Forex minimum deposit 10$

Be wary of leverage don’t trade when the market is volatile

Fxdailyreport.Com

As a beginner in the forex trading industry, the questions you often hear is regarding the minimum deposit.

Free forex bonuses

You see questions such as growing your $10 account into a $100 account or something more. The good news about this is that yes, you can. There are various forex brokers that offer a minimum of at least $10 in your account of better yet, don’t require any minimum deposit at all. When you find a broker that suits your needs, your trading experience runs smoothly than before. In this article, we’ll be talking about forex trading with low investment and whether or not you can trade with $10 in your account.

Can I trade forex with $10?

As mentioned earlier, the key is to find the right forex broker that lets you trade with a low deposit or no minimum deposit required. However, even when you find a broker that lets you trade with just $10, the challenge is in growing that account into a profitable one. A lot of traders get their accounts blown as fast as they started and this is for various factors such as a lack of risk management or a lack of knowledge. Trading with a $10 account will be much more challenging than trading with a $50 account as it will take more discipline, patience, and self-control. This is also where leverage comes into the picture. When your broker gives you high leverage despite having just a $10 account, it’s easy to think you can enter as many trades as you want, as long as it fits the leverage. You’ll be surprised how many traders have this mindset and this is precisely why they don’t profit from forex trading. In the following, we’ll be talking about how to grow your $10.

5 forex brokers with low minimum deposit $1 and $5

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

Do your research

You can’t enter the trading industry with zero knowledge as to how the financial market works, how to set your stop loss and take profit, or even which strategies to implement in your trades. If you’re the type of trader that expects you can rely on others for growing your $10 account, you’ll lose right from the start. Doing your research and studying about forex means that you’ll have a certain knowledge by the time you enter and exit your trades.

Be wary of leverage

There are pros and cons to high leverage so you shouldn’t be too excited when finding a broker that offers you high leverage. A lot of traders make the mistake of over trading because of high leverage, and this is what causes them to lose their profits. To trade effectively with a $10 account, enter trades gradually. Even with high leverage, practice discipline, and proper risk management with all your traders. For instance, it’s not advisable to enter 2 trades with a 0.2 lot size if you’re growing a $10 account. Proper risk management means that you don’t implement greed and emotions in your trades.

Don’t trade when the market is volatile

Advanced trades thrive when the market is volatile just because they already have adequate experience with trading. As a beginner, it’s not advisable to trade during volatile times as you might feel overwhelmed and lose heart immediately when you see your trades losing. Rather, trade during the times when the market is moving gradually and take it from there.

Never trade with emotions

In this entire list, this is something you should never do when trading. In trading with any low investment, don’t apply your emotions, or else, you’ve already lost. Trading with emotions might lead you to close all your trades when you’re losing, even when it’s just a retest, or over-trading a single currency when you have profited. You must remember to always detach your emotions when trading if you want to succeed.

In conclusion, I hope this article was able to shed insight into forex trading with low investment. While a lot of experts say it’s recommendable to deposit a high investment to truly succeed, you can still trade forex with as low as $10. If you have the right discipline, knowledge, and values, you can easily turn your $10 into $100. It may not be overnight, but it’s still very much doable.

Fxdailyreport.Com

As a beginner in the forex trading industry, the questions you often hear is regarding the minimum deposit. You see questions such as growing your $10 account into a $100 account or something more. The good news about this is that yes, you can. There are various forex brokers that offer a minimum of at least $10 in your account of better yet, don’t require any minimum deposit at all. When you find a broker that suits your needs, your trading experience runs smoothly than before. In this article, we’ll be talking about forex trading with low investment and whether or not you can trade with $10 in your account.

Can I trade forex with $10?

As mentioned earlier, the key is to find the right forex broker that lets you trade with a low deposit or no minimum deposit required. However, even when you find a broker that lets you trade with just $10, the challenge is in growing that account into a profitable one. A lot of traders get their accounts blown as fast as they started and this is for various factors such as a lack of risk management or a lack of knowledge. Trading with a $10 account will be much more challenging than trading with a $50 account as it will take more discipline, patience, and self-control. This is also where leverage comes into the picture. When your broker gives you high leverage despite having just a $10 account, it’s easy to think you can enter as many trades as you want, as long as it fits the leverage. You’ll be surprised how many traders have this mindset and this is precisely why they don’t profit from forex trading. In the following, we’ll be talking about how to grow your $10.

5 forex brokers with low minimum deposit $1 and $5

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $1 spread: fixed spread from 3 pips leverage: up to 1:1000 regulation: CBR, cysec and FFMS | 30% forex deposit bonus | visit broker |

Do your research

You can’t enter the trading industry with zero knowledge as to how the financial market works, how to set your stop loss and take profit, or even which strategies to implement in your trades. If you’re the type of trader that expects you can rely on others for growing your $10 account, you’ll lose right from the start. Doing your research and studying about forex means that you’ll have a certain knowledge by the time you enter and exit your trades.

Be wary of leverage

There are pros and cons to high leverage so you shouldn’t be too excited when finding a broker that offers you high leverage. A lot of traders make the mistake of over trading because of high leverage, and this is what causes them to lose their profits. To trade effectively with a $10 account, enter trades gradually. Even with high leverage, practice discipline, and proper risk management with all your traders. For instance, it’s not advisable to enter 2 trades with a 0.2 lot size if you’re growing a $10 account. Proper risk management means that you don’t implement greed and emotions in your trades.

Don’t trade when the market is volatile

Advanced trades thrive when the market is volatile just because they already have adequate experience with trading. As a beginner, it’s not advisable to trade during volatile times as you might feel overwhelmed and lose heart immediately when you see your trades losing. Rather, trade during the times when the market is moving gradually and take it from there.

Never trade with emotions

In this entire list, this is something you should never do when trading. In trading with any low investment, don’t apply your emotions, or else, you’ve already lost. Trading with emotions might lead you to close all your trades when you’re losing, even when it’s just a retest, or over-trading a single currency when you have profited. You must remember to always detach your emotions when trading if you want to succeed.

In conclusion, I hope this article was able to shed insight into forex trading with low investment. While a lot of experts say it’s recommendable to deposit a high investment to truly succeed, you can still trade forex with as low as $10. If you have the right discipline, knowledge, and values, you can easily turn your $10 into $100. It may not be overnight, but it’s still very much doable.

Best forex brokers with low/no minimum deposit for 2021

Top rated:

If you are thinking of getting involved in the forex trading market and you are looking for the top forex brokers, or maybe you are already dealing with an FX broker, one of the most important things you may be thinking about is the minimum deposit.

In the forex market, there are often a few trading conditions that you will have to abide by, which sometimes means a minimum deposit to get into forex trading. With these brokers though, that is not the case.

The reviews we have conducted for this top 10 show that they do not have any minimum deposit requirement, although in some cases you will find a forex broker minimum deposit based on funding amount.

The following top 10 brokers are great for all traders, but particularly for new traders seeking an excellent low deposit start in currency trading, particularly with the credit/debit card deposits that are often cheaply available.

Table of contents

Why a minimum or 0$ deposit is not the only thing to consider

Conducting an in-depth technical analysis in search of a broker with no minimum deposit or a low one is not all you should think about though.

You should also consider the fact that you will likely be trading with some kind of leverage. This and other factors can really help determine the best broker choice for your forex trading future.

In fact, the best situation for you is one where you have a minimum deposit broker that also allows you to trade with minimum trade size. This is something we will get into more at the end of the post.

For now, let’s take a look at the very best forex brokers with low or no minimum deposit.

Best forex brokers with low or no minimum deposits

In no particular order, here is the best low or no minimum deposits brokers chosen after thorough broker reviews on each:

1. Oanda

Trading with oanda broker, the first thing you will be glad to notice is that there is no minimum deposit at all.

The broker also has no minimum trade size. In the forex market and for your trading career, this can mean great flexibility as you can trade as low as 1 unit in your base currency without worrying about lot-size trading.

Deposits for trading with the oanda broker and trading platform can be made in the form of wire transfers, all major credit cards (visa/mastercard), ewallets such as paypal and some other oanda deposit methods may be available depending on your area. Almost all of these come with no real money fee attached at all.

Oanda can also be connected with zulutrade to open many copy trading opportunities and is widely considered to be a very trustworthy option particularly if you are based in europe and want to get started in forex trading with a small amount of money.

2. FBS

Getting into the forex market with FBS is one of the best value ways you can become a trader. This is because you can start a mini account with FBS that only requires $10 from within europe, or $1 from outside as the minimum deposit. This is the FBS cent account. A micro account with a $5 minimum deposit is also available but not within europe.

These kinds of currency trading account types allow you to trade in micro lost of 1,000 units and to trade as low as 10 units or 0.1 nano lots. Compared to the standard forex market trading lot size, this would be 0.0001 standard lots. So, as you can see, real money is still at risk, but in a very controlled way.

Again here, the wire transfer, visa/mastercard, and ewallets like neteller and skrill are all available for deposit with on fee in the majority of cases.

The FBS accounts are also a great choice for non-europeans with super high leverage available, and islamic accounts too.

Of the 5 XM accounts that are offered, two, in particular, have a very low and attractive minimum deposit if you are getting involved in the forex market. These are the micro and standard accounts both with a minimum deposit of just $5.

As with other brokers, the micro account will make it less risky in terms of your real money trading. Here you can benefit from micro lots down to 0.1 nano lots to help you get a taste of the forex market.

When it comes to XM deposit methods, you can choose between the ever-present wire transfer, all major credit cards from either visa or mastercard and some ewallet and local specific methods. All of these methods, for the most part, are free of any XM fee.

Islamic trading accounts are also widely available from the broker as well as the XM ultra low account, which allows you to trade with either micro or standard lots, lower spreads starting from 0.6 pips and it has minimum initial deposit of $50

4. FXTM

FXTM is another major force in the forex trading industry and an excellent place to get started if you are looking for a low minimum deposit broker. Our FXTM broker review showed that you can start micro trading here with the cent account for as little as a $10 deposit.

Again these accounts allow for mini trading with micro lots of 1,000 units and nano lots of just 10 units making trading here very accessible indeed.

Deposits are made available through all of the popular channels including wire transfers, major credit and debit cards from visa, mastercard, and maestro, and ewallets like neteller and skrill. Other localized funding methods may be available depending on location, and all FXTM deposits should be free of any fees.

FXTM islamic accounts are again available where needed and the broker caters particularly well to traders in african countries like nigeria who want to get into the forex market. Crypto deposits are also accepted if you are based outside the remit of european regulations.

5. Roboforex

If you are looking to jump into forex trading with a wide range of account choices, then roboforex may be just the place for you. There are a total of 6 account types to choose from, 3 of these account types have a great low minimum deposit of just $10. These forex trading accounts are the pro standard, ECN pro, and pro cent which allows for micro trading from micro lots of 1,000 units to nano lots of 100 units through the MT4 trading platform and the MT5 trading platform through which you can trade as low as 0.1 nano lots.

For deposits with this broker you can avail of wire transfers, major credit cards, and ewallet options like neteller, webmoney, advcash, and perfectmoney. There may be other funding methods available depending on your area, and most of the deposit methods mentioned carry no fee at all from the broker.

Yet again, if you are in forex trading and need an islamic account, this broker has you covered and is a really good choice if you are looking for standard forex trading accounts with a low minimum deposit.

6. Instaforex

Considering forex brokers with a low or no minimum deposit, then instaforex is another option. They offer two types of micro trading cent accounts with a minimum deposit of just $1 on each. These allow you to engage in mini trading for as little as 0.0001 standard lots, a real risk-free way to engage in the forex market.

Spreads on these accounts start from just 1 pip and the cent eurica account offers a zero spread option with commission from 0.03% in its place which could be an attractive proposition depending on your forex trading style.

Deposits at instaforex can be made by way of wire transfer, major credit cards, and ewallets such as neteller and skrill. In many cases, there are no fees at all to get started trading or make a deposit.

As with the majority of top brokers today, islamic trading is well catered for with this broker.

7. Alpari

The next broker with a very low minimum deposit for forex trading that you should consider is alpari. This broker offers micro trading accounts with the low minimum deposit of $5 to get started. With these accounts as with other cent type mini trading accounts, you can expect both micro and nano lots of 1000, and 10 units to be available.

Deposits to fund your real money forex trading here can be made with a wire transfer, trusted credit cards from either visa, mastercard, or maestro, and ewallet options from neteller and skrill respectively. There are typically no deposit fees with this broker.

Alpari has extensive experience in the forex trading industry, offering the best in trading platforms and islamic accounts for those who require them.

Why is lot size important with low deposits?

You may be wondering why the lot size has been mentioned frequently and why this may impact you as a trader.

The fact is that if you are a european based forex trader, it has become very difficult to have a low minimum deposit and be able to trade significant amounts within the standard trading accounts that this opens up. This is all due to the 30:1 leverage limitation placed by regulators in europe. For example, in order to invest 1$ in a micro lot (1000 units), you would need minimum leverage of 1000:1.

So, if you don’t have leverage, the only solution is to have the smallest trading sizes available.

Some brokers will allow you to open positions for 0.1 nano lots (basically 1/100 of a micro lot), which translates in minimum leverage terms to 10:1.

The only solution that you have available for really low deposit trading if nano lots are not available is unfortunately just to step up your deposit a little more. In these cases as a forex trader, $50 is typically sufficient although it depends on the asset.

With all of that said, given the number of broker options available, it is still very much possible for european traders, even those constrained by strict 30:1 leverage to experience very low deposit trading in the forex market and others.

Brokers with low or 0$ minimum deposit good for non EU users

The following brokers still have very low, or even no minimum deposit requirements to enter the forex market as the brokers above also have. The only difference here is that with these brokers, micro trading through cent accounts is not necessary.

In this case, the best thing you can do is use these brokers to avail of higher leverage availability if you are located outside of an area like cysec regulation where leverage is limited.

5 best low minimum deposit forex brokers 2021

Are you looking for a broker that will let you start with a low minimum first deposit? Then, you are in the right place!

Low minimum deposit brokers are popular for a number of reasons. The main two are that new traders want to start with a low capital outlay. The other main reason is that some traders will first want to test a new broker will a small amount of money before making a larger deposit.

In this post we go through the best low deposit brokers and how you can start using them in your own trading.

Best low minimum deposit forex brokers

Eagle FX

| eagle FX | regulation | min deposit | STP / ECN | open an account |

| nil | $10 | yes | trade now |

Eaglefx is another newer broker on the scene that offers small minimum deposit options along with the ability to use large leverage.

Eaglefx offers super fast trading execution times along with dedicated client support that is available 24 hours a day and seven days a week.

The signup process to eaglefx is very easy and after you have signed up you will be given the free MT4 platform you can use on either your desktop or mobile devices to trade in either real or demo mode.

Longhorn FX

| longhorn FX | regulation | min deposit | leverage | open an account |

| nil | $10 | 1:500 | trade now |

Longhorn FX is a newer broker that is located in th saint vincent and the grenadines.

Longhorn offers trading on over 150 assets with leverage available up to 1:500 making it attractive to a lot of traders.

After signing up you get access to the MT4 platform that you can use to trade both in demo and ‘real' modes.

Longhorn FX offer small spreads and fast trading execution times making it a good option for many different types of trader.

FP markets

| FP markets | regulation | min deposit | leverage | open an account |

| ASIC, cysec. | $100 | 1:500 | trade now |

no withdrawal or deposit fees. Customer support through whatsapp messages. A demo account is offered.

FP markets is also an australian based broker that is regulated by ASIC.

This broker has been around a long time as it was founded in 2005. With FP markets you have many different deposit and withdrawal options including all the major cards and paypal.

FP markets offer a large range of education and market analysis and along with their MT5 charts, they also offer other trading platforms to suit your individual needs including IRESS.

Octafx

| octafx | regulation | min deposit | leverage | open an account |

| cysec | $5 | 1:500 | trade now |

Octafx is a STP style broker that has opened more than 1.5 million trading accounts.

Octafx covers 100 countries and they have won 28 different industry. Along with their MT5 platform you also get access to MT4 and ctrader platforms.

Octafx offer a large range of free education and market analysis and you also gain access to their copy trading platform. This allows you to copy other professional traders and make money from their winning trades.

Forex.Com (for US)

| forex.Com | regulation | min deposit | market maker | open an account |

| NFA, CFTC + others | $100 | yes | trade now |

low FX fees. Numerous trading pairs. A wide range of research tools. Offers MT4 and other trading platforms.

Forex.Com has established itself as one of the best brokers in the world.

This is our number one recommendation for traders in the US as they have strong regulation including being regulated with the CFTC.

With forex.Com you get access to spreads as low as 0.2, the ability to trade on over 80 currency pairs and a wide range of trading platforms.

The MT5 platform on forex.Com comes with 20 free, easy to install eas and custom indicators. When opening an account with forex.Com you also get access to the full suite of downloadable, web, and mobile apps.

What is a low minimum deposit?

A low minimum deposit broker will allow you to start trading with a very small amount of capital. This can sometimes be as low as just $5.

The question you need to ask is what is the lowest amount of capital you should be depositing to give yourself the best chance of success.

Whilst you can start with just $5, is that going to give you a realistic chance of success? Probably not because you will be very constricted in both the amount you can trade and the assets you can trade.

Thinking about lot size with small deposit

Just because you make a low deposit does not mean you cannot trade with correct money management strategies.

Even with a smaller account it is important to think about your lot size and how you calculate your trade entries.

If you are not sure what your lot size is and how to calculate it correctly, then read HERE.

Correctly managing your risk with a small deposit

Being able to correctly manage your risk when using a smaller account size is going to be crucial to your success.

Many traders will trade wildly when they have a smaller account because the amount being risked is smaller. These traders will make far more trades than they should and also risk a higher percentage of their account than they should.

Even with a smaller account it is still important you use proper risk management and only risk a small percentage each trade.

What is a minimum deposit broker?

A minimum deposit forex broker will let you deposit a very small sum of money to get started trading. This is a good option if you are new to trade or want to test out the broker.

Can I start trading with $5?

Yes, there are multiple brokers who will let you start with as little as $5. This is often a good place to start before making larger deposits.

Why would I start with a low deposit?

New traders will often start with a small or low minimum deposit when they are first starting out. Other traders who are looking to test a new broker will also often start with a small deposit.

Avatrade minimum deposit – A forex trading guide

Founded in 2006 as ava FX, avatrade is an online trading platform with headquarters in dublin, ireland, that offers services to amateur and experienced forex traders worldwide. Since 2013, their services have been used by more than 200,000 registered traders on five continents, including africa, australia and asia. Avatrade prides itself on its secure trading facilities regulated by organisations across the globe, extensive customer service and a user-oriented trading environment. The avatrade deposit minimum makes them a popular option in online trading. But where does this put avatrade in a forex comparison for traders worldwide?

- Low minimum deposit amount

- Variety of trading platforms

- Trader benefits

- Increased security

Before we get started, take A look at our other avatrade guides:

Avatrade minimum deposit amount

The minimum deposit for opening an account with avatrade is just £100. Available deposit methods include debit card (visa/mastercard), bank wire transfers and e-wallets such as paypal, skrill and neteller.

For non-UK traders, the initial minimum deposit amount is:

Because avatrade is focused first and foremost on the convenience and satisfaction of its customers, the deposit is one of the lowest among various forex trading companies. This minimum deposit amount is aimed at traders who want to get started in the business but do not have a large amount of start-up capital.

With avatrade, new customers receive a sign-up bonus. This bonus is determined by the initial deposit but can be up to 40% of the deposit and helps beginners find their feet.

Although many other forex brokers charge a similar fee of the minimum $100, and some even charge extremely low fees – as low as $10 – these brokers do not include the same benefits that avatrade offers for its customers.

Avatrade minimum deposit vs other brokers

At the entry-level, the avatrade min deposit still presents the options of assistance and additional education to even the most inexperienced customer.

And while this minimum deposit fee might seem like too little to trade with, the fact that avatrade offers over 59 trading pairs and 250 different trading instruments makes it a sufficient deposit amount to trade with success as a beginner or less experienced trader.

Create account with avatrade

Avatrade: low minimum deposit

Avatrade offers wide range of etfs available to trade as cfds.

Avatrade deposit methods

For traders in the UK, you can deposit funds into your avatrade account via credit cards and wire transfer. But before funding your account, please make sure that the verification process of your account is completed and that all of your uploaded documents have been approved.

Payment made via credit cards will be transferred instantly to your trading account, while deposits by wire transfer can take up to 10 business days, depending on your bank and country.

Steps to deposit

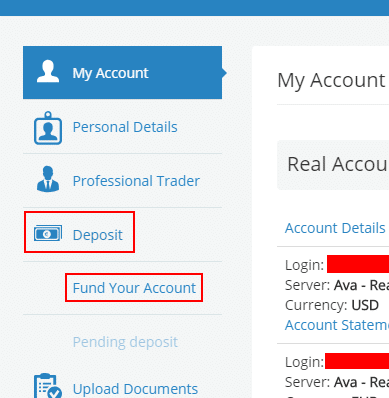

- The first step is logging in to your avatrade account, then go to the ‘deposit' section

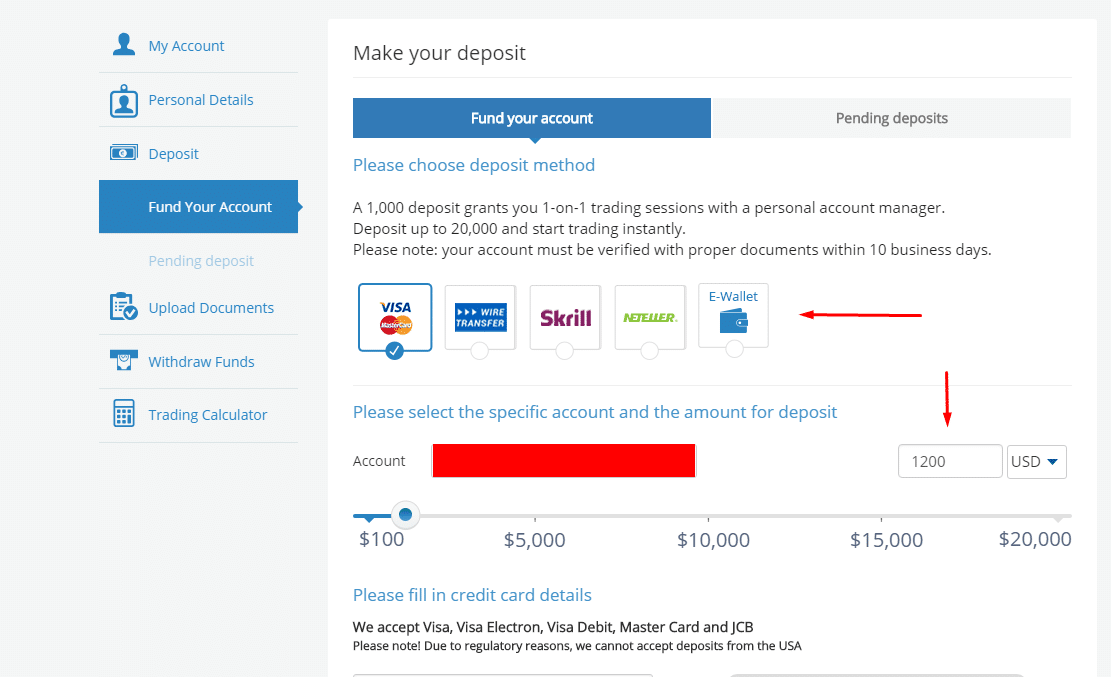

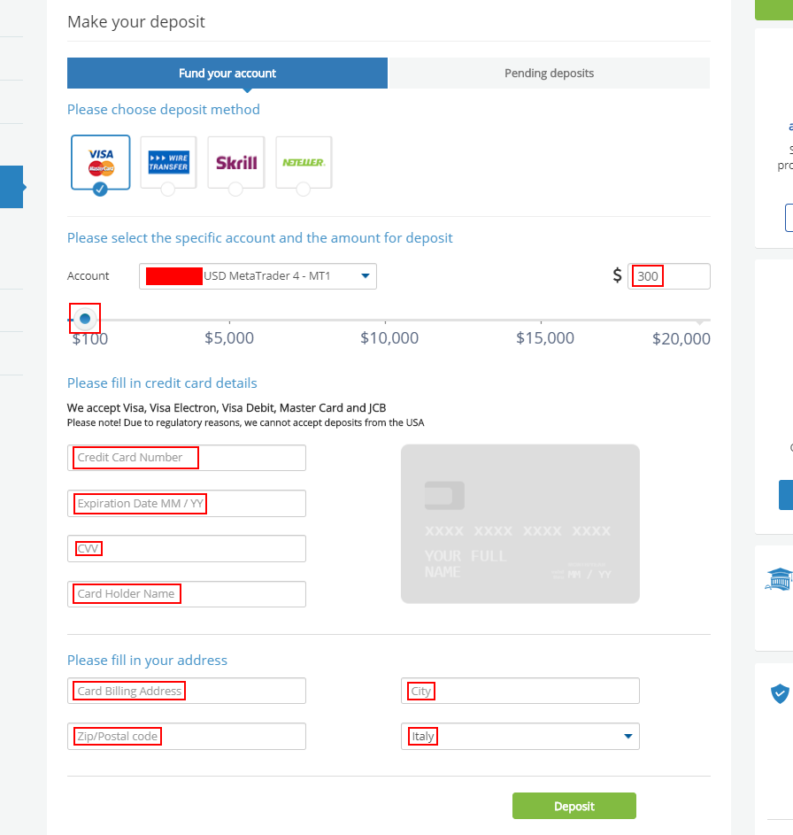

- Click on ‘fund your account' and select your preferred method.

- Then, select the specific trading account you wish to deposit into from the drop down menu.

- Enter the amount you wish to deposit and add the payment method details into the fields.

- Lastly, click on “deposit” to complete the transaction.

Avatrade withdrawal methods

The first thing you need to ensure before making a withdrawal from your avatrade trading account is to confirm that your account is verified. The avatrade UK withdrawal process takes only one or two working days.

As a result of international anti-money laundering regulations, withdrawals can only be sent via the payment methods by which you funded your account.

Essentially, currency accepted in making deposits and withdrawals for traders in the UK is GBP.

Wide range of automated trading platforms

Various automated trading platforms are offered to avatrade users as a means of increasing success for the individual trader and appealing to their unique trading preferences.

This function allows the trader to use the advantages of mirror trade, which mirrors strategies tried and tested by professionals and incorporates their history of successful trading into the trader’s methods.

One of the most popular automated platforms for this is zulutrade, which offers professional trading recommendations from programs and experts which can be utilized in the trader’s account.

The various available trading platforms with avatrade make for a convenient and interactive trading process with the best available forex platform options in the world.

- Avatradego

- Metatrader4 (MT4)

- Mac trading

- Mobile trading

- MT4 floating spreads

The MQL5 signals service platform also provides UK users with the option to link their accounts to trading signals from signal providers both in the UK and around the world.

This function then mimics the chosen trading patterns via the signals and applies them to the users trading methods and strategies. This method adds the benefits of faster trading execution and tighter spreads.

By this, it is meant that the difference between buying and selling price, counted in pips, is less. Customers can also choose between fixed and floating spreads, which continuously fluctuate.

Spreads from as low as 0.8 pips are available, making avatrade one of the most competitive contenders for best forex broker globally.

CFD and cryptocurrencies

Cryptocurrencies trading with avatrade

The low fees available for avatrade customers extend to all aspects and trading platforms, including the five major cryptocurrencies in today’s trade market with an avatrade minimum deposit of $100.

- Bitcoin (BTC),

- Bitcoin cash (BCH)

- Bitcoin gold (BTG)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- EOS

Trading with cryptocurrencies is beneficial for traders because it offers diverse currency options with values that fluctuate according to global supply and demand, creating unexpected potential at any time.

A cryptocurrency wallet is also safe from theft or hacking, which guarantees the security of online trading. Cryptos are traded 24/7, unlike the 24/5 availability of standard forex trading services.

Crypto trading, like avatrade’s other services, is available in 14 languages and is also available on the numerous platforms that avatrade offers.

Take this quick quiz to help us find the best path for you

CFD trading with avatrade

In addition to forex and crypto trading, avatrade offers CFD trading options for their customers. CFD, which stands for contract for difference, allows customers to make money off the differences in stock prices as they change between the opening prices and closing prices.

This option gives users access to a broader range of markets accessible on the automated trading platforms, and avatrade does not charge a commission on these shares.

Avatrade is one of the first online brokers in the world to offer this service to their customers and allows customers to create a 21-day demo-account to explore the CFD option before paying the avatrade deposit fee for a standard account.

Avatrade's global reputation

A detailed forex broker comparison was conducted by brokernotes in march 2018 among three of the largest trading companies in the UK: avatrade, IG and LCG. Avatrade was ranked first, with an extensive list of reasons why. Firstly, avatrade is regulated by five major organisations:

- Central bank of ireland

- Financial services agency(FSA) in japan

- Financial services board (FSB) in south africa

- British virgin islands (BVI) financial services commission

- Australian securities and investments commission (ASIC)

In general, avatrade’s fees – specifically the avatrade deposit and spreads – are lower than other brokers’ and offer a greater variety of trade markets and instruments. At $100, the avatrade min deposit to set up a standard live account that provides customers with additional trading advantages. A free demo-account allows potential customers to test the services first and get comfortable with the world of online trading before signing up for a paid account.

Avatrade also has the most funding options between the three brokers, including paypal and neteller. There are 59 forex trading pairs offered, including exotic forex pairs. With their global services reaching 150 countries, they possess a large customer base across south africa. Just one example of their reputation is that avatrade was ranked second best of all the forex trading brokers in the country in may 2018, according to top 8 forex brokers.

Guaranteed trader benefits

Avatrade hosts various seasonal promotions and bonuses online throughout the course of each year which assist traders in increasing their positions in the trading business. For the month of may in 2018, new trader accounts received bonuses determined by their initial deposits.

With the avatrade minimum deposit at 100 GBP/ EUR/ AUD/ USD, for this promotion, new users could receive up to 40% of their deposit back as a bonus, with the maximum bonus being $16,000.

The option between fixed and floating spreads proves to be highly beneficial to traders as it acts as an extra opportunity to make money. Traders therefore make money off of the unpredictable and changing differences between buying and selling prices.

This is only one example of the promotions that run on avatrade.

Other trader benefits include the regulated security of the platform, the option to trade cryptocurrencies, permittance of scalping and hedging.

Besides, professional assistance with trading and the ability to leverage higher positions, up to 400:1, meaning that margins can be decreased and the fact that traders can build up the money they need to take necessary trading actions.

There are no extra charges for inactivity or withdrawals, which allows traders to save money. Traders have the added exclusive benefit of additional trading education tools which can be used to increase their trading success.

These educational tools include videos, webinars, ebooks and online training courses that are included in the original account activation deposit fee.

Reliable security measures for client funds and identity safety

Avatrade is a licensed investment firm that has official regulations from five different areas, as mentioned above. They consider customer safety to be their primary concern and take all the necessary precautions to ensure this safety.

By being regulated in ireland, the british virgin islands, japan, australia and south africa, avatrade is one of the safest online platforms to trade with because of their careful management of clients’ assets.

Clients can rest assured that their finances are in safe hands with avatrade’s credible reputation approved by organisations like ASIC, FSB and FSA. These regulations ensure that the procedures of financial management and reporting are conducted transparently and follow the necessary strict requirements.

The internal security measures taken by avatrade include a 256-bit SSL encryption across the website to prevent hacking, a true-site identity assurance seal to protect user identities and personal information, and the garnering of approval from the american institute of certified public accountants as webtrust certified, making it an undoubtedly secure online option.

Besides, they also use mcafee secure to prevent hacks and identity theft and keep all client funds in separate accounts from those used for the avatrade business funds.

This gives clients the guarantee that their money is safely stored and the best security protects their details.

Quality customer service

According to an avatrade review published on recommended forex in 2018, avatrade is rated at 9.4 out of 10 for the many essential characteristics it possesses, one of them being its user-friendly and focused platform.

Avatrade is open to all traders, regardless of their level of experience. Less experienced traders are encouraged to make use of a variety of learning platforms.

Their educational resources consist of courses including trading for beginners, sharp trader, forex ebook and free training video tutorials and webinars for traders of all levels to help improve their skills and abilities.

These tools are designed to help traders learn the economic market and stay up to date with the latest news in finances.

In addition to 24/5 assistance via live chat, email or phone, avatrade assists in 14 different languages to ensure all customers can be helped. Upon the customer’s first $1,000 deposit, avatrade assigns an account manager to the individual trader to guide them in their future financial decisions.

The numerous choices that avatrade makes regarding platforms, currencies, markets and advanced security, and the numerous awards they have one, such as most reliable broker in 2015, relay their key message of excellent customer service clearly.

A final word on avatrade

Online forex trading continues to churn out new platforms with lower deposits or tighter spreads, but few brokers have most or all the desired advantages wrapped up in one the way that avatrade does.

For traders, whether beginners or experts, the keys to look for in a forex broker are excellent customer service, endless opportunities for success and a true atmosphere of support for each individual.

Avatrade objectively offers this to all clients, whether starting with a £100 deposit or going in with ten times as much, showing that all their customers are valued, not just the experienced or professional traders. The benefits of educational tools, available representatives and ample platforms and currencies to choose from make it a welcoming option for traders, not only in the UK, but across the globe.

Aside from the apparent benefits, they also have a highly credible reputation and multiple regulations and trading licenses throughout countries like japan, south africa and australia, who can vouch for their quality service and security. With the guaranteed safety of your money and identity, avatrade leaves little to be desired.

People who read this also viewed:

How long does it take to withdraw from avatrade?

It takes between 24-48 hours to process a withdrawal request if the account verification process has been completed and approved by avatrade. This is the process for credit cards, debit cards and e-money. In the case of wire transfers, it can take up to 10 business days for the funds to reflect in your account.

Does avatrade have a bonus?

Yes, avatrade has a welcome bonus. You need to have an official registration on the page and then, to make an initial deposit in order to claim for the promotion.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage . 75 % of retail investor accounts lose money when trading cfds with this provider . You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money .

Hotforex minimum deposit guide (2021)

Trading with hotforex? You should be very well equipped if you have had a look at our hotforex review.

If you are looking to explore the broker on a deeper level though, we have created this guide especially for you.

Here you will learn more about the funding methods available with the broker as well as the hotforex minimum deposit amount that is required by the broker in every instance.

Table of contents

72.90% of retail CFD accounts lose money

Hotforex account base currency

The HF markets base currency is that which you can trade in through your account. Top forex brokers will usually make several base currencies available, giving you a range of choices when trading. This is also the case with HF markets.

The base currency that you will have access to depends on the area where your account is regulated. Typically within this, USD are available everywhere. Euro as a base currency is also available within europe as you would expect.

Other base currencies are available. These will depend on the area where you are located. Some examples of this are the fact that GBP is accepted if you are trading from within the UK, NGN is available for nigeria based traders, and ZAR is also accessible for those within south africa.

This represents a good degree of choice for all types of trader no matter your location around the world.

Hotforex funding and deposit methods

An especially extensive range of deposit methods are available from hotforex. These each have an associated minimum deposit which you may wish to take into account.

With that in mind, let’s take a closer look at each hotforex deposit option and the corresponding minimum deposit for hotforex:

Wire transfer

Wire transfer is a deposit method which we always expect to see, and it is indeed available again with HF markets. This method of deposit is available around the world to all traders.

There is no minimum deposit associated with this method, although as a trader you should be aware that a deposit of under $250 with the HF markets entity, and under $100 with the hotforex entity will leave you liable for a bank fee. You may also wish to check with your bank to find out if they levy any fees in this regard. The time it takes to process your deposit will depend on your bank but typically this can range between 2-5 business days.

Credit/debit cards

Credit and debit card deposits are among the most convenient for traders. Naturally, HF markets and hotforex broker branches facilitates this by offering deposit by visa, mastercard, maestro, and unionpay to all traders who require it. Debit card funding only is available under DFSA regulation, while credit card and debit card funding are available under every other regulatory type.

The hotforex broker minimum deposit that applies to this funding method is $50 and the process is completely free of any fee. It is also effectively instant in how quickly you can access the funds. This typically takes a maximum of 10 minutes.

Ewallets

Ewallets are another popular deposit method that is made available by HF markets. These are not available under DFSA regulation though they are available in europe through either neteller or skrill. The minimum deposit using these methods is $5, although under FCA and cysec regulation this minimum is increased to $50. The deposit itself should be accessible within 10 minutes.

Cryptos

You can also deposit with the hotforex entity using certain cryptos. This is available under the SV regulation using skrill, bitpay or other methods. Through these methods mentioned, the current minimum amount for funding is $5 although it can be subject to change. The funds are usually available quickly within a 10 minute period.

Other hotforex deposit methods

There are other HF markets deposit methods available which depend on where you are located in the world. These are particularly common outside the cysec and FCA area. These deposit methods usually carry no fees and are typically instant.

The following HF minimum deposits do apply though within the following areas:

- Indonesia – 200,000 IDR

- Malaysia – 50 MYR

- Thailand – 50 THB

- Vietnam – 300,000 VND

If you are trading from within south america, other local deposit methods from a number of local banks are available although fees could vary in these cases, so it would be best to check with your bank and the broker support team.

Hotforex minimum deposits

As per the other forex trading low minimum deposit brokers, having looked at the variety of ways that are available to fund your account, let’s take a more in-depth look at how the minimum deposit with HF markets is reflected on the account type you select.

This will also depend somewhat on the regulatory area where you are based because HF markets and hotforex, despite being the same broker, are 2 separate entities.

Micro account

The hotforex micro account is a great starting place for any new traders. The account allows value trading with microlots and facilitates a minimum deposit of only 5 USD (or 70 ZAR if you’re trading from south africa). An islamic micro account, where required, is offered by this entity.

Zero account

The HF markets and hotforex zero account is available under multiple regulatory bodies, cysec, SV, FCA, DFSA, and DFSA. The only small difference is that under DFSA regulation it is known as a VIP account.

This account type balances lower spreads with slightly higher commissions. The minimum deposit here is 200 USD, EUR, or GBP, and 2800 ZAR. Again, islamic accounts are available if needed.

VIP account

The VIP account is essentially very similar to the zero account with the difference being the region. This account is available under DFSA regulation and as an added bonus it does allow you contact with a HF markets relationship manager.

The hotforex minimum deposit on this account type id $20,000 or 74,000 AED. Again the islamic account is available on request.

Related guides:

Auto account

Next we have the HF markets auto account. This only offered by the hotforex broker branch, and it’s available under SV and FSCA regulation and allows for autotrading and connection with the MQL5 community to find and follow signal providers.

When it comes to the minimum funding amounts, these currently stand at 200 USD or EUR and 2800 ZAR within south africa with an islamic account available to anyone who requires.

Hfcopy account

The hfcopy account allows you to become either a copy trader or a signal provider. This account type is available under both cysec and SV rules with a minimum deposit as follows:

- Signal providers should deposit a minimum of 1,000 EUR or 500 USD depending on area

- While copy traders need to start with 300 EUR or 100 USD, again, depending on the branch of the broker.

FIX account

The hotforex FIX account is one that used to be available under SV regulation. This is no longer the case. It had previously offered fixed spreads with a minimum deposit of $500. Luckily though, there are many other account types to choose from.

PAMM account

The PAMM account offered by the hotforex entity is available only to premium account holders and with a hotforex minimum deposit of $250. This account is only available if you are regulated within the SV jurisdiction.

Premium account

The HF markets premium account is again available in several areas of regulation and comes with a minimum HF markets deposit of 100 EUR, USD, or GBP. In south africa, the minimum deposit amount should be 1400 ZAR while under DFSA regulation you will need to deposit 400AED.

There are many trading benefits in terms of cost and other factors that are available to premium account traders which may be unavailable to other traders. This account type can also be linked to a PAMM account as mentioned above. Islamic account options also remain available to premium account holders.

Premium pro

The last account type we will take a look at is the highest level HF markets account which boasts a lower spread than the others. This account is available under cysec, SV, FCA, DFSA, and FSCA regulation with a minimum deposit of 500 EUR, USD, or GBP (changing to 400 if you are based in the UK under FCA). With DFSA regulation 2000AED is also acceptable.

Again there are a host of benefits although commissions are a little higher. It can also be linked with a PAMM account and finally once again islamic account options are available.

Hotforex deposit bonus

The final area for us to cover may be an important one depending on your trading goals and expectations. However you should be aware of the fact that ESMA, within europe, banned deposit bonuses. Due to this stringent regulatory environment, there are no deposit bonuses or contests available under HF markets EU.

$30 no deposit bonus

HF markets typically do offer a range of bonuses to those traders located outside of cysec and FCA regulatory areas. Within these regions, it is difficult due to stringent regulatory environments.

The one which is available as a hotforex no deposit bonus is a $30 bonus. Although this amount is not immediately available for you to withdraw, you can do so once you have met some of the trading requirements. You can then withdraw any profits which you have made from this HF markets no deposit bonus.

72.90% of retail CFD accounts lose money

Best low forex minimum deposit brokers

How much money do you need to start forex trading? What is the forex minimum deposit requirement? What are the low minimum deposit forex brokers? Those types of questions always preoccupy traders’ minds, particularly those of beginner forex traders when they choose among the vast number of forex brokers. Nevertheless, all forex traders consider minimum deposit. Certainly, each and every one of us like to deposit thousands of dollars into our forex account and start making tons of money right away. However, it is always recommended to begin with a small forex deposit so that you will not blow up your hard-earned money in seconds. There are other benefits of starting out with low trading capital.There exist significant differences between forex brokers with respect to execution type, trading platform, number of markets, spreads and other trading fees. Low minimum deposit requirements allow you to assess those characteristics and decide if the broker is right one for you before investing large capital.

Is forex trading with no minimum deposit possible?

There are some forex brokers who let the traders open a trading account without any initial deposit. For instance, forex.Com minimum deposit is $0. Though, you will have to fund your account in order to be able to start trading. Demo accounts could be another option to be used if you do not want to make any real deposit. Demo accounts are oftenly preferred by novice traders for gaining experience and by veteran traders for analyzing the trading conditions. However, live accounts and demo accounts provided by the very same forex broker might differ substantially in terms of trading conditions. Therefore, demo accounts could be misleading if you try to investigate the spreads and execution time.

Start forex trading with $1 – which brokers?

There are numerous forex brokers that offer forex account with only $1 initial deposit. Four of them are in my list, though I recommend exness and FBS amongst the four. If you can not make a final decision between exness and FBS, I advice to you go with exness due to the tighter regulation. Once again, you will not be able to open any trades if you deposit only $1 into your forex account. Therefore, even though the minimum deposit requirement is $1, you shall deposit more in order to be able start trading forex properly.

Best forex brokers with low minimum deposit

Low forex minimum deposit – the advantages

Forex trading is a serious business and it requires loads of time and effort in order to be able to become a consistently profiting trader. Forex brokers who demand low minimum deposit for opening a trading account gives you the opportunity to gain experience at the risk of lower cost. If you are a beginner trader and invest $5000 without prior trading experience, it is highly likely that you would lose your entire investment in a short time. Compare it to a forex broker with $50 minimum deposit requirement. Your risk would be only $50 which would not hurt even as close as losing $5000 in case you blow up your account.

- Assess the trading conditions

It is commonly known that demo accounts are identical to live accounts in terms of trading conditions. This is false for many forex brokers. Demo accounts and live accounts are registered in different trading servers by some brokers. Therefore, they could differ with respect to spreads, execution time, slippage and leverage. Through demanding a low deposit for opening a live trading account, forex brokers could let you test the actual trading conditions.

- Examine the operational and institutional aspects

Since you will need to deposit real money into your account, you would also be able to assess the operational and institutional aspects of the broker. Forex brokers might apply various fees and require some documentation for opening a real account and funding your account. Demo accounts would never give you an idea regarding those prospects of forex brokers. Opening a live account is going to familiarize you with funding fees and speed, quality of customer services and operational efficiency of a forex broker.

What else to consider in low minimum deposit forex brokers

Regulation of a broker is always by far the most important criteria regardless of your account size. Choosing an unregulated broker is not a smart move since they are not subjected to obligatory requirements that would bar them for probable wrongdoings and hold them liable if they do anything illegal.

Low minimum deposit could be tempting however, I would strongly urge you to also take regulation into consideration while you are opening a live trading account. No need to be concerned, there are plenty of regulated forex brokers that provide trading services for an initial deposit as low as $1. By the way, not all unregulated brokers are fraud but you better approach a regulated one to minimize the risk of being scammed.

- Leverage

Leverage makes it possible to trade high volumes with a low capital which effectively makes leverage very important for small deposit accounts. However, leverage is a double-edged sword and could easily wipe out your account in a matter of seconds if you are not following proper money and risk management strategy.

Imagine that you only have $50 dollars in your trading account with leverage 30:1. It would almost be impossible to trade even the micro lot size because your account could fall to margin call or stop-out level following a miniscule volatility in the market. You will not even have a chance to open more than one trade at a time. If you are going to trade less than $100 capital, I recommend at least 500:1 leverage.

- Spreads

Low minimum deposit usually comes at the expense of higher forex spreads and trading fees. The brokers have to make some revenue in order to be able to provide you the promised trading services. A larger trading account brings more revenue compared to a smaller account. For example, client A deposits $1000, whereas client B deposits only $50. If the broker’s source of revenue relies on only spreads, client A is going to be more attractive in terms of revenue for the broker because it could trade higher volumes relative to client B.

Therefore, client B is likely to incur higher spreads for the sake of the broker’s profitability. You should make sure that the spreads are reasonable and will not eat your account up while choosing a low minimum deposit forex broker.

- Bonus

Free money is always a good way to set up a safety net for your account against margin call and stop-out if you are particularly trading on a low capital. Forex brokers offer free bonus and promotions such as deposit bonus, recovery bonus and welcome bonus to appeal traders. Those bonuses are added to your account in the form of credit and can be used for executing new trades.

The scale and conditions of bonuses differ across the brokers. Most of the time, the bonus can not be withdrawn and is removed from the account upon you withdraw your money. Nonetheless, some brokes offer withdrawable bonuses given that certain conditions are met. Those conditions are usually based on a specific number of trades executed or lots traded.

Best forex brokers – top 10 brokers 2021 in ukraine

How should you compare forex brokers, and find the best one for you? In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options – everything that makes a broker tick, and impacts your success as a trader.

The “best” forex broker will often be a matter of individual preference for the forex trader. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements.

But we can help you choose…

Below are a list of comparison factors, some will be more important to you than others but all are worth considering. Details on all these elements for each brand can be found in the individual reviews.

Forex brokers in ukraine

How to find the best forex broker

The main criteria for finding the best forex brokers in ukraine 2021 are these – we will expand on each area later on in the article:

- Trading conditions/fees – this is the most important part of your global forex broker appraisal. There is no way around that. One forex broker may charge you 10 times less for the same trade than another. Take note of “hidden” fees, such as withdrawals fees, or inactivity fees.

- Market coverage – you need to be able to trade the fx pair or product of your choice/preference.

- Accessibility and affordability – beginner forex traders and small-timers need love too. You should never be forced into making a minimum deposit that you cannot afford to lose. Minimum deposits range from $10 to $1000 (or the £ / € equivalent). It might be worth investing more for a platform that suits you better, so stay open minded.

- Trading platforms – the forex trading platform and the tools it features are your primary weapons in your personal war for profits. Pick the one that suits you best. Remember many platforms are configurable, so they can be tailored to suit you. Personal preference will play a large part here, as many trading platforms offer very similar services, but look and feel very different. Is a mobile platform your priority, or a desktop web trading platform?

- Mobile trading apps – being able to trade on the go may be important. Some mobile apps are superior to others. Ideally the mobile platform will function just as the web based version.

- Deposits and withdrawals – you have to move funds to and from the broker, quickly and preferably cheaply. The deposit/withdrawal methods supported by the forex broker determine whether or not you can accomplish that. Financing an account may also require a specific payment method.

- Reputation – people talk. It is well worth listening to what traders say about a forex broker they have already tried.

- Regulation – when push comes to shove, legal recourse is your first, last and only hope to settle the problems you might have with your forex broker. A proper regulatory framework is preventive in nature. It aims to keep such problems from popping up in the first place.

- Customer support – you need someone to talk to when you run into problems with your deposits, actual trading, or – god forbid – withdrawals. Competent support is a must. From opening an account, to help with the platform, customer support can be important.

- Company background and history – knowing the past exploits of your forex broker can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet for example. You want peace of mind that your trading funds are segregated, and held safely and securely.

- Education – it never hurts to improve your understanding of how the forex markets work and how you can make the most of the opportunities they present. Some brokers offer extensive educational tools.

- Account opening / registration – is it a simple process to open an account? Do clients need to be verified? These processes are not always the same and might be worth considering if opening a trading account has been problematic in the past.

Broker costs

The services that forex brokers provide are not free. You pay for them through spreads, commissions and rollover fees. Low trading fees are a huge draw.

The fee structures differ from one forex broker to another, and even from one account type to another. There are two widely used basic setups.

- The broker charges a spread only. All other fees – with the exception of the rollover rate – are included in the spread.

- Besides the spread, a commission is charged as well. This commission is based on the amount you trade.

Spreads

Of these two forex broker fee arrangements, the second one is arguably the more transparent. That said, the commission/spread combination may not be the cheaper choice in every instance.

The spread can be fixed or variable. Fixed spreads are always constant. ECN broker may even deliver zero spreads. Variable spreads change, depending on the traded asset, volatility and available liquidity.

A currency market and spread go hand in hand.

Daily spreads may only differ slightly among brokers, but active traders (or even hyper active traders) are trading so frequently that small differences can mount up and need to be calculated to compare trading costs.

The lowest spreads suit frequent traders.

Some brokers focus on fixed spreads. There are indeed 1 pip fixed spread forex brokers out there too.

Forex brokers with low spreads are certainly popular. Do take commission and rollover/swap into account as well with such brokers though.

What is the rollover rate?

Forex positions kept open overnight incur an extra fee. This fee results from the extension of the open position at the end of the day, without settling. The rollover rate results from the difference between the interest rates of the two currencies. The first of the pair is the base currency, while the second is the quote currency.

Forex pairs traded

While most forex brokers offer impressive-looking selections of currency pairs, not all of them cover minors and exotics. Does the broker offer the markets or currency pairs you want to trade?

If you are trading major pairs (see below), then all brokers will cater for you.

If you want to trade thai bahts or swedish krone as the base currencies you will need to double check the asset lists and tradable currencies.

Majors

The aussie dollar ans swiss franc, while considered ‘minor’ pairs, are often traded in high volume. You can read more about those here: aud/usd or usd/chf

That said, there are brokers out there that will truly go out of their way to cater to their traders’ needs. Some will even add international exotics and currency markets on request.

Such flexibility is obviously a major asset, positively impacting the overall quality of the service.

What about crypto?

Cryptocurrency pairs are quite ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are both popular.

The massive volatility associated with these products makes scalping a viable strategy for profitable trading.

Some traders are in the forex game specifically to trade the crypto volatility. Such operators obviously need a forex broker that features as many crypto pairs as possible.

Micro accounts

Not everyone trades forex on a massive scale. In fact, many forex traders are small-timers. Such forex clients appreciate forex brokers’ micro accounts, some of which have the US dollar as their base currency.

Some forex micro accounts do not even have a set minimum deposit requirement. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings.

Note however that the spreads/commissions on such micro accounts tend to be quite adverse.

It is however, a cheaper introduction to a complex market (similar to cfd accounts) – and trading for real beats a demo account for genuine experience learning how to trade.

Trading platforms

Forex trading platforms are more or less customisable trading environments for online trading.

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Some may include sentiment indicators or event calendars.

Metatrader 4 or 5

Integration with popular software packages like metatrader 4 or 5 (MT4 or MT5) might be crucial for some traders. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure.

Trading view

Tradingview is also a popular choice. Some forex brokers allow their traders to trade directly on the world’s top social trading network.

Proprietary solutions are often interesting, though in some cases less than optimal. For traders who base their strategies on the use of eas and VPS, a proprietary platform that does not support such features, is useless.

While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and eas.

Make sure you understand any and all restrictions in this regard, before you sign up.

If you want scalping, see if your broker is a forex broker for scalping.

For those who want to trade on the go, a mobile trading app is obviously important. While all forex brokers feature such apps these days, some mobile platforms are very simplistic.

They lack all the advanced analysis and market research features, and as such, are hardly useful.

Tools & features

From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience.

Again, the availability of these as a deciding factor on opening account will be down to the individual.

Level 2 (or level II) data is one such tool, where preference might be given to a brand delivering it.

Deposits and withdrawals

There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. Such disparities mostly result from the internal procedures observed by different brokers.

At one given broker, it can take as much as 5 times longer to fund an account than at another. The incurred costs differ quite a bit as well.

Otherwise, the payment process largely hinges on the accepted money transfer methods.

It would make sense for brokers to adopt as many such methods as possible, yet some still fall well short of the mark.

Education

Some traders may rely on their broker to help learn to trade. From guides, to classes and webinars, educational resources vary from brand to brand.

A broker however, is not always the best source for impartial trading advice. Consider checking other sources too – such as our trading education page!

Payment methods

The most common methods are bank wire, VISA and mastercard. The majority brokers tend to accept skrill and neteller too.

Forex brokers with paypal are much rarer. The same goes for forex brokers accepting bitcoin.

We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency.

Proper forex brokers always provide a local-specific payment solution to their target countries.

Customer feedback

Based on actual user feedback, forex broker reputation can best be gleaned from various community review sites and forums.

You have to take this type of feedback with a grain of salt, to say the least.

First of all: disgruntled traders are always more motivated to post feedback. They are not likely to be unbiased.

Secondly: not all of this feedback is factually correct. Furthermore, there is no way to actually fact-check/verify this data. Even sites like trustpilot are blighted with fake posts or scam messages. There is no quality control or verification of posts.

That said, it is still relevant. If there’s a forex broker about which no one has ever said anything good, chances are it might have issues. To the trained eye, genuine trader reviews are relatively easy to spot.

The utter lack of community feedback is red flag as well. People always have something to say about their forex broker or trading account. Therefore, something is definitely amiss if there is no information available in this regard.

Regulation

Regulation should be an important consideration if trading on the forex market. Whether the regulator is inside, or outside, of europe is going to have serious consequences on your trading.

ESMA (the european securities and markets authority) have imposed strict rules on forex firms regulated in europe. This includes the following regulators:

ESMA have jurisdiction over all regulators within the EEA

The rules include caps or limits on leverage, and varies on financial products. Forex leverage is capped at 1:30 (or x30). Outside of europe, leverage can reach 1:500 (x500).

Traders in europe can apply for professional status. This removes their regulatory protection, and allows brokers to offer higher levels of leverage (among other things).

Outside of europe, the largest regulators of trading accounts and brokers are:

These cover the bulk of countries outside europe. Forex brokers catering for india, hong kong, qatar etc are likely to have regulation in one of the above, rather than every country they support.

Some brands are regulated across the globe (one is even regulated in 5 continents). Some bodies issue licenses, and others have a register of legal firms.

So to reiterate, an ASIC forex broker can offer higher leverage to a trader in europe.

Offshore regulation – such as licensing provided by vanuatu, belize and other island nations – is not trust-inspiring. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections.

Regulators such as ESMA (european securities and markets authority) generally frown upon bonuses.

Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. Those same ESMA rules are also why some brands are duty bound to display warnings about CFD trading creating a “risk of losing all your money“.

Security

Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security.

Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed.

A worthy consideration. Some regulators will set a higher benchmark than others – and being registered is not the same as being regulated.

Account security also differs among brokers. Some may offer the additional layer of protection of 2FA (two-factor authentication) to ensure only you have access to the account.

Demo accounts

Try before you buy. Most credible brokers are willing to let you see their platforms risk free. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances.

Try as many as you need to before making a choice – and remember having multiple accounts is fine (even recommended).

FX leverage

For european forex traders this can have a big impact. Forex leverage is capped at 1:30 by the majority of brokers regulated in europe. Assets such as gold, oil or stocks are capped separately.

In australia however, traders can utilise leverage of 1:500. That makes a huge difference to deposit and margin requirements. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish.

Just note that higher leverage increases potential losses, just as it does potential profits.

Company history

A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers. It will also likely blacklist them.

This practice creates a sort of online trail, an operational history of sorts, highlighting the past sins of currently “reputable” forex brokers.

What’s interesting about this history is how little exposure it receives. You actually have to scour the archives of regulators to happen upon such relevant bits of information.

Bonus

From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Regulatory pressure has changed all that.

Bonuses are now few and far between. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice.

Also always check the terms and conditions and make sure they will not cause you to over-trade. Many have time limits or turnover requirements.

Additional account details

When comparing brokers, there are also other elements that may affect your decision. These will not affect all traders, but might be vital to some.

Order execution types

Once you click the “open trade” or “enter” button in your trading interface, you start a rather intricate process. Your broker uses a number of different methods to execute your trades.

Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Some brokers only support certain order execution methods. For instance, your broker may act as a market maker and not use an ECN for trade execution.

If you are looking for this method specifically, you will need to seek out an ECN forex broker.

Ecns are great for limit orders, as they match buy and sell orders automatically within the network.

Some other options that your forex broker can use are:

- Order to the floor. Mostly used for stocks. This execution type is handled manually, through actual trading floors/regional exchanges. It is therefore extremely slow.

- Order to third market maker. This execution type involves a third party, which is a market maker. This party is the one handling the order.

- Order to market maker. This method is essentially the same as the above one. The market maker handles trade execution. Some market makers pay brokers to send them orders. Thus, your order may not end up with the best market maker.

- Internalization. When using this method, the broker matches the order from its own inventory of assets. This execution method is therefore extremely fast.

Order execution is extremely important when it comes to choosing a forex broker. It also goes hand-in-hand with regulatory requirements.

Broker reporting

Both ESMA and the US’s SEC require brokers to report the quality of the execution their services provide. Regulators aim to make sure that traders get the best possible execution.

Mifid II sets clear guidelines in this regard. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

This may seem tedious, but it is the only way to head off fraud. The prices are compared to the public quotes. If the broker executes trades at better prices than the public quotes, it has some additional explaining to do.

If it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

These examples yet again showcase the importance of a proper regulatory background.

Account types

From cash, margin or PAMM accounts, to bronze, silver, gold and VIP levels, account types can vary. The differences can be reflected in costs, reduced spreads, access to level II data, settlement or different leverage.

Micro accounts might provide lower trade size limits for example.