1:5000 leverage

- Single universal platform without requotes or order deviations.

- Offers limitless possibilities for different trading styles and manages multiple activities.

- Cross-connects with liquidity providers, ecns, exchanges, and technology providers for the lowest possible latency.

Free forex bonuses

All transactions are handled securely without any additional fees on transactions made for from our side, however, please be reminded that some PSP’s or your bank may have their own charges.

1:5000 leverage

Hextra prime average spread is one of the best raw spreads available with fast order execution in A real, deep, diverse, liquidity you can trade on.

- Our diverse and proprietary liquidity mix keeps spreads tight 24/7

- Lightning-fast order execution with a speed of only milliseconds.

- Low latency fiber-optic server to reduce slippage

Execute larger positions

When using leverage, one should always remember about risk management even when your account is protected with negative balance protection and stop order.

- Trade positions larger than the amount of money in your trading account.

- Leverage depends on the account type and the amount of equity in the account.

- Decide what leverage to trade with ranging from 1:1 to 1:5000

All-time best bonus programs

Hextra prime offers clients multiple trading benefits; starting with a 100% welcome bonus as well as the 50% deposit bonus, both support floating & margin bonus.

- Start with 100% welcome bonus on your first deposit on each account.

- Upscale your equity and profit by subsequently funding your account and get the 50% deposit bonus.

- All clients are eligible for bonuses per IP address with a amass amount of bonuses.

World’s popular metatrader 4

An all-rounder platform, offering flexible trading systems, expert advisors, and the ability to execute your winning strategy whatever the complexity.

- Single universal platform without requotes or order deviations.

- Offers limitless possibilities for different trading styles and manages multiple activities.

- Cross-connects with liquidity providers, ecns, exchanges, and technology providers for the lowest possible latency.

Your money your way

All transactions are handled securely without any additional fees on transactions made for from our side, however, please be reminded that some PSP’s or your bank may have their own charges.

- Zero markup fees on deposits and withdrawals for all methods.

- No hidden fees or commissions will be stated if it is there.

- Funds deposited in the same amount credited to your account

Institutional grade trading

Execute larger positions

All-time best bonus programs

Hextra prime offers clients multiple trading benefits; starting with a 100% welcome bonus as well as the 50% deposit bonus, both support floating & margin bonus.

- Start with 100% welcome bonus on your first deposit on each account.

- Upscale your equity and profit by funding subsequently your account and get the 50% deposit bonus.

- All clients are eligible for bonuses per IP address with a amass amount of bonuses.

World’s popular metatrader 4

Your money your way

INTRODUCING BROKERS

Beneficial features that A partnership needs:-

Become our partner and start earning an ongoing commission on trading activity for every client referred to hextra prime based on our partnership program and commission structure.

Up to 70% from lot traded commission

10% on sub-affiliates income

Sales commission on target based

Variety of extra commissions

Low to zero cost to start

Access to detail statistics

Marketing support provided

INSTRUMENTS AVAILABLE

Global markets at your fingertips

Forex

Forex market is the largest and most traded financial market in the world, that opens 24 hours a day, five days a week being traded both online and offline with price quotes changing constantly.

Metals

Highly valued since ancient times, precious metals were always associated with monetary wealth, while base metals are often more abundant in nature and sometimes easier to mine and far less expensive for use in manufacturing.

Energies

Energies are innately volatile markets due to the direct effect that world events can have including economic growth, political instability in oil and gas producing countries, weather forecasts, extreme weather conditions, and government regulations.

Cryptocurrencies

Cryptos are digital currencies that are decentralized and exponentially changing the financial sector through the use of blockchain technology, make them perfect for trading 24 hours a day, for straight 7 days a week without stop.

Indices (coming soon)

Indices, also known as stock indexes, measure a specific section of the stock market’s price performance of a group of stocks allowing you to become exposed to a whole sector by opening up a single position.

Soft commodities (coming soon)

The soft commodity is known as agriculture products refers to futures contracts where the actuals are grown rather than extracted or mined also sometimes referred to as tropical commodities or food and fiber commodities.

Forex

Forex market is the largest and most traded financial market in the world, that opens 24 hours a day, five days a week being traded both online and offline with price quotes changing constantly.

Metals

Highly valued since ancient times, precious metals were always associated with monetary wealth, while base metals are often more abundant in nature and sometimes easier to mine and far less expensive for use in manufacturing.

Energies

Energies are innately volatile markets due to the direct effect that world events can have including economic growth, political instability in oil and gas producing countries, weather forecasts, extreme weather conditions, and government regulations.

Cryptocurrencies

Cryptos are digital currencies that are decentralized and exponentially changing the financial sector through the use of blockchain technology, make them perfect for trading 24 hours a day, for straight 7 days a week without stop.

Indices (coming soon)

Indices, also known as stock indexes, measure a specific section of the stock market’s price performance of a group of stocks allowing you to become exposed to a whole sector by opening up a single position.

Soft commodities (coming soon)

The soft commodity is known as agriculture products refers to futures contracts where the actuals are grown rather than extracted or mined also sometimes referred to as tropical commodities or food and fiber commodities.

ELECTRONIC COMMUNICATION NETWORK

ECN account types

Trading platform :

Meta trader

Commission

(per 0.01 lot)

Spreads from

(pips)

No bonus

Try free demo

Trading platform :

Meta trader

Commission

(per 0.01 lot)

Spreads from

(pips)

Bonus available

Try free demo

ECN trading

Start trading in 4 steps

1. Register

Open your account with hextra prime

2. Verify

Upload documents to verify your account

3. Fund

Make a deposit and claim your bonuses

4. Trade

Start trading on variety type of market and instruments

Powered by ECN technology

CONTACT US 24/5

COMPANY

TRADERS

PARTNERS

RESOURCES

SHORTCUTS

Information

Legal announcement: hextra prime is incorporated in saint vincent & the grenadines as a licensed business company under financial services authority with registration number 25989 BC 2020. The website is owned and operated by hextra prime group of companies.

General disclaimer: trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses. The company under no circumstances shall be liable to any persons or entity for any loss or damage in the whole or part caused by, resulting from, or relating to any transactions related to cfds. Hextra prime assumes no liability for errors, inaccuracies, or omissions, does not warrant the accuracy, completeness of information, text, graphics, links, or other items within these materials.

Risk warning: trading leveraged products such as forex and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments and level of experience, before trading, and if necessary, seek independent advice.

Regional restrictions: hextra prime currently only accepts clients from asia & pacific confederation specifically from south east asia. Hextra prime does not provide services to residents of the americas region, arab states, CIS countries, and european nations.

Information

Legal announcement: hextra prime is incorporated in saint vincent & the grenadines as a licensed business company under financial services authority with registration number 25989 BC 2020. The website is owned and operated by hextra prime group of companies.

General disclaimer: trading forex, cfds, and any financial derivative instruments on margin carries a high level of risk and may not be suitable for all investors, as you could sustain losses. The company under no circumstances shall be liable to any persons or entity for any loss or damage in the whole or part caused by, resulting from, or relating to any transactions related to cfds. Hextra prime assumes no liability for errors, inaccuracies, or omissions, does not warrant the accuracy, completeness of information, text, graphics, links, or other items within these materials.

Risk warning: trading leveraged products such as forex and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investments and level of experience, before trading, and if necessary, seek independent advice.

Regional restrictions: hextra prime currently only accepts clients from asia & pacific confederation specifically from south east asia. Hextra prime does not provide services to residents of the americas region, arab states, CIS countries, and european nations.

MT4 & MT5 forex brokers - highest leverage ranking 2018

Have you seen the FX leverage 1:5000?

‘leverage’ is a powerful tool for forex traders.

By utilizing higher leverage, you can invest even from 1 USD in forex market.

The average leverage available in forex market is around 1:200 – 1:500 .

But did you know that there are online FX & CFD brokers which offer extraordinary leverage?

In the below page, you can check out the ‘ranking of the highest FX leverage’.

Now, let’s review the top 3 brokers with the highest leverage in the world!

1. Forexmart – 1:5000 leverage

EU regulated MT4 broker, forexmart offers the highest forex leverage in the world.

Although, the condition (leverage 1:5000) is available only to residents of limited countries .

You maybe eligible to take advantage of this trading condition?

Visit forexmart’s official website from below to find out!

NBP (negative balance protection) is fully supported .

2. FBS – 1:3000 leverage

FBS’s 1:3000 leverage is available for all traders.

The broker with over 8 million traders registered . It’s not just the leverage, but they also have 10 attractive bonus promotions and great trading conditions.

You can start with $50 no deposit bonus and $123 no deposit bonus, to find out how FBS is providing amazing service for traders.

1:3000 leverage is available with standard, ECN and zero spread account types.

NBP (negative balance protection) is fully supported .

3. Justforex – 1:3000 leverage

Justforex’s 1:3000 is available on MT4 for traders from all over the world.

Only with hercules finance, you can get the following conditions in one MT4 account:

- Leverage 1:3000

- Unlimited $5 per lot cash back

- 100% deposit bonus to get up to $20,000 (available for withdrawal after trading)

You wouldn’t miss out this opportunity. Signup from below to take advantage of all the above promotions!

NBP (negative balance protection) is fully supported .

Post tags

- #FBS

- #forex

- #forexmart

- #FX

- #justforex

- #leverage

- #metatrader4

- #MT4

- #MT5

- #ranking

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

Forexmart with 1:5000 leverage, introduces "market analysis" section updated everyday

Launch of “analytical reviews” section by forexmart.

Forexmart, the online FX broker in cyprus, is happy to announce that the broker has just released the “market analysis” section.

Since then you won’t have to look for financial analytics on third-party resources – you just need to visit the relevant section on the forexmart website.

In this new analytical section it will be possible to find up-to-date information about popular currency pairs, trade ideas and recommendations, as well as analytical reviews, forecasts, charts and overall description of the current market situation .

Forexmart hopes that this innovation makes your trade more convenient and pleasant.

Stay tuned and remain abreast of the latest economic trends with forexmart!

Forexmart with world’s highest leverage

The cypriot FX broker, forexmart is also proud to offer the highest leverage in the world.

The leverage 1:5000 is provided only by forexmart .

Along with the many bonus promotions they offer, there are many advantages on their trading conditions.

Currently, the broker is running following types of bonus promotions.

- No deposit bonus

- Deposit bonus

- Cash back

- Trading contest

Check out the latest offer in the page below!

Forexmart

Post tags

Forexmart with official EU license and leverage 1:5000. Many promotions are available!

Comments

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Can someone show me how calculation for withdraw?Let say i make 3 lot size and making profit 50 us.How much can withdraw?

There are many brokers like forexmart, but none of them are exactly like it. I don’t know what’s the difference but general conditions and the support team attitude are very very nice.

Good service and transparency. The only worth place to trade forex.

The more I trade with forexmart, the more I have a feeling of choosing the right broker, good luck to all!

Opened an account at forexmart recently. At first glance they got some interesting services. Especially the leverage made me happy )))

I became interested in bitcoin, a very popular currency right now in italy. I decided to trade exactly with it. By the way, it’s not so easy to find a broker which allows to trade with bitcoin. Forexmart gives such an opportunity. I have been trading with it for about a month. Bitcoin is growing, I read a lot of information on it, including the broker’s analytics. Well, a good profit comes out )

I traded with forexmart in my free time to earn money for vacation. Bingo! – I withdrew all my money yesterday. Well not all, but those over the bonus

Related

Page navigation

Related posts

Features

Axiory $25 no deposit bonus

Windsor brokers loyalty programme

Windsor brokers 20% deposit bonus

Windsor brokers $30 free account

US stocks pre-market trading is now available with exness

FBS 12th anniversary raffle

Land-FX wins the best trading platform award by world forex award

MTN money payment is available for rwanda

Traders trust adds exotic FX pairs - HKD, SGD, CZK, ZAR and more

Interviewing the top forex trader who won the hotforex contest

What's the most profitable forex currency pairs?

Make a deposit to yadix MT4 with perfect money

All forex brokers

All crypto-currency exchanges

Latest article

Axiory $25 no deposit bonus

How to get axiory's $25 no deposit bonus to trade forex for free?

Windsor brokers loyalty programme

Windsor brokers' loyalty programme will reward you for redeemable points.

Windsor brokers 20% deposit bonus

Deposit at least 500 USD to get 20% bonus from windsor brokers.

Windsor brokers $30 free account

Open windsor brokers' $30 free account to start trading without risking your own funds.

US stocks pre-market trading is now available with exness

What is pre-market trading of US stocks? How does it work?

FBS 12th anniversary raffle until 2021/7/1

FBS celebrates the 12th anniversary with prizes totaling $1,200,000.

Land-FX wins the best trading platform award by world forex award

Land-FX MT4 and MT5 are awarded as the best trading platform.

Page navigation

Hercules.Finance

Sitemap

Services

- Bonds

- Cfds

- Commodities

- Copy trade

- Cryptocurrency

- Energies

- Etfs

- Forex

- Indices

- Metals

- Mirror trade

- Social trade

- Stocks

Promotions

Community & support

Who is hercules.Finance?

Hercules.Finance is a financial education website powered by a team of financial specialists and IT experts, mainly introduce solutions of forex, CFD and commodity investment, and a number of payment services. With more than 30 partnered companies all over the world, hercules.Finance offers trusted and timely information for investors and users of the services. By referring to hercules.Finance, you can find all latest news/information, financial technical/fundamental analysis, main/exclusive bonus promotions of partnered companies and a number of educational materials of finance. For the list of all partnered companies, please visit here. For more latest information of the website, please visit hercules.Finance.

Risk warning

Foreign exchange and contracts for difference ("cfds") are complex financial products that are traded on margin. Trading forex & cfds carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, forex & cfds may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Past performance of forex & cfds is not a reliable indicator of future results. All information on hercules is only published for general information purposes. We do not present any guarantees for the accuracy and reliability of this information. Please note the spreads displayed in the website are all included extra trading commissions, as it shows the whole commissions charged by each broker. Before you engage in trading foreign exchange, please make yourself acquainted with its specifics and all the risks associated with it. Any action you take upon the information you find on this website is strictly at your own risk and we will not be liable for any losses and/or damages in connection with the use of our website.

1:1000 leverage on ECN accounts. Yes, and I am a hobgoblin

FXTM claims that it can offer 1:1000 leverage on all accounts that are executed via a ‘live market’ ECN. We suspect that this is not the case and that all such orders are being executed internally via a dealing desk, as no liquidity provider or aggregator in the world will allow this. Here are our findings

This is one of those moments in which a choice is presented as to whether to fall off one’s chair in disbelief, or to dismiss such a claim outright.

Retail FX brokerage FXTM, which is an acronym for forextime, that operates in cyprus and is owned by alpari founder andrey dashin, has made a very bold claim that it is allowing a stratospheric leverage ratio of 1:1000 on accounts whose trades the company claims are executed via an electronic communications network (ECN).

An ECN is an electronic execution network which consists of a series of bank and non-bank liquidity providers, therefore when a FX or electronic trading company that operates on an OTC (over the counter) basis states that it offers an ECN execution model, it is stating that it is not internalizing any trades and is sending them to the liquidity provider, which then executes them via the network of aggregated liquidity providers which includes banks and institutional venues.

Making a claim to offer leverage to retail customers at a ratio of 1:1000 even if execution is taking place on a b-book basis is alarming enough, as most of the time, small retail accounts will not be capitalized enough in the live market to be able to make any winning trades, and in ALL recognized regulatory jurisdictions, offering such high leverage to retail clients is illegal, except for with dealing desk licenses in cyprus.

FXTM is able to circumvent such legislation by offering this facility via its IFSC (belize) registered company, and belize, as per many offshore, unrecognized jurisdictions, means pretty much no recourse for clients if something goes awry.

Aside from the regulatory disdain for high leverage around the world, and the odds which are stacked against retail customers in such a highly leveraged environment, there is absolutely no way possible that any retail firm would be able to execute trades via a liquidity provider rather than their own dealing desk at this ratio.

The extension of credit, and risk management procedure of tier 1 banks to OTC derivatives firms is at an all time low. Banks absolutely do not want to extend credit, even to firms that operate in recognized jurisdictions, are massively well capitalized and have a maximum leverage ratio of 1:25.

Citibank, the world’s largest interbank FX dealer by percentage of global order flow (over 16% of the global tier 1 FX liquidity market) has stated that it considers the extension of credit to OTC derivatives firms and liquidity providers a potential default risk ratio of an astonishing 56% – and that is among top quality and well capitalized business which is conducted in top quality regions. Not firms offering 1:1000 leverage in offshore jurisdictions with lax regulation.

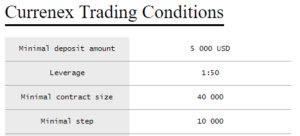

Source: currenex.Com

Putting out a message to potential customers that they are able to execute trades at a ratio of 1:1000 on a live market is, in our opinion, completely misleading, and is damaging to our otherwise very sophisticated industry whose top quality companies in britain, australia, cyprus, north america and the far east are continually striving for the provision of the best quality trading environments for their customers.

A look at FXTM’s cysec license shows that the firm is registered as “dealing on own account” which translates to a b-book license. We spoke to former employees at FXTM, all of whom confirmed that 95% of order flow is internalized.

In our quest to examine the rationale behind FXTM’s tall claim, and in the interests of upholding the quality reputation of liquidity providers and institutional firms around the world in that they do not engage in provision of such trading terms, financefeeds contacted senior executives at FXTM for comment on this matter.

Demetrios zamboglou, branch manager at FXTM’s UK office explained to financefeeds “this will just mean that if the prime broker provides 1% i.E. 1:100 then FXTM needs to have 10 times more in their PB account at all times to cover the client. In other words, the company deposited a lot of money with their liquidity providers.”

Financefeeds then contacted FXTM’s customer services department this morning and asked how it is possible to offer 1:1000 on a live market, with no dealing desk. The representative explained “as of september 1 this year, we will be offering 1:1000 on all ECN accounts.”

Financefeeds asked the representative how this can be when absolutely no liquidity provider or tier 1 bank will extend such a high ratio he said “we have the liquidity, therefore we can offer it. If the broker has a large liquidity, then this is entirely possible.”

The representative then asked us to open a demo account and to be able to view the leverage ratio. At that point, financefeeds asked the representative to explain how opening a demo account would show whether trades are being internalized or not, and he said “there is no dealing desk. We have different liquidity providers and execute trades via them”.

Bottom line – there is no way of telling, and we maintain that no liquidity provider will extend such high leverage to OTC derivatives firms.

In order to gain further perspective on risk management relating to high leverage, financefeeds took a close look at the trading conditions provided by ecns and prime of primes.

All ecns are very conservative. Currenex, one of the very largest, has a maximum leverage limit of 1:50.

Hotspot FX is an institutional ECN, and does not extend credit or leverage to its clients. Leverage and associated credit is determined by the client’s prime broker. Most prime brokerages today offer a maximum of 1:50.

1:1000 is theoretically possible in some cases but very very unlikely to ever be carried out – here is how it works

There are cases in which banks and liquidity providers can extend 1:1000 trading conditions to brokerages (that are not located in recognized regulated jurisdictions that restrict leverage on a national basis) and in order to find out, financefeeds met today with an institutional FX specialist in london who has direct relationships with tier 1 banks.

This particular senior executive explained “it is possible to do this as long as you as a broker can bridge the margin gap.”

He continued “whether it is a good idea or not is another thing entirely. If a broker offers this to ten clients and they have a maximum net open position of $10 million each, then the theoretical open positions across all clients would be $100 million and I would say they are all long or short. Clients would only give a broker $100,000 in total for this position, but the broker might be ok to do this as long as it has enough margin to cover the margin requirement at the liquidity provider.”

“currently, banks on average impose an average charge of 3% on USD or EUR, so therefore the broker’s requirement would be $3 million for margin on each of those trades” he explained.

“therefore, the broker would need to use $2.9 million of its own money to cover the gap, and in theory might need $3 million if those clients are segregated, therefore the broker not being able to use their funds for margin at the bank.”

When asked if he would extend such high leverage to a retail broker, this particular senior executive said “no we would not, the maximum we would allow is 1:50. Banks often keep it down to 1:33. Only market making brokers go over 1:100 as they cannot fund the gap if they are STP (straight through processing).”

According to standard practice, the larger a brokerage is, the more likely that its positions will net off to some extent, therefore if the firm has 20 clients, 10 could be long $100 million and 10 could be short $50 million, so therefore the overall position is $50 million but the broker has received margin for $150 million. In a circumstance like this, with $1.5 million margin receives the broker’s net position is $50 million with its prime brokerage, therefore at 3% it owes $1.5 million in margin.

If this is the case, then the client margins equal the broker’s bank margin requirements but in theory all clients could go the same way and the brokerage could owe more money to the banks than it has from clients.

On this basis, it can be considered nigh on impossible that FXTM is actually processing orders with 1:1000 leverage on anything other than its own dealing desk, and that the only way that it is not doing so is if it is passing the trades to another market maker, which would also debunk any inference that this is ECN execution, as offloading to another market maker does not equal an aggregated network of liquidity.

Best high leverage forex brokers 2021

Online trading has become more accessible for the average person since the rise of the internet. Brokerage houses quickly spotted the opportunity and provided retail traders access to the financial markets via leverage.

Trading financial markets, like the FX market, can be expensive and without leverage simply impossible for the retail trader. Leverage, however, is a double-edged sword – while it enables traders to multiply their position sizes, it also increases the risk involved.

Top brokers for leverage

Below is the choice of forex brokers who provide 500:1 and 400:1 leverage options. Let’s compare!

Do you know another forex broker that offers the highest leverage of 400:1 or higher?

Please suggest by adding a comment below.

What is leverage?

Simply put, leverage acts as a multiplier of a trader’s capital. Enabled by the broker, this allows the trader access to markets they would not be able to otherwise trade.

Leverage determines the amount traders move on the actual market. For instance, on a trading account having a leverage of 400:1, traders move on the real market 400 times more than the actual position in their retail account.

How does leverage work?

The leverage level of a broker is usually expressed as a ratio. It demonstrates a particular percentage of the total available capital that a trader is required to have in their account (e.G. Leverage 1:100 requires 1% margin).

Trading with leverage is common and simple as the only requirement is for a margin minimum held by the trader. It establishes the amount of money a broker requires from a trader to open a position and is expressed in percentages.

So let’s look at how leverage trading works:

A trader wants to open a trade with a contract size of 100,000 per lot but does not have the $130,000 to put down.

Using leverage of 1:500, he or she can dramatically reduce the amount of capital required.

$130,000 / 500 (leverage used) = $260.00 required capital

Using this leverage size, we can use a simple formula to work out the amount of investment needed:

Buy trade: ask price x contract size / leverage

Sell trade: bid price x contract size / leverage

1 lot = 100,000 contracts (contracts worth is based on the underlying instrument which in this case is GBP)

GBP/USD, 100 000 contracts are worth 100 000 units of GBP.

What is leverage trading?

Leverage trading increases the accessibility to financial markets by enabling retail traders to trade more significant volumes than otherwise possible. For instance, in a 1:1 leverage trading account, one can move on the market $1 for every $1 in the trading account. That’s not enough to trade multiple positions, and the volume moved would be so small that it won’t impact the value of a trading account.

Without leverage, the margin needed for a trade would often exceed the size of the account, making it impossible for retail traders to participate. In other words, to move $200,000 on the market you’ll need to come up with a deposit of $200,000, whereas only $1000 in a 200:1 leveraged account.

How to use leverage correctly

Money management is key when trading with high leverage. First, it is important to know how much a pip movement affects the trading account. That helps to establish the risk for each trade. Second, make sure that the target exceeds the risk involved.

For instance, if the risk per each trade is 1%, the reward should exceed 1%. For some, the minimum risk-reward ratio for each trade is 1:2, meaning the trading account stands to make $2 for every $1 risked on any given trade. This way, traders avoid the negative effects of leverage and benefit from it.

Guide to find a high leverage broker?

There are many forex brokers in the marketplace that offer high leverage trading. To make an informed choice, it’s best to consider several factors:

- Do they offer a demo account?

- What trading platform are they using (MT4/MT5)?

- Where are they regulated?

- What platforms do they offer?

- How much leverage do they offer?

- What are the fees and on-going costs?

Which brokers offer high leverage?

Some forex brokers limit the maximum leverage on currency pairs to 1:25, 1:50, or a similar ratio. Obviously, these brokers are acting outside of jurisdictions imposing such restrictions. Current maximums on forex instruments that regulated forex brokers in the US may offer only leverage of 1:50, while the european broker under ESMA allowed using only 1:30.

It is not uncommon for some high leverage forex brokers to offer accounts in their offshore subdivisions with a much higher leverage under the same company management.

It is recommended to look into the average leverage offered across different asset classes to get a feel for what’s reasonable. For example, the maximum leverage for various financial instruments and commodities may look as follows:

Forex – 1:500

metals – 1:500

indices – 1:200

energy – 1:200

crypto – 1:100

Pros and cons of high leverage

Forex trading and high leverage pair well together as the number of people interested in entry into the speculative financial markets increases. As with every other financial instrument, there are inherent risks, but when handled with caution – high leverage trading on the forex market carries certain advantages.

- It opens opportunities to trade larger volume of currency pairs with an initially small balance.

- Traders can use “borrowed” capital as a funding source for forex trading.

- Multiple respected authorities like US FMA and CFTC, australian ASIC and european ESMA oversee and issue regulatory guidance on high leverage trading.

- Free demo accounts to learn before trading with real money.

- It opens access to many new markets, previously unaffordable for small traders and investors.

- Minimal margin requirements.

- There is a high potential to lose funds more easily.

- Some forex brokers offer unreasonably high leverage ratios (alike 1:1000)

- Many offshore brokers who circumvent industry and regulatory standards.

- Traders are prone to taking higher risks to ‘win big’.

Calculating profits in high-leverage trading

Leveraged forex trading extends certain margin privileges to traders in good faith as a way to facilitate more efficient trading of currencies. This means it is essential that traders maintain at least the minimum margin requirements for all open positions at all times in order to avoid any unexpected liquidation of trading positions.

While high-leverage forex trading carries certain risks – it also opens greater possibilities to accessing bigger lots and making greater profits.

Examples

Without leverage

If you wanted to open a position size of $10,000 (0.1 lots) and trade without leverage, you’d have to have at least that amount in your account. While the risk depends on your stop loss, let’s assume a 20 pip stop loss of 0.1 EURUSD is a risk of about $30, which is roughly 0.3% of the $10,000 position size.

With leverage

If you’re trading with a leverage of 100:1 and have entered a $100,000 position, the broker will set aside $1,000 from your account. The 100:1 leverage means you are now controlling $100,000 with $1,000.

Let’s say the $100,000 investment rises in value to $101,000 or $1,000. That means your ROI is 100% ($1,000 gain / $1,000 initial investment).

Can all traders use high leverage?

While all forex broker clients can use some form of leverage, not all can use high leverage to trade. Following the 2018 measures to protect retail clients, ESMA does not consider highly leveraged trading to be suitable for all investor types.

Retail clients are those who enjoy lower leverage and higher protections while professional clients have access to higher leverage and fewer regulatory restrictions but are confident they can manage the risks that go along.

ESMA has put in place various intervention measures on cfds, including establishing the maximum leverage limits available to the different client classifications, based on the trading instrument.

For retail client leverage limits are:

1:30 (3.33% margin) for forex majors

1:20 (5% margin) for main index cfds, forex small caps and gold cfds

1:10 (10% margin) for other commodity cfds except gold

1: 5 (20% margin) for individual stocks (equity cfds) and other underlyings

1:2 (50% margin) for cfds on cryptocurrencies

For professional client leverage limits are:

Up to 1:500 (0.2% margin) for forex majors, forex minors, some indices (ASX200, DAX30, DJI30, FTSE100, NQ100, SP500), and some commodities (gold, silver, XAUAUD, WTI and BRENT)

up to 1:200 (0.5% margin) for remaining indices and bonds

up to 1:100 (1% margin) for remaining commodities

up to 1:25 (4% margin) for forex exotics

UP to 1:20 (5% margin) for individual stocks (equity cfds) and cfds on cryptocurrencies

What are the main leverage ratios?

There are various levels of leverage and their use depends on the types of broker accounts and capital owned by the traders. Generally, the top most popular leverage ratios are:

- 1:20

- 1:33

- 1:50

- 1:100

- 1:200

Can US traders use high leverage?

US forex brokers are very restrictive in the leverage they offer, especially following the financial collapse in 2008. As per the commodity futures commission (CFTC) rule from october 2010, the maximum leverage available to US residents is 50:1.

The dodd frank act further prohibits US clients from trading forex with a counterparty that is not regulated in the US.

Risk management with forex leverage

There are widely accepted rules that investors should review when selecting a leverage level. The three basic rules of leverage are:

Maintain low levels of leverage.

Use trailing stops to reduce downside and protect capital.

Keep positions small and limit capital to 1% to 2% of the total trading capital on each position taken.

When you follow these rules, you can better manage leverage. New traders should be cautious about the forex leverage level they select and make a choice based on their trading experience, risk tolerance and comfort when operating in the global currency markets. Remaining conservative and trading only with the best high leverage brokers in 2020, is a good start to start building experience.

Is trading with leverage dangerous?

No, if a trader understands the simple basics of leveraged trading.

Yes, if a trader has no clues about what he is doing.

High leverage enables forex traders to trade larger capitals with multiple types of trades. Without leverage the majority of individual investors won’t be able to operate in the forex environment today.

Trading with high leverage is riskier than with low leverage. However, this is dependant on your risk management.

Recently regulators stepped in and tightened the conditions for trading with leverage. Of course, the idea is to protect the retail trader, but brokers hope to lower risks by closing the opening positions when there isn’t sufficient capital in the trading account before losses exceed deposits.

Moreover, high leverage accounts leave more free margin available to trade with. This way, traders can find more trading opportunities from a range of markets.

Conclusion

Leverage is one of the reasons why online trading is so popular. Without leverage, many retail traders couldn’t afford to trade.

Moreover, high leverage means less margin is required. This leaves more funds available in the trading account for new trades and potential drawdown.

Tight money management rules coupled with high leverage is the perfect combination for ambitious traders in search of ways to beat the financial markets. One without the other makes it difficult to reach financial independence.

Forex brokers offering 500:1 leverage

| broker | regulated | leverage | platforms | min.Deposit | review |

| 1:1000 | MT4, MT5, web | $10 | review website | ||

| 1:500 | MT5, web, ctrader | $100 | review website | ||

| 1:500 | MT4, MT5, iress | $100 | review website | ||

| 1:500 | MT4, MT5 | $5 | review website | ||

| 1:500 | MT4, MT5, fxpro markets, ctrader | $100 | review website | ||

| 1:1000 | MT4, MT5, web | $5 | review website |

One of the reasons why so many people are attracted to the forex market is that you can usually get much higher leverage than you would with stocks for example. And leverage as high as 1:500 is provided by a number of forex brokers, including some reliable and well-regulated ones.

In order to be a successful trader, however, you need to fully understand the nature of leverage, how it works, what are the risk associated with it, and how to reduce them. In this article, we will explain everything these things in detail, including the regulatory rules applicable to leverage in various jurisdictions.

What is leverage in forex trading?

First things first, and we’ll start off with a definition and clarification on the concept of leverage. Leverage is an essential part of forex margin trading, allowing any individual to access the foreign exchange market, and profit from relatively small price changes in currency pairs. It is usually defined as having the ability to control a large amount of money using none or very little of your own funds and borrowing the rest.

Basically, leverage increases buying and selling power by providing traders with virtual capital. Traders can operate with it, but can't withdraw it or lose it. All a trader can lose is their own deposit.

So, leverage is simply a way of trading with more money than you actually have in your account. Usually, it is expressed as a ratio, and if a broker offers 1:500 leverage, this means that for every $1 of their capital, you receive $500 to trade with. So, if you deposit $1 000 for example, you will be able to trade volumes at a value of $500 000, and multiply your profits by 500 times. This indeed sounds tempting, but there are some important things you should take into consideration.

Leverage and margin explained

In order to provide leverage to their clients, forex brokers require a certain amount of funds to be deposited in the trading account as collateral to cover the risk associated with leverage. This deposit is called margin and is usually expressed as a percentage. For example, brokers offering leverage of 1:500 have a margin requirement of 0.2%.

So the maximum size of the trade depends on the required margin and free funds in your trading account with the broker. For example, you cannot start out with an initial deposit of $100, and buy 3 standard lots with leverage of 1:500.

€ needed to open 1 standard lot EURUSD*

€ needed to open 1 mini lot*

*A standard contract size in forex is a lot - 100,000 currency units; A mini lot is 10,000 units and a micro lot is 1,000 units respectively.

Brokers often provide traders with a margin percentage to calculate the minimum equity needed to fund a trade. Once you have the margin percentage, simply multiply this with the trade size to calculate the amount of equity needed to place the trade. Here is the formula:

Equity = margin percentage x trade size

So, let's go back to our example. In order to buy three standard lots EURUSD with margin percentage of 0.2%, you need an equity of 0.02 х 300 000 or €600.

And bear in mind that the availabe funds in your account change after the transaction is open, as the profits and losses, including transaction costs accrue for each position. If you place a trade, and the exchange rate moves against you, your broker will require that you have enough capital in your account to meet the new margin requirements. If the equity in your account drops below the maintenance margin level, your broker will generate a margin call. This means you no longer have any usable/free margin, and the account needs more funding.

But what leverage should you use? It’s hard to determine the best level, as it mainly depends on the trader's skills and strategy, as well as on the actual vision of upcoming market moves. As a rule of thumb, the longer you expect to keep your position open, the lower the leverage should be. So, using leverage as high as 1:500 is especially popular among the so called scalpers – those who prefer short-term positions, lasting from several seconds to several minutes.

What are the dangers of using high leverage?

Leverage is often described as a two-edged sword, as it may maximize gains, however it can also increase losses too. And the higher the leverage you use, the greater the risk of loss. So, if the market turns against you, leverage will amplify your potential losses, and may wipe out your entire account in a matter of seconds. And we already discussed the margin call. That is why trading with leverage as high as 1:500 is recommended only for those who have some experience in the forex market.

Due to the high risk for losing one’s capital, the leverage available to retail traders is restricted in many countries. This includes major forex markets such as the US, the european union, and japan, but more on that later.

What can I do to mitigate the risk of high leverage?

Because of the inherent risk of margin trading, is it’s essential to understand and control leverage. And controlling it means determining the appropriate level for your trades and applying sound risk management strategy. Here are some of the most popular risk management strategies used by traders to mitigate the risk of high leverage:

This order type automatically closes your open position when a pre-set loss level is reached, thus lowering the risk of losing too big chunk of your capital. And guaranteed stop loss order, offered by some brokers, eliminates the risk of negative slippage when markets are volatile. This is a key risk management tool, but to be effective, they need to be placed correctly by the trader. Here, you may also take a look at a list of brokers offering guaranteed stop losses.

Set the right risk/reward ratio

Setting your risk/reward ratio right is another way to control the leverage risk. For example, a risk/reward ratio of 1:3 sounds quite reasonable. As an example, if you wanted to set your stop loss at 10 pips and your desired profit was 40 pips, your risk-reward calculation would be 10:40 or 1:4.

This practice involves a trader buying a currency pair while simultaneously placing a second trade selling the same pair. Although this creates no net profit, financial gains can be made with some tactical market timing.

Portfolio diversification

This is a classic risk management rule, and forex margin trading is no exception. By having a diverse range of investments, you protect yourself in cases where one market drops, as usually other markets are experiencing stronger performance at the same time.

And remember, never put at stake more than you are willing to lose, as forex is generally considered a high-risk investment. Also, having a forex trading plan and sticking to it in all situations is crucial for you as a trader.

In any case, caution is recommended cautious when using high leverage levels and another thing that is of utter importance is to choose a well-regulated broker who provides negative balance protection. This means that the stop out level is in place to help ensure you do not lose more money than your deposit, no matter what leverage level you use, and your account will be brought to a zero balance if it goes into negative as a result of trading activity.

Regulatory restrictions on leverage

Most jurisdictions where forex trading does not fall within the ‘grey area’ have certain restrictions on the use of leverage by retail investors due to the inherent risk of loss, and wouldn't allow brokers to offer levels as high as 1:500. Although regulators across the globe impose such restrictive measures in order to create a more secure and sustainable trading environment, the overall impact of these on forex businesses isn’t necessarily positive.

For example, after dodd–frank act was passed in 2010, requiring US forex brokers to provide leverage no higher than 1:50 (and to hold a minimum capital of at least 20 000 000 USD), most US forex brokers saw declines in trading volumes, and respectively, a dip in revenue. As a result, the majority of them either shut down or moved their business elsewhere. As the same happened in the EU in recent years, the US financial market now shows signs of revival.

We should also note that after leverage was capped in the US forex retail industry, this triggered a demand for brokers (outside the US) who accept US clients. US regulators keep threatening any broker that accepts US clients without a proper license with the NFA/CFTC, and have spread their tentacles inside many foreign governments through a series of memoranda of understanding agreements. Thus, NFA & CFTC have effectively extended US regulation to cover US residents doing business in countries that are parties to these agreements, and prevent traders from using leverage greater than 1:50.

Luckily, the introduction stricter forex rules in europe didn’t have the same devastating effect on the market. The european securities and markets authority (ESMA) imposed a number of restrictive measures to CFD providers, including a cap on leverage in 2018. This, however, didn’t seem to affect the brokers' business to such an extend as in the US.

More specifically, ESMA restricted the leverage allowed to retail investors throughout the EU and the EEA to 1:30 for major pairs. And the cap for non-major pairs and cfds is even lower than that:

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

And ESMA kept renewing these CFD intervention measures applicable to EU forex brokers, which were temporary by nature, until most national regulators turned them into permanent rules (with some variations by country). These include malta, italy, austria, germany, denmark, ireland and the netherlands, but the list is not exhaustive.

The cyprus securities and exchange commission (cysec) on the other hand, accepted a tiered risk-based approach to leverage as a permanent national measure for investor protection. And UK’s financial conduct authority (FCA) made ESMA’s CFD restrictions permanent, but allowed higher leverage for the sale of government bonds.

That said, we should also mention that some EU brokers have found ways to circumvent the restrictive measures, and offer leverage of up to 1:100 or even 1:200 to those clients who classify as “professional”. Another way for CFD providers established in the EU to provide higher leverage is to offering their clients to move their accounts to an intra-group third-country entity. These practices, however, have been denounced by ESMA as “undesirable”.

And the australian securities and investments commission (ASIC) may potentially follow and to impose leverage restrictions similar to those introduced by ESMA in order to strengthen consumer protection. The australian regulator made a proposition to cap leverage at 1:20 (for all forex pairs and gold) in 2019, but it hasn’t been accepted yet. As regards equity indices, ASIC suggests a maximum level of 1:15, commodities excluding gold 1:10, equities 1:5, and crypto-assets 1:2.

The leverage caps proposed by ASIC are also lower than japan (1:25), but in line with singapore and hong kong (1:20). That said, it seems so far that the harshest leverage restrictions are those in force in south korea and turkey (1:10).

The israel securities authority (ISA), on the other hand, has proposed leverage tiers which are actually significantly higher than those introduced by the pan european regulator. Also, the israeli regulator appears to have a different approach. More specifically, ISA proposed leverage to be capped at 1:100 for low-risk trades, up to 1:40 for medium-risk trades, and up to 1:20 for high-risk trades.

Brokers facing such leverage restrictions are placed in an awkward situation. They are left having to choose between potentially losing clients that seek greater leverage to offshore jurisdictions; or risk their reputation by engaging in legal changes to cater to the needs of their clients.

Fxdailyreport.Com

The advantages of trading with high leverage brokers can make the mouths of even the most experienced traders water. The sheer unpredictability with which positions emerge and the appeal of massive gains from relatively minimal capital investment make it an exciting world to do business. But just as the gains are sweet, trouble is real when trading with high leverage forex brokers. In fact, there have been rising calls amongst international regulators looking to clamp down on the less savvy consumer.

This is to stop traders from investing their life savings without a comprehensive understanding of the pros and cons of this intricate and potentially high-risk investment strategy. That said, here is a comprehensive list of the pros and cons of trading with high leverage forex brokers.

10 best forex brokers with highest leverage

| broker | info | bonus | open account |

|---|---|---|---|

| min deposit: $5 spread: from 0.2 pips leverage: 500:1 regulation: FSA (saint vincent and the grenadines), cysec | 50% deposit bonus, real contest 1st prize luxury car BMW X5 M, copy trading, trade&win. | Visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 3000:1 regulation: cysec, IFSC | $100 no-deposit bonus, 100% deposit bonus | visit broker | |

| min deposit: $5 spread: from 0 pips leverage: 888:1 “*this leverage does not apply to all the entities of XM group.” regulation: ASIC, cysec, IFSC belize | “50% +20% deposit bonus up to $5,000, loyalty program bonus “*clients registered under the EU regulated entity of the group are not eligible for the bonus and the loyalty program” | visit broker | |

| min deposit: $1 spread: from 0 pips leverage: 2000:1 regulation: FCA UK, cysec, FSP, bafin, CRFIN | 35% of the account deposit | visit broker | |

| min deposit: $100 spread: starting 0 pips leverage: up to 400:1 regulation: FCA UK, NFA, CFTC, ASIC, IIROC, FSA, CIMA | visit broker | ||

| min deposit: $300 spread: floating, from 0 pips leverage: 500:1 regulation: FCA UK reference number 579202 | visit broker | ||

| min deposit: $200 spread: starting 0 pips leverage: 500:1 regulation: ASIC australia, FCA UK | visit broker | ||

| min deposit: no minimum deposit spread: 1.2 pips leverage: 50:1 regulation: CFTC, NFA, FCA, MAS, ASIC, IIROC | visit broker | ||

| min deposit: $10 spread: leverage: regulation: cysec | - | visit broker | |

| min deposit: $200 spread: from 3 pips leverage: 400:1 regulation: NFA, FCA, cysec | visit broker |

Before we delve into the pros and cons, it is worth explaining what leverage is.

What is leverage ?

Leverage is a service offered by forex brokers. It allows FX traders to place orders that are significantly higher than their actual deposit. This, in turn, helps them achieve higher profits in the market. In the same way, when using leverage, the traders risk losing their deposit faster.

Pros of trading with high leverage forex brokers

The first and most obvious benefit of trading with high leverage forex brokers is that it earns you more money for less effort. Regardless of the nature of the instrument being traded or whether you are staking a small or large amount, the key role of high leverage brokers is to increase your profit by multiplying the stakes. Although the same effect could be achieved by investing more capital in each position, leverage works to ensure it is a step ahead in artificially boosting your available capital, usually by hundreds or even a thousand times.

- Increases capital efficiency

In conjunction with the point above, high leverage forex brokers give you the ability to earn high profits per transaction, naturally increasing the efficiency with which you are using your capital. For instance, if it takes you a week to generate $100 with an unleveraged position, leveraging it up means it will take a shorter period to deliver the same results.

In essence, this means that your capital and revenues will be freed up sooner and can be reinvested more times to deliver the most significant and fastest yields possible.

- Trading with low capital

A few years back, only the wealthy could make a profit through forex trading. This is until the introduction of leverage which allows anyone to do it. Leverage allows traders to start trading without having to provide large amounts of funds.

- Eases low volatility

Another important benefit of higher leverage forex trading is its ability to mitigate against low volatility. A volatile trade is one that delivers the highest profits. Unfortunately, due to the cautious nature of forex market traders, volatility tends to be at the lowest end of the scale. High leverage mitigates this by offering larger profits from smaller transaction sizes. High leverages allow traders to capitalize on even the smallest degrees of movement in market pricing.

High leverage FX brokers are the true double-edged sword. When they work for you, they really work for you. But when they turn against your position, trading with them can do some serious damage to your finances within the blink of an eye. Therefore, it is important that as a trader you also understand the disadvantages of trading forex with high leverage brokers.

- Heavier loss risks

The main disadvantage of using high leverage brokers in trading is that it carries a high amount of risk by paving the way for heavy losses. The goal of leveraging is simply upping your ante so that you are essentially playing with more money. Hence, when the games are up and done, you keep huge profits but also bear the losses.

High leverage can end up costing you a lot more than you bargained for, especially when your positions inevitably head south time and again. It is important to know that the higher the leverage you are trading with, the larger your chances of profit and loss are.

- A constant liability

When trading forex, it is crucial to understand that leveraging automatically builds a liability that must be met by your account by the end of the day. Regardless of whether a transaction is up or down, or how many additional costs you have covered at the end of the day, the basic cost must be met and will automatically be applied to your account.

This means that by simply entering into a position, you are by default handicapped since you will need to meet the automatic liability of the leverage portion at the close of the trade. Even if the transaction eventually trends towards zero, the leverage amount will still be owed and must be paid before you can move forward.

Any leveraged trade earns a higher cost. The funding applied to your position must be paid for in terms of interest. Whenever you leverage your transaction, you are essentially borrowing money from your broker and will be required to pay with interest. This interest is calculated and applied daily depending on the rates set by your broker.

Note that the higher the leverage amounts in the trade, the more interest you will incur and the commission the broker will charge to open the contract.

There is also the ever-present risk of falling below the margin requirements set by your broker. The margin call is the set percentage of any transaction size you are required to fulfill in terms of your own capital. If at any time you fall below that threshold, you can expect your brokers to prompt the margin call, which automatically liquidates your portfolio as far as meeting your obligations is concerned.

This could mean that any standing positions that could have run on to deliver massive profits are closed out early in addition to settling losing positions that may never recover.

The bottom line

when managed well, trading with high leverage brokers can be a successful and profitable move. Just make sure to never use high leverage if you are taking a hands-off approach to your trades.

So, let's see, what was the most valuable thing of this article: full ECN trading with one of the lowest spreads broker available in forex, metals, energies, cryptocurrencies, indices, and soft commodities. At 1:5000 leverage

Contents of the article

- Free forex bonuses

- 1:5000 leverage

- Execute larger positions

- All-time best bonus programs

- World’s popular metatrader 4

- Your money your way

- Institutional grade trading

- Execute larger positions

- All-time best bonus programs

- World’s popular metatrader 4

- Your money your way

- Beneficial features that A partnership needs:-

- Global markets at your fingertips

- Forex

- Metals

- Energies

- Cryptocurrencies

- Indices (coming soon)

- Soft commodities (coming soon)

- Forex

- Metals

- Energies

- Cryptocurrencies

- Indices (coming soon)

- Soft commodities (coming soon)

- ELECTRONIC COMMUNICATION NETWORK

- ECN account types

- Meta trader

- No bonus

- Meta trader

- Bonus available

- Start trading in 4 steps

- MT4 & MT5 forex brokers - highest leverage...

- 1. Forexmart – 1:5000 leverage

- 2. FBS – 1:3000 leverage

- 3. Justforex – 1:3000 leverage

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- Forexmart with 1:5000 leverage, introduces...

- Forexmart with world’s highest leverage

- Forexmart

- Post tags

- Comments

- Leave a reply cancel reply

- Related

- Page navigation

- Related posts

- Features

- All forex brokers

- All crypto-currency exchanges

- Latest article

- Page navigation

- Hercules.Finance

- 1:1000 leverage on ECN accounts. Yes, and I am a...

- Best high leverage forex brokers 2021

- Top brokers for leverage

- What is leverage?

- How does leverage work?

- What is leverage trading?

- How to use leverage correctly

- Guide to find a high leverage...

- Which brokers offer high...

- Pros and cons of high leverage

- Calculating profits in high-leverage...

- Can all traders use high...

- What are the main leverage...

- Can US traders use high leverage?

- Risk management with forex...

- Is trading with leverage dangerous?

- Conclusion

- Forex brokers offering 500:1...

- What is leverage in forex trading?

- Leverage and margin explained

- What are the dangers of using high leverage?

- What can I do to mitigate the risk of high...

- Regulatory restrictions on leverage

- Fxdailyreport.Com

- 10 best forex brokers with highest leverage

No comments:

Post a Comment