Free money for trading

First time applicants of credit cards can get some free money to spend. It is given in the form of free credit that can be used to buy stuff.

Free forex bonuses

For example, world mail panel credit points to your account every time you confirm receiving one of their mails.

Get free money now: $3695 from 27 ways

If you are ready to work hard and spend some time then you may find hundreds of ways to make money online or offline.

But have you ever thought off getting free money without doing anything or spending any time.

Yes! I am talking about absolutely free money in your pocket without doing anything.

So do you want to know how to get this free money?

I am going to show you not only 1 or 2 ways but 27 ways where you can get around $3695 free cash.

$3695 free money from 27 ways

I am sure you will make at least 20% of this amount today itself if you go through all the ways & take little action.

1. Free money from swagbucks – $10

Swagbucks is one of the most popular rewards program where you can get gifts & cash for shopping, searching the web, watching videos & completing simple surveys.

You can get $10 free signup bonus from swagbucks.

If you want more money, then you can find my swagbucks review which helps you to earn regularly from swagbucks by spending just 10-15 minutes.

2. Inboxdollars – $5 free cash

Inboxdollars is another rewards sites similar to swagbucks that will give you free money instantly upon signup. You can make more money by taking surveys, reading paid email, playing online games etc.

You can check this inboxdollars review to get more idea.

3. Mypoints – free $10 amazon card

Mypoints is one of the oldest reward program. Get a free $10 amazon card once you signup mypoints & purchase one or more items totalling $20.

You can get more cashback ranging from 3% to 5% for all your future purchase on sites like amazon, walmart, target etc.

Earn more by completing paid surveys, watching videos, playing games and reading emails.

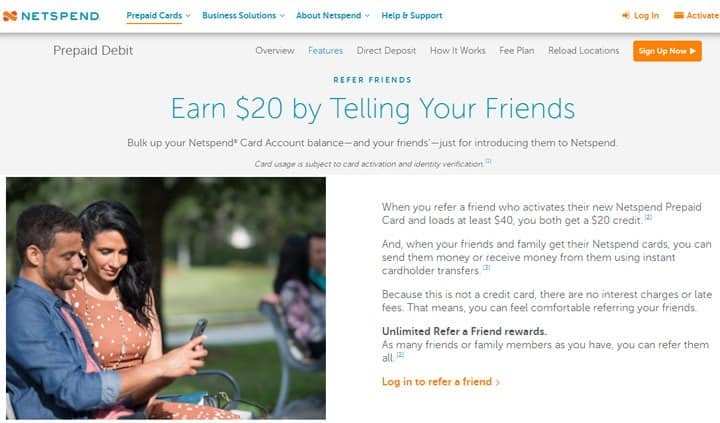

4. Netspend.Com account – free $20

You get an easy $20 free bonus for just requesting a prepaid, reloadable card from netspend.Com account.

In order to get the free $20, you’ll need to load a minimum of $40 on your card ( as prescribed by the website) using paypal, a bank account or one of the other options.

Go to the ATM and withdraw the $60 total from your card or spend the funds wherever you can use a credit card.

If you want to earn more free money from netspend then you can promote their refer-a-friend program where you can get $20 each when your friend opens a netspend account.

5. Airbnb – $40 free accommodation

I like airbnb a lot and I make sure that I book accommodation for my next trip from airbnb only. One main reason is that I find same quality as big hotels at less than half rates.

You will get $40 credit in your account once you signup airbnb and book accommodation for $75 or more.

6. Uber – $15 free ride

If this is your first ride for uber then you can get $15 free for your first ride. All you have to do is signup at uber & use the promo code HITTHEROAD.

7. Earn a $5 free cash from”stash”

Stash is one such app available for both android and apple smartphones which help you earn $5 from investing as little as $5 and make a 100% profit.

8. Earn free $10 and more from pocket change

Many smartphone apps like acorn, actually pay you for investing your pocket change by connecting to your bank account, credit and debit cards to save your digital change.

It automatically rounds up purchases with your connected accounts and invests the difference in your specified app account. Plus, they give you a free $10 when you download the app and make your first investment.

9. Open a bank account – up to $500 free

Select banks give you as much as US$ 500 free when you open certain types of accounts. Usually, banks offer this free cash when you open a premium account.

Meaning, you are required to maintain a daily balance that can range anything from $ 2,000 to $ 20,000. Usually, the bank will also levy a monthly or annual account maintenance charges.

The free money will be credited to your account as soon as you deposit the minimum stipulated amount. However, you need to observe all terms and conditions for the bank account.

Check this latest list of banks where you can open a checking account & get up to $500 free.

10. Get a credit card – $200 free

First time applicants of credit cards can get some free money to spend. It is given in the form of free credit that can be used to buy stuff.

Amounts range from $20 to $200, depending upon your credit ratings and other parameters. To qualify, you should be a first time applicant and have a good credit score.

Meaning, there should be no financial default against your name. Nor should you have availed a loan from any bank or lender institution. House mortgage is fine since it is considered as secured loan.

Check this list of the credit cards that offer up to $500.

11. Change your credit card – up to $2000 free

This is something very interesting and can get you as high as US$ 2,000 in free cash. However, you need to qualify. Firstly, you should have an excellent credit rating.

Secondly, you should have a credit card with a very high credit limit.

Thirdly, you need to have a healthy track record of repayment. In such cases, you can approach another credit card provider.

They will buy off your credit from the other bank, provided it is not high. Meaning, you get a new credit card with zero outstanding.

12. Get $50 free for sleeping

You can make as high as $50 per night or more for merely sleeping. Yes, we mean it- simply sleeping. Companies that make sofas and mattresses test their products for comfort through humans.

They ask people to try the mattress and report about the comfort. Sometimes, these sofas and mattresses are kept on displays in showrooms, for people to see how well you sleep on the product.

Mattress, pillows, blankets, beanbags and loads of other stuff is tested in this manner.

13. Gobaby – $20

The concept of gobaby was launched in new york by a mom. She rented prams, walkers and other baby stuff to passengers with infants transiting through the city or its airport.

If you have spare baby stuff lying in your house, you too can download the gobaby app and offer it for airline passengers to get rent up to $20. Gobaby is rapidly becoming popular across USA and will spread to every city and town.

14. Hoardings

Allowing new or established businesses to put up a hoarding on your garden, roof or window for a few days gets you enough money.

Here, we cannot say how much you can earn because realty and outdoor advertising prices vary according to each location.

However, you are assured of a decent income if you allow the company to use your premises for advertising. The hoardings and posters will be removed by the company’s outsourced advertising agency once your lease is over.

15. Ebates – $10 free cash

Ebates is a rebate card with a difference. You have to make all your purchases online. You can register online for ebates membership and get free $10 walmart gift card or ebates cash.

However, to get this $10 credit, you need to make purchases worth $25 within 90 days of joining ebates.

16. Returning airport/ shopping trolleys

This trick of getting free money was inadvertently advertised by hollywood hit ‘terminal’.

The movie depicts actor tom hanks stranded at the arrival lounge of an american airport and struggling for survival. He earns 25 cents for each airport baggage trolley returned.

You too can earn loads of free money provided you are willing to merely collect baggage and shopping trolleys and return them.

17. Forex trading at NPBFX – $20

Trading in foreign currencies has indeed become popular after the massive economic slowdown that affected USA and other parts of the world from 2008 to 2010.

The downturn shook the otherwise strong faith of americans in the US dollar.

Tens of thousands of americans turned to trading in foreign currencies to hedge their hard earned money against vagaries of the local economy.

End of this economic downturn however spelled bad for foreign exchange trading companies. To keep up the business, they offer $5 to $20 as startup credit for your foreign currency trading account.

One of the forex trading sites is NPBFX where you can register to get $20 free no deposit bonus.

18. Prescription transfer – $50

If you are on prescription medicines, this is one good way of getting some free money. All you need to do is transfer your prescription to another pharmacy.

To retain your loyalty, they will offer you free cash- at least $25 to $50. Often, this free money will be given as discount on your purchases.

Additionally, you can also transfer prescriptions of friends and relatives to get more free cash. You can find online coupon sites for such offers

19. Selling your name

If you have a good reputation in your profession and some degree of following, your name becomes a brand of sorts. You can lease your name to consulting companies or educational institutes.

For example, a noted football coach can officially lease his name to a training school. In return, you are assured of a part of their profits.

20. 401K matching funds

If your employer is giving you 401K matching funds then you can get free money. However after the recession many employers have cut this particular benefit.

But if you are still enrolled then you get absolutely free money under this program. The money that you will get is every year and it is like getting a bonus or a pay hike. But it is free.

21. Get free money $50 and more from de-clutter

I. Sell old cell phones and electronic devices for cash

You can sell old cell phones or apple devices for cash, instead of piling harmful thrash. There are some websites like gazelle interested in making a deal with you.

They pay for your shipping costs and send you packing material too. You just have to wait for a check in your mail or a gift card or cash transfer to your paypal account.

There are also apps for smart phones where you can sell old movies, CD’s or electronic devices in bulk to make approximately $50 or more depending on their schemes.

Ii. Sell your books online on ziffit.Com

If you've been looking for a way to sell your books online, there are many apps for ios or android devices, one such app is ziffit.Com.

You just enter your isbns or scan in the barcodes using the app to find out how much your books are worth. Delivery is all taken care of too.

Choose your preferred payment method bank transfers, paypal payments and cheques, as well as instant cash voucher.

Iii. Free money upto $150/box: sell your used clothes, toys, and games

You can make up to $150 per box if your clothes are in excellent condition or exchange it for branded clothes from various websites like swap.Com or thredup.Com

Upload a picture of any piece of furniture or item you want to sell and put it for sale in a public place like offerup or on special apps for smart phones. Give all details and specifications and there you go!

Chances are you will get good offers that can help you get quick cash.

22. Trade your junk mail and spam email for$10

Some market research websites like SBK center actually pay you for your junk mail.

Guess what? You’ll be rewarded for your junk mail with gift cards to some of your favourite stores, but the exact amount varies from company to company, and each company has a different way of paying.

For example, world mail panel credit points to your account every time you confirm receiving one of their mails.

23. Earn cash by saving email receipts

It sounds ridiculous but its true all your online purchases will now earn you money. There are certain apps where you signup for free and they help you get back your money spent.

They compare price drops on your purchase from partner retailers and claims the difference with the retailer or credit card issuer.

All you need to do is to save your email receipts and download the app earny.

24. Free money from cardpool – $10

There are some sites like cardpool.Com that are interested in buying your unused gift cards and you can actually trade them in exchange for cash or another gift card.

25. Free money from moneytalk – $10

‘post for gold’ websites like monkytalk.Com claims they give $10 free bonus just for joining their website. The gift in gold is not real money, it is a rewards system similar to coupons that can be redeemed from icdirect.Com inc for gifts or in special cases as cash rewards.

26. Free money $500 onwards earned through grants

Writers can use grants to help pay for taking a class, attending a conference, child care, traveling for research, producing a project, hiring a consultant, developing a website or to support you while you write. You just have to apply to the organisations and qualify.

Students, receive “free money” after completion of the free application for federal student aid (FAFSA) form. The information supplied through this form is used to make award determinations for grants, loans, some scholarships and federal work-study. Forms must be filled before deadline.

27. Community grants

Similar to elsewhere in the world, the US also consists of various communities and ethnic minorities. If you belong to any of these communities, you are eligible for grants.

These financial grants can run up to $ 5,000. However, these grants are given only for economic uplift of an individual or family. You can get these grants for higher studies or to set up a small business, if you have no other source of income.

Points to remember

Indeed, there are no free lunches, as the old adage goes. Similarly, there is no free money that you can earn without moving a finger. The 27 different ways to get free money that we mention also require minimal effort on your part.

A word of caution: beware of scammers. There is no dearth of fraudsters who pose as genuine and legitimate companies on the internet. Instead, there are phishing scams.

They make attractive offers of free money. In the process, they gleam away your personal details and use these for some nefarious acts.

Therefore, we advise you to read reviews about website that offers free money. The FBI and police have recorded cases where people’s identity details were stolen in classic cases called ‘identity theft.’

These scams can cause perfectly decent, honest people to be unwittingly branded as criminals- merely because someone else used their good credentials.

Best free trading apps in 2021

Mobile apps became very popular. They make your life a lot easier. There is an app for everything now. You can buy flight tickets, book a hotel or trade on the stock exchange.

There are a lot of trading apps out there so, to save you time, we selected the best free trading apps for you. Apps providing free stock and ETF trading are gaining popularity, so it is worth taking a look at them if you don't want to spend fortunes on your trading fees!

What are trading apps great for?

Trading apps can be used for trading, learning, charting, finding trading ideas, and also for market data and news. Some of the apps offer all of these features, while others only a few. Don't worry, we have made trading app top lists for all of these features!

Trading apps are usually offered by financial companies such as online brokers or banks. These apps can be great add-ons to your web or desktop trading platform, but they can also be the flagship product of a company, for instance in the case of robinhood and freetrade.

We see trading apps as excellent complementary tools to web-based trading platforms and other financial portals. When you want to buy a stock, you can make fundamental or technical analyses on a computer more conveniently, but it's easier to follow the price of the stocks you've already bought through a trading app. You can also intervene faster via an app, when, for example, you quickly need to sell your stocks.

And now, let's see the best free trading apps in 2021!

| app | approves clients from | app score | US stock trading fee |

|---|---|---|---|

| robinhood | US | 5.0 stars | $0.0 |

| trading 212 | globally | 4.9 stars | $0.0 |

| merrill edge | US | 4.8 stars | $0.0 |

| TD ameritrade | US, china, hong kong, malaysia, singapore, thailand, taiwan, canada (through TD direct investing) | 4.8 stars | $0.0 |

| freetrade | UK | 4.7 stars | $0.0 |

Just to make it clear again: with these apps, you can trade stocks and etfs for free.

Besides the best free trading apps, we have also selected the best trading apps for charting, trading ideas, market data, news, and learning.

| Name | best apps | score |

|---|---|---|

| best apps for charting a nd trading ide as | ||

| tradingview | best app for charting | 5.0 |

| stocktwits | best app for trading ideas | 5.0 |

| best apps for market data and news | ||

| investing.Com | best app for market data | 5.0 |

| bloomberg | best app for market news | 5.0 |

| best apps for learning | ||

| invstr | best app for learning to trade | 5.0 |

| trading game | best app for learning forex trading | 4.0 |

Now, let's take a closer look at the best trading apps in 2021!

How to get free money fast: need money now?

Get free money

Wondering how to get free money mailed to me?

If you are looking for ways to earn FREE MONEY you will love how easy it is to accumulate $500 in cash right now.

These are money-making opportunities that work and will help you make money fast, whether you are looking to pay off debt or just in urgent need of it.

These are not one-time cash making opportunities, but you can use these ideas to earn and save money EACH month – like how to get free starbucks!

Most of the options listed send you money into your paypal account, so make sure you have it set up. It’s easy and free to open one, and can be used for both personal and business purposes.

If you are thinking I need money now for free and fast – listed below are over 20 websites that pay you for doing the smallest things.

Some examples are scanning barcodes, installing apps on your phone and a research site that pays you up to $140/hr for helping with online research work. All these ideas and more are listed below.

Ready to learn ways to get free cash now?

This is your chance to get free money on paypal.

*this post may contain affiliate links, which means we may receive a commission if you make a purchase using our links below at no extra cost to you. Disclosure .

HOW TO GET FREE MONEY

1. Play and earn with pinterest

This is on top of my list as its the best way to get money in your bank account for free!

You can now make money on pinterest by sharing affiliate pins. And if someone clicks on your affiliate pin image to make a purchase you earn a commission.

How do I know for sure this works?

Because I put it to test and earned over $120 sharing a pin image of a recipe ebook in just one month.

If this is how much I made with ONE affiliate pin, can you imagine how much more one can make by share a few more affiliate pins.

Note: I wouldn’t recommend you pinning a huge range of affiliate pins. Try not to do over 3 – 4 affiliate pins a day.

I would also recommend not repeating the same pin image for your affiliate links. Creating new pin images for the same affiliate link will gain more traction on pinterest – as the platform prefers new images.

Here is a step by step post that explains it better, using this technique.

2. Survey junkie – free money on paypal

This is one of the most reputed and reliable survey sites in the market that is well paying.

Survey junkie is 100% legit when compared to the rest of the survey sites in the market. They have gained a good reputation from survey takers with over 6 million members that have joined them. While you can usually average $15 a survey, some surveys can go up to $50 a survey.

Completing surveys earn you points redeemable for paypal cash, or gift cards. You can cash out with as little as $10.

3. Get paid to spot an empty property

This one is for those that live in the UK.

You can earn a £20 amazon gift card just for spotting an empty or derelict property, through the youspotproperty website. That’s not all, you also get 1% of the purchase price if they bring the house back into use. Not bad at all right?

4. Swagbucks – free money to search the internet

Swagbucks is one of the easiest ways to get free money. This is your answer if you are looking to get free money on paypal instantly, because with swagbucks you get to earn daily.

We all use the internet to search for topics, whether its recipes, news, travel destinations, jobs and a ton of other things.

Get paid to search the internet with swagbucks.

So next time instead of searching the web with yahoo or google – sign up to swagbucks and use them for your internet search to earn points. Redeem the points for paypal cash or gift cards at amazon, walmart, target and thousand other retailers.

3 other ways to earn with swagbucks:

– daily surveys up to $35 each

– watch cooking shows and videos

– earn cashback while shopping at target, walmart and hundreds of retailers.

==> here is a list of ways you can receive free amazon gift cards for your shopping!

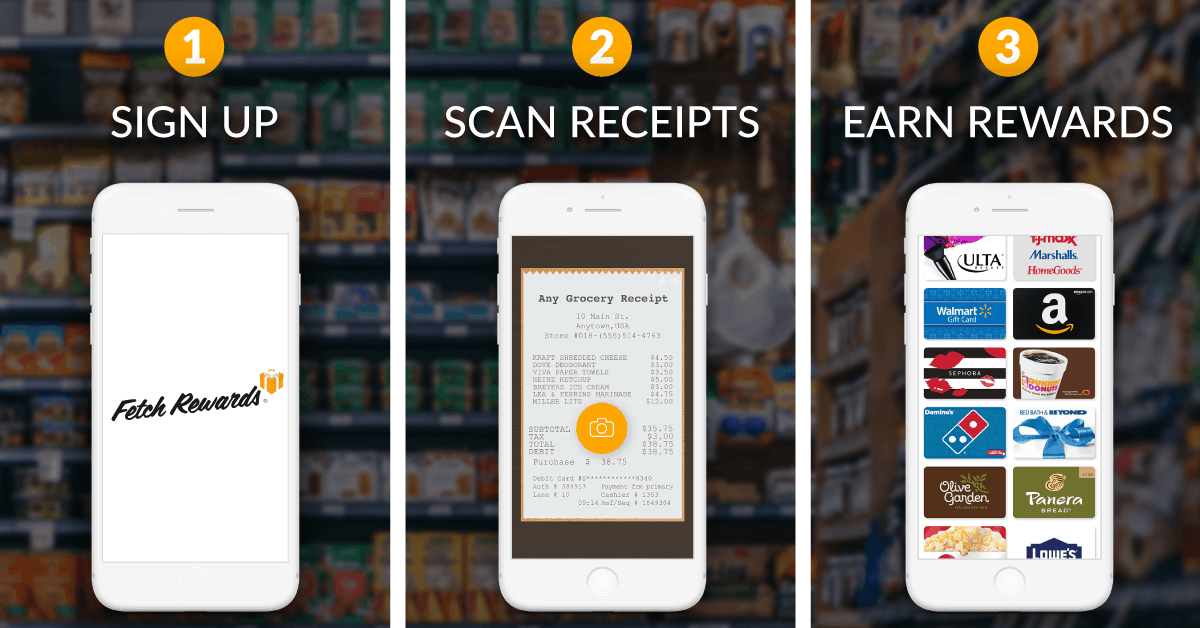

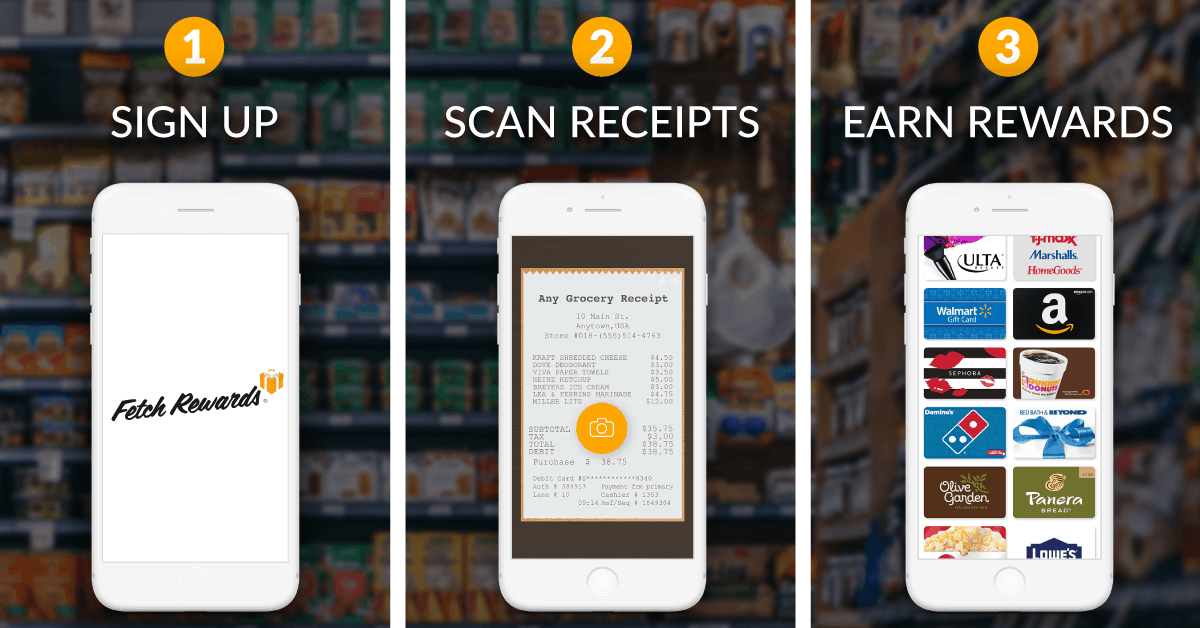

5. Free money for scanning your grocery receipts

Fetch reward is an app that pays you to scan your shopping receipts.

No couponing, no scanning barcodes, no surveys and no ads. Once you finish shopping, just scan your receipt to earn rewards in the form of e-gift cards from target, amazon, kohl’s, sephora and hundreds more.

You are allowed to scan up to 14 receipts in a 7 day period. Just keep in mind that the receipts should not be more than 14 days old.

Withdraw your rewards with as little as $3 in your account. Download fetch rewards for free on your phone to start getting free rewards.

6. Pinecone research – $3 flat rate/survey

This is one of the best research sites that pay free money for your opinion.

You get points for answering questions that are redeemable for cash via paypal or gift cards.

These questionnaires usually take under 10 minutes to complete and have a minimum earning potential of $3 and can go up to $10 for some surveys. This is good because you know you will be paid at least $3 for your effort, unlike some survey companies that pay less than a dollar.

You can sign up with pinecone research through invite-only. You can use the relevant links below to sign up based on your location.

7. Cut monthly bills – trim app

Trim is a free to use app that cuts the cost of your monthly bills.

Featured in major publications like fortune and the new york times, this app uses bank-level security when you connect your accounts to check for recurring subscriptions that can be eliminated to save you money.

The trim app will either cancel unwanted subscriptions or negotiate your bill down for you. Their website shows trim users are saving up to $400 on bills and subscriptions every year.

8. Download neilson digital – get $50 free money

Download the neiison digital app and get rewarded for having it installed.

Neilsen digital is a highly reputable company that allows you to download their app, so they can understand internet usage and behaviour to improve their products and services.

Their app is non-invasive, safe and secure and won’t impact the performance of your device.

They give away up to $10,000 in rewards each month and $50 every year, but you need to have the app installed to be eligible to earn.

9. Shoptracker – $39

Shoptacker is an app you download on your windows PC and share your amazon purchase history. Remember they do not have access to your bank details, but only to your purchase history. And in return, you earn $39 each year you have the app installed.

Just like paribus, once you download the app, you will need to connect your email account to view your amazon purchase history. This helps them with E-commerce research.

You earn $3 each month for participating and can cancel at any time.

Join shoptracker $3/month

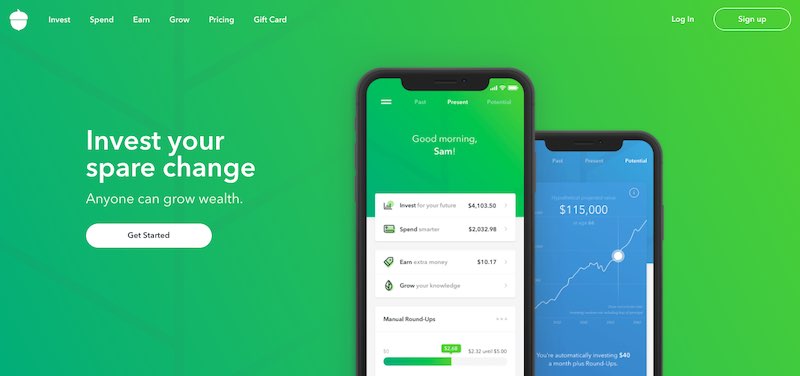

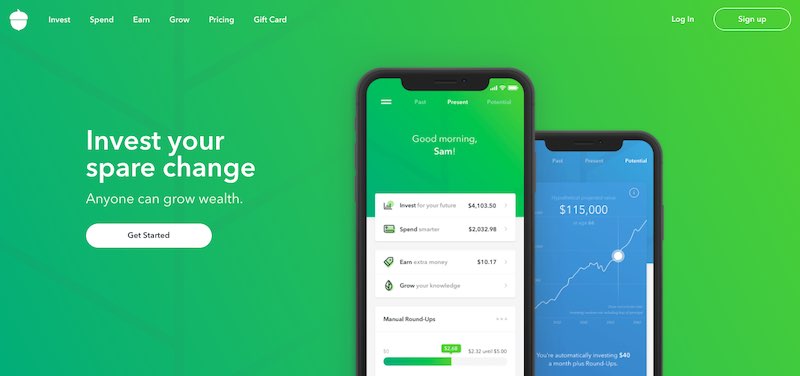

10. Ready to invest spare change? $5 bonus

Acorns is an investment app that saves you money for your retirement.

When you sign up with acorns, every time you do your shopping, acorn will take the spare change and invest it for you. So say you buy a burger for $4.50, acorns will round it up to the closest dollar and take the $0.50 and invest it.

I have a lot of loose change lying around in my bag and the car. But investing them and keeping them untouched is such a neat idea to save in the long run. Its never too early to start investing and not a bad idea to start with small money- they all add up!

Sign up for a $5 bonus and set up a free account.

11. Rakuten (previously ebates) – $25 per referral

Ebates is not only one of the biggest cashback apps that will give you free money for your shopping, but it also boasts one of the highest referral pay.

By referring your family and friends to rakuten (ebates), you earn $25 per referral. Once your friend joins and spends at least $25 when shopping with their favourite brands on rakuten you earn $25.

You need to be 18 years and above to be eligible and get paid via paypal or check.

Here is a coupon link for a $10 walmart gift card, when you sign up here.

If you enjoy using cashback sites, another generous american cashback site is topcashback.

Topcashback, gives you money back from your online purchases at amazon, walmart, macy’s, GNC live well and 3,500+ brands. And the best part, there is no minimum payout threshold.

12. Vindale research ( earn $5-$50)

You can earn $50 for surveying and reviewing each product, which can be a nice side hustle to do in your spare time or over the weekends.

Once you sign up (free) and confirm your email, you receive information via email regarding products and surveys that are available. On completion of your task, you get rewarded cash that is paid through paypal.

13. Respondent app – $300

This is one of the most rewarding ways to make money fast – perfect for those saying I need money desperately. Respondent is a free platform for researchers looking to find people to help with their study. You can earn $150-$300 an hour for helping with research work, which can be done as a one-on-one call or through an online questionnaire.

You can be a professional, a stay-at-home parent or a student to apply.

Here is a full review of respondent if you are looking for a high paying side job.

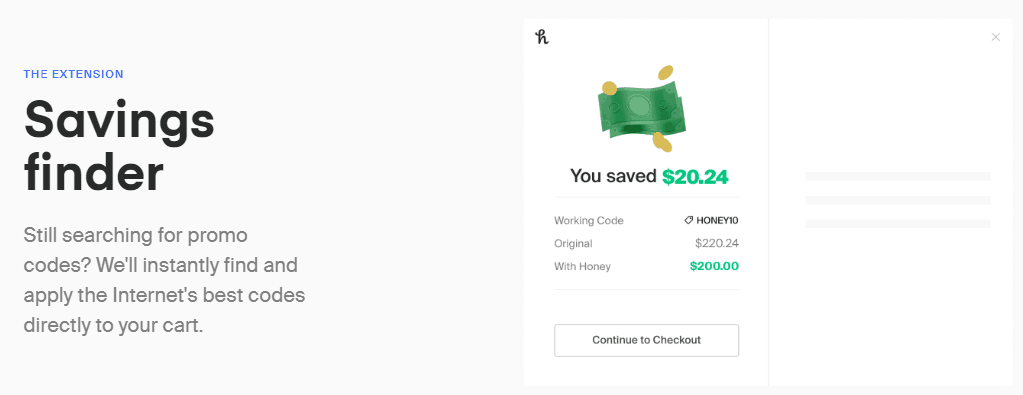

14. Coupon code finder – free extension

Honey is a free browser extension that automatically finds and adds coupons to your online checkout. So whether you shop at amazon or 28,000 other participating merchants you can save money on your online shopping.

Use our exclusive honey sign up link to begin.

Add their extension and get discount coupons automatically added the next time you shop online.

15. Global test market – $5 for surveys

Another well-paying survey site that averages $5 per surveys related to questions on food and consumer products.

You get rewarded points for each survey you complete and you can redeem these points for rewards from amazon, paypal, macy’s, kohls and even an option to donate to charity.

==> if you are looking for more survey sites that will make you an extra $400 a month you must read this.

16. Get paid to lose weight – up to $10,000

This is a popular website where you get paid to lose weight. Their site shows hundreds of success stories of both men and women that have lost weight and made money.

You join either a personal or a group challenge on the app and earn money when you lose weight. You can make small bets too.

Danielle was a healthywager that got paid $1,323 for her weight loss success, and there are many more that have earned thousands from healthy wage-read success stores here.

They have a prize calculator that will help you determine how much you can earn on reaching your weight loss goal. But this is not entirely a free way to earn, as you pay your bet each month, but once you succeed you can earn up to $10,000.

For example:

Say I bet $10 a month for 8 months to lose say 10 pounds that means I spend a total of $80 for the challenge. But if lose that 10 pounds within the 8 month period I could earn anything up to $10,000 in prize money. Not bad at all right?

Check out their weight loss calculator here to see how much money you can earn for your weight loss.

What a motivating idea to lose weight and make money right?

17. Gogokid- free $300 bonus

If you enjoy spending around 30 minutes to an hour a day tutoring kids online, there are many companies here that will pay you from $18 an hour to do this.

Here are a few companies that are currently hiring.

Gogokids is one such company that not only pays you to teach but also gives you an extra $300 bonus for new teachers. This is a limited time opportunity so don’t miss out.

18. Pay your selfie

This is an app that is available on google play and the appstore.

You will be given a list of surveys and asked to take a selfie of travel, workout, group selfie or even shopping. Most selfies are worth $1. Once you reach $20 you can cash out for a check.

They have been listed by big-name companies and is a reliable app. Sign up for free and click away!

19. Sell or rent

If you are looking to make some extra money selling things you don’t need anymore, you will love this post. It also shows you ways in which you can make money fast doing short tasks.

These are just a few ways to make money quick. Doing a little of everything can easily make you at least $1,000 a month.

If there are some personal favourites that have not been listed, please leave them in the comments below so I can add it to the list.

20. Improve credit score:

Nothing beats paying a lower interest rate when buying a house, and the best way to do this is by improving your credit score. Having a good credit score can help you save money on the interest you pay for mortgage and loans.

One of the best online tools to check your credit score for free is credit sesame.

21. Increase the interest on your savings

Using a high yielding savings account will help increase the amount of interest you earn. CIT is an online bank that allows you to earn up to 1.85% APY with their savings builder account. You will need to deposit at least $100 each month to be eligible for high-interest rates.

Final thoughts on free money:

There are many ways to get free money, like saving $500 a month following a not-so-strict frugal lifestyle. Or earn yourself free money on paypal instantly by using swagbucks for your internet searches.

And finally, make sure to use cashback sites like rakuten to get up to 40% money back when you shop online at big-brand retailers. Install rakuten’s chrome extension, so you remember to avail the cashback offers when you shop online.

Free bitcoin

Try executium for free

Free bitcoin for you

When you first sign up to executium, you will be pleased to know that we offer all of our new users a free sign up bonus of 0.002 bitcoin. This free bitcoin is given to you, by us, to show you just how much each and every one of our new users means to us. It also means that you can start trading right away.

Enabling you to trade instantly

We give every new sign up this free bitcoin which is basically going to be a way for you to cover the commissions that are taken by us, during your early days of using our platform. This means that you do not have to initially deposit any money into the system, allowing you to trial executium without having to worry about losing any of your own money.

Make your cryptocurrency work for you

When it comes to the commissions we take, here at executitum we pride ourselves on taking one of the lowest commission fees in the business, at the very low 0.015% commission. This means that, should you put in an order for 1 bitcoin, then we would take our 0.015% commission, which would actually come off of your free bitcoin.

So, if you were considering signing up with executium and giving our platform a go, then why not take advantage of this free bitcoin offer and spend a little bit of time trying us out, before you realise just how great we are. You are going to love it.

What is day trading with bitcoin?

A day trader is an investor who prefers to take advantage of the minor fluctuations in the token price that take place within the opening and the closing bell. This means that a day trader would close out all positions when the day ends and would start again the next day. By that time, he would have 100% cash position to purchase and sell. According to the securities and exchange commission, a day trader is someone who invests and makes same-day buy and sell transactions for at least 4 times in a 5-day time frame.

If you buy something from the market on monday and then sell it on tuesday, then that won't fall under day trading. Same day trading must be at least 6% of an investor's activity. To be a good day trader, an investor should make sure that they have a good understanding of the cryptocurrencies and bitcoin they are currently holding and how they have been performing, in order to give them a better understanding of when to hold on to them, when to buy more of them, and when to sell.

Some of the investors keep at least 2 accounts to separate the trading accounts. Doing this will prevent confusion, as they perform day trading on one account and intra-day trading on another account.

What is intra-day trading?

An intra-day trader is an investor who doesn't only limit themselves to same-day trading. Intra-day trading (or short term trading) doesn't have the same limitations and restrictions as day trading. Investors in bitcoin and cryptocurrencies can easily start this trading method even with a small amount of capital. The biggest notable difference between the two is that a day trader only profits on small price fluctuations while an intra-day trader profits by holding the positions for a number of days, hoping for the profit to be bigger.

Some suggest that intra-day trading is a lot less hectic than day trading, as you are not trying to get it all done within a one day margin, so you can relax a little bit more. However, those who are involved in trading will tell you that this is not always the case, as along with the possibility of bigger profits from intra-day trading, also comes the possibility of bigger losses.

Free trading demo account review

Are you looking for a free and unlimited trading demo account? – then this page is for you. In more than 7 years of experience in online trading, we have tested many providers and present you in the lower table in our top 3. Additionally, you will learn on this page why a demo account with virtual credit is so important for beginners and advanced traders.

Broker: review: spreads: advantages: open account: 1. IQ option

(5 / 5)

➜ read the review starting 1.0 pips + FX & options

+ best platform

+ start with $10

Criteria for a good trading demo account:

Not every trading demo account is optimal for the private trader. That’s why there are different criteria that make a good trader. All in all, however, it can be said that nowadays almost every online broker offers a free demo account. Sometimes, however, there are runtime restrictions or other functions that are limited.

The demo account is intended to simulate real money trading. Therefore, it is essential to choose a reputable provider. With brokers with an official regulation and financial license, there are no differences in the demo and real money trading from our experience.

- Free demo account

- Unlimited demo account

- There is no difference between the demo account and real money trading

- The account can be recharged with virtual money as desired

- All functions are available

Why is a demo account so important for beginners and advanced users?

A trading demo account is an account filled with virtual credit (play money). It simulates real money trading. Traders can therefore trade real market situations without risk. The account is particularly suitable for beginners who want to start trading. The first experiences can be collected in the demo account.

In general, it is about getting to know the trading platform of the broker better. In our experience, most beginners find it very complex to trade on the financial markets at first. After a few explanations and tests, however, one realizes that it is not so difficult. In addition to the trading platform, the broker can also test the trading conditions.

The spread and trading commission in the demo account is the same as in the real money account. New markets should also first be tested in virtual mode, especially in the short-term area (day trading). Beginners and advanced traders can benefit from this. In addition, trading strategies can be tried out or developed. In summary, the rule is that you should trade in the demo account until you are profitable and make progress.

Facts about the demo account:

- Trading in the demo account is risk-free and simulates real money trading

- Test the trading platforms sufficiently

- Learn online trading and control order execution

- Test the broker’s fees

- Test and develop new trading strategies

Free and unlimited demo account

In general, a demo account is always free of charge. From our experience, 99% of online brokers offer this service. Some few providers require a minimum deposit. From such offerers is urgently to be advised against, because these are often unserious. In addition, the account should have an unlimited duration.

Some providers have fixed expiration times for the test account. By a message to the support, this problem can be solved however and the running time was extended from my experiences up to now always. In summary, beginners and advanced traders have the opportunity to test open trading platforms and brokers. A demo account like the real money account should always be ready to trade.

IQ option trading demo account

No difference between real money and virtual credit

With good brokers there is no difference between demo and real money trading. The price movements and executions are the same. Gladly, the trader can also check this himself. With regulated providers you do not have to worry. Therefore, be sure to obtain an official license from a financial supervisory authority.

The top recommended brokers all have an official license and are even regulated several times. Also, the trading fees and/or the spread has no difference in the demo account to the real money trade. With these accounts, you can simulate real money trading 1 to 1.

- Choose a reputable provider for your trading demo account as well

- You trade in both accounts under the same conditions

Account recharge is quite simple

With the demo account, there is the possibility to recharge the credit as desired. Since it is a test account, the credit can shrink quickly. But this is no problem at all. Because over the web page of the broker one can recharge the account very simply in few clicks. If you have any questions you can contact the support.

Further training for traders

Especially many beginners trade in the demo account and this is also absolutely necessary for a newcomer. The brokers offer concrete training material. The offer ranges from trade tutorials to free-market analyses and webinars. The demo account is the best way to expand your knowledge.

In addition, you can gain personal experience in various market situations. Professionals generally talk about the fact that it takes several thousand hours of screening time to act successfully. Read also our 10 trading tips.

Education center (videos and more)

How long should I practice in a demo account?

From our experience, one should practice in the demo account until one has made demonstrably the first profits over a longer period of time. From our experience, a period of one month is suitable here. If you make a good profit week after week, you can slowly dare to trade real money.

It is important that you keep a statistic about your trades. The trading platform, however, already shows this very transparently. Alternatively, further tools can be added. It is best not to rush into anything. Trading a week longer in a demo account is better than losing real money because you don’t feel safe enough.

Conclusion: the demo account is the best way to learn online trading

The trading demo account is suitable for any trader and should be used before trading real money. It has many advantages which we have described to you on this page.

In addition, the creation of such an account is done in a few minutes. Online brokers meanwhile offer very easy access to the trading platform. Should he feel sure that a trader is safe enough for real money trading, he can start it directly.

In summary, the demo account is one of the most important tools of a trader, because with this account you can try many things about real market situations for free and without risk.

Good luck with your trading.

A demo account is necessary for each type of trader. You can try to trade the markets without risk.

8 best investment apps of 2021 | free stock trading and investing

Back in 2016, a survey conducted by harris poll revealed that almost 80% of american millennials weren’t investing in the stock market. 40% blamed their inability to invest with limited resources, and another 34% say they don’t know how to invest. Enter investment apps.

Even with minimal investment experience and limited resources, these apps allow you to get into the market and expand your portfolio.

You no longer need a stockbroker to trade. Companies with brokerage accounts like vanguard or TD ameritrade are entering the app space for iphones and android devices, but are not as intuitive as apps on this list. From the fresh college grad to the seasoned investor, there are powerful investment apps that make investing seamless and comfortably done from the convenience of your phone.

Let’s examine some of the best investment apps and which apps are best for different groups of investors.

What are the best investment apps?

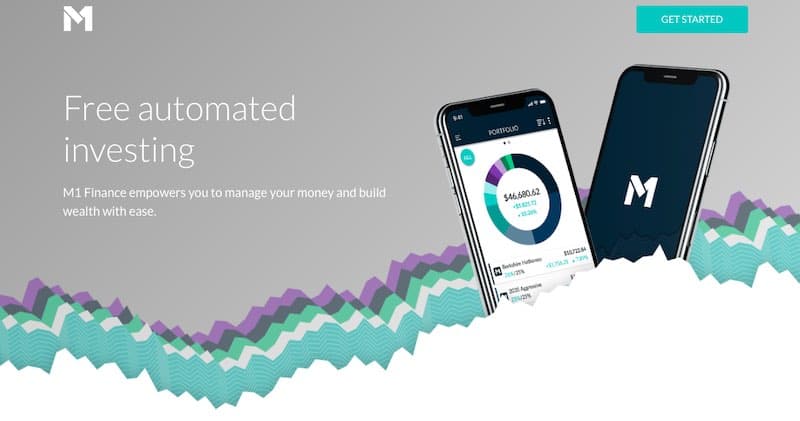

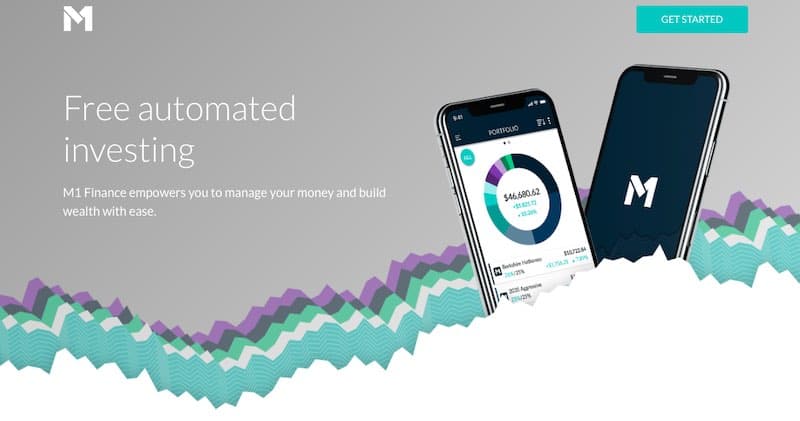

1. M1 finance

One of the best investment apps for commission-free trading

There are very few investment apps that combine robo-advisor and online brokerage functionalities as expertly as M1 finance. M1 finance is famed for its user-friendly interface and its low operational costs. They allow you to select from a broad range of portfolio templates and options – plus it’s free.

This investment app is suited to the investor more willing to delegate much of their portfolio management without having to pay for expert advisory services.

M1 finance takes care of all of this for you virtually. When you want to invest, this app will ask you to make your “pie.”

This pie combines your preferred investment options and unique investment goals. These personal finance options include exchange-traded funds and bonds (or stocks). This pie will determine how they automatically distribute your allocated capital across your preferred investment options.

Consequently, based on your returns, each slice of your pie would either expand or contract automatically. When you deposit more money to your account, this app distributes funds to restore individual pie slices of your choosing.

M1 finance is pretty unique.

First, it’s free to use – it comes with no hidden fees giving you one of the best platforms for fractional investing.

You can also secure personal and small business loans against your portfolio in particular conditions. M1 finance brings powerful automation to rebalancing and investing in general all within its platform.

One downside is that they don’t offer tax-loss harvesting. Additionally, you don’t have the option to purchase mutual funds.

Ultimately, this is the best investment app for those looking for a robo-advisor with zero charges for each trade executed.

Get started with M1 finance.

2. Robinhood

Best investing app for free stock trades

Robinhood is a hugely popular app for freely trading stocks and cryptocurrencies. This app is also free for etfs and options. Debuting in 2013, they are growing in leaps and bounds with over 4 million traders.

This app operates a zero minimum balance and is very navigable and easy to use. You may not get the abundant features of a traditional full-service broker, but this is a useful trading platform at a notably reduced cost.

Robinhood doesn’t charge commissions for trades executed, and they have a very user-friendly interface. The app creates an enjoyable mobile experience with quick access to trading.

Other brokers frequently give you just a handful of accounts, robinhood abundantly gives you access to more than 2,000 etfs with no fee. With their robinhood gold service, you can also acquire securities with borrowed money.

Here are a few things to keep in mind:

- The app often struggles to sync with other expense tracking software like personal capital

- If you want to use their research guides and tools, you have to pay $5 monthly

- They don’t have a desktop version

- If you’re going to transfer your account to another broker, there’s a $75 fee

Overall, their mobile app opened up investing to an entirely new market of people. Using robinhood makes it easy to buy and trade stocks and cryptocurrencies, create watchlists, and review real-time performance. Their cryptos are pretty limited compared to platforms like binance, but they include:

- Bitcoin (BTC)

- Bitcoin cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum classic (ETC)

- Litecoin (LTC)

In the end, if you’re new to investing and want an easy to use an app to manage all of your assets with a minimum investment, robinhood is a no-brainer.

Get started with robinhood.

3. Acorns

Best investment app for automated savings

Acorns is one of the best investment apps for rounding up your spare change to the next dollar. They function as part robo-advisor that can invest your money for you while still doubling as a savings tool for your extra income.

Acorns is an intuitive and easy-to-use money-making app. Within five minutes, you can set up your account and need to provide details like your age as well as risk tolerance.

Here’s how it works. Acorns rounds up purchases on your linked credit card or debit card to the nearest dollar and transfer the remaining change to your acorns account.

You can then invest this change in your preferred acorns investment portfolio. You also have the option of using acorns’ “found money” plan, which closely mirrors the way swagbucks works.

They offer three service levels:

- Core: $1/month (low cost and free for college students)

- Core + later: $2/month (added access to an IRA plan that is tax-deductible)

- Later + spend: $3/month (added debit card and branded checking account with zero fees).

Additionally, there are three account types. These are the retirement accounts, taxable accounts, and the checking account with debit card.

A notable standout here is simplicity. You get to build consistency in your saving habits invest more rather than keeping spare change in your bank account. If you are under 24 years old or a college student, you can get a free account for 48 months.

They do charge a small account fee in addition to other roth IRA fees. Compared to other investment apps, their portfolio options are a bit limited. For lower account balances, they could also charge you a percentage of monthly trading fees.

All things considered, if you are a new investor, this is an excellent tool for you.

Get started with acorns today.

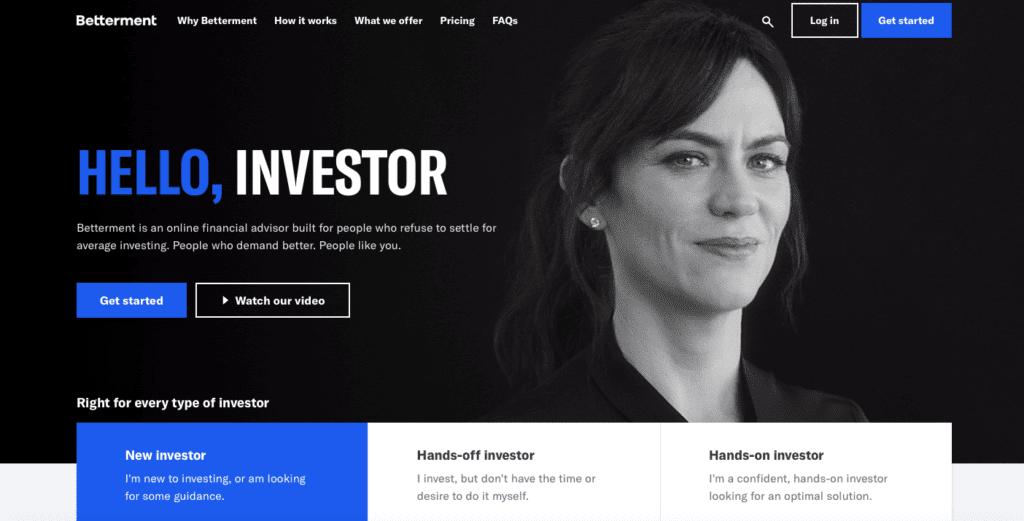

4. Betterment

Best for the long term investor

Betterment isn’t your typical investment app – they’re a full-service robo-advisor that automates your investing. First, they learn a little bit about your goals and personal habits. Next, they build a full portfolio designed to match your risk tolerance and time horizon. Finally, they optimize your portfolio with their tax-smart technology.

Additionally, betterment takes care of portfolio rebalancing – which matches your goals with the best asset reallocation.

They help you track your external investments (outside of betterment). This tracking software gives you a unified platform to keep track of all of your assets.

They operate at a zero minimum account – there is just a 0.25% annual fee for digital portfolio management. But if you need human interaction in the form of a team of expert financial advisors (who would interact with you via email and phone), you can choose betterment premium. With this plan, the account minimum is $100k, with a 0.40% annual fee.

They have four account types – smart saver, taxable investment, trust, and IRA.

If you’re looking for an investing app similar to wealthfront that combines robo-advisor capacities with long term strategies, betterment is a great choice. After signing up, you get access to their retirement calculators, tax-loss harvesting, relatively low management fees, seamless asset allocation, and human, financial advisors.

Get started with betterment today.

5. Stash app

The best value-based investment app

Stash was launched in 2015 with the drive to get more ordinary people into the investment market. Stash is excellent for value-based investments and is simple to use as one of the best apps to acquire fractional shares.

With just $5, you can open an account. You can make weekly automatic deposits (even as low as $5) into your account, and they charge a 0.25% annual fee if you have a balance of at least $5,000.

They offer three account types – iras, custodial accounts, and the taxable accounts

With stash, you can select from more than 150 stocks. This decent range of options allows you to find investments that match your interests. They also have investment themes comprised of a collection of companies you can invest in – as opposed to just one company.

You incur a monthly charge of $1 if your account balance is lesser than $5,000. In the end, I would recommend stash for you if you intend to build a robust portfolio of etfs and stocks but don’t have much money to start.

Get started with stash.

6. Stockpile

Best for gifting stocks

Stockpile launched as an online brokerage service in 2010. They allow you to acquire stock gift cards instead of having to buy stocks directly.

To use stockpile, you need to be 18+ years old, located in the united states. They charge you $0.99 per executed trade but no monthly fees.

First, you set up custodial accounts for your awards and buy them via stock gift cards. This feature is also a tremendous investing tool to help kids learn stock trading.

The recipient of your stockpile gift cards can use them to acquire stocks in many reputable companies like amazon, netflix, and google. With stockpile, you can purchase gift cards in the form of both e-cards or physical cards.

One benefit of stockpile is that you can acquire fractional shares of exchange-traded funds and stocks. With this approach, they make it more affordable to invest in high-value securities.

For example, instead of having to pay over $1,500 for a unit amazon share, with stockpile, you can affordably opt for 0.15 shares.

There are two types of stockpile accounts: custodial accounts and taxable investment accounts.

Their app doesn’t offer pre-made portfolios, and you can only access etfs and individual stocks. However, they’re an excellent tool for those looking for ways to acquire fractional shares and send gift cards to others.

Get started with stockpile today.

7. Ally invest

Best for the DIY investor

If you are that do-it-yourself investor who wants to micromanage the entire investing process, then ally invest is for you. They are an offering of ally bank – an online banking company with 24/7 support.

Ally invest allows you to take a more hands-on approach to investing. With their trading app, you can select investment options individually, which is in stark contrast to other apps that give you pre-made themes.

Because of this, ally invest is more flexible and gives you more control over your investments like stocks, options, and forex trades. They do have a large bank of informational content to help you, but this is a more manual process.

Ally invest stands out because of it’s zero account minimum, zero charges for etfs, flexibility, and helpful tools and calculators.

Here’s what to keep in mind about ally invest.

They will charge you transaction fees for mutual funds.

There is no automatic rebalancing or investing; you do it all yourself.

In the end, I don’t recommend ally invest for beginners. They’re more suited for seasoned investors who know the ropes and ready to take control of their finances. Mainly, ally invest works best for options traders, forex traders, and people who want to learn how to day trade.

Get started with ally invest.

8. Fundrise

Best for real estate investors

Fundrise features app-specific crowdfunded real estate investments. Sound risky? It may be – but your returns can be high without too much risk. They have 8.7 – 12.4% historical annual returns.

Customarily, most online real estate platforms restrict usage to accredited investors. These “accredited investors” in most cases must have a minimum net worth of $1 million excluding their home value (according to US securities law). Fundrise welcomes both accredited and non-accredited investors into the mix.

For their starter portfolio, the minimum balance you need is $500. Fundrise charges you a 0.15% advisory fee as well as an asset management fee of 0.85%.

There are two account types on fundrise – taxable accounts and iras. The latter has a minimum balance of $1000.

Why is fundrise unique?

With their app, you can diversify your portfolio with real estate assets at a price much lower than it would take traditionally. You also get help from experts, can choose from different investment plans, and get a 90-day money-back guarantee.

If you want to get started in real estate investing but don’t have the capital to go it on your own, fundrise is a great choice.

Best investment apps – adding it up

Whether you’re a seasoned investor or a newbie just looking to buy a few stocks, this list of the best investment apps will help you build your portfolio.

If you’re looking for the best app for free stock trades, I would get started with robinhood.

If you want to use an app with a more full-featured service, I would go with M1 finance.

To automate your savings, acorns is your best choice.

What do you think? Are there any investment apps that you use that I should add to this list? If you’re looking for ways to work from home or make money online, you can check out other related articles on my blog.

7 best free stock trading platforms

Thanks to the rise of fintech, investors now have the option to buy and sell stocks online or through mobile apps - and often free of charge.

There are dozens of trading apps and platforms that allow investors to invest cash in a variety of securities with minimal to no fees. With the increase in choices, here are the best free stock-trading platforms and how they compare.

7 best free stock trading platforms

Whether you're a beginner investor or have been playing the market since before the last recession, free stock trading platforms and apps provide a great opportunity to maximize your returns and keep trading easy and simple.

These investment platforms are top-notch.

1. E*TRADE

Although E*TRADE (ETFC) - get report accounts aren't always free, there are some promotions and accounts that allow investors to invest for free. Currently, E*TRADE is having a promotion when you open a new account. The promotion offers 60 days of commission-free trading for up to 500 trades with a minimum deposit of $10,000 or more.

The site offers 24/7 customer service, easy mobile trading, data and research information, and has trading vehicles that range from etfs to options. And while E*TRADE's commissions usually hit just under the $7 mark for normal (nonpromotional) trades, the site is still very popular for its ease of use and retirement services.

2. Robinhood

The free stock trading app has seen a meteoric rise in popularity in recent years, accumulating 6 million users in 2019 - and with good reason. Robinhood seems to be the darling of commission-free trading - as a fintech startup founded by baiju bhatt and vlad tenev in 2013 with their free stock trading model.

Although there has been some speculation over how robinhood makes money (given their free trading model), the app is very popular for its easy, free trading and variety of investment vehicles - including options and even cryptocurrency.

To get started, you simply have to submit an application to robinhood and meet a few basic requirements (although if you are planning to participate in options trading, additional requirements are necessary) - with no account minimum. As a bonus, there are no maintenance fees.

As somewhat of a drawback, robinhood doesn't currently allow fractional investing (you can only buy whole shares). But for its cost-efficiency and easily-accessible app format, robinhood is clearly a crowd favorite for a reason.

3. Charles schwab

Ideal for investors looking to get into etfs, charles schwab (SCHW) - get report has an impressive array of 200 etfs to choose from, all commission-free. And, as a bank and stockbroker all-in-one, the schwab app is a great one-stop-shop for investors.

Schwab also has no-transaction-fee mutual funds, with around 4,000 available. Their regular trades will set you back around $5 apiece. There is no minimum balance requirement (although normal accounts typically come with a $1,000 minimum).

Because of their wide selection of the commission-free etfs and mutual funds, schwab is a strong contender for free stock trading.

4. Acorns

If you're a beginner investor looking to make money in stocks, acorns is the perfect introductory stock trading app.

Acorns specializes in micro-investing - that is, investing your spare change in stocks. There is no minimum to create an account, but there is a $5 minimum to start investing.

The app takes the spare change you've got from linked debit or credit cards to invest in commission-free etfs. There are no fees for inactivity.

5. Vanguard

Boasting around 1,800 commission-free etfs (just shy of robinhood's 2,000,) vanguard offers a wide selection of free trading options. The platform offers over 3,000 transaction-free mutual funds to boot - including S&P 500 index funds.

The trading platform doesn't have a minimum account requirement, but they do charge $20 a year for a service fee.

6. TD ameritrade

Much like E*TRADE, TD ameritrade (AMTD) - get report offers a free trading promotional if you open an account. You can get up to 60 days of commission-free trading for options, etfs and other equities, as well as up to $600 if you deposit $3,000 or more.

And even when the 60 days runs out, trades average about $6.95 a trade - on par with several other competitors. But TD ameritrade also offers over 300 commission-free etfs, and hundreds of transaction-fee-free mutual funds to choose from.

As one of the biggest online trading platforms, TD ameritrade offers a variety of top-notch services including research, data, and information on stocks as well as cash management, among others.

7. M1 finance

M1 finance does things a bit differently (think: customization.)

In addition to being completely commission-free and fee-free, M1 finance allows investors to invest in fractional shares as small as one penny. And, what makes M1 finance different is it allows users to create "pies" - that is, pie graphs that are comprised of a variety of etfs, stocks, and bonds. The app also allows users to choose different kinds of pies based on their investment needs and risk tolerance.

Although there is a $100 minimum for investing, the app allows for total customization of your own portfolio, and offers different kinds of "pies" from moderate to "ultra-aggressive" or "market cap 100."

For a completely free, zero-commission stock trading app, M1 finance seems to offer a pretty good deal for the DIY investor.

The bottom line

So, which free stock trading platform is best for you?

While some platforms like TD ameritrade and E*TRADE only offer short-term free stock trading services through promotions or new accounts, they do offer some industry-leading services that may be worth the extra cost you'll incur when your trial run ends.

However, for the investor who wants a truly free stock trading experience, robinhood, acorns and M1 finance offer a formidable range of services and offerings - even including cryptocurrency and options. And, as trading is increasingly becoming mobile, these app-focused companies are optimized to provide a solid, easy-to-use trading experience from the comfort of your ios or android-enabled device.

Still, as always, it is important to examine your personal investment goals and be realistic about how much you are willing to pay for extra services (if you do opt for one of the bigger brokerage names). But thanks to the surge of fintech companies in recent years, there are plenty of investment options that offer free stock trading services that can help grow your returns - all with the touch of a button.

So, let's see, what was the most valuable thing of this article: do you want free money now? These 27 companies can give you real cash online without doing any work. You can earn $3695 free money in next few hours at free money for trading

Contents of the article

- Free forex bonuses

- Get free money now: $3695 from 27 ways

- $3695 free money from 27 ways

- 1. Free money from swagbucks – $10

- 2. Inboxdollars – $5 free cash

- 3. Mypoints – free $10 amazon card

- 4. Netspend.Com account – free $20

- 5. Airbnb – $40 free accommodation

- 6. Uber – $15 free ride

- 7. Earn a $5 free cash from”stash”

- 8. Earn free $10 and more from pocket change

- 9. Open a bank account – up to $500 free

- 10. Get a credit card – $200 free

- 11. Change your credit card – up to $2000 free

- 12. Get $50 free for sleeping

- 13. Gobaby – $20

- 14. Hoardings

- 15. Ebates – $10 free cash

- 16. Returning airport/ shopping trolleys

- 17. Forex trading at NPBFX – $20

- 18. Prescription transfer – $50

- 19. Selling your name

- 20. 401K matching funds

- 21. Get free money $50 and more from de-clutter

- I. Sell old cell phones and electronic devices...

- Ii. Sell your books online on...

- Iii. Free money upto $150/box:...

- 22. Trade your junk mail and spam email for$10

- 23. Earn cash by saving email receipts

- 24. Free money from cardpool – $10

- 25. Free money from moneytalk – $10

- 26. Free money $500 onwards earned through grants

- 27. Community grants

- Best free trading apps in 2021

- How to get free money fast: need money now?

- HOW TO GET FREE MONEY

- 1. Play and earn with pinterest This is on...

- 3. Get paid to spot an empty property

- 4. Swagbucks – free money to search the internet

- 5. Free money for scanning your grocery receipts

- 6. Pinecone research – $3 flat rate/survey

- 7. Cut monthly bills – trim app

- 8. Download neilson digital – get $50 free money

- 9. Shoptracker – $39

- 10. Ready to invest spare change? $5 bonus

- 11. Rakuten (previously ebates) – $25 per referral

- 12. Vindale research ( earn $5-$50)

- 13. Respondent app – $300

- 14. Coupon code finder – free extension

- 15. Global test market – $5 for surveys

- 16. Get paid to lose weight – up to $10,000

- 17. Gogokid- free $300 bonus

- 18. Pay your selfie

- 19. Sell or rent

- 20. Improve credit score:

- 21. Increase the interest on your savings

- Final thoughts on free money:

- Free bitcoin

- Try executium for free

- Free bitcoin for you

- Enabling you to trade instantly

- Make your cryptocurrency work for you

- What is day trading with bitcoin?

- What is intra-day trading?

- Free trading demo account review

- Criteria for a good trading demo account:

- Why is a demo account so important for beginners...

- Free and unlimited demo account

- No difference between real money and virtual...

- Account recharge is quite simple

- Further training for traders

- How long should I practice in a demo account?

- Conclusion: the demo account is the best way to...

- 8 best investment apps of 2021 | free stock...

- What are the best investment apps?

- 1. M1 finance

- 2. Robinhood

- 3. Acorns

- 4. Betterment

- 5. Stash app

- 6. Stockpile

- 7. Ally invest

- 8. Fundrise

- Best investment apps – adding it up

- 7 best free stock trading platforms

- 7 best free stock trading platforms

- The bottom line

Get free money

Wondering how to get free money mailed to me?

If you are looking for ways to earn FREE MONEY you will love how easy it is to accumulate $500 in cash right now.

These are money-making opportunities that work and will help you make money fast, whether you are looking to pay off debt or just in urgent need of it.

These are not one-time cash making opportunities, but you can use these ideas to earn and save money EACH month – like how to get free starbucks!

Most of the options listed send you money into your paypal account, so make sure you have it set up. It’s easy and free to open one, and can be used for both personal and business purposes.

If you are thinking I need money now for free and fast – listed below are over 20 websites that pay you for doing the smallest things.

Some examples are scanning barcodes, installing apps on your phone and a research site that pays you up to $140/hr for helping with online research work. All these ideas and more are listed below.

Ready to learn ways to get free cash now?

This is your chance to get free money on paypal.

*this post may contain affiliate links, which means we may receive a commission if you make a purchase using our links below at no extra cost to you. Disclosure .

HOW TO GET FREE MONEY

1. Play and earn with pinterest

This is on top of my list as its the best way to get money in your bank account for free!

You can now make money on pinterest by sharing affiliate pins. And if someone clicks on your affiliate pin image to make a purchase you earn a commission.

How do I know for sure this works?

Because I put it to test and earned over $120 sharing a pin image of a recipe ebook in just one month.

If this is how much I made with ONE affiliate pin, can you imagine how much more one can make by share a few more affiliate pins.

Note: I wouldn’t recommend you pinning a huge range of affiliate pins. Try not to do over 3 – 4 affiliate pins a day.

I would also recommend not repeating the same pin image for your affiliate links. Creating new pin images for the same affiliate link will gain more traction on pinterest – as the platform prefers new images.

Here is a step by step post that explains it better, using this technique.

2. Survey junkie – free money on paypal

This is one of the most reputed and reliable survey sites in the market that is well paying.

Survey junkie is 100% legit when compared to the rest of the survey sites in the market. They have gained a good reputation from survey takers with over 6 million members that have joined them. While you can usually average $15 a survey, some surveys can go up to $50 a survey.

Completing surveys earn you points redeemable for paypal cash, or gift cards. You can cash out with as little as $10.

3. Get paid to spot an empty property

This one is for those that live in the UK.

You can earn a £20 amazon gift card just for spotting an empty or derelict property, through the youspotproperty website. That’s not all, you also get 1% of the purchase price if they bring the house back into use. Not bad at all right?

4. Swagbucks – free money to search the internet

Swagbucks is one of the easiest ways to get free money. This is your answer if you are looking to get free money on paypal instantly, because with swagbucks you get to earn daily.

We all use the internet to search for topics, whether its recipes, news, travel destinations, jobs and a ton of other things.

Get paid to search the internet with swagbucks.

So next time instead of searching the web with yahoo or google – sign up to swagbucks and use them for your internet search to earn points. Redeem the points for paypal cash or gift cards at amazon, walmart, target and thousand other retailers.

3 other ways to earn with swagbucks:

– daily surveys up to $35 each

– watch cooking shows and videos

– earn cashback while shopping at target, walmart and hundreds of retailers.

==> here is a list of ways you can receive free amazon gift cards for your shopping!

5. Free money for scanning your grocery receipts

Fetch reward is an app that pays you to scan your shopping receipts.

No couponing, no scanning barcodes, no surveys and no ads. Once you finish shopping, just scan your receipt to earn rewards in the form of e-gift cards from target, amazon, kohl’s, sephora and hundreds more.

You are allowed to scan up to 14 receipts in a 7 day period. Just keep in mind that the receipts should not be more than 14 days old.

Withdraw your rewards with as little as $3 in your account. Download fetch rewards for free on your phone to start getting free rewards.

6. Pinecone research – $3 flat rate/survey

This is one of the best research sites that pay free money for your opinion.

You get points for answering questions that are redeemable for cash via paypal or gift cards.

These questionnaires usually take under 10 minutes to complete and have a minimum earning potential of $3 and can go up to $10 for some surveys. This is good because you know you will be paid at least $3 for your effort, unlike some survey companies that pay less than a dollar.

You can sign up with pinecone research through invite-only. You can use the relevant links below to sign up based on your location.

7. Cut monthly bills – trim app

Trim is a free to use app that cuts the cost of your monthly bills.

Featured in major publications like fortune and the new york times, this app uses bank-level security when you connect your accounts to check for recurring subscriptions that can be eliminated to save you money.

The trim app will either cancel unwanted subscriptions or negotiate your bill down for you. Their website shows trim users are saving up to $400 on bills and subscriptions every year.

8. Download neilson digital – get $50 free money

Download the neiison digital app and get rewarded for having it installed.

Neilsen digital is a highly reputable company that allows you to download their app, so they can understand internet usage and behaviour to improve their products and services.

Their app is non-invasive, safe and secure and won’t impact the performance of your device.

They give away up to $10,000 in rewards each month and $50 every year, but you need to have the app installed to be eligible to earn.

9. Shoptracker – $39

Shoptacker is an app you download on your windows PC and share your amazon purchase history. Remember they do not have access to your bank details, but only to your purchase history. And in return, you earn $39 each year you have the app installed.

Just like paribus, once you download the app, you will need to connect your email account to view your amazon purchase history. This helps them with E-commerce research.

You earn $3 each month for participating and can cancel at any time.

Join shoptracker $3/month

10. Ready to invest spare change? $5 bonus

Acorns is an investment app that saves you money for your retirement.

When you sign up with acorns, every time you do your shopping, acorn will take the spare change and invest it for you. So say you buy a burger for $4.50, acorns will round it up to the closest dollar and take the $0.50 and invest it.

I have a lot of loose change lying around in my bag and the car. But investing them and keeping them untouched is such a neat idea to save in the long run. Its never too early to start investing and not a bad idea to start with small money- they all add up!

Sign up for a $5 bonus and set up a free account.

11. Rakuten (previously ebates) – $25 per referral

Ebates is not only one of the biggest cashback apps that will give you free money for your shopping, but it also boasts one of the highest referral pay.

By referring your family and friends to rakuten (ebates), you earn $25 per referral. Once your friend joins and spends at least $25 when shopping with their favourite brands on rakuten you earn $25.

You need to be 18 years and above to be eligible and get paid via paypal or check.

Here is a coupon link for a $10 walmart gift card, when you sign up here.

If you enjoy using cashback sites, another generous american cashback site is topcashback.

Topcashback, gives you money back from your online purchases at amazon, walmart, macy’s, GNC live well and 3,500+ brands. And the best part, there is no minimum payout threshold.

12. Vindale research ( earn $5-$50)

You can earn $50 for surveying and reviewing each product, which can be a nice side hustle to do in your spare time or over the weekends.

Once you sign up (free) and confirm your email, you receive information via email regarding products and surveys that are available. On completion of your task, you get rewarded cash that is paid through paypal.

13. Respondent app – $300

This is one of the most rewarding ways to make money fast – perfect for those saying I need money desperately. Respondent is a free platform for researchers looking to find people to help with their study. You can earn $150-$300 an hour for helping with research work, which can be done as a one-on-one call or through an online questionnaire.

You can be a professional, a stay-at-home parent or a student to apply.

Here is a full review of respondent if you are looking for a high paying side job.

14. Coupon code finder – free extension

Honey is a free browser extension that automatically finds and adds coupons to your online checkout. So whether you shop at amazon or 28,000 other participating merchants you can save money on your online shopping.

Use our exclusive honey sign up link to begin.

Add their extension and get discount coupons automatically added the next time you shop online.

15. Global test market – $5 for surveys

Another well-paying survey site that averages $5 per surveys related to questions on food and consumer products.

You get rewarded points for each survey you complete and you can redeem these points for rewards from amazon, paypal, macy’s, kohls and even an option to donate to charity.

==> if you are looking for more survey sites that will make you an extra $400 a month you must read this.

16. Get paid to lose weight – up to $10,000

This is a popular website where you get paid to lose weight. Their site shows hundreds of success stories of both men and women that have lost weight and made money.

You join either a personal or a group challenge on the app and earn money when you lose weight. You can make small bets too.

Danielle was a healthywager that got paid $1,323 for her weight loss success, and there are many more that have earned thousands from healthy wage-read success stores here.

They have a prize calculator that will help you determine how much you can earn on reaching your weight loss goal. But this is not entirely a free way to earn, as you pay your bet each month, but once you succeed you can earn up to $10,000.

For example:

Say I bet $10 a month for 8 months to lose say 10 pounds that means I spend a total of $80 for the challenge. But if lose that 10 pounds within the 8 month period I could earn anything up to $10,000 in prize money. Not bad at all right?

Check out their weight loss calculator here to see how much money you can earn for your weight loss.

What a motivating idea to lose weight and make money right?

17. Gogokid- free $300 bonus

If you enjoy spending around 30 minutes to an hour a day tutoring kids online, there are many companies here that will pay you from $18 an hour to do this.

Here are a few companies that are currently hiring.

Gogokids is one such company that not only pays you to teach but also gives you an extra $300 bonus for new teachers. This is a limited time opportunity so don’t miss out.

18. Pay your selfie

This is an app that is available on google play and the appstore.