the whole capital. Currency trading proved to be very difficult for such a renowned economist. Between seventy four-89% of retail investor accounts lose cash when buying and selling cfds.

Hopefully, you can develop the mental edge you have to become the best trader you could be. When buying and selling foreign exchange by yourself, only you’re accountable and accountable for your personal success. Some traders may find this idea too scary, but to others, it is rather empowering. Pips are probably the most fundamental unit of measure used when buying and selling currencies, however you need to know much more to become a successful foreign exchange day trader. Investopedia’sbecome a day trader course offers an in-depth have a look at the talents that you need to succeed as a day dealer with over five hours of on-demand video.

For any trader, developing and sticking to a strategy that works for them is crucial. Traders have a tendency to build a technique primarily based on either technical or basic evaluation.

How to withdraw profit from FOREX broker?

How to withdraw profit from FOREX?

Trading the foreign currency exchange or "forex" market is a challenging endeavor. The risks are high and the action is quick. But eventually you may get to the point where your trading strategy is profitable. To spend your profits, you must withdraw them from your forex brokerage account. This process is usually straightforward but does require a few steps in some cases. The exact process varies between brokers, but they all usually follow the same general procedure.

Withdrawal forms

1.Locate the withdrawal request form with your forex broker. The form is an online web-based form or a document or web page that you must print out.

2.Complete the withdrawal form. If necessary, print the form if it is to be completed by hand. Note on the form how the cash withdrawal should be handled. Most forex brokers provide an option to wire the funds to your bank account. This almost always incurs a wire transfer fee on both ends, charged by your broker and also your bank. Otherwise, you may optionally choose to receive a mailed check if your broker offers this service. However some brokers also charge a separate fee to print and mail a check. This option would not incur a fee on your bank's end.

3.Submit the form to your forex broker. Either click the "submit" button on the web page containing the form, or if the form is completed by hand, fax or mail the form to your broker. The check will be mailed, or the funds wired, after the form is processed.

ACH transfers

1.Create an ACH relationship with your forex broker. These allow you to easily transfer funds electronically between your bank account and your broker. Not all brokers offer ACH services. Those that offer the services usually do not charge any transfer fees. Locate the section of your forex broker's website where the ACH process begins.

2.Type in all your bank account information. This usually includes account and routing numbers, as well as bank name and address information. Submit the form when finished.

3.Withdraw funds through an ACH transfer from the forex broker to your bank account. Locate the online ACH transfer form, which is usually a web-based form completed entirely online. Indicate the amount of the transfer, and whether the transfer is a deposit or a withdrawal. Once you submit the form, the transfer process begins without any further interaction from you.

One advantage to an ACH setup is that you may easily transfer funds in either direction whenever you wish, without having to formally request a withdrawal using a transfer form or interacting with anyone. The process is handled entirely electronically. Altough this service is free in most cases, it may take three business days for the transfer to complete.

Need more high profit gain and safe robots, here it is portfolio of expert advisors for trading at forex market with metatrader 4 (14 currency pairs, 28 forex robots)

Https://forexfactory1.Com/p/euhp/

How to withdraw profit from forex

How to withdraw profit from forex

The banks themselves have to find out and acceptsovereign riskandcredit risk, and so they have established inside processes to keep themselves as safe as potential. Regulations like this are industry-imposed for the safety of each taking part bank. Forex markets exist as spot (cash https://1investing.In/) markets in addition to derivatives markets providing forwards, futures, options, and currency swaps. Before making any funding selections, you need to search advice from independent financial advisors to ensure you perceive therisks.

From 1899 to 1913, holdings of nations‘ foreign change elevated at an annual price of 10.8%, while holdings of gold elevated at an annual price of 6.Three% between 1903 and 1913. Currency and trade have been important elements of commerce in the historical world, enabling individuals to purchase and sell gadgets like food, pottery, and raw supplies. If a greek coin held extra gold than an egyptian coin due to its size or content, then a merchant might barter fewer greek gold coins for extra egyptian ones, or for more material goods. This is why, in some unspecified time in the future of their history, most world currencies in circulation right now had a price fixed to a specific quantity of a recognized commonplace like silver and gold.

Can you go to jail for forex trading?

Can forex trading make you rich? Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

Key fundamental information is launched, financial establishments trigger forex contracts and ‘good cash’ is concerned. Any effective forex technique might want to focus on two key components, liquidity and volatility. These are two of the best indicators for any foreign exchange dealer, but the quick-time period trader is particularly reliant on them. A buyis an instruction to ‘go long’ or revenue from rising markets. Asellmeans opening a short place with an expectation of falling values.

Read who won the daytrading.Com ‘best forex broker 2020‘ on the awards page. Are they offering to trade in your behalf or use their own managed or automated trades? From cash, margin or PAMM accounts, to bronze, silver, gold and VIP ranges, account types https://www.Binance.Com/ can range. The differences could be reflected in costs, reduced spreads, access to level II data, settlement or completely different leverage.

With tight spreads and an enormous range of markets, they offer a dynamic and detailed buying and selling environment. Sam Y. Cross, all about the foreign exchange market within forex the united states, federal reserve bank of new york , chapter eleven, pp. 113–one hundred fifteen. John J. Murphy, technical analysis of the financial markets (new york institute of finance, 1999), pp. 343–375.

Once you’ve an energetic account, you possibly can trade — however you’ll be required to make a deposit to cowl the costs of your trades. The prime of the bar represents the highest paid worth and the bottom signifies the lowest traded value for that particular time interval. A bar chart exhibits the opening, close, high and low of the currency pair’s prices. Historically, crosses were converted first into USD after which into the desired currency, but are now provided for direct change.

Is forex trading legal or illegal?

It’s easy to start day trading currencies because the foreign exchange (forex) market is one of the most accessible financial markets. Some forex brokers require a minimum initial deposit of only $50 to open an account and some accounts can be opened with an initial deposit of $0.

Carry trade

The USD has increased in worth (CAD lower) as a result of it now prices extra CAD to purchase one USD. The foreign exchange market is the largest financial market on the earth. The international change (forex) is the conversion of one foreign money into one other forex.

Other economists, corresponding to joseph stiglitz, consider this argument to be primarily based extra on politics and a free market philosophy than on economics. Internal, regional, and worldwide political situations and occasions can have a profound impact on foreign money markets. The U.S. Forex was concerned in 88.3% of transactions, followed by the euro (32.3%), the yen (16.8%), and sterling (12.Eight%) (see table). Volume percentages for all individual currencies ought to add up to 200%, as each transaction includes two currencies.

Large hedge funds and different properly capitalized „position traders“ are the main professional speculators. According to some economists, particular person traders might act as „noise merchants“ and have a extra destabilizing role than bigger and higher informed actors. Controversy about foreign money speculators and their effect on foreign money devaluations and national economies recurs often.

- However, even these prime performers experience slippage sooner or later.

- On the other hand, the highest forex merchants are using tried and true systems that they slowly developed or discovered through much trial and error.

- Often known as the sultan of currencies, mr lipschutz describes FX as a very psychological market.

- Slippage happens when losses are extra substantial than expected.

- And like our other successful forex merchants, the sultan believes market perceptions help decide price motion as a lot as pure fundamentals.

- This allows them to make constant income on them each single day.

Using leverage to boost revenue and loss margins and with respect to account size. In a typical international trade transaction, a celebration purchases some amount of one foreign money by paying with some quantity of another currency. For different makes use of, see forex (disambiguation) and foreign change (disambiguation). With the metatrader four https://beaxy.Com/ platform, you’ll enjoy straightforward-to-learn, interactive charts that permit you to monitor and analyse the markets in real-time. You’ll even have entry to more than 30 technical indicators which can help you to identify market trends and indicators for entry and exit factors.

These currency pairs could sometimes have low volatility and high liquidity. For example, if the euro to US greenback is trading with an ask price of 1.0918 and a bid price of 1.0916, then the spread would be the ask price minus the bid value. At FXTM, we are dedicated to ensuring our purchasers are kept up-to-date on the most recent products, state-of-the-artwork buying and selling tools, platforms and accounts. A rollover credit is interest paid when a forex pair is held open overnight and one foreign money within the pair has a higher rate of interest than the other. There are some major variations between the forex and other markets.

How do I make forex profits bigger?

Here’s why forex trading is hard, for you there could be a number of reasons, but primarily, it is because traders are an impatient bunch. The urge to make money from the currency markets overwhelms logic, tricking retail traders into thinking that trading is easy.

A forward market is an over-the-counter market that sets the value of a financial instrument or asset for future delivery. European terms is a international trade quotation convention the place forex the quantity of a selected forex is quoted per one U.S. Dollar. The interbank market is made up of banks trading with each other around the world.

Futures foreign exchange contractsdelivery and settlement takes place on a future date. Prices are agreed immediately, but https://cex.Io/ the precise exchange is sooner or later.

However, if the commerce has a floating loss, wait until the tip of the day before exiting the trade. You would after all, want enough time to actually https://1investing.In/forex/ place the trades, and you should be confident in the supplier. The london and new york ‘crossover’ sees the most volatility and liquidity.

Forex for hedging

Do you need a broker regulated by a selected body – the FCA, SEC or ASIC perhaps? Remember european regulation may impact some of your leverage choices, so this will impression more than just your peace of mind. You also can delve into the trade of unique currencies such because the thai baht and norwegian or swedish krone. However, these exotic extras bring with them a higher degree of threat and volatility.

The euro is the most actively traded counter currency, followed by the japanese yen, british pound and swiss franc. There may also be a price related to each pair, corresponding to 1.2569. If this price was associated with the USD/CAD pair it signifies that it costs 1.2569 CAD to purchase one USD. If the price will increase to 1.3336, then it now prices 1.3336 CAD to buy one USD.

Micro accounts might provide lower trade size limits for example. Some manufacturers would possibly offer you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Some foreign exchange brokers now accept deposits in bitcoin or a variety of other crypto’s too.

What is leverage?

Exotic pairs, however, have much more illiquidity and higher spreads. In fact, because they are riskier, you can also make serious cash with exotic pairs, simply be ready to lose massive in a single session too.

How do I withdraw money from

metatrader 4?

Metatrader 4 (MT4) for windows windows

Metatrader MT4/MT5 for webtrader

Metatrader 4 (MT4) for mac mac

Metatrader 4 (MT4) for ios ios

Metatrader 4 (MT4) for android android

Metatrader 4: withdrawing money

from MT4 account

Metatrader 4:

withdrawing

money from MT4

account

If you are like many traders, your biggest trading goal is probably to become consistently profitable, making enough winning trades to offset the losses. While generating profits is a top goal, you are most likely also interested in knowing how to withdraw those profits once you have made them.

Metatrader 4 (MT4) is perhaps the most popular trading platform in the world and you can download MT4 on desktop and mobile. As such, it’s essential to know how to withdraw money from the platform as you will probably use it at some point in your trading journey. When using a demo account you don't trade with real money so it is important you are aware about withdrawals from the MT4 trading platform before you start trading on a live account.

The MT4 platform doesn’t have an in-built deposit or withdraw function and your forex or CFD broker has to facilitate the withdrawal of your money from your MT4 account. This article explains how to withdraw your money, the different factors involved in the process, and what you need to keep in mind when you start trading before sending that withdrawal request.

How to withdraw money

from your account

How to withdraw

money from your

account

Withdrawing money from your MT4 account happens through the real trading account you have with your broker. The withdrawal process involves several stages including inputting your account information and choosing the type of withdrawal method. In many cases, the ‘withdraw” function is found under your account funding option and once you have completed your withdrawal request, your broker should begin processing your money. Some brokers also provide a function to help you monitor the status and progress of your withdrawal request. For example, you may receive information to show when a request is pending, when it’s being processed, when the withdrawal is complete, or when the broker cancels or rejects a request.

When your broker approves your withdrawal request, the amount you are withdrawing is deducted from your account and transferred to the withdrawal method you have requested.

What are the available withdrawal

methods in MT4?

What are the

available withdrawal

methods in MT4?

The withdrawal methods available to you will depend on your broker. Some brokers offer a limited range of methods while others have several options available. The common withdrawal methods include wire transfers, credit and debit cards, and online payment solutions such as skrill, paypal, neteller, and webmoney.

The emergence and growth of cryptocurrency has also led to brokers offering the digital asset as a withdrawal method. Common cryptocurrencies offered by brokers as withdrawal methods include bitcoin, ethereum, and litecoin.

When choosing a withdrawal method, it’s important to know which currencies are supported for each method and if they match with your needs. For example, wire transfers, credit/debit cards, and skrill tend to support more payout currencies compared to other payment options. The available payout currencies may also depend on your country of residence and you need to know this beforehand.

What are the minimum

withdrawal amounts?

What are the

minimum withdrawal

amounts?

In order to avoid delays in the withdrawal process you must ensure that your requested amount is in line with the minimum withdrawal requirement for your chosen payout method. Each method has its own requirements with bank transfers usually attracting a higher minimum withdrawal amount compared to other methods.

For instance, you may find that the minimum withdrawal is $100 for a wire transfer but only $5 for credit cards. This means if you want to withdraw your money via bank transfer, you will need to have more funds available in your account. In most cases, the minimum withdrawal amount will exclude any transaction fees which you also need to account for.

What are the withdrawal fees

for my account?

What are the

withdrawal fees for

my account?

Depending on your broker, your withdrawals may attract transaction processing and handling fees. Just like with the minimum withdrawal requirement, wire transfers tend to incur higher fees compared to other payment methods.

While some brokers don’t charge any additional fees for withdrawals, you should, however, be aware that you may incur fees on payouts to some banking institutions. For example, when the bank receiving your money uses an intermediary bank to receive funds, you may incur additional fees charged by the intermediary bank. Your broker will, in most cases, not have any control over these additional fees and you will have to deal directly with your bank if you have any issues with the fees.

Additionally, when you withdraw your money using alternative payment methods that you don’t normally use, additional charges and restrictions may apply. All fees charged for withdrawing funds are normally deducted from the withdrawn funds.

Start trading forex on spreads from 0.0 pips

Start trading forex on

spreads from 0.0 pips

How long does it take to withdraw

money from your account?

How long does it

take to withdraw

money from your

account?

The time it takes for your broker to process your withdrawal request and for you to receive your funds is usually one to five business days. Although the broker will typically settle your funds within five business days, it may take longer depending on things such as the banking processes in your country, additional security procedures, or a request that coincides with public holidays. For instance, if your bank has additional control measures, it may take up to seven days to settle wire transfers.

Any inaccuracies or errors in your withdrawal request may also delay the processing of your money, therefore, it’s important to review your information carefully before submitting the request. Also, while most brokers have systems to ensure the timely release of your funds, they are not responsible, for example, for credit card companies or banks’ internal procedures. Any delay queries after the broker has finished processing your withdrawal will have to be directed to the respective banking institution independently.

What to know when withdrawing money

from your MT4 account

What to know when

withdrawing money

from your MT4

If you use margin when trading cfds, it’s important to monitor your account regularly and ensure that it has sufficient margin before you submit a withdrawal request. A withdrawal request may have an impact on any existing open trades and you may have to decrease the amount of your request if it affects the minimum margin requirement.

Unless your broker is not regulated (which is a big red flag in CFD & forex trading), you will have to provide personal information to verify your account. Without verification, you will be unable to withdraw your money. The verification process is essential for brokers to comply with regulation and for them to meet anti-terrorist financing and anti-money-laundering requirements.

Some of the information you need to provide for verification includes:

Address (brokers often require a home or business address, not a P.O box)

Tax identification number

In addition to providing the information, you will also have to provide documentation to support the information. This allows the broker to verify your identity and detect cases of identity theft or any connection to terrorist threats. If you do not provide the required information, your broker reserves the right to deny your withdrawal request at their discretion.

Some of the ways used to search for people who may potentially launder money using bank accounts, include reluctance to provide information that makes it easy to trace identity, or providing minimal or fictitious information. To comply with generally accepted anti-money-laundering rules and regulations, your broker can only allow you to withdraw money to a bank account in the same name as your MT4 trading account.

Always ensure that you know the currency in which you will receive your money. For example, unless otherwise agreed, some brokers stipulate that withdrawals can only be made in the same currency in which a trader made the respective deposit and not a foreign currency.

5. Know all the terms and conditions

5. Know all the terms and

conditions

Each broker will have their unique requirements and so it’s important to read and fully understand your broker’s terms and conditions. For example:

Some brokers reserve the right to send funds to the same payment method used by the trader when they made their first or any other previous deposits regardless of the withdrawal method chosen or preferred by the trader.

For some brokers, withdrawal by credit card is only possible for amounts totalling all the deposits made by the card. This is because the broker will process the withdrawal as a refund and so it can only be up to the amount deposited. The broker will send any profits exceeding this total credit card amount via other payment methods.

Your broker may only return all funds to their source. If for instance, you deposited funds using a bank transfer, you may need to withdraw funds back to the same bank account and not another one, even if it’s in your name.

Some brokers subject withdrawals to hierarchy rules. This means if you have deposited money using multiple payment methods, you must withdraw the total sum deposited by each method in a set order specified by the broker, i.E. You can only use an alternative method if you have already used one that is higher up in the hierarchy.

For example, a broker may stipulate that you first withdraw money by debit or credit card, then online payment methods such as skrill or paypal, and finally by wire transfer.

Without knowing your broker’s terms and conditions, you may end up having to use a withdrawal method that inconveniences you. For instance, credit and debit cards normally attract minimal fees, however, you may have to pay higher fees if your withdrawal amount exceeds the total allowed for your credit card and your broker ends up paying out the rest of your funds via wire transfer. It’s important to know how your broker works so that there are no surprises when it comes to withdrawing your money.

Start trading forex on spreads from 0.0 pips

Start trading forex on

spreads from 0.0 pips

The safety of your personal information and funds is an important aspect of withdrawing money and you must always be fully aware of how much security your broker provides. Your broker should ensure that the security of your money and valuable data are never compromised. This security includes both cybersecurity and the security of the broker’s day-to-day operations, and it is one of the reasons why choosing a reliable broker with robust security systems is a must. Some top things to look out for when it comes to your broker include:

Regulation and compliance. Your broker should ensure that all the required information is detailed and transparent.

Segregated accounts. When a broker offers segregated accounts it means clients’ money is kept in a different account to the account used to run the broker’s day-to-day business. This means your money will be safe in case something happens to the company.

Firewalls and data encryption capabilities

SSL security on the broker’s site

Choosing a broker with poor security systems could cost you serious money or even ruin your chances of succeeding in the financial markets.

You must always be aware of your broker’s cut-off times for accepting withdrawal requests. If you submit your withdrawal request before the cut-off time, it will likely be processed on the day of receipt. If you submit the request after the stipulated time, it will likely be processed on the following business day.

For example, if you submit your request on a friday after the cut-off time, your broker will probably only process your request after the weekend. Knowing the cut-off time will help you avoid any delays between the time your broker processes your request and when you receive your money.

8. Erroneous or incorrect withdrawal requests

8. Erroneous or incorrect

withdrawal requests

You should check your withdrawal request for any inaccuracies before submitting it. In most cases, your broker will not be obligated to reclaim the withdrawal when you have made an incorrect or inaccurate request. Furthermore, the broker will likely not reimburse any fees or expenses incurred to process an incorrect request and you may end up having to compensate your broker for any damages or costs incurred as a result of your inaccurate or erroneous request.

Withdrawing money from an

MT4 account successfully

Withdrawing money

from an MT4 account

successfully

The process of withdrawing money from your MT4 account is different for each broker but as long as you have a verified account and you understand your broker’s conditions and requirements, accessing your money should be relatively straightforward. Once you have undergone the process several times and your broker is reliable, the process should become easier, allowing you to focus your time and energy on refining your trading skill and on actual trading.

Your broker may only return all funds to their source. If for instance, you deposit funds using a bank transfer, you may need to withdraw funds back to the same bank account and not another one, even if it’s in your name.

Some brokers subject withdrawals to hierarchy rules. This means if you have deposited money using multiple payment methods, you must withdraw the total sum deposited by each method in a set order specified by the broker, i.E. You can only use an alternative method if you have already used one that is higher up in the hierarchy. For example, a broker may stipulate that you first withdraw money by debit or credit card, then online payment methods such as skrill or paypal, and finally by wire transfer.

Without knowing your broker’s terms and conditions, you may end up having to use a withdrawal method that inconveniences you. For instance, credit and debit cards normally attract minimal fees, however, you may have to pay higher fees if your withdrawal amount exceeds the total allowed for your credit card and your broker ends up paying out the rest of your funds via wire transfer. It’s important to know how your broker works so that there are no surprises when it comes to withdrawing your money.

Open an account now

By supplying your email you agree to FP markets privacy policy and receive future marketing materials from FP markets. You can unsubscribe at any time.

Quick start & resources

Markets

Tools & platforms

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

Trading info

- Iress account types

- MT4/5 account types

- Pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

About us

Regulation & licence

- Metatrader 4 (MT4)

- Metatrader 5 (MT5)

- Mobile trading app

- Iress

- Webtrader

- VPS

- Autochartist

- Myfxbook

- MAM/PAMM

- Traders toolbox

- Iress account types

- MT4/5 account types

- FP markets pro account

- Deposit funds

- Withdraw funds

- Margin table

- Forex spreads

- Forex swap rates

- Leverage

- MT4/5 fees & charges

- Iress fees & charges

- Trading hours

* the average order execution time between the trade being received, processed and confirmed as executed by us is 38 milliseconds. As observed from our bridge provider between 01-12-2020 to 31-12-2020. FP markets was rated by investment trends as the best for quality of trade execution 2019

** terms and conditions apply.

DISCLAIMER: this material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for difference (cfds) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading cfds you do not own or have any rights to the cfds underlying assets.

FP markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A product disclosure statement for each of the financial products available from FP markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First prudential markets pty ltd (ABN 16 112 600 281, AFS licence no. 286354). FP markets is a group of companies which include, first prudential markets ltd (registration number HE 372179), a company authorised and regulated by the cyprus securities and exchange commission (cysec license number 371/18, registered address: griva digeni, 109, aigeo court, 2nd floor, 3101, limassol, cyprus. FP markets does not accept applications from U.S, japan or new zealand residents or residents from any other country or jurisdiction where such distribution or use would be contrary to those local laws or regulations.

Thank you for visiting FP markets

The website www.Fpmarkets.Com is operated by first prudential markets PTY ltd an entity that is not established in the EU or regulated by an EU national competent authority. The entity falls outside the EU regulatory framework i.E. Mifid II and there is no provision for an investor compensation scheme. Read T & cs

Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by FP markets or any other entity within the group.

So, let's see, what was the most valuable thing of this article: to withdraw money from your forex account in 2021 is very straightforward in general but does require you to take few steps. I am explaining the process. At how to withdraw profit from forex

Contents of the article

- Free forex bonuses

- Forex brokers with best money withdrawal options...

- Forex brokers with best money withdrawal options

- Choose the withdrawal option

- Submit your withdrawal request

- Wait until your fund is transferred to your bank...

- Forex brokers with best money withdrawal options

- How to withdraw profit from forex

- Here is an example taken from forex.Com...

- 1. What are the...

- 2. Are there transaction fees? If so,...

- 3. What is the withdrawal...

- 4. How long does it take to receive the...

- 5. What is the minimum amount required to...

- 6. How does bonus affect the withdrawal...

- Here is an example taken from forex.Com...

- How to withdraw profit from forex

- How to withdraw profit from forex

- Powerful trading platforms & tools

- Trade the global markets, your way

- Mobile trading

- Reduced trading costs

- Market strategist

- Start trading currencies today with A risk-free...

- What’s the catch with forex trading?

- How do I grow 100 dollars in forex?

- What is the minimum deposit for forex?

- How to withdraw profit from FOREX broker?

- A guide on ‘taking profits’ from your forex trades

- Dave arrowsmith production designer +44 7967...

- How to withdraw profit from forex

- Use A micro forex account

- Do I need A broker to trade forex?

- Navigating U.S. Regulations for forex brokers

- How to withdraw profit from FOREX broker?

- How to withdraw profit from forex

- How to withdraw profit from forex

- Carry trade

- Forex for hedging

- What is leverage?

- How do I withdraw money from metatrader 4?

- Open an account now

- Quick start & resources

- Markets

- Tools & platforms

- Trading info

- About us

- Regulation & licence

- Thank you for visiting FP markets

No comments:

Post a Comment