Does fbs have nasdaq

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec).

Free forex bonuses

The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC). The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

FBS review and tutorial 2021

FBS is a top online broker offering MT4 & MT5 trading across a range of instruments.

Trade on nearly 50 leveraged forex pairs.

FBS is an online broker that offers financial market trading in forex and cfds. Our review in 2021 takes a thorough look at the broker’s legitimacy, leverage offering, spreads, and minimum deposits. Sign up for an FBS account and start trading.

History & headlines

FBS is a global broker founded in 2009. In the EU, FBS is operated by tradestone ltd and regulated by the cyprus securities and exchange commission (cysec). The global branch is run by FBS markets inc and regulated by the international financial services commission of belize (IFSC).

FBS has a head office location in cyprus and claims to have over 15 million active traders across more than 190 countries, from malaysia and indonesia to south africa, pakistan and the EU.

Trading platforms

FBS uses a non-dealing desk (NDD) system with STP for rapid order execution. After registration and login clients have a choice of two platforms to access the markets.

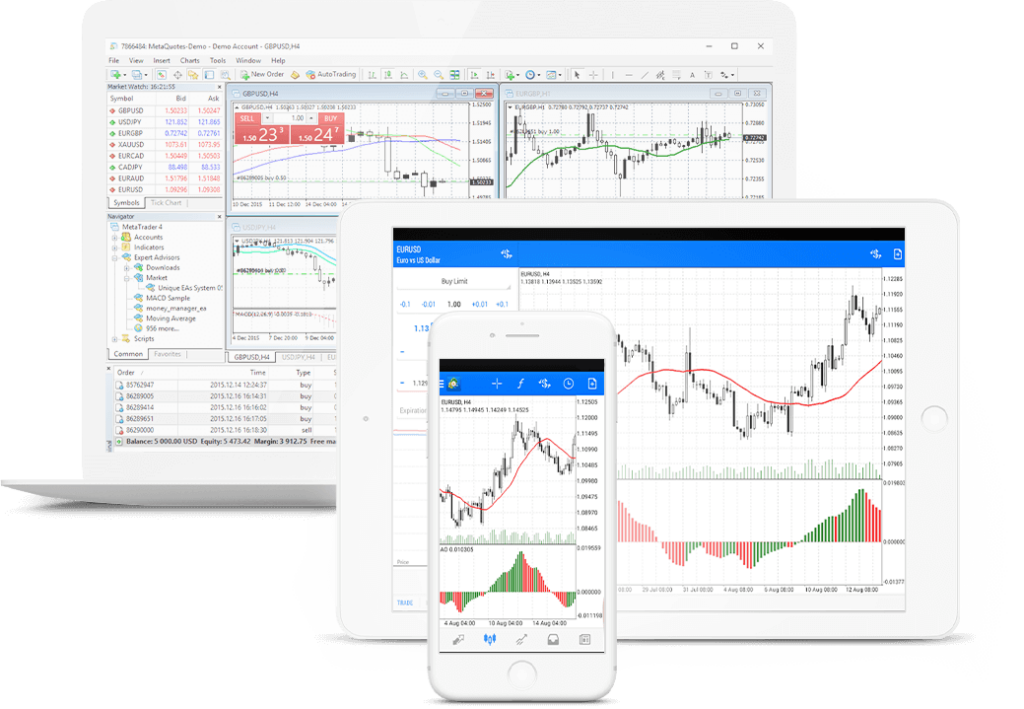

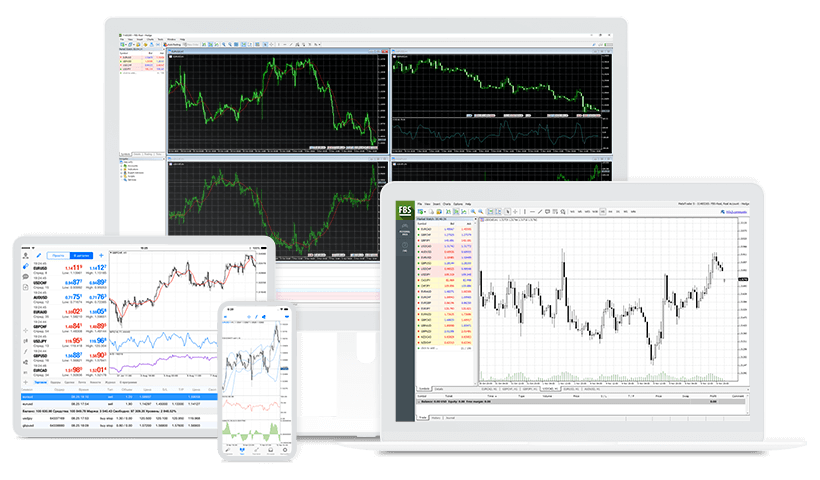

Metatrader 4

MT4 is a market-leading platform that FBS clients can download for PC. The trading platform includes a range of features:

- One-click execution and copy-trading

- Expert advisors (EA) service and apis

- Wide range of technical indicators and charting tools

- Support for clients using a virtual private server (VPS)

The global branch of FBS also offers MT4 multiterminal, which allows clients to operate multiple accounts simultaneously.

Metatrader 5

This broker recently added MT5 integration to its portfolio. This platform is a recent update to MT4 with greater versatility that offers the following:

- Hedging & netting

- Market depth view

- More technical indicators

- More order types and timeframes

MT4 and MT5 are also both available without a download via any browser through the webtrader solution. This service works across all operating systems and has all the features of the original software.

Markets

Clients can access a wide range of assets for trading:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and brent crude oil

- Stocks (global only) – 40 company shares

- Indices – four indices including the NASDAQ

Unfortunately trading on the FTSE100 is not offered and neither is cryptocurrencies, such as bitcoin.

Trading fees

Spreads offered by FBS vary by account type and region. For EURUSD, the global firm offers a spread of 3.0 pips on its micro account, 1.1 on its standard and cent accounts and zero pip spreads on its zero and ECN accounts. In the EU the same spread is 0.7 pips with both the standard and cent accounts. Our review was pleased to see competitive spreads with the zero and ECN accounts.

The global branch charges a fixed rate commission of $20 per lot on the zero spread account and $6 on the ECN account. It also charges $3 for stock trades and $25 for CFD trading.

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

FBS leverage

The maximum leverage available depends on account type and branch. In the EU the broker provides leverage up to 1:30 on standard and cent account types. Globally it offers up to 1:1000 on the cent account, 1:500 on the ECN account, and 1:3000 on other account types.

FBS has a margin call of 40% and lower, whereafter it is entitled to close a client’s position.

Mobile apps

FBS trader app

The owner and CEO have ensured that FBS trader is a free and fully-featured trading app. It can be downloaded to android (APK) devices from google play. Outside the EU it’s also available on ios. The broker’s downloadable app offers forex and top instruments for trading, alongside real-time stats and easy management.

MT4 & MT5 apps

Both metatrader platforms are also available as mobile apps from the app store and google play. The apps have the main features of the native platforms including technical analysis with the convenience of one-click trading on-the-go.

Payments

The minimum deposit at the online forex broker is different for each account type and trading region. The EU firm requires an initial deposit of €10 on the cent account and €100 on the standard. The global branch offers minimum deposits of $1, $5, $100, $500, and $1000 for the cent, micro, standard, zero spread, and ECN accounts respectively. Our review was pleased to see the low minimum deposit offering.

Several deposit and withdrawal methods are available including wire transfer (EU only), visa, and electronic payment systems, such as skrill and neteller. Deposits are instant for all methods bar wire transfer and withdrawals take up to 48 hours. Commission fees apply to withdrawals at the global FBS firm and identifying documents may be requested.

Demo account review

FBS offers demo versions of the cent and standard accounts in the EU. MT4 and MT5 integration are available and a range of instruments are offered to practice trading with zero deposit requirement. Once comfortable with the broker’s services, you can then sign up for a live account.

Trading bonuses

FBS has a wide selection of promotions and bonuses advertised on its global website. For example, the broker offers a trade $100 bonus with no deposit necessary. The broker credits clients with $100 and if the client has 30 active trading days with 5 lots traded, the bonus can be withdrawn. FBS also offers a 100% deposit bonus, which doubles the deposit available for trading, and many contests.

Licensing

FBS is a legitimate broker with regulations from respected authorities. The company that owns the EU branch of FBS is regulated by the cyprus securities and exchange commission (cysec). The global branch is regulated by the international financial services commission of belize (IFSC).

In the EU, the broker also offers negative balance protection to retail clients. Overall, we’re happy FBS is not a scam.

Note, traders from the USA cannot register for an account, though clients from most other countries are accepted, including canada, india and nigeria.

Additional features

The FBS website has an analysis section with resources including forex-related news, market updates, and a forex TV feature that displays informational videos, weekly insights, and trading plans. This broker also provides an economic calendar and forex calculators alongside extensive educational materials such as live webinars and tutorials.

Copy trading

The copytrade solution from FBS lets beginners replicate the success of top traders with secure, flexible trading tools. Clients can use the user-friendly mobile app to compare traders, allocate funds and create a unique trading portfolio.

Trading accounts

New clients have the option of several live account types. In the EU, the broker offers the standard and cent accounts. The global branch additionally offers the micro, zero spread, and ECN account. Order volumes are the same across account types. The ECN account has no trading limits and market execution is by ECN, unlike the other accounts which use STP. In general, the more you can deposit the higher the account tier and the more competitive the trading requirements.

When opening an account, you’ll need to submit documents to verify your name, address and the country you’re registering from.

Pros and cons

Benefits

Advantages of trading with FBS include:

- MT4 and MT5 integration

- Ultra-low minimum deposits

- Competitive zero-pip spreads

- Range of promotions & deposit bonuses

Drawbacks

Bad areas flagged in our review include:

- Fewer account and trading options in the EU

- Commissions payable on many trade types at the global firm

Trading hours

The FBS broker website is available at all times. Opening hours for each asset depends on the market and timezone, but forex runs 24 hours a day on weekdays. The broker also provides a virtual private server (VPS) service, which allows the client to keep their trading platform on a virtual machine 24/7.

Customer support

Customer support is available in english, spanish, portuguese, french, german and italian:

- Email – info@fbs.Eu

- Live chat – logo in bottom right

- Contact number – +357 25313540

- Address – vasileos georgiou A 89, office 101, potamos germasogeias 4048, limassol, cyprus

Global

Contact options including live chat, callback, and whatsapp are available on the global website.

Trader safety

FBS ensure client personal information and privacy is safeguarded. Transactional information is also protected using transport layer security (TLS). The metatrader platforms also offer dual-factor authentication at the login stage for added security.

FBS verdict

FBS is an international forex broker that offers low minimum deposits and a variety of trading accounts with MT4 and MT5 integration, alongside the FBS trader app. Spreads are competitive, and both novice and advanced traders will feel at home with this broker.

Accepted countries

FBS accepts traders from australia, thailand, united kingdom, south africa, singapore, hong kong, india, france, germany, norway, sweden, italy, denmark, united arab emirates, saudi arabia, kuwait, luxembourg, qatar and most other countries.

Traders can not use FBS from united states, japan, canada, myanmar, brazil, israel, iran.

Where is FBS regulated?

This broker is regulated in the EU by the cyprus securities and exchange commission (cysec) and elsewhere by the international financial services commission of belize (IFSC).

Is FBS a good broker?

FBS is a legitimate broker and not a scam. It is licensed by respected financial authorities and has positive online reviews.

Does FBS offer any bonuses?

The global branch of FBS offers 100% deposit bonuses and promotions where no deposit is required. This broker also offers trader contests and a VPS service.

What is the minimum deposit at FBS?

Clients can open an account with $1 at the global branch and $10 in the EU. The greater the initial deposit, the tighter the spreads and more advanced the trading tools.

What platforms does FBS offer?

FBS has both MT4 and MT5 platforms, which are available on any browser and as mobile apps. This broker also offers FBS trader, an in-house mobile application.

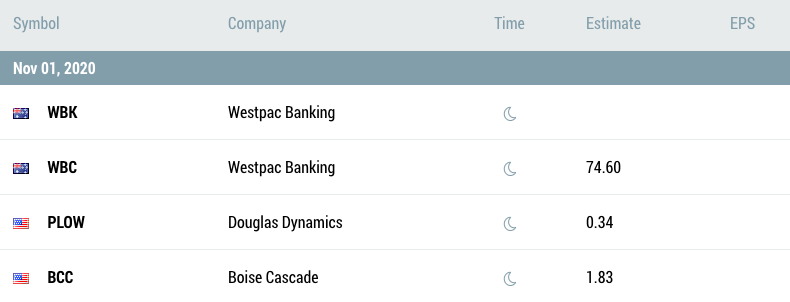

Does the FBS broker have trading on nas100?

Yes, clients can trade on the NASDAQ and three other major indices, including the S&P 500, dax30, and dow jones.

FBS now offers NASDAQ and S&P 500 stock indices on MT4 and MT5 accounts

Stock indices are available for all account types (except ECN) in MT4 and MT5.

New instruments: NASDAQ and S&P 500 indices

To make your trading even more powerful and get your income to the record high, FBS added new trading instruments which are NASDAQ and S&P 500.

If that means nothing to you, here’s a little overview.

NASDAQ and S&P 500 are stock market indices calculated based on the stock prices of the world’s biggest companies.

Most importantly, they show the rise and fall of these companies, reflecting the global economic situation.

From now on, you can trade these indices at FBS!

Trading symbols on MT4 and MT5

They are currently displayed in the following way:

- NASDAQ-19Z

S&P 500 includes 500 stock companies with the largest capitalizations. - S&P 500-19Z

the nasdaq composite index includes more than 3,000 corporations traded on the NASDAQ exchange.

You don’t buy stocks themselves, but you trade on their price relative to USD.

NASDAQ and S&P 500 trading are available for all FBS’s account types.

Hurry up to give them a test drive and earn more!

Post tags

FBS is an online forex & CFD broker based in belize and founded in 2009.

1:3000 highest leverage in the world & gorgeous bonus promotions only with FBS.

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

I do not want to trade FOREX

IS it possible to trade S&P 500 with MT4

But I’m trying so search them on my demo acc I cant find them

Been using fbs’s free vps for months and everything is going well. Even withdrawed over 4k last week with no problem. Great work fbs for these well-organized systems.

Says that fbs offer 3000 leverage but I can’t even select it for my mt5 account. What’s the reason?

I’ve had excellent experience with fbs right from the start, 6 years ago, till now. Everything works easily and quite well. The customer support is really awesome. I would give 10 stars if there was option for that!

I am joining FBS since 2016, 1. CS speak in my language 2. CS very helpful 3. Low spread and high leverage 4. Very fast transactions and I am very happy with this broker, very good FBS,

Honestly I believe fbs is the best fx broker among many. Spread can be better but their support is too good to be missed. Totally recommended.

Very friendly. I traded with several fx brokers but fbs support is really nice.

Very good broker. My account support helps me very nice and now no problem at all!

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Compare brokers for trading NASDAQ 100

For our trading nasdaq 100 comparison, we found 20 brokers that are suitable and accept traders from ukraine.

We found 20 broker accounts (out of 147) that are suitable for trading NASDAQ 100.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XTB

Platforms

Funding methods

82% of retail investor accounts lose money when trading cfds with this provider.

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About IG

Platforms

Funding methods

76% of retail investor accounts lose money when trading spread bets and cfds with this provider

Plus500

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About plus500

Platforms

Funding methods

76.4% of retail CFD accounts lose money

Avatrade

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About avatrade

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider.

Forex.Com

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About forex.Com

Platforms

Funding methods

79% of retail investor accounts lose money when trading cfds with this provider

Axitrader

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About axitrader

Platforms

Funding methods

68.5% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

Etoro

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About etoro

Platforms

Funding methods

71% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

XM group

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About XM group

Platforms

Funding methods

78.04% of retail investors lose money when trading spread bets and cfds with this provider.

City index

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About city index

Platforms

Funding methods

73% of retail investor accounts lose money when trading cfds with this provider

Easymarkets

Spreads from

What can you trade?

- Forex

- Crypto currencies

- Indices

- Commodities

- Stocks

- Etfs

About easymarkets

Platforms

Funding methods

83% of retail investor accounts lose money when trading cfds with this provider.

Between 54-87% of retail CFD accounts lose money. Based on 69 brokers who display this data.

The ultimate guide to

The NASDAQ-100

The nasdaq is an american stock market owned and operated by nasdaq inc. It is the second largest in the world by market capitalisation, after the new york stock exchange. The nasdaq-100 (NDX) is a modified capitalisation-weighted index composed of 100 of the largest equity securities listed on the nasdaq. It includes companies from a wide spectrum of nonfinancial industries, such as technology, health care, and retail. The nasdaq-100 is the premier large-cap growth index and provides the basis for benchmarking numerous investment products. Around 50 billion etps (exchanged traded products) were benchmarked to the nasdaq-100, according to a study by the nasdaq research team in 2015.

Nasdaq-100 was launched on january 31st, 1985, presenting itself as an alternative to the NYSE indices. It created two separate indices: the nasdaq-100, which consists of stocks from industry, retail, technology, telecommunication, healthcare, biotechnology, transportation, media & services; and the nasdaq financial-100, which consists of insurance firms, banking companies, brokerage, and mortgage companies. Nasdaq expected these to be used as benchmark indices by market participants, anticipating a healthy derivatives market to develop around them. The index was rebalanced to a modified market cap index on december 21st, 1998, followed by special rebalance effective from may 2nd, 2011.

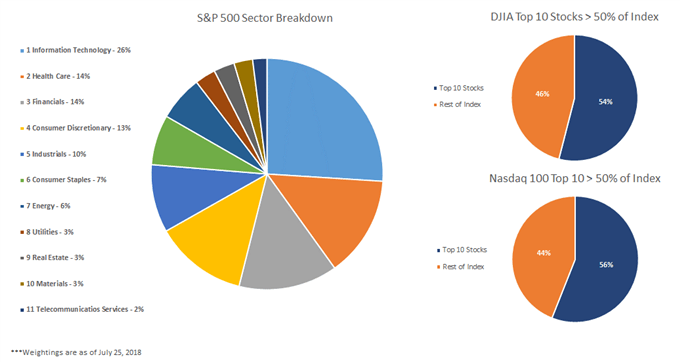

Composition

The index comprises 100 of the largest non-financial organisations, based on market capitalisation, that are listed on the nasdaq stock market. The past three decades have seen nasdaq-100 evolve from being the market’s technological index to a leading indicator of strong growth potential companies, who are leading industry-wide innovation. Companies included in the nasdaq-100 have driven economic growth in the recent years and they represent a shift in the business world in the 21st century. By the end of 2014, 448 stocks had been a member of the nasdaq-100 since its inception. In recent years, somewhere between 7 to 15 stocks have been added or removed each year. The top ten companies who have held the highest weights in the index during the recent years are apple, microsoft, amazon, google, facebook, gilead sciences, intel, cisco & comcast. The main sectors included in nasdaq 100 as at the 30th june 2019 were: technology – 53.48 %; consumer services – 24.63%; health care – 11.10%; consumer goods – 5.49%; industrials – 4.33%; and telecom – 0.97%.

The top ten securities by weight as at 1st may 2019 were as follows:

| TICKER | SECURITY | WEIGHT |

|---|---|---|

| AAPL | APPLE INC. | 10.70% |

| MSFT | MICROSOFT CORP | 10.57% |

| AMZN | AMAZON.COM INC | 10.12% |

| FB | FACEBOOK INC | 5.01% |

| GOOG | ALPHABET CL C CAP | 3.89% |

| GOOGL | ALPHABET CL A CMN | 4.43% |

| CMCSA | COMCAST CORP A | 2.34% |

| INTC | INTEL CORP | 2.73% |

| CSCO | CISCO SYSTEMS INC | 2.93% |

| NFLX | netflex | 1.98% |

Eligibility for nasdaq-100 inclusion

The eligibility criteria for any stock to be included in nasdaq-100 are as follows:

- Listing – the primary listing in the US must be exclusive to the nasdaq global market or the nasdaq global select market. Securities that were dually listed on other US markets prior to jan 1st, 2014 and have continuously maintained such a listing, are the exception to the rule.

- Security types – security types eligible for listing include common stocks, adrs and tracking stocks. Close-ended funds, convertible debentures, etfs, llcs, limited partnership interests, preferred stocks, rights, warrants and derivative securities are not eligible to be included in the index.

- Market capitalisation – there are no qualifying criteria for market capitalisation as such, inclusion is only determined based on the top 100 largest companies in the eligible industries by market capitalisation.

- Liquidity – A minimum of 3 months average daily trading volume (ADTV) of 200,000 shares.

- Security seasoning criteria – the security must have ‘seasoned’ in either the nasdaq, the NYSE or the NYSE amex for at least 3 months, excluding the month of the initial listing

How the value of nasdaq-100 is derived

The nasdaq-100 is a modified market capitalisation-weighted index, which means that its value is derived from the aggregate value of index share weights of each index security, multiplied by the last trading price of the security, which is then divided by the divisor of the index. The divisor serves the purpose of scaling down the obtained aggregate value, which is more desirable for the practical use of the index.

The base value of the index was set at 250, and reset to 125 when it closed at 800 on december 31st, 1993.

The index value is calculated on each trading day, based on the last traded price, once per second for the whole trading window of the day.

How to trade the nasdaq-100

The index can be traded through financial institutions such as brokers and serves as an underlying asset for a variety of products. These include exchange-traded funds (etfs) and derivative instruments such as futures, options, and contracts for difference (cfds).

Etfs are funds whose value reflect the value of an index as they are composed of shares that are present in the index itself. The etfs attempt to track the index as closely as possible. Etfs can be traded on the exchange and can be bought as individual stock, allowing traders to follow the index with just one holding.

Another way of speculating on the movement of the indices without owning the shares is through cfds. As cfds allow users to speculate on the value of the index, traders can go for long contracts when they believe the index will move up and the price will therefore increase; or go short on the CFD when they believe the index is going down and prices will therefore decline. Cfds are usually highly leveraged products, which means that traders can have a large holding for a relatively small margin. Margin refers to the proportion of the trade that is required to be put down as deposit.

CFD products are highly popular for the nasdaq-100 index.

Benefits of CFD trading on nasdaq-100

- Enables access to one of the most popular and growth oriented indices in the market without the requirement of actually owning shares in the underlying companies.

- Maximises the potential of the portfolio by using leverage – although it must be noted that this can also go against the trader when markets move in the opposite direction to which they have speculated.

- Allows traders to take a speculative stance on the overall market movement, whether they believe it will move up, or down.

- Cuts down the cost of a portfolio of companies by trading on the index.

- Availability of a large pool of regulated brokers who provide a platform to trade on NSD-100 cfds, making it convenient for traders.

However, it is necessary to keep in mind that cfds are highly leveraged products and pose a considerable risk of loss of capital. Only experienced traders with the right risk appetite should venture into trading in these instruments.

Authorised and regulated online CFD broker plus500 offers a US-TECH 100 (NQ) CFD which is based on the E-mini nasdaq 100 futures, itself based on the underlying nasdaq 100 index. Trades in the instruments are offered at a spread of 1.7, with a minimum contract size of 1, and an initial margin requirement of 0.33. The intuitive platform calculates the minimum trade sizes and margins required to place a trade automatically. The manual calculation is as follows: CFD margin = V (lots) × contract × market price × margin rate, %.

Current value of nasdaq-100 index

Conclusion

Nasdaq-100 is one of the most comprehensive market indices that captures the overall movement of 100 market mover stocks. The index is well diversified in sectoral allocation and has beaten multiple other indices in its returns. The index serves as the benchmark and underlying value for numerous other instruments such as etfs and multiple derivative products such as cfds. Cfds for the nasdaq-100 are readily available and offered by many regulated brokers, such as plus500 and avatrade. The trading platforms offered by these brokers are user-friendly and compatible on hand held devices as well as desk top computers.

Why choose XTB

for trading NASDAQ 100?

XTB scored best in our review of the top brokers for trading nasdaq 100, which takes into account 120+ factors across eight categories. Here are some areas where XTB scored highly in:

- 16+ years in business

- Offers 1,500+ instruments

- A range of platform inc. MT4, mirror trader, web trader, tablet & mobile apps

XTB offers three ways to tradeforex, cfds, social trading. If you wanted to trade NASDAQ100

The two most important categories in our rating system are the cost of trading and the broker’s trust score. To calculate a broker’s trust score, we take into account a range of factors, including their regulation history, years in business, liquidity provider etc.

XTB have a AAA trust score. This is largely down to them being regulated by financial conduct authority, segregating client funds, being segregating client funds, being established for over 16

Trust score comparison

| XTB | IG | plus500 | |

|---|---|---|---|

| trust score | AAA | AAA | AA |

| established in | 2002 | 1974 | 2008 |

| regulated by | financial conduct authority | financial conduct authority and ASIC | financial conduct authority (FRN 509909) and cyprus securities and exchange commission (license no. 250/14). Plus500au pty ltd (ACN 153301681), licensed by: ASIC in australia, AFSL #417727, FMA in new zealand, FSP #486026; authorised financial services provider in south africa, FSP #47546 |

| uses tier 1 banks | |||

| company type | private | private | private |

| segregates client funds |

A comparison of XTB vs. IG vs. Plus500

Want to see how XTB stacks up against IG and plus500? We’ve compared their spreads, features, and key information below.

Best brokers for trading NASDAQ 100, US-TECH 100

�� > compare CFD brokers > best brokers for trading NASDAQ 100, US-TECH 100

Compare NASDAQ brokers

NASDAQ brokers can offer access the popular US tech 100. Compare NAS100 brokers to choose the broker that offers the cheapest fees and the best trading platform to help you make money. These brokers are authorised and regulated by the FCA.

What is nasdaq 100?

The nasdaq 100 index (ticker: NDX) is the equity index comprised of the 100 largest companies listed on the nasdaq market. For those unfamiliar with the term nasdaq, it stands for National Association of Securities Dealers Automatic Quotations.

Currently, nasdaq is one of the largest stock exchanges in the world. Setup in 1971, nasdaq has a longstanding history of hosting growth company. It gained its popularity because nasdaq was the first exchange to trade stocks electronically. At that time, it was a quantum leap in share trading. (see GMG's guide to nasdaq)

Currently, some of the world's biggest tech companies are components of the nasdaq 100. For example, the five largest stocks of the index are apple, microsoft, amazon, facebook and google (see below):

Nasdaq 100 is capitalisation weighted, this means that companies with higher market capitalization carry a higher weightage in the index.

Can you trade the nasdaq 100 index?

Yes, you can. There are multiple financial products derived from the underlying nasdaq 100 index that you can trade with, including:

- Futures

- Options

- Exchange-traded funds (link)

- Investment funds

- Spread trading

The biggest ETF based on the nasdaq 100 index is the QQQ ETF (ticker: QQQ). For many years, this ETF is one of the most traded instruments in the US market. Investors like to gain exposure to the nasdaq through this ETF.

What is the attraction of nasdaq 100?

Nasdaq indices (100 and composite) are the most-followed equity indices in the world. NDX is attractive to investors and traders alike because:

- Nasdaq 100 is a growth index - you can participate in the best success stories

- Nasdaq 100 offers good liquidity - some of the NDX components were the most valuable in the world at one time or another (apple, microsoft, and amazon)

- Nasdaq 100 offers better relative performance than many other large-cap indices

Moreover, the index is volatile enough to attract traders. Therefore, daily liquidity of the index is good.

What drives the nasdaq 100?

Stock markets are driven by a wide variety of factors, including some of the following:

- Macro factors (e.G. GDP, unemployment, business indicators etc)

- Monetary factors (e.G., quantitative easing, rates movements, yield curve etc)

- Technical factors (e.G., new highs)

For the nasdaq 100, another factor to watch out for is speculative bubble.

During the nineties, for example, nasdaq stocks soared amidst a wave of speculative trading interest. Companies worth only millions only a short while ago attained multi-billion valuation - only to see these valuation figures collapsed to zero when the bubble burst. Easy come, easy go.

Next, if you are trading NDX short term, you will need to pay attention to news flow and data announcements because they can have massive impact on the index over the short term.

Another area to watch out for are federal reserve meetings and the release of FOMC minutes. Any change in interest rates beyond market expectations can cause violent swings in the SPX. For example, if investors were expecting a 0.25% hike but the central bank raised it by 0.5% - this may cause prices swing massively after the announcement.

Studying the reaction of the market to these factors are important.

How to trade the nasdaq 100 using technical indicators?

To trade the nasdaq profitably requires a good trading strategy, of which technical indicators may come in handy. Technical indicators include:

- Trend indicators like moving average

- Price action

- Oscillators

- Support & resistance levels (see GMG guide on support/resistance)

- Patterns like breakout and reversals

For example, you may use the moving averages to judge whether the index is still trending or due for a reaction.

Another favourite indicator is a break of resistance or support levels. Look at the nasdaq 100 ETF (QQQ) below. It was clear that the breakout above the 195 key resistance last month resulted in a persistent rally into 204 (see below). This resistance, now broken, may even convert into resistance.

Bear in mind, however, the different traders will gravitate towards different trading styles. Therefore you must find the technical indicators that best support your trading objectives.

NASDAQ : company listings

The NASDAQ (national association of securities dealers automated quotations) is an electronic stock exchange with more than 3,300 company listings. It currently has a greater trading volume than any other U.S. Stock exchange, carrying out approximately 1.8 billion trades per day. The NYSE is still considered the biggest exchange because its market capitalisation far exceeds that of the NASDAQ. The NASDAQ trades shares in a variety of companies, but is well known for being a high-tech exchange, trading many new, high growth, and volatile stocks. This is partially due to the fact that the listing fees on the NASDAQ are significantly lower than those for the new york stock exchange whose maximum price is only $150,000. The NASDAQ is a publicly owned company, trading its shares on its own exchange under the ticker symbol NDAQ.

The NASDAQ, as an electronic exchange, has no physical trading floor, but conducts all of its trades through a computer and telecommunications system. The exchange is a dealers' market, meaning brokers buy and sell stocks through a market maker rather than from each other. A market maker deals in a particular stock and holds a certain number of stocks on his own books so that when a broker wants to purchase shares, he can purchase them directly from the market maker.

The NASDAQ is located in new york's times square. The building is instantly recognisably by its large outdoor electronic display which provides up to the minute financial information 24 hours a day.

NASDAQ stock quotes are delayed by at least 20 minutes.

All other stock price and quote data is delayed by at least 15 minutes unless otherwise stated. By accessing the services available at ADVFN you are agreeing to be bound by ADVFN's terms & conditions

contact us | copyright 1999-2016 ADVFN PLC. | privacy policy | investment warning | data accreditations | investor relations

Facebook, inc. (FB)

| previous close | 258.33 |

| open | 259.52 |

| bid | 0.00 x 800 |

| ask | 0.00 x 800 |

| day's range | 254.91 - 264.17 |

| 52 week range | 137.10 - 304.67 |

| volume | 20,947,039 |

| avg. Volume | 19,236,124 |

| market cap | 746.118B |

| beta (5Y monthly) | 1.18 |

| PE ratio (TTM) | 25.97 |

| EPS (TTM) | 10.09 |

| earnings date | apr 27, 2021 - may 03, 2021 |

| forward dividend & yield | N/A (N/A) |

| ex-dividend date | N/A |

| 1y target est | 336.02 |

Gamestop traders may inflict even more pain on wall street: goldman

Wall street is far from being out of the woods as retail investors have their moment.

Is GBTC stock A good buy after bitcoin tumbles from highs?

GBTC stock, one of the few ways stock market investors can play bitcoin, has charged past a buy point. Is grayscale bitcoin trust a buy right now?

Microsoft (MSFT) search engine bing may gain if google exits australia

Microsoft (MSFT) may get a boost for its bing search engine if google exits australia, should a law mandating payments to news sites pass.

Facebook to let iphone users know how data is used for personalized ads

Facebook inc. Is letting iphone users know how their data is being used for personalized ads in a pre-emptive move before apple inc. Makes privacy changes to its operating system that facebook claims will hurt its advertising business.

Facebook rolls out iphone message amid apple privacy row

Social media giant claims it is ‘speaking up for small business’

2 stocks for a better retirement

Safety and tranquility are both important aspects of investing for retirement. It's these dependable companies that allow us to get a good night's sleep while owning shares, and it's these companies that work well for reliably building retirement wealth. While revenues for viacomcbs (NASDAQ: VIAC) (NASDAQ: VIAB) are still hampered by the pandemic -- down 9% year over year -- the trends are improving and the company is delivering elsewhere.

B/zmk9c3ryaw07ad0xndq7ct04mdt3pte0ndthchbpzd15dgfjahlvbg--/https://s.Yimg.Com/hd/cp-video-transcode/prod/2021-02/01/60187348901e2525cc6590c4/60187348901e2525cc6590c5_o_u_v2.Png" alt="2021 jobs: these are the best US cities for jobs in 2021" />

Facebook to prompt users about personalized ads ahead of apple privacy changes

Facebook inc said in a blog post monday it will begin rolling out a notification for iphone users globally about how data is used for personalized ads, in an attempt to get ahead of upcoming apple inc privacy changes that facebook says will hurt its advertising business. The full-screen prompt will ask facebook and instagram users to allow their app and website activity to be used for personalized ads and to "support businesses that rely on ads to reach customers." the social media giant has been waging a public fight against apple's plan to ask iphone users whether to allow apps to track them across other websites and apps, warning that apple's notification "suggest there is a tradeoff between personalized advertising and privacy," and will harm small businesses that rely on facebook ads.

Facebook tests pop-up for iphone users before ad tracking update

(bloomberg) -- facebook inc. Is testing a new full-screen prompt for iphone users about the social network’s data collection in an effort to get ahead of a similar pop-up that apple inc. Will soon require as part of an operating system software update.The ios 14 update, which hasn’t been rolled out yet for iphones and ipads, will require app developers like facebook to show users a pop-up asking for permission to “track you across apps and websites.” if users reject the request, it will be harder for facebook to show those people targeted ads, which make up the bulk of the company’s revenue. Facebook executives have argued the pop-up’s language is alarmist, and worry that it will discourage people from accepting it.So facebook is testing its own prompt that will appear before users see the one from apple. It asks for similar permissions, but frames them as a way to “get ads that are more personalized” and “support businesses that rely on ads to reach customers.”“apple’s new prompt suggests there is a tradeoff between personalized advertising and privacy; when in fact, we can and do provide both,” facebook wrote in a blog post monday. “the apple prompt also provides no context about the benefits of personalized ads.”facebook has fought the ios 14 changes publicly, and has repeatedly criticized apple for its plan to implement them. In december, it ran full-page ads in a number of prominent U.S. Newspapers criticizing apple over the planned update.The apple pop-up isn’t yet required of apps, but facebook said it will test its message to learn more about how users respond before the privacy rule kicks in.The new label is intended to help people understand how their data is being shared and better protect their privacy, apple has said. Chief executive officer tim cook last week accused big tech companies, without naming them, of “data exploitation” by selling user information to target ads.For more articles like this, please visit us at bloomberg.Comsubscribe now to stay ahead with the most trusted business news source.©2021 bloomberg L.P.

Biggest single-day market cap drops in US stocks

Facebook’s stock plummeted from $216 a share on jul. 25, 2018, to $176 the next day. Closely following facebook is the leading chipmaker intel (INTC), which lost more than $90 billion on sept. 22, 2000. the decline was a result of the company announcing weaker demand in europe that would result in lower-than-expected third-quarter results, which also came amidst the dot-com bubble bursting. The third-quarter revenue growth was expected to come in at half of what analysts expected. roughly 22% of the company’s market cap was wiped out.

Google testing search brinkmanship in australia

As big tech companies face serious social license issues, google needs to put as much thought into PR as it does in innovation.

Ex-googler turns virtual gifts into a $61 billion business

(bloomberg) -- in china’s popular online-streaming industry, virtual gift-giving is big. You can send your favorite live performer anything from a rose for 5 yuan (80 cents) to a space rocket for 500 yuan.The present is just a symbol, but the money is real -- and that’s what’s made kuaishou technology so successful.The bytedance ltd. Rival has become the biggest live-streaming platform for virtual gifts, with more paying monthly users than any other in the world. The firm, which takes a cut of the tips fans give to performers, raised $5.4 billion in hong kong in the biggest internet initial public offering since uber technologies inc. In 2019, terms for the deal obtained by bloomberg show.That’s poised to create at least four billionaires with a combined fortune valued at $15 billion, based on the ownership disclosed in kuaishou’s prospectus. Co-founders su hua and cheng yixiao will each be worth more than $5.5 billion, according to the bloomberg billionaires index.Kuaishou, which means “fast hand,” is one of china’s biggest internet success stories of the past decade, part of a generation of startups that thrived with backing from tencent holdings ltd. Along with tiktok parent bytedance, the outfit pioneered the live-streaming and bite-sized video format that’s since been adopted around the world by the likes of facebook inc.“the key resource of the internet is attention,” su wrote in kuaishou’s official biography in 2019. “it can be focused on large numbers of people like the sunlight, rather than a spotlight just on a certain group of people. That’s the simple logic behind kuaishou.”su, a native of china’s central hunan province, studied computer programming at the prestigious tsinghua university before joining google in beijing in 2006. There, he earned about $23,000 annually, eight times the country’s average salary back then. While he said he was “extremely happy,” a stay in silicon valley inspired him to start his own business, according to kuaishou’s biography.The 38-year-old quit google during the global financial crisis to start his own video-advertising venture, which didn’t come to fruition. After a short stint with baidu inc., he got acquainted with cheng in 2011 and they soon decided to pair up. In 2013, the duo transformed the kuaishou app from a GIF-maker to the social-video platform it is today, initially gaining popularity with its videos of life in rural china.With the rise of bytedance’s douyin, the chinese twin app of tiktok, kuaishou broadened its appeal, luring influencers backed by talent agencies and pop stars like taiwan’s jay chou. Along the way, it sped up monetization by creating ad slots and in-app stores for brands and merchants.While virtual gift purchases are still its bread and butter -- they make up almost two-thirds of its revenue -- the company is delving deeper into higher-margin businesses like e-commerce and online gaming. Its sales rose almost 50% to 40.7 billion yuan in the first nine months of last year, according to the IPO prospectus.Viewers spend an average of almost 90 minutes on kuaishou every day, and about a quarter of monthly users churn out content as well. While that robust engagement differentiates kuaishou from rival live-streaming platforms such as joyy inc. And momo inc., the recent launch of a short-video feed by tencent’s super-app wechat has brought competition to another level.Kuaishou’s debut could also be overshadowed by the potential IPO of its far larger rival, bytedance, whose 600 million douyin daily users are more than double kuaishou’s. Last valued at $180 billion, the world’s largest startup was said to be exploring a listing of some of its businesses in hong kong as the U.S. Last year attempted to ban tiktok and force a sale of the app on national-security concerns.“kuaishou has overhauled its product and become more similar to douyin,” said citic securities co. Analyst wang guanran in a jan. 26 note. “the two will face direct competition with each other in the future.”kuaishou isn’t immune to geo-political tensions either. While su told investors on a jan. 25 call that non-chinese markets have the potential to become a big earnings driver, its platforms including kwai and snack video are banned in india along with hundreds of chinese apps as new delhi and beijing clash over border disputes. In the U.S., its tiktok-style zynn service has gained little traction since launching last may.The company will also have to deal with a recent crackdown on live-streaming. China said in november it would require performers and gift givers to register with their real names, banned minors from tipping and asked the platforms to limit the value of virtual presents.Still, investors have been rushing to get a piece of the first short-video platform that will start trading feb. 5. The IPO priced at the top end of its marketed range, and the retail portion was the most subscribed ever, according to IFR, as the city’s market for new listings has been on fire lately. Some shares changed hands at more than double the listing price of HK$115 in gray-market trading on monday, people with knowledge of the matter said.The enthusiasm last year boosted the fortunes of top executives including those at nongfu spring co.’s zhong shanshan -- now asia’s richest person -- and blue moon group holdings ltd.’s pan dong.The kuaishou founder is cautious about the power he’s amassed. In the company’s biography, su compared his platform’s ability to control internet attention and traffic with the one ring from J.R.R. Tolkien’s “the lord of the rings” trilogy.“when you put on the ring, you’ll feel extremely powerful,” he wrote. “but in fact, it’s the ring and the power that are controlling you.”(updates with gray-market trading in 16th paragraph.)for more articles like this, please visit us at bloomberg.Comsubscribe now to stay ahead with the most trusted business news source.©2021 bloomberg L.P.

CNN ends facebook video deal, moves ‘go there’ daily show to its own digital platforms (EXCLUSIVE)

CNN’s “go there” live daily news show — after a year and half on facebook watch and just over 600 episodes — is ending its run on the social platform. Starting monday (feb. 1), news junkies will find “go there” on CNN’s owned-and-operated outlets, including the news network’s website and mobile apps. With the move, […]

3 stocks to watch on increasing adoption of virtual reality

Virtual reality seems poised to accelerate in adoption owing to its immersive experience and convenience, making it a good time to look at names like facebook (FB), alphabet (GOOGL) and sony (SNE)

After tripling in 2020, can the trade desk stock wow investors again?

Is it time to cash out, or can the trade desk deliver something close to a repeat performance this year? The trade desk's demand-side platform (DSP) enables marketers to plan, launch, and manage data-driven ad campaigns across various digital channels like desktop, mobile, social media, and CTV. What's more, the U.S. CTV market -- a core part of the trade desk's growth strategy -- is expected to expand even faster with ad spend surging 126% over the same period.

Facebook and twitter should not be in the censorship business

Twitter, facebook and other social media have become so pervasive that they have become the public square—and legally should be treated as such.

The top 50 robinhood stocks in february

The CBOE volatility index hit an all-time high in march 2020, with the broad-based S&P 500 setting records for both the fastest bear market decline and quickest rally back to all-time highs. Online investing app robinhood, which is known for its commission-free trades, fractional-share investing, and gifting of free stock to new users, has been particularly adept at attracting young investors. The thing about millennial and novice investors is that they often don't understand the finer points about compounding and the importance of long-term investing.

Billionaire david tepper’s top 10 stock holdings

In this article we looked into billionaire david tepper’s top 10 stock picks. Click to skip ahead and see billionaire tepper’s top 5 stock picks. Although billionaire david tepper’s hedge fund is not among the big losers like melvin capital and jack woodruff’s candlestick capital, he still warned investors to remain cautious amid speculative frenzy […]

Facebook’s CEO reaches out to australian lawmakers over proposed law – report

According to a reuters report published on jan. 31, last week, facebook CEO mark zuckerberg reached out to lawmakers in australia to discuss a planned law that would result in internet giants like facebook (FB) and google (GOOGL) paying media outlets for content used on their sites. However, mark zuckerberg failed to persuade lawmakers to change the policy, according to reuters. The report also says that australian treasurer josh frydenberg told australian broadcasting corp, “no, mark zuckerberg didn’t convince me to back down if that’s what you’re asking.” according to the proposed law, news media outlets can negotiate collectively or individually, over content that drives traffic to facebook and google’s websites. If these parties fail to reach an agreement, an arbitrator appointed by the australian government will set the fees for both parties. In view of this proposed law, earlier this month, facebook had said that it will stop news sharing if the australian government proceeds while google threatened to withdraw its search engine from the country. Companies like facebook are opposing this law as it would mean an increase in compliance costs and could also put a dent in its advertising revenues as the proposed law also states that companies will have to share their consumer data from such news content. Advertising is a major source of revenue for facebook. (see facebook stock analysis on tipranks) in the fourth quarter, facebook reported advertising revenues of $27.2 billion, up by 31% year-on-year. The advertising business made up about 96.8% of total revenues in 4Q for the company. Mark zuckerberg also warned of the timing of “platform changes, notably ios 14, as well as the evolving regulatory landscape,” during facebook’s 4Q results. William blair analyst ralph schackart reiterated a buy rating on the stock on jan. 28. Commenting on the company’s 4Q results, schackart noted, “in the first half of 2021, facebook will lap a period of growth that was negatively affected by reduced advertising demand during the early stages of the pandemic. Thus, year-over year growth rates in total revenue are expected to remain stable or modestly accelerate sequentially during the first and second quarters of 2021.” “in the second half of the year, facebook will lap periods of increasingly strong growth, which is expected to put significant pressure on year-over-year growth rates,” schackart added. The rest of the street is bullish about the stock with a strong buy consensus rating. That’s based on 35 analysts recommending a buy, 3 analysts suggesting a hold, and one analyst recommending a sell. The average analyst price target of $341.28 implies a 32.1% upside potential to current levels. Related news: facebook’s strong advertising revenues fuel blowout quarter boeing slips 4% on $6.5B pre-tax charge for 777X aircraft perspecta to be snapped up by veritas for $7.1B; shares pop 9.7% more recent articles from smarter analyst: judge dismisses majority of shareholder lawsuit against GE – report biogen shares gain 5.5% as FDA extends review period for alzheimer’s drug chevron's 4Q sales miss analysts' estimates; shares drop 4% wells fargo CEO’s annual salary falls 12% on weak 4Q results

Facebook's zuckerberg reached out to australian lawmakers over new media rules

Facebook inc CEO mark zuckerberg called australian lawmakers last week to discuss rules that would make internet giants pay news outlets for content but failed to persuade them to change policy, the country's treasurer said on sunday. Zuckerberg "reached out to talk about the code and the impact on facebook" and a constructive discussion followed last week between the social media billionaire, australian treasurer josh frydenberg and communications minister paul fletcher. "no, mark zuckerberg didn't convince me to back down if that's what you're asking," frydenberg told the australian broadcasting corp, without giving further details of the meeting.

These are the 5 best stocks to buy and watch now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist?

FB stock A buy? Facebook crushes Q4 earnings but predicts 'high opt-out rates'

Facebook just saw its best revenue growth in more than two years. Will apple's privacy change and political heat dent its momentum, or is FB stock a buy?

How facebook makes money: advertising, payments, and other fees

Facebook, which rakes in billions of dollars in profit selling ad space, is facing an antitrust lawsuit launched by the federal trade commission.

Analysis: gamestop's 'reddit rally' puts scrutiny on social media forums

Social media services including facebook inc and reddit restrict discussions about weapons, drugs and other illegal activity, but their rules do not specifically mention another lucrative regulated good: stocks. Users of a reddit group, in which 5 million members exchange investment ideas, generated significant profits by gorging on shares of gamestop corp and other out-of-favor companies that had been shorted by big hedge funds. Investors have used social media for years.

Stock market rally falls sharply as apple, facebook, AMD, tesla fall; GME stock, AMC skyrocket, novavax spikes on vaccine

The stock market fell sharply this week amid earnings from apple, facebook and tesla. GME stock and AMC skyrocketed in a jaw-dropping short-squeeze. Novavax leapt on its coronavirus vaccine.

Nasdaq trading basics: how to trade nasdaq 100

Trading the nasdaq 100 index: an introduction

The nasdaq 100 is a modified market-capitalization weighted index that consists of the largest 100 non-financial companies that are listed on the nasdaq stock exchange. It should not be confused with the nasdaq composite index.

Nasdaq trading involves using fundamental or technical analysis to determine price levels at which to enter a trade. Traders can take a bet on which way the price will go and then place stop losses and take-profits to manage risk.

This article will cover top nasdaq 100 trading strategies for traders of all levels, as well as an overview of the nasdaq trading hours.

Why trade the nasdaq 100 index?

Trading the nasdaq 100 gives traders a diversified exposure to great number of companies in the non-financial sector. Other reasons to trade the nasdaq 100 index include:

- The nasdaq 100 is one of the world’s most popular and widely followed indexes. There is no shortage of technical and fundamental analysis.

- The clear technical chart patterns which provide distinct entry and exit signals.

- The nasdaq provides traders with a great deal of liquidity which leads to tight spreads that offer inexpensive costs to enter and exit trades.

- Traders can trade the E-mini NASDAQ 100 futures on the CME (chicago mercantile exchange) almost 24/5.

How to trade nasdaq 100: top tips & strategies

Successful nasdaq trading involves similar analysis techniques used to trade a range of financial markets. Before entering a trade, traders should have a reason to enter the trade based on technical or fundamental analysis. Professional traders stick to strategies which contain principles and guidelines that they follow to be successful.

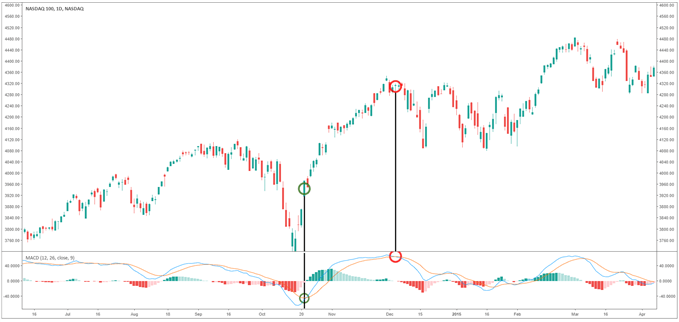

How to T rade the nasdaq 100 using technical A nalysis

Traders use technical analysis to analyze charts, looking for buy or sell signals. Technical analysts can use indicators to help them identify current trends in the market, shifts in sentiment or potential retracement patterns.

In the chart above we show how the MACD (moving average convergence divergence) can be used to filter buy and sell signals when trading nasdaq 100. The MACD consists of a MACD-line (blue line) and signal-line (orange line), when the two cross on the bottom, as shown in the chart above by the green circle, it offers a buy-signal. When the two cross at the top (the red circle) it offers a sell-signal.

There are a variety of different indicators that traders use. It is important that traders use an indicator they understand and feel comfortable. Indicators do not work all the time, so traders must implement proper risk management. Risk management includes using appropriate leverage , a positive risk-reward ratio and limiting the exposure of all open trades to less than 5% of total equity.

Technical indicators are not the only way to look for buy and sell signals when trading the nasdaq 100. Traders also use price patterns like support and resistance, ascending triangles, trend channels, elliot waves and others to find opportunities in the market.

How to trade the nasdaq using fundamental A nalysis

When trading the nasdaq, a range of underlying fundamental variables affect the price of the index. Traders must be aware of these variables and their possible impact on the index. These variables can range from macroeconomic variables to the fundamental composition of the index. Here are some of the main movers of the nasdaq 100 index:

- The largest companies in the nasdaq 100. The nasdaq is a market-capitalization weighted index so the largest companies tend to move it the most, like apple, microsoft and amazon. Some indices are weighted differently, and this can affect their price. It is important to understand the differences between the major indices .

- Changes in the federal reserve’s stance on monetary policy can have adverse effects on all stock markets, including the nasdaq 100 index.

- Economic data like inventory levels, employment, CPI, interest rates and GDP. This data can signal what actions the central bank will take on monetary policy.

- Trade wars and currency wars can impact large companies in the nasdaq by way of tariffs and trade barriers.

Advanced tips for trading the nasdaq 100 index

It is important for nasdaq traders to be patient and disciplined before entering a trade. Before even looking for a trade, a trader should know how much they are willing to risk and have a reasonable expectation of what they are looking to gain through the trade.

Here are some expert tips for trading the nasdaq 100:

- At dailyfx we recommend limiting your exposure to less than 5% on all open trades.

- Before entering a trade, decide on a risk-reward ratio. It is extremely important to have a positive risk-reward ratio. See our guide to traits of successful traders for the statistics on taking trades with a positive risk-reward ratio.

- Entering a trade before major economic data releases should be avoided. Major economic data can cause massive spikes in volatility, it is better to wait for the markets to settle before trading again.

- Record all your trades so that you can preview the trades afterwards. By doing this you can pinpoint and work on your weak spots.

- Do not trade if you are emotional, tired or bored. Only trade when you have done your research and analysis and are confident in the trade.

- Select the correct trading time frame that suites your goal.

Nasdaq trading hours

Nasdaq 100 futures can be traded on the chicago mercantile exchange (CME) from:

Sunday – friday 6:00pm – 5:00pm ET with a trading halt from 4:15pm – 4:30pm ET and a daily maintenance period from monday – thursday 5:00pm – 6:00pm ET.

There are also etfs that track the nasdaq 100 like invesco QQQ trust (QQQ) which trades on the NASDAQ exchange. This has:

- Pre-market trading hours from 4:00 a.M. To 9:30 a.M. ET

- Market hours from 9:30 a.M. To 4:00 p.M. ET

- After-market hours from 4:00 p.M. To 8:00 p.M. ET

Take your nasdaq trading to the next level

To stay ahead of the curve when trading nasdaq 100, traders should follow the nasdaq 100 live chart for price movements. We also recommend downloading our quarterly trading forecast on equities and reading our reputable traits of successful traders guide - where we analyzed over a million live trades and came to a striking conclusion.

Below is a snippet from our expert guide on the differences between dow, nasdaq, and S&P 500 such as how market capitalization and volatility affect them and how they are weighted.

Dailyfx provides forex news and technical analysis on the trends that influence the global currency markets.

So, let's see, what was the most valuable thing of this article: FBS is a forex trading broker offering a choice of platforms, products and live accounts. See our review for spreads, mobile apps, and fees. Sign up today. At does fbs have nasdaq

Contents of the article

- Free forex bonuses

- FBS review and tutorial 2021

- History & headlines

- Trading platforms

- Markets

- Trading fees

- FBS leverage

- Mobile apps

- Payments

- Demo account review

- Trading bonuses

- Licensing

- Additional features

- Trading accounts

- Pros and cons

- Trading hours

- Customer support

- Trader safety

- FBS verdict

- Accepted countries

- Where is FBS regulated?

- Is FBS a good broker?

- Does FBS offer any bonuses?

- What is the minimum deposit at FBS?

- What platforms does FBS offer?

- Does the FBS broker have trading on nas100?

- FBS now offers NASDAQ and S&P 500 stock indices...

- Stock indices are available for all account types...

- New instruments: NASDAQ and S&P 500 indices

- Trading symbols on MT4 and MT5

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Compare brokers for trading NASDAQ 100

- We found 20 broker accounts (out of 147)...

- Spreads from

- What can you trade?

- About XTB

- Platforms

- Funding methods

- Spreads from

- What can you trade?

- About IG

- Platforms

- Funding methods

- Plus500

- Avatrade

- Forex.Com

- Axitrader

- Etoro

- XM group

- City index

- Easymarkets

- The NASDAQ-100

- Composition

- Eligibility for nasdaq-100 inclusion

- How the value of nasdaq-100 is derived

- How to trade the nasdaq-100

- Benefits of CFD trading on nasdaq-100

- Current value of nasdaq-100 index

- Conclusion

- Why choose XTB for trading NASDAQ 100?

- A comparison of XTB vs. IG vs. Plus500

- Best brokers for trading NASDAQ 100, US-TECH 100

- Compare NASDAQ brokers

- What is nasdaq 100?

- Can you trade the nasdaq 100 index?

- What is the attraction of nasdaq 100?

- What drives the nasdaq 100?

- How to trade the nasdaq 100 using technical...

- NASDAQ : company listings

- Facebook, inc. (FB)

- Gamestop traders may inflict even more pain on...

- Is GBTC stock A good buy after bitcoin tumbles...

- Microsoft (MSFT) search engine bing may gain if...

- Facebook to let iphone users know how data is...

- Facebook rolls out iphone message amid apple...

- 2 stocks for a better retirement

- Facebook to prompt users about personalized ads...

- Facebook tests pop-up for iphone users before ad...

- Biggest single-day market cap drops in US stocks

- Google testing search brinkmanship in australia

- Ex-googler turns virtual gifts into a $61 billion...

- CNN ends facebook video deal, moves ‘go there’...

- 3 stocks to watch on increasing adoption of...

- After tripling in 2020, can the trade desk stock...

- Facebook and twitter should not be in the...

- The top 50 robinhood stocks in february

- Billionaire david tepper’s top 10 stock holdings

- Facebook’s CEO reaches out to australian...

- Facebook's zuckerberg reached out to australian...

- These are the 5 best stocks to buy and watch now

- FB stock A buy? Facebook crushes Q4 earnings but...

- How facebook makes money: advertising, payments,...

- Analysis: gamestop's 'reddit rally' puts scrutiny...

- Stock market rally falls sharply as apple,...

- Nasdaq trading basics: how to trade nasdaq 100

- Trading the nasdaq 100 index: an introduction

- Why trade the nasdaq 100 index?

- How to trade nasdaq 100: top tips & strategies

- Advanced tips for trading the nasdaq 100 index

- Nasdaq trading hours

- Take your nasdaq trading to the next level

No comments:

Post a Comment