Broker for forex trading

So you are a forex trader, or a new trading looking to break into the forex trading world in india?

Free forex bonuses

You have likely considered the global and indian forex market very carefully. When thinking about which of the top forex brokers offer to take up on opening an account, you may or may not have considered brokers in india, or at least those that are available for indian citizens. If that is the case, then you find yourself in the perfect place.

Top 10 best forex brokers in india for 2021

Top rated:

So you are a forex trader, or a new trading looking to break into the forex trading world in india? You have likely considered the global and indian forex market very carefully.

When thinking about which of the top forex brokers offer to take up on opening an account, you may or may not have considered brokers in india, or at least those that are available for indian citizens. If that is the case, then you find yourself in the perfect place.

Here we have taken at the foreign exchange market for indian citizens and compiled a listing of the best forex brokers in india just for you.

Table of contents

Is forex trading illegal in india?

For indian citizens, this is the key question when getting involved in forex trading. The simple answer here is no. This however comes with some complexities for indian forex traders that we will explain.

Forex trading in india is regulated by SEBI (securities and exchange board of india) similarly to the way in which foreign exchange and trading is regulated in other countries. The difference comes though with the fact that the RBI (reserve bank of india) has made trading with some other currencies and the indian rupee illegal for fear of devaluing the indian currency.

With that in mind then, the only forex trading acceptable for indian forex traders to participate in is that of INR based pairs with major currency the USD, EUR, GBP, and JPY. The indian government have recently relaxed the rules to allow the introduction of trading on other major foreign currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Other pairs are currently not available.

When it comes to online forex brokers and the indian forex market, it is however illegal for indian forex traders to use any online forex trading platform that is not regulated by SEBI. If you are reading this review as an indian citizen based abroad, then you typically have more freedom from these regulations and you can follow the regulations of your local area.

Disclaimer: the following top 10 illustrates international forex brokers that offer forex trading services in india. However, we couldn’t find any information regarding their SEBI compliances (except from alpari). If you’re based in india, and you want to open an account with them, contact local experts before taking any further action.

Top 10 of the best forex brokers in india today

1. Alpari

The first broker we will take a look at for indian forex trading is alpari. This is the only international broker that is considered a SEBI compliant forex broker for indian traders. As an indian forex trader or any other, we would recommend that you display some degree of caution in your forex trading here. This is due to the revocation of many of their top-tier regulations due to 2015 bankruptcy.

The broker is still regulated offshore by the FSC (C113012295). For indian citizens you can check up on the companies regulatory licensing through SEBI with the following registration numbers:

INE271381233

INE231376935

INE261383637

With alpari, there are no INR currency pairs available, though the other permitted pairs for indian traders are certainly available. The spreads with this broker start from 0 pips with the ECN accounts.

There are a total of 3 retail accounts available for indian traders. The standard account, ECN account, and micro account. The alpari minimum deposit starts from $5 for the micro account, $100 for a standard account, and $500 for ECN account holders. You can deposit indian rupee through a local bank transfer or neteller. This may incur some fees.

Best forex brokers for beginners in 2021

The forexbrokers.Com annual forex broker review (five years running) is the most cited in the industry. With over 50,000 words of research across the site, we spend hundreds of hours testing forex brokers each year. How we test.

The best forex brokers for beginners offer three essential benefits. The first, and most important, they are a regulated and trusted brand that offers a user-friendly web-based platform. Second, they provide a strong variety of educational resources. Third, they provide access to quality market research.

In our review of forex and CFD broker offerings, we spent endless hours opening demo accounts, navigating forex platforms, conducting market research, testing website usability, as well as watching educational videos and webinars.

Cfds are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65-82% of retail investor accounts lose money when trading cfds. You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money.

What is forex trading?

Forex trading is the process of exchanging one currency for another, known as buying or selling currency pairs, based on prevailing exchange rates from the forex market. The forex market is the largest global market, with nearly $6.59 trillion in currency traded on average, per day.

What is a forex broker?

When it comes to trading foreign currency, you use a forex broker, also known as a currency trading broker, to place your trades. When you trade forex, you buy or sell in currency pairs, e.G. "EUR / USD" (euro / U.S. Dollar). You open an account, deposit funds, then use the broker's trading platform to buy and sell currency using margin. The forex markets are open 24 hours a day, five days a week.

To learn more about the basics of trading forex, we recommend the school of pipsology alongside the NFA's trading forex booklet.

The best forex brokers for beginners

Here's a summary of the best forex brokers for beginner forex traders.

- Plus500 - best for beginners overall

- IG - excellent education, most trusted

- Etoro - best trading platform for copy trading

- Avatrade - quality educational resources

- CMC markets - best web trading platform, excellent education

- XTB - best customer service, great education

- OANDA - quality research, user-friendly platform

Best for beginners overall

Plus500 is a trusted global brand that offers retail forex and CFD traders an easy-to-use platform and a thorough selection of tradeable instruments. While educational materials are limited, the plus500 web-based trading platform is extremely user-friendly, making it excellent for beginner forex and CFD traders. Disclosure: being good for beginners does not mean it is easier to make money. Trading is risky. (76.4% of retail investor accounts lose money) read full review

Excellent education, most trusted - visit site

Regulated and trusted across the globe, IG offers traders the ultimate package of excellent trading and research tools, industry-leading education, competitive pricing, and an extensive list of tradeable products. This fantastic all-round experience makes IG the best overall broker in 2021. (75% of retail investor accounts lose money) read full review

Best trading platform for copy trading - visit site

Etoro is excellent for social copy trading and cryptocurrency trading, and is our top pick for both categories in 2021. Furthermore, etoro offers a user-friendly web platform and mobile app that is great for casual investors, including beginners. (75% of retail investor accounts lose money) read full review

Quality educational resources - visit site

Avatrade is a trusted global brand best known for offering traders an extensive selection of trading platform options. Our testing found avatrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and a winner for investor education. (73% of retail investor accounts lose money) read full review

Best web trading platform, excellent education

When it comes to education, CMC markets competes with the best in the industry by offering forex and CFD traders a diverse selection of education in a variety of formats, including written articles, video updates, podcasts, and live webinars. Education aside, the CMC markets next generation trading platform is fast, reliable, and comes packed with tools and features. (76% of retail investor accounts lose money) read full review

Best customer service, great education - visit site

As a trusted multi-asset broker, XTB offers traders outstanding customer service and an excellent trading experience overall thanks to the xstation 5 trading platform. I was left impressed with XTB's education offering, thanks to its extensive written content and video materials. The only drawback is a lack of live webinars currently, although archived recordings are available. (82% of retail investor accounts lose money) read full review

Quality research, user-friendly platform

As a trusted global brand, OANDA provides forex and CFD traders a limited offering of FX pairs and cfds but stands out for its reputation and quality market research. OANDA's trading platform suite, fxtrade, is easy-to-use for new forex traders. OANDA provides a good balance of educational materials in both written and video formats, along with webinars conducted by its staff. (73.5% of retail investor accounts lose money) read full review

Educational materials comparison

Taken from our forex broker comparison tool, here's a comparison of the education features for the best forex brokers for beginners.

| Feature | plus500 | IG visit site | etoro visit site | avatrade visit site |

| has education - forex | no | yes | yes | yes |

| has education - cfds | no | yes | no | no |

| client webinars | no | yes | yes | yes |

| client webinars (archived) | no | yes | no | yes |

| videos - beginner trading videos | no | yes | yes | yes |

| videos - advanced trading videos | no | yes | yes | yes |

| investor dictionary (glossary) | no | yes | yes | yes |

How much money do you need to trade forex?

While some forex brokers do not require a minimum deposit to start trading forex, most do. Unless opening a demo account, which uses virtual money to practice, most forex brokers require a minimum deposit of between $100 - $250 to start trading.

What are the most popular currency pairs?

The seven most frequently traded currency pairs (also known as the “majors”) are EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD, and USD/CAD. Approximately 85% of all forex trades take place across these seven pairs.

Can you get rich by trading forex?

While some forex traders will be able to get rich trading forex, the vast majority will not. Forex trading is risky. Historically speaking, several hedge fund managers have been able to get rich trading forex. For example, george soros made over £1 billion in profit by short selling the sterling in 1992.

How do I start trading forex?

First, it is important to practice. Start by opening a demo account so you can get used to the trading platform and tools. Reading books is also important to learn how to conduct market research and perform technical analysis. Then, when ready, open an account, fund it, and start trading.

How do I choose a forex broker?

To select a forex broker, start by looking for brokers that are regulated in your country. Next, read full length forex reviews to assess the trading costs, tools, research capabilities, customer service, and other features of each forex broker. Finally, compare your top two choices side-by-side to decide on a winner.

Which forex brokers accept US or non-US clients?

Forex brokers who hold regulatory status in the US can accept US-based clients. Meanwhile, forex brokers who accept non-US clients will usually need to hold licenses in the countries where their clients reside.

For example, if you reside within the european union (EU), you will be able to open an account with an EU-regulated broker. In contrast, if you live in a US state, you will need to open an account with a US-regulated broker.

The best forex trading platforms for beginners

- Plus500 - webtrader

- IG - IG web platform

- Etoro - etoro copytrader

- Avatrade - avatrade webtrader

- CMC markets - next generation

- XTB - xstation 5

- OANDA - fxtrade

Read next

Methodology

For our 2021 forex broker review we assessed, rated, and ranked 27 international forex brokers. Each broker was graded on 108 different variables and, in total, over 50,000 words of research were produced.

While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time (live in person or over the web) for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors quality data they can trust. Learn more about how we test.

Forex risk disclaimer

"there is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses." learn more.

About the author: steven hatzakis steven hatzakis is the global director of research for forexbrokers.Com. Steven previously served as an editor for finance magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

About the author: blain reinkensmeyer as head of research, blain reinkensmeyer has 18 years of trading experience with over 1,000 trades placed during that time. Referenced as a leading expert on the US online brokerage industry, blain has been quoted in the new york times, forbes, and the chicago tribune, among others.

Trading cfds, FX, and cryptocurrencies involve a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading cfds with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how cfds, FX, and cryptocurrencies work. All data was obtained from a published website as of 12/14/2020 and is believed to be accurate, but is not guaranteed. The forexbrokers.Com staff is constantly working with its online broker representatives to obtain the latest data. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page.

The names, products, services, branding/logos, and other trademarks or images featured or cited within this website (www.Forexbrokers.Com) are the property of their respective owners and the owners retain all legal rights therein. These trademark holders are not affiliated with forexbrokers.Com and the use or display of names, trademarks or service marks of another is not a representation that the other is affiliated with, sponsors, or endorses forexbrokers.Com or any of its reviews, products, or services. Forexbrokers.Com declares no affiliation, sponsorship, nor any partnership with any trademark holders unless otherwise stated.

Plus500uk ltd is authorised and regulated by the financial conduct authority (FRN 509909).

IG - 76% of retail investor accounts lose money when trading cfds with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advertiser disclosure: forexbrokers.Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. How do we make money? Our partners compensate us through paid advertising. While partners may pay to provide offers or be featured, e.G. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Here is a list of our partners.

Disclaimer: it is our organization's primary mission to provide reviews, commentary, and analysis that are unbiased and objective. While forexbrokers.Com has some data verified by industry participants, it can vary from time to time. Operating as an online business, this site may be compensated through third party advertisers. Our receipt of such compensation shall not be construed as an endorsement or recommendation by forexbrokers.Com, nor shall it bias our reviews, analysis, and opinions. Please see our general disclaimers for more information.

© 2021 reink media group LLC.

All rights reserved.

Trade with the global forex trading specialist

Why FOREX.Com?

Metatrader

Trade over 500 markets including equities, indices, FX and commodities on the new and improved MT5

Competitive pricing

Maximize your potential with straightforward pricing choices to suit your trading style

Active trader

Earn rebates and one-on-one professional support when you qualify for our active trader program

Financial strength you can depend on

/media/forex/images/stonex-rebranding/stonex-wh-285x95.Png" alt="stonex logo" />

Your FOREX.Com account gives you access to our full suite of downloadable, web, and mobile apps.

/media/forex/images/global/homepage/allplatforms-latest.Png" alt="forex platforms" width="570" height="340" />

Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX.Com.

/media/forex/images/global/homepage/uk-mt4apps-latest.Png" alt="metatrader apps" width="570" height="340" />

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize forex trading opportunities.

Ready to learn about forex?

New trader?

Welcome, we’ll show you how forex works and why you should trade it.

Have some experience?

Let’s create a trading plan that will help you stay on track and meet your goals.

Want to go deep on strategy?

Great, we have guides on specific strategies and how to use them.

Not sure where to start?

Take our short quiz and get matched resources that fit your trading style.

Open an account in as little as 5 minutes

Tell us about yourself

Fund your account

Start trading

Go to content for my region

Try a demo account

Your form is being processed.

I would like to learn about

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Contracts for difference (cfds) are not available to US residents.

FOREX.Com is a trading name of GAIN global markets inc. Which is authorized and regulated by the cayman islands monetary authority under the securities investment business law of the cayman islands (as revised) with license number 25033.

FOREX.Com may, from time to time, offer payment processing services with respect to card deposits through its affiliate, GAIN capital UK ltd, devon house, 58 st katharine’s way, london, E1W 1JP, united kingdom.

GAIN global markets inc. Is part of the GAIN capital holdings, inc. Group of companies, which has its principal place of business at 135 US hwy 202/206, bedminster, NJ 07921, USA. All are separate but affiliated subsidiaries of stonex group inc.

Top 10 best forex brokers in india for 2021

Top rated:

So you are a forex trader, or a new trading looking to break into the forex trading world in india? You have likely considered the global and indian forex market very carefully.

When thinking about which of the top forex brokers offer to take up on opening an account, you may or may not have considered brokers in india, or at least those that are available for indian citizens. If that is the case, then you find yourself in the perfect place.

Here we have taken at the foreign exchange market for indian citizens and compiled a listing of the best forex brokers in india just for you.

Table of contents

Is forex trading illegal in india?

For indian citizens, this is the key question when getting involved in forex trading. The simple answer here is no. This however comes with some complexities for indian forex traders that we will explain.

Forex trading in india is regulated by SEBI (securities and exchange board of india) similarly to the way in which foreign exchange and trading is regulated in other countries. The difference comes though with the fact that the RBI (reserve bank of india) has made trading with some other currencies and the indian rupee illegal for fear of devaluing the indian currency.

With that in mind then, the only forex trading acceptable for indian forex traders to participate in is that of INR based pairs with major currency the USD, EUR, GBP, and JPY. The indian government have recently relaxed the rules to allow the introduction of trading on other major foreign currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Other pairs are currently not available.

When it comes to online forex brokers and the indian forex market, it is however illegal for indian forex traders to use any online forex trading platform that is not regulated by SEBI. If you are reading this review as an indian citizen based abroad, then you typically have more freedom from these regulations and you can follow the regulations of your local area.

Disclaimer: the following top 10 illustrates international forex brokers that offer forex trading services in india. However, we couldn’t find any information regarding their SEBI compliances (except from alpari). If you’re based in india, and you want to open an account with them, contact local experts before taking any further action.

Top 10 of the best forex brokers in india today

1. Alpari

The first broker we will take a look at for indian forex trading is alpari. This is the only international broker that is considered a SEBI compliant forex broker for indian traders. As an indian forex trader or any other, we would recommend that you display some degree of caution in your forex trading here. This is due to the revocation of many of their top-tier regulations due to 2015 bankruptcy.

The broker is still regulated offshore by the FSC (C113012295). For indian citizens you can check up on the companies regulatory licensing through SEBI with the following registration numbers:

INE271381233

INE231376935

INE261383637

With alpari, there are no INR currency pairs available, though the other permitted pairs for indian traders are certainly available. The spreads with this broker start from 0 pips with the ECN accounts.

There are a total of 3 retail accounts available for indian traders. The standard account, ECN account, and micro account. The alpari minimum deposit starts from $5 for the micro account, $100 for a standard account, and $500 for ECN account holders. You can deposit indian rupee through a local bank transfer or neteller. This may incur some fees.

Trading advantages of roboforex forex broker

No limits in providing outstanding benefits to roboforex clients.

- Tight spreads

from 0 pips - Fastest order

execution - 4 account currencies

(EUR, USD, CNY, GOLD) - Micro accounts with the

minimum lot size of 0.01 - 8 asset

classes - Affiliate program

50% profit sharing

Roboforex bonus programs

Roboforex provides for its clients best promotional offers on financial markets.

Start trading with roboforex now and unleash the powerful benefits!

Profit share bonus

up to 60%

- Bonus up to 20,000 USD.

- Can be used during "drawdown".

- Deposit from 10 USD.

- Withdraw the profit received when trading your own funds.

Get bonus

Classic bonus

up to 120%

- Bonus up to 50,000 USD.

- Сan’t be used during "drawdown".

- Deposit from 10 USD.

- Trade with bonus funds and withdraw the profit.

Get bonus

Cashback (rebates)

up to 15%

- Receive cashback for the trading volume of just 10 lots.

- Available for all verified clients.

- Receive real money as cashback and withdraw it instantly.

Learn more

Up to 10%

on account balance

- Payments for the trading volume starting from 1 lot.

- No restrictions: withdraw instantly.

- Receive % on account balance every month.

Learn more

Account types

- First deposit

- Execution type

- Spreads

- Instruments

- Bonuses

- Platforms

Pro-standard

The most popular account type at roboforex, which is suitable for both beginners and experienced traders.

Prime

"prime" accounts combine all best features of ECN accounts and are suitable for advanced traders.

Pro-cent

Pro-cent accounts provide an opportunity to trade micro lots and is best suitable for beginners, who want to test our trading conditions with minimum investments.

ECN account type is intended for professionals, who prefer the best trading conditions with tight spreads.

R trader

R trader is a multi-asset web platform, which combines modern technologies, a classic but taken to a new level design, and access to the world’s major financial markets.

- First deposit 100 USD

- Execution type market execution

- Spreads floating from 0 points

- Instruments over 12,000 stocks, indices,

forex, etfs, cfds, cryptocurrencies - Bonuses not available

- Platforms R trader - web platform

By opening a demo account at roboforex, you can test our trading conditions - instruments, spreads, swaps, execution speed - without investing real money.

- First deposit not required

- Execution type market execution

- Spreads depends on type of account

- Instruments depends on type of account

- Bonuses limited number of offers

- Platforms

depends on type of account

Trading platforms

The most popular platform for trading on the forex market, which includes a knowledge database, trading robots, and indicators.

- 3 types of order execution

- 9 time frames for trading

- 50 integrated indicators for technical analysis

- Variety of order types

The latest version of metatrader platform with an opportunity to choose between netting and hedging systems.

- 4 types of order execution

- Multi-currency tester

- Market depth

- 6 types of pending orders

Roboforex trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

- Trade from any browser or mobile device (ios, android).

- Get the same functionality as on desktop platforms.

- Control your positions and orders from any place in the world.

Multi-asset web-based trading platform with the fastest in the industry financial charts and advanced technical analysis tools.

- Over 12,000 stocks, indices, FX, etfs, cryptocurrencies.

- Minimum deposit: 100 USD.

- Trading robots builder. No programming skills required.

Trading platforms center

Exclusive trading platforms

For those traders who prefer to be always on the move we present exclusive roboforex trading platforms: webtrader and mobiletrader.

Security of client's funds

Your funds are fully secured when you trade with roboforex.

- Regulated activities: IFSC license

no. 000138/107 - Negative balance

protection - Participant of the financial

commission compensation fund - Execution quality certificate

start trading now

8 asset classes

Discover the world’s key markets through roboforex accounts and platforms.

Forex

We offer transparent and reliale access to trading FX with more than 40 currency pairs

Forex trading benefits

- Institutional spreads from 0 points

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:2000

- Fastest execution possible

read more

Stocks

Access to more than 12,000 stocks through R trader platform and more than 50 via metatrader 4/5 terminals

Stocks trading benefits

- Minimum deposit: 100 USD

- Free stock exchange market data online

- Leverage: up to 1:20

- Metatrader4, metatrader5, R trader platforms

read more

Indices

In its most regularly traded format, an index is defined as a portfolio of stocks that represents a particular market or market sector

Indices trading benefits

- Metatrader4, metatrader5, R trader platforms

- Tight spreads - no mark up

- Leverage: up to 1:100

- Over 10 instruments

read more

Trade fast-growing global ETF industry with over $3 trillion in assets in management

Etfs trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Leverage: up to 1:20

- Сorporate events supported and handled by the system automatically

read more

Soft commodities

Trade etfs on grown commodities such as coffee, cocoa, sugar, corn, wheat, soybean, fruit

Soft commodities trading benefits

- Minimum deposit: 100 USD

- R trader platform

- Over 100 instruments

- Leverage: up to 1:20

read more

Energies

Trade cfds and commodity etfs on energy market including oil, natural gas, heating oil, ethanol and purified terephthalic acid

Energies trading benefits

- Tight spreads

- Metatrader4, R trader platforms

- Ideal instrument for day traders

- Minimum deposit: 10 USD

- Leverage: up to 1:100

read more

Metals

Trade cfds and commodity etfs on precious metals including gold, platinum, palladium, silver as well as gold/dollar and silver/dollar pairs.

Metals trading benefits

- Hedge against political instability and dollar weakness

- Minimum deposit: 10 USD

- Metatrader4, metatrader5, ctrader, R trader platforms

- Leverage: up to 1:1000

read more

Cryptocurrencies

Bitcoin, litecoin and ethereum proved to have great potential for investment and speculation

Cryptocurrencies trading benefits

- Metatrader4, metatrader5, R trader platforms

- Over 20 cryptoinstruments

- Leverage: up to 1:50

- Trading 24/7

read more

0% commissions

When our clients deposit their trading accounts, the commission is always 0%. Roboforex covers all expenses. Choose the payment system according to your convenience, not cost effectiveness.

Roboforex also compensates its clients' commission for funds withdrawal twice a month.

Instant withdrawals

- Automatic withdrawal system: withdrawals within a minute for certain payment methods

- System works 24/7

- Simple, reliable, and fast

More than 20 ways to deposit funds

Become an investor on forex

For easy short-term investments

- Choose among over 1,000 traders.

- Get detailed statistics on trader's performance.

- Unsubscribe at any time.

Copyfx platform will be perfect for those, who search for a simple but reliable way to invest on forex.

Roboforex market analytics

Forex analytics

Forex technical analysis & forecast for february 2021

Fibonacci retracements analysis 01.02.2021 (GOLD, USDCHF)

The aussie is being pulled down. Overview for 01.02.2021

Economic calendar

Exclusive market analytics

Claws & horns is an independent analytical company providing brokers with a set of necessary analytical tools.

Fxwirepro™ is a leading analytical company, which provides the participants of financial markets with research reports in the real-time mode.

Company news

Roboforex: changes in trading schedule (martin luther king jr. Day)

Roboforex: changes in trading schedule (christmas and new year holidays)

Roboforex received prestigious awards of the financial sector

Winner of more than 10 prestigious awards

Roboforex was recognized by the most respected experts of the financial industry.

More than 800,000 clients from 169 countries.

Best investment products (global)

Best partnership program (LATAM)

Most trusted

broker

Most transparent

asian forex broker

Best global mobile

trading app

Best broker

of the CIS

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Roboforex ltd is an international broker regulated by the IFSC, license no. 000138/107, reg. Number 128.572.

Risk warning: there is a high level of risk involved when trading leveraged products such as forex/cfds. 58.42% of retail investor accounts lose money when trading cfds with this provider. You should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. You should not trade or invest unless you fully understand the true extent of your exposure to the risk of loss. When trading or investing, you must always take into consideration the level of your experience. Copy-trading services imply additional risks to your investment due to nature of such products. If the risks involved seem unclear to you, please apply to an outside specialist for an independent advice. Roboforex ltd and it affiliates do not target EU/EEA clients. Roboforex ltd and it affiliates don't work on the territory of the USA, canada, japan, australia, bonaire, curaçao, east timor, liberia, saipan, russia, sint eustatius, tahiti, turkey, guinea-bissau, micronesia, northern mariana islands, svalbard and jan mayen, south sudan, and other restricted countries.

At roboforex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital. Therefore, the company took additional measures to ensure compliance with its obligations to the clients. We have implemented a civil liability insurance program for a limit of 5,000,000 EUR, which includes market-leading coverage against omissions, fraud, errors, negligence, and other risks that may lead to financial losses of clients.

© roboforex, 2009-2021.

All rights reserved.

Best forex brokers

Luke jacobi

Contributor, benzinga

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.Com

Forex trading is arguably one of the easiest financial markets to begin trading in. To get started, you just need to open and fund an account with a regulated online broker. Choosing the best forex broker to trade forex does require some initial research to find the one most suitable for your trading needs and experience level.

Best forex brokers right now:

- Best overall forex broker: FOREX.Com

- Best for ultra-low spreads: cedarfx

- Best for beginner traders: etoro

- Best for non-US traders: HYCM

- Best for commodities: avatrade

- Best for intermediate traders: pepperstone

- Best for advanced forex traders: interactive brokers

- Best for mobile traders: plus500

- Best forex platform: IG markets

Table of contents [ hide ]

The best forex brokers

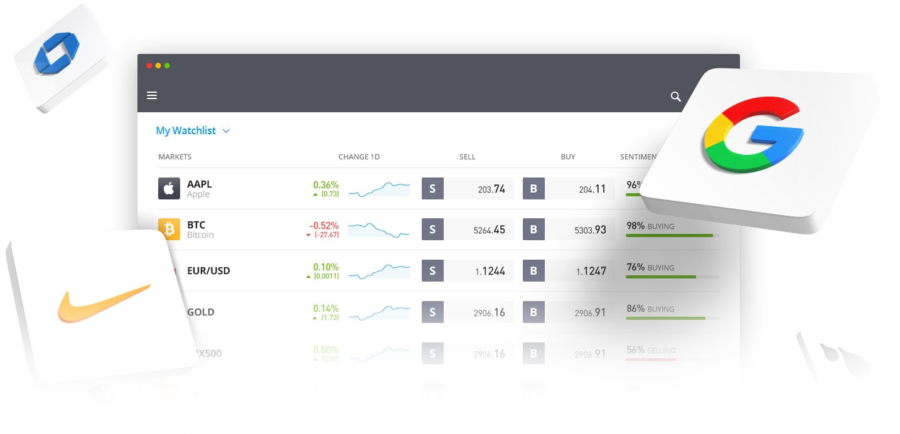

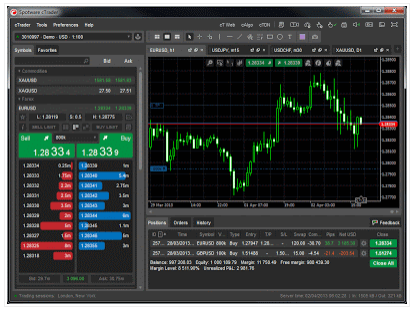

Benzinga’s picks for the best forex brokers in 6 key categories appear below along with details about each broker and a screenshot of their trading platforms.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

1. Best overall forex broker: FOREX.Com

FOREX.Com is a subsidiary of GAIN capital holdings (NYSE: GCAP) and ranks as the best overall forex broker.

You will only need $50 to open up an account to start trading up to 80 currency pairs on FOREX.Com’s advanced trading platforms, which include metatrader for non-U.S. Residents.

This broker accepts U.S. Clients and is regulated in the U.S. By the commodities futures trading commission (CFTC) and the national futures association (NFA). FOREX.Com also has oversight from regulators in 6 major world jurisdictions through its subsidiaries.

You can check out benzinga’s FOREX.Com review for more information about this excellent broker.

Account minimum

Pairs offered

Commisions

2. Best for ultra-low spreads: cedarfx

Cedarfx believes in combining the finest market conditions with excellent pricing and technology so clients can grow their accounts. A low spread generally indicates that volatility is low and liquidity is high and cedarfx prides itself

Cedarfx offers 2 account types: 0% commission accounts and eco accounts.

You get access to direct access to global financial markets, with over 170+ tradable assets available through metatrader4. Trade forex, crypto pairs, stocks, indices and commodities through a single platform!

You can practice your strategy and get familiar with the MT4 platform before trading using deposited funds through the free demo account.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

3. Best for beginner traders: etoro

Etoro specializes in social trading, which is ideal for beginners since you can follow the trades of expert traders with a proven track record. In addition to its world-class social trading network, etoro has excellent educational resources for forex beginners. Etoro’s intuitive multi-asset trading and social trading platforms and apps can be used by anyone immediately. Unfortunately, etoro does not support the metatrader 4 and 5 (MT4 and MT5) trading platforms.

The broker lets you trade over 2,000 different assets and has a minimum deposit of $50. Etoro currently accepts clients from most U.S. States where it is registered with the U.S. Financial crimes enforcement network (fincen) as a money services business, instead of with the NFA and CFTC as an online broker. The company is also regulated in australia, the U.K. And cyprus in the EU.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

4. Best for non-US traders: HYCM

Highly regulated HYCM offers stocks, forex, indices, cryptocurrencies, commodities and etfs. The company also offers excellent trading conditions and great liquidity.

HYCM uses metatrader 4 to trade the markets and adds in technical analysis, flexible trading systems and expert advisors (eas).

You’ll also encounter low spreads and low-cost trading, which includes 3 spread levels: fixed spreads, variable spreads and raw spreads:

- You can access up to 500:1 leverage through HYCM, depending on where you live and which currency pair you’re trading.

- Account minimums with HYCM may vary depending on your base currency and the type of account you open. You should have at least $100 to $200 ready to go before you open an account.

- You can customize your account levels with varying fee structures to fit your risk tolerance and trade frequency.

- HYCM even offers swap-free accounts that do not accrue interest for each of its fee types to allow islamic investors to trade freely without worrying about being in conflict with religious laws.

You’ll also find a range of education and research tools for endless education opportunities through HYCM.

Account minimum

Pairs offered

Minimum trade size

Spread

Commisions

5. Best for commodities: avatrade

Avatrade, one of the most secure brokers in the industry, carries 7 regulations across 6 continents (europe, australia, japan, british virgin islands, UAE and south africa). You’ll be pleasantly surprised by its asset availability, leading platforms and generous trading conditions (you can leverage your positions up to 400:1).

Avatrade offers an exceptionally user-oriented perspective, including a 24-hour multilingual support desk for a broad range of instruments, platforms and services for every level of trader. Instruments include:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Indices

You’ll find a range of automated trading platforms, including desktop, tablet, mobile and web-based trading with metatrader 4, metatrader 5, its proprietary webtrader, avaoptions and the award-winning avatradego. Client funds are held in segregated accounts for increased security and fast profits withdrawal.

Avatrade’s innovative technology and cutting-edge trading features also include 1-on-1 training sessions with a dedicated account manager.

Commissions

Account minimum

6. Best for intermediate traders: pepperstone

U.K.-based pepperstone gets our vote for best broker for intermediate traders. It has regulatory oversight in the U.K. And australia, although it does not currently accept U.S. Clients. The broker lets you trade in 61 major, minor and exotic currency pairs and requires a minimum deposit of $200. Pepperstone provides support for the metatrader 4 and 5 and ctrader platforms.

In addition to forex, pepperstone offers trading in cryptocurrencies, energy, metals, commodities and stock index contracts for difference (cfds). Customer balances are maintained in segregated accounts for safety in the australian national bank and barclays U.K.

Pricing

Account minimum

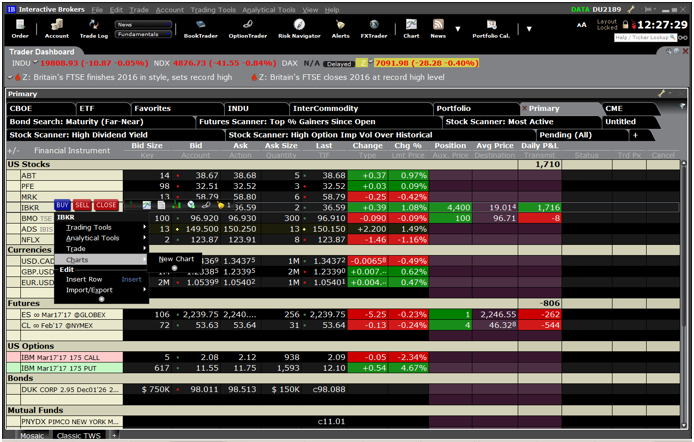

7. Best for advanced forex traders: interactive brokers

Interactive brokers offers some of the lowest costs in the business, including a $0 commission on U.S.-listed stocks and exchange-traded funds (etfs). Because of interactive’s world-class brokerage services in 33 countries that cover 134 markets worldwide, the company has oversight from most of the world’s largest financial regulators, including the U.S. SEC, CFTC and NFA. Interactive also submits to regulatory oversight in the U.K., australia and canada, and it has agencies in japan, hong kong, india and luxembourg.

Interactive brokers offers trading in 23 different currencies and their pairs, and the broker requires a $10,000 minimum margin deposit that is applied to commissions for the first 8 months, followed by a $2,000 minimum starting on the 9th month.

Minimum commissions apply, as well as maintenance fees and charges for inactivity, so interactive brokers would be best for advanced, active and well-funded professional traders. Interactive’s proprietary trading platforms, including its client portal, desktop trader workstation (TWS) and mobile application have been rated as some of the best in the business.

8. Best for mobile traders: plus500

U.K.- based plus500 has oversight from the FCA and is a leading provider of CFD trading on over 1,000 tradable assets including forex currency pairs, stock shares, cryptocurrencies, etfs, options and indices. The company keeps your money in segregated accounts but does not offer services to U.S.-based clients.

Plus500 offers trading in 70 currency pairs featuring competitive spreads on its forex cfds and leverage of up to 300:1. The intuitive interface featured on both the plus500 desktop and mobile trading platforms can be accessed immediately by novices and professionals, which makes plus500 our pick for mobile traders.

Commissions

Account minimum

9. Best forex platform: IG markets

IG markets gives clients access to trade cfds in more than 17,000 different markets including forex, shares, indices, commodities, bonds, etfs, options and short-term interest rate cfds. You can trade up to 80 different currency pairs through IG and the broker requires a $250 minimum deposit.

IG accepts U.S.-based clients due to oversight from the CFTC and NFA. IG holds your money in segregated accounts under trustee arrangements for added security. In addition to its proprietary trading platform, IG offers support for 3rd-party forex platforms such as metatrader 4 and prorealtime. It also allows application programming interface (API) trading.

Forex market explained

In the forex market, traders agree to exchange 1 currency for another to make a transaction in that currency pair at a particular level known as the exchange rate. Like stock prices, this exchange rate fluctuates based on supply and demand factors, as well as on the forex market’s overall expectations of future events.

Forex traders can make money on a currency transaction in 2 ways. First, if they buy or go long a currency and it goes up in value versus the sold currency, then they earn a profit. Second, if they sell or go short a currency and it goes down versus the bought currency, then they also profit.

Many currency pairs quoted in the forex market show substantial volatility or fluctuations, which can result in gains or losses for traders. The daily candlestick chart below shows changes in the exchange rate of the EUR/USD currency pair, which is the european union’s euro quoted in terms of the U.S. Dollar from november 2018 until april 2020.

Risk and reward in forex trading

Rewards are generated in forex trading when you take a long or short position in a currency pair that subsequently appreciates in value. The risk in doing a forex transaction is when the market doesn’t perform as expected once you have done a forex trade.

Many brokers allow traders to magnify the gains or losses they take on a position via the use of leverage. Leverage is typically expressed as the ratio of the size of a position you can control by placing one unit of base currency on deposit as margin. Hence, a 500:1 leverage ratio would mean that you can control a $500 position with a $1 margin deposit.

Furthermore, most successful traders have a minimum risk/reward ratio for a trade before they will consider taking it, such as 1:2 or 1:3. For example, if you think the chances of a trade making 20 pips is around the same as the chances of it losing 10 pips, then your risk/reward ratio of that trade is 1:2. If that meets your risk/reward ratio criteria, then you might consider that trade worthy of executing.

Choose your broker wisely

Since your forex broker will be your primary trading partner, you want to choose one carefully to make sure they are reputable and will fit your requirements as a trader. Open a demo account with an online broker you’re thinking of using to see whether it is a good fit. Demo account trading can also help prevent potentially costly errors that might arise from you being unfamiliar with the broker’s trading platform.

Methodology

These top brokers were chosen for this review for various reasons depending on the specific category in which we felt they excelled. Baseline requirements included the strength of their regulatory environment, their generally good overall reputation with clients earned over an extended period and a substantial number of currency pairs available for trading.

Fxdailyreport.Com

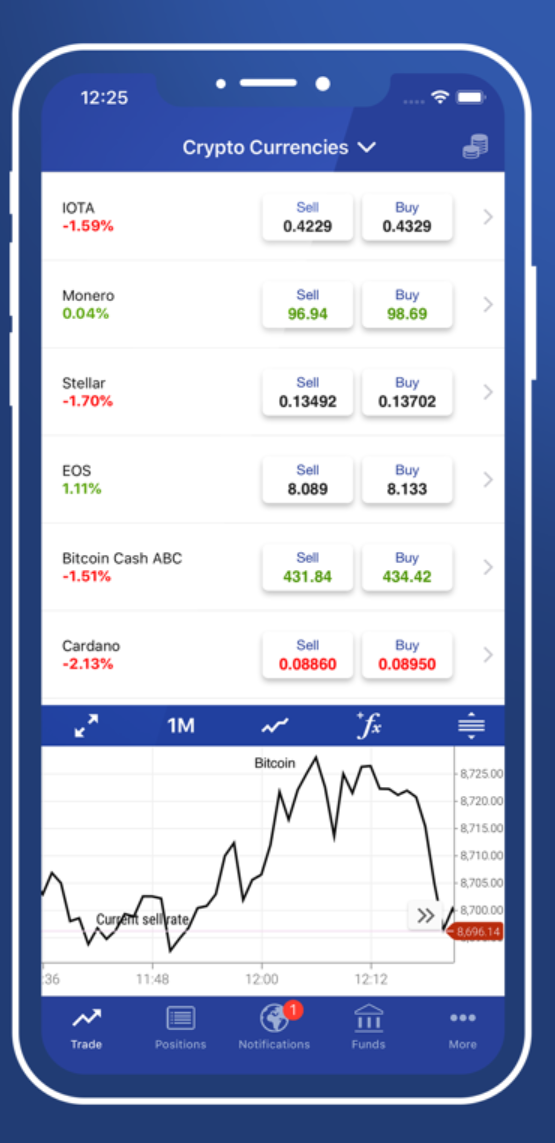

Over the last few years, cryptocurrency trading has become one of the most attractive niches in forex trading. Other than it being extremely profitable, the lack of regulation is its biggest appeal. Still, cryptocurrencies like bitcoin, ethereum ripple, dash, and litecoin are dynamic, unstable instruments that need to be handled cautiously and in the most optimal way. To achieve this, you need to choose a trustworthy, well-established broker to carry out your cryptocurrency trading.

This is crucial to getting on the right track from the beginning when trading cryptocurrencies. When choosing a broker, it is important to note that not all are the same. A broker that meets the needs of another trader may not meet yours. Here are a few tips to help you choose the best forex broker for cryptocurrency trading:

- Regulation and reputation

To avoid dealing with an unprofessional broker and being scammed, you need to make sure all your crypto trades are made solely with a regulated broker. When choosing a forex broker to work with, make sure they are regulated within your jurisdiction to legally offer you their services. Regulated forex brokers are under constant supervision of the regulatory body. If you are in the UK, make sure to trade with a broker that is regulated by the FCA. If in europe, ensure they are regulated by the cysec. In case you are in australia, they should be regulated by the ASIC.

- An efficient trading platform

It is important to note that cryptocurrency trading is more volatile than forex. Therefore, it demands that the platform is superbly responsive to be able to make moves in time. A good broker’s platform should be efficient to use. To beat the competition, the best cryptocurrency brokers work to attract clients by creating an intuitive trading platform that is suitable for both experienced and new traders. They offer technical analysis tools and basic risk management features like take profit or stop loss. Other sites also offer additional features, including price alerts, social trading networks or advanced educational centers. The crypto trading platform should allow you to trade in the market manage your accounts, perform technical analysis, and receive the latest news on all cryptocurrencies.

Top recommended crypto forex brokers in 2021

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: 0 spread: non-spread, fee 0.1% per trade leverage: non-leverage regulation: - | visit broker | ||

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

- Transparent fees and commissions

All brokers, whether trading crypto coins or forex, charge commissions and offer margin accounts to traders. A reliable forex broker for crypto coins should inform you precisely the type of fees and commissions they charge as well as the risks involved. The common fees and charges made by brokers include:

• wallet fees

• transaction fees

• trading fees

- Competitive technology

The last thing you want as a crypto trader is to get margin called simply because you could not log in to close an order. The cryptocurrency trading market is a 24/7 global market. The prices keep moving and are not limited to your time zone. Hence, when choosing a broker, you need to choose one whose platform offers full-time access.

For instance, when trading cryptocurrencies, mobile apps are a necessity as you may need to make or break deal-critical decisions throughout the day. If possible, consider using a reputable broker with a mobile app so that you are able to make successful trading decisions even while in transit.

- Access to crowd wisdom

Today, there are some broker platforms that let you leverage the wisdom of seasoned cryptocurrency traders. This feature can go a long way in improving your returns on investment. Such a trading platform lets you observe the hottest trading trends of other seasoned and successful traders in the market.

Digital currencies trading keeps growing in popularity by the day. More and more people, be it speculators or beginner traders want to be able to make key decisions on time, every minute. Therefore, they need to have a setup ready as soon as they are verified by a broker. When choosing a cryptocurrency broker to trade with, consider one that can quickly get you started so that you can begin trading with minimal downtime.

- User-friendly platform

This is one of the most important features to consider when choosing a trading platform to trade with. Digital money trading can be unclear, especially when a technical language is used. Also, because digital money works a little bit differently from any traditional money system. A good broker should be able to understand blockchain and cryptography terms. They should make an effort to explain it in their platform to make it easy to understand by a layman.

They should include clear notifications about the spreads offers, leverage available, deposit methods, the minimum cryptocurrency deposit to trade and the least amount that can be placed in a trade. Make sure you are able to establish all these details before registering with a broker.

- High-quality customer service

Cryptocurrency trading occurs 24/7. This demands the need for round the clock customer support. Better still, live support is highly preferred over auto attendants taking into consideration the intricacies involved in trading digital currencies.

- Deposits and withdrawals

Make sure to choose a broker that allows deposits and withdrawals through multiple platforms such as wire transfer, credit/debit card e-payment among others.

- Good financial backing

A good FX broker for cryptocurrency should have a sound financial backing. This ensures that your digital coins are safe and that the forex broker will not go bankrupt soon after signing up with them.

Cryptocurrency trading is a risky investment. New and fraudulent forex brokers for cryptocurrency trading are emerging every month, launching with crafty marketing campaigns intended to prey on an innocent investor. Therefore, ensure you proceed with caution. Cryptocurrencies are extremely volatile instruments to trade. So, ensure you are in the know of any breaking news, regulatory matters, and rumors which all dictate the market behavior. Above all, make sure you are working with a reputable, reliable and experienced broker.

While it would be easier to point a finger and tell you the best crypto broker, we know and understand that each client has different preferences. Be knowledgeable about all your options and think about how you can spot a broker that is safe now, and in the long-run.

6 причин выбрать justforex

Спреды от 0 пунктов

Низкие плавающие спреды на всех типах счетов, спреды на raw spread от 0 пунктов.

Две версии торговой платформы metatrader

Вы можете выбрать платформу MT4 или MT5 в соответствии с вашими потребностями и предпочтениями.

Кредитное плечо до 1:3000

Возможность выбрать удобное кредитное плечо от 1:1 до 1:3000.

170+ торговых инструментов

Мы предлагаем ряд валютных пар, драгоценных металлов для трейдеров, которые хотят зарабатывать на разных рынках.

Все стратегии разрешены

Использование советников, торговля на новостях, хеджирование, скальпинг и т.Д.

Исполнение ордера от 0,01 с

Исполнение ордера при нормальных условиях на рынке происходит за доли секунды.

Я начал работать с этой компанией после того, как получил welcome-бонус в прошлом году. Условия я выполнил, деньги получил. Продолжаю работать и не планирую менять брокера.

Я – новичок в форексе, но мне очень нравится профессионализм этой команды. Поддержка работает круглосуточно и отвечает на все вопросы. Они даже помогли мне найти хорошие статьи по форексу и открыть демо счет. Раздел "аналитика" – просто обязателен, как для новичков, так и для профи. Лично я читаю его каждый день и рекомендую каждому это делать. JF, вы – лучшие!

Я торговал с разными брокерами, и justforex – самый честный, как по мне. Проблем с выводом, верификацией и торговлей нет. На все вопросы отвечают и действительно стараются решать проблемы. Хорошие ребята, обратите на них внимание.

Я торгую с JF уже почти год. И за этот год проблем вообще не было. Мне нравятся их конкурсы и промо-акции – это хорошая возможность испытать себя и подзаработать в процессе. Больше всего мне нравится счет raw spread – нет проскальзываний, быстрое исполнение и очень много пар для торговли. Просто мечта. P.S. Спасибо за вашу работу, народ, мы видим как вы стараетесь!

Эрик из поддержки – молодец! У меня были проблемы с регистрацией карты, но вы во всем разобрались за пару минут. Я вывел уже больше 1 000 USD и продолжаю торговать.

Top 10 best forex brokers in india for 2021

Top rated:

So you are a forex trader, or a new trading looking to break into the forex trading world in india? You have likely considered the global and indian forex market very carefully.

When thinking about which of the top forex brokers offer to take up on opening an account, you may or may not have considered brokers in india, or at least those that are available for indian citizens. If that is the case, then you find yourself in the perfect place.

Here we have taken at the foreign exchange market for indian citizens and compiled a listing of the best forex brokers in india just for you.

Table of contents

Is forex trading illegal in india?

For indian citizens, this is the key question when getting involved in forex trading. The simple answer here is no. This however comes with some complexities for indian forex traders that we will explain.

Forex trading in india is regulated by SEBI (securities and exchange board of india) similarly to the way in which foreign exchange and trading is regulated in other countries. The difference comes though with the fact that the RBI (reserve bank of india) has made trading with some other currencies and the indian rupee illegal for fear of devaluing the indian currency.

With that in mind then, the only forex trading acceptable for indian forex traders to participate in is that of INR based pairs with major currency the USD, EUR, GBP, and JPY. The indian government have recently relaxed the rules to allow the introduction of trading on other major foreign currency pairs such as EUR/USD, GBP/USD, and USD/JPY. Other pairs are currently not available.

When it comes to online forex brokers and the indian forex market, it is however illegal for indian forex traders to use any online forex trading platform that is not regulated by SEBI. If you are reading this review as an indian citizen based abroad, then you typically have more freedom from these regulations and you can follow the regulations of your local area.

Disclaimer: the following top 10 illustrates international forex brokers that offer forex trading services in india. However, we couldn’t find any information regarding their SEBI compliances (except from alpari). If you’re based in india, and you want to open an account with them, contact local experts before taking any further action.

Top 10 of the best forex brokers in india today

1. Alpari

The first broker we will take a look at for indian forex trading is alpari. This is the only international broker that is considered a SEBI compliant forex broker for indian traders. As an indian forex trader or any other, we would recommend that you display some degree of caution in your forex trading here. This is due to the revocation of many of their top-tier regulations due to 2015 bankruptcy.

The broker is still regulated offshore by the FSC (C113012295). For indian citizens you can check up on the companies regulatory licensing through SEBI with the following registration numbers:

INE271381233

INE231376935

INE261383637

With alpari, there are no INR currency pairs available, though the other permitted pairs for indian traders are certainly available. The spreads with this broker start from 0 pips with the ECN accounts.

There are a total of 3 retail accounts available for indian traders. The standard account, ECN account, and micro account. The alpari minimum deposit starts from $5 for the micro account, $100 for a standard account, and $500 for ECN account holders. You can deposit indian rupee through a local bank transfer or neteller. This may incur some fees.

So, let's see, what was the most valuable thing of this article: discover our top 10 featuring the best brokers for indian traders, including useful advices and information about forex trading regulation in india. At broker for forex trading

Contents of the article

- Free forex bonuses

- Top 10 best forex brokers in india for 2021

- Is forex trading illegal in india?

- Top 10 of the best forex brokers in india today

- Best forex brokers for beginners in 2021

- What is forex trading?

- What is a forex broker?

- The best forex brokers for beginners

- Educational materials comparison

- How much money do you need to trade forex?

- What are the most popular currency pairs?

- Can you get rich by trading forex?

- How do I start trading forex?

- How do I choose a forex broker?

- Which forex brokers accept US or non-US clients?

- The best forex trading platforms for beginners

- Read next

- Methodology

- Forex risk disclaimer

- Trade with the global forex trading specialist

- Why FOREX.Com?

- Financial strength you can depend on

- Leverage our experts

- Ready to learn about forex?

- New trader?

- Have some experience?

- Want to go deep on strategy?

- Not sure where to start?

- Open an account in as little as 5 minutes

- Try a demo account

- Top 10 best forex brokers in india for 2021

- Is forex trading illegal in india?

- Top 10 of the best forex brokers in india today

- Trading advantages of roboforex forex broker

- Roboforex bonus programs

- Profit share bonus up to 60%

- Classic bonus up to 120%

- Cashback (rebates) up to 15%

- Up to 10% on account balance

- Account types

- Trading platforms

- Roboforex trading platforms

- Exclusive trading platforms

- Roboforex bonus programs

- Security of client's funds

- 8 asset classes

- 0% commissions

- Instant withdrawals

- Become an investor on forex

- Roboforex market analytics

- Forex analytics

- Forex technical analysis & forecast for february...

- Fibonacci retracements analysis 01.02.2021 (GOLD,...

- The aussie is being pulled down. Overview for...

- Economic calendar

- Exclusive market analytics

- Company news

- Roboforex: changes in trading schedule (martin...

- Roboforex: changes in trading schedule (christmas...

- Roboforex received prestigious awards of the...

- Forex analytics

- Winner of more than 10 prestigious awards

- Best investment products (global)

- Best partnership program (LATAM)

- Most trusted broker

- Most transparent asian forex broker

- Best global mobile trading app

- Best broker of the CIS

- Official sponsor of "starikovich-heskes" team at...

- Official sponsor of muay thai fighter andrei...

- 8 asset classes

- Best forex brokers

- Best forex brokers right now:

- The best forex brokers

- Account minimum

- Pairs offered

- Minimum trade size

- Spread

- Commisions

- 1. Best overall forex broker: FOREX.Com

- 2. Best for ultra-low spreads: cedarfx

- 3. Best for beginner traders: etoro

- 4. Best for non-US traders: HYCM

- 5. Best for commodities: avatrade

- 6. Best for intermediate traders: pepperstone

- 7. Best for advanced forex traders: interactive...

- 8. Best for mobile traders: plus500

- 9. Best forex platform: IG markets

- Forex market explained

- Risk and reward in forex trading

- Choose your broker wisely

- Methodology

- Fxdailyreport.Com

- Top recommended crypto forex brokers in 2021

- 6 причин выбрать justforex

- Спреды от 0 пунктов

- Две версии торговой платформы metatrader

- Кредитное плечо до 1:3000

- 170+ торговых инструментов

- Все стратегии разрешены

- Исполнение ордера от 0,01 с

- Top 10 best forex brokers in india for 2021

- Is forex trading illegal in india?

- Top 10 of the best forex brokers in india today

No comments:

Post a Comment