Online cfd trading

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" /> earn rebates and one-on-one professional support when you qualify for our active trader program

Free forex bonuses

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader apps" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

An introduction to contract for differences (cfds)

A contract for difference (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at contract time. Cfds allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD contract does not consider the asset's underlying value: only the price change between the trade entry and exit.

This is accomplished through a contract between client and broker and does not utilize any stock, forex, commodity, or futures exchange. Trading cfds offers several major advantages that have increased the instruments' enormous popularity in the past decade.

Key takeaways

- A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

- A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset.

- Some advantages of cfds include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

- A disadvantage of cfds is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD.

- Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin.

Contract for differences (CFD)

How cfds work

A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities or derivatives) between the time the contract opens and closes.

It is an advanced trading strategy that is utilized by experienced traders only. There is no delivery of physical goods or securities with cfds. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down.

Essentially, investors can use cfds to make bets about whether or not the price of the underlying asset or security will rise or fall. Traders can bet on either upward or downward movement. If the trader that has purchased a CFD sees the asset's price increase, they will offer their holding for sale. The net difference between the purchase price and the sale price are netted together. The net difference representing the gain from the trades is settled through the investor's brokerage account.

On the other hand, if the trader believes that the asset's value will decline, an opening sell position can be placed. In order to close the position, the trader must purchase an offsetting trade. Then, the net difference of the loss is cash-settled through their account.

Countries where you can trade cfds

CFD contracts are not allowed in the U.S. They are allowed in listed, over-the-counter (OTC) markets in many major trading countries, including the united kingdom, germany, switzerland, singapore, spain, france, south africa, canada, new zealand, hong kong, sweden, norway, italy, thailand, belgium, denmark, and the netherlands.

As for australia, where CFD contracts are currently allowed, the australian securities and investment commission (ASIC) has announced some changes in the issue and distribution of cfds to retail clients. ASIC’s goal is to strengthen consumer protections by reducing CFD leverage available to retail clients and by targeting CFD product features and sales practices that amplify retail clients’ CFD losses. ASIC’s product intervention order will be effective on march 29, 2021.

The U.S. Securities and exchange commission (SEC) has restricted the trading of cfds in the U.S., but non-residents can trade using them.

Fast fact

CFD trading is surging in 2020; the increase in popularity may be because of covid-19-induced volatility in the markets. A key feature of cfds is that they allow you to trade on markets that are heading downwards, in addition to those that are heading up—allowing them to deliver profit even when the market is in turmoil.

The costs of cfds

The costs of trading cfds include a commission (in some cases), a financing cost (in certain situations), and the spread—the difference between the bid price (purchase price) and the offer price at the time you trade.

There is usually no commission for trading forex pairs and commodities. However, brokers typically charge a commission for stocks. For example, the broker CMC markets, a U.K.-based financial services company, charges commissions that start from 10%, or $0.02 cents per share for U.S. And canadian-listed shares. The opening and closing trades constitute two separate trades, and therefore you are charged a commission for each trade.

A financing charge may apply if you take a long position; this is because overnight positions for a product are considered an investment (and the provider has lent the trader money to buy the asset). Traders are usually charged an interest charge on each of the days they hold the position.

For example, suppose that a trader wants to buy cfds for the share price of glaxosmithkline. The trader places a £10,000 trade. The current price of glaxosmithkline is £23.50. The trader expects that the share price will increase to £24.80 per share. The bid-offer spread is 23.48-23.50.

The trader will pay a 0.1% commission on opening the position and another 0.1% when the position is closed. For a long position, the trader will be charged a financing charge overnight (normally the LIBOR interest rate plus 2.5%).

The trader buys 426 contracts at £23.48 per share, so their trading position is £10,002.48. Suppose that the share price of glaxosmithkline increases to £24.80 in 16 days. The initial value of the trade is £10,002.48 but the final value is £10,564.80.

The trader's profit (before charges and commission) is: £10,564.80 – £10,002.48 = £562.32.

Since the commission is 0.1%, upon opening the position the trader pays £10. Suppose that interest charges are 7.5%, which must be paid on each of the 16 days that the trader holds the position. (426 x £23.48 x 0.075/365 = £2.06. Since the position is open for 16 days, the total charge is 16 x £2.06 = £32.89.)

When the position is closed, the trader must pay another 0.01% commission fee of £10.

The trader's net profit is equal to profits minus charges: 526.32 (profit) – 10 (commission) – 32.89 (interest) – 10 (commission)= £473.43 (net profit).

Advantages of cfds

Higher leverage

Cfds provide higher leverage than traditional trading. standard leverage in the CFD market is subject to regulation. It once was as low as a 2% maintenance margin (50:1 leverage), but is now limited in a range of 3% (30:1 leverage) and could go up to 50% (2:1 leverage). Lower margin requirements mean less capital outlay for the trader and greater potential returns. However, increased leverage can also magnify a trader's losses.

Global market access from one platform

Many CFD brokers offer products in all the world's major markets, allowing around-the-clock access. Investors can trade cfds on a wide range of worldwide markets.

No shorting rules or borrowing stock

Certain markets have rules that prohibit shorting, require the trader to borrow the instrument before selling short, or have different margin requirements for short and long positions. CFD instruments can be shorted at any time without borrowing costs because the trader doesn't own the underlying asset.

Professional execution with no fees

CFD brokers offer many of the same order types as traditional brokers including stops, limits, and contingent orders, such as "one cancels the other" and "if done." some brokers offering guaranteed stops will charge a fee for the service or recoup costs in another way.

Brokers make money when the trader pays the spread. Occasionally, they charge commissions or fees. To buy, a trader must pay the ask price, and to sell/short, the trader must pay the bid price. This spread may be small or large depending on the volatility of the underlying asset; fixed spreads are often available.

No day trading requirements

Certain markets require minimum amounts of capital to day trade or place limits on the number of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions, and all account holders can day trade if they wish. Accounts can often be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements.

Variety of trading opportunities

Brokers currently offer stock, index, treasury, currency, sector, and commodity cfds. This enables speculators interested in diverse financial vehicles to trade cfds as an alternative to exchanges.

Disadvantages of cfds

Traders pay the spread

While cfds offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, cfds trim traders' profits through spread costs.

Weak industry regulation

The CFD industry is not highly regulated. A CFD broker's credibility is based on reputation, longevity, and financial position rather than government standing or liquidity. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

Risks

CFD trading is fast-moving and requires close monitoring. As a result, traders should be aware of the significant risks when trading cfds. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset.

Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can't guarantee you won't suffer losses, especially if there's a market closure or a sharp price movement. Execution risks also may occur due to lags in trades.

Because the industry is not regulated and there are significant risks involved, cfds are banned in the U.S. By the securities and exchange commission (SEC).

Example of a CFD trade

Suppose that a stock has an ask price of $25.26 and the trader buys 100 shares. The cost of the transaction is $2,526 (plus any commission and fees). This trade requires at least $1,263 in free cash at a traditional broker in a 50% margin account, while a CFD broker requires just a 5% margin, or $126.30.

A CFD trade will show a loss equal to the size of the spread at the time of the transaction. If the spread is $0.05 cents, the stock needs to gain $0.05 cents for the position to hit the break-even price. While you'll see a $0.05 gain if you owned the stock outright, you would have also paid a commission and incurred a larger capital outlay.

If the stock rallies to a bid price of $25.76 in a traditional broker account, it can be sold for a $50 gain or $50 / $1,263 = 3.95% profit. However, when the national exchange reaches this price, the CFD bid price may only be $25.74. The CFD profit will be lower because the trader must exit at the bid price and the spread is larger than on the regular market.

In this example, the CFD trader earns an estimated $48 or $48 / $126.30 = 38% return on investment. The CFD broker may also require the trader to buy at a higher initial price, $25.28 for example. Even so, the $46 to $48 earned on the CFD trade denotes a net profit, while the $50 profit from owning the stock outright doesn't include commissions or other fees. Thus, the CFD trader ends up with more money in their pocket.

Cfds faqs

What are cfds?

Contracts for differences (cfds) are contracts between investors and financial institutions in which investors take a position on the future value of an asset. The difference between the open and closing trade prices are cash-settled. There is no physical delivery of goods or securities; a client and the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed.

How do cfds work?

A contract for difference (CFD) allows traders to speculate on the future market movements of an underlying asset, without actually owning or taking physical delivery of the underlying asset. Cfds are available for a range of underlying assets, such as shares, commodities, and foreign exchange. A CFD involves two trades. The first trade creates the open position, which is later closed out through a reverse trade with the CFD provider at a different price.

If the first trade is a buy or long position, the second trade (which closes the open position) is a sell. If the opening trade was a sell or short position, the closing trade is a buy.

The net profit of the trader is the price difference between the opening trade and the closing-out trade (less any commission or interest).

Why are cfds illegal in the U.S.?

Part of the reason that cfds are illegal in the U.S. Is that they are an over-the-counter (OTC) product, which means that they don't pass through regulated exchanges. Using leverage also allows for the possibility of larger losses and is a concern for regulators.

The commodity futures trading commission (CFTC) and the securities and exchange commission (SEC) prohibit residents and citizens of the U.S. From opening CFD accounts on domestic or foreign platforms.

Is trading cfds safe?

Trading cfds can be risky, and the potential advantages of them can sometimes overshadow the associated counterparty risk, market risk, client money risk, and liquidity risk. CFD trading can also be considered risky as a result of other factors, including poor industry regulation, potential lack of liquidity, and the need to maintain an adequate margin due to leveraged losses.

Can you make money with cfds?

Yes, of course, it is possible to make money trading cfds. However, trading cfds is a risky strategy relative to other forms of trading. Most successful CFD traders are veteran traders with a wealth of experience and tactical acumen.

The bottom line

Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees. However, high leverage magnifies losses when they occur, and having to pay a spread to enter and exit positions can be costly when large price movements do not occur. Indeed, the european securities and markets authority (ESMA) has placed restrictions on cfds to protect retail investors.

CFD trading in singapore

CFD trading in singapore is big business. In fact, it’s the fourth-largest CFD market globally. Here we’ll look at how traders can get started, the best CFD brokers and platforms in singapore 2021, plus answer any regulatory and legal questions.

CFD brokers in singapore

What is A CFD?

A contract for difference (CFD) is a tradable agreement to exchange the difference in the value of an asset. If we take stocks and shares as an example, you could speculate on the change in value of the singapore stock exchange, or on the share price of a specific stock, without actually owning the underlying asset.

Online CFD trading is attractive partly because it’s available in so many markets. You can trade cfds on stocks, forex, commodities, and cryptocurrency. But despite wide-ranging market access, stick to classes you understand.

CFD traders in singapore can also benefit from leverage, meaning you can borrow money from a brokerage to increase your position size. This is also known as trading on margin. The benefit of trading on leverage is that by increasing your trade size you can amplify potential profits. Of course, it also means the possibility of larger losses.

How to trade

CFD trading in singapore is straightforward:

- Open an account – most singaporean traders benefit from instant account activation once their ID and address have been validated. Traders can then consider finance options and fund their account.

- Find an opportunity – informed by your strategy, identify a market opportunity to use a CFD instrument, such as on stocks.

- Enter a position – on your trading platform, take a position depending on whether you think price will rise or fall.

- Risk management – set a stop-loss order to automatically close out a trade when losses reach a certain point. Use a stop-limit order to automatically protect profits when they hit a specific level.

- Monitor & close – keep an eye on your charting software for real-time changes to the market. If you haven’t set stop-loss and stop-limit orders, close out the trade when you’re ready.

Accounts

Which CFD brokerage account is best in singapore will depend on user needs. Most providers have a tiered account system with varying minimum deposits. In general, the greater the minimum investment required, the more competitive the fees, the better the leverage options, and the greater the access to customer support.

Trading platforms

The best online CFD trading platform in singapore for one trader might feel clunky and lacking to the next. With that said, metatrader (MT4) and webtrader are popular options. Some brokers also use their own proprietary software, which can allow for extensive customisation.

Regardless of the system, staple requirements should be prompt deposits and withdrawals. Also essential are intuitive pattern recognition tools for analysing a stock index, for example. Mobile traders will need to check the platform is accessible through an android or ios app. Overall, choose a system that will complement your strategy. And be wary of opting for the cheapest trading platform as you want the best tools at your disposal.

How to choose a broker

The number of online CFD brokers in singapore is growing. Fortunately, the competition means providers are offering lower fees, ample products, and excellent platforms.

When doing your brokerage comparison, consider:

- Costs – commissions and spreads will eat into returns. So, make sure you’re aware of all the trading fees before you open an account.

- Platform – metatrader (MT4) is the most popular, but bespoke software can allow for a more personalised feel. Request a demo account to explore the platform before you invest money.

- Customer service – opt for the cheapest online brokerage in singapore and you may find customer support, be it through live chat or the phone, just isn’t available when you really need it.

- Additional tools – what else can the broker offer to improve your CFD trading success? Automated trading algorithms can streamline an already proven strategy, for example.

According to customer reviews, some of the best online CFD trading brokers in singapore are:

- Maybank kim eng – traders from singapore can get up to 20x leverage on this DMA platform.

- CMC markets – one of the largest brokers in singapore, CMC markets has a huge offering with competitive leverage.

- IG markets – IG markets receives great customer reviews, offering cfds in indices, shares, FX, commodities, and more. IG markets also offers an ECN trading account.

- Phillip CFD – although smaller than some of the other brokers on this list, it is reputable with a long list of loyal singaporean CFD traders.

- Oanda – A well-established international broker, oanda is particularly good for traders interested in cfds in forex and cryptocurrency.

- DBS vickers – the popular online trading platform offers a suite of cfds to singapore traders, including across forex, stocks, and commodities. The platform is also available on a mobile-friendly app and provides extensive market insights.

- Interactive brokers – IB offers impressive commission rates, but they do charge for basic tools such as market data and news insights.

For further guidance on CFD brokers, see here.

Educational resources

CFD trading in singapore is competitive. So, the more additional educational resources you can get your hands on the better. Head to online forums, such as hardwarezone for tips from singapore traders. Videos, newsletters and demo accounts are also all great ways to hone your CFD shares strategy, for example.

For further guidance on day trading learning, see here.

Final word

CFD trading in singapore is hugely popular. Giving investors access to a breadth of markets with high leverage options, cfds appeal to traders of all experience levels. It is true the regulatory oversight isn’t as robust as in other jurisdictions, such as the UK or US. However, the best trading platforms in singapore still make for a great environment to trade cfds.

How can I trade cfds in singapore?

To start CFD trading in singapore, sign up at an online brokerage, fund your account, and take a position when you see an opportunity. But make sure you have a clear strategy and risk management tools in place before you put real money on the line.

Is CFD trading legal in singapore?

CFD trading in singapore is legal and regulated by the monetary authority of singapore (MAS), although as a relatively new market, MAS has a lax reputation. Nonetheless, all brokers should be licensed with the MAS financial institutions directory. As part of your due diligence, check the provider’s website for a license number.

Part of the protection afforded to those trading cfds in singapore with a regulated broker is that client funds are segregated. If the provider were to go bankrupt, user funds would be protected. Regulated brokers are also required to issue prospective clients with a comprehensive list of risks.

Which CFD trading account is best in singapore?

The best trading account will depend on your needs. Consider the minimum account deposit, speed of payment methods, and the customer support available. Also check customer reviews online.

What’s the best CFD trading platform in singapore?

Whilst there isn’t a universal best platform in singapore, metatrader (MT4) is the most popular. With that said, the bespoke software available at some providers often allows for customisation.

How much money do I need to start CFD trading?

Minimum deposits vary between platforms, however you can start CFD trading in singapore with S$250.

CFD trading

What are cfds

CFD stands for Contract For Difference. This type of financial instrument allows you to trade an underlying index, share or commodity contract without actually having to own it. The CFD price is the price of the underlying asset. So if the price of the underlying asset, eg. Gold or facebook stock goes up, so will the price of the CFD. Similarly, if the price of the underlying asset goes down, so will the price of the CFD. It is important to emphasize that you don’t actually own the asset you trade.

Avatrade is a pioneering broker – we were one of the first online brokers to offer CFD trading, giving individual traders access to a large range of markets which were not accessible to them before.

Open a CFD trading account today and enjoy the benefits of an internationally regulated broker!

Why trade with avatrade?

- Trade with confidence – avatrade is an internationally regulated broker with dedicated trading websites. We have 7 regulations, across 6 continents.

- Large variety of CFD instruments – trade commodities, indices, etfs, stocks, bonds and cryptocurrencies like bitcoin and ethereum cfds.

- Powerful platforms – manage your trades manually via MT4/MT5 and webtrader, or use our automated trading platforms.

- Leveraged trading – use leverage on various cfds to amplify your exposure to the markets.

- Master your trading skills – expand your horizons by making the most of our educational materials & daily updates.

- Best in class customer service – multilingual live support with a dedicated account manager.

What is CFD trading?

CFD trading is quite similar to forex trading. When trading on the platform, you select the instrument you wish to trade and enter your order. If you think the price of a certain instrument, e.G. Crude oil, will increase, you’ll want to BUY the crude oil CFD. The same goes the other way – if you predict the value will go down, you short sell the CFD.

Naturally, as with any type of trade or investment, wrong predictions can lead to the loss of money, and one should be aware of the risks involved in CFD trading before starting out. There is plenty more to learn about CFD trading, and you can browse through our education section, to watch video tutorials, read articles, get news updates, and more. You can find more information on cfds and their advantages here.

How to trade cfds with avatrade

Trading platforms

Avatrade offers a variety of trading platforms, for both manual as well as automated trading. We supply a range of useful tools like the exclusive avaprotect feature, which can help elevate your trading. We have a variety of platforms made for desktop, web and mobile too. We also offer you the option of opening a demo-account, so you can practice trading before you start trading with your own money.

Leveraged trading

Leverage is a facility offered by some brokers which enables traders to hold trading positions that are larger than what one’s own capital would otherwise allow.

It is important to remember that the profits and losses are determined by the position size, and as leverage trading can magnify profits, it can also heighten losses.

Open a CFD trading account today and enjoy the benefits of an internationally regulated broker!

How much will it cost to trade cfds?

Avatrade does not charge any exchange fees or commission and offers tight spreads on open positions. The spread is the difference between the BUY and SELL prices of a certain instrument. When calculating the cost for a position, you need to multiply the spread by the size of the position. For example, if the spread for crude oil trading is $0.03 USD, the cost for opening a 10 barrel-position is $0.03 X 10 barrels = $0.3 USD.

Most of the CFD instruments are traded on market spreads, which means that the spreads are affected by the liquidity of the market. The more liquidity, the narrower the spread will get.

You can review the levels of leverage and spreads for all CFD instruments on our trading conditions & charges page.

CFD contract rollover

Each index and commodity CFD is based on a contract defining its rates, charges, etc. Each of these specific CFD contracts has an expiry date, which is the date that the contract expires and automatically replaced by a new contract, just like the real market. In order not to disturb traders during market hours, the contract rollover takes place over the weekend.

For more information, you are welcome to visit our CFD rollover page.

Start trading cfds with avatrade

If you think you know which way the markets will go and you want to start trading – it’s time to join avatrade and enjoy the best CFD trading experience!

Still not sure? Take a look at the avatrade reviews by our clients!

Register for a trading account now to enter the markets, or try our risk-free demo account.

What is a contract for difference?

A contract for difference (CFD) is a popular form of derivative trading. CFD tradingвђ‹вђ‹ enables you to speculate on the rising or falling prices of fast-moving global financial markets, such as forex, indices, commodities, shares and treasuries.

Get tight spreads, no hidden fees and access to 9,300+ instruments.

CFD meaning

A contract for difference (CFD) is essentially a contract between an investor and an investment bank or spread betting firm. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities.

What is CFD trading?

Some of the benefits of CFD trading are that you can trade on marginвђ‹вђ‹, and you can go short (sell) if you think prices will go down or go long (buy) if you think prices will rise. Cfds have many advantages and are tax efficient in the UK, meaning that there is no stamp duty to pay. Please note, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the ukвђ‹.Вђ‹ you can also use CFD trades to hedge an existing physical portfolio. With a CFD trading account, our clients can choose between trading at homeвђ‹вђ‹ and on-the-go, as our platform is very flexible for traders of all backgrounds.

Introduction to CFD trading: how does CFD trading work?

With CFD trading, you don't buy or sell the underlying asset (for example a physical share, currency pair or commodity). Instead, you buy or sell a number of units for a particular financial instrument вђ‹, depending on whether you think prices will go up or down. We offer cfds on a wide range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our most popular stock indices is the UK 100, which aggregates the price movements of all the stocks listed on the UK's FTSE 100 index.

For every point the price of the instrument moves in your favour, you gain multiples of the number of CFD units you have bought or sold. For every point the price moves against you, you will make a loss.

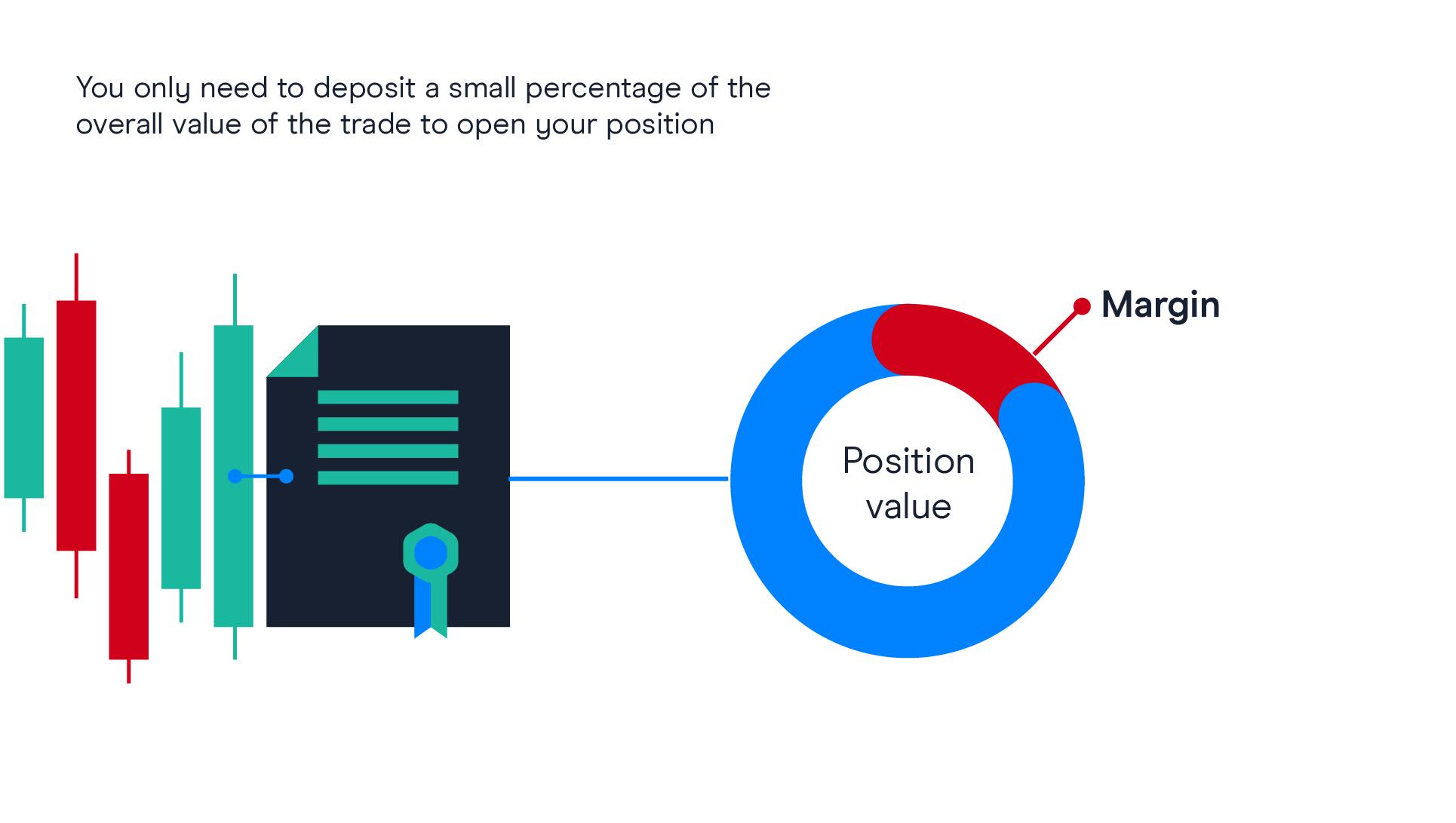

What is margin and leverage?

Contracts for difference (cfds) is a leveraged productвђ‹, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called вђ˜trading on marginвђ™ (or margin requirement). While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of your capital, but as the account has negative balance protection, you can't lose more than your account value.

What are the costs of CFD trading?

Spread: when trading cfds, you must pay the spread, which is the difference between the buy and sell price. You enter a buy trade using the buy price quoted and exit using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads.

Holding costs: at the end of each trading day (at 5pm new york time), any positions open in your account may be subject to a charge called a 'CFD holding costвђ‹'. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

Market data fees: to trade or view our price data for share cfds, you must activate the relevant market data subscription, for which a fee will be charged. View our market data feesвђ‹.

Commission (only applicable for shares): you must also pay a separate commission charge when you trade share cfds. Commission on UK-based shares on our CFD platform starts from 0.10% of the full exposure of the position, and there is a minimum commission charge of ВЈ9. View the examples below to see how to calculate commissions on share cfds.

Example 1 - opening trade

A 12,000 unit trade on UK company ABC at a price of 100p would incur a commission charge of ВЈ12 to enter the trade:

12,000 (units) x 100p (entry price) = ВЈ12,000 x 0.10%

Example 2 - opening trade

A 5,000 unit trade on UK company ABC at a price of 100p would incur the minimum commission charge of ВЈ9 to enter the trade:

5,000 (units) x 100p (entry price) = 5,000 x 0.10%

= ВЈ5.00 ВЈ9.00 (as this is less than the minimum commission charge for UK share cfds, the minimum commission charge of ВЈ9 would be applied to this trade.)

Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed. The above calculation can be applied for a closing trade; the only difference is that you use the exit price rather than the entry price. Learn more about CFD commissionsвђ‹ and trading costs.

What instruments can I trade?

When you trade cfds with us, you can take a position on thousands of instruments. Our spreads start from 0.7 points on forex pairs including EUR/USD and AUD/USD. You can also trade the UK 100 and germany 30 from 1 point and gold from 0.3 points. See our range of marketsвђ‹вђ‹ here. There is also the option to trade cfds over traditional share trading, which means that you do not have to take ownership of the physical share.

Example of a CFD trade

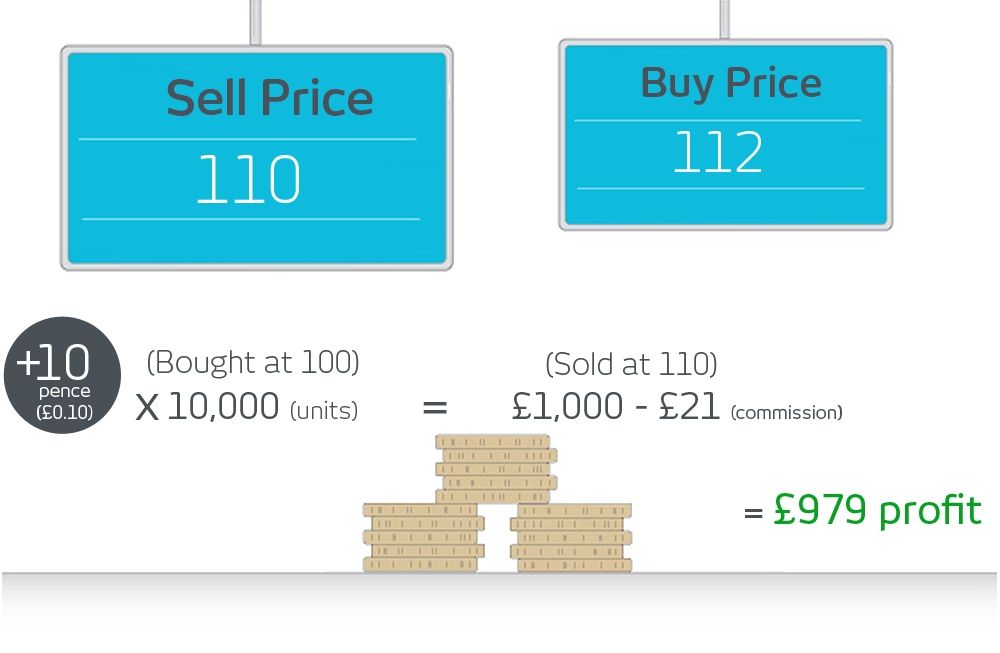

Buying a company share in a rising market (going long)

In this example, UK company ABC is trading at 98 / 100 (where 98 pence is the sell price and 100 pence is the buy price). The spread is 2.

You think the companyвђ™s price is going to go up so you decide to open a long position by buying 10,000 cfds, or вђ˜unitsвђ™ at 100 pence. A separate commission charge of ВЈ10 would be applied when you open the trade, as 0.10% of the trade size is ВЈ10 (10,000 units x 100p = ВЈ10,000 x 0.10%).

Company ABC has a margin rate of 3%, which means you only have to deposit 3% of the total value of the trade as position margin. Therefore, in this example your position margin will be ВЈ300 (10,000 units x 100p = ВЈ10,000 x 3%).

Remember that if the price moves against you, itвђ™s possible to lose more than your margin of ВЈ300, as losses will be based on the full value of the position.

Outcome A: a profitable trade

Let's assume your prediction was correct and the price rises over the next week to 110 / 112. You decide to close your buy trade by selling at 110 pence (the current sell price). Remember, commission is charged when you exit a trade too, so a charge of ВЈ11 would be applied when you close the trade, as 0.10% of the trade size is ВЈ11 (10,000 units x 110p = ВЈ11,000 x 0.10%).

The price has moved 10 pence in your favour, from 100 pence (the initial buy price or opening price) to 110 pence (the current sell price or closing price). Multiply this by the number of units you bought (10,000) to calculate your profit of ВЈ1000, then subtract the total commission charge (ВЈ10 at entry + ВЈ11 at exit = ВЈ21) which results in a total profit of ВЈ979.

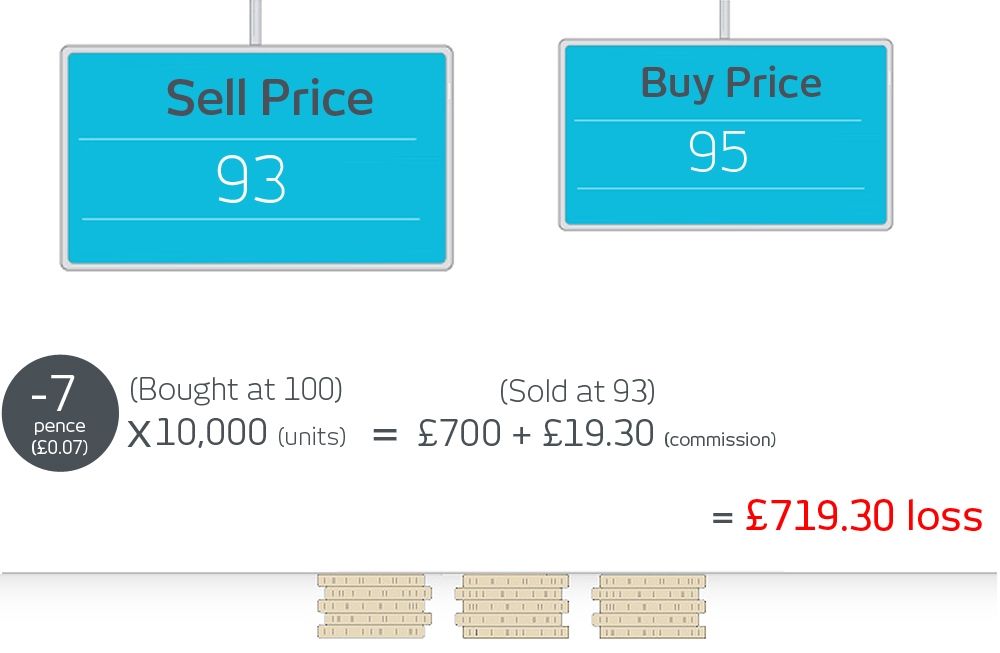

Outcome B: a losing trade

Unfortunately, your prediction was wrong and the price of company ABC drops over the next week to 93 / 95. You think the price is likely to continue dropping so, to limit your losses, you decide to sell at 93 pence (the current sell price) to close the trade. As commission is charged when you exit a trade too, a charge of ВЈ9.30 would apply, as 0.10% of the trade size is ВЈ9.30 (10,000 units x 93p = ВЈ9,300 x 0.10%).

The price has moved 7 pence against you, from 100 pence (the initial buy price) to 93 pence (the current sell price). Multiply this by the number of units you bought (10,000) to calculate your loss of ВЈ700, plus the total commission charge (ВЈ10 at entry + ВЈ9.30 at exit = ВЈ19.30) which results in a total loss of ВЈ719.30.

Short-selling cfds in a falling market

CFD trading enables you to sell (short) an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price move. If your prediction turns out to be correct, you can buy the instrument back at a lower price to make a profit. If you are incorrect and the value rises, you will make a loss. This loss can exceed your deposits.

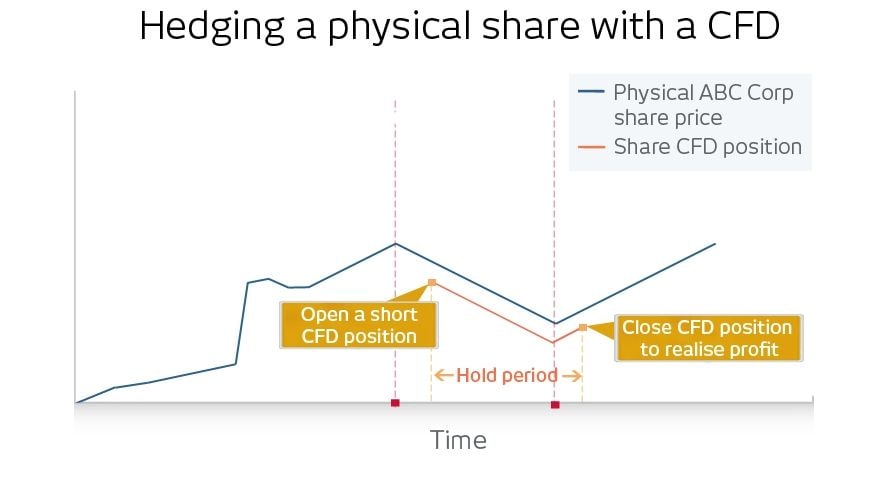

Hedging your physical portfolio with CFD trading

If you have already invested in an existing portfolio of physical shares with another broker and you think they may lose some of their value over the short term, you can hedge your physical shares using cfds. By short selling the same shares as cfds, you can try and make a profit from the short-term downtrend to offset any loss from your existing portfolio.

For example, say you hold ВЈ5000 worth of physical ABC corp shares in your portfolio; you could hold a short position or short sell the equivalent value of ABC corp with cfds. Then, if ABC corpвђ™s share price falls in the underlying market, the loss in value of your physical share portfolio could potentially be offset by the profit made on your short selling CFD trade. You could then close out your CFD trade to secure your profit as the short-term downtrend comes to an end and the value of your physical shares starts to rise again.

Trading cfds means that you can hedge physical share portfolios, which is a popular strategy for many investors, especially in volatile markets.

CFD trading platform

Familiarise yourself with our award-winning online trading platformвђ‹, next generation. This CFD trading platform comes complete with a wide range of technical indicators, chart forums and price projection tools to suit the needs of traders of all experience levels.

Seamlessly open and close trades, track your progress and set up alerts

CFD trading app

Our trading platform is also available for traders on-the-go, thanks to advances in technology. Our CFD mobile app is suitable for both android and ios users, and we offer software for smart tablets. Learn more about our mobile applicationsвђ‹вђ‹ here.

CMC markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Apply for a live account

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or paypal

One touch, instant trading available on 9,300+ instruments

133 houndsditch

london

EC3A 7BX

- Trading platforms

- Next generation

- Charting features

- Trading tools

- News & insight

- Order execution

- Mobile trading apps

- Iphone

- Ipad

- Android

- Support

- Help topics

- Getting started faqs

- Account applications faqs

- Funding and withdrawals faqs

- Platform faqs

- Product faqs

- Charges faqs

- Complaints faqs

- Security faqs

- Glossary

Spread bets and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading cfds with this provider.В you should consider whether you understand how spread bets and cfds work and whether you can afford to take the high risk of losing your money.

CMC markets is, depending on the context, a reference to CMC markets germany gmbh, CMC markets UK plc or CMC spreadbet plc. CMC markets germany gmbh is a company licensed and regulated by the bundesanstalt fгјr finanzdienstleistungsaufsicht (bafin) under registration number 154814. CMC markets UK plc and CMC spreadbet plc are registered in the register of companies of the financial conduct authority under registration numbers 173730 and 170627.

CFD trading

Flexible and accessible , CFD trading offers you the chance to find opportunity in a huge variety of financial markets – whether they’re moving up or down in price. Trade cfds with IG and you’ll have all the expertise of the world’s no.1 provider at your disposal. 1

In order to prioritise the service we give our existing clients, IG is not currently allowing any new positions to be opened on the US stocks gamestop and AMC entertainment. Clients are still able to close existing positions.

We continue to see high volatility in these and other stocks and positions may be subject to margin changes at short notice. High volatility increases the risk of sudden, large or rapid losses.

Call 010 344 0053 or email helpdesk.Za@ig.Com to talk about opening a trading account. We’re here 24 hours a day, from 9am saturday to 11pm friday.

Why trade cfds with us?

Manage risk effectively - never stay below zero with negative balance protection 2

Take your capital further. Open a position for a fraction of the cost with our competitive margin rates

Support when you need it. Round the clock assistance from 6am saturday to 10pm friday

Keep your finger on the pulse react to breaking news with custom price alerts

Open a position from any position use the UK's best web-based platform and mobile trading app 4

Get an interactive education become a better trader with free trading courses on IG academy

What is CFD trading?

Trade cfds to speculate on whether an asset's will move up or down without having to own the asset

What are the benefits?

- 17,000+ markets

- Free up your capital

- Go short or long

- Free from stamp duty

How do I trade cfds?

- Open a trading account

- Find an opportunity

- Take a position

- Monitor your trade

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

What markets can I trade with cfds?

Forex

Indices

Shares

Get spreads from just 0.6 points on pairs like EUR/USD with the UK’s no.1 FX provider. 3

Deal on global stock indices, with more 24-hour markets than any other provider.

Choose from over 12,000 interntional shares and exchange traded funds.

Commodities

Market data

Other markets

Trade metals, energies and soft commodities, with spreads from 0.3 points.

Access our comprehensive range of market data, charts, news and analysis to plan your strategies.

Discover our options markets, interest rates, bonds, sectors and more.

How much will I have to pay?

Margins

Cfds are leveraged, meaning you can win, or lose, a significant amount more than you deposit initially. This initial deposit is called a margin.

Spreads and commission

Your main payment for CFD trading is the spread - the price between the buy and the sell price. This is our charge for executing your trade.

We charge a spread on every market except for share cfds, which you'll pay a commission on instead. We work to keep these charges among the lowest in the business.

| Market | retail margin | leverage equivalent | professional margin what is this? | Leverage equivalent |

| forex | 3.33% | 1:30 | 0.45% | 1:222 |

| indices | 5% | 1:20 | 0.45% | 1:222 |

| shares | 20% | 1:5 | 4.5% | 1:22 |

| commodities | 5% | 1:20 | 0.45% | 1:222 |

| cryptocurrencies | 50% | 1:2 | 4.5% | 1:22 |

| minium spreads from | commission per side from | |

| forex | 0.6 | - |

| indices | 0.1 | - |

| shares | - | 10% |

| commodities | 0.3 | - |

| cryptocurrencies | 0.1 | - |

It’s free, quick and simple to create a CFD trading account with us. Open one today, and you’ll get access to over 17,000 financial markets.

When you’re ready, you choose your trade size. What’s more, new CFD traders get lower minimums for one month.

Choose the world’s no.1 CFD provider

Why open a trading account with anyone but the best CFD provider? More traders around the world choose to trade cfds with us than anyone else, making us the world’s no1.

Choose the world’s no.1 CFD provider

Why open a trading account with anyone but the best CFD provider? More traders around the world choose to trade cfds with us than anyone else, making us the world’s no1.

Choose the world’s no.1 CFD provider

Why open a trading account with anyone but the best CFD provider? More traders around the world choose to trade cfds with us than anyone else, making us the world’s no1.

Choose the world’s no.1 CFD provider

Why open a trading account with anyone but the best CFD provider? More traders around the world choose to trade cfds with us than anyone else, making us the world’s no1.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets

You might be interested in…

Share dealing vs cfds

Risk management

Easy-to-use platforms

Learn more about the differences between trading contracts for difference (cfds) and share dealing.

Understand the risks of trading, and discover the tools we offer to help you mitigate them.

Explore the fast, user-friendly trading platforms that you can use to trade cfds with us.

1 based on revenue excluding FX (published financial statements, june 2020).

2 negative balance protection applies to trading-related debt only, and is not available to professional traders.

3 by number of primary relationships with FX traders (investment trends UK leveraged trading report released june 2020).

Markets

CFD trading

Trading platforms

IG analysis

Contact us

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you understand how cfds work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

IG is a trading name of IG markets ltd and IG markets south africa limited. International accounts are offered by IG markets limited in the UK (FCA number 195355), a juristic representative of IG markets south africa limited (FSP no 41393). South african residents are required to obtain the necessary tax clearance certificates in line with their foreign investment allowance.

IG provides execution only services and enters into principal to principal transactions with its clients on IG’s prices. Such trades are not on exchange. Whilst IG is a regulated FSP, cfds issued by IG are not regulated by the FAIS act as they are undertaken on a principal-to-principal basis.

The information on this site is not directed at residents of the united states or belgium or any particular country outside south africa and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Voted SA’s top CFD provider in business day investors monthly annual stockbroker awards in 2012 and 2013, best platform for active day traders in 2013 and 2014, SA's best online broker in 2015 and 2017 and SA's best CFD provider in 2020.

CFD : guida trading sicuro

Un CFD (contract for diffence) è l'acronimo di contratto per dfferenza e rappresenta attualmente lo strumento derivato più utilizzato per fare trading online. Si tratta di un contratto tra due parti, il trader ed un broker, che esprime la differenza di prezzo di un asset di mercato.

La differenza si esprime tra il prezzo di acquisto e di chiusura moltiplicato il numero di azioni specificate nel contratto. Si tratta di un modo di operare che ricalca molto quello che avviene nell'acquisto di azioni. I prezzi indicati dal broker CFD sono molto simili al prezzo di mercato ed è possibile negoziare CFD ricevendo un addebito di una commissione.

Questo tipo di trading è diventato ormai popolare come strumento alternativo che consente di speculare sui movimenti dei prezzi dei titoli azionari ma anche sugli indici di borsa.

Vantaggi dei contratti per differenza (CFD)

Ci sono molti vantaggi che li rendono adatti ad essere utilizzati dai trader :

- La negoziazione avviene sul margine in modo da poter massimizzare i guadagni

- Non ci sono le imposte di bollo tradizionali che si pagano quando si acquistano azioni in banca

- È possibile guadagnare in qualunque situazione anche quando una azione scende non solo quando sale

- Con un solo account è possibile accedere a tanti mercati

- È possibile fare money management ed impostare degli stop per poter controllare i rischi

Rischi CFD

Si tratta di strumenti finanziari leveraged e che dunque possono comportare dei rischi di perdita di capitali. Cerchiamo dunque di elencare i principali rischi:

- Sia i profitti che le perdite possono essere amplificate se non si impostano degli stop loss e le posizioni aperte sono negative

- Si tratta di strumenti poco adatti a chi ama a investire a lungo termine

- Acquistando dei CFD non si diventa azionisti dell'azienda (questo può essere anche un vantaggio a volte)

Fare trading con i CFD

Vediamo come funziona brevemente il trading CFD elencando alcune caratteristiche che bisogna tenere in considerazione.

Trade a marginazione o su margine

Quando si fa trading con i CFD per ogni transazione non si ha bisogno di investire l'intero capitale ma è sufficiente solo una percentuale dell'intero capitale, questo è detto margine iniziale. L'effetto leva si ottiene utilizzando il margine. In questo modo è come se aveste a disposizione un capitale più ampio dato dall'effetto moltiplicatore della leva finanziaria. In questo modo potete comprare azioni o speculare sul forex in quantità maggiore.

Questo margine deve essere mantenuto sulle posizioni aperte in modo da coprire eventuali perdite. Se una posizione aperta va in modo contrario a quanto previsto il vostro capitale residuo si riduce. Se questo raggiunge un livello tale inferiore al margine richiesto ci sarà una margin call e sarà richiesto ulteriore capitale per mantenere aperta la posizione oppure si sarà costretti a chiuderla.

Trading su salita o discesa dei mercati

Da un punto di vista tecnico il trading con i derivati consente di scambiare posizioni long o short. Con long si indica il fatto di acquistare un bene con l'aspettativa che il suo valore aumenti proprio come accade acquistando una azione. Una posizione short si apre, invece, quando il trader crede che il prezzo del bene scenderà e dunque si dovrà vender per ricavare un profitto. Questo tipo di situazioni sono impossibili se invece investite in azioni a lungo termine.

Usando i CFD ma anche le opzioni binarie si può andare long o short con molta facilità facendo enormi profitti anche quando il valore di un bene cala drasticamente.

Tasse trading e commissioni

Come sapete acquistando azioni si pagano delle imposte di bollo molto salate. Per questo motivo conviene sempre operare con i broker CFD che sono praticamente gratuiti ed offrono delle condizioni molto più convenienti.

CFD su azioni e indici

I derivati sono ormai utilizzati non solo nel forex ma anche per fare trading su indici e azioni. Ad esempio plus500 offre una grandissima scelta su titoli azionari, coppie di valute, indici di borsa.

Come funzionano i CFD

Poichè il trading leveraged comporta dei rischi i broker seri offrono degli strumenti per fare risk management mettendo a disposizione stop loss e limit orde in modoa da poter gestire il rischio dovuto ai movimenti rapidi di mercato.

Stop loss

Uno stop loss rappresenta un livello di prezzo fissato dal cliente su una determinata posizione che, se viene raggiunta, chiude automaticamente una posizione al prezzo desiderato.

Supponiamo di voler acquistare azioni apple ed il prezzo è fissato. Impostando uno stop loss se la quotazione cala di evita di perdere soldi inutili perchè l'ordine viene bloccato quando raggiunge il livello fissato. In caso contrario il trader lasciando la posizione aperta di notte, ad esempio, non avrebbe il tempo di intervenire dunque realizzerebbe una perdita maggiore.

In alcuni casi è possibile impostare anche degli ordini di arresto per aspettare finchè un titolo si muove nella giusta direzione prima di aprire.

Limit order

Un ordine limite è un tipo di ordine che viene eseguito ad un prezzo migliore rispetto al prezzo di mercato. In pratica si usa per tenere una posizione aperta che è profittevole in modo da guadagnare di più dopo che il prezzo ha raggiunto un determinato livello di profitto.

Strategie di trading con i CFD

Ci sono vari tipi di strategie che possono essere utilizzate per fare trading con i CFD. Il consiglio migliore è sempre quello di impostare un piano di trading prima e seguirlo fedelmente senza deviazioni.

Poichè i CFD sono convenienti da un punto di vista economico e possono consentire di operare sui margini sono dei prodotti ideali per il trading a breve termine. Una ulteriore strategia da applicare potrebbe essere quella della copertura. Si può usare un CFD per protegger il proprio investimento contro le condizioni variabili di mercato. Ad esempio se prendiamo come riferimento il mercato azionario potrebbe essere più conveniente aprire una posizione short su azioni piuttosto che vendere le azioni fisiche per acquistarle in un secondo tempo.

Migliori broker CFD

In questa tabella potete trovare tutti i migliori siti italiani che offrono il trading via CFD:

| Broker | caratteristiche | vantaggi | recensione | apri un conto |

|---|---|---|---|---|

| broker ideale per principianti | social e copy trading | recensione | iscriviti | |

| sicurezza al massimo | deposito minimo, servizio CFD | recensione | iscriviti | |

| segnali gratuiti | conto demo da 100.000 € | recensione | iscriviti | |

| conti zero spread | commissioni basse | recensione | iscriviti |

Si tratta di broker italiani rigorosamente autorizzati dalla consob che offrono le condizioni più convenienti. E' questo significa garantirsi il massimo, la possibilità di fare i massimi profitti sfruttando la qualità delle migliori piattaforme di trading.

© 2021 comefaretradingonline.Com. P. IVA IT02302220740 - tutti i diritti riservati. E' vietata la riproduzione parziale e o totale dei contenuti del sito.

Contatti | informativa privacy | trading responsabile | informativa rischi

Tutti gli strumenti finanziari presenti su questo sito comportano rischi di perdere capitale. Il tuo capitale potrebbe essere a rischio, pertanto è consigliabile fare trading dopo una certa esperienza. Le informazioni che trovi su comefaretradingonline.Com sono a carattere informativo e non costituiscono incentivi ad investimenti o operazioni finanziarie. Il sito non ha carattere di periodicità e dunque declina ogni responsabilità per errori, imprecisioni che potete segnalare.

Cfds sono strumenti finanziari complessi e comportano un alto rischio di perdita di denaro rapidamente a causa della leva. Tra il 74-89% dei trader retail perdono soldi facendo trading CFD. Prima di fare trading cerca di capire come funzionano i CFD ed i rischi che comportano.

CFD trading in singapore

CFD trading in singapore is big business. In fact, it’s the fourth-largest CFD market globally. Here we’ll look at how traders can get started, the best CFD brokers and platforms in singapore 2021, plus answer any regulatory and legal questions.

CFD brokers in singapore

What is A CFD?

A contract for difference (CFD) is a tradable agreement to exchange the difference in the value of an asset. If we take stocks and shares as an example, you could speculate on the change in value of the singapore stock exchange, or on the share price of a specific stock, without actually owning the underlying asset.

Online CFD trading is attractive partly because it’s available in so many markets. You can trade cfds on stocks, forex, commodities, and cryptocurrency. But despite wide-ranging market access, stick to classes you understand.

CFD traders in singapore can also benefit from leverage, meaning you can borrow money from a brokerage to increase your position size. This is also known as trading on margin. The benefit of trading on leverage is that by increasing your trade size you can amplify potential profits. Of course, it also means the possibility of larger losses.

How to trade

CFD trading in singapore is straightforward:

- Open an account – most singaporean traders benefit from instant account activation once their ID and address have been validated. Traders can then consider finance options and fund their account.

- Find an opportunity – informed by your strategy, identify a market opportunity to use a CFD instrument, such as on stocks.

- Enter a position – on your trading platform, take a position depending on whether you think price will rise or fall.

- Risk management – set a stop-loss order to automatically close out a trade when losses reach a certain point. Use a stop-limit order to automatically protect profits when they hit a specific level.

- Monitor & close – keep an eye on your charting software for real-time changes to the market. If you haven’t set stop-loss and stop-limit orders, close out the trade when you’re ready.

Accounts

Which CFD brokerage account is best in singapore will depend on user needs. Most providers have a tiered account system with varying minimum deposits. In general, the greater the minimum investment required, the more competitive the fees, the better the leverage options, and the greater the access to customer support.

Trading platforms

The best online CFD trading platform in singapore for one trader might feel clunky and lacking to the next. With that said, metatrader (MT4) and webtrader are popular options. Some brokers also use their own proprietary software, which can allow for extensive customisation.

Regardless of the system, staple requirements should be prompt deposits and withdrawals. Also essential are intuitive pattern recognition tools for analysing a stock index, for example. Mobile traders will need to check the platform is accessible through an android or ios app. Overall, choose a system that will complement your strategy. And be wary of opting for the cheapest trading platform as you want the best tools at your disposal.

How to choose a broker

The number of online CFD brokers in singapore is growing. Fortunately, the competition means providers are offering lower fees, ample products, and excellent platforms.

When doing your brokerage comparison, consider:

- Costs – commissions and spreads will eat into returns. So, make sure you’re aware of all the trading fees before you open an account.

- Platform – metatrader (MT4) is the most popular, but bespoke software can allow for a more personalised feel. Request a demo account to explore the platform before you invest money.

- Customer service – opt for the cheapest online brokerage in singapore and you may find customer support, be it through live chat or the phone, just isn’t available when you really need it.

- Additional tools – what else can the broker offer to improve your CFD trading success? Automated trading algorithms can streamline an already proven strategy, for example.

According to customer reviews, some of the best online CFD trading brokers in singapore are:

- Maybank kim eng – traders from singapore can get up to 20x leverage on this DMA platform.

- CMC markets – one of the largest brokers in singapore, CMC markets has a huge offering with competitive leverage.

- IG markets – IG markets receives great customer reviews, offering cfds in indices, shares, FX, commodities, and more. IG markets also offers an ECN trading account.

- Phillip CFD – although smaller than some of the other brokers on this list, it is reputable with a long list of loyal singaporean CFD traders.

- Oanda – A well-established international broker, oanda is particularly good for traders interested in cfds in forex and cryptocurrency.

- DBS vickers – the popular online trading platform offers a suite of cfds to singapore traders, including across forex, stocks, and commodities. The platform is also available on a mobile-friendly app and provides extensive market insights.

- Interactive brokers – IB offers impressive commission rates, but they do charge for basic tools such as market data and news insights.

For further guidance on CFD brokers, see here.

Educational resources

CFD trading in singapore is competitive. So, the more additional educational resources you can get your hands on the better. Head to online forums, such as hardwarezone for tips from singapore traders. Videos, newsletters and demo accounts are also all great ways to hone your CFD shares strategy, for example.

For further guidance on day trading learning, see here.

Final word

CFD trading in singapore is hugely popular. Giving investors access to a breadth of markets with high leverage options, cfds appeal to traders of all experience levels. It is true the regulatory oversight isn’t as robust as in other jurisdictions, such as the UK or US. However, the best trading platforms in singapore still make for a great environment to trade cfds.

How can I trade cfds in singapore?

To start CFD trading in singapore, sign up at an online brokerage, fund your account, and take a position when you see an opportunity. But make sure you have a clear strategy and risk management tools in place before you put real money on the line.

Is CFD trading legal in singapore?

CFD trading in singapore is legal and regulated by the monetary authority of singapore (MAS), although as a relatively new market, MAS has a lax reputation. Nonetheless, all brokers should be licensed with the MAS financial institutions directory. As part of your due diligence, check the provider’s website for a license number.

Part of the protection afforded to those trading cfds in singapore with a regulated broker is that client funds are segregated. If the provider were to go bankrupt, user funds would be protected. Regulated brokers are also required to issue prospective clients with a comprehensive list of risks.

Which CFD trading account is best in singapore?

The best trading account will depend on your needs. Consider the minimum account deposit, speed of payment methods, and the customer support available. Also check customer reviews online.

What’s the best CFD trading platform in singapore?

Whilst there isn’t a universal best platform in singapore, metatrader (MT4) is the most popular. With that said, the bespoke software available at some providers often allows for customisation.

How much money do I need to start CFD trading?

Minimum deposits vary between platforms, however you can start CFD trading in singapore with S$250.

So, let's see, what was the most valuable thing of this article: FOREX.Com offers forex and CFD trading with award winning trading platforms, tight spreads, quality executions and 24 hour live support. At online cfd trading

Contents of the article

- Free forex bonuses

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- An introduction to contract for differences (cfds)

- How cfds work

- The costs of cfds

- Advantages of cfds

- Higher leverage

- Global market access from one platform

- No shorting rules or borrowing stock

- Professional execution with no fees

- No day trading requirements

- Variety of trading opportunities

- Disadvantages of cfds

- Example of a CFD trade

- Cfds faqs

- What are cfds?

- How do cfds work?

- Why are cfds illegal in the U.S.?

- Is trading cfds safe?

- Can you make money with cfds?

- The bottom line

- CFD trading in singapore

- CFD brokers in singapore

- What is A CFD?

- How to trade

- Accounts

- Trading platforms

- How to choose a broker

- Educational resources

- Final word

- How can I trade cfds in singapore?

- Is CFD trading legal in singapore?

- Which CFD trading account is best in singapore?

- What’s the best CFD trading platform in singapore?

- How much money do I need to start CFD trading?

- CFD trading

- What are cfds

- Why trade with avatrade?

- What is CFD trading?

- How to trade cfds with avatrade

- Start trading cfds with avatrade

- What is a contract for difference?

- CFD meaning

- What is CFD trading?

- Introduction to CFD trading: how does CFD trading...

- What are the costs of CFD trading?

- What instruments can I trade?

- Example of a CFD trade

- Short-selling cfds in a falling market

- Hedging your physical portfolio with CFD trading

- CFD trading platform

- CFD trading app

- CFD trading

- Why trade cfds with us?

- What is CFD trading?

- What are the benefits?

- How do I trade cfds?

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Trade seamlessly, wherever you are

- Feel secure with a trusted provider

- Open an account now

- Open an account now

- Fast execution on a huge range of markets

- Trade seamlessly, wherever you are

- Feel secure with a trusted provider

- Start trading now

- Start trading now

- What markets can I trade with cfds?

- How much will I have to pay?

- Choose the world’s no.1 CFD...

- Choose the world’s no.1 CFD...

- Choose the world’s no.1 CFD...

- Choose the world’s no.1 CFD...

- Start trading now

- Start trading now

- You might be interested in…

- Share dealing vs cfds

- Risk management

- Easy-to-use platforms

- Markets

- CFD trading

- Trading platforms

- IG analysis

- Contact us

- CFD : guida trading sicuro

- Vantaggi dei contratti per differenza (CFD)

- Rischi CFD

- Fare trading con i CFD

- Trade a marginazione o su margine

- Trading su salita o discesa dei mercati

- Tasse trading e commissioni

- CFD su azioni e indici

- Come funzionano i CFD

- Strategie di trading con i CFD

- Migliori broker CFD

- CFD trading in singapore

- CFD brokers in singapore

- What is A CFD?

- How to trade

- Accounts

- Trading platforms

- How to choose a broker

- Educational resources

- Final word

- How can I trade cfds in singapore?

- Is CFD trading legal in singapore?

- Which CFD trading account is best in singapore?

- What’s the best CFD trading platform in singapore?

- How much money do I need to start CFD trading?

No comments:

Post a Comment